Key Insights

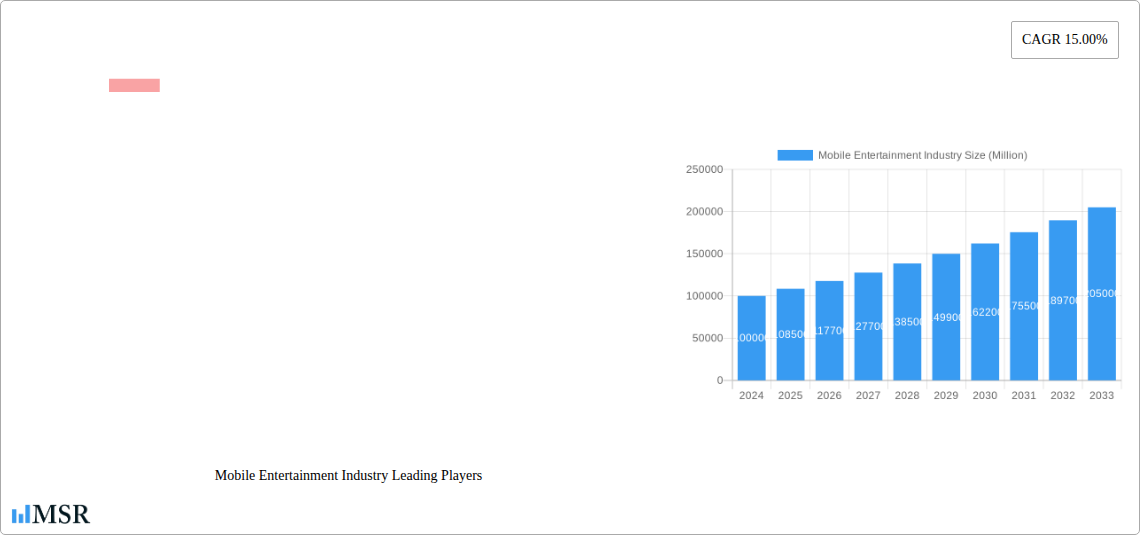

The global Mobile Entertainment Industry is poised for significant expansion, with a current market size of an estimated $100 billion in 2024. Driven by the increasing penetration of smartphones, widespread availability of high-speed internet, and a growing demand for on-the-go content consumption, the industry is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This growth trajectory is fueled by evolving consumer preferences for accessible and personalized entertainment experiences across various formats, including mobile gaming, streaming video, and music. Emerging economies, particularly in the Asia Pacific region, are expected to contribute substantially to this growth due to a burgeoning young population and increasing disposable incomes, leading to a heightened adoption of mobile entertainment services.

Mobile Entertainment Industry Market Size (In Billion)

Key growth drivers for this dynamic market include advancements in mobile technology, such as 5G integration and improved device capabilities, which enhance user experience and enable more sophisticated content. The proliferation of diverse content platforms and the rise of influencer culture further stimulate engagement. However, the industry faces certain restraints, including increasing data costs, intense competition among content providers, and evolving regulatory landscapes in different regions. Nonetheless, the overarching trend points towards a continued surge in mobile entertainment consumption, with segments like mobile gaming and video streaming expected to dominate, driven by innovative content creation and a deeper integration of entertainment into daily digital routines. The market is characterized by a highly competitive landscape with major players like Google, Apple, Meta, and Tencent driving innovation and market share.

Mobile Entertainment Industry Company Market Share

Mobile Entertainment Industry Report: Dominating the Digital Landscape (2019–2033)

Unlock the future of digital engagement with this comprehensive Mobile Entertainment Industry report. Delve into the dynamic forces shaping global mobile gaming, streaming video, and music consumption. With a robust forecast period from 2025–2033 and a base year of 2025, this analysis leverages historical data from 2019–2024 to provide unparalleled insights into market size, CAGR, and future potential, projected to reach billions in value.

This indispensable report is your guide to understanding the mobile entertainment market, a sector experiencing exponential growth driven by smartphone penetration, 5G adoption, and evolving consumer behavior. Discover how giants like Facebook, Electronic Arts Inc, Netflix Inc, Google LLC, Spotify Technology SA, Snap Inc, Rovio Entertainment Corporation, Tencent Holdings Limited, Amazon com Inc, OnMobile Global Limited, AT&T Inc, and Apple Inc are strategically positioning themselves to capture the billions in revenue generated by mobile games, mobile video streaming, and mobile music. Gain actionable intelligence on emerging trends, technological disruptions, and the regulatory landscape impacting this lucrative digital entertainment industry.

Mobile Entertainment Industry Market Concentration & Dynamics

The mobile entertainment industry exhibits a moderate to high market concentration, with a few dominant players holding significant market share, particularly in the mobile gaming segment. Tencent Holdings Limited and Electronic Arts Inc lead in gaming revenue, while Netflix Inc and Google LLC (YouTube) command the mobile video space. Spotify Technology SA remains a frontrunner in mobile music streaming. Innovation ecosystems are robust, fueled by advancements in mobile technology, AI-driven personalization, and cloud gaming solutions. Regulatory frameworks are evolving, with a growing focus on data privacy and content moderation, impacting platforms like Facebook and Snap Inc. Substitute products, such as PC gaming and traditional media, are increasingly being challenged by the convenience and accessibility of mobile entertainment. End-user trends highlight a demand for personalized content, interactive experiences, and seamless cross-platform integration. M&A activities are a key dynamic, with strategic acquisitions aimed at expanding content libraries, acquiring new technologies, and consolidating market presence. For instance, recent M&A deal counts are estimated to be in the hundreds, with multi-billion dollar transactions becoming commonplace. Apple Inc and Google LLC continue to shape the app store dynamics and operating system landscape for iOS and Android users.

Mobile Entertainment Industry Industry Insights & Trends

The mobile entertainment industry is on an explosive growth trajectory, driven by a confluence of technological advancements and shifting consumer preferences. The projected market size is expected to surpass several hundred billions of dollars by the end of the forecast period. The Compound Annual Growth Rate (CAGR) is estimated to be robust, likely in the high single-digit to low double-digit range, reflecting sustained expansion. Key growth drivers include the ubiquitous presence of smartphones, enabling billions of users worldwide to access a vast array of entertainment options on the go. The accelerating rollout of 5G technology is a significant catalyst, promising lower latency and higher bandwidth, which will revolutionize experiences in mobile gaming with cloud-based gameplay and immersive mobile video streaming in high definition.

Technological disruptions are constantly reshaping the competitive landscape. Advancements in Artificial Intelligence (AI) are powering personalized content recommendations on platforms like Netflix Inc and Spotify Technology SA, enhancing user engagement and retention. Augmented Reality (AR) and Virtual Reality (VR) technologies, while still nascent in widespread mobile adoption, present future opportunities for interactive gaming and immersive storytelling. The rise of influencer marketing and user-generated content, popularized by platforms like Facebook and Snap Inc, further diversifies the entertainment ecosystem.

Evolving consumer behaviors are central to this growth. There is a pronounced shift towards on-demand consumption, with users preferring to access content whenever and wherever they choose. This trend strongly favors subscription-based models, as seen with Netflix Inc, Spotify Technology SA, and Apple Inc's Apple Music. The gamification of everyday experiences is also evident, with mobile games becoming a primary form of leisure for a significant portion of the global population. The integration of social features within entertainment apps, exemplified by Tencent Holdings Limited's WeChat, fosters community and shared experiences. Furthermore, the increasing demand for shorter-form, easily digestible content, popularized by platforms like YouTube and TikTok (part of ByteDance, not listed but a key player), caters to shrinking attention spans and on-the-go lifestyles. The ongoing expansion of Android and iOS ecosystems, coupled with the increasing sophistication of mobile hardware, ensures a fertile ground for continued innovation and revenue generation within the mobile entertainment sector, projected to be worth hundreds of billions.

Key Markets & Segments Leading Mobile Entertainment Industry

The mobile entertainment industry is characterized by diverse segments and regions, each contributing significantly to its overall growth.

Type: Games

- Dominance Analysis: The Games segment consistently emerges as a dominant force, accounting for the largest share of revenue and user engagement within the mobile entertainment market. This dominance is fueled by the widespread availability of powerful smartphones capable of running sophisticated gaming applications and the addictive nature of mobile gaming experiences. The sheer number of mobile games available on platforms like Google LLC's Google Play Store and Apple Inc's App Store, ranging from casual puzzle games to immersive role-playing experiences, ensures a broad appeal across demographics.

- Drivers:

- Accessibility and Affordability: Low entry barriers, with many games offering free-to-play models and in-app purchases, make gaming accessible to a vast global audience.

- Technological Advancements: Continuous improvements in mobile chipsets, graphics capabilities, and network speeds enable more visually appealing and complex mobile games.

- Social Integration: Features like multiplayer modes, leaderboards, and in-game social communities foster engagement and retention, as seen with titles developed by Electronic Arts Inc and Rovio Entertainment Corporation.

- Esports Growth: The burgeoning mobile esports scene further elevates the popularity and commercial viability of competitive mobile games.

Type: Video

- Dominance Analysis: Mobile Video streaming is another critical segment, experiencing rapid expansion due to the proliferation of smartphones and improved mobile internet connectivity. Platforms like Netflix Inc, Google LLC (YouTube), and Amazon com Inc (Prime Video) have made extensive libraries of movies, TV shows, and user-generated content readily available on mobile devices. The convenience of watching content on demand, anytime and anywhere, has made mobile video a primary entertainment source for billions.

- Drivers:

- Content Libraries: Extensive and diverse content offerings, including original series and licensed productions, attract and retain subscribers.

- Subscription Models: Recurring revenue streams from subscription services provide financial stability and enable investment in new content.

- 5G Infrastructure: Enhanced mobile network speeds facilitate seamless streaming of high-definition and 4K video content.

- Social Sharing and Virality: The ability to easily share video content across social media platforms amplifies reach and engagement.

Type: Music

- Dominance Analysis: The Mobile Music segment, led by players like Spotify Technology SA and Apple Inc (Apple Music), has transformed how people consume music. Streaming services have largely replaced traditional music sales, offering vast catalogs of songs and personalized playlists. Mobile devices are the primary listening devices for a significant portion of the global population, making this segment indispensable.

- Drivers:

- Vast Music Catalogs: Access to millions of songs across various genres caters to diverse musical tastes.

- Personalized Playlists and Recommendations: AI-powered algorithms curate unique listening experiences for users.

- Offline Listening Capabilities: The ability to download music for offline playback enhances user convenience.

- Integration with Smart Devices: Seamless integration with smart speakers and other connected devices expands listening opportunities.

Operating System: iOS & Android

- Dominance Analysis: iOS and Android are the two dominant operating systems that underpin the entire mobile entertainment ecosystem. Their widespread adoption ensures that the vast majority of mobile users have access to the myriad of entertainment applications and services. The competitive landscape between these two platforms drives innovation in app development and hardware capabilities, directly impacting the user experience across all entertainment segments. Google LLC and Apple Inc are instrumental in setting the standards and providing the infrastructure for this growth.

- Drivers:

- Market Penetration: Near-ubiquitous smartphone ownership globally.

- App Store Ecosystems: Robust app stores provide a centralized platform for discovery and distribution of entertainment content.

- Hardware Innovation: Continuous advancements in smartphone processing power, display quality, and battery life enhance mobile entertainment experiences.

Mobile Entertainment Industry Product Developments

Product innovation is relentless in the mobile entertainment industry, driven by the pursuit of enhanced user engagement and expanded market reach. Companies are constantly refining their offerings, from the immersive gameplay mechanics in titles by Electronic Arts Inc and Tencent Holdings Limited to the personalized content curation algorithms powering Netflix Inc and Spotify Technology SA. The development of interactive features, social integration within apps, and the exploration of emerging technologies like AR and VR are key to maintaining a competitive edge. For instance, the introduction of cloud gaming services aims to bring console-quality gaming to mobile devices, while advanced video compression techniques enable smoother streaming of higher-resolution content. Apple Inc and Google LLC continue to push the boundaries of mobile hardware, providing a platform for increasingly sophisticated entertainment applications. These advancements ensure a dynamic and evolving product landscape, designed to capture the attention and spending of billions of global users.

Challenges in the Mobile Entertainment Industry Market

Despite its rapid growth, the mobile entertainment industry faces significant challenges. Regulatory hurdles concerning content moderation, data privacy, and in-app purchases can impact revenue streams and operational strategies for companies like Facebook and Google LLC. Intense competitive pressures from established giants and agile new entrants lead to a constant need for innovation and customer acquisition, often driving up marketing costs. Monetization strategies remain a complex balancing act between free-to-play models and subscription services, with user churn being a persistent concern. Furthermore, cybersecurity threats and the risk of intellectual property infringement pose ongoing threats to revenue and brand reputation. The significant investment required for content creation and technology development also presents a barrier to entry for smaller players.

Forces Driving Mobile Entertainment Industry Growth

Several potent forces are propelling the mobile entertainment industry forward. The continued increasing penetration of smartphones globally provides an ever-expanding user base. The rapid deployment of 5G networks is a critical technological enabler, promising lower latency and higher bandwidth that will enhance immersive experiences in gaming and video streaming. Evolving consumer behavior, characterized by a preference for on-demand, personalized, and accessible entertainment, perfectly aligns with the offerings of the mobile sector. Furthermore, significant investments by major technology companies like Google LLC, Apple Inc, and Amazon com Inc in content creation, platform development, and infrastructure development are fueling innovation and market expansion. Favorable economic conditions in emerging markets also present a substantial opportunity for growth.

Challenges in the Mobile Entertainment Industry Market

Long-term growth catalysts for the mobile entertainment industry lie in continuous innovation and strategic expansion. The exploration and integration of emerging technologies such as AI-powered content personalization, cloud gaming, and immersive AR/VR experiences will be crucial for retaining user interest and attracting new audiences. Strategic partnerships and collaborations, for example, between mobile operators and content providers, can unlock new distribution channels and revenue streams. Market expansions into underserved or emerging economies, coupled with the development of localized content, represent a significant opportunity for sustained growth. The ongoing evolution of monetization models, moving beyond traditional advertising and subscriptions, will also be key to long-term financial health. Companies like Netflix Inc and Spotify Technology SA are already experimenting with hybrid models to cater to diverse user preferences.

Emerging Opportunities in Mobile Entertainment Industry

The mobile entertainment industry is rife with emerging opportunities for forward-thinking stakeholders. The metaverse and Web3 technologies present a transformative frontier, offering new avenues for interactive gaming, virtual economies, and decentralized content ownership, creating potential for billions in new revenue. The increasing demand for interactive and social entertainment is driving the growth of live streaming, co-watching features, and community-driven platforms, benefiting companies like Facebook and Snap Inc. Furthermore, the untapped potential in emerging markets across Africa, Southeast Asia, and Latin America, with their rapidly growing youth populations and increasing smartphone adoption, offers substantial growth prospects. The development of niche content genres and personalized experiences catering to specific demographics and interests also presents a significant opportunity for differentiation and customer loyalty.

Leading Players in the Mobile Entertainment Industry Sector

- Electronic Arts Inc

- Netflix Inc

- Google LLC

- Spotify Technology SA

- Snap Inc

- Rovio Entertainment Corporation

- Tencent Holdings Limited

- Amazon com Inc

- OnMobile Global Limited

- AT&T Inc

- Apple Inc

Key Milestones in Mobile Entertainment Industry Industry

- September 2021: In Kenya, Netflix is releasing a new free Android mobile plan that will allow users to watch a limited selection of its repertoire, including full seasons of certain shows. The Netflix mobile plan for Android allows users to join up without having to submit any financial information, signaling a strategic move to expand subscriber base in emerging markets.

- August 2021: Netflix began testing its games inside their android app for their members in Poland. The paying subscribers will try out two games, "Stranger Things: 1984" and "Stranger Things 3", marking Netflix's foray into interactive mobile gaming.

- July 2021: Gamestacy announced its partnership with Beamable to launch Influenzer, a unique social, Multiplayer mobile game. This soft launch is anticipated to usher new options for gender-specific games in the rapidly growing mobile games market, highlighting innovation in game design.

- May 2021: NetEase announced the launch of new games for their diverse portfolio of mobile as well as a personal computer and also contained updates for over 60 products at its Seventh Annual Product Launch, demonstrating a robust pipeline of new content and updates across multiple platforms.

Strategic Outlook for Mobile Entertainment Industry Market

The strategic outlook for the mobile entertainment industry is overwhelmingly positive, driven by persistent innovation and expanding market reach. Key growth accelerators include the further integration of AI for hyper-personalized user experiences, the continued rollout of 5G which will enable more sophisticated gaming and streaming, and the exploration of nascent technologies like the metaverse to create novel entertainment dimensions. Companies that can effectively leverage data analytics to understand and cater to evolving consumer preferences, while simultaneously developing engaging content across diverse segments like mobile games, video streaming, and music, will be best positioned for success. Strategic acquisitions and partnerships will remain critical for consolidating market share and accessing new technologies or user bases. The industry is poised for continued expansion, projected to generate billions in revenue and shape the future of digital leisure for years to come.

Mobile Entertainment Industry Segmentation

-

1. Type

- 1.1. Games

- 1.2. Video

- 1.3. Music

-

2. Operating System

- 2.1. iOS

- 2.2. Android

- 2.3. Others

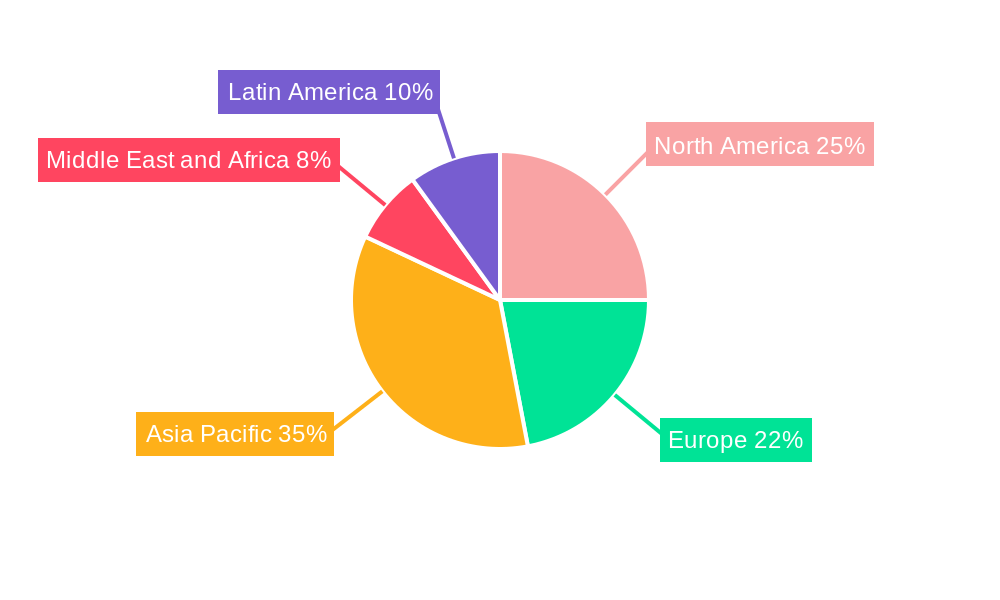

Mobile Entertainment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Mobile Entertainment Industry Regional Market Share

Geographic Coverage of Mobile Entertainment Industry

Mobile Entertainment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing penetration of smartphones across the globe; Growth in mobile network accessibility in recent years such as 4G and 5G

- 3.3. Market Restrains

- 3.3.1. Paid version of some applications can challenge further penetration

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Subscription video-on-demand (SVOD)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Entertainment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Games

- 5.1.2. Video

- 5.1.3. Music

- 5.2. Market Analysis, Insights and Forecast - by Operating System

- 5.2.1. iOS

- 5.2.2. Android

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Mobile Entertainment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Games

- 6.1.2. Video

- 6.1.3. Music

- 6.2. Market Analysis, Insights and Forecast - by Operating System

- 6.2.1. iOS

- 6.2.2. Android

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Mobile Entertainment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Games

- 7.1.2. Video

- 7.1.3. Music

- 7.2. Market Analysis, Insights and Forecast - by Operating System

- 7.2.1. iOS

- 7.2.2. Android

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Mobile Entertainment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Games

- 8.1.2. Video

- 8.1.3. Music

- 8.2. Market Analysis, Insights and Forecast - by Operating System

- 8.2.1. iOS

- 8.2.2. Android

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Mobile Entertainment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Games

- 9.1.2. Video

- 9.1.3. Music

- 9.2. Market Analysis, Insights and Forecast - by Operating System

- 9.2.1. iOS

- 9.2.2. Android

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Mobile Entertainment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Games

- 10.1.2. Video

- 10.1.3. Music

- 10.2. Market Analysis, Insights and Forecast - by Operating System

- 10.2.1. iOS

- 10.2.2. Android

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Facebook

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Electronic Arts Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Netflix Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Spotify Technology SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Snap Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rovio Entertainment Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tencent Holdings Limite

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amazon com Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 OnMobile Global Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AT&T Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Apple Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Facebook

List of Figures

- Figure 1: Global Mobile Entertainment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Mobile Entertainment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Mobile Entertainment Industry Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Mobile Entertainment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Mobile Entertainment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Mobile Entertainment Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Mobile Entertainment Industry Revenue (undefined), by Operating System 2025 & 2033

- Figure 8: North America Mobile Entertainment Industry Volume (K Unit), by Operating System 2025 & 2033

- Figure 9: North America Mobile Entertainment Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 10: North America Mobile Entertainment Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 11: North America Mobile Entertainment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Mobile Entertainment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Mobile Entertainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Mobile Entertainment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Mobile Entertainment Industry Revenue (undefined), by Type 2025 & 2033

- Figure 16: Europe Mobile Entertainment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Mobile Entertainment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Mobile Entertainment Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Mobile Entertainment Industry Revenue (undefined), by Operating System 2025 & 2033

- Figure 20: Europe Mobile Entertainment Industry Volume (K Unit), by Operating System 2025 & 2033

- Figure 21: Europe Mobile Entertainment Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 22: Europe Mobile Entertainment Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 23: Europe Mobile Entertainment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Mobile Entertainment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Mobile Entertainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Mobile Entertainment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Mobile Entertainment Industry Revenue (undefined), by Type 2025 & 2033

- Figure 28: Asia Pacific Mobile Entertainment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Mobile Entertainment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Mobile Entertainment Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Mobile Entertainment Industry Revenue (undefined), by Operating System 2025 & 2033

- Figure 32: Asia Pacific Mobile Entertainment Industry Volume (K Unit), by Operating System 2025 & 2033

- Figure 33: Asia Pacific Mobile Entertainment Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 34: Asia Pacific Mobile Entertainment Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 35: Asia Pacific Mobile Entertainment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Mobile Entertainment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Mobile Entertainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Mobile Entertainment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Mobile Entertainment Industry Revenue (undefined), by Type 2025 & 2033

- Figure 40: Middle East and Africa Mobile Entertainment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Middle East and Africa Mobile Entertainment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East and Africa Mobile Entertainment Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East and Africa Mobile Entertainment Industry Revenue (undefined), by Operating System 2025 & 2033

- Figure 44: Middle East and Africa Mobile Entertainment Industry Volume (K Unit), by Operating System 2025 & 2033

- Figure 45: Middle East and Africa Mobile Entertainment Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 46: Middle East and Africa Mobile Entertainment Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 47: Middle East and Africa Mobile Entertainment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Mobile Entertainment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Mobile Entertainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Mobile Entertainment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Mobile Entertainment Industry Revenue (undefined), by Type 2025 & 2033

- Figure 52: Latin America Mobile Entertainment Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Latin America Mobile Entertainment Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Mobile Entertainment Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Mobile Entertainment Industry Revenue (undefined), by Operating System 2025 & 2033

- Figure 56: Latin America Mobile Entertainment Industry Volume (K Unit), by Operating System 2025 & 2033

- Figure 57: Latin America Mobile Entertainment Industry Revenue Share (%), by Operating System 2025 & 2033

- Figure 58: Latin America Mobile Entertainment Industry Volume Share (%), by Operating System 2025 & 2033

- Figure 59: Latin America Mobile Entertainment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: Latin America Mobile Entertainment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Mobile Entertainment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Mobile Entertainment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Entertainment Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Mobile Entertainment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Mobile Entertainment Industry Revenue undefined Forecast, by Operating System 2020 & 2033

- Table 4: Global Mobile Entertainment Industry Volume K Unit Forecast, by Operating System 2020 & 2033

- Table 5: Global Mobile Entertainment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Mobile Entertainment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Mobile Entertainment Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Mobile Entertainment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Mobile Entertainment Industry Revenue undefined Forecast, by Operating System 2020 & 2033

- Table 10: Global Mobile Entertainment Industry Volume K Unit Forecast, by Operating System 2020 & 2033

- Table 11: Global Mobile Entertainment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Mobile Entertainment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Mobile Entertainment Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Mobile Entertainment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Mobile Entertainment Industry Revenue undefined Forecast, by Operating System 2020 & 2033

- Table 16: Global Mobile Entertainment Industry Volume K Unit Forecast, by Operating System 2020 & 2033

- Table 17: Global Mobile Entertainment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Mobile Entertainment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Mobile Entertainment Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Mobile Entertainment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Mobile Entertainment Industry Revenue undefined Forecast, by Operating System 2020 & 2033

- Table 22: Global Mobile Entertainment Industry Volume K Unit Forecast, by Operating System 2020 & 2033

- Table 23: Global Mobile Entertainment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Mobile Entertainment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Mobile Entertainment Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Mobile Entertainment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Mobile Entertainment Industry Revenue undefined Forecast, by Operating System 2020 & 2033

- Table 28: Global Mobile Entertainment Industry Volume K Unit Forecast, by Operating System 2020 & 2033

- Table 29: Global Mobile Entertainment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Mobile Entertainment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Mobile Entertainment Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Global Mobile Entertainment Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Mobile Entertainment Industry Revenue undefined Forecast, by Operating System 2020 & 2033

- Table 34: Global Mobile Entertainment Industry Volume K Unit Forecast, by Operating System 2020 & 2033

- Table 35: Global Mobile Entertainment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Mobile Entertainment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Entertainment Industry?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Mobile Entertainment Industry?

Key companies in the market include Facebook, Electronic Arts Inc, Netflix Inc, Google LLC, Spotify Technology SA, Snap Inc, Rovio Entertainment Corporation, Tencent Holdings Limite, Amazon com Inc, OnMobile Global Limited, AT&T Inc, Apple Inc.

3. What are the main segments of the Mobile Entertainment Industry?

The market segments include Type, Operating System.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing penetration of smartphones across the globe; Growth in mobile network accessibility in recent years such as 4G and 5G.

6. What are the notable trends driving market growth?

Increasing Adoption of Subscription video-on-demand (SVOD).

7. Are there any restraints impacting market growth?

Paid version of some applications can challenge further penetration.

8. Can you provide examples of recent developments in the market?

September 2021 - In Kenya, Netflix is releasing a new free Android mobile plan that will allow users to watch a limited selection of its repertoire, including full seasons of certain shows. The Netflix mobile plan for Android allows users to join up without having to submit any financial information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Entertainment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Entertainment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Entertainment Industry?

To stay informed about further developments, trends, and reports in the Mobile Entertainment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence