Key Insights

The global Electromagnetic Flowmeter market is projected for significant expansion, anticipated to reach approximately $14.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.91% from 2025 to 2033. This growth is driven by increasing demand for precise fluid measurement in industries such as water and wastewater treatment, chemicals and petrochemicals, and power generation. Key factors include the focus on process optimization, stringent environmental regulations, and the need for efficient resource management. The expanding oil and gas and food and beverage sectors further contribute to this trend. Market players are innovating with smart flowmeters featuring enhanced connectivity and remote monitoring capabilities.

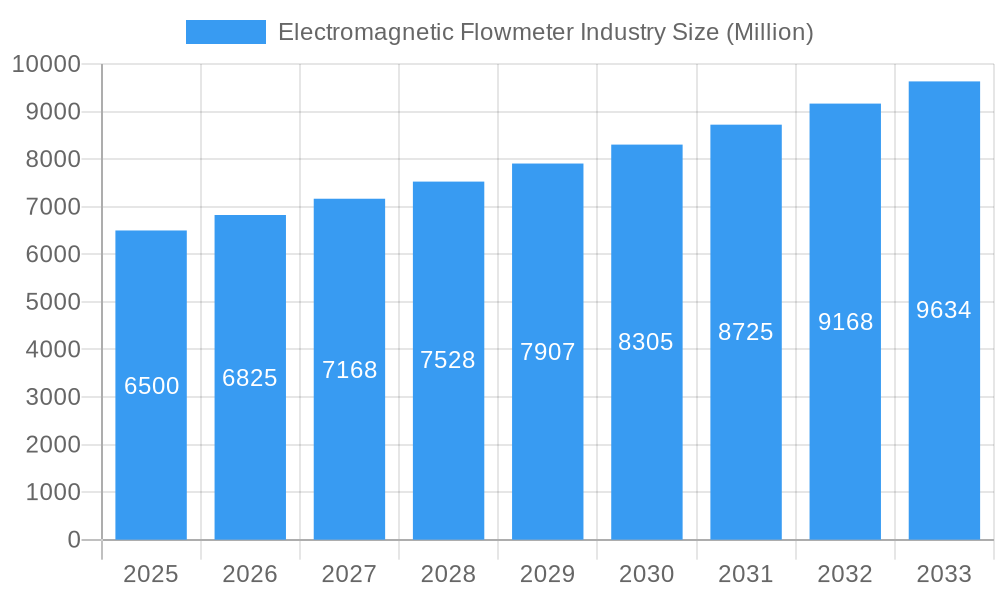

Electromagnetic Flowmeter Industry Market Size (In Billion)

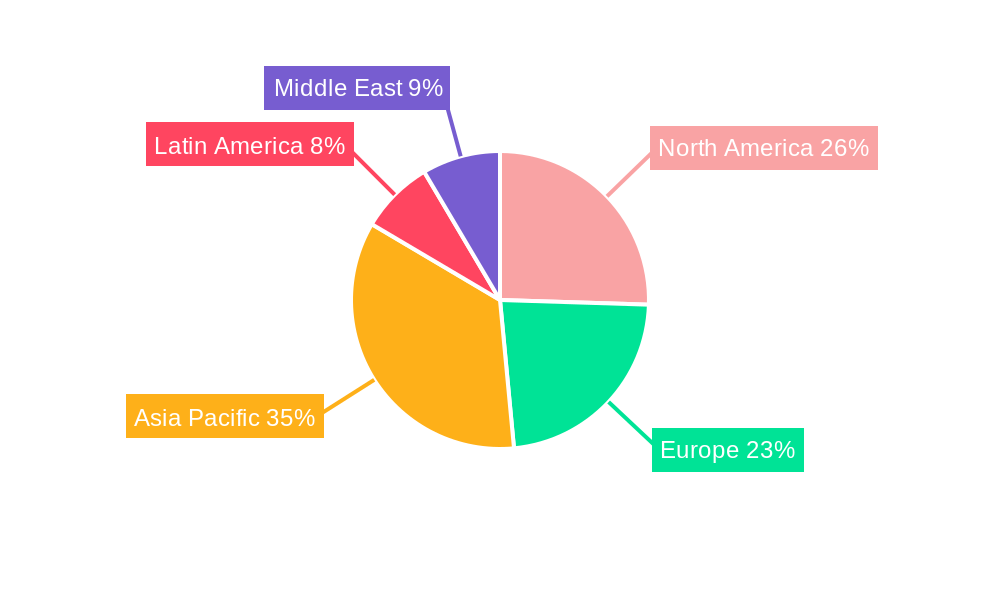

The market is segmented by flowmeter type, with in-line magnetic flowmeters widely used. Low-flow magnetic flowmeters are gaining traction for high-accuracy applications involving small fluid volumes, while insertion magnetic flowmeters offer a cost-effective solution for large pipe diameters. Geographically, the Asia Pacific region is expected to lead due to rapid industrialization and infrastructure investment. North America and Europe remain substantial markets with established players and a demand for high-performance solutions. Key companies like Honeywell International Inc., ABB Ltd., Siemens AG, and Endress+Hauser AG are investing in R&D to drive innovation and market expansion.

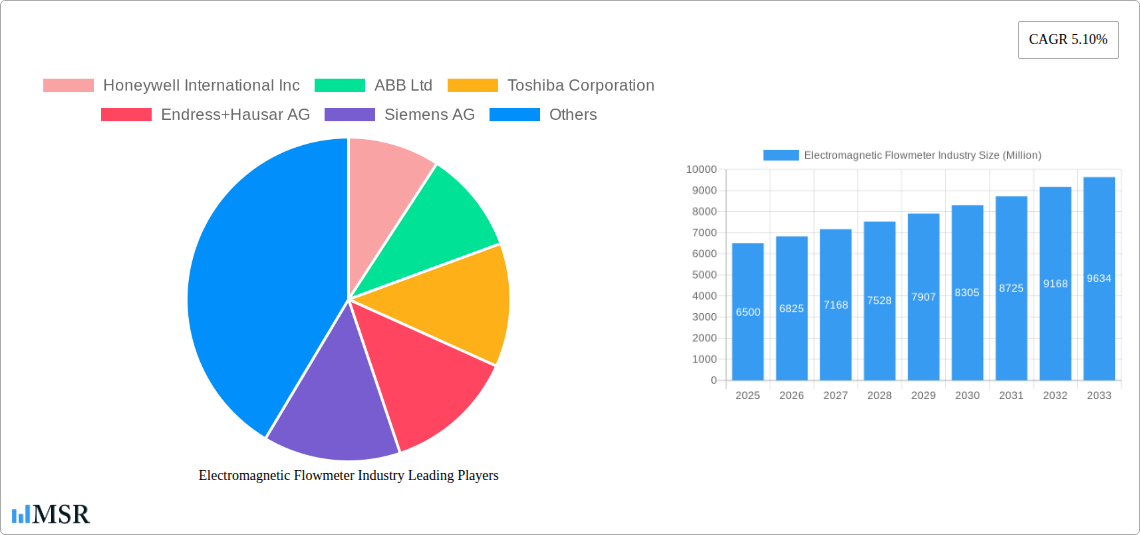

Electromagnetic Flowmeter Industry Company Market Share

This report provides comprehensive insights into the Electromagnetic Flowmeter Market for the Study Period 2019–2033, with a Base Year of 2025. It analyzes market dynamics, technological advancements, and growth trajectories across key sectors including Water and Wastewater, Chemicals and Petrochemicals, Power Generation, Metals and Mining, Oil and Gas, and Food and Beverages. Essential for industry leaders, investors, and procurement professionals, this analysis details the competitive landscape and emerging opportunities in flowmeter technology.

Electromagnetic Flowmeter Industry Market Concentration & Dynamics

The Electromagnetic Flowmeter Industry exhibits a moderately concentrated market, driven by a handful of global players and a growing number of specialized manufacturers. Innovation ecosystems are robust, with significant investments in R&D fueling the development of advanced digital flowmeters and smart metering solutions. Regulatory frameworks, particularly those concerning water quality and industrial emissions, are increasingly stringent, creating a demand for accurate and reliable electromagnetic flow measurement. Substitute products, such as Coriolis and ultrasonic flowmeters, offer alternative solutions, but electromagnetic flowmeters maintain a strong position due to their cost-effectiveness and suitability for conductive fluids. End-user trends highlight a growing preference for IoT-enabled devices, predictive maintenance capabilities, and enhanced data analytics for process optimization. Mergers and acquisitions (M&A) activities are present, though less frequent, indicating a mature market seeking strategic consolidation and technology acquisition. While specific market share data fluctuates, leading companies like Siemens AG and Endress+Hauser AG command significant portions of the global market. M&A deal counts have seen a steady but modest increase, averaging 2-3 significant transactions annually over the historical period.

Electromagnetic Flowmeter Industry Industry Insights & Trends

The Electromagnetic Flowmeter Industry is poised for substantial growth, fueled by escalating global demand for accurate fluid management across diverse industrial sectors. The market size is projected to reach approximately $2.5 Billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% projected throughout the Forecast Period 2025–2033. This growth is primarily driven by the increasing need for efficient water and wastewater treatment, stringent environmental regulations mandating precise monitoring of industrial effluents, and the expansion of the oil and gas industry. Technological disruptions, such as the integration of IoT capabilities, wireless communication protocols like 4G-LTE and NB-IoT, and advanced diagnostic features, are transforming electromagnetic flowmeter technology. These innovations enable real-time data transmission, remote monitoring, and predictive maintenance, significantly improving operational efficiency and reducing downtime for end-users. Evolving consumer behaviors are characterized by a greater emphasis on sustainability, resource conservation, and data-driven decision-making. Industries are actively seeking solutions that offer precise measurement, minimize waste, and ensure compliance with environmental standards, directly benefiting the electromagnetic flowmeter market. The increasing adoption of smart cities initiatives and the modernization of aging water infrastructure also present significant opportunities for market expansion.

Key Markets & Segments Leading Electromagnetic Flowmeter Industry

The Electromagnetic Flowmeter Industry is significantly influenced by its diverse applications and product segments.

Dominant Applications:

- Water and Wastewater: This sector is a primary driver of demand, accounting for an estimated 35% of the market share. Factors contributing to its dominance include the global imperative for clean water, aging infrastructure requiring upgrades, and strict regulations on wastewater discharge. Economic growth and population expansion further amplify this demand.

- Chemicals and Petrochemicals: This segment represents approximately 25% of the market. High process accuracy requirements, the need for safe handling of corrosive and hazardous fluids, and the continuous expansion of petrochemical facilities drive the adoption of reliable electromagnetic flowmeters. Technological advancements in material science and sensor technology are critical here.

- Oil and Gas: Contributing around 15% to the market, this sector relies on electromagnetic flowmeters for accurate custody transfer, process monitoring, and exploration activities, especially in offshore applications where robust and reliable instrumentation is paramount.

Dominant Product Segments:

- In-line Magnetic Flowmeters: These constitute the largest product segment, estimated at 60% market share. Their widespread use in various industrial processes, ease of installation, and high accuracy for conductive liquids make them the preferred choice.

- Low Flow Magnetic Flowmeters: While a smaller segment, this is a high-growth area with approximately 20% market share, driven by applications in pharmaceuticals, laboratory testing, and specialized chemical processing where precise measurement of small fluid volumes is critical.

- Insertion Magnetic Flowmeters: Accounting for about 15% of the market, these are favored for their cost-effectiveness in larger pipe sizes and situations where inline installation is not feasible, particularly in large-scale water distribution networks and industrial cooling systems.

The continued economic development in emerging economies, coupled with significant investments in infrastructure development, particularly in regions like Asia-Pacific and North America, further propels the growth of these key markets and segments.

Electromagnetic Flowmeter Industry Product Developments

Product innovation in the Electromagnetic Flowmeter Industry focuses on enhancing accuracy, connectivity, and usability. Recent developments include the introduction of advanced digital communication interfaces, remote diagnostics, and self-calibration features, improving operational efficiency and reducing maintenance costs. The integration of IoT capabilities enables seamless data integration with plant control systems, facilitating real-time monitoring and process optimization. Furthermore, the development of new materials and sensor designs is expanding the application range of these flowmeters to more challenging environments and fluids. Companies are also focusing on miniaturization and energy efficiency for battery-powered or remote applications.

Challenges in the Electromagnetic Flowmeter Industry Market

The Electromagnetic Flowmeter Industry faces several challenges. High initial investment costs for advanced models can be a barrier for smaller enterprises. The need for specific conductive fluids limits their application in certain processes. Intense competition from alternative flowmeter technologies and established players can impact pricing and market share. Furthermore, fluctuations in raw material prices and supply chain disruptions can affect production costs and lead times. Stringent calibration requirements and the need for specialized technical expertise for installation and maintenance also present operational hurdles.

Forces Driving Electromagnetic Flowmeter Industry Growth

Several key forces are driving the growth of the Electromagnetic Flowmeter Industry. The global imperative for accurate water management and conservation, especially in the Water and Wastewater sector, is a major catalyst. Increasingly stringent environmental regulations worldwide necessitate precise monitoring of industrial discharges and process flows, directly boosting demand for flowmeters. Technological advancements, such as the development of smart, connected devices with IoT capabilities, are enhancing data accuracy and enabling remote monitoring and diagnostics. The expansion of industries like Chemicals and Petrochemicals and Oil and Gas, coupled with significant infrastructure development projects globally, further fuels the demand for reliable flow measurement solutions.

Challenges in the Electromagnetic Flowmeter Industry Market

Long-term growth catalysts in the Electromagnetic Flowmeter Industry are centered on continuous innovation and market expansion. The ongoing shift towards Industry 4.0 and the proliferation of smart factories are creating a demand for highly integrated and intelligent flowmeter solutions that can contribute to predictive maintenance and process automation. Emerging economies present significant untapped markets, with increasing investments in industrialization and infrastructure development creating new avenues for growth. Furthermore, the growing focus on sustainability and circular economy principles will drive the need for precise monitoring and control of resources, further solidifying the importance of electromagnetic flowmeters. Strategic partnerships and collaborations between technology providers and end-users will also be crucial for developing tailored solutions and accelerating market penetration.

Emerging Opportunities in Electromagnetic Flowmeter Industry

Emerging opportunities in the Electromagnetic Flowmeter Industry lie in several key areas. The increasing adoption of digital twins and advanced data analytics presents a chance to offer value-added services beyond basic flow measurement, including predictive maintenance and process optimization. The development of portable and wireless electromagnetic flowmeters for temporary or mobile applications, particularly in the Oil and Gas exploration and utility sectors, offers a niche growth area. The growing demand for precise flow measurement in emerging industries like biotechnology and advanced materials manufacturing also presents new market frontiers. Furthermore, the focus on water scarcity and the need for efficient irrigation systems in agriculture create a substantial opportunity for cost-effective and robust electromagnetic flowmeter solutions.

Leading Players in the Electromagnetic Flowmeter Industry Sector

- Honeywell International Inc

- ABB Ltd

- Toshiba Corporation

- Endress+Hauser AG

- Siemens AG

- KROHNE Messtechnik GmbH

- OMEGA Engineering Inc (Spectris PLC)

- Azbil Corporation

- Emerson Electric Corporation

- Yokogawa Electric Corporation

Key Milestones in Electromagnetic Flowmeter Industry Industry

- June 2022: Endress+Hauser dedicated a new facility in France. Endress+Hauser manufactures flowmeters in Cernay for delivery to customers around the world. The additional 10,000 sq m of space will be used primarily to manufacture electromagnetic flowmeters. The new building was designed chiefly to manufacture the Progmag H and Dosimag H electromagnetic flowmeters, mainly used in the food and life sciences industries.

- December 2021: ABB introduced the world's first electromagnetic AquaMaster4 Mobile Comms flowmeter with bidirectional connectivity to power intelligent water loss management. AquaMaster4 Mobile Comms flowmeter is the latest wireless solution for continuous flow measurement, the logging of accurate data, and the communication of information critical for water management. With its superior connectivity on 4G-LTE and NB-IoT networks, the AquaMaster4 electromagnetic flowmeter enables 60% lower power consumption, identifying leaks ten times faster than the market standard.

Strategic Outlook for Electromagnetic Flowmeter Industry Market

The strategic outlook for the Electromagnetic Flowmeter Industry Market is overwhelmingly positive, driven by continuous technological innovation and expanding industrial applications. The market is expected to witness sustained growth, with a significant emphasis on developing intelligent, connected flowmeters that integrate seamlessly with IoT platforms and provide advanced data analytics. Companies that focus on enhancing product accuracy, expanding their product portfolios to cater to niche applications like low-flow and high-temperature environments, and investing in smart manufacturing capabilities will be well-positioned for success. Strategic partnerships, particularly with software providers and system integrators, will be crucial for offering comprehensive solutions. Furthermore, a strong focus on sustainability and energy efficiency in product design will resonate with the evolving demands of the global market, unlocking further growth potential. The increasing adoption of these electromagnetic flowmeter solutions across developing economies is anticipated to be a key growth accelerator.

Electromagnetic Flowmeter Industry Segmentation

-

1. Product

- 1.1. In-line Magnetic Flowmeters

- 1.2. Low Flow Magnetic Flowmeters

- 1.3. Insertion Magnetic Flowmeters

-

2. Application

- 2.1. Water and Wastewater

- 2.2. Chemicals and Petrochemicals

- 2.3. Power Generation

- 2.4. Metals and Mining

- 2.5. Oil and Gas

- 2.6. Food and Beverages

- 2.7. Other Ap

Electromagnetic Flowmeter Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Electromagnetic Flowmeter Industry Regional Market Share

Geographic Coverage of Electromagnetic Flowmeter Industry

Electromagnetic Flowmeter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Water Shortage and the Growing Population; Technological Innovations in Irrigation

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Industry to Witness the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. In-line Magnetic Flowmeters

- 5.1.2. Low Flow Magnetic Flowmeters

- 5.1.3. Insertion Magnetic Flowmeters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water and Wastewater

- 5.2.2. Chemicals and Petrochemicals

- 5.2.3. Power Generation

- 5.2.4. Metals and Mining

- 5.2.5. Oil and Gas

- 5.2.6. Food and Beverages

- 5.2.7. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. In-line Magnetic Flowmeters

- 6.1.2. Low Flow Magnetic Flowmeters

- 6.1.3. Insertion Magnetic Flowmeters

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water and Wastewater

- 6.2.2. Chemicals and Petrochemicals

- 6.2.3. Power Generation

- 6.2.4. Metals and Mining

- 6.2.5. Oil and Gas

- 6.2.6. Food and Beverages

- 6.2.7. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. In-line Magnetic Flowmeters

- 7.1.2. Low Flow Magnetic Flowmeters

- 7.1.3. Insertion Magnetic Flowmeters

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water and Wastewater

- 7.2.2. Chemicals and Petrochemicals

- 7.2.3. Power Generation

- 7.2.4. Metals and Mining

- 7.2.5. Oil and Gas

- 7.2.6. Food and Beverages

- 7.2.7. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. In-line Magnetic Flowmeters

- 8.1.2. Low Flow Magnetic Flowmeters

- 8.1.3. Insertion Magnetic Flowmeters

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water and Wastewater

- 8.2.2. Chemicals and Petrochemicals

- 8.2.3. Power Generation

- 8.2.4. Metals and Mining

- 8.2.5. Oil and Gas

- 8.2.6. Food and Beverages

- 8.2.7. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. In-line Magnetic Flowmeters

- 9.1.2. Low Flow Magnetic Flowmeters

- 9.1.3. Insertion Magnetic Flowmeters

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water and Wastewater

- 9.2.2. Chemicals and Petrochemicals

- 9.2.3. Power Generation

- 9.2.4. Metals and Mining

- 9.2.5. Oil and Gas

- 9.2.6. Food and Beverages

- 9.2.7. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East Electromagnetic Flowmeter Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. In-line Magnetic Flowmeters

- 10.1.2. Low Flow Magnetic Flowmeters

- 10.1.3. Insertion Magnetic Flowmeters

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water and Wastewater

- 10.2.2. Chemicals and Petrochemicals

- 10.2.3. Power Generation

- 10.2.4. Metals and Mining

- 10.2.5. Oil and Gas

- 10.2.6. Food and Beverages

- 10.2.7. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Endress+Hausar AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KROHNE Messtechnik GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OMEGA Engineering Inc (Spectris PLC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Azbil Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emerson Electric Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yokogawa Electric Corporation*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Electromagnetic Flowmeter Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 21: Latin America Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Latin America Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Electromagnetic Flowmeter Industry Revenue (billion), by Product 2025 & 2033

- Figure 27: Middle East Electromagnetic Flowmeter Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East Electromagnetic Flowmeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Electromagnetic Flowmeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Electromagnetic Flowmeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Electromagnetic Flowmeter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 17: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Electromagnetic Flowmeter Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electromagnetic Flowmeter Industry?

The projected CAGR is approximately 7.91%.

2. Which companies are prominent players in the Electromagnetic Flowmeter Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Toshiba Corporation, Endress+Hausar AG, Siemens AG, KROHNE Messtechnik GmbH, OMEGA Engineering Inc (Spectris PLC), Azbil Corporation, Emerson Electric Corporation, Yokogawa Electric Corporation*List Not Exhaustive.

3. What are the main segments of the Electromagnetic Flowmeter Industry?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Water Shortage and the Growing Population; Technological Innovations in Irrigation.

6. What are the notable trends driving market growth?

Water and Wastewater Industry to Witness the Highest Growth.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

June 2022 - EEndress+Hauser dedicated a new facility in France. Endress+Hauser manufactures flowmeters in Cernay for delivery to customers around the world. The additional 10,000 sq m of space will be used primarily to manufacture electromagnetic flowmeters. The new building was designed chiefly to manufacture the Progmag H and Dosimag H electromagnetic flowmeters, mainly used in the food and life sciences industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electromagnetic Flowmeter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electromagnetic Flowmeter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electromagnetic Flowmeter Industry?

To stay informed about further developments, trends, and reports in the Electromagnetic Flowmeter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence