Key Insights

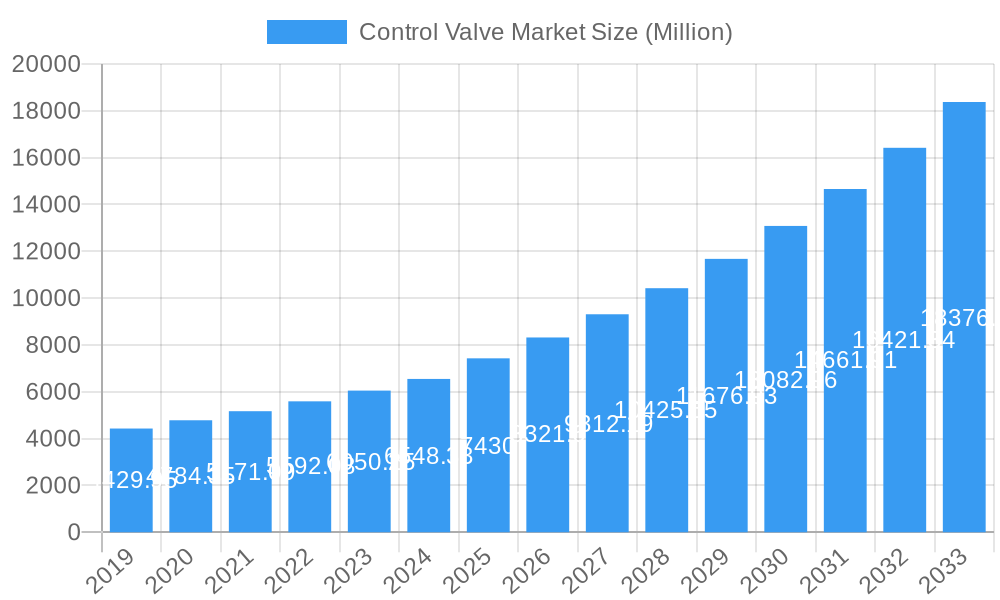

The global Control Valve Market is projected for substantial growth, estimated at USD 7.43 billion in the base year 2025, and is expected to expand at a robust Compound Annual Growth Rate (CAGR) of 12.00% through 2033. This dynamic expansion is fueled by increasing industrial automation across key sectors, particularly the oil and gas, chemical, petrochemical, and fertilizer industries, which are critically dependent on precise flow control for efficiency and safety. The demand for advanced control valves, such as Globe and Ball valves, is being driven by stringent regulatory requirements for environmental protection and process optimization, alongside significant investments in infrastructure development and upgrades within these core industries. Furthermore, the burgeoning energy sector, encompassing both traditional power generation and the rapidly growing renewable energy domain, presents a substantial opportunity for control valve manufacturers as new facilities are built and existing ones are modernized to improve performance and reduce emissions.

Control Valve Market Market Size (In Billion)

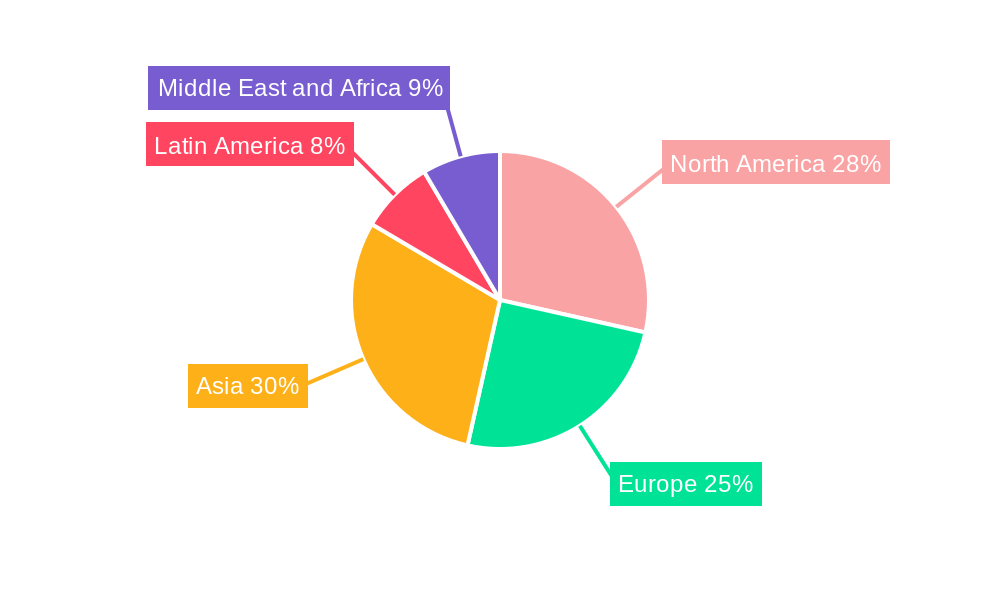

The market landscape is characterized by several key trends, including the increasing adoption of smart control valves equipped with digital communication capabilities and advanced diagnostic features, enabling predictive maintenance and remote monitoring. This technological evolution is crucial for enhancing operational reliability and reducing downtime, a paramount concern in high-stakes industrial environments. However, the market also faces certain restraints, such as the high initial cost of sophisticated control valve systems and the need for skilled labor to install, operate, and maintain them. Supply chain disruptions and fluctuating raw material prices can also pose challenges to market growth. Despite these hurdles, the relentless pursuit of operational excellence and the ongoing digital transformation across industrial sectors are expected to propel the control valve market forward, with regions like Asia and North America anticipated to lead in market share due to rapid industrialization and technological adoption.

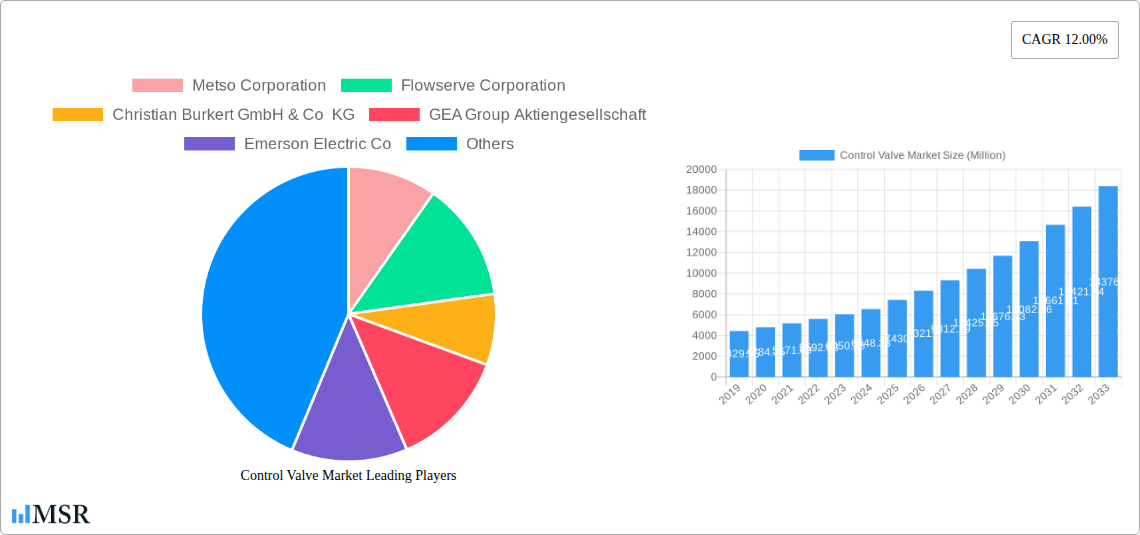

Control Valve Market Company Market Share

Here is an SEO-optimized and engaging report description for the Control Valve Market, incorporating your provided details and adhering to all specified requirements.

Global Control Valve Market: In-Depth Analysis & Future Outlook (2019-2033)

This comprehensive report delves deep into the global control valve market, offering a robust analysis of its current landscape and future trajectory. Covering the historical period from 2019 to 2024, the base year and estimated year of 2025, and a detailed forecast period from 2025 to 2033, this research provides actionable insights for oil and gas, chemical, petrochemical, fertilizer, energy and power, water and wastewater treatment, and metal and mining industries. Discover the latest industry developments, key market drivers, and emerging opportunities shaping the industrial valve market.

Control Valve Market Market Concentration & Dynamics

The global control valve market exhibits a moderate to high concentration, with leading players like Metso Corporation, Flowserve Corporation, Emerson Electric Co, and Baker Hughes Company holding significant market shares. Innovation ecosystems are robust, driven by continuous R&D in areas like smart control valves, digital twins, and advanced materials to enhance efficiency and reduce environmental impact. Regulatory frameworks, particularly concerning safety and emissions in the oil and gas and chemical industries, play a crucial role in shaping product development and market entry. Substitute products, while present, often struggle to match the precision and reliability of advanced control valves in critical applications. End-user trends are increasingly focused on automation, predictive maintenance, and energy efficiency, propelling demand for intelligent and connected valve solutions. Merger and acquisition (M&A) activities, such as the Precision Pump & Valve ("PPV") partnership with Beaumont Manufacturing & Distribution ("BMD") in March 2024, are strategically reshaping the competitive landscape and expanding market reach, particularly within the oil and gas surface production market. The market has witnessed approximately 15-20 significant M&A deals over the past five years, aimed at consolidating capabilities and expanding product portfolios.

Control Valve Market Industry Insights & Trends

The global control valve market is poised for substantial growth, projected to reach an estimated xx Billion USD by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025–2033. This expansion is fueled by escalating investments in industrial automation across diverse sectors, including the rapidly growing energy and power sector, where advanced control valves are essential for efficient power generation and distribution. The burgeoning demand for sophisticated process control in the chemical, petrochemical, and fertilizer industries is a significant growth driver, necessitating precise flow management and safety compliance. Furthermore, the global push for improved water management and infrastructure development is stimulating demand for reliable water and wastewater treatment solutions. Technological disruptions, such as the integration of the Internet of Things (IoT) and artificial intelligence (AI) into valve systems, are creating "smart valves" capable of real-time monitoring, diagnostics, and predictive maintenance, thereby enhancing operational efficiency and reducing downtime. The increasing adoption of additive manufacturing, as evidenced by Emerson's Fisher Whisper Trim Technology announced in November 2023, is enabling the creation of more sophisticated and noise-reducing trim designs, further pushing the boundaries of performance. Consumer behavior is shifting towards seeking integrated solutions that offer not only valve functionality but also data analytics and remote management capabilities, driving innovation in connectivity and software integration within the industrial automation sphere. The market size was approximately xx Billion USD in 2024, underscoring a healthy upward trend.

Key Markets & Segments Leading Control Valve Market

The oil and gas industry stands as a dominant end-user segment within the global control valve market. This leadership is driven by continuous exploration and production activities, complex refining processes, and the increasing demand for efficient transportation of crude oil and natural gas. The inherent need for high-integrity, robust valves capable of withstanding extreme pressures, temperatures, and corrosive environments solidifies its position. The chemical and petrochemical industries are also major contributors, propelled by the growing global demand for chemicals, plastics, and fuels, which necessitates precise and reliable process control.

Dominant End-User Industries:

- Oil and Gas: Driven by exploration, production, refining, and transportation. Economic growth and energy demand are key factors.

- Chemical, Petrochemical, and Fertilizer: Fueled by global demand for manufactured goods, food production, and industrial expansion.

- Energy and Power: Expanding capacity, renewable energy integration, and grid modernization initiatives are crucial.

Leading Valve Types:

- Ball Valves: Known for their tight shut-off capabilities and versatility, they are widely used across various industries.

- Globe Valves: Their precise throttling capabilities make them indispensable in applications requiring fine flow control.

- Butterfly Valves: Cost-effectiveness and suitability for large-diameter pipelines contribute to their significant market presence.

Regionally, North America and Asia Pacific are leading markets, owing to significant industrial development, substantial investments in infrastructure, and the presence of major oil and gas reserves. The increasing adoption of advanced manufacturing technologies and stringent environmental regulations in these regions further bolster the demand for high-performance control valves. For instance, the economic growth in emerging economies within Asia Pacific, coupled with their focus on industrialization and infrastructure development, presents a substantial growth avenue.

Control Valve Market Product Developments

Product innovation in the control valve market is accelerating, with a strong emphasis on smart valve technologies, enhanced diagnostics, and improved material science. Key advancements include the development of self-regulating valves, predictive maintenance capabilities powered by AI and IoT, and the use of additive manufacturing to create intricate designs that reduce noise and improve flow efficiency, as exemplified by Emerson's Fisher Whisper Trim Technology. These innovations are crucial for meeting the evolving demands of industries such as oil and gas and chemical processing for greater automation, safety, and operational uptime. The integration of advanced sensor technologies and communication protocols is enabling real-time data acquisition and remote monitoring, providing users with unparalleled control and insight into their processes, thereby creating a competitive edge for manufacturers investing in these cutting-edge solutions.

Challenges in the Control Valve Market Market

The control valve market faces several challenges that can impede its growth trajectory. Stringent regulatory compliance, particularly regarding safety and environmental standards in sectors like oil and gas and chemical manufacturing, necessitates significant R&D investment and can lead to longer product development cycles. Supply chain disruptions, as experienced globally in recent years, can impact raw material availability and component sourcing, leading to price volatility and delivery delays. Intense competitive pressure from both established players and emerging manufacturers, especially in price-sensitive markets, requires constant innovation and cost optimization to maintain market share. The cybersecurity of connected smart valves is also an emerging concern, requiring robust security measures to prevent unauthorized access and data breaches.

Forces Driving Control Valve Market Growth

Several powerful forces are propelling the control valve market forward. The relentless pursuit of industrial automation and operational efficiency across various sectors, including energy and power and water and wastewater treatment, is a primary driver. Technological advancements, such as the integration of IoT, AI, and advanced sensor technologies into valves, are creating "smart valves" that offer predictive maintenance and remote monitoring capabilities, enhancing overall productivity. Growing global demand for essential commodities and manufactured goods, particularly from emerging economies, is fueling expansion in the chemical, petrochemical, and fertilizer industries, thereby increasing the need for sophisticated process control solutions. Furthermore, increasing environmental regulations and the global focus on sustainability are pushing industries to adopt more energy-efficient and leak-proof valve technologies.

Challenges in the Control Valve Market Market

The control valve market continues to grapple with the need for highly specialized expertise and skilled labor for the design, manufacturing, installation, and maintenance of complex valve systems. The significant upfront investment required for research and development, especially in cutting-edge technologies like smart valves and advanced materials, poses a barrier for smaller players. Furthermore, the global economic uncertainties and geopolitical instability can lead to fluctuating demand patterns and impact capital expenditure decisions by end-user industries, creating a degree of unpredictability in market growth. Ensuring seamless interoperability between different manufacturers' control systems and smart valves remains a technical hurdle that the industry is actively working to address through standardization efforts.

Emerging Opportunities in Control Valve Market

The control valve market is ripe with emerging opportunities driven by evolving technological landscapes and shifting industry demands. The increasing adoption of Industry 4.0 principles and the "smart factory" concept presents a significant opportunity for manufacturers of intelligent and connected control valves that can integrate seamlessly into digitalized operational environments. The growing focus on decarbonization and the energy transition is creating new demand for specialized valves used in renewable energy infrastructure, such as hydrogen production and storage, and carbon capture technologies. Furthermore, the expansion of digitalization in developing economies and the continuous need for upgrades in aging infrastructure across sectors like water and wastewater treatment offer substantial growth potential for both standard and advanced control valve solutions.

Leading Players in the Control Valve Market Sector

- Metso Corporation

- Flowserve Corporation

- Christian Burkert GmbH & Co KG

- GEA Group Aktiengesellschaft

- Emerson Electric Co

- CIRCOR International Inc

- Baker Hughes Company

- Neway Valve (Suzhou) Co Lt

- IMI PLC

Key Milestones in Control Valve Market Industry

- March 2024: Precision Pump & Valve ("PPV") announced a partnership with Beaumont Manufacturing & Distribution ("BMD"). This strategic alliance aims to enhance PPV's service offerings within the oil and gas surface production market, including upstream and midstream users, fabrication shops, and other clients across the United States, by providing access to all BMD products.

- November 2023: Emerson unveiled its innovative Fisher Whisper Trim Technology for rotary and globe valves. This development expands its portfolio of noise reduction solutions, leveraging additive manufacturing and advanced techniques to create next-generation trim designs with significantly enhanced noise attenuation capabilities.

Strategic Outlook for Control Valve Market Market

The strategic outlook for the control valve market is characterized by continuous innovation and expansion into new applications and geographies. Key growth accelerators include the ongoing integration of digital technologies, such as IoT and AI, to create more intelligent and autonomous valve systems that offer predictive maintenance and enhanced operational insights. The increasing global emphasis on sustainability and environmental protection will drive demand for energy-efficient and leak-proof valve solutions, particularly in sectors like water and wastewater treatment and energy and power. Strategic partnerships and collaborations, akin to the PPV and BMD agreement, will be crucial for expanding market reach and diversifying product portfolios. Furthermore, the sustained industrial development in emerging economies presents a significant long-term growth opportunity for both standard and advanced control valve offerings.

Control Valve Market Segmentation

-

1. Type

- 1.1. Globe

- 1.2. Ball

- 1.3. Butterfly

- 1.4. Plug

- 1.5. Diaphragm

- 1.6. Other Types of Valves

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical, Petrochemical, and Fertilizer

- 2.3. Energy and Power

- 2.4. Water and Wastewater Treatment

- 2.5. Metal and Mining

- 2.6. Other

Control Valve Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Control Valve Market Regional Market Share

Geographic Coverage of Control Valve Market

Control Valve Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing emphasis on Power and Water and Wastewater in Emerging Markets; Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive

- 3.3. Market Restrains

- 3.3.1. ; High Capital Investment and Increasing Use of Fiber Optic Transmission Cables; Regulatory Constraints and Limited Orbital Locations

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Globe

- 5.1.2. Ball

- 5.1.3. Butterfly

- 5.1.4. Plug

- 5.1.5. Diaphragm

- 5.1.6. Other Types of Valves

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical, Petrochemical, and Fertilizer

- 5.2.3. Energy and Power

- 5.2.4. Water and Wastewater Treatment

- 5.2.5. Metal and Mining

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Globe

- 6.1.2. Ball

- 6.1.3. Butterfly

- 6.1.4. Plug

- 6.1.5. Diaphragm

- 6.1.6. Other Types of Valves

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Chemical, Petrochemical, and Fertilizer

- 6.2.3. Energy and Power

- 6.2.4. Water and Wastewater Treatment

- 6.2.5. Metal and Mining

- 6.2.6. Other

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Globe

- 7.1.2. Ball

- 7.1.3. Butterfly

- 7.1.4. Plug

- 7.1.5. Diaphragm

- 7.1.6. Other Types of Valves

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Chemical, Petrochemical, and Fertilizer

- 7.2.3. Energy and Power

- 7.2.4. Water and Wastewater Treatment

- 7.2.5. Metal and Mining

- 7.2.6. Other

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Globe

- 8.1.2. Ball

- 8.1.3. Butterfly

- 8.1.4. Plug

- 8.1.5. Diaphragm

- 8.1.6. Other Types of Valves

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Chemical, Petrochemical, and Fertilizer

- 8.2.3. Energy and Power

- 8.2.4. Water and Wastewater Treatment

- 8.2.5. Metal and Mining

- 8.2.6. Other

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Globe

- 9.1.2. Ball

- 9.1.3. Butterfly

- 9.1.4. Plug

- 9.1.5. Diaphragm

- 9.1.6. Other Types of Valves

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Chemical, Petrochemical, and Fertilizer

- 9.2.3. Energy and Power

- 9.2.4. Water and Wastewater Treatment

- 9.2.5. Metal and Mining

- 9.2.6. Other

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Globe

- 10.1.2. Ball

- 10.1.3. Butterfly

- 10.1.4. Plug

- 10.1.5. Diaphragm

- 10.1.6. Other Types of Valves

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Chemical, Petrochemical, and Fertilizer

- 10.2.3. Energy and Power

- 10.2.4. Water and Wastewater Treatment

- 10.2.5. Metal and Mining

- 10.2.6. Other

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Control Valve Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Globe

- 11.1.2. Ball

- 11.1.3. Butterfly

- 11.1.4. Plug

- 11.1.5. Diaphragm

- 11.1.6. Other Types of Valves

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Oil and Gas

- 11.2.2. Chemical, Petrochemical, and Fertilizer

- 11.2.3. Energy and Power

- 11.2.4. Water and Wastewater Treatment

- 11.2.5. Metal and Mining

- 11.2.6. Other

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Metso Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Flowserve Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Christian Burkert GmbH & Co KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 GEA Group Aktiengesellschaft

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Emerson Electric Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CIRCOR International Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Baker Hughes Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Neway Valve (Suzhou) Co Lt

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 IMI PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Metso Corporation

List of Figures

- Figure 1: Global Control Valve Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Control Valve Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Control Valve Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Control Valve Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Control Valve Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Control Valve Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Control Valve Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Control Valve Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Control Valve Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Control Valve Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Control Valve Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Control Valve Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Control Valve Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Control Valve Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Control Valve Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Control Valve Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Control Valve Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Control Valve Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Control Valve Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Control Valve Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Control Valve Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Control Valve Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Control Valve Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Control Valve Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Control Valve Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Control Valve Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Control Valve Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Control Valve Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Latin America Control Valve Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Control Valve Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Control Valve Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Control Valve Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Control Valve Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Control Valve Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Middle East and Africa Control Valve Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Control Valve Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Control Valve Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Control Valve Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Control Valve Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Control Valve Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Control Valve Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Control Valve Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Control Valve Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Control Valve Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Control Valve Market Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Control Valve Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Control Valve Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Control Valve Market?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the Control Valve Market?

Key companies in the market include Metso Corporation, Flowserve Corporation, Christian Burkert GmbH & Co KG, GEA Group Aktiengesellschaft, Emerson Electric Co, CIRCOR International Inc, Baker Hughes Company, Neway Valve (Suzhou) Co Lt, IMI PLC.

3. What are the main segments of the Control Valve Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing emphasis on Power and Water and Wastewater in Emerging Markets; Focus of End Users on Environmental Issues and Refurbishment of Aging Infrastructure to Stay Competitive.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; High Capital Investment and Increasing Use of Fiber Optic Transmission Cables; Regulatory Constraints and Limited Orbital Locations.

8. Can you provide examples of recent developments in the market?

March 2024: Precision Pump & Valve ("PPV") announced a partnership with Beaumont Manufacturing & Distribution ("BMD"). The new partnership will allow PPV to further serve customers in the oil and gas surface production market, including midstream and upstream users, fabrication shops, and others. The partnership will allow PPV to provide all BMD products to oil producers across the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Control Valve Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Control Valve Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Control Valve Market?

To stay informed about further developments, trends, and reports in the Control Valve Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence