Key Insights

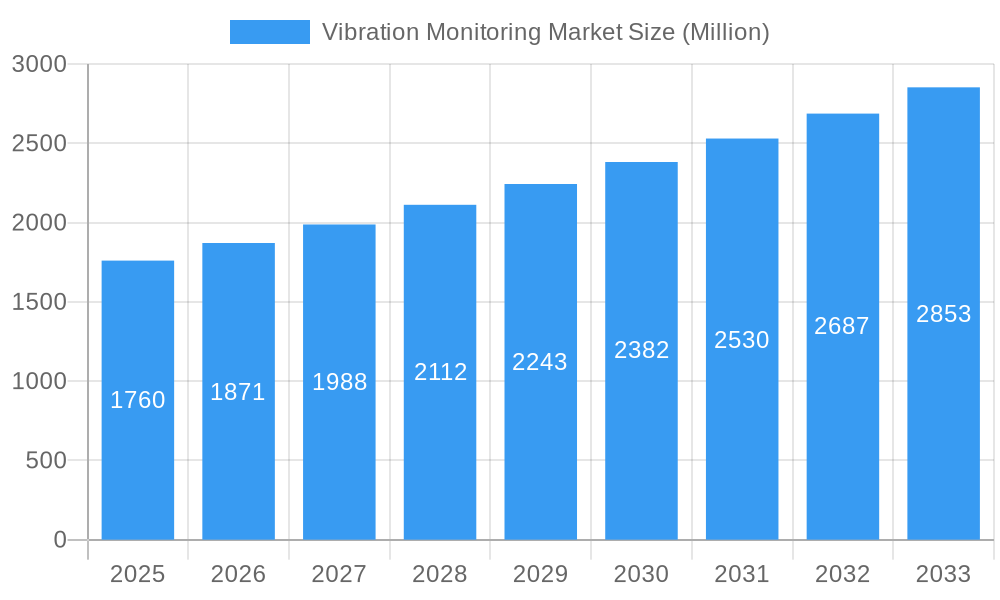

The global Vibration Monitoring Market is poised for significant expansion, projected to reach an estimated USD 1.76 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.30% during the forecast period of 2025-2033. This growth is propelled by a confluence of critical drivers, primarily the escalating demand for predictive maintenance across industries to minimize unplanned downtime and optimize operational efficiency. The increasing adoption of Industrial Internet of Things (IIoT) technologies, coupled with advancements in sensor technology and data analytics, is further fueling market momentum. Companies are increasingly investing in sophisticated vibration monitoring systems to detect early signs of equipment failure, thereby reducing costly repairs and enhancing safety protocols, particularly in high-risk sectors. Furthermore, stringent regulatory mandates concerning industrial safety and environmental protection are also contributing to the widespread implementation of vibration monitoring solutions.

Vibration Monitoring Market Market Size (In Billion)

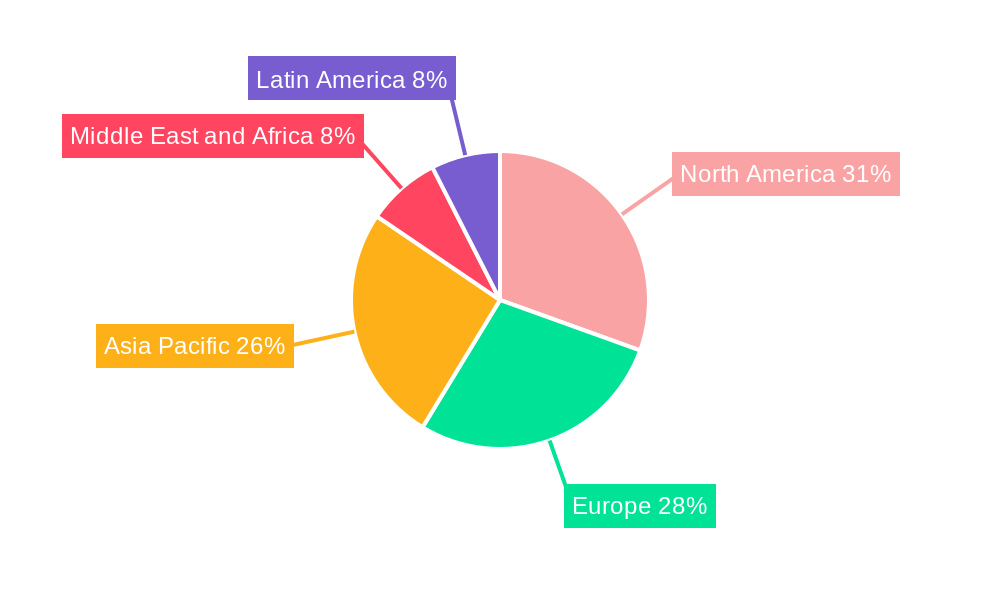

The market's trajectory is characterized by several key trends. The growing sophistication of software solutions, offering advanced data analysis and AI-powered diagnostics, is a prominent trend. This is complemented by an expanding service landscape, encompassing installation, calibration, and ongoing maintenance, which enhances user adoption and system effectiveness. Segmentation analysis reveals a balanced demand across hardware, software, and services, with hardware components like accelerometers and velocity sensors remaining foundational. Key end-user industries driving this growth include Automotive, Oil & Gas, Energy & Power, and Mining, where the criticality of machinery uptime and safety is paramount. Geographically, regions like North America and Europe are anticipated to maintain substantial market shares due to established industrial bases and early adoption of advanced technologies, while the Asia Pacific region is expected to witness the highest growth rates owing to rapid industrialization and increasing investments in manufacturing infrastructure.

Vibration Monitoring Market Company Market Share

Gain a critical edge in the rapidly evolving vibration monitoring market with this in-depth industry analysis. Covering the study period 2019–2033, including a robust forecast period of 2025–2033 and a detailed look at the historical period 2019–2024, this report provides unparalleled insights into market dynamics, technological advancements, and strategic opportunities. With the base year 2025 serving as a pivotal benchmark, explore the projected market size of $25,000 Million by 2033, driven by a compelling CAGR of 7.5%. This indispensable resource is engineered for industry leaders, investors, and decision-makers seeking to capitalize on the burgeoning demand for predictive maintenance, asset integrity management, and industrial automation solutions.

Vibration Monitoring Market Market Concentration & Dynamics

The vibration monitoring market exhibits a moderately concentrated landscape, with key players investing heavily in research and development to foster innovation ecosystems. Major companies are actively engaged in strategic partnerships and collaborations to enhance their product portfolios and expand market reach. Regulatory frameworks, particularly concerning industrial safety and environmental compliance, are indirectly influencing the adoption of advanced condition monitoring systems. The threat of substitute products, such as basic manual inspections, is diminishing as the benefits of continuous, automated vibration analysis become more apparent. End-user trends are shifting towards proactive maintenance strategies, driven by the desire to minimize downtime and optimize operational efficiency across various sectors, including oil and gas, energy and power, and manufacturing. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic repositioning. In the historical period (2019-2024), there have been an estimated 15 M&A deals valued at over $50 Million each, reflecting the pursuit of synergistic growth and technological integration. Market share among top vendors currently hovers around 40%, indicating significant room for new entrants and specialized players.

- Innovation Ecosystems: Focus on AI-driven analytics, wireless sensor networks, and cloud-based platforms.

- Regulatory Frameworks: Increasing emphasis on machinery safety standards and predictive maintenance mandates.

- End-User Trends: Growing adoption of IoT-enabled solutions for remote monitoring and real-time diagnostics.

- M&A Activities: Strategic acquisitions aimed at expanding product offerings and geographic presence.

Vibration Monitoring Market Industry Insights & Trends

The global vibration monitoring market is experiencing robust growth, propelled by several interconnected factors. A primary growth driver is the escalating need for predictive maintenance and condition monitoring solutions across critical industries. As assets age and operational demands increase, industries are actively seeking ways to prevent unexpected equipment failures, thereby reducing costly downtime and maintenance expenses. The digital transformation, often referred to as Industry 4.0, is a significant technological disruption, fostering the integration of vibration sensors, accelerometers, and advanced analytics into industrial processes. The proliferation of the Internet of Things (IoT) has enabled the development of smart sensors and connected systems, allowing for continuous data collection and real-time vibration analysis. This trend facilitates remote monitoring capabilities, enhancing operational visibility and enabling quicker responses to potential issues.

Evolving consumer behaviors, particularly in the industrial sector, are characterized by a greater emphasis on asset lifecycle management and reliability. Companies are moving away from reactive maintenance strategies towards more proactive and predictive approaches, recognizing the substantial return on investment from early issue detection. The increasing complexity of machinery and the demand for higher operational efficiency further necessitate sophisticated monitoring solutions. The vibration monitoring market size is estimated to reach $25,000 Million by 2033, with a projected Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This growth is fueled by advancements in sensor technology, data processing capabilities, and the development of sophisticated software platforms capable of interpreting complex vibration data patterns. The integration of machine learning (ML) and artificial intelligence (AI) is further enhancing the accuracy and predictive power of these systems, allowing for the identification of subtle anomalies that might otherwise go unnoticed. The demand for specialized vibration monitoring systems in sectors such as oil and gas, energy and power, and automotive is particularly high, driven by the critical nature of their operations and the substantial financial implications of equipment failure.

Key Markets & Segments Leading Vibration Monitoring Market

The vibration monitoring market is witnessing significant leadership from North America and Europe, driven by their advanced industrial infrastructure, strong emphasis on operational efficiency, and early adoption of technological innovations like Industry 4.0 and IoT in predictive maintenance. Within these regions, countries like the United States and Germany are at the forefront, benefiting from substantial investments in R&D and a robust manufacturing base.

Dominant Region: North America

- Drivers: High concentration of oil and gas, energy and power, and automotive industries; proactive adoption of advanced technologies; stringent safety regulations.

- Detailed Dominance: The United States, in particular, leads due to the extensive deployment of vibration monitoring solutions in its vast oil and gas fields, power generation facilities, and automotive manufacturing plants. Government initiatives promoting industrial modernization and cybersecurity further bolster market growth.

Dominant Segment: Hardware

- Sub-Segments: Accelerometer, Velocity, Displacement, Other Hardware.

- Drivers: Essential for data acquisition; continuous innovation in sensor technology leading to higher accuracy and smaller form factors; increasing demand for wireless and intrinsically safe sensors for hazardous environments.

- Detailed Dominance: Accelerometers are the most prominent hardware component, followed by velocity and displacement sensors. The increasing demand for more precise and reliable data is driving the development of advanced accelerometers with integrated signal processing capabilities. The surge in IIoT adoption is also fueling the growth of wireless vibration sensors, reducing installation costs and complexity. The market is also seeing a rise in specialized hardware for specific applications, contributing to the overall hardware segment's dominance. The hardware segment is projected to account for approximately 60% of the total market revenue by 2033.

Dominant End-User Industry: Energy and Power

- Drivers: Critical need for continuous uptime; large-scale and complex machinery; stringent safety requirements; high cost of unplanned downtime.

- Detailed Dominance: The energy and power sector, encompassing power generation plants (nuclear, thermal, renewable), transmission, and distribution networks, relies heavily on vibration monitoring to ensure the reliability and safety of turbines, generators, pumps, and other critical equipment. The lifespan extension of aging infrastructure and the integration of new renewable energy sources further necessitate advanced monitoring solutions.

Vibration Monitoring Market Product Developments

Recent product developments in the vibration monitoring market are significantly enhancing system capabilities and expanding application potential. STMicroelectronics' May 2022 release of the ASM330LHHX inertial measurement unit (IMU) with an integrated machine-learning (ML) core represents a significant leap towards automation. This ML core enables real-time response and sophisticated functions with low power consumption, ideal for applications like telematics, anti-theft systems, and, crucially, vibration monitoring and compensation. Furthermore, Banner Engineering's April 2022 introduction of the Snap Signal IIoT product line provides a flexible, brand-agnostic platform for capturing and standardizing data from industrial machines. This innovation directly supports the upgrade to Industry 4.0 and unlocks potential in vibration monitoring system applications by simplifying data integration and analysis. These advancements underscore a trend towards smarter, more integrated, and energy-efficient solutions.

Challenges in the Vibration Monitoring Market Market

Despite its robust growth, the vibration monitoring market faces several challenges that impact its expansion trajectory.

- High Initial Investment Costs: The upfront cost of sophisticated vibration monitoring systems, including sensors, data acquisition hardware, and software licenses, can be a significant barrier for small and medium-sized enterprises (SMEs).

- Technical Expertise and Skilled Workforce: A lack of skilled personnel capable of installing, configuring, and interpreting the data from advanced vibration analysis tools can hinder widespread adoption.

- Data Overload and Interpretation: While collecting vast amounts of data is crucial, effectively analyzing and deriving actionable insights from this data can be complex and resource-intensive.

- Cybersecurity Concerns: As IoT connectivity increases, ensuring the security of sensitive operational data transmitted from vibration monitoring devices becomes paramount, posing potential risks if not adequately addressed.

Forces Driving Vibration Monitoring Market Growth

Several powerful forces are propelling the vibration monitoring market forward. The relentless drive for operational efficiency and cost reduction across industries is a primary catalyst. Companies are increasingly recognizing that predictive maintenance, powered by vibration analysis, significantly minimizes unplanned downtime, leading to substantial savings in repair costs and lost productivity. The accelerating pace of digital transformation and the widespread adoption of Industry 4.0 principles are fostering the integration of smart sensors and IoT devices, enabling real-time condition monitoring. Furthermore, stringent industrial safety regulations and a growing emphasis on asset integrity management are compelling organizations to invest in advanced monitoring solutions to prevent catastrophic failures and ensure compliance. The continuous innovation in sensor technology, leading to more accurate, durable, and cost-effective accelerometers and other sensors, also plays a crucial role in expanding the market.

Challenges in the Vibration Monitoring Market Market

Addressing long-term growth catalysts in the vibration monitoring market requires a strategic focus on innovation and market penetration. The increasing demand for integrated solutions that combine vibration monitoring with other condition monitoring techniques, such as thermal imaging and acoustic analysis, presents a significant opportunity. This holistic approach offers a more comprehensive understanding of asset health. Furthermore, the expansion of cloud-based platforms for data storage, analysis, and remote access democratizes advanced analytics, making them accessible to a broader range of users and industries. The development of AI and machine learning algorithms specifically tailored for vibration analysis will enhance predictive capabilities, allowing for earlier and more accurate detection of anomalies. Strategic partnerships between sensor manufacturers, software providers, and industrial end-users are also vital for developing customized solutions that meet specific industry needs and accelerate market adoption.

Emerging Opportunities in Vibration Monitoring Market

Emerging opportunities in the vibration monitoring market are numerous and ripe for exploitation. The growing adoption of Condition Monitoring in the renewable energy sector, particularly for wind turbines and solar panel tracking systems, is a significant growth area. The expansion of the IIoT ecosystem creates demand for wireless and battery-powered vibration sensors capable of seamless integration with existing industrial networks. Furthermore, the increasing use of edge computing allows for on-device data processing, reducing latency and bandwidth requirements, which is crucial for real-time applications. The development of specialized vibration monitoring solutions for emerging industries like electric vehicles (EVs), robotics, and advanced manufacturing processes presents substantial untapped potential. The increasing global focus on asset longevity and sustainability also drives the demand for effective predictive maintenance strategies.

Leading Players in the Vibration Monitoring Market Sector

- Honeywell International Inc

- Azima DLI Corporation

- Banner Engineering

- National Instruments Corporation

- SKF

- Bruel & Kjaer Sound & Vibration Measurement

- STMicroelectronics

- Meggit PLC

- PCB Piezotronics Inc

- Rockwell Automation Inc

- Schaeffler AG

- Analog Devices Inc

- SPM Instrument AB

- General Electric Corporation

- Data Physics Corporation

- Emerson Electric Company

Key Milestones in Vibration Monitoring Market Industry

- May 2022: STMicroelectronics released ASM330LHHX, the first inertial measurement unit (IMU) with a machine-learning (ML) core, enhancing automation and enabling low-power vibration monitoring applications.

- April 2022: Banner Engineering introduced the Snap Signal IIoT product line, facilitating data capture and conversion to standard protocols, thereby unlocking potential in vibration monitoring system applications and enabling Industry 4.0 upgrades.

Strategic Outlook for Vibration Monitoring Market Market

The vibration monitoring market is poised for sustained growth, driven by an increasing awareness of the benefits of predictive maintenance and the accelerating adoption of digitalization across industries. Key growth accelerators include the continuous innovation in sensor technology, the development of AI-powered analytics platforms, and the expansion of IoT connectivity. The increasing demand for enhanced asset reliability, reduced operational costs, and improved safety standards will continue to fuel the adoption of advanced vibration monitoring systems. Strategic opportunities lie in the development of integrated solutions, the expansion into emerging markets and industries, and the provision of comprehensive service offerings that encompass installation, training, and data interpretation. The focus on sustainability and asset longevity will further solidify the market's importance in the industrial landscape.

Vibration Monitoring Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Accelerometer

- 1.1.2. Velocity

- 1.1.3. Displacement

- 1.1.4. Other Hardware

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Oil and Gas

- 2.3. Energy and Power

- 2.4. Mining

- 2.5. Food and Beverage

- 2.6. Chemicals

- 2.7. Other End-user Industries

Vibration Monitoring Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Vibration Monitoring Market Regional Market Share

Geographic Coverage of Vibration Monitoring Market

Vibration Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness About Predictive Maintenance and Augmenting it with Analytics; Increasing Use of Wireless Systems for Vibration Monitoring

- 3.3. Market Restrains

- 3.3.1. ; High Maintenance Requirements and Inability to Provide Secondary Protection

- 3.4. Market Trends

- 3.4.1. Oil and Gas to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vibration Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Accelerometer

- 5.1.1.2. Velocity

- 5.1.1.3. Displacement

- 5.1.1.4. Other Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Oil and Gas

- 5.2.3. Energy and Power

- 5.2.4. Mining

- 5.2.5. Food and Beverage

- 5.2.6. Chemicals

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Vibration Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.1.1. Accelerometer

- 6.1.1.2. Velocity

- 6.1.1.3. Displacement

- 6.1.1.4. Other Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.1.1. Hardware

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Oil and Gas

- 6.2.3. Energy and Power

- 6.2.4. Mining

- 6.2.5. Food and Beverage

- 6.2.6. Chemicals

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Vibration Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.1.1. Accelerometer

- 7.1.1.2. Velocity

- 7.1.1.3. Displacement

- 7.1.1.4. Other Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.1.1. Hardware

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Oil and Gas

- 7.2.3. Energy and Power

- 7.2.4. Mining

- 7.2.5. Food and Beverage

- 7.2.6. Chemicals

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Vibration Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.1.1. Accelerometer

- 8.1.1.2. Velocity

- 8.1.1.3. Displacement

- 8.1.1.4. Other Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.1.1. Hardware

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Oil and Gas

- 8.2.3. Energy and Power

- 8.2.4. Mining

- 8.2.5. Food and Beverage

- 8.2.6. Chemicals

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Vibration Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.1.1. Accelerometer

- 9.1.1.2. Velocity

- 9.1.1.3. Displacement

- 9.1.1.4. Other Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.1.1. Hardware

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Oil and Gas

- 9.2.3. Energy and Power

- 9.2.4. Mining

- 9.2.5. Food and Beverage

- 9.2.6. Chemicals

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Vibration Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.1.1. Accelerometer

- 10.1.1.2. Velocity

- 10.1.1.3. Displacement

- 10.1.1.4. Other Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.1.1. Hardware

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Oil and Gas

- 10.2.3. Energy and Power

- 10.2.4. Mining

- 10.2.5. Food and Beverage

- 10.2.6. Chemicals

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Azima DLI Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Banner Engineering

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 National Instruments Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SKF

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bruel & Kjaer Sound & Vibration Measurement

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 STMicroelectronics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Meggit PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PCB Piezotronics Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockwell Automation Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Schaeffler AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Analog Devices Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SPM Instrument AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 General Electric Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Data Physics Corporation*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Emerson Electric Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Vibration Monitoring Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Vibration Monitoring Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Vibration Monitoring Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Vibration Monitoring Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Vibration Monitoring Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Vibration Monitoring Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Vibration Monitoring Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Vibration Monitoring Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Vibration Monitoring Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Vibration Monitoring Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Vibration Monitoring Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Vibration Monitoring Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Vibration Monitoring Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Vibration Monitoring Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Vibration Monitoring Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Vibration Monitoring Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Vibration Monitoring Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Vibration Monitoring Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Vibration Monitoring Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Vibration Monitoring Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Vibration Monitoring Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Vibration Monitoring Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Vibration Monitoring Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Vibration Monitoring Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Vibration Monitoring Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Vibration Monitoring Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Vibration Monitoring Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Vibration Monitoring Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Vibration Monitoring Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Vibration Monitoring Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Vibration Monitoring Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vibration Monitoring Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Vibration Monitoring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Vibration Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Vibration Monitoring Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Vibration Monitoring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Vibration Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Vibration Monitoring Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Vibration Monitoring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Vibration Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Vibration Monitoring Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Vibration Monitoring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Vibration Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Vibration Monitoring Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Vibration Monitoring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Vibration Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Vibration Monitoring Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Vibration Monitoring Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Vibration Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vibration Monitoring Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Vibration Monitoring Market?

Key companies in the market include Honeywell International Inc, Azima DLI Corporation, Banner Engineering, National Instruments Corporation, SKF, Bruel & Kjaer Sound & Vibration Measurement, STMicroelectronics, Meggit PLC, PCB Piezotronics Inc, Rockwell Automation Inc, Schaeffler AG, Analog Devices Inc, SPM Instrument AB, General Electric Corporation, Data Physics Corporation*List Not Exhaustive, Emerson Electric Company.

3. What are the main segments of the Vibration Monitoring Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness About Predictive Maintenance and Augmenting it with Analytics; Increasing Use of Wireless Systems for Vibration Monitoring.

6. What are the notable trends driving market growth?

Oil and Gas to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

; High Maintenance Requirements and Inability to Provide Secondary Protection.

8. Can you provide examples of recent developments in the market?

May 2022: STMicroelectronics released ASM330LHHX, the first inertial measurement unit (IMU), taking a step closer to high levels of automation with its machine-learning (ML) core. The ML core enabled fast real-time response and sophisticated functions with low system power demand. The ASM330LHHX had two operating modes. One was the low-power mode for running always-on applications like telematics, anti-theft systems, motion-activated functions, and vibration monitoring and compensation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vibration Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vibration Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vibration Monitoring Market?

To stay informed about further developments, trends, and reports in the Vibration Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence