Key Insights

The global Safety Instrumented Systems (SIS) market is poised for significant growth, projected to reach $4784.1 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.4% through 2033. This expansion is driven by the increasing implementation of stringent safety regulations across industries and the growing complexity of industrial processes requiring advanced protective measures. Heightened awareness of the severe consequences of industrial accidents, both human and financial, is a key demand driver for reliable SIS. Critical applications like Emergency Shutdown Systems (ESD) and Fire and Gas Monitoring and Control (F&GC) are pivotal to this growth, offering essential protection against catastrophic events. The Chemicals and Petrochemicals sector, alongside Power Generation, are leading SIS adoption due to their inherently high-risk operational environments.

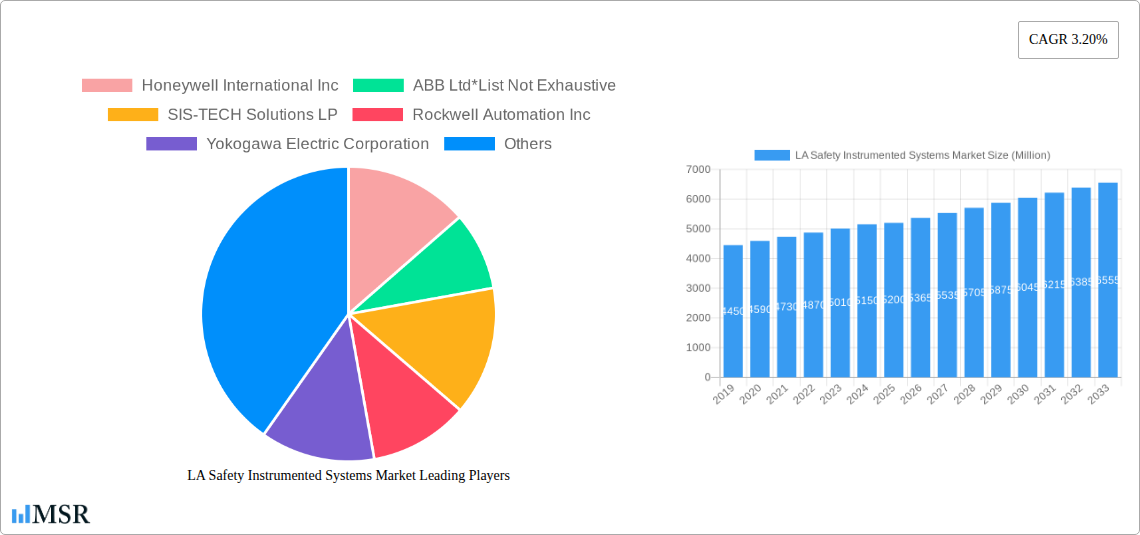

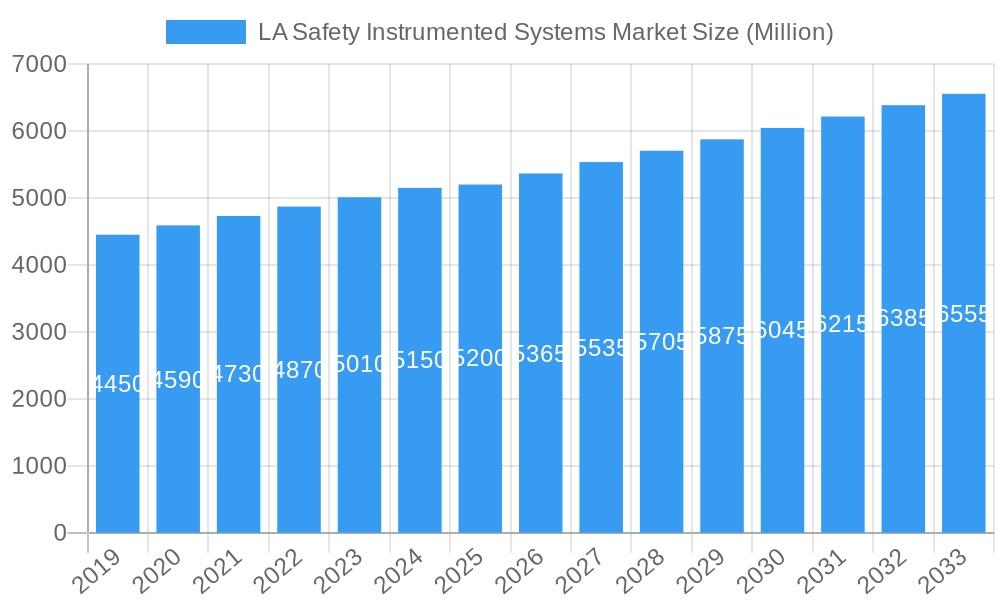

LA Safety Instrumented Systems Market Market Size (In Billion)

Emerging trends, including the integration of Industrial Internet of Things (IIoT) and artificial intelligence (AI) into SIS, are enhancing predictive capabilities and real-time monitoring, thereby improving overall safety performance. Advanced diagnostics and remote monitoring solutions are also gaining traction, enabling proactive maintenance and reduced downtime. While technological advancements and regulatory mandates drive market benefits, restraints such as high initial investment costs for sophisticated SIS and a shortage of skilled personnel for installation and maintenance present challenges to widespread adoption, particularly in developing regions. Nonetheless, the unwavering commitment to enhanced operational safety and continuous innovation in SIS technology are expected to propel the market forward, with substantial opportunities in regions like Asia Pacific and North America.

LA Safety Instrumented Systems Market Company Market Share

Gain critical insights into the global Safety Instrumented Systems (SIS) Market with our comprehensive, SEO-optimized report. Spanning a study period from 2019 to 2033, with a base year of 2025, this research offers an exhaustive analysis of market dynamics, industry trends, key segments, and leading players. Essential for stakeholders navigating the complex industrial safety landscape, this report delivers actionable intelligence for strategic decision-making. Driven by stringent safety regulations and a growing demand for reliable industrial automation, the Safety Instrumented Systems (SIS) Market is on track for significant expansion. Our research covers the historical period of 2019-2024 and a detailed forecast from 2025-2033, providing a 360-degree view of this vital sector.

LA Safety Instrumented Systems Market Market Concentration & Dynamics

The LA Safety Instrumented Systems (SIS) market exhibits a moderate to high concentration, characterized by the presence of a few dominant global players alongside a growing number of specialized providers. Innovation ecosystems are rapidly evolving, driven by advancements in digital technologies, IIoT integration, and AI-powered diagnostics, fostering a competitive environment. Regulatory frameworks such as IEC 61508 and IEC 61511 are pivotal, dictating design, implementation, and maintenance standards, thereby influencing market entry and product development. Substitute products, while limited in direct replacement for core SIS functionalities, can emerge in the form of advanced process control systems with integrated safety features. End-user trends are increasingly focused on lifecycle management, predictive maintenance, and cybersecurity for SIS, reflecting a shift towards holistic safety solutions. Mergers and Acquisitions (M&A) activity, while not at an all-time high, remains a key strategy for market leaders to expand their technology portfolios, geographical reach, and customer base. For instance, recent M&A activities have focused on acquiring expertise in specialized areas like cybersecurity for critical infrastructure and advanced analytics for SIS performance optimization. The market share distribution is dynamic, with key players continually vying for dominance through technological superiority and comprehensive service offerings. M&A deal counts are expected to fluctuate based on strategic consolidation and the emergence of new technologies.

LA Safety Instrumented Systems Market Industry Insights & Trends

The global LA Safety Instrumented Systems (SIS) market is experiencing robust growth, projected to reach an estimated USD 12,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period of 2025–2033. This expansion is primarily fueled by the escalating need for enhanced industrial safety and the implementation of stringent government regulations across various end-user industries. The increasing complexity of industrial processes, coupled with a growing emphasis on minimizing operational risks and preventing catastrophic failures, necessitates the deployment of sophisticated SIS. Technological disruptions are playing a significant role, with the integration of the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) transforming the functionality and efficiency of SIS. These advancements enable real-time monitoring, predictive maintenance, and remote diagnostics, thereby enhancing system reliability and reducing downtime. Evolving consumer behaviors, particularly within the oil & gas, chemicals, and power generation sectors, are shifting towards integrated safety solutions that offer a comprehensive approach to risk management rather than standalone systems. The demand for fail-safe, highly reliable, and intrinsically safe SIS is paramount, as any failure can lead to severe accidents, environmental damage, and substantial financial losses. Furthermore, the growing awareness of cybersecurity threats targeting industrial control systems is driving the demand for secure and robust SIS solutions, capable of withstanding sophisticated cyber-attacks. The expanding global industrial base, particularly in emerging economies, is also contributing to market growth as new facilities are established and existing ones are upgraded to meet modern safety standards. The proactive adoption of digital twin technology for SIS simulation and testing is another emerging trend that is expected to further accelerate market growth by improving design accuracy and operational efficiency.

Key Markets & Segments Leading LA Safety Instrumented Systems Market

The LA Safety Instrumented Systems (SIS) market is characterized by strong performance across several key segments and regions, driven by distinct industry needs and regulatory landscapes.

Dominant Application Segments:

- Emergency Shutdown Systems (ESD): These systems are fundamental to preventing catastrophic failures and are therefore in high demand across all hazardous industries. Their critical role in immediately halting processes during emergencies makes them a cornerstone of industrial safety.

- Fire and Gas Monitoring and Control (F&GC): Essential for detecting and mitigating fire and gas leaks, F&GC systems are indispensable in sectors such as oil & gas, chemicals, and petrochemicals, where the risk of such incidents is inherently high.

- High Integrity Pressure Protection Systems (HIPPS): As industrial processes operate under increasingly demanding pressure conditions, HIPPS are crucial for preventing over-pressurization and subsequent equipment damage or hazardous releases. Their implementation is driven by stringent safety standards and the high cost of potential failures.

Dominant End-User Industries:

- Chemicals and Petrochemicals: This sector consistently represents the largest market share due to the inherent risks associated with handling volatile substances, stringent regulatory compliance, and the scale of operations. The need for robust ESD, F&GC, and HIPPS is paramount.

- Oil & Gas: From upstream exploration and production to downstream refining, the oil and gas industry relies heavily on SIS to ensure safe operations, especially in offshore platforms, refineries, and pipelines. The increasing complexity of exploration and the drive for enhanced recovery further boost demand.

- Power Generation: With a growing global demand for electricity, power plants (including thermal, nuclear, and renewable) require reliable SIS to manage critical processes, prevent accidents, and ensure continuous operation. Burner Management Systems (BMS) are particularly critical in thermal power generation.

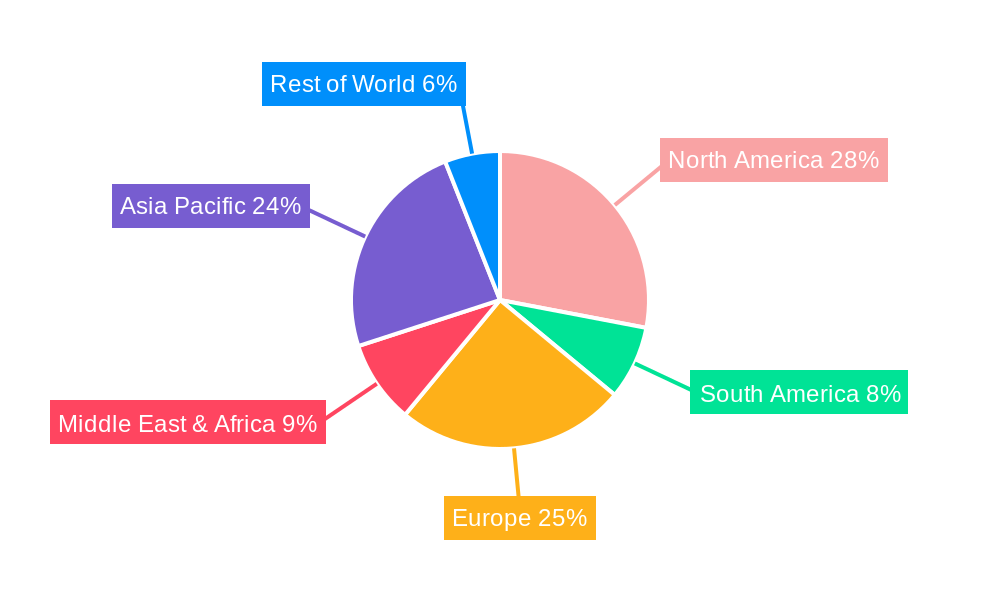

Regional Dominance:

- North America and Europe: These regions continue to lead the LA Safety Instrumented Systems market due to well-established industrial bases, rigorous safety regulations, and high adoption rates of advanced technologies. Economic growth and significant investments in infrastructure and plant upgrades in sectors like petrochemicals and power generation bolster demand.

- Asia Pacific: This region is emerging as a high-growth market, fueled by rapid industrialization, increasing foreign direct investment, and a growing emphasis on occupational safety and environmental protection. The expanding oil & gas and chemical industries, particularly in China and India, are significant growth drivers.

The dominance of these segments and regions is underpinned by economic growth, the imperative of infrastructure safety, and evolving safety consciousness. Manufacturers and service providers are strategically focusing their resources and product development efforts to cater to the specific requirements and regulatory demands of these leading markets.

LA Safety Instrumented Systems Market Product Developments

The LA Safety Instrumented Systems (SIS) market is witnessing continuous innovation focused on enhancing reliability, intelligence, and cybersecurity. Leading manufacturers are integrating advanced diagnostics and self-checking capabilities into their SIS, allowing for early detection of potential faults and predictive maintenance. The incorporation of IIoT connectivity enables real-time data streaming and remote monitoring, facilitating proactive safety management. Furthermore, there is a significant push towards developing SIS solutions that are inherently cyber-resilient, offering robust protection against evolving cyber threats. These product developments are directly impacting market relevance by enabling industries to achieve higher safety integrity levels (SIL), reduce operational risks, and ensure compliance with increasingly stringent global safety standards. Innovations in areas like functional safety management software and integrated safety and automation platforms are also gaining traction, offering a more holistic approach to plant safety.

Challenges in the LA Safety Instrumented Systems Market Market

The LA Safety Instrumented Systems (SIS) market faces several significant challenges. Regulatory complexity and evolving compliance standards necessitate continuous adaptation and investment in system upgrades, posing a barrier for smaller enterprises. The high cost of initial implementation and maintenance can be prohibitive, particularly for organizations in developing economies. The shortage of skilled personnel with expertise in designing, implementing, and maintaining SIS is a growing concern, impacting project timelines and operational efficiency. Cybersecurity threats targeting critical infrastructure are escalating, demanding robust and constantly updated security protocols for SIS, which adds complexity and cost. Finally, interoperability issues between different vendors' SIS components can hinder seamless integration and lifecycle management, impacting overall system performance.

Forces Driving LA Safety Instrumented Systems Market Growth

Several key forces are propelling the growth of the LA Safety Instrumented Systems (SIS) market. Stringent government regulations and industry standards, such as IEC 61508 and IEC 61511, mandate the implementation of SIS to ensure worker safety and environmental protection, creating a consistent demand. The increasing complexity and hazardous nature of industrial processes in sectors like oil & gas and chemicals necessitate advanced safety solutions. Growing awareness of the potential financial and reputational costs of industrial accidents is driving proactive investments in safety systems. Furthermore, technological advancements, including the integration of IIoT, AI, and advanced analytics, are enhancing the functionality and effectiveness of SIS, making them more attractive to end-users. The drive for operational efficiency and reduced downtime also indirectly fuels SIS adoption, as reliable safety systems prevent costly disruptions.

Challenges in the LA Safety Instrumented Systems Market Market

One of the primary long-term growth catalysts for the LA Safety Instrumented Systems (SIS) market is the continuous advancement in digital technologies. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enabling predictive maintenance capabilities, allowing for the early detection of potential system failures before they occur, thus significantly reducing downtime and enhancing safety. Furthermore, the increasing focus on cybersecurity for industrial control systems is creating a demand for integrated safety and security solutions. Innovations in wireless SIS technologies are also paving the way for easier deployment and reduced installation costs, particularly in challenging environments. Partnerships and collaborations between SIS vendors and cybersecurity firms are expected to lead to more comprehensive and robust safety offerings. The expansion of SIS into new and emerging applications, such as renewable energy infrastructure and advanced manufacturing, also presents substantial long-term growth opportunities.

Emerging Opportunities in LA Safety Instrumented Systems Market

Emerging opportunities in the LA Safety Instrumented Systems (SIS) market are abundant, driven by evolving industrial landscapes and technological frontiers. The growing adoption of IIoT and cloud-based solutions is creating opportunities for data-driven safety analytics and remote monitoring services, enhancing lifecycle management. The increasing demand for cybersecurity solutions tailored for SIS in critical infrastructure presents a significant growth avenue, as cyber threats become more sophisticated. Furthermore, the expansion of SIS into niche industries such as pharmaceuticals, food & beverage, and mining, which are also subject to safety regulations, opens up new market segments. The development of integrated safety and automation platforms that offer seamless functionality and data synergy is another promising area. Finally, the increasing focus on sustainability and environmental protection is driving the need for SIS that can effectively manage and mitigate risks associated with complex environmental processes, creating unique opportunities for specialized solutions.

Leading Players in the LA Safety Instrumented Systems Market Sector

- Honeywell International Inc

- ABB Ltd

- SIS-TECH Solutions LP

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Schlumberger Limited

- Emerson Electric Company

Key Milestones in LA Safety Instrumented Systems Market Industry

- July 2022: MSA Safety Incorporated announced a contract for USD 9 million from the London Fire Brigade to supply firefighters with MSA's new M1 Self-Contained Breathing Apparatus (SCBA) and telemetry technology, showcasing advancements in safety equipment for emergency responders.

- June 2022: ABB, working alongside Hyundai Engineering and Técnicas Reunidas, made the largest petrochemical investment in the European region. ABB will deliver several systems aimed at ensuring the complex operates at optimum safety levels, including a Burner Management System (BMS), an Emergency Shutdown System (ESD), and High-Integrity Pressure Protection System (HIPPS). These will be complemented by an industrial cyber security solution focused on mitigating cyber threats toward the complex, highlighting the integration of multiple SIS and cybersecurity measures in large-scale industrial projects.

Strategic Outlook for LA Safety Instrumented Systems Market Market

The strategic outlook for the LA Safety Instrumented Systems (SIS) market is highly positive, driven by an unwavering commitment to industrial safety and the continuous pursuit of operational excellence. Key growth accelerators include the increasing adoption of digital technologies such as AI and IoT, which are transforming SIS from reactive to proactive safety measures through predictive analytics and remote monitoring. The ongoing global emphasis on regulatory compliance and risk mitigation, especially in hazardous industries, will continue to fuel demand for advanced SIS solutions. Strategic opportunities lie in developing integrated cybersecurity solutions for SIS, addressing the growing threat landscape. Furthermore, expanding offerings to emerging markets and niche industrial applications presents significant potential for market penetration. Investments in research and development focused on enhancing SIL ratings, improving system diagnostics, and ensuring seamless interoperability will be crucial for maintaining a competitive edge and driving sustainable growth in the years to come.

LA Safety Instrumented Systems Market Segmentation

-

1. Application

- 1.1. Emergency Shutdown Systems (ESD)

- 1.2. Fire and Gas Monitoring and Control (F&GC)

- 1.3. High Integrity Pressure Protection Systems (HIPPS)

- 1.4. Burner Management Systems (BMS)

- 1.5. Turbo Machinery Control

- 1.6. Other Applications

-

2. End User

- 2.1. Chemicals and Petrochemicals

- 2.2. Power Generation

- 2.3. Pharmaceutical

- 2.4. Food and Beverage

- 2.5. Oil and

- 2.6. Other End Users

LA Safety Instrumented Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LA Safety Instrumented Systems Market Regional Market Share

Geographic Coverage of LA Safety Instrumented Systems Market

LA Safety Instrumented Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Regulatory Environment in the Industry; Presence of Robust SIS Service Ecosystem

- 3.3. Market Restrains

- 3.3.1. Operational Complexity and High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Chemical and Petrochemical Industry is expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LA Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Emergency Shutdown Systems (ESD)

- 5.1.2. Fire and Gas Monitoring and Control (F&GC)

- 5.1.3. High Integrity Pressure Protection Systems (HIPPS)

- 5.1.4. Burner Management Systems (BMS)

- 5.1.5. Turbo Machinery Control

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Chemicals and Petrochemicals

- 5.2.2. Power Generation

- 5.2.3. Pharmaceutical

- 5.2.4. Food and Beverage

- 5.2.5. Oil and

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America LA Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Emergency Shutdown Systems (ESD)

- 6.1.2. Fire and Gas Monitoring and Control (F&GC)

- 6.1.3. High Integrity Pressure Protection Systems (HIPPS)

- 6.1.4. Burner Management Systems (BMS)

- 6.1.5. Turbo Machinery Control

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Chemicals and Petrochemicals

- 6.2.2. Power Generation

- 6.2.3. Pharmaceutical

- 6.2.4. Food and Beverage

- 6.2.5. Oil and

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America LA Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Emergency Shutdown Systems (ESD)

- 7.1.2. Fire and Gas Monitoring and Control (F&GC)

- 7.1.3. High Integrity Pressure Protection Systems (HIPPS)

- 7.1.4. Burner Management Systems (BMS)

- 7.1.5. Turbo Machinery Control

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Chemicals and Petrochemicals

- 7.2.2. Power Generation

- 7.2.3. Pharmaceutical

- 7.2.4. Food and Beverage

- 7.2.5. Oil and

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe LA Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Emergency Shutdown Systems (ESD)

- 8.1.2. Fire and Gas Monitoring and Control (F&GC)

- 8.1.3. High Integrity Pressure Protection Systems (HIPPS)

- 8.1.4. Burner Management Systems (BMS)

- 8.1.5. Turbo Machinery Control

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Chemicals and Petrochemicals

- 8.2.2. Power Generation

- 8.2.3. Pharmaceutical

- 8.2.4. Food and Beverage

- 8.2.5. Oil and

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa LA Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Emergency Shutdown Systems (ESD)

- 9.1.2. Fire and Gas Monitoring and Control (F&GC)

- 9.1.3. High Integrity Pressure Protection Systems (HIPPS)

- 9.1.4. Burner Management Systems (BMS)

- 9.1.5. Turbo Machinery Control

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Chemicals and Petrochemicals

- 9.2.2. Power Generation

- 9.2.3. Pharmaceutical

- 9.2.4. Food and Beverage

- 9.2.5. Oil and

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific LA Safety Instrumented Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Emergency Shutdown Systems (ESD)

- 10.1.2. Fire and Gas Monitoring and Control (F&GC)

- 10.1.3. High Integrity Pressure Protection Systems (HIPPS)

- 10.1.4. Burner Management Systems (BMS)

- 10.1.5. Turbo Machinery Control

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Chemicals and Petrochemicals

- 10.2.2. Power Generation

- 10.2.3. Pharmaceutical

- 10.2.4. Food and Beverage

- 10.2.5. Oil and

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SIS-TECH Solutions LP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rockwell Automation Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yokogawa Electric Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schlumberger Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Emerson Electric Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global LA Safety Instrumented Systems Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America LA Safety Instrumented Systems Market Revenue (million), by Application 2025 & 2033

- Figure 3: North America LA Safety Instrumented Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America LA Safety Instrumented Systems Market Revenue (million), by End User 2025 & 2033

- Figure 5: North America LA Safety Instrumented Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America LA Safety Instrumented Systems Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America LA Safety Instrumented Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America LA Safety Instrumented Systems Market Revenue (million), by Application 2025 & 2033

- Figure 9: South America LA Safety Instrumented Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America LA Safety Instrumented Systems Market Revenue (million), by End User 2025 & 2033

- Figure 11: South America LA Safety Instrumented Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America LA Safety Instrumented Systems Market Revenue (million), by Country 2025 & 2033

- Figure 13: South America LA Safety Instrumented Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe LA Safety Instrumented Systems Market Revenue (million), by Application 2025 & 2033

- Figure 15: Europe LA Safety Instrumented Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe LA Safety Instrumented Systems Market Revenue (million), by End User 2025 & 2033

- Figure 17: Europe LA Safety Instrumented Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe LA Safety Instrumented Systems Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe LA Safety Instrumented Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa LA Safety Instrumented Systems Market Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa LA Safety Instrumented Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa LA Safety Instrumented Systems Market Revenue (million), by End User 2025 & 2033

- Figure 23: Middle East & Africa LA Safety Instrumented Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa LA Safety Instrumented Systems Market Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa LA Safety Instrumented Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific LA Safety Instrumented Systems Market Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific LA Safety Instrumented Systems Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific LA Safety Instrumented Systems Market Revenue (million), by End User 2025 & 2033

- Figure 29: Asia Pacific LA Safety Instrumented Systems Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific LA Safety Instrumented Systems Market Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific LA Safety Instrumented Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global LA Safety Instrumented Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global LA Safety Instrumented Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global LA Safety Instrumented Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 12: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global LA Safety Instrumented Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 18: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global LA Safety Instrumented Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 30: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global LA Safety Instrumented Systems Market Revenue million Forecast, by End User 2020 & 2033

- Table 39: Global LA Safety Instrumented Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: China LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific LA Safety Instrumented Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LA Safety Instrumented Systems Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the LA Safety Instrumented Systems Market?

Key companies in the market include Honeywell International Inc, ABB Ltd*List Not Exhaustive, SIS-TECH Solutions LP, Rockwell Automation Inc, Yokogawa Electric Corporation, Schlumberger Limited, Emerson Electric Company.

3. What are the main segments of the LA Safety Instrumented Systems Market?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4784.1 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Regulatory Environment in the Industry; Presence of Robust SIS Service Ecosystem.

6. What are the notable trends driving market growth?

Chemical and Petrochemical Industry is expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Operational Complexity and High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

July 2022 - MSA Safety Incorporated announced a contract for USD 9 million from the London Fire Brigade to supply firefighters with MSA's new M1 Self-Contained Breathing Apparatus (SCBA) and telemetry technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LA Safety Instrumented Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LA Safety Instrumented Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LA Safety Instrumented Systems Market?

To stay informed about further developments, trends, and reports in the LA Safety Instrumented Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence