Key Insights

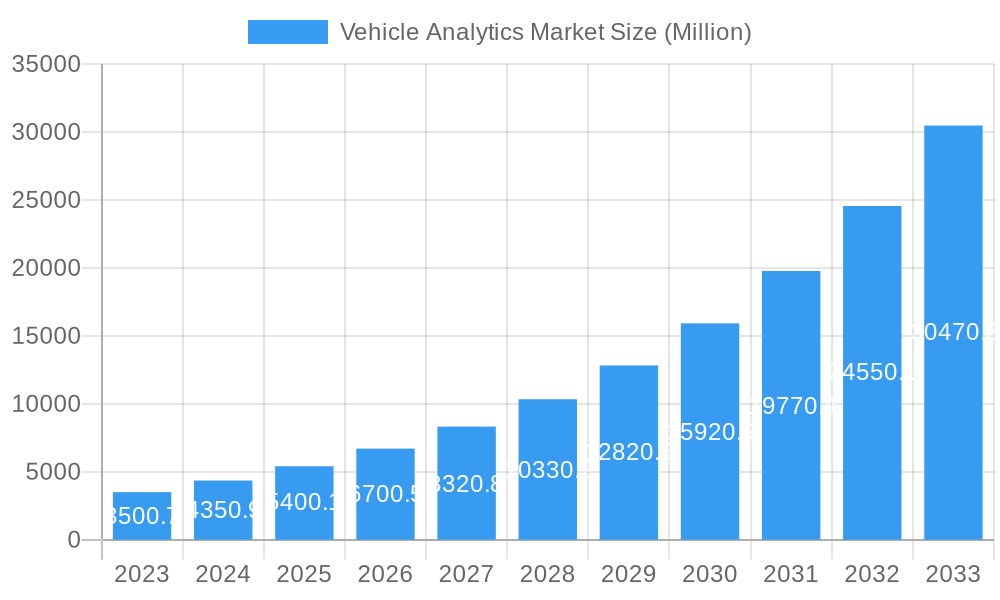

The global Vehicle Analytics Market is experiencing phenomenal growth, projected to reach a substantial market size with a compelling CAGR of 24.30%. This expansion is fueled by the increasing adoption of connected vehicles and the burgeoning demand for data-driven insights to optimize fleet operations, enhance safety, and improve vehicle performance. Key drivers include the rising need for predictive maintenance, enabling proactive identification of potential component failures and minimizing downtime for commercial fleets and individual vehicles. Furthermore, the escalating focus on safety and security management, through real-time monitoring and advanced threat detection, is a significant growth catalyst. The market is witnessing a surge in solutions for driver performance analysis, empowering organizations to enhance driving habits, reduce fuel consumption, and mitigate accident risks. The ubiquitous integration of telematics and IoT devices in vehicles is providing the foundational data infrastructure for these advanced analytical capabilities.

Vehicle Analytics Market Market Size (In Billion)

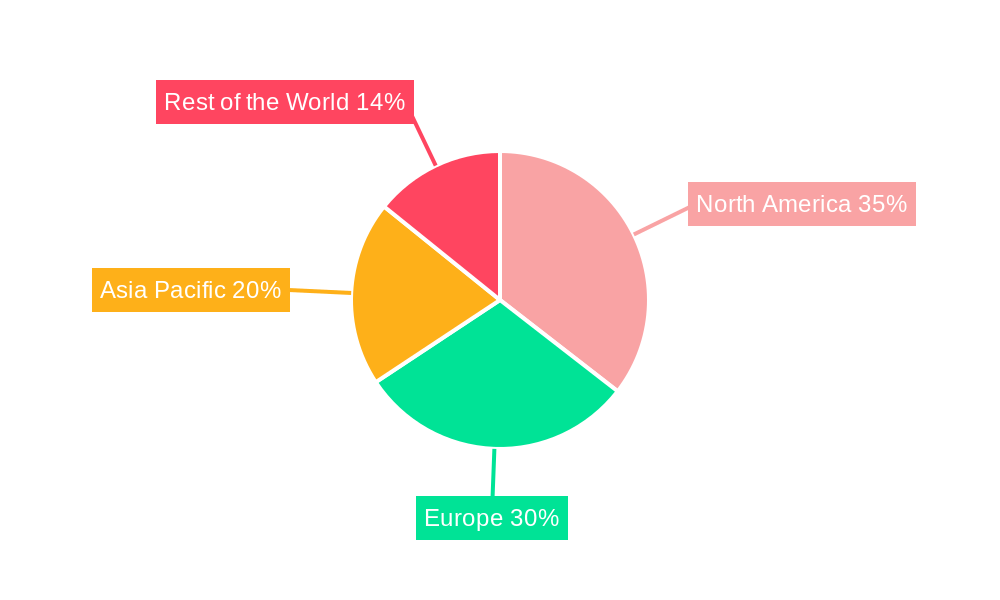

The market is segmented across various deployment models, with both on-premise and cloud solutions catering to diverse industry needs, though cloud adoption is rapidly gaining traction due to its scalability and cost-effectiveness. The applications are broad, encompassing not only predictive maintenance and safety but also extending to driver behavior analysis and other specialized functions. The primary end-users are fleet owners, who are actively leveraging vehicle analytics to boost operational efficiency and reduce costs. Insurers are also recognizing the value of this data for risk assessment and personalized premium offerings. Original Equipment Manufacturers (OEMs) and service providers are integrating these solutions to enhance customer experience and develop new revenue streams. Geographically, North America and Europe are leading the market due to early adoption of advanced automotive technologies and stringent safety regulations, while the Asia Pacific region is poised for significant growth driven by rapid vehicle sales and increasing digitalization. Restraints, such as data privacy concerns and the initial investment costs, are being addressed through evolving regulatory frameworks and more accessible technological solutions.

Vehicle Analytics Market Company Market Share

Comprehensive Vehicle Analytics Market Report: Unlocking Insights for a Connected Future (2019–2033)

Dive deep into the dynamic world of vehicle analytics with this essential market report. Spanning the historical period of 2019–2024 and projecting future growth through 2033, this analysis provides unparalleled insights for stakeholders seeking to capitalize on the evolving automotive landscape. With a base year of 2025 and an estimated year of 2025, our report offers a robust understanding of current market dynamics and future trajectories. The global Vehicle Analytics Market is projected to reach XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Explore the impact of cutting-edge technologies, evolving consumer demands, and strategic industry developments that are reshaping how vehicles are designed, operated, and maintained.

Vehicle Analytics Market Market Concentration & Dynamics

The Vehicle Analytics Market is characterized by a growing but moderately concentrated landscape, driven by significant investments in connected car technology and data-driven decision-making. Key players are actively shaping innovation ecosystems, focusing on advanced analytics for predictive maintenance, enhanced safety, and optimized driver performance. Regulatory frameworks, while still evolving, are increasingly emphasizing data privacy and cybersecurity, influencing market strategies and product development. The emergence of substitute products, such as advanced sensor arrays and integrated telematics solutions, complements the core analytics platforms. End-user trends indicate a strong demand for actionable insights across fleet owners, insurers, and OEMs, leading to increased adoption of cloud-based solutions. Mergers and acquisitions (M&A) activities are moderate, with companies strategically acquiring capabilities to expand their market reach and technological portfolios. The market is witnessing a steady inflow of venture capital, fueling innovation and competition.

- Market Share Insights: Leading companies hold significant but not dominant market shares, indicating room for new entrants and niche players.

- M&A Activities: A trend towards strategic acquisitions of specialized analytics firms and technology providers to bolster existing offerings.

- Innovation Ecosystems: Strong collaborations between tech giants, automotive manufacturers, and specialized analytics firms to drive cutting-edge solutions.

- Regulatory Impact: Growing influence of data protection regulations (e.g., GDPR, CCPA) on data handling and analytics strategies.

Vehicle Analytics Market Industry Insights & Trends

The Vehicle Analytics Market is experiencing robust growth, fueled by the proliferation of connected vehicles and the increasing volume of data generated by automotive systems. This surge in data offers unprecedented opportunities for businesses to enhance operational efficiency, improve customer experience, and develop innovative services. The primary drivers include the escalating demand for predictive maintenance solutions, which enable early detection of potential vehicle issues, thereby reducing downtime and maintenance costs. Safety and security management applications are also gaining significant traction, with analytics enabling real-time monitoring, threat detection, and accident reconstruction. Furthermore, driver performance analysis is crucial for fleet management, insurance telematics, and promoting safer driving habits, contributing to a substantial portion of the market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is transforming raw data into actionable intelligence, enabling sophisticated pattern recognition, anomaly detection, and forecasting capabilities. The growing adoption of cloud-based analytics platforms further democratizes access to these powerful tools, lowering implementation barriers for businesses of all sizes.

The market size for Vehicle Analytics is estimated to reach XX Billion in 2025 and is projected to grow significantly by 2033. The CAGR during the forecast period (2025–2033) is anticipated to be XX%. The increasing complexity of vehicle architectures, coupled with the drive towards autonomous and semi-autonomous driving features, necessitates advanced analytics for system monitoring, diagnostics, and performance optimization. Insurance companies are increasingly leveraging vehicle data for personalized premiums, risk assessment, and fraud detection, creating a lucrative segment for analytics providers. OEMs are utilizing this data for product development, understanding real-world usage patterns, and enhancing after-sales services. The trend towards mobility-as-a-service (MaaS) further amplifies the need for efficient fleet management and personalized mobility solutions, all underpinned by sophisticated vehicle analytics.

Key Markets & Segments Leading Vehicle Analytics Market

The Vehicle Analytics Market is experiencing significant leadership from the Cloud deployment segment, driven by its scalability, flexibility, and cost-effectiveness compared to on-premise solutions. This shift is particularly pronounced in regions with robust digital infrastructure and a strong inclination towards adopting advanced technologies.

Deployment:

- Cloud: Dominating the market due to its agility, accessibility, and ability to handle massive data volumes generated by connected vehicles. Cloud platforms facilitate easier integration of AI and ML, enabling real-time analytics and predictive capabilities. The global adoption of cloud services across industries underpins this segment's leadership.

- On-premise: While still relevant for highly regulated industries or specific enterprise needs with stringent data control requirements, on-premise deployments are gradually being surpassed by the advantages offered by cloud solutions.

Application:

- Predictive Maintenance: This application is a primary growth driver. The ability to anticipate vehicle failures before they occur leads to substantial cost savings, reduced downtime, and improved fleet availability. The increasing complexity of modern vehicles, with their intricate electronic components and sensors, makes predictive maintenance indispensable.

- Economic Growth: Increased vehicle utilization across various sectors fuels demand for efficient maintenance strategies.

- Technological Advancements: Sophisticated sensor technology and AI algorithms enhance the accuracy of predictive models.

- Safety and Security Management: Crucial for enhancing driver safety, preventing accidents, and securing vehicles against theft and tampering. Analytics play a vital role in real-time monitoring of driver behavior, vehicle diagnostics for safety compliance, and post-accident analysis.

- Regulatory Compliance: Stricter safety regulations mandate advanced monitoring and reporting capabilities.

- Consumer Awareness: Growing public concern for road safety and vehicle security boosts demand for these solutions.

- Driver Performance Analysis: Essential for fleet operators to optimize fuel efficiency, improve driver behavior, and reduce insurance premiums. Telematics data, analyzed through sophisticated algorithms, provides insights into driving patterns, speeding, harsh braking, and idling.

- Fleet Optimization: Businesses continually seek ways to reduce operational costs and enhance productivity.

- Insurance Telematics: The growth of usage-based insurance (UBI) models directly drives demand for driver performance data.

- Other Applications: Encompasses areas like infotainment personalization, traffic management, and supply chain logistics, which are nascent but rapidly growing segments.

End-user Industry:

- Fleet Owners: This segment represents a dominant force in the Vehicle Analytics Market. The sheer volume of vehicles managed by commercial fleets, including logistics, transportation, and delivery services, creates a substantial demand for analytics solutions that optimize operations, reduce costs, and enhance efficiency.

- Infrastructure Development: Expansion of logistics networks and e-commerce drives the need for efficient fleet management.

- Competitive Landscape: Businesses increasingly rely on data-driven insights to maintain a competitive edge.

- Insurers: A key beneficiary and driver of vehicle analytics. Insurers utilize data for risk assessment, personalized premium setting, fraud detection, and claims processing, leading to more accurate underwriting and reduced losses.

- Technological Integration: Insurers are actively integrating telematics data into their risk models.

- Customer Retention: Offering personalized policies based on driving behavior can improve customer satisfaction.

- OEMs and Service Providers: Original Equipment Manufacturers (OEMs) leverage vehicle analytics for product development, understanding real-world vehicle performance, improving customer service, and offering connected services. Aftermarket service providers utilize diagnostics data to offer proactive maintenance and repair solutions.

- Product Innovation: Data insights inform the design and features of future vehicle models.

- Customer Loyalty: Connected services enhance the ownership experience and foster brand loyalty.

- Other End-user Industries: Includes government agencies for traffic management and public safety, public transportation authorities, and ride-sharing companies, each with specific analytical needs.

Vehicle Analytics Market Product Developments

Product development in the Vehicle Analytics Market is characterized by continuous innovation in AI and ML algorithms for enhanced predictive accuracy and real-time insights. Companies are focusing on developing integrated platforms that offer comprehensive solutions for predictive maintenance, safety monitoring, and driver behavior analysis. The trend is towards miniaturized, power-efficient hardware integrated with sophisticated software for seamless data capture and transmission. Furthermore, the development of secure, cloud-native analytics solutions is paramount, ensuring data integrity and privacy while facilitating scalability. Emphasis is also placed on user-friendly dashboards and reporting tools that translate complex data into actionable intelligence for diverse end-users.

Challenges in the Vehicle Analytics Market Market

The Vehicle Analytics Market faces several challenges that can impede its growth. Data security and privacy concerns remain paramount, with stringent regulations and the potential for cyber threats necessitating robust protection measures. The integration of disparate data sources from various vehicle systems and sensors can be complex and costly. Furthermore, the high initial investment required for advanced analytics infrastructure and skilled personnel can be a barrier for smaller players and certain end-user segments. The lack of standardized data formats across different vehicle manufacturers and models also contributes to interoperability issues, hindering seamless data analysis.

- Data Security & Privacy: Ensuring compliance with evolving data protection laws and safeguarding against cyberattacks.

- Data Integration Complexity: Merging data from diverse vehicle components and external sources.

- High Initial Investment: Costs associated with hardware, software, and skilled analytics professionals.

- Lack of Standardization: Inconsistent data formats across different OEMs and vehicle models.

Forces Driving Vehicle Analytics Market Growth

Several key forces are propelling the growth of the Vehicle Analytics Market. The accelerating adoption of connected car technologies, including telematics devices and built-in connectivity, generates vast amounts of data essential for analytics. The increasing demand for enhanced vehicle safety and security, driven by both consumer expectations and regulatory mandates, fuels the need for sophisticated monitoring and analysis tools. Furthermore, the continuous pursuit of operational efficiency and cost reduction by fleet owners and transportation companies makes predictive maintenance and driver performance optimization highly attractive. The growing integration of AI and ML capabilities is unlocking deeper insights and enabling more accurate predictions, thereby enhancing the value proposition of vehicle analytics solutions.

Challenges in the Vehicle Analytics Market Market

Long-term growth in the Vehicle Analytics Market is contingent on addressing foundational challenges and fostering continuous innovation. The development and adoption of robust cybersecurity measures are critical to building trust and ensuring the integrity of sensitive vehicle data. Overcoming data fragmentation and establishing industry-wide data standardization protocols will streamline integration and enhance the scalability of analytics platforms. Investing in training and upskilling the workforce to manage and interpret complex data sets will be crucial. Furthermore, continuous research and development in areas like edge computing for real-time analytics and federated learning for privacy-preserving data analysis will be key to sustained growth and market leadership.

Emerging Opportunities in Vehicle Analytics Market

Emerging opportunities in the Vehicle Analytics Market are vast and diversified. The burgeoning market for autonomous and semi-autonomous vehicles presents a significant opportunity, requiring advanced analytics for sensor fusion, decision-making algorithms, and safety validation. The growth of the electric vehicle (EV) ecosystem offers new avenues for battery health monitoring, charging optimization, and energy management analytics. Moreover, the increasing demand for personalized in-car experiences, driven by the automotive infotainment segment, opens doors for analytics solutions that tailor content and services to individual drivers and passengers. The integration of vehicle data with smart city infrastructure for improved traffic flow and urban planning also represents a promising frontier.

- Autonomous & Semi-Autonomous Vehicles: Analytics for sensor fusion, AI decision-making, and safety validation.

- Electric Vehicle (EV) Ecosystem: Battery health monitoring, charging optimization, and energy management analytics.

- Personalized In-Car Experiences: Tailoring infotainment, navigation, and service offerings.

- Smart City Integration: Enhancing traffic management, public safety, and urban mobility solutions.

Leading Players in the Vehicle Analytics Market Sector

- IBM Corporation

- Teletrac Navman US Ltd

- HARMAN International Industries Inc (Samsung Electronics Co Ltd)

- Microsoft Corporation

- Intelligent Mechatronic Systems Inc

- Genetec Inc

- Inquiron Ltd

- CloudMade

- SAP SE

Key Milestones in Vehicle Analytics Market Industry

- October 2022: BMW partnered with Amazon Web Services (AWS) to develop software that would collect and analyze data generated by connected vehicles. The data collection would expedite the development of features to enhance software life cycle management.

- May 2022: Red Hat, Inc., one of the global providers of open-source solutions, and General Motors announced a partnership to accelerate the development of software-defined cars at the edge. The businesses plan to build an innovation ecosystem around the Red Hat In-Vehicle Operating System, which provides a functional-safety certified Linux operating system basis for GM's Ultifi software platform's continued evolution.

Strategic Outlook for Vehicle Analytics Market Market

The strategic outlook for the Vehicle Analytics Market is exceptionally positive, driven by the continuous evolution of automotive technology and the ever-increasing demand for data-driven insights. The convergence of IoT, AI, and big data analytics will further unlock new frontiers in vehicle performance optimization, predictive maintenance, and enhanced safety features. Strategic partnerships between technology providers, OEMs, and data analytics firms will be crucial for co-developing innovative solutions and expanding market reach. Investments in cloud infrastructure and edge computing will facilitate real-time data processing and enable more sophisticated predictive capabilities. The growing emphasis on sustainability and the electrification of the automotive sector will also present significant opportunities for specialized analytics solutions focused on energy management and battery lifecycle optimization.

Vehicle Analytics Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Application

- 2.1. Predictive Maintenence

- 2.2. Safety and Security Management

- 2.3. Driver Performance Analysis

- 2.4. Other Applications

-

3. End-user Industry

- 3.1. Fleet Owners

- 3.2. Insurers

- 3.3. OEMs and Service Providers

- 3.4. Other End-user Industries

Vehicle Analytics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Vehicle Analytics Market Regional Market Share

Geographic Coverage of Vehicle Analytics Market

Vehicle Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Adoption Of Vehicle Telematics; Advancements in Technology

- 3.2.2 Such as Artificial Intelligence and Predictive Analytics Leading to Applications in Vehicle Management

- 3.3. Market Restrains

- 3.3.1. High Cost of Solutions Limiting Adoption in High End Cars

- 3.4. Market Trends

- 3.4.1. Predictive Maintenence is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Predictive Maintenence

- 5.2.2. Safety and Security Management

- 5.2.3. Driver Performance Analysis

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Fleet Owners

- 5.3.2. Insurers

- 5.3.3. OEMs and Service Providers

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Predictive Maintenence

- 6.2.2. Safety and Security Management

- 6.2.3. Driver Performance Analysis

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Fleet Owners

- 6.3.2. Insurers

- 6.3.3. OEMs and Service Providers

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Predictive Maintenence

- 7.2.2. Safety and Security Management

- 7.2.3. Driver Performance Analysis

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Fleet Owners

- 7.3.2. Insurers

- 7.3.3. OEMs and Service Providers

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Predictive Maintenence

- 8.2.2. Safety and Security Management

- 8.2.3. Driver Performance Analysis

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Fleet Owners

- 8.3.2. Insurers

- 8.3.3. OEMs and Service Providers

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Australia and New Zealand Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Predictive Maintenence

- 9.2.2. Safety and Security Management

- 9.2.3. Driver Performance Analysis

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Fleet Owners

- 9.3.2. Insurers

- 9.3.3. OEMs and Service Providers

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Predictive Maintenence

- 10.2.2. Safety and Security Management

- 10.2.3. Driver Performance Analysis

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Fleet Owners

- 10.3.2. Insurers

- 10.3.3. OEMs and Service Providers

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Middle East and Africa Vehicle Analytics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 11.1.1. On-premise

- 11.1.2. Cloud

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Predictive Maintenence

- 11.2.2. Safety and Security Management

- 11.2.3. Driver Performance Analysis

- 11.2.4. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Fleet Owners

- 11.3.2. Insurers

- 11.3.3. OEMs and Service Providers

- 11.3.4. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 IBM Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Teletrac Navman US Ltd*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 HARMAN International Industries Inc (Samsung Electronics Co Ltd)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Microsoft Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Intelligent Mechatronic Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Genetec Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Inquiron Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CloudMade

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SAP SE

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 IBM Corporation

List of Figures

- Figure 1: Global Vehicle Analytics Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Vehicle Analytics Market Revenue (undefined), by Deployment 2025 & 2033

- Figure 3: North America Vehicle Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Vehicle Analytics Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Vehicle Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Vehicle Analytics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Vehicle Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Vehicle Analytics Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Vehicle Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Vehicle Analytics Market Revenue (undefined), by Deployment 2025 & 2033

- Figure 11: Europe Vehicle Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Vehicle Analytics Market Revenue (undefined), by Application 2025 & 2033

- Figure 13: Europe Vehicle Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Vehicle Analytics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Europe Vehicle Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Vehicle Analytics Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Vehicle Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Vehicle Analytics Market Revenue (undefined), by Deployment 2025 & 2033

- Figure 19: Asia Vehicle Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Vehicle Analytics Market Revenue (undefined), by Application 2025 & 2033

- Figure 21: Asia Vehicle Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Vehicle Analytics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Asia Vehicle Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Vehicle Analytics Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Vehicle Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Vehicle Analytics Market Revenue (undefined), by Deployment 2025 & 2033

- Figure 27: Australia and New Zealand Vehicle Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Australia and New Zealand Vehicle Analytics Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Australia and New Zealand Vehicle Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Australia and New Zealand Vehicle Analytics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Australia and New Zealand Vehicle Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Australia and New Zealand Vehicle Analytics Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Vehicle Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Vehicle Analytics Market Revenue (undefined), by Deployment 2025 & 2033

- Figure 35: Latin America Vehicle Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Latin America Vehicle Analytics Market Revenue (undefined), by Application 2025 & 2033

- Figure 37: Latin America Vehicle Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Latin America Vehicle Analytics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Latin America Vehicle Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Latin America Vehicle Analytics Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Latin America Vehicle Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Vehicle Analytics Market Revenue (undefined), by Deployment 2025 & 2033

- Figure 43: Middle East and Africa Vehicle Analytics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 44: Middle East and Africa Vehicle Analytics Market Revenue (undefined), by Application 2025 & 2033

- Figure 45: Middle East and Africa Vehicle Analytics Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Vehicle Analytics Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 47: Middle East and Africa Vehicle Analytics Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Middle East and Africa Vehicle Analytics Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East and Africa Vehicle Analytics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 2: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Vehicle Analytics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 6: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Vehicle Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 10: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Vehicle Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 14: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Vehicle Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 18: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Vehicle Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 22: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Vehicle Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Vehicle Analytics Market Revenue undefined Forecast, by Deployment 2020 & 2033

- Table 26: Global Vehicle Analytics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Global Vehicle Analytics Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Vehicle Analytics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Analytics Market?

The projected CAGR is approximately 22.3%.

2. Which companies are prominent players in the Vehicle Analytics Market?

Key companies in the market include IBM Corporation, Teletrac Navman US Ltd*List Not Exhaustive, HARMAN International Industries Inc (Samsung Electronics Co Ltd), Microsoft Corporation, Intelligent Mechatronic Systems Inc, Genetec Inc, Inquiron Ltd, CloudMade, SAP SE.

3. What are the main segments of the Vehicle Analytics Market?

The market segments include Deployment, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption Of Vehicle Telematics; Advancements in Technology. Such as Artificial Intelligence and Predictive Analytics Leading to Applications in Vehicle Management.

6. What are the notable trends driving market growth?

Predictive Maintenence is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Solutions Limiting Adoption in High End Cars.

8. Can you provide examples of recent developments in the market?

October 2022: BMW partnered with Amazon Web Services (AWS) to develop software that would collect and analyze data generated by connected vehicles. The data collection would expedite the development of features to enhance software life cycle management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Analytics Market?

To stay informed about further developments, trends, and reports in the Vehicle Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence