Key Insights

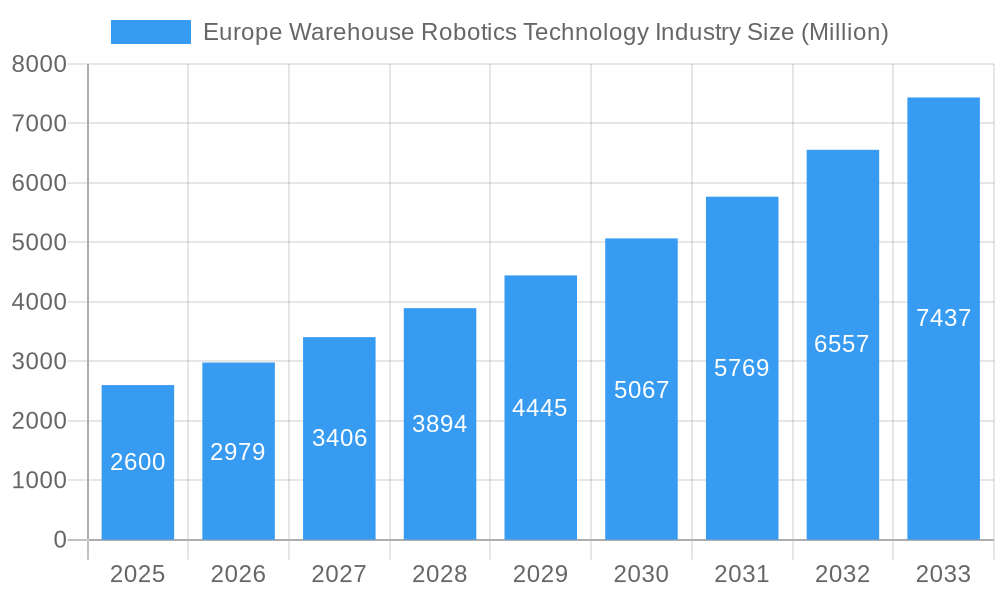

The Europe Warehouse Robotics Technology Industry is poised for significant expansion, projected to reach a substantial market size of USD 2.60 billion in 2025. This growth trajectory is fueled by an impressive Compound Annual Growth Rate (CAGR) of 14.72%, indicating a robust demand for automated solutions in warehouses across the continent. Key drivers for this surge include the escalating need for enhanced operational efficiency, reduced labor costs, and improved accuracy in warehouse operations. The burgeoning e-commerce sector, coupled with increasing supply chain complexities, necessitates advanced automation to manage higher volumes and faster fulfillment times. Furthermore, technological advancements in artificial intelligence, machine learning, and the Internet of Things (IoT) are enabling more sophisticated and adaptable robotic solutions, making them increasingly attractive to businesses.

Europe Warehouse Robotics Technology Industry Market Size (In Billion)

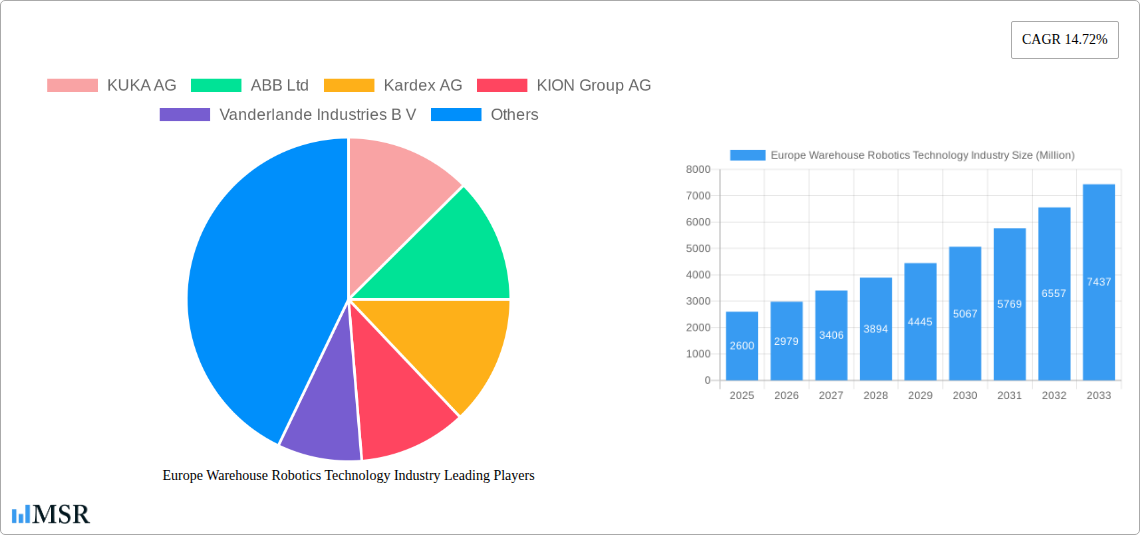

The market is characterized by a diverse range of product segments and end-user applications. Industrial Robots, Sortation Systems, Conveyors, Palletizers, Automated Storage and Retrieval Systems (ASRS), and Mobile Robots (AGVs and AMRs) are integral to modern warehousing. These technologies are vital for streamlining functions such as storage, packaging, and trans-shipments across key industries like Food and Beverage, Automotive, Retail, Electrical and Electronics, and Pharmaceuticals. Major players such as KUKA AG, ABB Ltd, and KION Group AG are at the forefront of innovation, developing cutting-edge solutions to meet the evolving demands of the European market. The region, particularly countries like Germany, the United Kingdom, and France, is a hub for adoption, driven by stringent efficiency mandates and a proactive approach to technological integration. Despite these positive trends, potential restraints such as high initial investment costs and the need for skilled labor to manage and maintain robotic systems, alongside concerns regarding job displacement, warrant careful consideration as the market continues its upward trajectory.

Europe Warehouse Robotics Technology Industry Company Market Share

Europe Warehouse Robotics Technology Industry: Unlocking Efficiency and Innovation (2019–2033)

This comprehensive report delves into the dynamic Europe warehouse robotics technology industry, a sector poised for unprecedented growth and transformation. Spanning the historical period 2019–2024 and projecting through the forecast period 2025–2033, with a base year of 2025, this analysis provides critical market insights and strategic recommendations for industry stakeholders. Discover key trends, market drivers, and the competitive landscape shaping the future of warehouse automation, logistics robotics, and supply chain efficiency across Europe.

Europe Warehouse Robotics Technology Industry Market Concentration & Dynamics

The Europe warehouse robotics technology industry is characterized by a moderately consolidated market, with key players like KUKA AG, ABB Ltd, and KION Group AG holding significant market share. The innovation ecosystem is robust, fueled by substantial R&D investments in areas such as artificial intelligence (AI) and machine learning (ML) for enhanced warehouse automation. Regulatory frameworks are evolving to support the adoption of advanced robotics, focusing on safety and interoperability standards. The threat of substitute products, while present in some traditional logistics functions, is diminishing as the capabilities and cost-effectiveness of warehouse robotics improve. End-user trends are heavily influenced by the booming e-commerce fulfillment sector, driving demand for faster, more accurate, and flexible logistics solutions. Mergers and acquisitions (M&A) activity is a significant dynamic, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, Vanderlande Industries B V (part of Toyota Industries Corporation) has been instrumental in various integration efforts. The M&A deal counts are expected to remain high as companies seek to capitalize on market opportunities.

Europe Warehouse Robotics Technology Industry Industry Insights & Trends

The Europe warehouse robotics technology industry is experiencing significant expansion, driven by a confluence of powerful factors. The estimated market size for warehouse robotics in Europe is projected to reach XX Billion Euros by 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This robust growth is primarily propelled by the relentless surge in e-commerce sales, demanding faster order fulfillment and optimized warehouse management systems. Businesses are increasingly recognizing the tangible benefits of warehouse automation, including increased throughput, reduced operational costs, enhanced accuracy, and improved worker safety. Technological disruptions are at the forefront of this evolution. Advances in industrial robots, mobile robots (AGVs and AMRs), and automated storage and retrieval systems (ASRS) are revolutionizing traditional warehousing operations. The integration of AI and ML algorithms is enabling more intelligent and adaptive robotic solutions, capable of handling complex tasks and making real-time operational decisions. Evolving consumer behaviors, characterized by a preference for rapid delivery and personalized shopping experiences, further amplify the need for highly efficient and responsive logistics operations. The adoption of conveyors, sortation systems, and palletizers is also crucial in streamlining the flow of goods within warehouses. This report meticulously analyzes the interplay of these factors, providing deep industry insights into market dynamics and future trajectories.

Key Markets & Segments Leading Europe Warehouse Robotics Technology Industry

The Europe warehouse robotics technology industry is witnessing leadership across various segments and end-user applications, driven by distinct regional strengths and specific industry demands.

Dominant Segments by Type:

- Mobile Robots (AGVs and AMRs): This segment is experiencing explosive growth, particularly in the retail and e-commerce fulfillment sectors. The flexibility and scalability of Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) make them ideal for dynamic warehouse environments. Drivers include the need for adaptable material handling, reduced reliance on manual labor for repetitive tasks, and the ability to navigate complex layouts.

- Automated Storage and Retrieval System (ASRS): ASRS solutions are crucial for maximizing storage density and optimizing inventory management, especially in sectors with high SKU volumes like electrical and electronics and pharmaceuticals. Economic growth and the need for efficient space utilization are key drivers.

- Industrial Robots: While traditionally strong in the automotive sector for complex assembly and handling, industrial robots are increasingly being deployed in other areas for packaging and specialized tasks within warehouses. High precision and repeatability are key advantages.

- Conveyors and Sortation Systems: These form the backbone of material flow in many large distribution centers, facilitating trans-shipments and enabling high-speed sorting of goods. Infrastructure development and the increasing volume of goods being moved are significant drivers.

- Palletizers: Essential for efficient storage and transportation of goods, palletizers are seeing advancements in speed and flexibility to meet the demands of various industries.

Dominant Segments by Function:

- Storage: The demand for efficient and high-density storage solutions is a primary driver, directly impacting the adoption of ASRS and advanced shelving systems integrated with robotics.

- Packaging: Robotics are increasingly integral to packaging operations, from picking and placing to sealing and labeling, improving speed and consistency.

- Trans-shipments: Efficient handling of goods during trans-shipments in distribution hubs is heavily reliant on automated systems like conveyors and sortation robots.

Dominant End-User Applications:

- Retail & E-commerce: This sector is the undisputed leader in warehouse robotics adoption due to the overwhelming demand for rapid fulfillment, high order volumes, and the need for sophisticated inventory management.

- Food and Beverage: The need for hygiene, traceability, and efficient handling of temperature-sensitive products is driving the adoption of specialized robotics in this sector.

- Automotive: While a mature market for industrial robots, the automotive sector is increasingly integrating advanced robotics for intralogistics and parts management within its vast supply chains.

- Electrical and Electronics: The complexity and high value of goods in this sector necessitate precise handling and inventory control, making robotics a crucial investment.

- Pharmaceutical: Stringent regulatory requirements, the need for sterile environments, and the handling of high-value medications are pushing the adoption of advanced warehouse automation solutions.

Europe Warehouse Robotics Technology Industry Product Developments

The Europe warehouse robotics technology industry is a hotbed of innovation, with companies consistently launching advanced solutions. Recent developments include smarter mobile robots with enhanced navigation capabilities, AI-powered picking robots for intricate tasks, and highly integrated ASRS that optimize space utilization and retrieval times. Companies are focusing on developing robots that are more collaborative, safer to operate alongside human workers, and capable of adapting to diverse warehouse environments. These product developments are crucial for maintaining competitive edges and meeting the evolving demands for speed, accuracy, and flexibility in warehouse automation.

Challenges in the Europe Warehouse Robotics Technology Industry Market

Despite its strong growth trajectory, the Europe warehouse robotics technology industry faces several hurdles. High initial investment costs for advanced warehouse automation solutions can be a significant barrier for small and medium-sized enterprises (SMEs). Regulatory complexities and the need for skilled labor to operate and maintain these systems also present challenges. Furthermore, supply chain disruptions, as witnessed in recent years, can impact the availability of critical components for robotic systems. Competitive pressures are intense, requiring continuous innovation and cost optimization.

Forces Driving Europe Warehouse Robotics Technology Industry Growth

The Europe warehouse robotics technology industry is propelled by several key forces. The escalating demand for e-commerce fulfillment and same-day delivery services necessitates highly efficient and automated logistics operations. Technological advancements, including breakthroughs in AI, sensor technology, and robotics design, are making warehouse robots more capable and cost-effective. Economic factors, such as labor shortages and rising labor costs in many European countries, are further incentivizing automation. Supportive government initiatives and industry standards promoting supply chain efficiency also contribute significantly to market expansion.

Challenges in the Europe Warehouse Robotics Technology Industry Market

Long-term growth catalysts for the Europe warehouse robotics technology industry are multifaceted. Continued investment in research and development will unlock new applications for robots in previously untapped areas of warehousing. Strategic partnerships between technology providers and logistics firms will foster greater integration and adoption of advanced solutions. Market expansions into emerging economies within Europe, coupled with the development of more scalable and modular robotic systems, will also fuel sustained growth. The increasing focus on sustainability and energy efficiency in logistics will drive the development of eco-friendly robotic solutions.

Emerging Opportunities in Europe Warehouse Robotics Technology Industry

Emerging opportunities in the Europe warehouse robotics technology industry are abundant. The burgeoning demand for personalized logistics and the growth of the gig economy will necessitate more flexible and adaptable warehouse automation. Innovations in robotics for cold chain logistics and the pharmaceutical sector present significant growth avenues. Furthermore, the integration of robotics with IoT and big data analytics will unlock new efficiencies and predictive maintenance capabilities. The development of robots capable of performing more complex tasks, such as delicate handling and quality inspection, represents a key future opportunity.

Leading Players in the Europe Warehouse Robotics Technology Industry Sector

- KUKA AG

- ABB Ltd

- Kardex AG

- KION Group AG

- Vanderlande Industries B V

- KNAPP AG

- BEUMER Group GmbH & Co KG

- Siemens AG

- Viastore Systems GmbH (Toyota Industries Corporation)

- Mecalux SA

- SSI Schaefer AG

Key Milestones in Europe Warehouse Robotics Technology Industry Industry

- August 2022: ABB Limited announced joining the technology alliance program with Berkshire Grey Inc. to provide more customers with robotics and artificial intelligence that improve e-commerce fulfillment throughput and warehouse efficiency. Through this collaboration, the company aimed to provide flexible, cost-effective warehouse automation solutions and optimize customers' operations.

- September 2022: Yanmar America Corporation introduced an advanced automated guided vehicle (AGV) solution to its Adairsville, GA, manufacturing facility. The addition of the modular AGV system to Yanmar's Powerpack series generator production line boosted production capacity tenfold and increased the quality of products delivered to customers.

Strategic Outlook for Europe Warehouse Robotics Technology Industry Market

The strategic outlook for the Europe warehouse robotics technology industry market is overwhelmingly positive. The continuous drive for operational efficiency, coupled with the increasing adoption of AI-powered robotics, will serve as significant growth accelerators. Focus areas for strategic growth will include developing solutions for increasingly complex e-commerce fulfillment demands, expanding the application of robots in specialized sectors like pharmaceuticals and food & beverage, and fostering greater interoperability between different robotic systems. Investment in research and development for next-generation mobile robots and advanced ASRS will be crucial. Furthermore, strategic partnerships and acquisitions will continue to shape the competitive landscape, enabling companies to offer comprehensive end-to-end warehouse automation solutions.

Europe Warehouse Robotics Technology Industry Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

-

2. Function

- 2.1. Storage

- 2.2. Packaging

- 2.3. Trans-shipments

- 2.4. Other Functions

-

3. End-user Application

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End User Applications

Europe Warehouse Robotics Technology Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

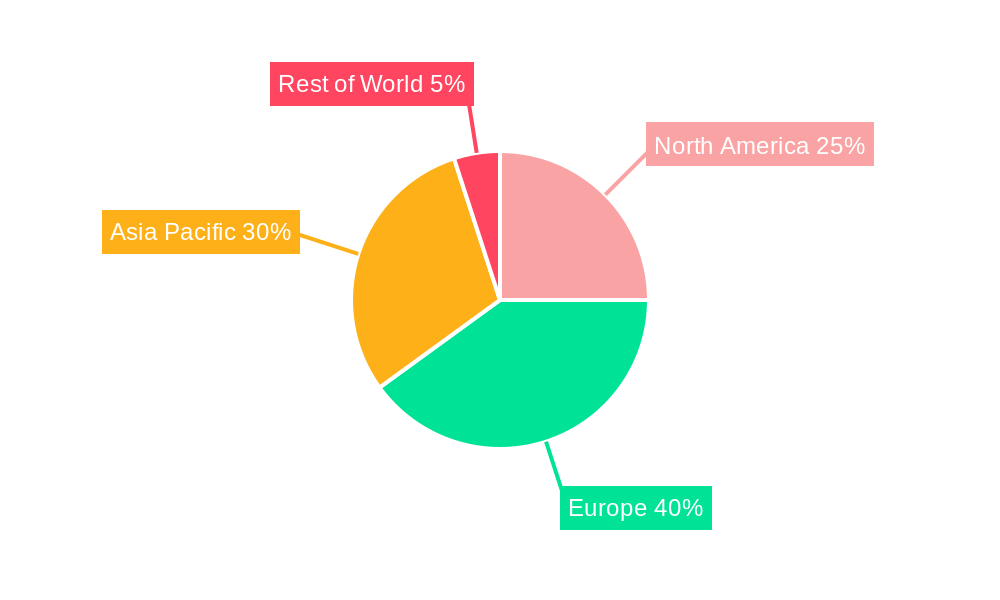

Europe Warehouse Robotics Technology Industry Regional Market Share

Geographic Coverage of Europe Warehouse Robotics Technology Industry

Europe Warehouse Robotics Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of SKUs; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Warehouse Automation by E-Commerce Industry to Drive the Studied Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Packaging

- 5.2.3. Trans-shipments

- 5.2.4. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Application

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End User Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Warehouse Robotics Technology Industry Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 KUKA AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Kardex AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 KION Group AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Vanderlande Industries B V

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KNAPP AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BEUMER Group GmbH & Co KG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Siemens A

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Viastore Systems GmbH (Toyota Industries Corporation)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mecalux SA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 SSI Schaefer AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 KUKA AG

List of Figures

- Figure 1: Europe Warehouse Robotics Technology Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Warehouse Robotics Technology Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 4: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 5: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: France Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Italy Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Netherlands Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Function 2020 & 2033

- Table 16: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 17: Europe Warehouse Robotics Technology Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United Kingdom Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: France Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Italy Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Belgium Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Sweden Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Norway Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Poland Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Denmark Europe Warehouse Robotics Technology Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Warehouse Robotics Technology Industry?

The projected CAGR is approximately 14.72%.

2. Which companies are prominent players in the Europe Warehouse Robotics Technology Industry?

Key companies in the market include KUKA AG, ABB Ltd, Kardex AG, KION Group AG, Vanderlande Industries B V, KNAPP AG, BEUMER Group GmbH & Co KG, Siemens A, Viastore Systems GmbH (Toyota Industries Corporation), Mecalux SA, SSI Schaefer AG.

3. What are the main segments of the Europe Warehouse Robotics Technology Industry?

The market segments include Type, Function, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of SKUs; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

Increasing Investment in Warehouse Automation by E-Commerce Industry to Drive the Studied Market's Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

August 2022: ABB Limited announced joining the technology alliance program with Berkshire Grey Inc. to provide more customers with robotics and artificial intelligence that improve e-commerce fulfillment throughput and warehouse efficiency. Through this collaboration, the company aimed to provide flexible, cost-effective warehouse automation solutions and optimize customers' operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Warehouse Robotics Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Warehouse Robotics Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Warehouse Robotics Technology Industry?

To stay informed about further developments, trends, and reports in the Europe Warehouse Robotics Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence