Key Insights

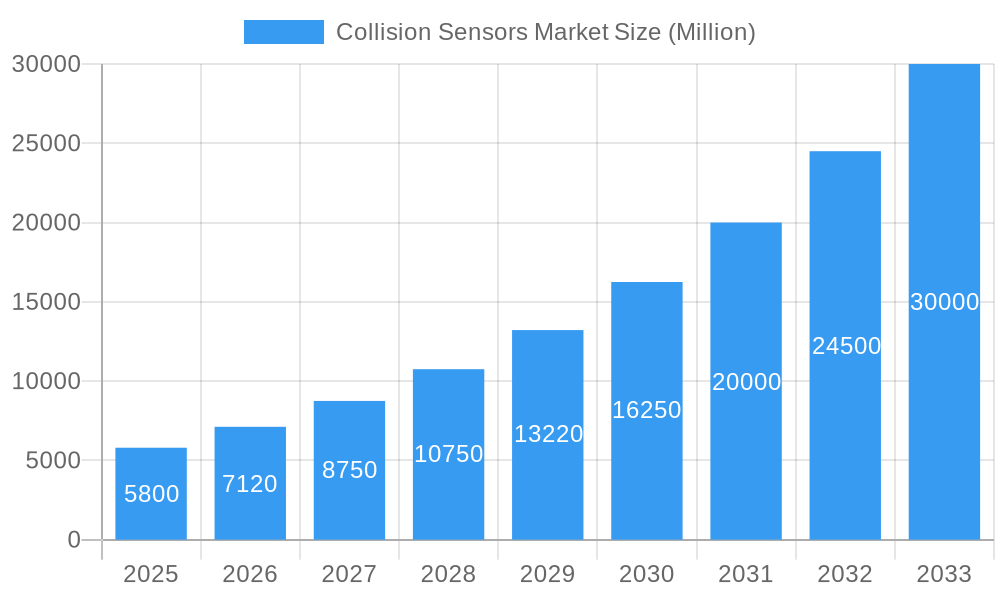

The global Collision Sensors Market is projected for significant expansion, expected to reach a market size of $65.14 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.6% from 2025 to 2033. This growth is driven by the increasing adoption of Advanced Driver-Assistance Systems (ADAS) in vehicles. Key applications such as Adaptive Cruise Control, Forward Collision Warning, Blind Spot Monitoring, and Lane Departure Warning are experiencing high demand due to evolving safety regulations and consumer preference for enhanced vehicle safety. The integration of advanced technologies like Radar, Camera, and LiDAR sensors is crucial for precise object detection and improved vehicle performance, further stimulating market growth. The automotive sector is the primary end-user, propelled by continuous innovation in autonomous driving and safety features.

Collision Sensors Market Market Size (In Billion)

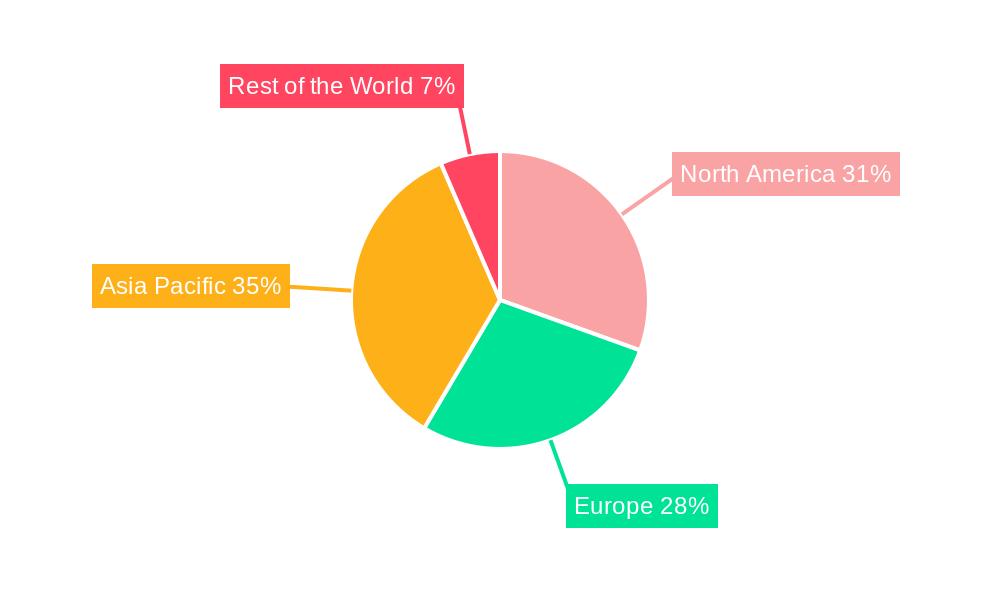

Market growth is further supported by stringent government mandates for vehicle safety, rising consumer awareness of road safety, and rapid technological advancements in sensor technology, leading to cost efficiencies and performance improvements. Emerging trends such as the proliferation of connected vehicles, the development of semi-autonomous and fully autonomous driving capabilities, and the increasing integration of ADAS in commercial vehicles contribute to a positive market outlook. Challenges include the initial investment cost for advanced sensor integration and potential data processing and cybersecurity concerns. Geographically, North America and Europe lead the market, supported by mature automotive industries and strict safety standards. The Asia Pacific region, particularly China and Japan, is identified as a high-growth area, driven by substantial automotive production and a growing focus on intelligent transportation systems.

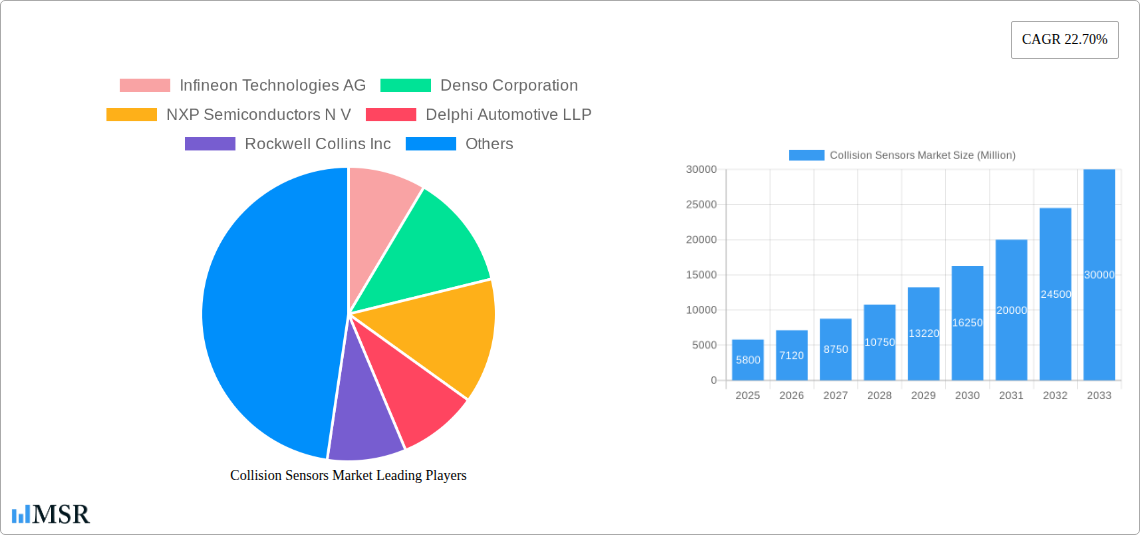

Collision Sensors Market Company Market Share

Collision Sensors Market: Unlocking Advanced Safety and Autonomous Driving

Report Description:

Dive deep into the rapidly evolving Collision Sensors Market with this comprehensive, SEO-optimized report. Explore critical insights into automotive safety systems, ADAS (Advanced Driver-Assistance Systems), and the burgeoning field of autonomous driving. This report offers a meticulous analysis of market dynamics, technological advancements, and key growth drivers shaping the global landscape from 2019 to 2033, with a base and estimated year of 2025. Discover market opportunities, challenges, and strategic imperatives for stakeholders in this multi-billion dollar industry. With a projected market size of over $XX Million in 2025, this research provides actionable intelligence for manufacturers, suppliers, automotive OEMs, and technology providers.

Collision Sensors Market Market Concentration & Dynamics

The Collision Sensors Market exhibits a moderate to high concentration, driven by a mix of established global players and emerging technology specialists. Key companies like Infineon Technologies AG, Denso Corporation, NXP Semiconductors N.V., Continental AG, and Robert Bosch GmbH command significant market share due to their extensive R&D capabilities, broad product portfolios, and strong relationships with automotive manufacturers. The innovation ecosystem is robust, characterized by continuous advancements in sensor accuracy, miniaturization, and integration into vehicle architectures. Regulatory frameworks, particularly those mandating advanced safety features like Forward Collision Warning Systems and Automatic Emergency Braking (AEB), are substantial drivers. The proliferation of Blind Spot Monitors and Lane Departure Warning Systems further fuels demand. Substitute products are limited, given the unique function of collision sensors in preventing accidents. End-user trends are strongly skewed towards the automobile sector, with increasing adoption in passenger cars, commercial vehicles, and emerging electric vehicles (EVs). M&A activities are observed as companies seek to expand their technological prowess, market reach, or acquire complementary capabilities. For instance, several strategic acquisitions of smaller sensor technology firms by larger automotive suppliers have been noted in recent years, aimed at consolidating market positions and accelerating product development. The overall market is dynamic, influenced by consumer demand for enhanced safety and the drive towards higher levels of vehicle autonomy.

Collision Sensors Market Industry Insights & Trends

The global Collision Sensors Market is poised for substantial growth, driven by an unwavering commitment to enhancing vehicle safety and the accelerating adoption of autonomous driving technologies. The market size is projected to reach approximately $XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of over XX% during the forecast period of 2025–2033. This growth is underpinned by several key factors. Firstly, increasing consumer awareness and demand for advanced safety features are compelling automotive manufacturers to integrate a wider array of ADAS (Advanced Driver-Assistance Systems), including Adaptive Cruise Control, Forward Collision Warning Systems, and Blind Spot Monitors, into their vehicle offerings. Government regulations worldwide are increasingly mandating the inclusion of these safety technologies, further solidifying market expansion. Secondly, the relentless pursuit of autonomous driving capabilities necessitates sophisticated and reliable sensor suites. Technologies like Radar, Camera, and LiDAR are becoming indispensable for perceiving the vehicle's environment, detecting potential hazards, and enabling safe navigation. The miniaturization and cost reduction of these sensors, coupled with improvements in processing power, are making them more accessible for widespread integration across different vehicle segments and price points. The evolving consumer behavior, prioritizing safety and convenience, is a significant trend. Consumers are actively seeking vehicles equipped with features that can mitigate accident risks and enhance driving comfort. This shift in preference is directly translating into increased demand for innovative collision sensor solutions. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into sensor processing algorithms is enhancing their accuracy, reducing false positives, and enabling more complex decision-making processes, thereby propelling market growth. The expansion of the electric vehicle (EV) market also plays a crucial role, as EVs are often designed with advanced technological features, including comprehensive collision avoidance systems, from their inception. The maritime and aerospace sectors are also witnessing a growing adoption of collision sensing technologies, albeit at a nascent stage, for navigation and safety enhancements.

Key Markets & Segments Leading Collision Sensors Market

The Collision Sensors Market is experiencing dominant growth driven by specific regions and application segments.

- Dominant Region: North America, particularly the United States, currently leads the market, propelled by stringent safety regulations, high consumer spending on advanced vehicle features, and a strong presence of leading automotive OEMs and technology developers. The region's robust infrastructure for testing and development of autonomous technologies further solidifies its leadership.

- Dominant Country: The United States continues to be the frontrunner, with a significant portion of the global market share attributed to its large automotive market and early adoption of ADAS technologies.

- Dominant Application Segment:

- Adaptive Cruise Control (ACC): This application is a major revenue generator, driven by consumer demand for enhanced driving comfort and safety, especially in highway driving scenarios.

- Forward Collision Warning System (FCW): Mandates and voluntary safety ratings by organizations like NHTSA and Euro NCAP have significantly boosted the adoption of FCW systems, making it a critical segment.

- Blind Spot Monitor (BSM): The increasing complexity of urban driving environments and the need to enhance driver awareness have made BSM systems a standard feature in many new vehicles.

- Parking Sensor: While a more established technology, the continuous improvement in resolution and integration with advanced parking assist systems ensures its continued relevance and growth.

- Dominant Technology:

- Radar: Due to its reliability in various weather conditions, long-range detection capabilities, and cost-effectiveness, radar sensors are currently the most widely adopted technology in collision sensing. They are instrumental in applications like ACC and FCW.

- Camera: Advancements in image processing and AI have made camera-based systems highly effective for object recognition, lane detection, and traffic sign recognition, often working in conjunction with radar.

- Dominant End-User:

- Automobile: This segment represents the overwhelming majority of the Collision Sensors Market, encompassing passenger cars, commercial vehicles, and trucks. The increasing integration of ADAS and the drive towards Level 2 and Level 3 autonomous driving are key growth accelerators.

Drivers of Dominance:

- Economic Growth: Rising disposable incomes in key automotive markets translate to higher demand for vehicles equipped with advanced safety features.

- Infrastructure Development: Investments in smart city initiatives and connected vehicle infrastructure complement the functionality of collision sensors.

- Regulatory Push: Mandates for safety features, emissions standards, and autonomous driving development initiatives from governments globally are significant catalysts.

- Technological Advancements: Continuous improvements in sensor resolution, processing power, and AI integration are making collision sensing more effective and affordable.

Collision Sensors Market Product Developments

Product innovation in the Collision Sensors Market is characterized by a relentless pursuit of enhanced accuracy, reduced size, lower power consumption, and improved integration capabilities. Manufacturers are developing next-generation radar sensors with higher resolution and better object discrimination, crucial for sophisticated ADAS and autonomous driving. Camera systems are being enhanced with AI-powered analytics for more precise identification of pedestrians, cyclists, and complex road scenarios. The integration of LiDAR technology, once confined to high-end autonomous vehicles, is becoming more accessible, offering a 3D perception of the environment. Furthermore, there's a growing trend towards sensor fusion, where data from multiple sensor types (radar, camera, ultrasonic) is combined to provide a more comprehensive and robust understanding of the surroundings, minimizing the risk of false positives and negatives. These advancements are critical for enabling Level 2+ and Level 3 autonomous driving capabilities, as well as improving the performance of existing ADAS features like Adaptive Cruise Control and Automatic Emergency Braking.

Challenges in the Collision Sensors Market Market

Despite robust growth, the Collision Sensors Market faces several challenges. High development costs associated with advanced sensor technologies like LiDAR and sophisticated AI algorithms can be a barrier, particularly for smaller manufacturers. Ensuring the reliability and accuracy of these sensors across diverse environmental conditions (e.g., extreme weather, poor lighting) remains an ongoing challenge, impacting system performance and driver confidence. Regulatory hurdles and evolving standards for autonomous driving technologies can create uncertainty for product development roadmaps. Furthermore, supply chain disruptions, as seen in recent global events, can impact the availability and cost of critical components. Intense competition among established players and emerging startups also puts pressure on profit margins, necessitating continuous innovation and cost optimization.

Forces Driving Collision Sensors Market Growth

The Collision Sensors Market is propelled by a confluence of powerful forces. The escalating global focus on road safety and the desire to reduce traffic fatalities and injuries is a primary driver, leading to increased adoption of ADAS (Advanced Driver-Assistance Systems). The relentless advancement and eventual widespread deployment of autonomous driving technology fundamentally rely on sophisticated collision sensing capabilities, acting as a major long-term growth catalyst. Stringent government regulations worldwide, mandating safety features like Forward Collision Warning Systems and Automatic Emergency Braking, provide a consistent demand for these technologies. Evolving consumer preferences for safer and more convenient driving experiences further accelerate market penetration. Additionally, the growth of the automotive industry, particularly in emerging economies, coupled with increasing vehicle production volumes, directly translates to a larger addressable market for collision sensors.

Challenges in the Collision Sensors Market Market

The Collision Sensors Market navigates a landscape with persistent challenges. Ensuring the absolute reliability and robustness of sensors under all operating conditions, including severe weather, dust, and varying light levels, remains a critical concern. The complexity and cost of developing and integrating advanced sensor fusion algorithms, necessary for higher levels of autonomy, can be substantial. The rapid pace of technological evolution necessitates continuous R&D investment, leading to a short product lifecycle and potential obsolescence. Moreover, the standardization of safety protocols and data sharing among different vehicle manufacturers and infrastructure providers is still in its nascent stages, posing integration challenges. Cybersecurity threats to connected vehicle systems, including the sensor networks, also represent a significant long-term challenge requiring robust protective measures.

Emerging Opportunities in Collision Sensors Market

The Collision Sensors Market is ripe with emerging opportunities. The continued expansion of the autonomous driving landscape, from Level 2 to Level 3 and beyond, will demand increasingly sophisticated and integrated sensor suites. Growth in niche markets like agricultural vehicles, construction equipment, and off-road vehicles presents new avenues for adoption. The development of more affordable and compact LiDAR solutions is expected to democratize its use across a wider range of automotive segments. Advancements in sensor AI and machine learning for predictive maintenance and proactive hazard identification offer significant value addition. Furthermore, the integration of collision sensors with vehicle-to-everything (V2X) communication technology promises to unlock a new era of cooperative perception and safety, creating substantial growth potential. The increasing demand for advanced driver-assistance systems in the commercial vehicle sector, including trucks and delivery vans, is another significant opportunity.

Leading Players in the Collision Sensors Market Sector

- Infineon Technologies AG

- Denso Corporation

- NXP Semiconductors N.V.

- Delphi Automotive LLP

- Rockwell Collins Inc

- Aisin Seiki Co Ltd

- Continental AG

- Autoliv Inc

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Murata Manufacturing Co Ltd

- Analog Devices Inc

- General Electric Company

- Honeywell International Inc

- ZF Friedrichshafen AG

Key Milestones in Collision Sensors Market Industry

- 2019: Increased adoption of Level 2 ADAS features like adaptive cruise control and lane keeping assist in mainstream passenger vehicles.

- 2020: Significant advancements in AI and machine learning algorithms for improved object detection and sensor fusion in camera and radar systems.

- 2021: Growing interest and initial deployments of LiDAR in commercial autonomous vehicle fleets and premium passenger cars.

- 2022: Release of new automotive-grade radar chips with enhanced resolution and range, supporting more sophisticated safety applications.

- 2023: Increased regulatory focus and public discourse around the safety and deployment of autonomous driving technologies, influencing sensor development priorities.

- 2024: Continued integration of ultrasonic sensors for enhanced low-speed maneuvering and parking assist functions, alongside advancements in their range and accuracy.

Strategic Outlook for Collision Sensors Market Market

The future of the Collision Sensors Market is exceptionally promising, driven by the relentless pursuit of safer and more autonomous mobility. Key growth accelerators will include the widespread adoption of Level 3 and Level 4 autonomous driving, requiring highly advanced and redundant sensor systems. Strategic partnerships between sensor manufacturers, automotive OEMs, and AI technology providers will be crucial for developing integrated and intelligent solutions. Expansion into emerging markets and non-automotive applications, such as industrial automation and robotics, will offer new revenue streams. Continuous innovation in sensor miniaturization, cost reduction, and enhanced performance in adverse conditions will be paramount for sustained market leadership. The focus will shift towards developing predictive safety systems that can anticipate and prevent accidents before they occur, moving beyond mere detection.

Collision Sensors Market Segmentation

-

1. Application

- 1.1. Adaptive Cruise Control

- 1.2. Forward Collision Warning System

- 1.3. Blind Spot Monitor

- 1.4. Lane Departure Warning System

- 1.5. Parking Sensor

- 1.6. Other Applications

-

2. Technology

- 2.1. Ultrasonic

- 2.2. Radar

- 2.3. Camera

- 2.4. LiDar

-

3. End-User

- 3.1. Automobile

- 3.2. Aerospace & Defense

- 3.3. Maritime

- 3.4. Rail

- 3.5. Other End-users

Collision Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Collision Sensors Market Regional Market Share

Geographic Coverage of Collision Sensors Market

Collision Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Awareness about Vehicle Security; Technological AdvancementS and Development in Sensors; Rising Adoption of Collision Sensors in Military and Defense Sectors

- 3.3. Market Restrains

- 3.3.1. ; Increased Price of the Technology; Less Use of These Sensors in Low Priced Car

- 3.4. Market Trends

- 3.4.1. Growing Use of Radar Technology to Continue Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Collision Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Adaptive Cruise Control

- 5.1.2. Forward Collision Warning System

- 5.1.3. Blind Spot Monitor

- 5.1.4. Lane Departure Warning System

- 5.1.5. Parking Sensor

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Ultrasonic

- 5.2.2. Radar

- 5.2.3. Camera

- 5.2.4. LiDar

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Automobile

- 5.3.2. Aerospace & Defense

- 5.3.3. Maritime

- 5.3.4. Rail

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Collision Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Adaptive Cruise Control

- 6.1.2. Forward Collision Warning System

- 6.1.3. Blind Spot Monitor

- 6.1.4. Lane Departure Warning System

- 6.1.5. Parking Sensor

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Ultrasonic

- 6.2.2. Radar

- 6.2.3. Camera

- 6.2.4. LiDar

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Automobile

- 6.3.2. Aerospace & Defense

- 6.3.3. Maritime

- 6.3.4. Rail

- 6.3.5. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Collision Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Adaptive Cruise Control

- 7.1.2. Forward Collision Warning System

- 7.1.3. Blind Spot Monitor

- 7.1.4. Lane Departure Warning System

- 7.1.5. Parking Sensor

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Ultrasonic

- 7.2.2. Radar

- 7.2.3. Camera

- 7.2.4. LiDar

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Automobile

- 7.3.2. Aerospace & Defense

- 7.3.3. Maritime

- 7.3.4. Rail

- 7.3.5. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Collision Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Adaptive Cruise Control

- 8.1.2. Forward Collision Warning System

- 8.1.3. Blind Spot Monitor

- 8.1.4. Lane Departure Warning System

- 8.1.5. Parking Sensor

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Ultrasonic

- 8.2.2. Radar

- 8.2.3. Camera

- 8.2.4. LiDar

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Automobile

- 8.3.2. Aerospace & Defense

- 8.3.3. Maritime

- 8.3.4. Rail

- 8.3.5. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Collision Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Adaptive Cruise Control

- 9.1.2. Forward Collision Warning System

- 9.1.3. Blind Spot Monitor

- 9.1.4. Lane Departure Warning System

- 9.1.5. Parking Sensor

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Ultrasonic

- 9.2.2. Radar

- 9.2.3. Camera

- 9.2.4. LiDar

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Automobile

- 9.3.2. Aerospace & Defense

- 9.3.3. Maritime

- 9.3.4. Rail

- 9.3.5. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Denso Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 NXP Semiconductors N V

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Delphi Automotive LLP

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rockwell Collins Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aisin Seiki Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Continental AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Autoliv Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Robert Bosch GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Texas Instruments Incorporated

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Murata Manufacturing Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Analog Devices Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 General Electric Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Honeywell International Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 ZF Friedrichshafen AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Collision Sensors Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Collision Sensors Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Collision Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 4: North America Collision Sensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Collision Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Collision Sensors Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Collision Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 8: North America Collision Sensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 9: North America Collision Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Collision Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Collision Sensors Market Revenue (billion), by End-User 2025 & 2033

- Figure 12: North America Collision Sensors Market Volume (K Unit), by End-User 2025 & 2033

- Figure 13: North America Collision Sensors Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Collision Sensors Market Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Collision Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Collision Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Collision Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Collision Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Collision Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 20: Europe Collision Sensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Collision Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Collision Sensors Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Collision Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 24: Europe Collision Sensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 25: Europe Collision Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Europe Collision Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 27: Europe Collision Sensors Market Revenue (billion), by End-User 2025 & 2033

- Figure 28: Europe Collision Sensors Market Volume (K Unit), by End-User 2025 & 2033

- Figure 29: Europe Collision Sensors Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Collision Sensors Market Volume Share (%), by End-User 2025 & 2033

- Figure 31: Europe Collision Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Collision Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Collision Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Collision Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Collision Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 36: Asia Pacific Collision Sensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 37: Asia Pacific Collision Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Collision Sensors Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Asia Pacific Collision Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 40: Asia Pacific Collision Sensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Asia Pacific Collision Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Asia Pacific Collision Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 43: Asia Pacific Collision Sensors Market Revenue (billion), by End-User 2025 & 2033

- Figure 44: Asia Pacific Collision Sensors Market Volume (K Unit), by End-User 2025 & 2033

- Figure 45: Asia Pacific Collision Sensors Market Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Asia Pacific Collision Sensors Market Volume Share (%), by End-User 2025 & 2033

- Figure 47: Asia Pacific Collision Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Collision Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Collision Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Collision Sensors Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Collision Sensors Market Revenue (billion), by Application 2025 & 2033

- Figure 52: Rest of the World Collision Sensors Market Volume (K Unit), by Application 2025 & 2033

- Figure 53: Rest of the World Collision Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of the World Collision Sensors Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Rest of the World Collision Sensors Market Revenue (billion), by Technology 2025 & 2033

- Figure 56: Rest of the World Collision Sensors Market Volume (K Unit), by Technology 2025 & 2033

- Figure 57: Rest of the World Collision Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 58: Rest of the World Collision Sensors Market Volume Share (%), by Technology 2025 & 2033

- Figure 59: Rest of the World Collision Sensors Market Revenue (billion), by End-User 2025 & 2033

- Figure 60: Rest of the World Collision Sensors Market Volume (K Unit), by End-User 2025 & 2033

- Figure 61: Rest of the World Collision Sensors Market Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Rest of the World Collision Sensors Market Volume Share (%), by End-User 2025 & 2033

- Figure 63: Rest of the World Collision Sensors Market Revenue (billion), by Country 2025 & 2033

- Figure 64: Rest of the World Collision Sensors Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Collision Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Collision Sensors Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Collision Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Collision Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Collision Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Collision Sensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Global Collision Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Collision Sensors Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Global Collision Sensors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Collision Sensors Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Collision Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Collision Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Collision Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Global Collision Sensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 13: Global Collision Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Global Collision Sensors Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Global Collision Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Collision Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Collision Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Collision Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Collision Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 24: Global Collision Sensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 25: Global Collision Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global Collision Sensors Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 27: Global Collision Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Global Collision Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Global Collision Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Collision Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Global Collision Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 38: Global Collision Sensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 39: Global Collision Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global Collision Sensors Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 41: Global Collision Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Collision Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Rest of Asia Pacific Collision Sensors Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Rest of Asia Pacific Collision Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Global Collision Sensors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 52: Global Collision Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 53: Global Collision Sensors Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 54: Global Collision Sensors Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 55: Global Collision Sensors Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 56: Global Collision Sensors Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 57: Global Collision Sensors Market Revenue billion Forecast, by Country 2020 & 2033

- Table 58: Global Collision Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Collision Sensors Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Collision Sensors Market?

Key companies in the market include Infineon Technologies AG, Denso Corporation, NXP Semiconductors N V, Delphi Automotive LLP, Rockwell Collins Inc, Aisin Seiki Co Ltd, Continental AG, Autoliv Inc, Robert Bosch GmbH, Texas Instruments Incorporated, Murata Manufacturing Co Ltd, Analog Devices Inc, General Electric Company, Honeywell International Inc , ZF Friedrichshafen AG.

3. What are the main segments of the Collision Sensors Market?

The market segments include Application, Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 65.14 billion as of 2022.

5. What are some drivers contributing to market growth?

; Rising Awareness about Vehicle Security; Technological AdvancementS and Development in Sensors; Rising Adoption of Collision Sensors in Military and Defense Sectors.

6. What are the notable trends driving market growth?

Growing Use of Radar Technology to Continue Dominating the Market.

7. Are there any restraints impacting market growth?

; Increased Price of the Technology; Less Use of These Sensors in Low Priced Car.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Collision Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Collision Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Collision Sensors Market?

To stay informed about further developments, trends, and reports in the Collision Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence