Key Insights

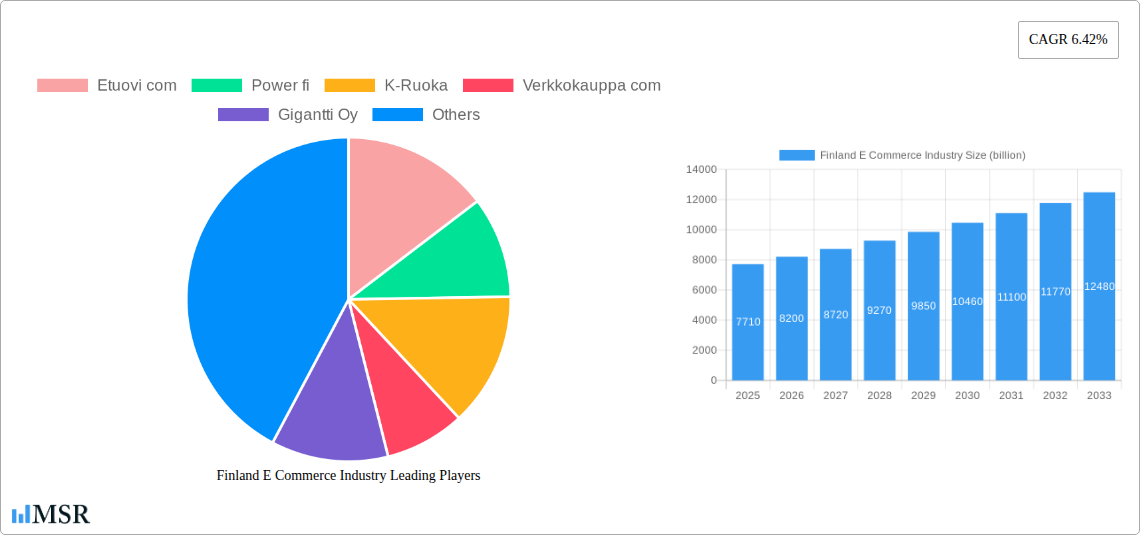

The Finland E-commerce Industry is poised for substantial growth, projected to reach USD 7.71 billion in 2025. This expansion is fueled by a robust CAGR of 6.42%, indicating a dynamic and evolving market landscape. The primary drivers of this growth include the increasing digitalization of consumer behavior, enhanced internet penetration, and the growing adoption of online shopping for everyday necessities and specialized goods. The market is experiencing a significant shift in consumer preferences towards convenience, wider product selection, and competitive pricing, all readily available through online channels. The B2C segment, particularly in fashion and apparel, beauty and personal care, and consumer electronics, is expected to dominate, driven by younger demographics actively engaging in online retail. Furthermore, the B2B e-commerce sector is also gaining traction as Finnish businesses embrace digital procurement for greater efficiency and cost savings.

Finland E Commerce Industry Market Size (In Billion)

The e-commerce ecosystem in Finland is characterized by a diverse range of applications, from fast-moving consumer goods like food and beverages to durable goods such as furniture and home appliances. The "Others" category, encompassing toys, DIY, and media, also contributes significantly to market diversification. Leading companies like Etuovi.com, Verkkokauppa.com, and H&M are actively shaping the market through innovative strategies, enhanced user experiences, and strategic partnerships. The market's expansion is further supported by evolving logistical networks and payment solutions that cater to the growing online consumer base. While the market benefits from strong digital infrastructure and a tech-savvy population, potential restraints could include intense competition, evolving regulatory landscapes, and the need for continuous adaptation to emerging e-commerce technologies and consumer trends.

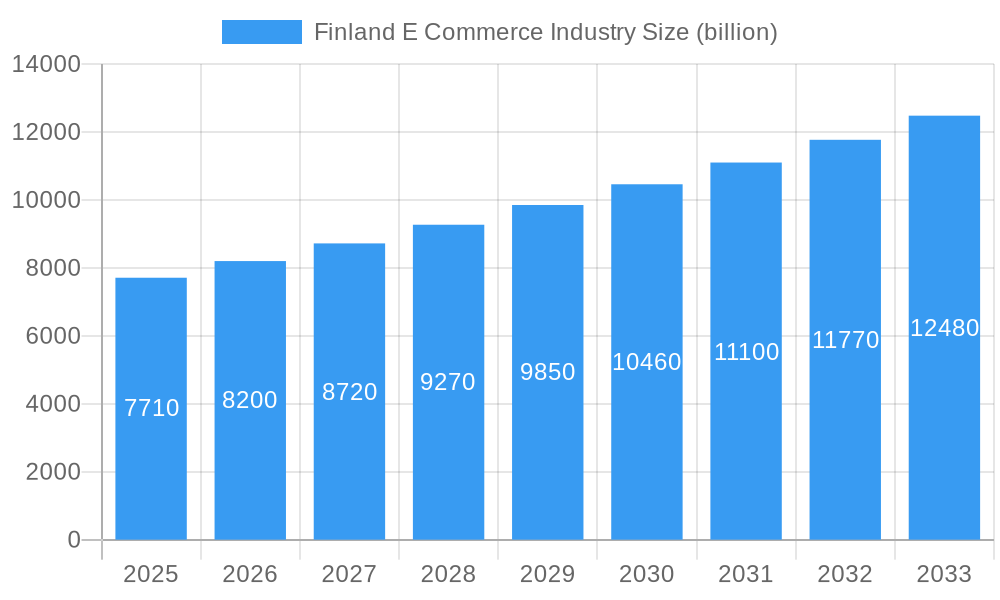

Finland E Commerce Industry Company Market Share

Unlock the Future of Finnish Online Retail: A Comprehensive Report on the Finland E-commerce Industry

Dive deep into the dynamic landscape of the Finland e-commerce industry with this in-depth report. Explore market projections, key growth drivers, and emerging opportunities shaping the Finnish online retail market. This indispensable resource is designed for e-commerce investors, Finnish retailers, online businesses, and market analysts seeking to capitalize on the burgeoning digital economy in Finland. Our analysis covers a comprehensive study period from 2019–2033, with a base and estimated year of 2025, and a detailed forecast period of 2025–2033, building upon historical data from 2019–2024. Discover actionable insights into B2C e-commerce, B2B e-commerce, and the critical segments driving Finland's digital commerce growth.

Finland E Commerce Industry Market Concentration & Dynamics

The Finland e-commerce market exhibits a moderate to high concentration, with a few dominant players, including Verkkokauppa.com and Gigantti Oy, holding significant market share, particularly in consumer electronics and general merchandise. However, the Finnish online retail sector is increasingly characterized by a vibrant ecosystem of innovative startups and niche players like Etuovi.com (real estate) and K-Ruoka (groceries), fostering a competitive yet collaborative environment. Regulatory frameworks, such as GDPR and consumer protection laws, are well-established, ensuring a secure and trustworthy online shopping experience. Substitute products, primarily traditional brick-and-mortar retail, continue to pose a challenge, but the convenience and expanding product selection of e-commerce are steadily eroding their dominance. End-user trends are leaning towards personalization, sustainable shopping, and seamless omnichannel experiences. Mergers and acquisitions (M&A) activities are present, albeit selective, as larger entities seek to consolidate market position or acquire innovative technologies. For instance, acquisitions in the logistics and AI-powered customer service sectors are anticipated to increase.

- Market Share: Dominant players like Verkkokauppa.com and Gigantti Oy hold substantial shares in their respective categories.

- M&A Deal Counts: Moderate, with a growing trend in technology and logistics acquisitions.

- Innovation Ecosystem: Robust, driven by both established players and agile startups.

- Regulatory Frameworks: Mature and consumer-centric.

Finland E Commerce Industry Industry Insights & Trends

The Finland e-commerce industry is poised for substantial expansion, driven by a confluence of factors including increasing internet penetration, growing smartphone adoption, and a societal shift towards digital convenience. The market size for B2C e-commerce is projected to reach an impressive EUR XX billion by 2027, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Technological disruptions, such as the widespread adoption of Artificial Intelligence (AI) for personalized recommendations and customer service via chatbots, are revolutionizing the shopping experience. Augmented Reality (AR) is also emerging as a key technology, enabling virtual try-ons for fashion and furniture, further bridging the gap between online and offline shopping. Evolving consumer behaviors highlight a strong demand for fast and reliable delivery services, with Posti's significant investment in a new logistics center underscoring this trend. Furthermore, a growing consciousness around sustainability is influencing purchasing decisions, leading to an increased preference for eco-friendly products and packaging. The rise of social commerce and live shopping events is also contributing to new avenues for customer engagement and sales. The integration of seamless payment gateways and the growing trust in online transactions are fundamental pillars supporting this upward trajectory.

Key Markets & Segments Leading Finland E Commerce Industry

The Finland e-commerce market is primarily driven by the robust performance of its B2C segment, which is projected to achieve a Gross Merchandise Value (GMV) of EUR XX billion by 2027. This segment is further dissected into key applications, with Fashion and Apparel and Consumer Electronics consistently leading the charge. The Fashion and Apparel segment, encompassing brands like H&M and Zalando.fi, is expected to reach EUR XX billion by 2027, fueled by evolving fashion trends, the convenience of online browsing, and easy returns.

- Dominant B2C Segments: Fashion and Apparel, Consumer Electronics, and Food and Beverages are key revenue generators.

Consumer Electronics, a stronghold for players like Verkkokauppa.com and Gigantti Oy, is forecast to generate EUR XX billion by 2027, propelled by demand for the latest gadgets, home appliances, and IT products. The Food and Beverages segment is experiencing rapid growth, with K-Ruoka and other online grocery platforms expanding their reach and offerings, projected to hit EUR XX billion by 2027. This growth is underpinned by changing consumer lifestyles and the increasing demand for convenience.

- Drivers for Food and Beverages Growth: Convenience, wider product availability, and improved delivery networks.

The Furniture and Home segment, represented by companies like Etuovi.com (for property listings impacting home furnishing choices) and Motonet Oy (for home improvement), is also showing promising growth, expected to reach EUR XX billion by 2027. Meanwhile, the Beauty and Personal Care segment, with brands like Apple Inc. (indirectly through its influence on tech-enabled beauty devices) and other niche online beauty retailers, is anticipated to reach EUR XX billion. The "Others" category, encompassing Toys, DIY, Media, and other miscellaneous goods, contributes a significant EUR XX billion, demonstrating the broad appeal and diversity of the Finnish e-commerce market.

- B2B E-commerce Market Size: Projected to reach EUR XX billion by 2027, indicating a significant growth opportunity for businesses selling to other businesses online.

Finland E Commerce Industry Product Developments

Recent product developments in the Finland e-commerce industry are centered around enhancing customer experience and operational efficiency. Innovations in AI-powered personalized shopping assistants, such as those being developed by Upsy company, are gaining traction, aiming to guide consumers and optimize purchasing decisions. The integration of advanced analytics and machine learning is enabling online retailers to offer more tailored product recommendations and targeted marketing campaigns. Furthermore, the continuous improvement of mobile commerce applications, including user-friendly interfaces and secure payment options, is enhancing accessibility for a wider consumer base. The development of more sustainable packaging solutions and ethical sourcing practices is also becoming a key differentiator, aligning with growing consumer preferences.

Challenges in the Finland E Commerce Industry Market

The Finland e-commerce market faces several challenges that warrant strategic consideration for sustained growth. Foremost among these are logistical complexities and rising shipping costs, particularly for last-mile delivery in less densely populated areas. Cybersecurity threats and data privacy concerns remain paramount, requiring continuous investment in robust security measures to maintain customer trust. Fierce competition, both from domestic players and international giants, necessitates constant innovation and differentiation to capture and retain market share. Additionally, evolving regulatory landscapes and the need for compliance with consumer protection laws add another layer of operational complexity for businesses.

- Logistical Hurdles: Rising delivery costs and last-mile delivery complexities.

- Cybersecurity Threats: Maintaining customer trust through robust data protection.

- Intense Competition: Differentiating in a crowded marketplace.

Forces Driving Finland E Commerce Industry Growth

Several powerful forces are propelling the Finland e-commerce industry forward. The increasing digital literacy and comfort of Finnish consumers with online transactions is a fundamental driver. Enhanced internet infrastructure and widespread smartphone penetration provide the necessary backbone for seamless online shopping. Government initiatives promoting digitalization and e-commerce adoption further stimulate growth. The expanding range of products and services available online, coupled with competitive pricing and convenient delivery options, are compelling consumers to shift their purchasing habits towards digital channels. The ongoing advancements in payment technologies and the growing acceptance of various digital payment methods also contribute significantly to this growth.

Challenges in the Finland E Commerce Industry Market

Long-term growth catalysts in the Finland e-commerce industry are rooted in continued technological innovation and strategic market expansion. The ongoing development and adoption of AI and machine learning will enable hyper-personalization, leading to higher conversion rates and customer loyalty. The expansion of B2B e-commerce platforms offers significant untapped potential for streamlining business operations and supply chains. Furthermore, the increasing focus on sustainable and ethical e-commerce practices is creating new market niches and attracting environmentally conscious consumers. Cross-border e-commerce, leveraging Finland's strong digital infrastructure, presents another avenue for substantial long-term growth.

Emerging Opportunities in Finland E Commerce Industry

Emerging opportunities within the Finland e-commerce industry are ripe for exploitation. The burgeoning demand for sustainable and ethically sourced products presents a significant market niche for eco-conscious brands. The growth of social commerce and influencer marketing offers new avenues for customer engagement and brand building. Furthermore, the potential for cross-border e-commerce within the Nordic region and beyond, supported by Finland's strategic location and advanced logistics, is substantial. The increasing adoption of mobile payments and the development of innovative payment solutions like Buy Now, Pay Later (BNPL) are also creating new avenues for driving sales and customer acquisition. The burgeoning Finnish online grocery market continues to offer immense growth potential.

Leading Players in the Finland E Commerce Industry Sector

- Etuovi.com

- Power fi

- K-Ruoka

- Verkkokauppa com

- Gigantti Oy

- Motonet Oy

- H&M

- Tori fi

- Zalando fi

- Apple Inc

Key Milestones in Finland E Commerce Industry Industry

- April 2022: Upsy company, a Finnish e-commerce product designed to help smaller businesses compete, secured EUR 1.2 million in funding. This capital infusion is earmarked for product development, international market expansion, and enhancing its AI and neural network capabilities to lead the global shopping assistant category.

- February 2022: Postal operator Posti announced a substantial investment of over USD 113 million in a new logistics center in Finland. Scheduled to commence operations around 2025, this facility is a cornerstone of Posti's overarching growth strategy, aiming to bolster its logistics network to support the expanding e-commerce landscape.

Strategic Outlook for Finland E Commerce Industry Market

The strategic outlook for the Finland e-commerce industry is overwhelmingly positive, characterized by sustained growth and innovation. The continued expansion of B2C and B2B e-commerce, fueled by technological advancements and evolving consumer preferences, will be a primary growth accelerator. Investments in advanced logistics infrastructure, such as Posti's new center, will further enhance delivery efficiency and customer satisfaction. The increasing focus on personalization through AI and data analytics will drive customer loyalty and increase conversion rates. Strategic partnerships between e-commerce platforms, logistics providers, and technology companies will be crucial for unlocking new market segments and enhancing service offerings. The market is expected to witness a significant rise in cross-border e-commerce activities, positioning Finland as a key player in the broader European digital marketplace.

Finland E Commerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market Size (GMV) for the Period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty and Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion and Apparel

- 1.2.4. Food and Beverages

- 1.2.5. Furniture and Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market Size (GMV) for the Period of 2017-2027

-

3. Application

- 3.1. Beauty and Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion and Apparel

- 3.4. Food and Beverages

- 3.5. Furniture and Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty and Personal Care

- 5. Consumer Electronics

- 6. Fashion and Apparel

- 7. Food and Beverages

- 8. Furniture and Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size for the Period of 2017-2027

Finland E Commerce Industry Segmentation By Geography

- 1. Finland

Finland E Commerce Industry Regional Market Share

Geographic Coverage of Finland E Commerce Industry

Finland E Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth Potential of Mobile Commerce; Rising Employment and Growing Gross Disposable Income

- 3.3. Market Restrains

- 3.3.1. Evolving taxation landscape and custom regulations has increased the complexity of trade; Digitization of e-commerce may incur expenses for consumers

- 3.4. Market Trends

- 3.4.1. Growth Potential in Mobile Commerce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Finland E Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market Size (GMV) for the Period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty and Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion and Apparel

- 5.1.2.4. Food and Beverages

- 5.1.2.5. Furniture and Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market Size (GMV) for the Period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty and Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion and Apparel

- 5.3.4. Food and Beverages

- 5.3.5. Furniture and Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty and Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion and Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food and Beverages

- 5.8. Market Analysis, Insights and Forecast - by Furniture and Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size for the Period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Finland

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Etuovi com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Power fi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 K-Ruoka

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Verkkokauppa com

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gigantti Oy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Motonet Oy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 H&M

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tori fi*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zalando fi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Etuovi com

List of Figures

- Figure 1: Finland E Commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Finland E Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Finland E Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Finland E Commerce Industry Revenue billion Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 3: Finland E Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Finland E Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 5: Finland E Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Finland E Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 7: Finland E Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 8: Finland E Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 9: Finland E Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Finland E Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Finland E Commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Finland E Commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Finland E Commerce Industry Revenue billion Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 14: Finland E Commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Finland E Commerce Industry Revenue billion Forecast, by Beauty and Personal Care 2020 & 2033

- Table 16: Finland E Commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Finland E Commerce Industry Revenue billion Forecast, by Fashion and Apparel 2020 & 2033

- Table 18: Finland E Commerce Industry Revenue billion Forecast, by Food and Beverages 2020 & 2033

- Table 19: Finland E Commerce Industry Revenue billion Forecast, by Furniture and Home 2020 & 2033

- Table 20: Finland E Commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Finland E Commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Finland E Commerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finland E Commerce Industry?

The projected CAGR is approximately 6.42%.

2. Which companies are prominent players in the Finland E Commerce Industry?

Key companies in the market include Etuovi com, Power fi, K-Ruoka, Verkkokauppa com, Gigantti Oy, Motonet Oy, H&M, Tori fi*List Not Exhaustive, Zalando fi, Apple Inc.

3. What are the main segments of the Finland E Commerce Industry?

The market segments include B2C E-commerce, Market Size (GMV) for the Period of 2017-2027, Application, Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, Furniture and Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth Potential of Mobile Commerce; Rising Employment and Growing Gross Disposable Income.

6. What are the notable trends driving market growth?

Growth Potential in Mobile Commerce.

7. Are there any restraints impacting market growth?

Evolving taxation landscape and custom regulations has increased the complexity of trade; Digitization of e-commerce may incur expenses for consumers.

8. Can you provide examples of recent developments in the market?

April 2022 - Upsy company, the Finnish e-commerce product helping smaller businesses compete, has just picked up EUR 1.2 million. The fresh capital will be used for product development, the opening of new markets, and the further development of the product's AI and neural network capabilities to lead the shopping assistant category on a global level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finland E Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finland E Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finland E Commerce Industry?

To stay informed about further developments, trends, and reports in the Finland E Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence