Key Insights

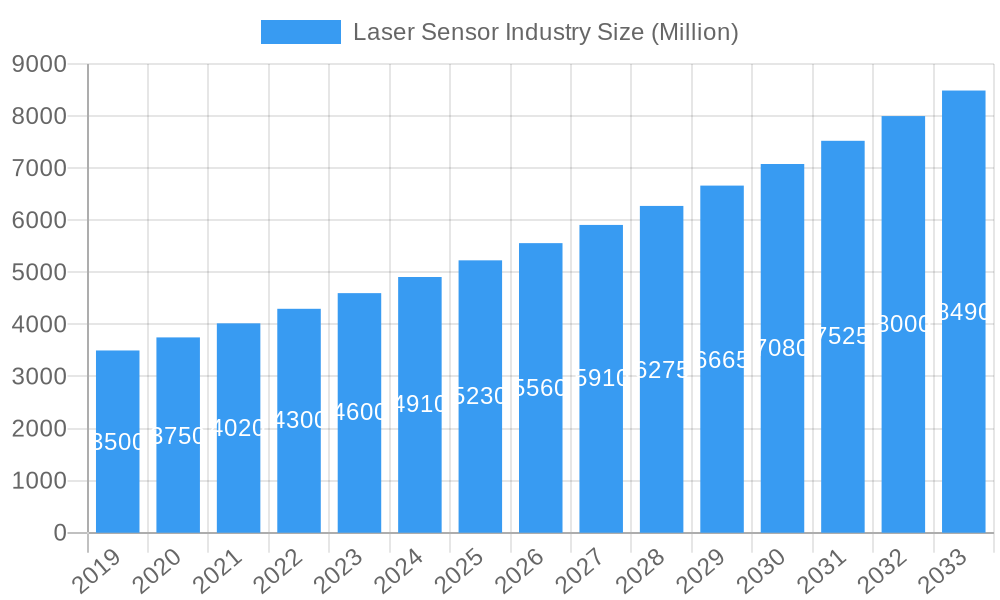

The global Laser Sensor market is poised for substantial growth, projected to reach a market size of approximately $5,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 9.61% expected to drive it to over $8,000 million by 2033. This robust expansion is fueled by the increasing demand for automation and precision across a multitude of industries. Key drivers include the burgeoning electronics manufacturing sector, where laser sensors are indispensable for intricate component placement, quality control, and assembly processes. The aviation industry's growing need for advanced diagnostics, inspection, and manufacturing of complex parts also significantly contributes to market momentum. Furthermore, the construction sector's adoption of laser scanning for surveying, BIM modeling, and precision measurement, alongside the automotive industry's drive towards enhanced driver-assistance systems and automated production lines, are powerful catalysts for this market's ascent. The inherent advantages of laser sensors – their accuracy, speed, non-contact measurement capabilities, and ability to operate in challenging environments – make them a preferred choice for sophisticated industrial applications.

Laser Sensor Industry Market Size (In Billion)

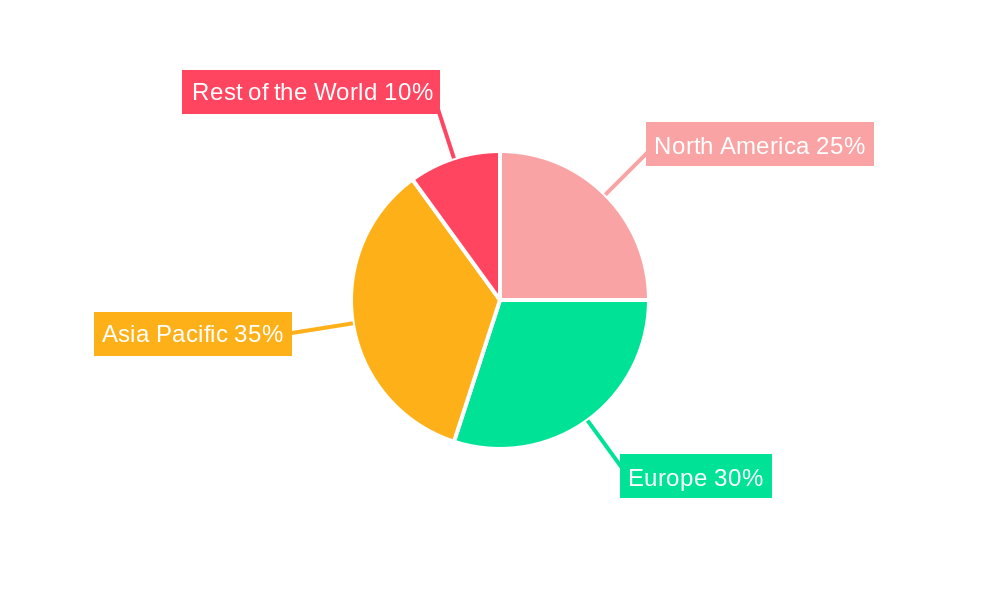

The market is characterized by a dynamic interplay of technological advancements and evolving application needs. The hardware and software segment, encompassing the core sensor technology and its integration capabilities, is expected to remain dominant, with significant innovation in areas like miniaturization, increased resolution, and enhanced signal processing. The services segment, including installation, maintenance, and customization, will also witness considerable growth as industries increasingly rely on these sophisticated solutions. Geographically, Asia Pacific, particularly China and Japan, is anticipated to lead market expansion due to its extensive manufacturing base and rapid adoption of Industry 4.0 technologies. North America and Europe will continue to be significant markets, driven by their advanced industrial infrastructure and ongoing investments in automation and smart manufacturing. However, potential restraints, such as the initial high cost of advanced laser sensor systems and the need for skilled personnel for operation and maintenance, might temper growth in certain segments, though these are likely to be mitigated by technological advancements and economies of scale in the long term.

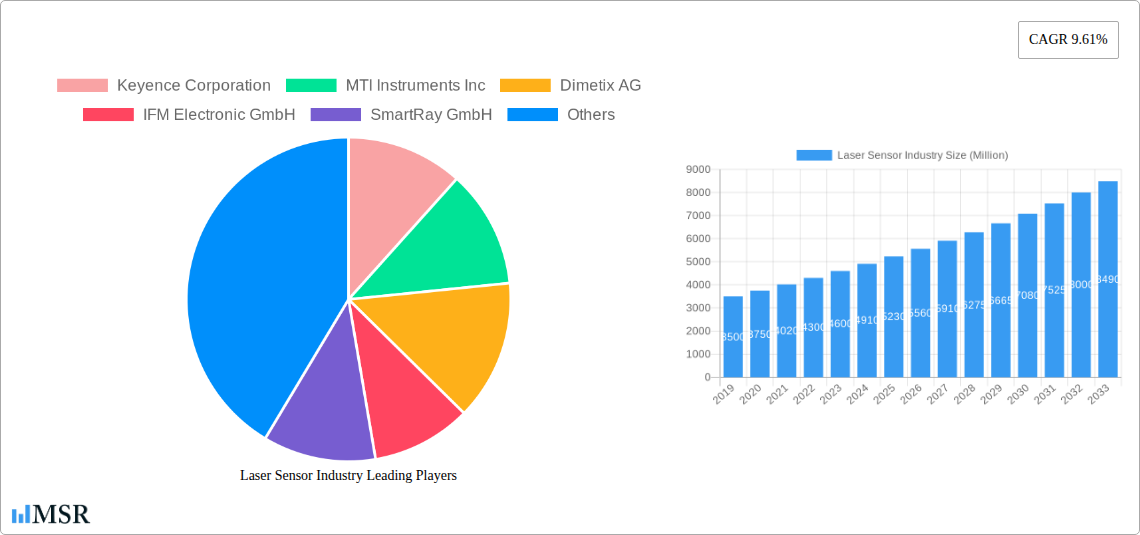

Laser Sensor Industry Company Market Share

Comprehensive Laser Sensor Industry Market Report: Growth, Innovations, and Strategic Outlook (2019-2033)

[Report Title] offers an in-depth analysis of the global laser sensor market, a critical component in modern automation and measurement across diverse industries. This report is meticulously crafted for industry stakeholders, including technology providers, manufacturers, investors, and researchers, seeking to understand the laser sensor market size, CAGR, growth drivers, key trends, and future opportunities. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides actionable insights based on a thorough examination of the historical period (2019–2024). We delve into the laser sensor industry dynamics, market concentration, and the leading players shaping this rapidly evolving sector.

Laser Sensor Industry Market Concentration & Dynamics

The laser sensor industry exhibits a moderate to high market concentration, with a dynamic interplay between established multinational corporations and agile specialized firms. Key players like Keyence Corporation, IFM Electronic GmbH, and Micro-Epsilon Messtechnik GmbH & Co KG hold significant market share, driven by their extensive product portfolios and robust distribution networks. The innovation ecosystem is particularly vibrant, fueled by continuous advancements in laser technology, miniaturization, and AI integration for enhanced data processing. Regulatory frameworks, primarily focused on safety standards (e.g., IEC 60825) and industry-specific compliance, play a crucial role in shaping product development and market entry. Substitute products, such as ultrasonic or vision sensors, offer alternatives in certain applications, necessitating laser sensor manufacturers to emphasize their unique advantages in precision, speed, and non-contact measurement capabilities. End-user trends indicate a strong demand for intelligent sensors capable of predictive maintenance and real-time data analysis, particularly within the Electronics Manufacturing and Automotive sectors. Merger and acquisition (M&A) activities, while not as frequent as in more mature industries, are strategically employed by larger companies to acquire niche technologies or expand their geographical reach. For instance, recent M&A deal counts in the broader industrial automation sector suggest potential consolidation opportunities.

Laser Sensor Industry Industry Insights & Trends

The laser sensor industry is poised for robust growth, projected to reach an estimated market size of over $8,500 Million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is primarily fueled by several key market growth drivers. The relentless drive towards industrial automation and Industry 4.0 initiatives across the globe is a significant catalyst, demanding precise and reliable measurement solutions. Technological disruptions, including advancements in solid-state lasers, high-resolution imaging, and sophisticated signal processing algorithms, are enabling the development of smaller, more powerful, and versatile laser sensors. These innovations are crucial for applications requiring high accuracy and speed. Evolving consumer behaviors, particularly the demand for personalized products and faster production cycles in sectors like Electronics Manufacturing, necessitate sophisticated quality control and process monitoring, where laser sensors excel. The increasing adoption of IoT (Internet of Things) devices and the proliferation of smart factories further augment the demand for connected and intelligent sensing solutions. Furthermore, government investments in infrastructure development, particularly in the Construction and Aviation industries, are creating new avenues for laser sensor deployment in surveying, alignment, and quality assurance. The rising complexity of automotive manufacturing, with its focus on advanced driver-assistance systems (ADAS) and autonomous driving technologies, also presents a substantial growth opportunity for high-performance laser sensors. The integration of AI and machine learning capabilities into laser sensor systems is another significant trend, enabling predictive maintenance, anomaly detection, and optimized process control, thereby enhancing operational efficiency for end-users.

Key Markets & Segments Leading Laser Sensor Industry

The laser sensor industry is experiencing dominant growth across several key regions and segments, driven by specific economic and technological factors.

Dominant Regions:

- Asia-Pacific is emerging as the leading region, propelled by its robust manufacturing base, particularly in Electronics Manufacturing and Automotive. The region's rapid industrialization, significant government support for technological adoption, and a large consumer market contribute to substantial demand for laser sensors. Countries like China, Japan, and South Korea are at the forefront of this growth.

- North America and Europe also represent significant markets, driven by strong investments in advanced manufacturing, aerospace, and defense sectors. The emphasis on precision, automation, and stringent quality control in these regions fuels the adoption of sophisticated laser sensor technologies.

Dominant Segments:

- Component: Hardware and Software: This segment is the backbone of the laser sensor industry.

- Hardware: High-precision optical components, advanced laser diodes, and sophisticated detector arrays are crucial.

- Software: Embedded firmware for data processing, calibration algorithms, and connectivity protocols are increasingly vital for smart sensor capabilities.

- Drivers: The continuous miniaturization of components, improved accuracy and resolution, and the integration of AI and machine learning for advanced analytics are key drivers.

- End-user Industry: Electronics Manufacturing: This sector is a primary consumer of laser sensors.

- Applications: High-precision measurement for semiconductor wafer inspection, PCB assembly, component placement, and quality control.

- Drivers: The growing demand for smaller, more complex electronic devices, the need for zero-defect manufacturing, and the rapid pace of product innovation.

- End-user Industry: Automotive: The automotive sector is a rapidly growing market for laser sensors.

- Applications: Used in ADAS, autonomous driving systems, precise assembly of vehicle components, and quality inspection during manufacturing.

- Drivers: The push towards electrification, autonomous driving, enhanced safety features, and stringent quality standards.

- End-user Industry: Aviation: The aerospace and defense sector relies on laser sensors for critical applications.

- Applications: Precision measurement for aircraft assembly, wing surface inspection, alignment of complex structures, and non-destructive testing.

- Drivers: The demand for lightweight yet robust aircraft, stringent safety regulations, and the development of advanced aerospace technologies.

- End-user Industry: Construction: Laser sensors are increasingly adopted in the construction industry.

- Applications: Site surveying, structural monitoring, precision alignment in building construction, and quality control of materials.

- Drivers: The need for greater accuracy, efficiency, and safety in construction projects, and the adoption of digital construction technologies.

Laser Sensor Industry Product Developments

Ongoing product developments in the laser sensor industry are characterized by remarkable technological advancements aimed at enhancing precision, speed, and intelligence. Innovations include the introduction of 2D and 3D laser scanners with ultra-high resolution, capable of capturing intricate details for advanced quality control and reverse engineering. Furthermore, miniaturization of laser sensor modules is enabling their integration into increasingly compact devices and automated systems. The development of robust sensor housings for harsh industrial environments, alongside enhanced resistance to dust, vibration, and extreme temperatures, is expanding their application scope. Advances in sensor fusion technology, combining laser data with other sensor inputs, are leading to more comprehensive and accurate real-time data acquisition.

Challenges in the Laser Sensor Industry Market

The laser sensor industry faces several challenges that can impact its growth trajectory.

- High initial investment costs: Advanced laser sensor systems can require significant capital expenditure, posing a barrier for smaller enterprises.

- Technical expertise requirement: The effective operation and maintenance of sophisticated laser sensors necessitate skilled personnel, leading to a talent gap.

- Environmental interference: Factors like ambient light, dust, and surface reflectivity can sometimes affect sensor performance, requiring careful installation and calibration.

- Intense competition: The presence of numerous players, both established and emerging, leads to price pressures and a need for continuous innovation to maintain competitive advantage.

- Stringent regulatory compliance: Adhering to evolving international and regional safety and performance standards can add to development and validation costs.

Forces Driving Laser Sensor Industry Growth

Several powerful forces are propelling the laser sensor industry forward.

- Industrial Automation & Industry 4.0: The widespread adoption of automated processes and smart factory concepts is a primary growth driver, necessitating precise and reliable measurement.

- Technological Advancements: Continuous innovation in laser technology, optics, and data processing enables the development of more accurate, faster, and intelligent sensors.

- Demand for Quality & Precision: Industries like electronics, automotive, and aerospace require increasingly higher levels of precision for product quality and manufacturing efficiency.

- Growth in Emerging Economies: Rapid industrialization and infrastructure development in emerging markets are creating significant demand for advanced sensing solutions.

- IoT and Big Data Integration: The ability of laser sensors to generate vast amounts of data, which can be integrated into IoT platforms for analysis, further fuels their adoption.

Challenges in the Laser Sensor Industry Market

The laser sensor industry is characterized by long-term growth catalysts that promise sustained expansion.

- Continued miniaturization and integration: The ability to create smaller, more power-efficient laser sensors will unlock new application areas in robotics, portable devices, and embedded systems.

- Advancements in AI and Machine Learning: Deeper integration of AI will enable laser sensors to perform more complex tasks such as predictive maintenance, anomaly detection, and adaptive process control, increasing their value proposition.

- Development of new laser technologies: Research into novel laser sources and optical configurations will lead to enhanced performance characteristics, such as greater wavelength flexibility and improved beam quality.

- Expansion into new industry verticals: As the capabilities of laser sensors become more widely recognized, their adoption is expected to grow in traditionally less penetrated sectors like healthcare, agriculture, and environmental monitoring.

- Strategic partnerships and collaborations: Companies will continue to form alliances to leverage complementary expertise, accelerate R&D, and expand market reach, fostering innovation and growth.

Emerging Opportunities in Laser Sensor Industry

The laser sensor industry presents a fertile ground for emerging opportunities, driven by evolving technological landscapes and market demands.

- Smart Cities and Infrastructure Monitoring: The increasing deployment of smart city initiatives offers opportunities for laser sensors in traffic management, urban planning, and structural health monitoring of bridges and buildings.

- Advanced Robotics and Automation: The proliferation of collaborative robots (cobots) and autonomous mobile robots (AMRs) will drive demand for compact, high-performance laser sensors for navigation, object recognition, and precise manipulation.

- Medical and Healthcare Applications: Opportunities lie in using laser sensors for non-invasive diagnostics, precise surgical guidance, and advanced medical imaging.

- Augmented Reality (AR) and Virtual Reality (VR) Integration: Laser sensors can play a crucial role in capturing real-world spatial data for immersive AR/VR experiences, particularly in industrial training and design.

- Sustainability and Environmental Monitoring: Laser sensors can be employed for accurate environmental measurements, such as air quality monitoring, pollution detection, and resource management, aligning with global sustainability goals.

Leading Players in the Laser Sensor Industry Sector

- Keyence Corporation

- MTI Instruments Inc

- Dimetix AG

- IFM Electronic GmbH

- SmartRay GmbH

- Rockwell Automation Inc

- Micro-Epsilon Messtechnik GmbH & Co KG

- First Sensor AG

- Baumer Electric AG

Key Milestones in Laser Sensor Industry Industry

- 2019: Introduction of advanced 3D laser scanners with enhanced resolution for detailed surface inspection.

- 2020: Increased integration of AI algorithms into laser sensor firmware for real-time data analysis and anomaly detection.

- 2021: Development of smaller, more power-efficient laser sensor modules for integration into portable and robotic applications.

- 2022: Significant advancements in laser triangulation technology, improving accuracy and speed in measurement.

- 2023: Growing adoption of laser sensors in autonomous vehicle development for enhanced perception systems.

- 2024: Focus on developing laser sensors with improved resistance to harsh environmental conditions for wider industrial applicability.

Strategic Outlook for Laser Sensor Industry Market

The strategic outlook for the laser sensor industry is overwhelmingly positive, characterized by continued innovation and expanding market reach. Key growth accelerators include the persistent demand for automation across all industrial sectors, driven by the pursuit of efficiency and cost reduction. The ongoing miniaturization and intelligence of laser sensor technology will unlock novel applications in areas such as augmented reality, advanced robotics, and the Internet of Medical Things (IoMT). Strategic partnerships and collaborations between sensor manufacturers, software developers, and end-users will be crucial for co-creating integrated solutions that address complex industry challenges. Furthermore, the increasing focus on sustainability and environmental monitoring presents a significant opportunity for laser sensors to contribute to more efficient resource management and pollution control. Companies that can effectively navigate the evolving technological landscape, adapt to diverse end-user needs, and offer robust, intelligent, and cost-effective solutions are well-positioned for sustained success in this dynamic market.

Laser Sensor Industry Segmentation

-

1. Component

- 1.1. Hardware and Software

- 1.2. Services

-

2. End-user Industry

- 2.1. Electronics Manufacturing

- 2.2. Aviation

- 2.3. Construction

- 2.4. Automotive

- 2.5. Other End-user Industries

Laser Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Laser Sensor Industry Regional Market Share

Geographic Coverage of Laser Sensor Industry

Laser Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Adoption of Industry 4.0 and Smart Manufacturing Practices; Reduction of Price Leading to Large Scale Application

- 3.3. Market Restrains

- 3.3.1. ; High Requirement of Power and Energy Density for Measuring Smaller Beams

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware and Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Electronics Manufacturing

- 5.2.2. Aviation

- 5.2.3. Construction

- 5.2.4. Automotive

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware and Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Electronics Manufacturing

- 6.2.2. Aviation

- 6.2.3. Construction

- 6.2.4. Automotive

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware and Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Electronics Manufacturing

- 7.2.2. Aviation

- 7.2.3. Construction

- 7.2.4. Automotive

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware and Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Electronics Manufacturing

- 8.2.2. Aviation

- 8.2.3. Construction

- 8.2.4. Automotive

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Rest of the World Laser Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware and Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Electronics Manufacturing

- 9.2.2. Aviation

- 9.2.3. Construction

- 9.2.4. Automotive

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Keyence Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 MTI Instruments Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dimetix AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IFM Electronic GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SmartRay GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rockwell Automation Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Micro-Epsilon Messtechnik GmbH & Co KG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 First Sensor AG*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Baumer Electric AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Laser Sensor Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: North America Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 9: Europe Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 10: Europe Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 11: Europe Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 15: Asia Pacific Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Asia Pacific Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Laser Sensor Industry Revenue (undefined), by Component 2025 & 2033

- Figure 21: Rest of the World Laser Sensor Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Rest of the World Laser Sensor Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Laser Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Laser Sensor Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Laser Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Laser Sensor Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 5: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 10: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 17: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: India Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Laser Sensor Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Laser Sensor Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 25: Global Laser Sensor Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Laser Sensor Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Sensor Industry?

The projected CAGR is approximately 10.54%.

2. Which companies are prominent players in the Laser Sensor Industry?

Key companies in the market include Keyence Corporation, MTI Instruments Inc, Dimetix AG, IFM Electronic GmbH, SmartRay GmbH, Rockwell Automation Inc, Micro-Epsilon Messtechnik GmbH & Co KG, First Sensor AG*List Not Exhaustive, Baumer Electric AG.

3. What are the main segments of the Laser Sensor Industry?

The market segments include Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Adoption of Industry 4.0 and Smart Manufacturing Practices; Reduction of Price Leading to Large Scale Application.

6. What are the notable trends driving market growth?

Automotive is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Requirement of Power and Energy Density for Measuring Smaller Beams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laser Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laser Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laser Sensor Industry?

To stay informed about further developments, trends, and reports in the Laser Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence