Key Insights

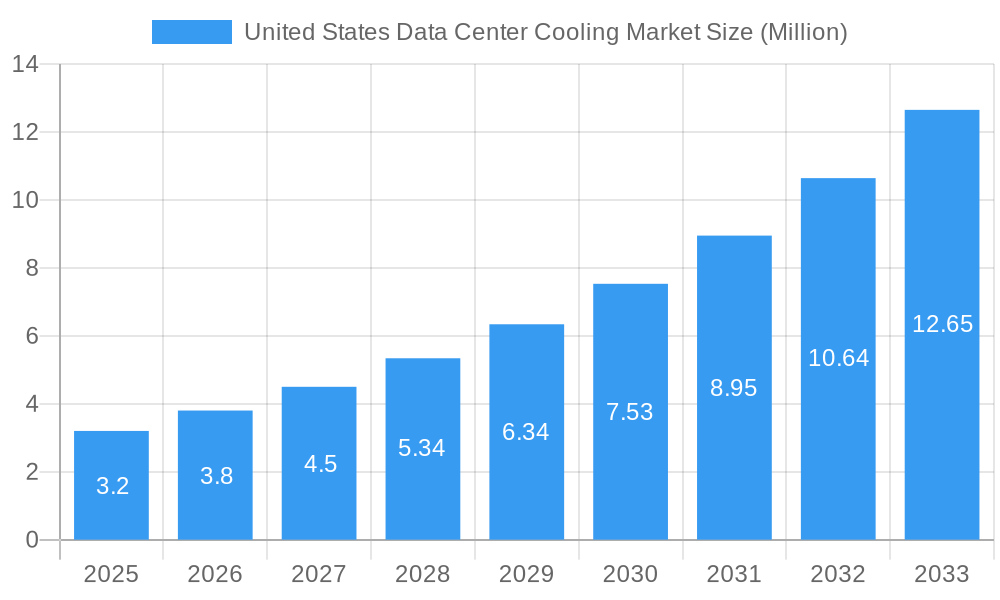

The United States Data Center Cooling Market is experiencing robust expansion, projected to reach an impressive $3.20 Million by 2025. This dynamic growth is fueled by a significant Compound Annual Growth Rate (CAGR) of 18.90%, indicating a strong and sustained upward trajectory. The escalating demand for data processing power, driven by the proliferation of cloud computing, big data analytics, and the burgeoning Internet of Things (IoT), is a primary catalyst. As data centers become more dense and power-hungry, efficient and advanced cooling solutions are paramount to maintain optimal operating temperatures and prevent hardware failure. Hyperscalers, with their massive data infrastructure needs, are leading this charge, investing heavily in state-of-the-art cooling technologies.

United States Data Center Cooling Market Market Size (In Million)

The market's evolution is further shaped by the increasing adoption of liquid-based cooling solutions, such as immersion cooling and direct-to-chip cooling, which offer superior thermal management capabilities compared to traditional air-based methods. While air-based cooling, including chillers, CRAC units, and economizers, remains a significant segment, the trend is leaning towards more energy-efficient and higher-performance liquid alternatives. The IT and Telecom sector is the dominant end-user industry, but significant growth is also anticipated from healthcare and media & entertainment, both increasingly reliant on robust data infrastructure. While hyperscalers and enterprise data centers are key consumers, the colocation segment is also witnessing substantial investment, further driving the need for advanced cooling. This market is characterized by intense competition among established players like Johnson Controls, Schneider Electric, and Vertiv, all vying to offer innovative and sustainable cooling solutions that address the growing thermal challenges in the US data center landscape.

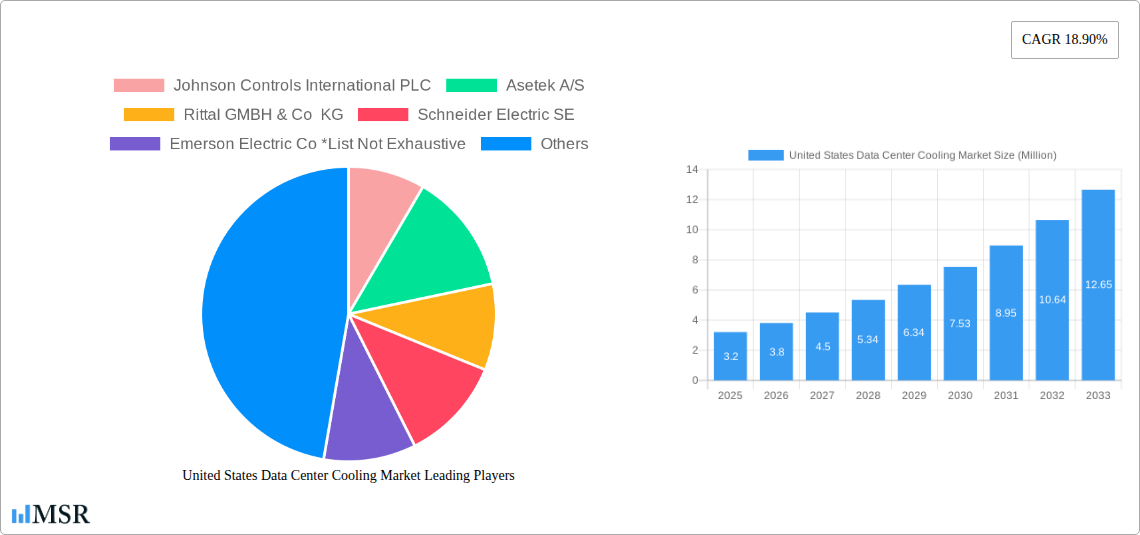

United States Data Center Cooling Market Company Market Share

United States Data Center Cooling Market: Comprehensive Analysis & Growth Projections (2019-2033)

**Gain actionable intelligence on the dynamic United States data center cooling market. This in-depth report provides a definitive forecast from 2025-2033, building upon historical data from 2019-2024. Essential for data center operators, IT infrastructure providers, technology vendors, and investors, this analysis delves into market size, growth drivers, competitive landscape, and emerging opportunities in *data center liquid cooling*, *hyperscale data center cooling*, *enterprise data center cooling*, and *colocation data center cooling*. We dissect key segments including *air-based cooling* (chillers, CRAHs) and liquid-based cooling (immersion cooling, direct-to-chip cooling), and analyze end-user industries such as IT and Telecom, Healthcare, and Federal Agencies. Discover key industry developments and strategic imperatives shaping the future of US data center infrastructure.

United States Data Center Cooling Market Market Concentration & Dynamics

The United States data center cooling market exhibits a moderate to high level of market concentration, driven by significant capital investments and the need for specialized expertise. Key players like Johnson Controls International PLC, Schneider Electric SE, and Vertiv Group Corp hold substantial market shares due to their extensive product portfolios and established service networks. Innovation ecosystems are thriving, with continuous R&D in advanced liquid cooling solutions and energy-efficient air-based cooling technologies. Regulatory frameworks, particularly concerning energy efficiency and environmental impact, are increasingly influencing market dynamics, pushing for sustainable cooling practices. The threat of substitute products remains low for core cooling functions, but integration with smart building management systems and advanced AI-driven optimization are emerging as competitive differentiators. End-user trends are heavily influenced by the exponential growth in data generated by AI, IoT, and high-performance computing, demanding more powerful and efficient cooling solutions. Mergers and acquisition (M&A) activities are observed as companies seek to expand their geographic reach, technological capabilities, and product offerings. For instance, recent strategic partnerships, like the one between Kelvion and Rosseau for enhanced immersion cooling, signal a consolidation of expertise. Over the historical period (2019-2024), M&A deal counts have seen a steady increase, reflecting the market's drive for scale and innovation.

United States Data Center Cooling Market Industry Insights & Trends

The United States data center cooling market is poised for substantial growth, driven by the insatiable demand for digital infrastructure and the increasing power density of modern IT hardware. The market size is projected to reach approximately $XX Billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by several pivotal factors. Firstly, the rapid proliferation of hyperscale data centers catering to cloud computing giants like AWS, Google Cloud, and Microsoft Azure necessitates advanced cooling to manage immense heat loads. Secondly, the burgeoning adoption of Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC) is creating unprecedented processing power, leading to significantly higher thermal outputs per rack, making traditional air cooling insufficient and driving the adoption of liquid cooling technologies such as direct-to-chip cooling and immersion cooling. The ongoing digital transformation across various sectors, including IT and Telecom, Healthcare, and Media and Entertainment, further amplifies the need for robust and scalable data center facilities, consequently boosting the demand for sophisticated cooling systems.

Furthermore, government initiatives promoting energy efficiency and sustainability are creating a favorable environment for the deployment of eco-friendly cooling solutions. The increasing focus on edge computing and the decentralization of data processing also contribute to market growth, as smaller, localized data centers require efficient and compact cooling systems. Technological disruptions, such as the development of more efficient chillers and economizers within air-based cooling, and advancements in rear-door heat exchangers, are continuously pushing the boundaries of thermal management. Evolving consumer behaviors, characterized by an increasing reliance on data-intensive applications and services, directly translate into higher data center utilization and, therefore, greater demand for effective cooling. The energy consumption of data centers is a critical concern, and the market is witnessing a strong trend towards solutions that minimize operational expenditure while maximizing cooling performance. This includes the adoption of free cooling techniques, advanced liquid cooling for direct heat removal, and intelligent power management systems integrated with cooling infrastructure. The commitment to reducing the carbon footprint of data centers is a significant long-term driver, pushing innovation towards greener and more sustainable cooling methods.

Key Markets & Segments Leading United States Data Center Cooling Market

The United States data center cooling market is dominated by several key segments, each contributing significantly to the overall market expansion. Within Cooling Technology, Air-based Cooling currently holds a substantial market share, primarily driven by established infrastructure and cost-effectiveness for moderate-density environments. This includes Chillers and Economizers which are crucial for large-scale facilities, and Computer Room Air Handlers (CRAHs), a staple in most data centers. However, Liquid-based Cooling is experiencing rapid growth and is set to capture a larger market share in the coming years. This surge is propelled by the increasing adoption of Direct-to-chip Cooling and Immersion Cooling technologies, essential for managing the extreme heat generated by modern, high-density computing loads prevalent in AI and HPC applications. The growth in Liquid-based Cooling is further supported by advancements in Rear-door Heat Exchangers, offering a more targeted and efficient cooling approach.

In terms of Type, Hyperscalers (Owned and Leased) represent the largest and fastest-growing segment. The massive scale of hyperscale operations, driven by global cloud providers, necessitates continuous investment in state-of-the-art cooling infrastructure. Colocation data centers also contribute significantly, as they cater to a diverse range of clients requiring scalable and efficient cooling solutions. While Enterprise (On-premise) data centers continue to invest, their growth trajectory is less steep compared to hyperscale and colocation, often focusing on upgrading existing facilities rather than building new ones at the same pace.

The End-user Industry landscape is led by IT and Telecom, which is the primary driver of data center growth due to cloud computing, mobile data, and network infrastructure demands. The Federal and Institutional Agencies segment is also a significant contributor, with increasing investments in secure and high-performance computing for defense, research, and public services. The Healthcare industry is experiencing a notable rise in data center cooling needs due to the digitization of medical records, advancements in medical imaging, and the growth of telehealth. The Media and Entertainment sector also contributes to demand, driven by the explosion of streaming services, content creation, and data analytics for personalized experiences. The Other End-user Industry category, encompassing finance, manufacturing, and retail, also shows consistent demand for reliable data center cooling as they undergo digital transformation.

Key drivers for Air-based Cooling dominance include:

- Established Infrastructure and Expertise: Widespread familiarity and readily available maintenance.

- Lower Initial Investment for Lower Densities: Cost-effective for traditional racks.

Key drivers for Liquid-based Cooling growth include:

- Rising Power Densities: Essential for AI/ML and HPC workloads exceeding 30kW per rack.

- Energy Efficiency Gains: Potential for significant reductions in PUE (Power Usage Effectiveness).

- Space Optimization: Higher cooling capacity in a smaller footprint.

- Technological Advancements: Improved reliability and scalability of immersion and direct-to-chip solutions.

United States Data Center Cooling Market Product Developments

The United States data center cooling market is witnessing a wave of innovative product developments aimed at enhancing thermal management efficiency and sustainability. Companies are actively developing advanced liquid cooling solutions, including more efficient immersion cooling fluids and modular direct-to-chip cooling systems capable of handling extreme heat loads from next-generation processors. Simultaneously, enhancements in air-based cooling are ongoing, with smarter CRAHs and more efficient chiller and economizer systems being introduced. The market relevance of these developments is paramount, as they directly address the growing challenges of power consumption, operational costs, and the increasing thermal demands of AI and HPC workloads. These advancements provide a competitive edge by enabling data center operators to achieve higher densities, improve energy efficiency, and meet stringent environmental regulations.

Challenges in the United States Data Center Cooling Market Market

The United States data center cooling market faces several significant challenges that could impede growth. A primary hurdle is the high initial cost of advanced liquid cooling solutions, which can be a deterrent for some organizations, particularly smaller enterprises. Supply chain disruptions for specialized components, exacerbated by global geopolitical factors, can lead to project delays and increased costs. Furthermore, the lack of skilled personnel proficient in installing, operating, and maintaining advanced cooling systems, especially liquid cooling technologies, poses a substantial restraint. Regulatory compliance and evolving energy efficiency standards can also create complexities, requiring continuous adaptation and investment. Lastly, operational complexity and maintenance requirements for some advanced cooling systems necessitate a shift in operational paradigms for many data center operators.

Forces Driving United States Data Center Cooling Market Growth

Several powerful forces are propelling the growth of the United States data center cooling market. The relentless expansion of cloud computing and hyperscale data centers is a primary driver, requiring ever-increasing capacity and advanced cooling. The explosive growth of Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC) applications generates immense heat densities, necessitating more potent cooling solutions like liquid cooling. The ongoing digital transformation across all industries fuels demand for more data processing and storage, directly impacting data center infrastructure needs. Furthermore, increasing government investments in critical infrastructure and national security translate into substantial data center build-outs requiring robust cooling. Finally, a growing focus on sustainability and energy efficiency encourages the adoption of advanced cooling technologies that reduce operational costs and environmental impact.

Challenges in the United States Data Center Cooling Market Market

Long-term growth catalysts for the United States data center cooling market are deeply intertwined with technological innovation and strategic market expansions. The continuous evolution of AI and HPC workloads will create an enduring demand for cutting-edge liquid cooling solutions, including more efficient immersion cooling and direct-to-chip cooling technologies. Partnerships and collaborations between technology providers, such as the recent Kelvion and Rosseau alliance, will accelerate the development and deployment of these advanced solutions. Furthermore, the increasing demand for edge computing will drive the development of compact and highly efficient cooling systems for distributed data centers. Government incentives for green data center initiatives and the pursuit of net-zero carbon emissions will also serve as long-term growth catalysts, pushing the market towards more sustainable cooling practices and driving adoption of innovative, energy-saving technologies.

Emerging Opportunities in United States Data Center Cooling Market

Emerging opportunities in the United States data center cooling market are diverse and promising. The rapid expansion of the edge computing segment presents a significant opportunity for developing compact, modular, and highly efficient cooling solutions tailored for localized data processing. The growing demand for sustainable and green data center solutions creates a market for innovative cooling technologies that minimize energy consumption and water usage. The increasing adoption of AI and ML in data center operations itself offers opportunities for AI-powered cooling management systems that optimize performance and reduce costs. Furthermore, the development of specialized cooling solutions for high-density computing environments within sectors like scientific research, financial modeling, and autonomous vehicle development represents a niche but rapidly growing market segment. The trend towards modular data centers also opens avenues for pre-engineered cooling modules that can be rapidly deployed.

Leading Players in the United States Data Center Cooling Market Sector

- Johnson Controls International PLC

- Asetek A/S

- Rittal GMBH & Co KG

- Schneider Electric SE

- Emerson Electric Co

- Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- Fujitsu General Limited

- Stulz GmbH

- Airedale International Air Conditioning

- Vertiv Group Corp

Key Milestones in United States Data Center Cooling Market Industry

- March 2024: German heat exchanger manufacturer Kelvion and US immersion cooling company Rosseau announced a partnership to deliver enhanced immersion cooling solutions for the high-performance computing (HPC) market.

- January 2024: Data center firm Aligned launched a new liquid cooling system called DeltaFlow. The liquid cooling technology is designed to support high-density computing requirements and supercomputers and can cool densities up to 300 kW per rack. The new DeltaFlow system works simultaneously with Aligned's air-cooled Delta technology, enabling no change in power delivery or existing data hall temperatures.

Strategic Outlook for United States Data Center Cooling Market Market

The strategic outlook for the United States data center cooling market is overwhelmingly positive, driven by sustained demand and continuous innovation. Key growth accelerators include the ongoing surge in AI and HPC workloads, necessitating the widespread adoption of advanced liquid cooling technologies. The continued expansion of hyperscale and colocation data centers will maintain a strong demand for both traditional and next-generation cooling systems. Strategic opportunities lie in developing and marketing highly energy-efficient solutions that align with increasing sustainability mandates. Furthermore, companies that can offer integrated cooling solutions, encompassing hardware, software, and services, will be well-positioned to capture market share. The focus on innovation in modular and scalable cooling architectures, catering to the evolving needs of edge computing and distributed data centers, will be crucial for long-term success.

United States Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-chip Cooling

- 1.2.3. Rear-door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscalers (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Industry

United States Data Center Cooling Market Segmentation By Geography

- 1. United States

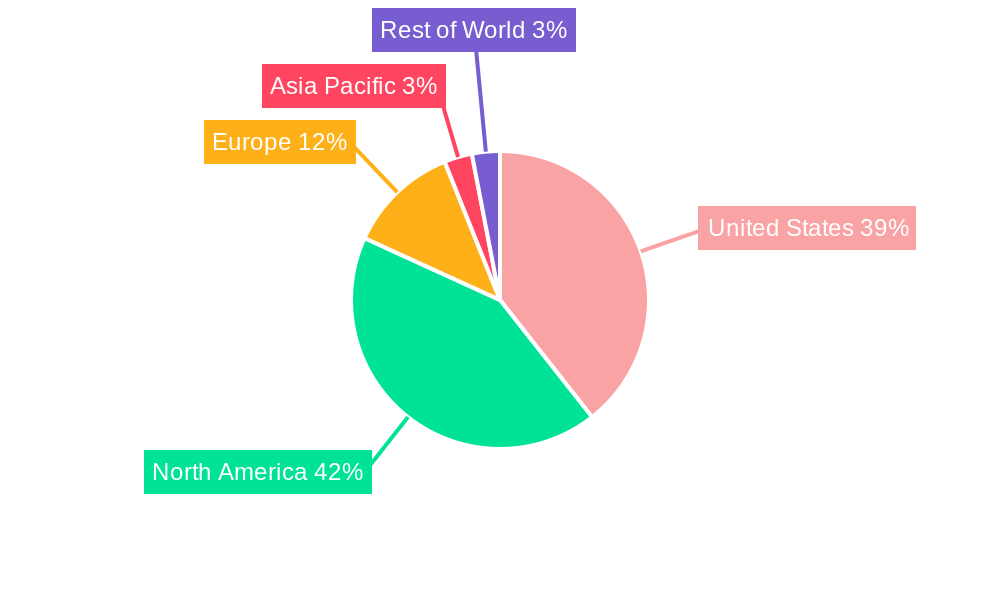

United States Data Center Cooling Market Regional Market Share

Geographic Coverage of United States Data Center Cooling Market

United States Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-Performance Computing across Europe; Growing Rack Power Density

- 3.3. Market Restrains

- 3.3.1 Cost

- 3.3.2 Adaptability Requirement and Power Outages

- 3.4. Market Trends

- 3.4.1. The IT & Telecommunication Segment Holds the Majority Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Data Center Cooling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-chip Cooling

- 5.1.2.3. Rear-door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscalers (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Industry

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Asetek A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rittal GMBH & Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emerson Electric Co *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujitsu General Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stulz GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Airedale International Air Conditioning

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: United States Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Data Center Cooling Market Share (%) by Company 2025

List of Tables

- Table 1: United States Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2020 & 2033

- Table 2: United States Data Center Cooling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: United States Data Center Cooling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2020 & 2033

- Table 6: United States Data Center Cooling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States Data Center Cooling Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: United States Data Center Cooling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Data Center Cooling Market?

The projected CAGR is approximately 18.90%.

2. Which companies are prominent players in the United States Data Center Cooling Market?

Key companies in the market include Johnson Controls International PLC, Asetek A/S, Rittal GMBH & Co KG, Schneider Electric SE, Emerson Electric Co *List Not Exhaustive, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, Fujitsu General Limited, Stulz GmbH, Airedale International Air Conditioning, Vertiv Group Corp.

3. What are the main segments of the United States Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-Performance Computing across Europe; Growing Rack Power Density.

6. What are the notable trends driving market growth?

The IT & Telecommunication Segment Holds the Majority Share.

7. Are there any restraints impacting market growth?

Cost. Adaptability Requirement and Power Outages.

8. Can you provide examples of recent developments in the market?

March 2024: German heat exchanger manufacturer Kelvion and US immersion cooling company Rosseau announced a partnership to deliver enhanced immersion cooling solutions for the high-performance computing (HPC) market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the United States Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence