Key Insights

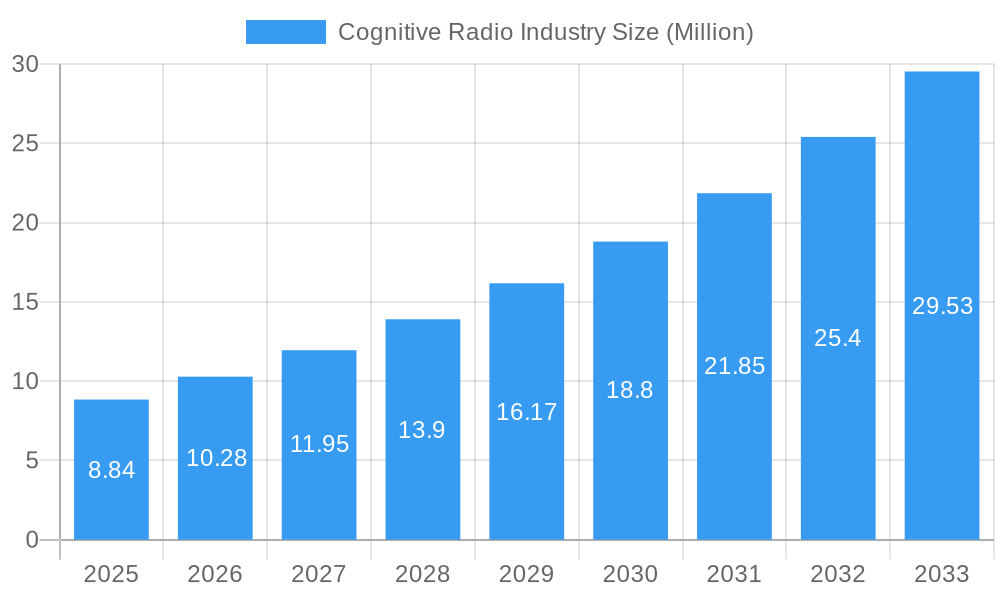

The Cognitive Radio market is poised for substantial expansion, with a projected market size of approximately $8.84 million in 2025, escalating at an impressive Compound Annual Growth Rate (CAGR) of 16.48% through 2033. This robust growth trajectory is primarily propelled by the increasing demand for intelligent and adaptable wireless communication systems across various sectors. Key drivers fueling this surge include the burgeoning need for efficient spectrum utilization, the relentless pursuit of enhanced network performance, and the growing integration of Artificial Intelligence and Machine Learning in radio technology. The dynamic evolution of wireless technologies, coupled with government initiatives aimed at optimizing spectrum allocation and fostering innovation, further underpins this market's upward momentum. Early adoption in military and defense applications, driven by the requirement for secure and adaptable communication in complex environments, has laid a strong foundation. The increasing complexity of the radio frequency spectrum necessitates solutions that can dynamically adjust transmission parameters, making cognitive radio an indispensable technology.

Cognitive Radio Industry Market Size (In Million)

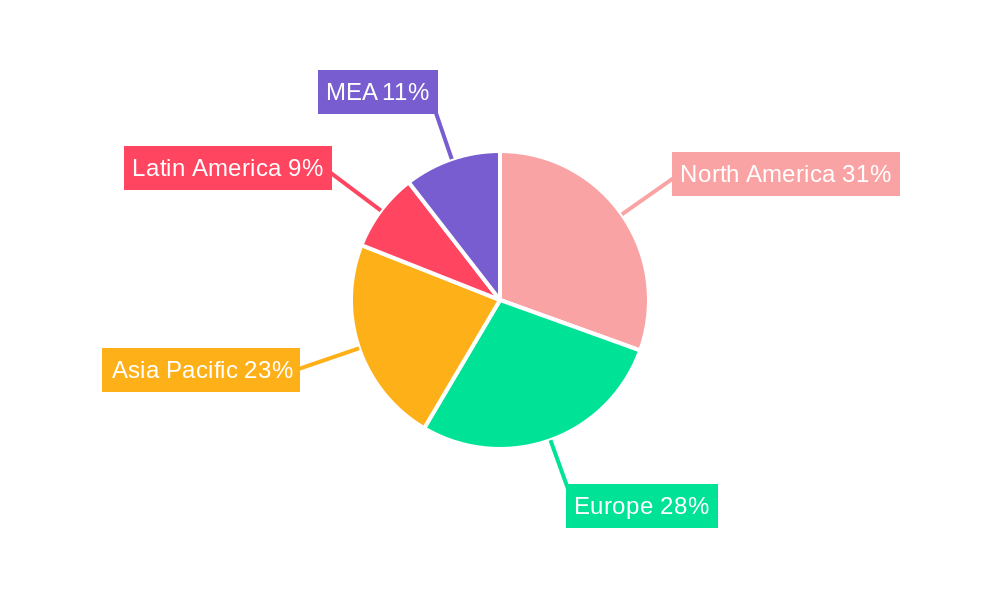

The market is segmented across diverse applications, with Spectrum Sensing & Allocation and Location Detection emerging as critical areas, addressing the challenges of spectrum scarcity and the demand for precise positioning in wireless networks. Cognitive Routing and Quality of Service (QoS) Optimization are also gaining significant traction as networks become more sophisticated and user demands for seamless connectivity rise. The service landscape is dominated by Professional Services, assisting in the deployment and integration of these advanced systems, with Managed Services expected to grow as organizations seek to outsource the complexities of cognitive radio network management. Telecommunication, IT & ITes, and Government & Defense sectors are the primary end-users, reflecting the technology's strategic importance in critical infrastructure and advanced communication networks. Geographically, North America and Europe are leading the adoption, with Asia Pacific showing rapid growth potential due to its expanding telecommunications infrastructure and smart city initiatives.

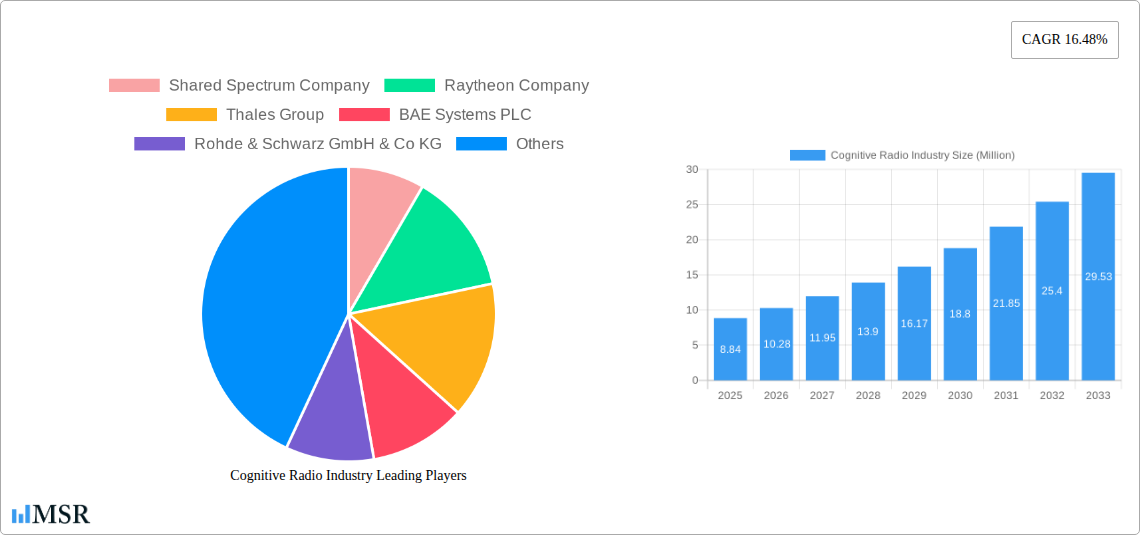

Cognitive Radio Industry Company Market Share

This comprehensive report delves deep into the Cognitive Radio Industry, offering unparalleled insights into market dynamics, key trends, and future growth trajectories. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this analysis is your definitive guide to navigating the evolving landscape of intelligent wireless communications. Discover how spectrum sensing & allocation, location detection, cognitive routing, and QoS optimisation are revolutionizing telecommunication, IT & ITes, government & defense, and transportation sectors. The report analyzes market size projected to reach $XX million by 2033, with a Compound Annual Growth Rate (CAGR) of XX%.

Cognitive Radio Industry Market Concentration & Dynamics

The Cognitive Radio Industry exhibits a dynamic market concentration, characterized by a mix of established players and emerging innovators. Key companies like Shared Spectrum Company, Raytheon Company, Thales Group, BAE Systems PLC, and Rohde & Schwarz GmbH & Co KG are driving advancements, alongside specialized firms such as Spectrum Signal Processing (Vecima) and Rockwell Collins Inc (United Technologies Company). The innovation ecosystem thrives on cross-industry collaborations and substantial R&D investments, particularly in areas like artificial intelligence for network management. Regulatory frameworks are continuously adapting to facilitate dynamic spectrum access and ensure efficient spectrum utilization, a critical factor for market expansion. While direct substitute products are limited, advancements in AI-driven network optimization and software-defined networking (SDN) present indirect competitive pressures. End-user trends are increasingly demanding more efficient, flexible, and secure wireless connectivity, fueling the adoption of cognitive radio solutions. Mergers and acquisitions (M&A) activities, while moderate, are strategically focused on acquiring core technologies and expanding market reach, with an estimated XX M&A deals recorded during the historical period. The market share distribution is concentrated among the top players, estimated to hold XX% of the total market value.

Cognitive Radio Industry Industry Insights & Trends

The Cognitive Radio Industry is on an unprecedented growth trajectory, propelled by the escalating demand for efficient and intelligent wireless communication solutions. The market size, estimated to be $XX million in the base year 2025, is projected to surge significantly over the forecast period. This expansion is primarily driven by the increasing complexity of wireless networks, the proliferation of connected devices, and the growing need for dynamic spectrum management to alleviate spectrum scarcity. Technological disruptions, including advancements in artificial intelligence (AI), machine learning (ML), and software-defined networking (SDN), are fundamentally reshaping the cognitive radio landscape. These innovations enable cognitive radios to learn, adapt, and make autonomous decisions in real-time, optimizing spectrum utilization and enhancing network performance. Evolving consumer behaviors, characterized by a higher expectation for seamless and high-quality connectivity across various applications, further fuel market growth. The report forecasts a robust CAGR of XX% from 2025 to 2033, underscoring the industry's immense potential. Key market segments such as spectrum sensing & allocation are witnessing substantial growth as organizations strive to maximize their spectral resources. The integration of cognitive radio technology into 5G and future 6G networks is anticipated to be a major catalyst, unlocking new use cases and revenue streams. Furthermore, the increasing adoption of IoT devices and the rise of smart cities are creating a compelling need for adaptable and self-optimizing wireless communication systems. The global market size is expected to reach $XX million by the end of 2033.

Key Markets & Segments Leading Cognitive Radio Industry

The Cognitive Radio Industry's dominance is being shaped by several key markets and segments, with the Telecommunication sector leading the charge, driven by the insatiable demand for enhanced mobile broadband and efficient spectrum utilization. The Government & Defense sector is another significant contributor, leveraging cognitive radio for secure, adaptable, and jam-resistant communication in critical operations. The Application segment of Spectrum Sensing & Allocation is the primary driver, enabling dynamic spectrum access and mitigating interference, crucial for the efficient operation of modern wireless networks. The increasing deployment of 5G infrastructure and the ongoing research into 6G technologies are significant economic growth factors. Furthermore, advancements in infrastructure development and increasing government investments in digital transformation initiatives are creating fertile ground for cognitive radio adoption.

- Dominant Application Segment: Spectrum Sensing & Allocation is crucial for optimizing the use of limited radio spectrum, leading to widespread adoption in telecommunications and defense.

- Drivers: Spectrum scarcity, increasing data traffic, regulatory mandates for dynamic spectrum access.

- Key End-user Industries:

- Telecommunication: Driven by 5G/6G deployment, IoT growth, and the need for enhanced network efficiency.

- Drivers: Increasing smartphone penetration, data consumption growth, network densification.

- Government & Defense: Essential for secure, resilient, and adaptive battlefield communications and surveillance.

- Drivers: National security imperatives, modernization of military communication systems, border control applications.

- Telecommunication: Driven by 5G/6G deployment, IoT growth, and the need for enhanced network efficiency.

- Dominant Service Segment: Professional Services are paramount, assisting in the integration, deployment, and customization of cognitive radio solutions.

- Drivers: Complexity of cognitive radio systems, need for specialized expertise, increasing demand for consulting and implementation services.

Cognitive Radio Industry Product Developments

Product developments in the Cognitive Radio Industry are characterized by rapid innovation, focusing on enhancing adaptability, intelligence, and efficiency. Companies are actively developing advanced algorithms for real-time spectrum analysis and dynamic spectrum sharing, enabling radios to intelligently adapt their operating parameters. The integration of AI and ML into cognitive radio platforms is a key trend, leading to more sophisticated self-optimization capabilities and predictive network management. Furthermore, there's a growing emphasis on miniaturization and power efficiency, making cognitive radio solutions viable for SWaP-constrained platforms, such as those used in aerospace and defense. These advancements are creating competitive edges by offering superior performance, reduced interference, and improved overall network resilience.

Challenges in the Cognitive Radio Industry Market

Despite its promising growth, the Cognitive Radio Industry faces several challenges. Regulatory hurdles surrounding dynamic spectrum access and licensing remain a significant barrier, creating uncertainty and slowing down widespread adoption. Supply chain issues, particularly for specialized components, can impact production timelines and costs. Competitive pressures from established wireless technologies and the high cost of initial investment for advanced cognitive radio systems also pose challenges. Quantifiable impacts include delayed product launches due to regulatory approvals, leading to an estimated XX% loss in potential market revenue, and increased operational costs by XX% due to component scarcity.

Forces Driving Cognitive Radio Industry Growth

Several key forces are propelling the Cognitive Radio Industry forward. Technologically, the continuous advancements in Artificial Intelligence (AI) and Machine Learning (ML) are enabling more sophisticated and autonomous decision-making capabilities in cognitive radios. Economically, the increasing demand for efficient spectrum utilization to support the burgeoning number of connected devices and data-intensive applications is a major driver. Regulatory bodies are also evolving, with a growing recognition of the benefits of dynamic spectrum access, creating a more favorable environment for growth. The expansion of 5G networks and the anticipation of 6G further necessitate intelligent wireless solutions.

Challenges in the Cognitive Radio Industry Market

While the future is bright, long-term growth catalysts for the Cognitive Radio Industry lie in overcoming current limitations and embracing innovation. Continued investment in research and development is crucial to push the boundaries of AI and ML algorithms, enabling even more adaptive and predictive radio behavior. Strategic partnerships between technology providers, network operators, and regulatory bodies will be instrumental in streamlining spectrum access policies and fostering wider market acceptance. Furthermore, exploring and developing new market segments beyond traditional telecommunications, such as advanced IoT applications and smart infrastructure, will unlock significant untapped potential.

Emerging Opportunities in Cognitive Radio Industry

Emerging opportunities in the Cognitive Radio Industry are abundant and ripe for exploration. The increasing adoption of the Internet of Things (IoT) across various sectors presents a massive opportunity for cognitive radios to manage the complex and dynamic connectivity requirements of billions of devices. The development of smart cities relies heavily on efficient wireless communication, making cognitive radio an ideal solution for managing urban networks. Furthermore, advancements in edge computing and the demand for low-latency applications in areas like autonomous vehicles and augmented reality will create new use cases and drive demand for intelligent, real-time wireless solutions. The ongoing transition towards 6G networks also promises to unlock entirely new paradigms for wireless communication, where cognitive radio will play a central role.

Leading Players in the Cognitive Radio Industry Sector

- Shared Spectrum Company

- Raytheon Company

- Thales Group

- BAE Systems PLC

- Rohde & Schwarz GmbH & Co KG

- Spectrum Signal Processing (Vecima)

- Rockwell Collins Inc (United Technologies Company)

- Innovation Nutaq Inc (NuRAN Wireless Inc)

Key Milestones in Cognitive Radio Industry Industry

- March 2023: Intellisense Systems Inc. selected BrainChip's Akida neuromorphic technology to enhance cognitive communication capabilities on size, weight, and power (SWaP)-constrained platforms for commercial and government markets. This development offers NASA applications to improve space communication stability and dependability, particularly for cognitive radio equipment.

- February 2023: Italian manufacturer Neva SGR invested in CoreTigo, a company providing tools for machine builders and system integrators to create more connected production environments, decreasing industrial automation system complexity by reimagining traditional network concepts.

- November 2022: Ericsson announced an $11.9 million USD investment to bolster the UK's future wireless connectivity capabilities, focusing on network security, resilience, cognitive networks, AI, and energy efficiency, with a strong emphasis on 6G research.

Strategic Outlook for Cognitive Radio Industry Market

The strategic outlook for the Cognitive Radio Industry is exceptionally positive, driven by an increasing global demand for intelligent, adaptable, and efficient wireless communication solutions. The continued evolution of 5G and the foundational research for 6G networks will serve as significant growth accelerators, necessitating advanced spectrum management and network optimization capabilities that cognitive radio excels at. Strategic opportunities lie in forging deeper collaborations between technology developers and regulatory bodies to create more flexible spectrum policies, and in expanding into emerging markets like advanced IoT, autonomous systems, and smart infrastructure. Investments in AI and ML research will further enhance the self-learning and autonomous decision-making capabilities of cognitive radios, solidifying their role as a cornerstone of future wireless communication.

Cognitive Radio Industry Segmentation

-

1. Application

- 1.1. Spectrum Sensing & Allocation

- 1.2. Location Detection

- 1.3. Cognitive Routing

- 1.4. QoS (Quality of Service) Optimisation

- 1.5. Other Applications

-

2. Service

- 2.1. Professional Services

- 2.2. Managed Services

-

3. End-user Industry

- 3.1. Telecommunication

- 3.2. IT & ITes

- 3.3. Government & Defense

- 3.4. Transportation

- 3.5. Other End-user Industries

Cognitive Radio Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. MEA

- 5.1. UAE

- 5.2. South Africa

- 5.3. Saudi Arabia

- 5.4. Rest Of MEA

Cognitive Radio Industry Regional Market Share

Geographic Coverage of Cognitive Radio Industry

Cognitive Radio Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need to Optimise the Spectrum Utilisation; Rising Development of 5G Service Applications Among End-user Industries

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Computational Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Telecommunication Sector is Gaining Traction Due to Emergence of 5G Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cognitive Radio Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Spectrum Sensing & Allocation

- 5.1.2. Location Detection

- 5.1.3. Cognitive Routing

- 5.1.4. QoS (Quality of Service) Optimisation

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Professional Services

- 5.2.2. Managed Services

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Telecommunication

- 5.3.2. IT & ITes

- 5.3.3. Government & Defense

- 5.3.4. Transportation

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. MEA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cognitive Radio Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Spectrum Sensing & Allocation

- 6.1.2. Location Detection

- 6.1.3. Cognitive Routing

- 6.1.4. QoS (Quality of Service) Optimisation

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Professional Services

- 6.2.2. Managed Services

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Telecommunication

- 6.3.2. IT & ITes

- 6.3.3. Government & Defense

- 6.3.4. Transportation

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Cognitive Radio Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Spectrum Sensing & Allocation

- 7.1.2. Location Detection

- 7.1.3. Cognitive Routing

- 7.1.4. QoS (Quality of Service) Optimisation

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Professional Services

- 7.2.2. Managed Services

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Telecommunication

- 7.3.2. IT & ITes

- 7.3.3. Government & Defense

- 7.3.4. Transportation

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Cognitive Radio Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Spectrum Sensing & Allocation

- 8.1.2. Location Detection

- 8.1.3. Cognitive Routing

- 8.1.4. QoS (Quality of Service) Optimisation

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Professional Services

- 8.2.2. Managed Services

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Telecommunication

- 8.3.2. IT & ITes

- 8.3.3. Government & Defense

- 8.3.4. Transportation

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Cognitive Radio Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Spectrum Sensing & Allocation

- 9.1.2. Location Detection

- 9.1.3. Cognitive Routing

- 9.1.4. QoS (Quality of Service) Optimisation

- 9.1.5. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Professional Services

- 9.2.2. Managed Services

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Telecommunication

- 9.3.2. IT & ITes

- 9.3.3. Government & Defense

- 9.3.4. Transportation

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. MEA Cognitive Radio Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Spectrum Sensing & Allocation

- 10.1.2. Location Detection

- 10.1.3. Cognitive Routing

- 10.1.4. QoS (Quality of Service) Optimisation

- 10.1.5. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Professional Services

- 10.2.2. Managed Services

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Telecommunication

- 10.3.2. IT & ITes

- 10.3.3. Government & Defense

- 10.3.4. Transportation

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shared Spectrum Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Raytheon Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thales Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BAE Systems PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Rohde & Schwarz GmbH & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Spectrum Signal Processing (Vecima)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rockwell Collins Inc (United Technologies Company)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Innovation Nutaq Inc (NuRAN Wireless Inc )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Shared Spectrum Company

List of Figures

- Figure 1: Global Cognitive Radio Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cognitive Radio Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cognitive Radio Industry Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Cognitive Radio Industry Volume (K Unit), by Application 2025 & 2033

- Figure 5: North America Cognitive Radio Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Cognitive Radio Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Cognitive Radio Industry Revenue (Million), by Service 2025 & 2033

- Figure 8: North America Cognitive Radio Industry Volume (K Unit), by Service 2025 & 2033

- Figure 9: North America Cognitive Radio Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: North America Cognitive Radio Industry Volume Share (%), by Service 2025 & 2033

- Figure 11: North America Cognitive Radio Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: North America Cognitive Radio Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Cognitive Radio Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Cognitive Radio Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Cognitive Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Cognitive Radio Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Cognitive Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Cognitive Radio Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Cognitive Radio Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Cognitive Radio Industry Volume (K Unit), by Application 2025 & 2033

- Figure 21: Europe Cognitive Radio Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Cognitive Radio Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Cognitive Radio Industry Revenue (Million), by Service 2025 & 2033

- Figure 24: Europe Cognitive Radio Industry Volume (K Unit), by Service 2025 & 2033

- Figure 25: Europe Cognitive Radio Industry Revenue Share (%), by Service 2025 & 2033

- Figure 26: Europe Cognitive Radio Industry Volume Share (%), by Service 2025 & 2033

- Figure 27: Europe Cognitive Radio Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: Europe Cognitive Radio Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Cognitive Radio Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Cognitive Radio Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Cognitive Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Cognitive Radio Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Cognitive Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Cognitive Radio Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Cognitive Radio Industry Revenue (Million), by Application 2025 & 2033

- Figure 36: Asia Pacific Cognitive Radio Industry Volume (K Unit), by Application 2025 & 2033

- Figure 37: Asia Pacific Cognitive Radio Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Cognitive Radio Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Asia Pacific Cognitive Radio Industry Revenue (Million), by Service 2025 & 2033

- Figure 40: Asia Pacific Cognitive Radio Industry Volume (K Unit), by Service 2025 & 2033

- Figure 41: Asia Pacific Cognitive Radio Industry Revenue Share (%), by Service 2025 & 2033

- Figure 42: Asia Pacific Cognitive Radio Industry Volume Share (%), by Service 2025 & 2033

- Figure 43: Asia Pacific Cognitive Radio Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Cognitive Radio Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Cognitive Radio Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Cognitive Radio Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Cognitive Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Cognitive Radio Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Cognitive Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Cognitive Radio Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Cognitive Radio Industry Revenue (Million), by Application 2025 & 2033

- Figure 52: Latin America Cognitive Radio Industry Volume (K Unit), by Application 2025 & 2033

- Figure 53: Latin America Cognitive Radio Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: Latin America Cognitive Radio Industry Volume Share (%), by Application 2025 & 2033

- Figure 55: Latin America Cognitive Radio Industry Revenue (Million), by Service 2025 & 2033

- Figure 56: Latin America Cognitive Radio Industry Volume (K Unit), by Service 2025 & 2033

- Figure 57: Latin America Cognitive Radio Industry Revenue Share (%), by Service 2025 & 2033

- Figure 58: Latin America Cognitive Radio Industry Volume Share (%), by Service 2025 & 2033

- Figure 59: Latin America Cognitive Radio Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 60: Latin America Cognitive Radio Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Latin America Cognitive Radio Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Latin America Cognitive Radio Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Latin America Cognitive Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Latin America Cognitive Radio Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Cognitive Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Cognitive Radio Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: MEA Cognitive Radio Industry Revenue (Million), by Application 2025 & 2033

- Figure 68: MEA Cognitive Radio Industry Volume (K Unit), by Application 2025 & 2033

- Figure 69: MEA Cognitive Radio Industry Revenue Share (%), by Application 2025 & 2033

- Figure 70: MEA Cognitive Radio Industry Volume Share (%), by Application 2025 & 2033

- Figure 71: MEA Cognitive Radio Industry Revenue (Million), by Service 2025 & 2033

- Figure 72: MEA Cognitive Radio Industry Volume (K Unit), by Service 2025 & 2033

- Figure 73: MEA Cognitive Radio Industry Revenue Share (%), by Service 2025 & 2033

- Figure 74: MEA Cognitive Radio Industry Volume Share (%), by Service 2025 & 2033

- Figure 75: MEA Cognitive Radio Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 76: MEA Cognitive Radio Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: MEA Cognitive Radio Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: MEA Cognitive Radio Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: MEA Cognitive Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: MEA Cognitive Radio Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: MEA Cognitive Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: MEA Cognitive Radio Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cognitive Radio Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Cognitive Radio Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Cognitive Radio Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Global Cognitive Radio Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 5: Global Cognitive Radio Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Cognitive Radio Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Cognitive Radio Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Cognitive Radio Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Cognitive Radio Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Cognitive Radio Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Global Cognitive Radio Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global Cognitive Radio Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 13: Global Cognitive Radio Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Cognitive Radio Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Cognitive Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Cognitive Radio Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Cognitive Radio Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Cognitive Radio Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global Cognitive Radio Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 24: Global Cognitive Radio Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 25: Global Cognitive Radio Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Cognitive Radio Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Cognitive Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Cognitive Radio Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Cognitive Radio Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Cognitive Radio Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Cognitive Radio Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 40: Global Cognitive Radio Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 41: Global Cognitive Radio Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 42: Global Cognitive Radio Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Cognitive Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Cognitive Radio Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: China Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Japan Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Korea Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Rest of Asia Pacific Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Global Cognitive Radio Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Cognitive Radio Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 55: Global Cognitive Radio Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 56: Global Cognitive Radio Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 57: Global Cognitive Radio Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 58: Global Cognitive Radio Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 59: Global Cognitive Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Cognitive Radio Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Brazil Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Argentina Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Argentina Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Cognitive Radio Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Cognitive Radio Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Cognitive Radio Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 70: Global Cognitive Radio Industry Volume K Unit Forecast, by Service 2020 & 2033

- Table 71: Global Cognitive Radio Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 72: Global Cognitive Radio Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 73: Global Cognitive Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Cognitive Radio Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 75: UAE Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: UAE Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: South Africa Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: South Africa Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Saudi Arabia Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Saudi Arabia Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest Of MEA Cognitive Radio Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest Of MEA Cognitive Radio Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cognitive Radio Industry?

The projected CAGR is approximately 16.48%.

2. Which companies are prominent players in the Cognitive Radio Industry?

Key companies in the market include Shared Spectrum Company, Raytheon Company, Thales Group, BAE Systems PLC, Rohde & Schwarz GmbH & Co KG, Spectrum Signal Processing (Vecima), Rockwell Collins Inc (United Technologies Company), Innovation Nutaq Inc (NuRAN Wireless Inc ).

3. What are the main segments of the Cognitive Radio Industry?

The market segments include Application, Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need to Optimise the Spectrum Utilisation; Rising Development of 5G Service Applications Among End-user Industries.

6. What are the notable trends driving market growth?

Telecommunication Sector is Gaining Traction Due to Emergence of 5G Applications.

7. Are there any restraints impacting market growth?

Lack of Proper Computational Security Infrastructure.

8. Can you provide examples of recent developments in the market?

March 2023: Intellisense Systems Inc. selected BrainChip's Akida neuromorphic technology to improve the cognitive communication capabilities on size, weight, and power (SWaP)-constrained platforms (such as spacecraft and robotics) for commercial and government markets. The NECR technology from Intellisense offers NASA a variety of applications and can be used to improve the stability and dependability of space communication and networking, particularly for cognitive radio equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cognitive Radio Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cognitive Radio Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cognitive Radio Industry?

To stay informed about further developments, trends, and reports in the Cognitive Radio Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence