Key Insights

The global Motion Sensor Industry is experiencing significant growth, projected to reach a market size of $8.88 billion by 2025. This expansion is driven by the increasing integration of motion sensors in wearable technology, advancements in MEMS technology for smaller and more efficient sensors, and growing demand in entertainment and healthcare sectors for applications like immersive gaming, remote patient monitoring, and fall detection.

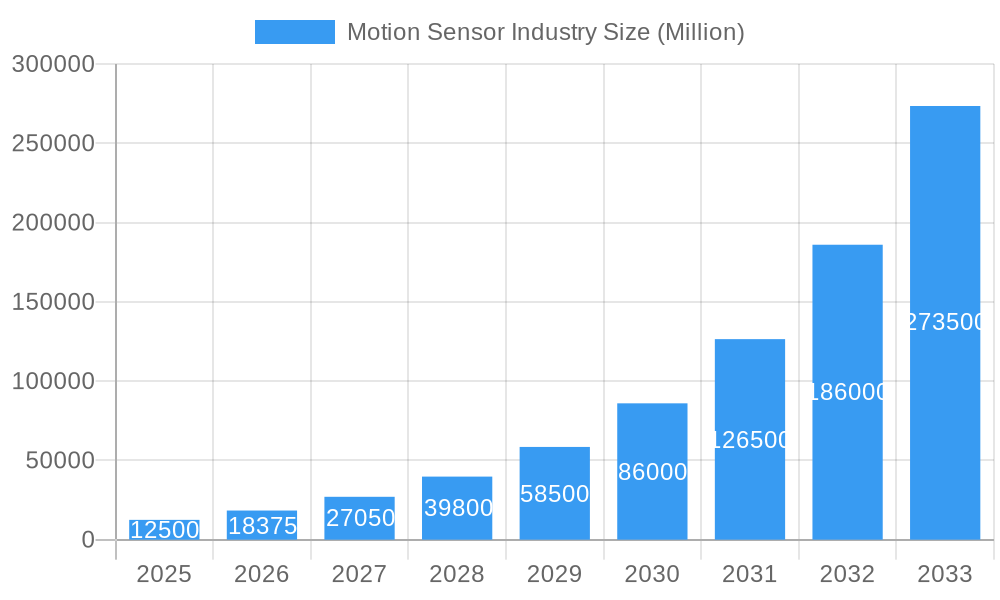

Motion Sensor Industry Market Size (In Billion)

The industry is forecasted for continued robust growth from 2025 to 2033, fueled by sensor miniaturization, enhanced accuracy, and AI integration for intelligent motion analysis. Emerging applications in smart clothing and advanced sports gear offer personalized performance feedback and injury prevention. Key market trends and competitive strategies are thoroughly analyzed, with leading companies like Bosch Sensortec, TDK Corporation, and Analog Devices Inc. driving innovation. Despite potential regulatory challenges in medical-grade devices and data security, sustained market expansion is anticipated due to widespread consumer demand for smart, connected devices.

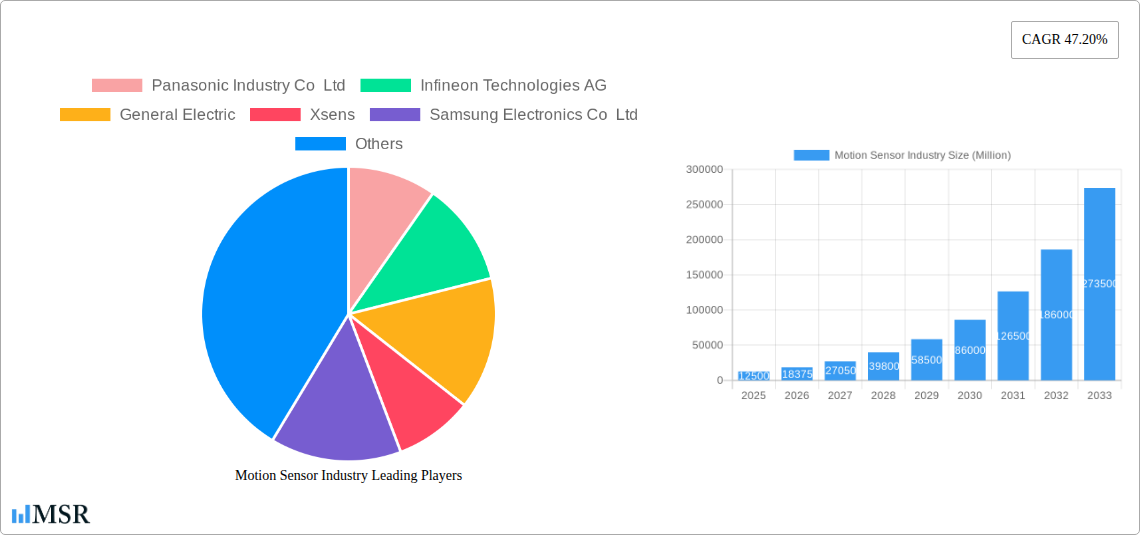

Motion Sensor Industry Company Market Share

Motion Sensor Industry Market Analysis: Size, CAGR, and Future Outlook (2019–2033)

Gain comprehensive insights into the dynamic motion sensor industry with our detailed market report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis focuses on key technologies including accelerometers, inertial gyroscopes, and MEMS. Explore critical applications such as smart watches, fitness bands, activity monitors, smart clothing, and sports gear. Discover the transformative impact across vital end-user industries: healthcare, sports/fitness, consumer electronics, entertainment and media, and government and public utilities. The report highlights a projected market size of $8.88 billion by 2025 with a CAGR of 11.1%.

This in-depth report provides actionable intelligence for industry stakeholders, including manufacturers, technology providers, investors, and policymakers, to navigate this rapidly expanding market. Understand key market drivers, technological innovations, competitive landscapes, and future growth trajectories.

Motion Sensor Industry Market Concentration & Dynamics

The motion sensor industry exhibits a moderate to high level of market concentration, driven by the dominance of a few key players in MEMS fabrication and integrated motion sensor solutions. Innovation ecosystems are thriving, particularly in the consumer electronics and healthcare sectors, fueled by substantial R&D investments. Regulatory frameworks are evolving to address data privacy and device safety, indirectly influencing motion sensor integration. Substitute products, primarily in less sophisticated sensing technologies, are being increasingly displaced by the advanced capabilities of modern motion sensors. End-user trends point towards a growing demand for personalized health monitoring and immersive entertainment experiences, further propelling market growth. Mergers and acquisitions (M&A) activities are observed as companies seek to consolidate their market position, acquire innovative technologies, and expand their product portfolios. The M&A deal count has seen a steady increase over the historical period, reflecting strategic consolidation. Market share is heavily influenced by technological prowess and the ability to integrate motion sensors seamlessly into high-volume consumer devices.

Motion Sensor Industry Industry Insights & Trends

The global motion sensor industry is poised for substantial growth, driven by the relentless pursuit of enhanced user experiences and data-driven insights across a multitude of applications. The market size is projected to reach an estimated $XX million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% projected for the forecast period (2025–2033). Key growth drivers include the pervasive adoption of wearable technology, the burgeoning Internet of Things (IoT) ecosystem, and the increasing demand for sophisticated gesture recognition and human-machine interaction. Technological disruptions, such as advancements in ultra-low-power MEMS technology and AI-driven motion analytics, are redefining the capabilities of motion sensors. Evolving consumer behaviors, characterized by a heightened focus on health and wellness, a desire for more intuitive device interfaces, and the demand for personalized digital experiences, are creating new avenues for motion sensor integration. The miniaturization and improved accuracy of devices like accelerometers and inertial gyroscopes are critical enablers for these trends, allowing for discreet and effective monitoring in diverse environments. The integration of advanced motion sensor capabilities into smart home devices, automotive systems, and industrial automation further contributes to the market's expansion.

Key Markets & Segments Leading Motion Sensor Industry

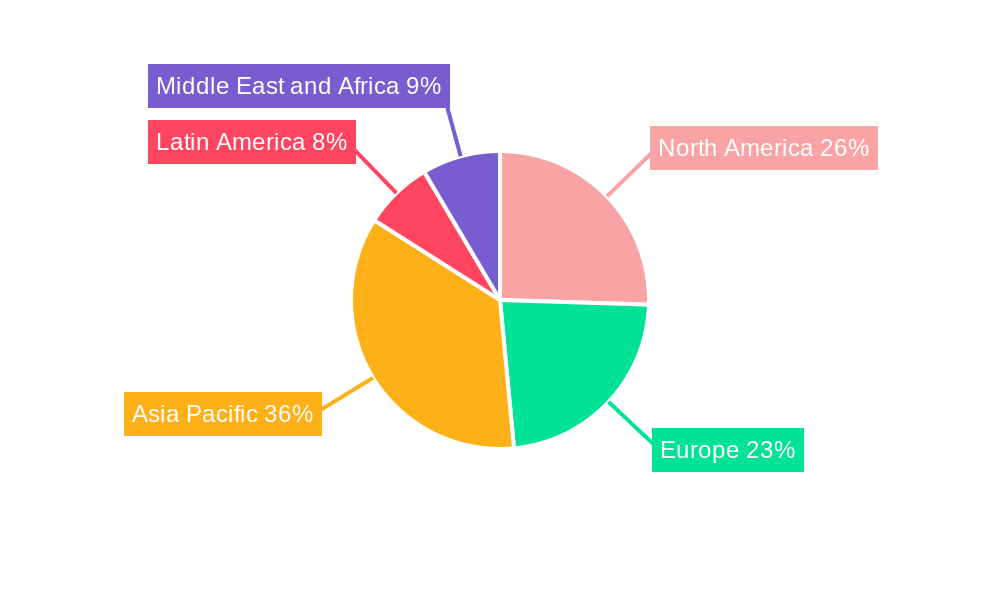

The motion sensor industry is witnessing robust growth across several key regions and segments. North America and Asia Pacific currently lead in market share, driven by significant investments in consumer electronics, advanced manufacturing, and a strong consumer appetite for wearable technology.

Dominant Segments by Type:

- MEMS: This segment dominates due to its versatility, cost-effectiveness, and ability to integrate multiple sensing functionalities into a single chip. Its widespread application in consumer electronics, automotive, and industrial sectors solidifies its leadership.

- Accelerometers: Crucial for detecting linear acceleration and gravity, accelerometers are indispensable in fitness trackers, smartphones, and automotive safety systems.

- Inertial Gyroscopes: Essential for measuring angular velocity and rotation, gyroscopes are key to advanced navigation, gaming, and virtual reality applications.

Dominant Segments by Application:

- Smart Watches & Fitness Bands: These wearables represent a colossal market for motion sensors, enabling activity tracking, health monitoring, and gesture control.

- Activity Monitors: Expanding beyond wearables, these devices are integrated into clothing and other objects to provide comprehensive activity and health insights.

- Consumer Electronics: This broad category encompasses smartphones, tablets, gaming consoles, and smart home devices, all increasingly reliant on sophisticated motion sensing for user interaction and functionality.

Dominant Segments by End-user Industry:

- Consumer Electronics: This sector remains the largest consumer of motion sensors, benefiting from miniaturization, cost reduction, and the demand for intuitive user interfaces. Economic growth and a high disposable income in key markets fuel this dominance.

- Healthcare: The integration of motion sensors for remote patient monitoring, fall detection, and rehabilitation is a rapidly expanding segment, driven by an aging global population and the demand for personalized healthcare solutions. Advancements in medical device technology further bolster this trend.

- Sports/Fitness: Beyond wearables, dedicated sports equipment and performance analysis tools are leveraging advanced motion sensors to provide real-time feedback and insights for athletes.

Motion Sensor Industry Product Developments

Recent product developments in the motion sensor industry underscore a strong emphasis on enhanced performance, reduced power consumption, and increased integration. Innovations like Analog Devices Inc's ADXL367 three-axis MEMS accelerometer, offering a two-fold improvement in power consumption and over 30% improvement in noise performance, are expanding the operational lifespan of battery-powered devices and reducing maintenance needs. TDK Corporation's ICM-45xxx SmartMotion family introduces industry-leading 6-axis MEMS motion sensors with on-chip self-calibration and the novel BalancedGyro technology for superior vibration rejection and temperature stability. These advancements are crucial for applications demanding high accuracy and reliability in challenging environments, offering competitive edges through extended field time and lower power footprints.

Challenges in the Motion Sensor Industry Market

Despite robust growth, the motion sensor industry faces several challenges. Regulatory hurdles related to data privacy and device certification can impede market entry and product deployment. Supply chain disruptions, particularly for specialized semiconductor components, can impact production timelines and costs. Intense competitive pressures among established players and emerging startups necessitate continuous innovation and cost optimization. The high cost of developing and integrating advanced motion sensor solutions for niche applications can also act as a restraint, limiting widespread adoption in some segments. Furthermore, the increasing complexity of motion sensor data requires sophisticated algorithms and processing power, adding to development overhead.

Forces Driving Motion Sensor Industry Growth

The motion sensor industry is propelled by several powerful forces. Technological advancements, including miniaturization, improved accuracy, and ultra-low power consumption, are expanding the applicability of motion sensors. The burgeoning Internet of Things (IoT) ecosystem, with its vast network of connected devices, creates an insatiable demand for sensing capabilities. Evolving consumer preferences for smart and connected devices, particularly in wearables and smart home technology, are significant growth catalysts. Furthermore, the increasing application of motion sensors in critical sectors like healthcare for remote monitoring and in automotive for advanced driver-assistance systems (ADAS) further fuels market expansion. Government initiatives promoting smart city development and digitalization also contribute to the upward trajectory.

Challenges in the Motion Sensor Industry Market

Long-term growth catalysts in the motion sensor industry are rooted in continuous innovation and strategic market expansion. The ongoing development of novel sensing materials and architectures promises even greater accuracy and functionality. Partnerships and collaborations between sensor manufacturers, device integrators, and software developers are crucial for unlocking new application possibilities and creating integrated solutions. Furthermore, the expansion of motion sensor applications into emerging markets and industries, such as advanced robotics, industrial automation, and augmented/virtual reality, represents significant long-term growth potential. The increasing focus on data analytics and AI-driven insights derived from motion data will also drive demand for more sophisticated and capable sensors.

Emerging Opportunities in Motion Sensor Industry

Emerging opportunities in the motion sensor industry are abundant, driven by advancements in artificial intelligence, edge computing, and the expansion of the IoT. The development of highly specialized motion sensors for niche applications like precision agriculture, industrial predictive maintenance, and advanced sports analytics presents significant growth potential. The increasing demand for personalized health and wellness solutions, including continuous monitoring of vital signs and activity levels, opens new avenues for motion sensor integration in medical devices and smart health platforms. Furthermore, the rapid growth of the metaverse and immersive entertainment experiences will necessitate advanced motion tracking and gesture recognition capabilities, creating a substantial market for innovative motion sensor solutions.

Leading Players in the Motion Sensor Industry Sector

- Panasonic Industry Co Ltd

- Infineon Technologies AG

- General Electric

- Xsens

- Samsung Electronics Co Ltd

- Bosch Sensortec GmbH

- NXP Semiconductors

- Zoll Medical Corporation

- Texas Instruments Incorporated

- TDK Corporation

- Analog Devices Inc

Key Milestones in Motion Sensor Industry Industry

- May 2022: Analog Devices Inc announced the ADXL367 three-axis MEMS accelerometer for healthcare and industrial applications, including vital signs monitoring and hearing aids. This device offers a two-fold improvement in power consumption and over 30% improvement in noise performance, extending battery life and reducing maintenance. Features include 200 nW motion detection in wakeup mode and 970 nW in measurement.

- January 2022: TDK Corporation launched the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors. This family introduced on-chip self-calibration, the industry's lowest power consumption, and the world's first BalancedGyro (BG) technology, enabling maximum vibration rejection and temperature stability performance. The ICM-45xxx family offers the world's lowest power 6-axis motion sensors, allowing the gyroscope to be on 40% of the time.

Strategic Outlook for Motion Sensor Industry Market

The strategic outlook for the motion sensor industry is exceptionally positive, driven by ongoing technological advancements and expanding market applications. Key growth accelerators include the increasing demand for smart and connected devices across consumer electronics, automotive, and industrial sectors. The persistent rise of wearable technology and the proactive integration of motion sensors in healthcare for remote monitoring and preventative care represent significant future potential. Furthermore, the growing adoption of advanced sensor fusion techniques and AI-driven data analytics will unlock novel applications and enhance the value proposition of motion sensing solutions. Strategic opportunities lie in developing ultra-low-power, high-accuracy sensors and exploring new markets such as robotics, augmented reality, and smart infrastructure.

Motion Sensor Industry Segmentation

-

1. Type

- 1.1. Accelerometers

- 1.2. Inertial Gyroscopes

- 1.3. MEMS

-

2. Application

- 2.1. Smart Watches

- 2.2. Fitness Bands

- 2.3. Activity Monitors

- 2.4. Smart Clothing

- 2.5. Sports Gear

-

3. End-user Industry

- 3.1. Healthcare

- 3.2. Sports/Fitness

- 3.3. Consumer Electronics

- 3.4. Entertainment and Media

- 3.5. Government and Public Utilities

Motion Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East

Motion Sensor Industry Regional Market Share

Geographic Coverage of Motion Sensor Industry

Motion Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Awareness; Growing Demand for Wearable Fitness Monitors

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Manufacturing

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motion Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Accelerometers

- 5.1.2. Inertial Gyroscopes

- 5.1.3. MEMS

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Watches

- 5.2.2. Fitness Bands

- 5.2.3. Activity Monitors

- 5.2.4. Smart Clothing

- 5.2.5. Sports Gear

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Healthcare

- 5.3.2. Sports/Fitness

- 5.3.3. Consumer Electronics

- 5.3.4. Entertainment and Media

- 5.3.5. Government and Public Utilities

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Motion Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Accelerometers

- 6.1.2. Inertial Gyroscopes

- 6.1.3. MEMS

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Watches

- 6.2.2. Fitness Bands

- 6.2.3. Activity Monitors

- 6.2.4. Smart Clothing

- 6.2.5. Sports Gear

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Healthcare

- 6.3.2. Sports/Fitness

- 6.3.3. Consumer Electronics

- 6.3.4. Entertainment and Media

- 6.3.5. Government and Public Utilities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Motion Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Accelerometers

- 7.1.2. Inertial Gyroscopes

- 7.1.3. MEMS

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Watches

- 7.2.2. Fitness Bands

- 7.2.3. Activity Monitors

- 7.2.4. Smart Clothing

- 7.2.5. Sports Gear

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Healthcare

- 7.3.2. Sports/Fitness

- 7.3.3. Consumer Electronics

- 7.3.4. Entertainment and Media

- 7.3.5. Government and Public Utilities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Motion Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Accelerometers

- 8.1.2. Inertial Gyroscopes

- 8.1.3. MEMS

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Watches

- 8.2.2. Fitness Bands

- 8.2.3. Activity Monitors

- 8.2.4. Smart Clothing

- 8.2.5. Sports Gear

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Healthcare

- 8.3.2. Sports/Fitness

- 8.3.3. Consumer Electronics

- 8.3.4. Entertainment and Media

- 8.3.5. Government and Public Utilities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Motion Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Accelerometers

- 9.1.2. Inertial Gyroscopes

- 9.1.3. MEMS

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Watches

- 9.2.2. Fitness Bands

- 9.2.3. Activity Monitors

- 9.2.4. Smart Clothing

- 9.2.5. Sports Gear

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Healthcare

- 9.3.2. Sports/Fitness

- 9.3.3. Consumer Electronics

- 9.3.4. Entertainment and Media

- 9.3.5. Government and Public Utilities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Motion Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Accelerometers

- 10.1.2. Inertial Gyroscopes

- 10.1.3. MEMS

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Smart Watches

- 10.2.2. Fitness Bands

- 10.2.3. Activity Monitors

- 10.2.4. Smart Clothing

- 10.2.5. Sports Gear

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Healthcare

- 10.3.2. Sports/Fitness

- 10.3.3. Consumer Electronics

- 10.3.4. Entertainment and Media

- 10.3.5. Government and Public Utilities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic Industry Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infineon Technologies AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xsens

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bosch Sensortec GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zoll Medical Corporation*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TDK Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Analog Devices Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Panasonic Industry Co Ltd

List of Figures

- Figure 1: Global Motion Sensor Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Motion Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Motion Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Motion Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Motion Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Motion Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America Motion Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Motion Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Motion Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Motion Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Motion Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Motion Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Motion Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Motion Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Motion Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Motion Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Motion Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Motion Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Motion Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Motion Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Motion Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Motion Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Motion Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Motion Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Motion Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Motion Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Latin America Motion Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Motion Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Latin America Motion Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Motion Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Latin America Motion Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Motion Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Motion Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Motion Sensor Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East and Africa Motion Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Motion Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: Middle East and Africa Motion Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Motion Sensor Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Motion Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Motion Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Motion Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Motion Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Motion Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Motion Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Motion Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Motion Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Motion Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Motion Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Motion Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Motion Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Motion Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Motion Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Motion Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Motion Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Motion Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Motion Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Motion Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: India Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Motion Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Motion Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Motion Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Motion Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Latin America Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Motion Sensor Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 35: Global Motion Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Motion Sensor Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 37: Global Motion Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Motion Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motion Sensor Industry?

The projected CAGR is approximately 11.1%.

2. Which companies are prominent players in the Motion Sensor Industry?

Key companies in the market include Panasonic Industry Co Ltd, Infineon Technologies AG, General Electric, Xsens, Samsung Electronics Co Ltd, Bosch Sensortec GmbH, NXP Semiconductors, Zoll Medical Corporation*List Not Exhaustive, Texas Instruments Incorporated, TDK Corporation, Analog Devices Inc.

3. What are the main segments of the Motion Sensor Industry?

The market segments include Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Awareness; Growing Demand for Wearable Fitness Monitors.

6. What are the notable trends driving market growth?

Consumer Electronics Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; High Cost of Manufacturing.

8. Can you provide examples of recent developments in the market?

May 2022: Analog Devices Inc announced a three-axis MEMS accelerometer for various healthcare and industrial applications, including vital signs monitoring, hearing aids, and motion-enabled metering devices. The ADXL367 accelerometer improves power consumption by two times versus a previous generation of the device (ADXL362) while improving noise performance by up to over 30%. The new accelerometer also provides extended field time that maximizes battery life and reduces maintenance frequency and cost. The features include 200 nW motion detection in wakeup mode and 970 nW in measurement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motion Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motion Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motion Sensor Industry?

To stay informed about further developments, trends, and reports in the Motion Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence