Key Insights

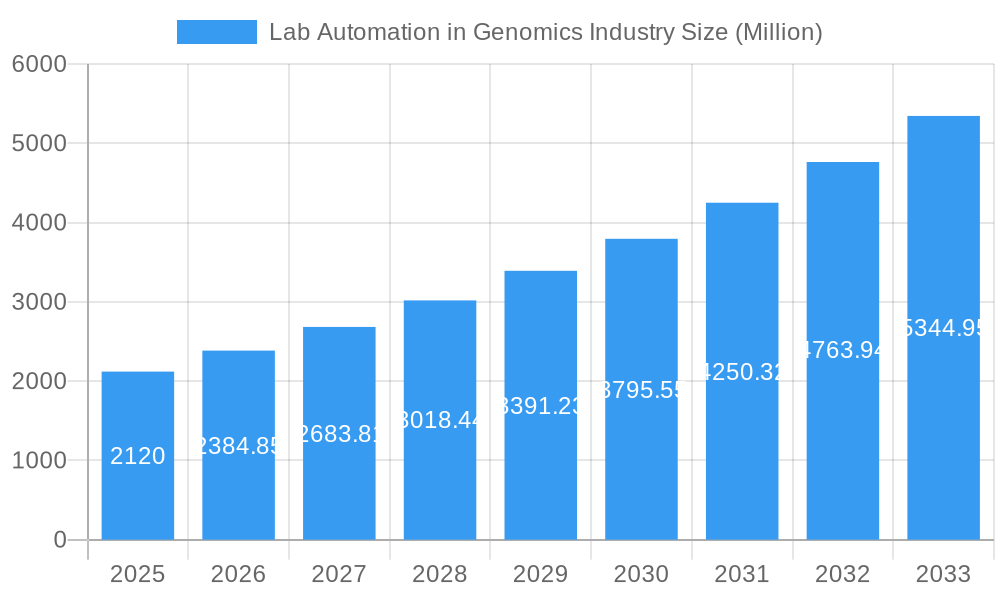

The global Lab Automation in Genomics market is poised for substantial expansion, projected to reach a value of $2.12 billion in the base year 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 12.43% throughout the forecast period of 2025-2033. Key drivers underpinning this surge include the escalating demand for high-throughput screening in drug discovery and development, the increasing complexity of genomic research requiring precise and reproducible workflows, and the continuous technological advancements in robotics, artificial intelligence, and machine learning applied to laboratory processes. Furthermore, the growing adoption of precision medicine, which necessitates large-scale genomic data analysis, is a significant catalyst. The market is segmented into various crucial components, including automated liquid handlers, automated plate handlers, robotic arms, automated storage and retrieval systems (AS/RS), and vision systems. These segments collectively enable laboratories to enhance efficiency, reduce human error, and accelerate research timelines, making lab automation an indispensable tool in modern genomics.

Lab Automation in Genomics Industry Market Size (In Billion)

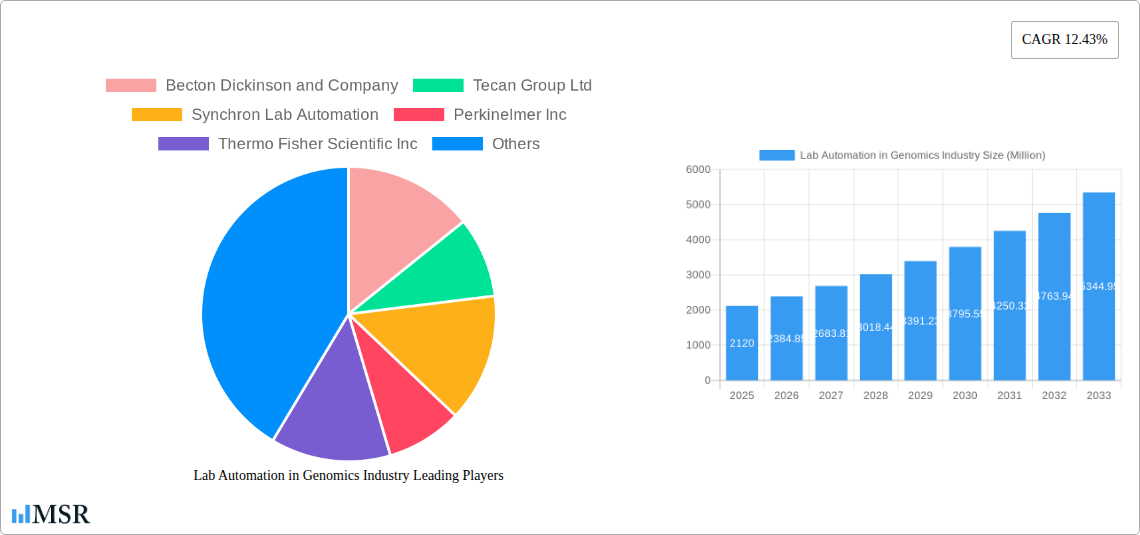

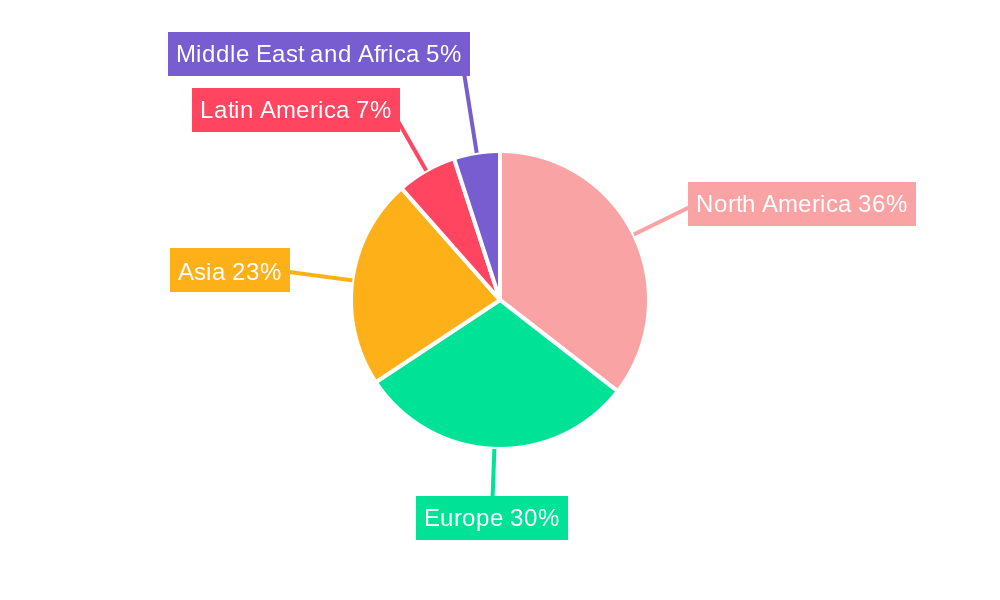

The competitive landscape for lab automation in genomics is dynamic and characterized by the presence of major industry players such as Becton Dickinson and Company, Tecan Group Ltd, Thermo Fisher Scientific Inc., and Danaher Corporation/Beckman Coulter. These companies are actively investing in research and development to innovate and introduce more sophisticated automation solutions. Emerging trends include the integration of AI and machine learning for predictive analytics and optimized experimental design, the development of more modular and scalable automation systems to cater to diverse laboratory needs, and the increasing demand for cloud-based software solutions that facilitate remote monitoring and data management. While the market is robust, potential restraints could include the high initial capital investment required for advanced automation systems, the need for skilled personnel to operate and maintain these complex technologies, and concerns regarding data security and regulatory compliance in handling sensitive genomic information. Geographically, North America and Europe currently lead the market due to established research infrastructure and significant investment in life sciences, with the Asia Pacific region showing rapid growth potential.

Lab Automation in Genomics Industry Company Market Share

Unlocking the Future of Precision: Lab Automation in Genomics Industry Report 2024-2033

Dive deep into the transformative landscape of lab automation within the genomics sector. This comprehensive report, spanning the study period of 2019–2033, with a base and estimated year of 2025, offers an unparalleled analysis of market dynamics, technological advancements, and strategic imperatives shaping the future of genomic research and diagnostics. Discover how automation is revolutionizing workflows, enhancing throughput, and accelerating discoveries.

Lab Automation in Genomics Industry Market Concentration & Dynamics

The lab automation in genomics industry exhibits a moderate to high market concentration, characterized by the presence of established global players alongside emerging innovators. The innovation ecosystem is robust, driven by continuous R&D investment in areas like AI-powered robotics and miniaturization. Regulatory frameworks are evolving, with stringent quality control standards influencing adoption rates. Substitute products are limited, as dedicated lab automation solutions offer unparalleled efficiency and precision for complex genomic workflows. End-user trends are increasingly leaning towards high-throughput screening, personalized medicine, and rapid diagnostics, all of which heavily rely on advanced automation. Merger and acquisition (M&A) activities are on the rise, with an estimated XX M&A deals in the historical period (2019-2024), indicating a drive for consolidation and acquisition of key technologies and market share. Leading companies are actively engaging in strategic partnerships to expand their technological portfolios and geographic reach.

- Key M&A Drivers: Expansion into new therapeutic areas, acquisition of niche automation technologies, and market penetration in high-growth regions.

- Innovation Hubs: North America and Europe are key centers for R&D and adoption of cutting-edge lab automation solutions.

- Impact of Regulatory Standards: Compliance with GLP and ISO standards necessitates investment in validated and reliable automation systems.

Lab Automation in Genomics Industry Industry Insights & Trends

The global lab automation in genomics market size is projected to reach an impressive XX Million USD by 2025, with a compelling Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This substantial growth is propelled by an increasing demand for high-throughput genomic sequencing, a surge in complex drug discovery and development pipelines, and the growing need for personalized medicine. Technological disruptions, such as advancements in artificial intelligence (AI) and machine learning (ML) integrated into robotic platforms, are significantly enhancing analytical capabilities and predictive accuracy. Evolving consumer behaviors, particularly within the healthcare sector, are prioritizing faster turnaround times for diagnostic tests and a more streamlined patient journey, further fueling the adoption of automated laboratory solutions. The rising prevalence of genetic diseases and the expanding scope of genomic research for various applications, from infectious disease surveillance to oncology, are creating sustained demand for efficient and scalable automation. Furthermore, government initiatives and funding for life sciences research and infrastructure development are acting as significant catalysts for market expansion. The integration of robotics, advanced software for data analysis, and miniaturized detection technologies are collectively contributing to a paradigm shift in genomic research, enabling scientists to process larger volumes of samples with greater precision and reduced human error. The market is witnessing a strong trend towards integrated automation systems that can handle entire workflows, from sample preparation to data interpretation, thereby optimizing laboratory operations and accelerating scientific breakthroughs.

Key Markets & Segments Leading Lab Automation in Genomics Industry

North America, particularly the United States, currently dominates the lab automation in genomics industry, driven by a robust research infrastructure, significant government and private funding for life sciences, and a high adoption rate of advanced technologies. The presence of leading pharmaceutical companies, contract research organizations (CROs), and academic institutions fuels the demand for sophisticated automation solutions. Economic growth and substantial investments in healthcare innovation further solidify its leading position.

Equipment Segments Dominance:

- Automated Liquid Handlers: This segment holds a significant market share due to its fundamental role in nearly all genomic workflows, including sample preparation, assay setup, and reagent dispensing.

- Drivers: High-throughput screening needs in drug discovery, personalized medicine initiatives, and increasing adoption in clinical diagnostics.

- Dominance Analysis: Precision, speed, and reproducibility in handling minute liquid volumes are critical for genomic assays, making advanced liquid handlers indispensable.

- Automated Plate Handlers: Essential for moving and managing microplates in high-throughput screening and assay development, this segment is crucial for optimizing workflow efficiency.

- Drivers: Integration with other automated systems, increasing plate-based assays, and the need to reduce manual intervention in repetitive tasks.

- Dominance Analysis: Their ability to seamlessly integrate with liquid handlers and incubators makes them a cornerstone of automated genomic workflows.

- Robotic Arms: These versatile components are vital for complex manipulation tasks, sample tracking, and integrating disparate instruments within a unified automation system.

- Drivers: Increasing demand for flexible and adaptable automation solutions, enabling customized workflow design.

- Dominance Analysis: Their dexterity and programmability allow for complex pick-and-place operations, crucial for intricate genomic assays.

- Automated Storage and Retrieval Systems (AS/RS): As genomic data and sample libraries grow exponentially, efficient storage and retrieval solutions are becoming paramount for managing vast biobanks.

- Drivers: The need for long-term sample preservation, efficient inventory management, and rapid access to samples for research.

- Dominance Analysis: Secure, temperature-controlled, and high-capacity AS/RS are essential for supporting large-scale genomic projects.

- Vision Systems: Increasingly integrated into automation platforms, vision systems monitor processes, identify errors, and ensure the integrity of samples and workflows.

- Drivers: Enhanced quality control, real-time process monitoring, and the drive for error reduction in complex assays.

- Dominance Analysis: Their role in verifying sample integrity, plate identification, and pipetting accuracy is critical for the reliability of genomic experiments.

Lab Automation in Genomics Industry Product Developments

Product development in lab automation for genomics is characterized by an increasing focus on integration, intelligence, and miniaturization. Companies are innovating to create modular, scalable systems that can handle end-to-end workflows, from nucleic acid extraction to library preparation and sequencing. AI-powered software is being integrated to optimize experimental design, analyze results, and predict outcomes, thereby enhancing the efficiency and accuracy of genomic research. Miniaturization of instruments and assays is leading to reduced reagent consumption and smaller laboratory footprints. Furthermore, the development of specialized automation solutions for single-cell genomics, spatial transcriptomics, and liquid biopsy analysis is opening new avenues for research and diagnostics.

Challenges in the Lab Automation in Genomics Industry Market

Despite its immense potential, the lab automation in genomics industry faces several challenges. The high initial investment cost for sophisticated automation systems can be a barrier for smaller laboratories and academic institutions. Integration complexities between different hardware and software components from various vendors can lead to significant implementation hurdles. Technical expertise required to operate and maintain these advanced systems is often scarce, necessitating specialized training. Regulatory compliance and validation for automated processes in clinical settings add another layer of complexity. Moreover, scalability issues can arise when adapting automation solutions to vastly different experimental scales or throughput requirements.

- Quantifiable Impact: Estimated XX% of potential adopters cite high upfront costs as a primary deterrent.

- Implementation Delays: Integration challenges can add an average of XX weeks to deployment timelines.

Forces Driving Lab Automation in Genomics Industry Growth

The growth of the lab automation in genomics industry is propelled by several key forces. Technological advancements, particularly in robotics, AI, and machine learning, are enabling more sophisticated and efficient automation solutions. The growing volume of genomic data generated by sequencing technologies necessitates automated methods for processing and analysis. Increasing demand for personalized medicine and targeted therapies requires high-throughput capabilities that automation provides. Furthermore, government funding and initiatives supporting life sciences research and the development of diagnostic tools are significant growth drivers. The need to reduce errors and improve reproducibility in complex genomic assays further fuels the adoption of automated systems.

Challenges in the Lab Automation in Genomics Industry Market

Long-term growth catalysts for the lab automation in genomics industry are deeply rooted in continuous innovation and strategic market expansion. The development of more affordable and user-friendly automation platforms will broaden accessibility to smaller labs and emerging markets. Advancements in AI and machine learning will lead to smarter, self-optimizing automation systems capable of complex decision-making and predictive analysis. Strategic partnerships and collaborations between technology providers, research institutions, and pharmaceutical companies will accelerate the development and adoption of novel solutions. Furthermore, the expansion of automation into new application areas, such as agricultural genomics and environmental monitoring, will unlock significant future growth potential.

Emerging Opportunities in Lab Automation in Genomics Industry

Emerging opportunities in the lab automation in genomics industry are abundant, driven by unmet needs and novel applications. The rise of point-of-care diagnostics presents a significant opportunity for portable and simplified automation solutions. The growing field of synthetic biology will require highly precise and automated platforms for gene synthesis and assembly. Furthermore, the increasing focus on antimicrobial resistance (AMR) surveillance and infectious disease outbreak response demands rapid and scalable genomic analysis, a niche perfectly suited for advanced automation. The demand for cloud-based automation management and data analytics platforms is also on the rise, offering opportunities for integrated software solutions.

- New Market Segments: Veterinary genomics, food safety testing, and forensic science.

- Technological Trends: CRISPR gene editing automation, organ-on-a-chip integration.

Leading Players in the Lab Automation in Genomics Industry Sector

- Becton Dickinson and Company

- Tecan Group Ltd

- Synchron Lab Automation

- Perkinelmer Inc

- Thermo Fisher Scientific Inc

- Eli Lilly and Company

- Danaher Corporation / Beckman Coulter

- Siemens Healthineers AG

- Agilent Technologies Inc

- Hudson Robotics Inc

- F Hoffmann-La Roche Ltd

Key Milestones in Lab Automation in Genomics Industry Industry

- July 2022: MAKO Medical Laboratories announced to expand molecular and COVID-19 test processing capacity by purchasing four additional high-tech liquid handling automation systems to allow the lab to more than double the COVID-19 testing capacity of a single lab technician in the future. This move underscored the critical role of automation in rapidly scaling diagnostic capabilities during public health crises.

- July 2022: University Hospital Southampton (UHS) NHS Foundation Trust signed a strategic collaboration agreement with the robotic automation solution provider, Automata, to build new applications for laboratory automation technology. This partnership highlights the growing interest in applying advanced robotics to streamline clinical laboratory workflows and improve patient care within healthcare institutions.

Strategic Outlook for Lab Automation in Genomics Industry Market

The strategic outlook for the lab automation in genomics industry market is overwhelmingly positive, driven by sustained innovation and an ever-increasing demand for precision and efficiency in genomic research and diagnostics. Growth accelerators include the continued integration of AI and machine learning for intelligent automation, the development of more cost-effective and scalable solutions, and the expansion into new and emerging application areas like personalized therapeutics and advanced diagnostics. Strategic opportunities lie in catering to the burgeoning needs of the personalized medicine sector, facilitating rapid response to infectious disease outbreaks, and supporting the growing complexity of multi-omics research. Companies that focus on modularity, user-friendliness, and robust data integration will be well-positioned to capture significant market share and drive future advancements in genomic discovery.

Lab Automation in Genomics Industry Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Vision Systems

Lab Automation in Genomics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Lab Automation in Genomics Industry Regional Market Share

Geographic Coverage of Lab Automation in Genomics Industry

Lab Automation in Genomics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Research and Development by Pharmaceutical and Biotech Companies; Growing Demand from Drug Discovery and Genomics

- 3.3. Market Restrains

- 3.3.1. Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Vision Systems

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Vision Systems

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Vision Systems

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Latin America Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Vision Systems

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Middle East and Africa Lab Automation in Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 10.1.1. Automated Liquid Handlers

- 10.1.2. Automated Plate Handlers

- 10.1.3. Robotic Arms

- 10.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 10.1.5. Vision Systems

- 10.1. Market Analysis, Insights and Forecast - by Equipment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tecan Group Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Synchron Lab Automation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Perkinelmer Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thermo Fisher Scientific Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eli Lilly and Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation / Beckman Coulter

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens Healthineers AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Agilent Technologies Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hudson Robotics Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 F Hoffmann-La Roche Ltd *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Lab Automation in Genomics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 3: North America Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 4: North America Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 7: Europe Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 8: Europe Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 11: Asia Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: Asia Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 15: Latin America Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 16: Latin America Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Lab Automation in Genomics Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 19: Middle East and Africa Lab Automation in Genomics Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 20: Middle East and Africa Lab Automation in Genomics Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Lab Automation in Genomics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 2: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 4: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 6: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 8: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 10: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 12: Global Lab Automation in Genomics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Genomics Industry?

The projected CAGR is approximately 12.43%.

2. Which companies are prominent players in the Lab Automation in Genomics Industry?

Key companies in the market include Becton Dickinson and Company, Tecan Group Ltd, Synchron Lab Automation, Perkinelmer Inc, Thermo Fisher Scientific Inc, Eli Lilly and Company, Danaher Corporation / Beckman Coulter, Siemens Healthineers AG, Agilent Technologies Inc, Hudson Robotics Inc, F Hoffmann-La Roche Ltd *List Not Exhaustive.

3. What are the main segments of the Lab Automation in Genomics Industry?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Research and Development by Pharmaceutical and Biotech Companies; Growing Demand from Drug Discovery and Genomics.

6. What are the notable trends driving market growth?

Automated Liquid Handlers to Witness High Growth.

7. Are there any restraints impacting market growth?

Growing Trend of Digital Transformation for Laboratories with IoT; Effective Management of the Huge Amount of Data Generated.

8. Can you provide examples of recent developments in the market?

July 2022: MAKO Medical Laboratories announced to expand molecular and COVID-19 test processing capacity by purchasing four additional high-tech liquid handling automation systems to allow the lab to more than double the COVID-19 testing capacity of a single lab technician in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Genomics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Genomics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Genomics Industry?

To stay informed about further developments, trends, and reports in the Lab Automation in Genomics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence