Key Insights

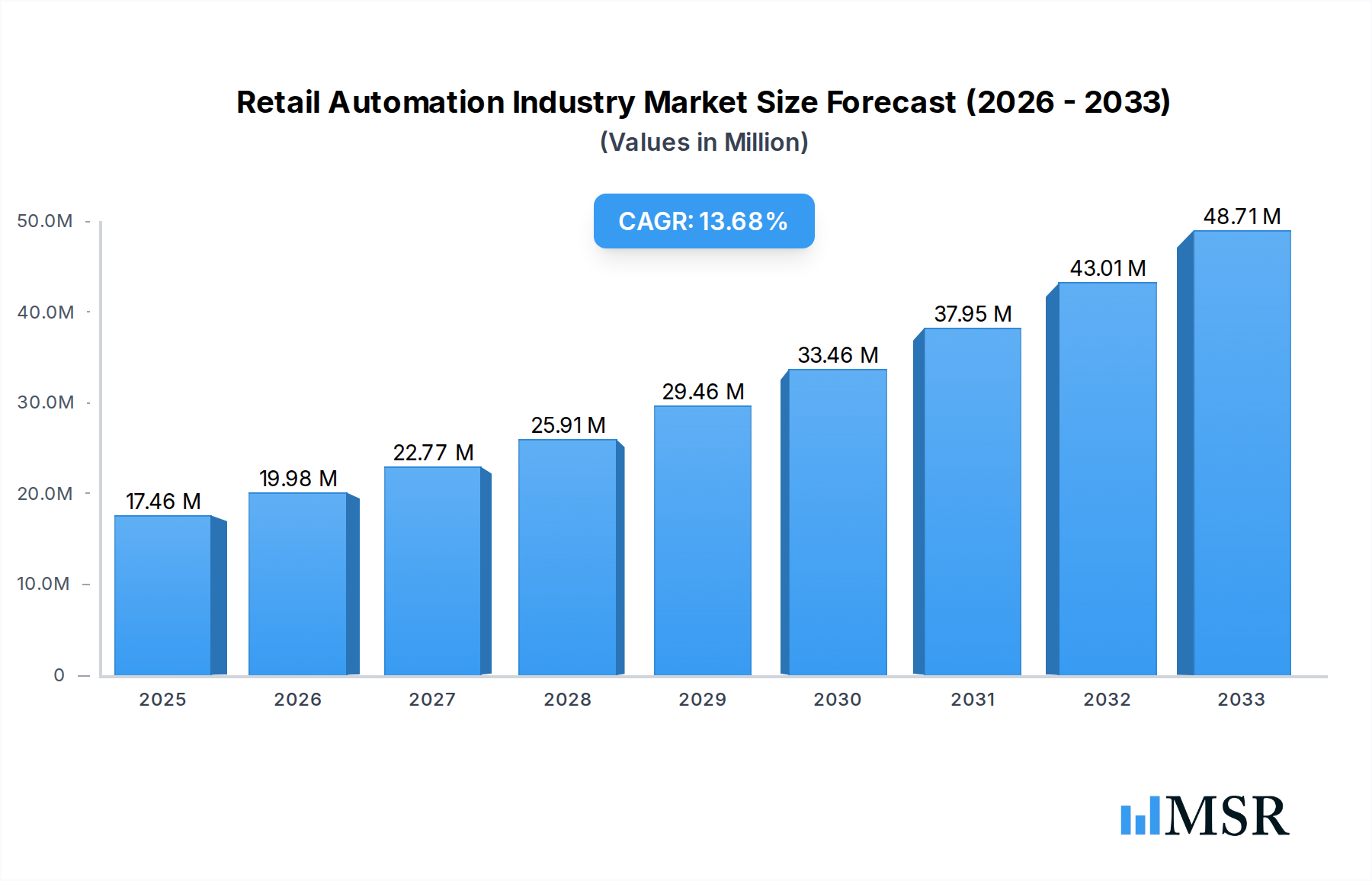

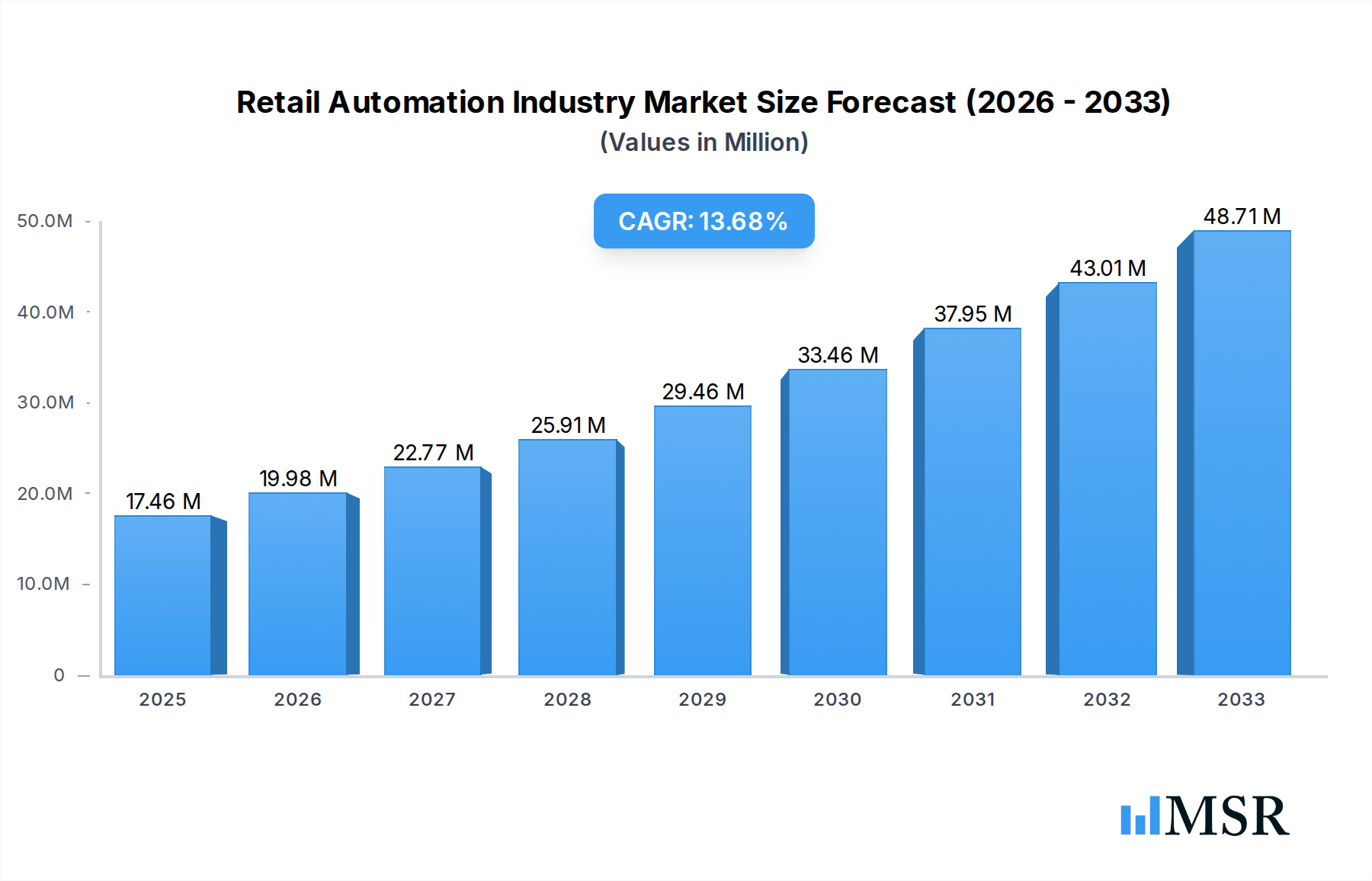

The global Retail Automation Industry is poised for remarkable expansion, with a current estimated market size of 17.46 Million and a projected Compound Annual Growth Rate (CAGR) of 14.66% during the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing demand for enhanced operational efficiency, improved customer experiences, and cost reduction across the retail sector. Key drivers include the widespread adoption of self-checkout systems to alleviate long queues and staff shortages, the integration of RFID and barcode scanners for streamlined inventory management and faster transaction processing, and the deployment of advanced POS systems that offer integrated payment solutions and customer relationship management functionalities. The escalating e-commerce landscape also plays a significant role, necessitating automated solutions for faster fulfillment and last-mile delivery. Furthermore, the growing emphasis on personalized shopping experiences is pushing retailers to invest in automation technologies that can gather and analyze customer data effectively.

Retail Automation Industry Market Size (In Million)

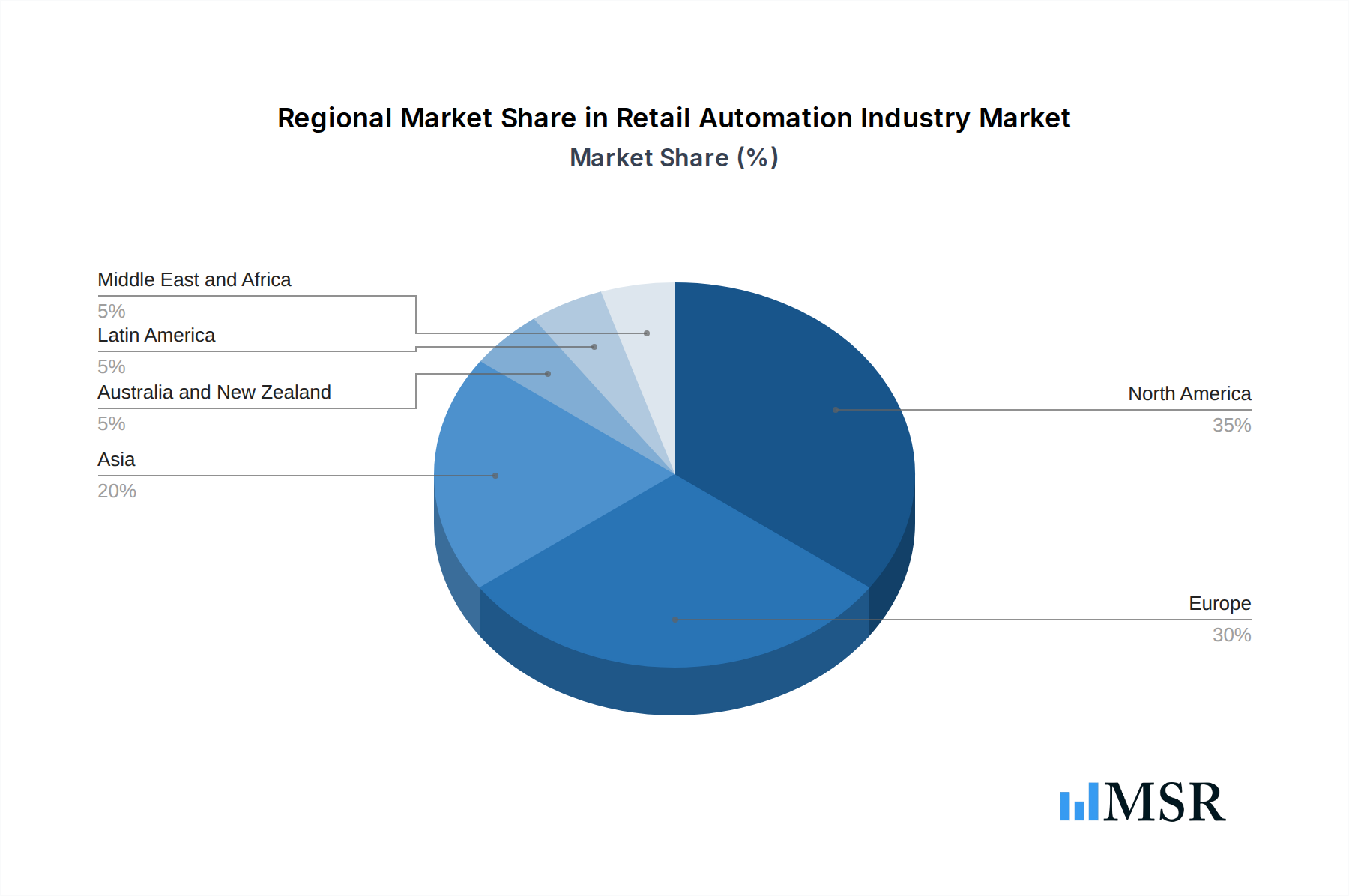

The industry is witnessing significant trends such as the rise of contactless payment solutions, the implementation of AI-powered analytics for demand forecasting and personalized marketing, and the growing adoption of robotic process automation for back-end operations. While the market is brimming with opportunities, certain restraints need to be addressed. High initial investment costs for sophisticated automation hardware and software can be a barrier for small and medium-sized enterprises. Additionally, concerns regarding data security and privacy associated with increased automation, along with the need for skilled personnel to manage and maintain these advanced systems, present ongoing challenges. The market is segmented across hardware, software, and various end-users, with grocery and general retail segments expected to dominate due to their high transaction volumes and continuous need for efficiency. North America and Europe are leading the adoption, while Asia is emerging as a rapidly growing market.

Retail Automation Industry Company Market Share

Retail Automation Industry: Market Analysis, Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the global Retail Automation Industry, providing actionable insights for industry stakeholders. Spanning the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this report leverages extensive data to illuminate market dynamics, technological advancements, and strategic opportunities. Discover how POS systems, self-checkout systems, RFID and barcode scanners, and advanced retail automation software are revolutionizing grocery, general, and hospital retail sectors.

Retail Automation Industry Market Concentration & Dynamics

The Retail Automation Industry exhibits a moderate to high level of market concentration, with a few key players dominating significant market share. However, the presence of innovative startups and specialized solution providers fosters a dynamic innovation ecosystem. Regulatory frameworks, while generally supportive of technological adoption for efficiency, can vary by region, impacting implementation timelines and costs. Substitute products, such as traditional manual processes, are steadily being eroded by the superior efficiency and cost-effectiveness of automated solutions. End-user trends are a significant driver, with retailers increasingly prioritizing enhanced customer experiences, streamlined operations, and data-driven decision-making. Mergers and acquisitions (M&A) activities are on the rise, driven by the pursuit of market consolidation, technology acquisition, and expanded service offerings. These M&A deals, estimated to be in the hundreds annually, are reshaping the competitive landscape. Key metrics such as market share distribution, patent filings related to retail automation, and the volume of M&A transactions are critical indicators of these dynamics.

Retail Automation Industry Industry Insights & Trends

The Retail Automation Industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer behaviors, and the imperative for operational efficiency. The estimated market size for the Retail Automation Industry is projected to reach 250 Billion USD by the end of the forecast period, with a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. Key growth drivers include the increasing demand for personalized customer experiences, the need to optimize inventory management and reduce shrinkage, and the rising labor costs that necessitate automation. Technological disruptions are at the forefront, with advancements in AI, IoT, computer vision, and robotics enabling more sophisticated in-store automation solutions. The proliferation of POS systems is a foundational element, while the adoption of self-checkout systems is rapidly expanding to reduce wait times and improve customer flow. Furthermore, the integration of RFID and barcode scanners is revolutionizing inventory accuracy and supply chain visibility. Evolving consumer behaviors, such as the preference for frictionless shopping and the increasing reliance on mobile devices for in-store navigation and purchasing, are directly fueling the adoption of these technologies. The market is also witnessing a surge in demand for integrated retail automation software that offers comprehensive solutions for order management, customer relationship management (CRM), and data analytics. The growing importance of data analytics derived from these automated systems is enabling retailers to gain deeper insights into consumer behavior, optimize pricing strategies, and personalize marketing efforts, further propelling market expansion.

Key Markets & Segments Leading Retail Automation Industry

The dominant region for Retail Automation Industry adoption is North America, with the United States leading the charge due to its early adoption of technology and a mature retail landscape. Several factors contribute to this dominance:

- Economic Growth: A strong economic foundation in the US allows for significant investment in advanced retail technologies.

- Infrastructure: Highly developed retail infrastructure, including widespread internet connectivity and advanced logistics networks, supports seamless integration of automation solutions.

- Consumer Expectations: North American consumers have a high expectation for convenience and speed, pushing retailers to adopt solutions like self-checkout and mobile POS.

- Technological Savvy: A technologically proficient consumer base readily adopts new retail innovations.

Within the segments, Hardware holds a significant share, primarily driven by the widespread deployment of:

- POS Systems: Essential for every retail transaction, POS systems are constantly being upgraded with enhanced features and cloud connectivity. The market for POS systems is estimated to be valued at 50 Billion USD in the base year of 2025.

- Self-Checkout Systems: Driven by a desire to reduce labor costs and improve customer throughput, self-checkout systems are experiencing rapid growth. This segment is projected to grow at a CAGR of 15% during the forecast period.

- RFID and Barcode Scanners: Crucial for inventory management and loss prevention, the demand for these devices is escalating. The market for RFID and Barcode Scanners is expected to reach 20 Billion USD by 2025.

- Other Hardware Types: This includes smart shelves, digital signage, and robotic assistants, all contributing to a more automated in-store experience.

The Software segment is experiencing explosive growth, with retailers increasingly relying on sophisticated retail automation software for analytics, CRM, inventory management, and personalized marketing. This segment is predicted to grow at a CAGR of 14%.

In terms of end-users, the Grocery segment represents the largest market for retail automation. The high volume of transactions, the need for efficient inventory management of perishable goods, and the pressure to reduce food waste make automation a critical necessity. The grocery retail automation market is estimated to be valued at 70 Billion USD in 2025. The General retail segment, encompassing apparel, electronics, and general merchandise, also shows strong adoption, driven by the need for enhanced customer experience and omnichannel integration. The Hospital segment, while smaller, is increasingly adopting retail automation for its pharmacies, gift shops, and patient service points, focusing on efficiency and accuracy.

Retail Automation Industry Product Developments

Product innovations in retail automation are rapidly advancing, focusing on enhancing customer experience and operational efficiency. Innovations include the development of AI-powered self-checkout systems that can identify items more accurately, smart shelves that automatically detect stock levels, and robotic solutions for inventory counting and store cleaning. The integration of IoT devices with POS systems is enabling real-time data collection and predictive analytics. Furthermore, advancements in RFID and barcode scanners are leading to faster read times and greater accuracy. The market relevance of these developments lies in their ability to reduce costs, improve customer satisfaction, and provide retailers with a significant competitive edge.

Challenges in the Retail Automation Industry Market

Despite the strong growth trajectory, the Retail Automation Industry faces several challenges. High upfront investment costs for advanced automation solutions can be a barrier for small and medium-sized retailers. Integrating new systems with existing legacy infrastructure can be complex and time-consuming. Supply chain disruptions, as witnessed in recent years, can impact the availability of critical hardware components. Furthermore, data security and privacy concerns related to the vast amounts of data collected by automated systems require robust cybersecurity measures. The need for a skilled workforce to manage and maintain these sophisticated systems also presents a challenge.

Forces Driving Retail Automation Industry Growth

Several forces are propelling the growth of the Retail Automation Industry. Technological advancements, including the widespread availability of AI, IoT, and cloud computing, are making sophisticated automation solutions more accessible and cost-effective. The increasing demand for a seamless and personalized customer experience is a primary driver, as consumers expect faster checkouts, more relevant recommendations, and convenient shopping journeys. The need to optimize operational efficiency, reduce labor costs, and minimize errors is compelling retailers to invest in automation. Furthermore, the growing adoption of e-commerce and the need for effective omnichannel strategies are pushing brick-and-mortar stores to adopt automation to compete effectively.

Challenges in the Retail Automation Industry Market

Long-term growth catalysts for the Retail Automation Industry are deeply rooted in continuous innovation and strategic market expansion. The ongoing development of more intuitive and user-friendly automation solutions will lower adoption barriers. Partnerships between technology providers and retailers are crucial for co-creating solutions that address specific industry needs. The expansion of automation into new retail verticals and emerging markets will unlock significant growth potential. Furthermore, the increasing focus on sustainability and circular economy principles within retail will likely drive the adoption of automation for more efficient resource management and waste reduction.

Emerging Opportunities in Retail Automation Industry

Emerging opportunities in the Retail Automation Industry are abundant. The rise of autonomous stores, powered by computer vision and AI, presents a significant opportunity for frictionless shopping experiences. The integration of augmented reality (AR) and virtual reality (VR) with retail automation can revolutionize product visualization and customer engagement. The growing demand for hyper-personalization, driven by advanced data analytics from automated systems, opens avenues for highly targeted marketing and product offerings. Furthermore, the development of sustainable and energy-efficient automation solutions caters to the increasing consumer and regulatory focus on environmental responsibility. The expansion of the "as a service" model for retail automation also presents a more accessible entry point for many businesses.

Leading Players in the Retail Automation Industry Sector

- RapidPricer B V

- Honeywell International Inc

- Fiserv Inc

- Emarsys eMarketing Systems AG

- NCR Corporation

- Datalogic S p A

- Fujitsu Limited

- Diebold Nixdorf Incorporated

- ECR Software Corporation

- Posiflex Technology Inc

Key Milestones in Retail Automation Industry Industry

- October 2022: Focal Systems, a leading retail automation provider, entered into a partnership with Piggly Wiggly Midwest locations. Piggly Wiggly Midwest will be conducting a trial of the Focal Operating System (FocalOS) in its stores across Wisconsin and Illinois. The primary objective of this collaboration is to enhance the customer experience by leveraging FocalOS to digitize and automate various aspects of their business, including ordering, inventory management, merchandising, and in-store personnel management.

- February 2022: RetailNext Inc., a prominent player in the field of smart store retail analytics aimed at improving the shopping experience, announced an expansion of its free traffic system upgrades. This move comes as more retailers grapple with the expensive task of upgrading their outdated hardware to keep up with the latest industry standards.

Strategic Outlook for Retail Automation Industry Market

The strategic outlook for the Retail Automation Industry is exceptionally positive, driven by the sustained demand for efficiency, enhanced customer experiences, and data-driven insights. Future growth will be shaped by the continuous integration of AI and machine learning to create more intelligent and predictive automation systems. The expansion of self-service technologies beyond checkout, including personalized assistance and in-store navigation, will be a key trend. The report forecasts continued M&A activity as larger players seek to acquire innovative technologies and expand their market reach. Strategic partnerships between technology vendors, retailers, and data analytics firms will be crucial for developing holistic and integrated automation solutions, ensuring the industry's sustained expansion and evolution.

Retail Automation Industry Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. POS System

- 1.1.2. Self -checkout System

- 1.1.3. RFID and Barcode Scanners

- 1.1.4. Other Hardware Types

- 1.2. Software

-

1.1. Hardware

-

2. End-User

- 2.1. Grocery

- 2.2. General

- 2.3. Hospital

Retail Automation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Retail Automation Industry Regional Market Share

Geographic Coverage of Retail Automation Industry

Retail Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Quality and Fast Service; Growth and Competition among Retail Industry and E -commerce

- 3.3. Market Restrains

- 3.3.1. Slow Adoption of Automated Machine Learning Tools

- 3.4. Market Trends

- 3.4.1. Growth and Competition among Retail Industry and E -commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. POS System

- 5.1.1.2. Self -checkout System

- 5.1.1.3. RFID and Barcode Scanners

- 5.1.1.4. Other Hardware Types

- 5.1.2. Software

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Grocery

- 5.2.2. General

- 5.2.3. Hospital

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.1.1. POS System

- 6.1.1.2. Self -checkout System

- 6.1.1.3. RFID and Barcode Scanners

- 6.1.1.4. Other Hardware Types

- 6.1.2. Software

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Grocery

- 6.2.2. General

- 6.2.3. Hospital

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.1.1. POS System

- 7.1.1.2. Self -checkout System

- 7.1.1.3. RFID and Barcode Scanners

- 7.1.1.4. Other Hardware Types

- 7.1.2. Software

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Grocery

- 7.2.2. General

- 7.2.3. Hospital

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.1.1. POS System

- 8.1.1.2. Self -checkout System

- 8.1.1.3. RFID and Barcode Scanners

- 8.1.1.4. Other Hardware Types

- 8.1.2. Software

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Grocery

- 8.2.2. General

- 8.2.3. Hospital

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.1.1. POS System

- 9.1.1.2. Self -checkout System

- 9.1.1.3. RFID and Barcode Scanners

- 9.1.1.4. Other Hardware Types

- 9.1.2. Software

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Grocery

- 9.2.2. General

- 9.2.3. Hospital

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.1.1. POS System

- 10.1.1.2. Self -checkout System

- 10.1.1.3. RFID and Barcode Scanners

- 10.1.1.4. Other Hardware Types

- 10.1.2. Software

- 10.1.1. Hardware

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Grocery

- 10.2.2. General

- 10.2.3. Hospital

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Retail Automation Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Hardware

- 11.1.1.1. POS System

- 11.1.1.2. Self -checkout System

- 11.1.1.3. RFID and Barcode Scanners

- 11.1.1.4. Other Hardware Types

- 11.1.2. Software

- 11.1.1. Hardware

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Grocery

- 11.2.2. General

- 11.2.3. Hospital

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 RapidPricer B V

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Fiserv Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Emarsys eMarketing Systems AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 NCR Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Datalogic S p A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujitsu Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Diebold Nixdorf Incorporated

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ECR Software Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Posiflex Technology Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 RapidPricer B V

List of Figures

- Figure 1: Global Retail Automation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Retail Automation Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Retail Automation Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Retail Automation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Retail Automation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Retail Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Retail Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Retail Automation Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Retail Automation Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Retail Automation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Retail Automation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Retail Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Retail Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Retail Automation Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Retail Automation Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Retail Automation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 17: Asia Retail Automation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Retail Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Retail Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Retail Automation Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Retail Automation Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Retail Automation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Australia and New Zealand Retail Automation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Australia and New Zealand Retail Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Retail Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Retail Automation Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Retail Automation Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Retail Automation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 29: Latin America Retail Automation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Latin America Retail Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Retail Automation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Retail Automation Industry Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Retail Automation Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Retail Automation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 35: Middle East and Africa Retail Automation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 36: Middle East and Africa Retail Automation Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Retail Automation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Retail Automation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 11: Global Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 17: Global Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Retail Automation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 23: Global Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 26: Global Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Retail Automation Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Retail Automation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 29: Global Retail Automation Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Automation Industry?

The projected CAGR is approximately 14.66%.

2. Which companies are prominent players in the Retail Automation Industry?

Key companies in the market include RapidPricer B V, Honeywell International Inc, Fiserv Inc, Emarsys eMarketing Systems AG, NCR Corporation, Datalogic S p A, Fujitsu Limited, Diebold Nixdorf Incorporated, ECR Software Corporation, Posiflex Technology Inc .

3. What are the main segments of the Retail Automation Industry?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Quality and Fast Service; Growth and Competition among Retail Industry and E -commerce.

6. What are the notable trends driving market growth?

Growth and Competition among Retail Industry and E -commerce.

7. Are there any restraints impacting market growth?

Slow Adoption of Automated Machine Learning Tools.

8. Can you provide examples of recent developments in the market?

October 2022: Focal Systems, a leading retail automation provider, entered into a partnership with Piggly Wiggly Midwest locations. Piggly Wiggly Midwest will be conducting a trial of the Focal Operating System (FocalOS) in its stores across Wisconsin and Illinois. The primary objective of this collaboration is to enhance the customer experience by leveraging FocalOS to digitize and automate various aspects of their business, including ordering, inventory management, merchandising, and in-store personnel management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Automation Industry?

To stay informed about further developments, trends, and reports in the Retail Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence