Key Insights

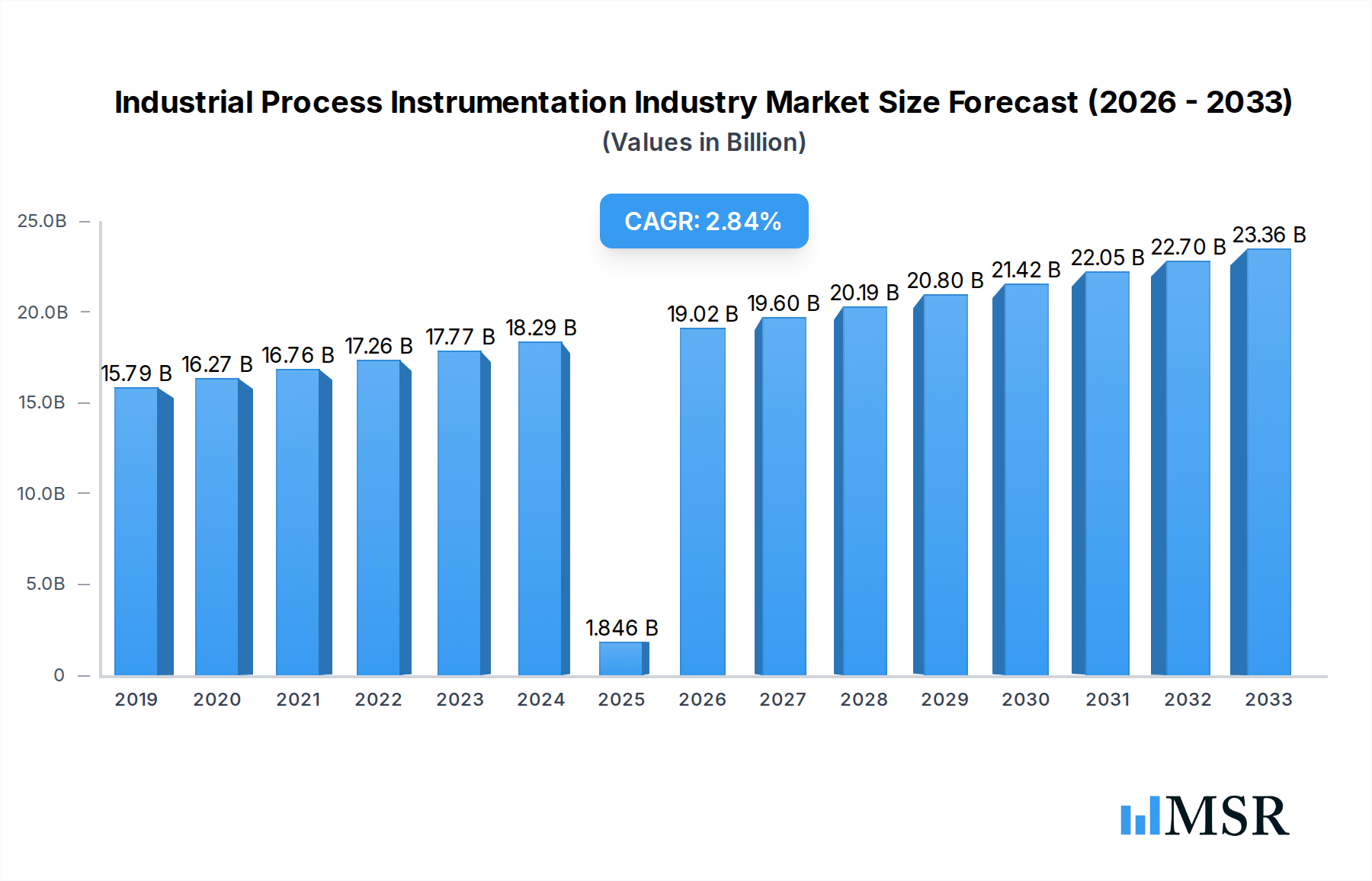

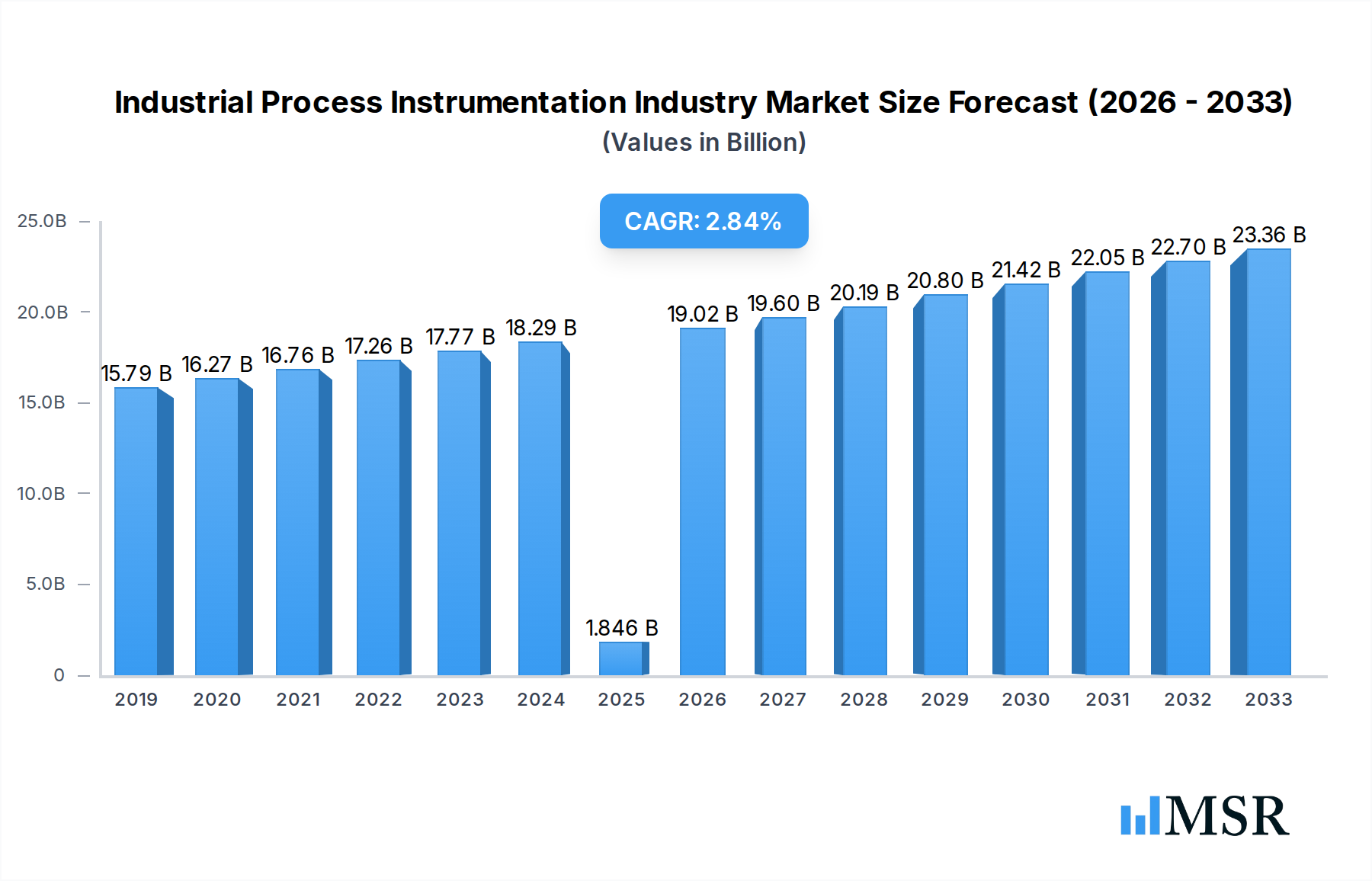

The Industrial Process Instrumentation market is poised for significant expansion, projected to reach $18.46 million in 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 3.35% over the forecast period. This steady growth is underpinned by a confluence of accelerating industrial automation initiatives across diverse sectors and the increasing demand for precise control and monitoring in manufacturing processes. Key drivers include the perpetual need for enhanced operational efficiency, stringent safety regulations mandating sophisticated monitoring systems, and the relentless pursuit of improved product quality through advanced instrumentation. The market is witnessing a strong adoption of Programmable Logic Controllers (PLCs) and Distributed Control Systems (DCS) for their superior automation capabilities, alongside SCADA for comprehensive plant monitoring. The burgeoning need for real-time data acquisition and analysis is further propelling the integration of these technologies, creating a dynamic landscape for growth.

Industrial Process Instrumentation Industry Market Size (In Billion)

The segmentation of the market reveals a strong performance across various end-user industries, with Water and Wastewater Treatment, Chemical Manufacturing, and Energy & Utilities leading the charge in adopting advanced process instrumentation. The Oil and Gas Extraction sector also remains a significant contributor, driven by the imperative for safe and efficient operations. Trends such as the increasing adoption of the Industrial Internet of Things (IIoT) for predictive maintenance and remote monitoring, along with the growing demand for smart sensors and wireless instrumentation, are shaping the future trajectory of this market. While the market is largely driven by these positive forces, restraints such as the high initial investment costs associated with advanced instrumentation and the complexity of integration with legacy systems in some established industries could pose challenges. Nevertheless, the overarching trend towards digital transformation and the critical role of process instrumentation in achieving operational excellence ensure a positive outlook for the industry.

Industrial Process Instrumentation Industry Company Market Share

Here is the SEO-optimized and engaging report description for the Industrial Process Instrumentation Industry, designed for immediate use without modification:

Industrial Process Instrumentation Industry Market Analysis: Comprehensive Report 2025-2033

Gain unparalleled insights into the dynamic Industrial Process Instrumentation Industry with this in-depth market analysis. Covering the Study Period 2019–2033, with a Base Year and Estimated Year of 2025 and a Forecast Period from 2025–2033, this report delves into market dynamics, technological advancements, and strategic opportunities. Discover how leading players like Emerson Electric Company, Metso Corporation, Honeywell International Inc, ABB Ltd, Endress+ Hauser AG, Mitsubishi Electric Corporation, Siemens AG, Danaher Corporation, Omron Corporation, Rockwell Automation Inc, and Yokogawa Electric Corporation are shaping the future of process automation and industrial control systems.

This essential report provides a deep dive into transmitters, control valves, Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA), and Manufacturing Execution Systems (MES) across key end-user sectors including Water and Wastewater Treatment, Chemical Manufacturing, Energy & Utilities, Oil and Gas Extraction, and Metals and Mining. Understand the critical role of smart instrumentation and Industry 4.0 technologies in driving efficiency and compliance in industrial manufacturing.

2024 marks a pivotal point for understanding the trajectory of this multi-Million dollar industry. Whether you are a manufacturer, supplier, investor, or policymaker, this report offers the actionable intelligence needed to navigate the evolving landscape of industrial automation solutions and secure competitive advantages.

Industrial Process Instrumentation Industry Market Concentration & Dynamics

The Industrial Process Instrumentation Industry is characterized by moderate to high market concentration, with a few dominant global players holding significant market share. Key companies like Siemens AG, Emerson Electric Company, and Honeywell International Inc. are at the forefront, driving innovation and influencing market trends. The innovation ecosystem is robust, fueled by continuous R&D investments in areas such as AI-powered analytics, IoT integration, and advanced sensor technologies. Regulatory frameworks, particularly concerning safety, environmental compliance, and data security, play a crucial role in shaping product development and market entry strategies across various regions. Substitute products, while present in certain niche applications, generally face challenges in matching the integrated functionality and reliability offered by established industrial process instrumentation solutions. End-user trends are strongly influenced by the adoption of Industry 4.0 principles, demanding smarter, more connected, and data-driven instrumentation. Mergers and acquisitions (M&A) activities remain a significant driver of market consolidation and strategic expansion. Over the historical period (2019-2024), there have been approximately XX M&A deals, underscoring a trend towards portfolio enhancement and market penetration. Companies are actively seeking to expand their offerings in areas like predictive maintenance and digital twins.

Industrial Process Instrumentation Industry Industry Insights & Trends

The Industrial Process Instrumentation Industry is experiencing robust growth, projected to reach a market size of over $XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is primarily driven by increasing global industrialization, the growing demand for enhanced operational efficiency, and the imperative for stringent compliance with environmental and safety regulations. Technological disruptions, particularly the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), are revolutionizing how process instrumentation is designed, deployed, and utilized. These advancements are enabling more sophisticated data analytics, predictive maintenance capabilities, and remote monitoring, thereby optimizing production processes and reducing downtime. Evolving consumer behaviors within the industry are shifting towards a greater emphasis on sustainable practices, energy efficiency, and digital transformation initiatives. End-users are actively seeking solutions that not only improve productivity but also minimize environmental impact and enhance worker safety. The adoption of smart sensors, connected devices, and cloud-based platforms is accelerating as businesses strive to achieve greater visibility and control over their operations. The shift towards digital twins and virtual commissioning is also gaining traction, offering new avenues for simulation, optimization, and risk mitigation in complex industrial environments. Furthermore, the increasing complexity of manufacturing processes necessitates more advanced and reliable instrumentation to ensure consistent product quality and process integrity.

Key Markets & Segments Leading Industrial Process Instrumentation Industry

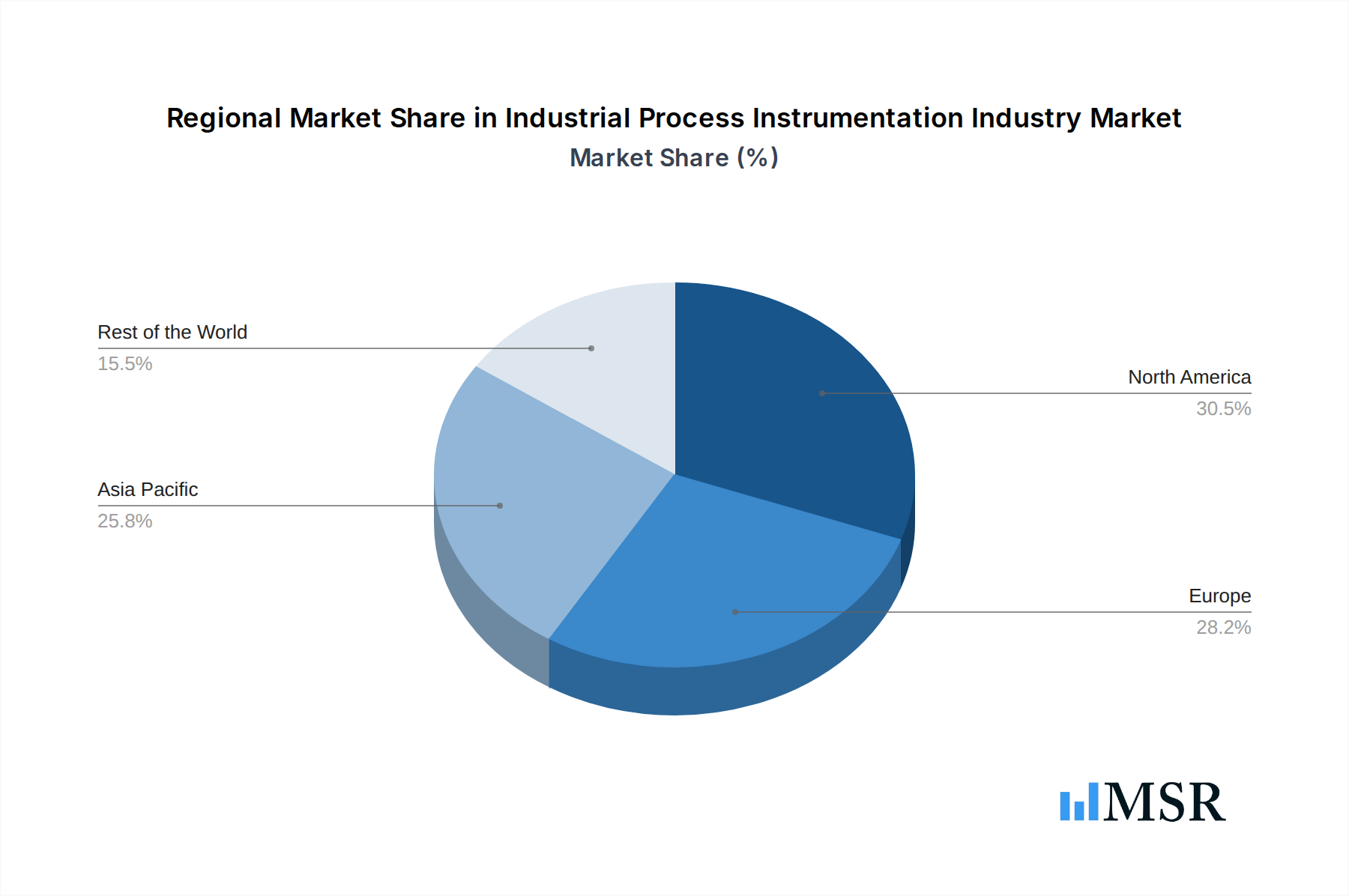

The global Industrial Process Instrumentation Industry is led by dominant regions and segments that are capitalizing on industrial growth and technological adoption. North America and Europe currently represent the largest markets, driven by advanced manufacturing sectors and significant investments in infrastructure and digital transformation. Asia-Pacific, however, is emerging as the fastest-growing region due to rapid industrialization in countries like China and India, and increasing adoption of smart manufacturing technologies.

Instrument Dominance:

- Transmitters: These are foundational to process monitoring and control, with significant demand across all major end-user industries. Their continuous evolution towards greater accuracy, connectivity (e.g., HART, Fieldbus), and diagnostic capabilities fuels their market leadership.

- Control Valves: Essential for regulating flow, pressure, and temperature, control valves are critical components in virtually every industrial process. Advancements in smart valve technology, including integrated diagnostics and fail-safe mechanisms, are driving their growth.

Technology Dominance:

- Programmable Logic Controller (PLC): PLCs remain a cornerstone of industrial automation due to their reliability, flexibility, and cost-effectiveness for discrete and sequential control applications. Their integration with higher-level systems is a key trend.

- Distributed Control System (DCS): DCS solutions are vital for large-scale, continuous process control in industries like chemical manufacturing and energy. Their ability to manage complex operations and provide centralized control is a major driver.

- Supervisory Control and Data Acquisition (SCADA): SCADA systems are indispensable for monitoring and controlling geographically dispersed assets and processes, particularly in utilities and oil & gas. The demand for real-time data and remote access is propelling their market.

- Manufacturing Execution System (MES): MES bridges the gap between enterprise resource planning (ERP) and plant floor operations, providing real-time visibility and control over production. The drive for operational efficiency and quality management strongly supports MES adoption.

End-User Dominance:

- Energy & Utilities: This sector, encompassing power generation, transmission, and distribution, is a massive consumer of process instrumentation. The need for reliable grid management, renewable energy integration, and efficient resource utilization drives significant demand.

- Oil and Gas Extraction: The upstream, midstream, and downstream segments of the oil and gas industry rely heavily on robust instrumentation for exploration, production, refining, and transportation, especially with increased focus on safety and environmental monitoring.

- Chemical Manufacturing: The complexity and hazardous nature of chemical processes necessitate precise and reliable instrumentation for safety, quality control, and process optimization.

- Water and Wastewater Treatment: Growing global populations and stricter water quality regulations are spurring investment in advanced process instrumentation for efficient treatment and management of water resources.

- Metals and Mining: Automation and process control are crucial for optimizing extraction, processing, and refining in the metals and mining sector, particularly with advancements in resource efficiency and environmental stewardship.

Industrial Process Instrumentation Industry Product Developments

Recent product developments highlight a strong focus on enhancing connectivity, intelligence, and user-friendliness. Hawk Measurement Systems (HAWK) has innovated with the industry's first Guided Wave Radar Position Transmitter with Power over Ethernet communications, signaling a leap in asset monitoring and data transmission efficiency. SymphonyAI Industrial’s AI-incorporated MOM 360 solution exemplifies the trend towards intelligent manufacturing operations management, integrating MES capabilities with AI for workflow optimization and Industry 4.0 readiness. AMETEK Process Instruments’ launch of a novel e-commerce platform in the US market signifies a move towards greater accessibility and convenience for customers. Parker Hannifin's introduction of EEMUA 182 compliant EP Series Pro-Bloc instrument valves with dual block and bleed functionality underscores a commitment to safety, reliability, and compliance in critical applications. These innovations collectively point to a market driven by digitalization, advanced analytics, and seamless integration.

Challenges in the Industrial Process Instrumentation Industry Market

The Industrial Process Instrumentation Industry faces several challenges, including stringent and evolving regulatory landscapes that necessitate continuous product adaptation and compliance efforts, impacting development timelines and costs. Supply chain disruptions, exacerbated by geopolitical factors and material shortages, can lead to increased lead times and price volatility for critical components. Intense competitive pressures, particularly from emerging players and the commoditization of certain instrument types, challenge profit margins and require continuous differentiation through innovation. Furthermore, the need for specialized expertise to install, maintain, and operate advanced instrumentation presents a hurdle for some end-users, requiring ongoing training and support investments. The estimated financial impact of these challenges on market growth is approximately XX% annually.

Forces Driving Industrial Process Instrumentation Industry Growth

Several key forces are driving the growth of the Industrial Process Instrumentation Industry. The pervasive adoption of Industry 4.0 principles and the Internet of Things (IoT) is a primary catalyst, fostering the demand for connected, intelligent, and data-rich instrumentation that enables smart manufacturing and predictive maintenance. Economic factors, including global industrial expansion and increased capital expenditure in sectors like energy, manufacturing, and infrastructure, directly translate into higher demand for process control and automation solutions. Growing regulatory mandates concerning environmental protection, worker safety, and product quality are compelling industries to invest in advanced instrumentation for precise monitoring and compliance. Technological advancements, such as AI, machine learning, and advanced sensor technologies, are creating new capabilities and applications, driving innovation and market expansion. The continuous need for enhanced operational efficiency, reduced downtime, and improved process optimization across all industrial sectors further underpins this growth trajectory.

Challenges in the Industrial Process Instrumentation Industry Market

Long-term growth catalysts for the Industrial Process Instrumentation Industry are deeply rooted in the ongoing digital transformation and the increasing complexity of industrial operations. The relentless pursuit of greater operational efficiency, energy savings, and reduced environmental impact will continue to fuel demand for sophisticated instrumentation. Innovations in areas like advanced analytics, digital twins, and cybersecurity for industrial control systems are creating new markets and expanding the utility of existing solutions. Strategic partnerships and collaborations between instrumentation manufacturers, software providers, and system integrators will be crucial for delivering comprehensive, end-to-end solutions that address the evolving needs of diverse industries. Furthermore, the expansion of industrial automation into emerging economies and the retrofitting of older facilities with modern instrumentation represent significant long-term growth opportunities. The industry's ability to adapt to and capitalize on these transformative trends will define its sustained success.

Emerging Opportunities in Industrial Process Instrumentation Industry

Emerging opportunities in the Industrial Process Instrumentation Industry are abundant, driven by new technologies and shifting market demands. The burgeoning field of edge computing presents a significant opportunity for developing intelligent instrumentation that can perform real-time data processing and analysis closer to the source, reducing latency and bandwidth requirements. The growing focus on sustainability and circular economy principles is creating demand for instrumentation that can precisely monitor and optimize resource utilization, waste reduction, and emissions control. The integration of AI and machine learning into instrumentation for advanced predictive maintenance and prescriptive analytics offers a substantial avenue for value creation and differentiation. Furthermore, the expansion of the IIoT ecosystem and the development of standardized communication protocols are opening doors for new interoperable solutions and service models. Exploring niche applications within rapidly growing sectors like advanced manufacturing, biopharmaceuticals, and smart agriculture also presents considerable potential for market expansion.

Leading Players in the Industrial Process Instrumentation Industry Sector

- Emerson Electric Company

- Metso Corporation

- Honeywell International Inc.

- ABB Ltd.

- Endress+ Hauser AG

- Mitsubishi Electric Corporation

- Siemens AG

- Danaher Corporation

- Omron Corporation

- Rockwell Automation Inc.

- Yokogawa Electric Corporation

Key Milestones in Industrial Process Instrumentation Industry Industry

- July 2022: Hawk Measurement Systems (HAWK) launched the industry's first Guided Wave Radar Position Transmitter with Power through Ethernet communications, enhancing asset monitoring and data transmission.

- May 2022: SymphonyAI Industrial launched its AI-incorporated MOM 360 manufacturing operations management solution, integrating MES capabilities and AI for workflow optimization to achieve Industry 4.0 objectives.

- March 2022: AMETEK Process Instruments introduced a novel e-commerce platform for its US market, improving customer accessibility and convenience for purchasing equipment.

- January 2022: Parker Hannifin introduced its new EEMUA 182 compliant EP Series Pro-Bloc instrument valves, featuring dual block and bleed functionality for enhanced safety and reliability.

Strategic Outlook for Industrial Process Instrumentation Industry Market

The strategic outlook for the Industrial Process Instrumentation Industry is exceptionally positive, driven by the accelerating pace of digital transformation and the increasing demand for sophisticated automation solutions. Key growth accelerators include the continued integration of AI and machine learning for predictive and prescriptive analytics, enabling industries to move beyond reactive maintenance to proactive optimization. The expansion of the Industrial Internet of Things (IIoT) ecosystem and the development of robust cybersecurity solutions for connected industrial environments will be critical. Furthermore, a strong emphasis on sustainability and the need for precise instrumentation to monitor and manage environmental impact will create significant market opportunities. Companies that focus on developing integrated, end-to-end solutions, leveraging cloud technologies, and fostering strategic partnerships will be well-positioned to capitalize on future market potential and achieve sustained competitive advantage. The ongoing development of smart infrastructure and the increasing adoption of automation in emerging economies will further propel market growth.

Industrial Process Instrumentation Industry Segmentation

-

1. Instrument

- 1.1. Transmitter

- 1.2. Control Valve

-

2. Technology

- 2.1. Programmable Logic Controller (PLC)

- 2.2. Distributed Control System (DCS)

- 2.3. Supervisory Control and Data Acquisition (SCADA)

- 2.4. Manufacturing Execution System (MES)

-

3. End-User

- 3.1. Water and Wastewater Treatment

- 3.2. Chemical Manufacturing

- 3.3. Energy & Utilities

- 3.4. Oil and Gas Extraction

- 3.5. Metals and Mining

- 3.6. Other Process Industries

Industrial Process Instrumentation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Process Instrumentation Industry Regional Market Share

Geographic Coverage of Industrial Process Instrumentation Industry

Industrial Process Instrumentation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for energy-efficient production processes; High level of efficiency with minimum cost

- 3.3. Market Restrains

- 3.3.1. Higher cost of research and development; Higher cost of implementation and maintenance of solutions and devices

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Treatment is Expected to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Instrument

- 5.1.1. Transmitter

- 5.1.2. Control Valve

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Programmable Logic Controller (PLC)

- 5.2.2. Distributed Control System (DCS)

- 5.2.3. Supervisory Control and Data Acquisition (SCADA)

- 5.2.4. Manufacturing Execution System (MES)

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Water and Wastewater Treatment

- 5.3.2. Chemical Manufacturing

- 5.3.3. Energy & Utilities

- 5.3.4. Oil and Gas Extraction

- 5.3.5. Metals and Mining

- 5.3.6. Other Process Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Instrument

- 6. North America Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Instrument

- 6.1.1. Transmitter

- 6.1.2. Control Valve

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Programmable Logic Controller (PLC)

- 6.2.2. Distributed Control System (DCS)

- 6.2.3. Supervisory Control and Data Acquisition (SCADA)

- 6.2.4. Manufacturing Execution System (MES)

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Water and Wastewater Treatment

- 6.3.2. Chemical Manufacturing

- 6.3.3. Energy & Utilities

- 6.3.4. Oil and Gas Extraction

- 6.3.5. Metals and Mining

- 6.3.6. Other Process Industries

- 6.1. Market Analysis, Insights and Forecast - by Instrument

- 7. Europe Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Instrument

- 7.1.1. Transmitter

- 7.1.2. Control Valve

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Programmable Logic Controller (PLC)

- 7.2.2. Distributed Control System (DCS)

- 7.2.3. Supervisory Control and Data Acquisition (SCADA)

- 7.2.4. Manufacturing Execution System (MES)

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Water and Wastewater Treatment

- 7.3.2. Chemical Manufacturing

- 7.3.3. Energy & Utilities

- 7.3.4. Oil and Gas Extraction

- 7.3.5. Metals and Mining

- 7.3.6. Other Process Industries

- 7.1. Market Analysis, Insights and Forecast - by Instrument

- 8. Asia Pacific Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Instrument

- 8.1.1. Transmitter

- 8.1.2. Control Valve

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Programmable Logic Controller (PLC)

- 8.2.2. Distributed Control System (DCS)

- 8.2.3. Supervisory Control and Data Acquisition (SCADA)

- 8.2.4. Manufacturing Execution System (MES)

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Water and Wastewater Treatment

- 8.3.2. Chemical Manufacturing

- 8.3.3. Energy & Utilities

- 8.3.4. Oil and Gas Extraction

- 8.3.5. Metals and Mining

- 8.3.6. Other Process Industries

- 8.1. Market Analysis, Insights and Forecast - by Instrument

- 9. Rest of the World Industrial Process Instrumentation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Instrument

- 9.1.1. Transmitter

- 9.1.2. Control Valve

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Programmable Logic Controller (PLC)

- 9.2.2. Distributed Control System (DCS)

- 9.2.3. Supervisory Control and Data Acquisition (SCADA)

- 9.2.4. Manufacturing Execution System (MES)

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Water and Wastewater Treatment

- 9.3.2. Chemical Manufacturing

- 9.3.3. Energy & Utilities

- 9.3.4. Oil and Gas Extraction

- 9.3.5. Metals and Mining

- 9.3.6. Other Process Industries

- 9.1. Market Analysis, Insights and Forecast - by Instrument

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Emerson Electric Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Metso Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 ABB Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Endress+ Hauser AG *List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Electric Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Danaher Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Omron Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Rockwell Automation Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yokogawa Electric Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Emerson Electric Company

List of Figures

- Figure 1: Global Industrial Process Instrumentation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 3: North America Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 4: North America Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 11: Europe Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 12: Europe Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 19: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 20: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by Instrument 2025 & 2033

- Figure 27: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by Instrument 2025 & 2033

- Figure 28: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Rest of the World Industrial Process Instrumentation Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Industrial Process Instrumentation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 2: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 6: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 10: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 14: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 15: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Instrument 2020 & 2033

- Table 18: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Industrial Process Instrumentation Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Process Instrumentation Industry?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Industrial Process Instrumentation Industry?

Key companies in the market include Emerson Electric Company, Metso Corporation, Honeywell International Inc, ABB Ltd, Endress+ Hauser AG *List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Danaher Corporation, Omron Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation.

3. What are the main segments of the Industrial Process Instrumentation Industry?

The market segments include Instrument, Technology , End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for energy-efficient production processes; High level of efficiency with minimum cost.

6. What are the notable trends driving market growth?

Water and Wastewater Treatment is Expected to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

Higher cost of research and development; Higher cost of implementation and maintenance of solutions and devices.

8. Can you provide examples of recent developments in the market?

July 2022 - Hawk Measurement Systems (HAWK), a pioneer in positioning, level, asset monitoring, and fiber optical monitoring systems, created the industry's first Guided Wave Radar Position Transmitter with Power through Ethernet communications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Process Instrumentation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Process Instrumentation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Process Instrumentation Industry?

To stay informed about further developments, trends, and reports in the Industrial Process Instrumentation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence