Key Insights

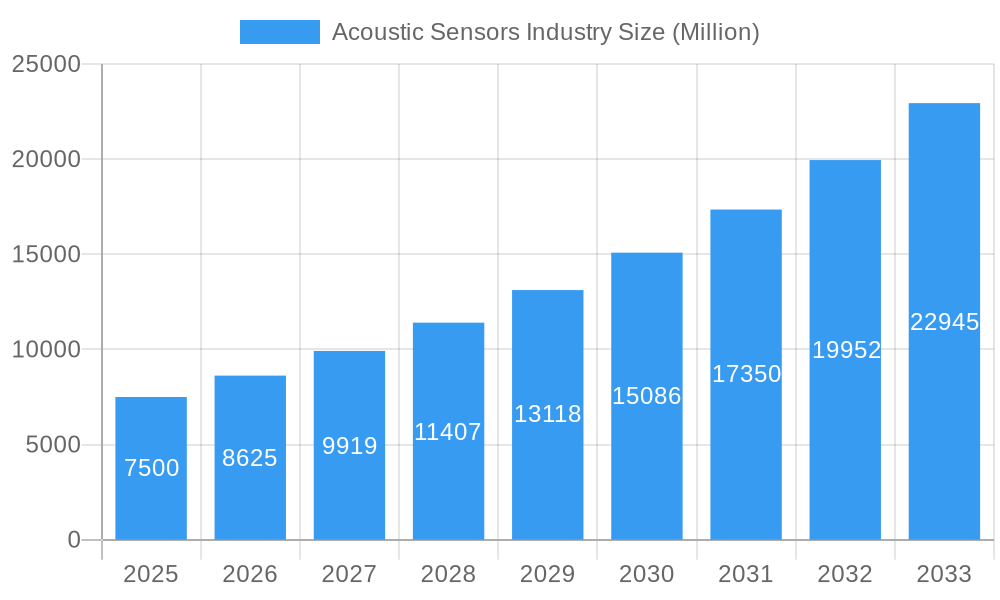

The global Acoustic Sensors market is projected to reach $7.50 billion by 2025, driven by a remarkable CAGR of 15.00% through 2033. This substantial growth stems from increasing adoption across diverse industries, including automotive for ADAS and safety features, aerospace and defense for structural health monitoring and surveillance, healthcare for diagnostics and patient monitoring, and consumer electronics for smart devices and wearables.

Acoustic Sensors Industry Market Size (In Billion)

Key market trends include sensor miniaturization, advancements in materials and manufacturing for improved performance and durability, and the growing demand for flexible wireless acoustic sensor solutions. While high R&D and manufacturing costs, along with stringent regulatory compliance, present challenges, continuous innovation in sensing parameters and expanding applications ensure a dynamic and promising future for the acoustic sensors industry.

Acoustic Sensors Industry Company Market Share

Acoustic Sensors Market Analysis: Growth, Trends, and Forecasts (2019-2033)

This comprehensive report details the global Acoustic Sensors market, a critical sector for automotive, aerospace & defense, consumer electronics, healthcare, and industrial applications. The analysis covers the study period 2019–2033, with a focus on the base year 2025 and the forecast period 2025–2033. Explore market dynamics, emerging trends, and growth strategies. Key segments include wired and wireless acoustic sensors, surface wave and bulk wave technologies, and parameters such as temperature, pressure, and torque.

Acoustic Sensors Industry Market Concentration & Dynamics

The Acoustic Sensors market exhibits a moderate to high concentration, driven by a few key players and a growing number of specialized innovators. The innovation ecosystem is characterized by significant R&D investment in miniaturization, increased sensitivity, and enhanced data processing capabilities. Regulatory frameworks, particularly in aerospace & defense and healthcare, are becoming more stringent, emphasizing reliability and compliance. Substitute products, while present in some niche applications, are largely outpaced by the performance and cost-effectiveness of advanced acoustic sensor solutions. End-user trends are increasingly demanding real-time, high-fidelity acoustic data for predictive maintenance, enhanced safety, and improved user experiences. Mergers and acquisitions (M&A) activity is expected to rise as larger companies seek to acquire innovative technologies and expand their market reach. Recent M&A deal counts indicate strategic consolidation, with approximately 5-10 significant deals annually over the historical period. Market share is currently dominated by companies holding roughly 40-50% of the overall market, with the remainder fragmented among smaller, specialized vendors.

Acoustic Sensors Industry Industry Insights & Trends

The global Acoustic Sensors market is poised for substantial growth, projected to reach an estimated USD 8,000 Million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025–2033. This expansion is fueled by escalating demand across diverse industries. In the automotive sector, the integration of advanced driver-assistance systems (ADAS) and the proliferation of electric vehicles (EVs) are driving the need for precise acoustic monitoring for noise reduction, structural integrity, and system diagnostics. The aerospace & defense industry continues to be a significant driver, with applications in surveillance, navigation, and the development of sophisticated anti-submarine warfare (ASW) systems, as evidenced by recent contract awards. The consumer electronics market benefits from the increasing use of voice recognition, smart home devices, and wearable technology, all of which rely on high-performance acoustic sensors. Furthermore, advancements in healthcare are leveraging acoustic sensing for non-invasive diagnostics, patient monitoring, and advanced medical imaging. The industrial sector is witnessing a surge in adoption for predictive maintenance, condition monitoring of machinery, and process optimization, leading to reduced downtime and increased operational efficiency. Technological disruptions, such as the development of novel materials for sensor fabrication and the integration of artificial intelligence (AI) for data analysis, are further accelerating market penetration. Evolving consumer behaviors, particularly the growing preference for smart, connected devices and enhanced safety features, are creating new avenues for acoustic sensor applications.

Key Markets & Segments Leading Acoustic Sensors Industry

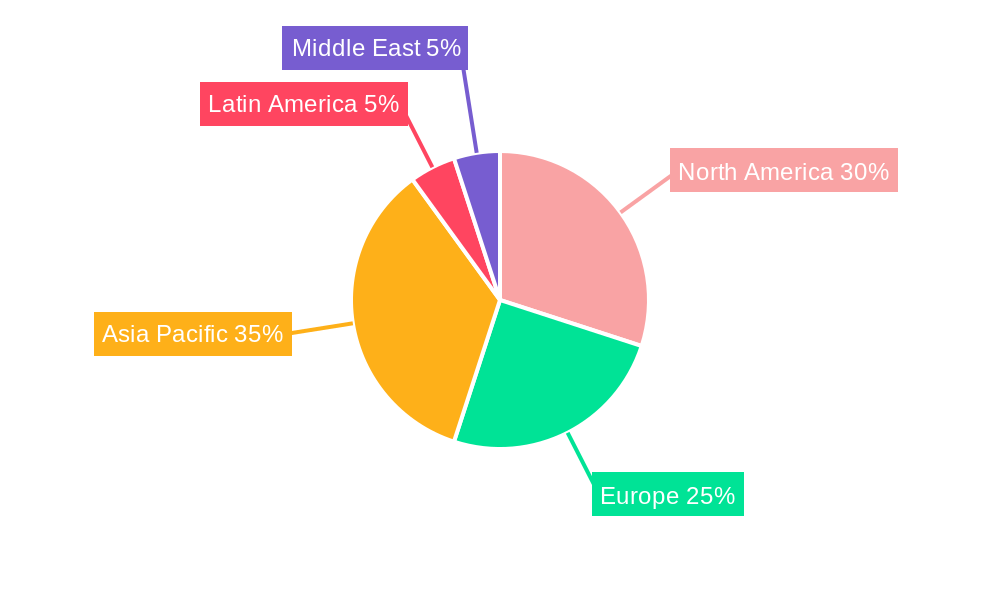

The Asia Pacific region is emerging as a dominant force in the Acoustic Sensors market, driven by robust economic growth, significant manufacturing capabilities, and increasing adoption of advanced technologies across its key economies, particularly China, Japan, and South Korea. This dominance is further bolstered by substantial investments in infrastructure development and a rapidly expanding automotive manufacturing base.

Type:

- Wired Acoustic Sensors: While still holding a significant market share due to their reliability and cost-effectiveness in fixed installations, wired sensors are facing increasing competition from wireless alternatives in mobile and dynamic applications.

- Wireless Acoustic Sensors: This segment is experiencing rapid growth, driven by the demand for flexibility, ease of installation, and reduced cabling costs, particularly in the IoT and industrial automation sectors.

Wave Type:

- Surface Wave (SAW) Sensors: These sensors are gaining prominence due to their high sensitivity and suitability for measuring various physical parameters like temperature and pressure, finding strong application in automotive and industrial settings.

- Bulk Wave (BW) Sensors: Known for their robustness and ability to withstand harsh environments, bulk wave sensors are critical in demanding applications within aerospace & defense and industrial machinery.

Sensing Parameter:

- Temperature: A foundational sensing parameter with widespread application across all sectors, driving significant market demand.

- Pressure: Crucial for applications ranging from engine diagnostics in automotive to flight control systems in aerospace.

- Torque: Increasingly important in advanced automotive powertrains and industrial machinery for precise control and efficiency.

Application:

- Automotive: This segment represents a substantial market share due to the increasing complexity of vehicle systems, including ADAS, infotainment, and engine monitoring. The push towards electrification and autonomous driving further amplifies this demand.

- Aerospace & Defense: A high-value segment characterized by stringent performance requirements and critical applications like surveillance, navigation, and ASW operations. The development of advanced military equipment and commercial aviation safety systems fuels consistent demand.

- Industrial: This sector is a major growth engine, driven by the adoption of Industry 4.0 principles, predictive maintenance, and the need for real-time monitoring of machinery and processes to enhance efficiency and prevent costly failures.

- Consumer Electronics: A rapidly expanding segment fueled by the proliferation of smart devices, voice assistants, and wearable technology, where acoustic sensing is integral to user interaction and functionality.

- Healthcare: A growing segment leveraging acoustic sensors for diagnostic tools, patient monitoring devices, and medical equipment, where accuracy and reliability are paramount.

The increasing adoption of smart technologies, the development of advanced sensor materials, and the growing need for high-precision monitoring in these key application areas are collectively driving the dominance of these segments within the global acoustic sensors market.

Acoustic Sensors Industry Product Developments

Recent product innovations in the Acoustic Sensors industry are focused on enhancing sensitivity, miniaturization, and integration with advanced processing capabilities. Companies are developing novel MEMS-based acoustic sensors for applications requiring high spatial resolution and low power consumption, such as advanced driver-assistance systems and medical diagnostics. The development of surface acoustic wave (SAW) and bulk acoustic wave (BAW) technologies continues to yield sensors with improved performance in temperature and pressure sensing, crucial for harsh industrial and automotive environments. Furthermore, the integration of acoustic sensors with wireless communication modules and AI algorithms is enabling smarter, more autonomous systems capable of real-time data analysis and predictive capabilities. These advancements are creating significant competitive edges and opening new market opportunities.

Challenges in the Acoustic Sensors Industry Market

The Acoustic Sensors industry faces several challenges that can impede its growth trajectory. Regulatory hurdles, particularly stringent standards for safety and performance in sectors like aerospace and healthcare, can increase development costs and time-to-market. Supply chain disruptions, as experienced globally, can impact the availability of raw materials and components, leading to production delays and increased costs. Competitive pressures from both established players and emerging startups necessitate continuous innovation and aggressive pricing strategies. Furthermore, the need for specialized expertise in acoustic engineering and signal processing can create a talent gap. The cost of integrating advanced acoustic sensing solutions into existing systems can also be a barrier for some potential adopters.

Forces Driving Acoustic Sensors Industry Growth

Several key factors are propelling the Acoustic Sensors industry forward. Technological advancements, including the miniaturization of sensors, improvements in material science for enhanced performance, and the integration of AI for sophisticated data analysis, are critical growth drivers. Economic factors, such as the overall growth in end-use industries like automotive and industrial automation, directly translate into higher demand for acoustic sensors. Furthermore, increasing global investments in smart infrastructure and the expansion of the Internet of Things (IoT) ecosystem are creating new opportunities. Supportive government initiatives and research funding for advanced technologies also play a crucial role in fostering innovation and market expansion within the acoustic sensing domain.

Challenges in the Acoustic Sensors Industry Market

Long-term growth catalysts in the Acoustic Sensors market are rooted in continued innovation and strategic market expansion. The ongoing evolution towards autonomous systems in automotive and robotics requires increasingly sophisticated acoustic perception capabilities, driving demand for advanced sensor arrays and processing. The expansion of the smart cities concept, incorporating environmental monitoring, traffic management, and public safety, will necessitate widespread deployment of acoustic sensors. Furthermore, the growing emphasis on preventative healthcare and remote patient monitoring creates a significant opportunity for non-invasive acoustic diagnostic devices. Strategic partnerships between sensor manufacturers, system integrators, and end-users will be crucial for co-developing tailored solutions and accelerating market penetration.

Emerging Opportunities in Acoustic Sensors Industry

Emerging opportunities in the Acoustic Sensors industry are diverse and promising. The burgeoning field of underwater acoustics presents significant potential for advancements in marine research, offshore energy exploration, and naval defense applications. The growing demand for noise-cancellation technologies in consumer electronics and industrial settings is creating a niche for advanced acoustic sensors capable of precise sound wave detection and manipulation. The development of novel acoustic imaging techniques for non-destructive testing in materials science and civil engineering also offers a significant growth avenue. Furthermore, the increasing focus on environmental monitoring and smart agriculture necessitates robust acoustic sensing solutions for wildlife tracking, pest detection, and agricultural machinery performance analysis.

Leading Players in the Acoustic Sensors Industry Sector

- Dytran Instruments Inc

- Honeywell Sensing and Productivity Solutions

- Vectron International Inc (Microchip technology Incorporated)

- Campbell Scientific Inc

- Siemens AG

- API Technologies Corp

- IFM Efector Inc

- CTS Corporation

- Murata Manufacturing Co Ltd

- Transense Technologies PLC

Key Milestones in Acoustic Sensors Industry Industry

- February 2022: TAIYO YUDEN (U.S.A.) INC announced a collaboration with TTI, Inc., a global supplier of electronic components. This partnership aims to expand TAIYO YUDEN's presence and impact in critical sectors like automotive and electrification, communication infrastructures, and beyond, broadening its global customer base.

- December 2021: Microchip Technology Inc. announced a significant expansion of its Gallium Nitride (GaN) Radio Frequency (RF) power device portfolio, introducing new MMICs and discrete transistors capable of covering frequencies up to 20 gigahertz (GHz). This advancement complements their existing offerings of surface acoustic wave (SAW) sensors and microelectromechanical systems (MEMS) oscillators, alongside highly integrated modules combining microcontrollers (MCUs) with RF transceivers (Wi-Fi MCUs) supporting protocols like Bluetooth, Wi-Fi, and LoRa.

- December 2021: The Naval Air Systems Command announced a USD 222.3 million contract to ERAPSCO and Lockheed Martin Corp.'s Rotary and Mission Systems segment for the production of up to 18,000 AN/SSQ-125 multi-static sonobuoys. These disposable electromechanical ASW acoustic sensors are crucial for airborne anti-submarine warfare (ASW) operations, enabling the tracking of underwater threats and enhancing precision air-launched torpedo attacks by relaying vital underwater sounds.

Strategic Outlook for Acoustic Sensors Industry Market

The strategic outlook for the Acoustic Sensors market is highly positive, with significant growth accelerators expected in the coming years. The continued integration of acoustic sensing into the automotive industry, particularly with the advent of electric and autonomous vehicles, will be a major growth engine. The expansion of smart manufacturing and Industry 4.0 initiatives globally will drive demand for predictive maintenance and condition monitoring solutions. Furthermore, the increasing adoption of IoT devices across consumer and industrial applications will create vast opportunities for wireless acoustic sensor networks. Investments in R&D for novel materials, miniaturization, and advanced signal processing, including AI and machine learning, will be crucial for maintaining a competitive edge and unlocking new application areas, ensuring sustained market expansion.

Acoustic Sensors Industry Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Wave Type

- 2.1. Surface Wave

- 2.2. Bulk Wave

-

3. Sensing Parameter

- 3.1. Temperature

- 3.2. Pressure

- 3.3. Torque

-

4. Application

- 4.1. Automotive

- 4.2. Aerospace & Defense

- 4.3. Consumer Electronics

- 4.4. Healthcare

- 4.5. Industrial

- 4.6. Other Applications

Acoustic Sensors Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Acoustic Sensors Industry Regional Market Share

Geographic Coverage of Acoustic Sensors Industry

Acoustic Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Telecommunications Market; Low Manufacturing Costs

- 3.3. Market Restrains

- 3.3.1. Technical Challenges Associated with Acoustic Sensors

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Acoustic Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Wave Type

- 5.2.1. Surface Wave

- 5.2.2. Bulk Wave

- 5.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 5.3.1. Temperature

- 5.3.2. Pressure

- 5.3.3. Torque

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Automotive

- 5.4.2. Aerospace & Defense

- 5.4.3. Consumer Electronics

- 5.4.4. Healthcare

- 5.4.5. Industrial

- 5.4.6. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Acoustic Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Wave Type

- 6.2.1. Surface Wave

- 6.2.2. Bulk Wave

- 6.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 6.3.1. Temperature

- 6.3.2. Pressure

- 6.3.3. Torque

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Automotive

- 6.4.2. Aerospace & Defense

- 6.4.3. Consumer Electronics

- 6.4.4. Healthcare

- 6.4.5. Industrial

- 6.4.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Acoustic Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Wave Type

- 7.2.1. Surface Wave

- 7.2.2. Bulk Wave

- 7.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 7.3.1. Temperature

- 7.3.2. Pressure

- 7.3.3. Torque

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Automotive

- 7.4.2. Aerospace & Defense

- 7.4.3. Consumer Electronics

- 7.4.4. Healthcare

- 7.4.5. Industrial

- 7.4.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Acoustic Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Wave Type

- 8.2.1. Surface Wave

- 8.2.2. Bulk Wave

- 8.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 8.3.1. Temperature

- 8.3.2. Pressure

- 8.3.3. Torque

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Automotive

- 8.4.2. Aerospace & Defense

- 8.4.3. Consumer Electronics

- 8.4.4. Healthcare

- 8.4.5. Industrial

- 8.4.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Acoustic Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Wave Type

- 9.2.1. Surface Wave

- 9.2.2. Bulk Wave

- 9.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 9.3.1. Temperature

- 9.3.2. Pressure

- 9.3.3. Torque

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Automotive

- 9.4.2. Aerospace & Defense

- 9.4.3. Consumer Electronics

- 9.4.4. Healthcare

- 9.4.5. Industrial

- 9.4.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Acoustic Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Wave Type

- 10.2.1. Surface Wave

- 10.2.2. Bulk Wave

- 10.3. Market Analysis, Insights and Forecast - by Sensing Parameter

- 10.3.1. Temperature

- 10.3.2. Pressure

- 10.3.3. Torque

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Automotive

- 10.4.2. Aerospace & Defense

- 10.4.3. Consumer Electronics

- 10.4.4. Healthcare

- 10.4.5. Industrial

- 10.4.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dytran Instruments Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell Sensing and Productivity Solutions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vectron International Inc (Microchip technology Incorporated)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Campbell Scientific Inc *List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 API Technologies Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IFM Efector Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CTS Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Murata Manufacturing Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Transense Technologies PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dytran Instruments Inc

List of Figures

- Figure 1: Global Acoustic Sensors Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Acoustic Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Acoustic Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Acoustic Sensors Industry Revenue (billion), by Wave Type 2025 & 2033

- Figure 5: North America Acoustic Sensors Industry Revenue Share (%), by Wave Type 2025 & 2033

- Figure 6: North America Acoustic Sensors Industry Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 7: North America Acoustic Sensors Industry Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 8: North America Acoustic Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Acoustic Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Acoustic Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Acoustic Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Acoustic Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Acoustic Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Acoustic Sensors Industry Revenue (billion), by Wave Type 2025 & 2033

- Figure 15: Europe Acoustic Sensors Industry Revenue Share (%), by Wave Type 2025 & 2033

- Figure 16: Europe Acoustic Sensors Industry Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 17: Europe Acoustic Sensors Industry Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 18: Europe Acoustic Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Europe Acoustic Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Acoustic Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Acoustic Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Acoustic Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Acoustic Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Acoustic Sensors Industry Revenue (billion), by Wave Type 2025 & 2033

- Figure 25: Asia Pacific Acoustic Sensors Industry Revenue Share (%), by Wave Type 2025 & 2033

- Figure 26: Asia Pacific Acoustic Sensors Industry Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 27: Asia Pacific Acoustic Sensors Industry Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 28: Asia Pacific Acoustic Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Acoustic Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Acoustic Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Acoustic Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Acoustic Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: Latin America Acoustic Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Latin America Acoustic Sensors Industry Revenue (billion), by Wave Type 2025 & 2033

- Figure 35: Latin America Acoustic Sensors Industry Revenue Share (%), by Wave Type 2025 & 2033

- Figure 36: Latin America Acoustic Sensors Industry Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 37: Latin America Acoustic Sensors Industry Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 38: Latin America Acoustic Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Latin America Acoustic Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Acoustic Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Latin America Acoustic Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East Acoustic Sensors Industry Revenue (billion), by Type 2025 & 2033

- Figure 43: Middle East Acoustic Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East Acoustic Sensors Industry Revenue (billion), by Wave Type 2025 & 2033

- Figure 45: Middle East Acoustic Sensors Industry Revenue Share (%), by Wave Type 2025 & 2033

- Figure 46: Middle East Acoustic Sensors Industry Revenue (billion), by Sensing Parameter 2025 & 2033

- Figure 47: Middle East Acoustic Sensors Industry Revenue Share (%), by Sensing Parameter 2025 & 2033

- Figure 48: Middle East Acoustic Sensors Industry Revenue (billion), by Application 2025 & 2033

- Figure 49: Middle East Acoustic Sensors Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Middle East Acoustic Sensors Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East Acoustic Sensors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Acoustic Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Acoustic Sensors Industry Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 3: Global Acoustic Sensors Industry Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 4: Global Acoustic Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Acoustic Sensors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Acoustic Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Acoustic Sensors Industry Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 8: Global Acoustic Sensors Industry Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 9: Global Acoustic Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Acoustic Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Acoustic Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Acoustic Sensors Industry Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 13: Global Acoustic Sensors Industry Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 14: Global Acoustic Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Acoustic Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Acoustic Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Acoustic Sensors Industry Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 18: Global Acoustic Sensors Industry Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 19: Global Acoustic Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Acoustic Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Acoustic Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Acoustic Sensors Industry Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 23: Global Acoustic Sensors Industry Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 24: Global Acoustic Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Acoustic Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Acoustic Sensors Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Acoustic Sensors Industry Revenue billion Forecast, by Wave Type 2020 & 2033

- Table 28: Global Acoustic Sensors Industry Revenue billion Forecast, by Sensing Parameter 2020 & 2033

- Table 29: Global Acoustic Sensors Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Acoustic Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Acoustic Sensors Industry?

The projected CAGR is approximately 13.11%.

2. Which companies are prominent players in the Acoustic Sensors Industry?

Key companies in the market include Dytran Instruments Inc, Honeywell Sensing and Productivity Solutions, Vectron International Inc (Microchip technology Incorporated), Campbell Scientific Inc *List Not Exhaustive, Siemens AG, API Technologies Corp, IFM Efector Inc, CTS Corporation, Murata Manufacturing Co Ltd, Transense Technologies PLC.

3. What are the main segments of the Acoustic Sensors Industry?

The market segments include Type, Wave Type, Sensing Parameter, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Telecommunications Market; Low Manufacturing Costs.

6. What are the notable trends driving market growth?

Consumer Electronics to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Technical Challenges Associated with Acoustic Sensors.

8. Can you provide examples of recent developments in the market?

February 2022 - TAIYO YUDEN (U.S.A.) INC announced a collaboration with TTI., Inc., a global supplier of electronic components. TAIYO YUDEN (U.S.A.) INC. will be able to expand its existence and make an impact in sectors such as the automotive and electrification industries, communication infrastructures, and more as a result of this collaboration. This advancement will broaden the company's global customer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Acoustic Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Acoustic Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Acoustic Sensors Industry?

To stay informed about further developments, trends, and reports in the Acoustic Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence