Key Insights

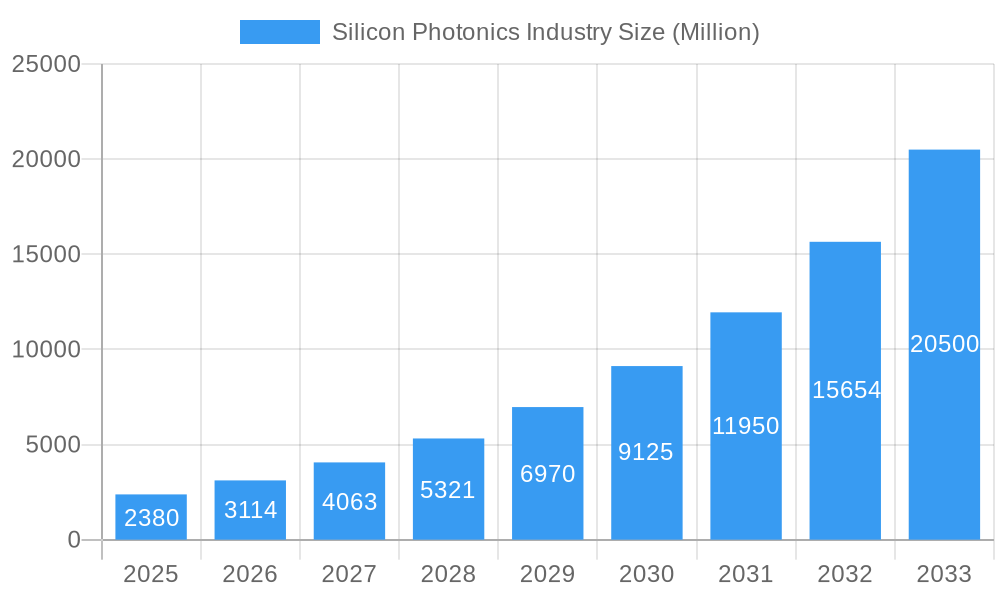

The Silicon Photonics market is poised for remarkable expansion, projected to reach an estimated $2.38 billion in 2025. This growth is fueled by an exceptional Compound Annual Growth Rate (CAGR) of 30.50% from 2019 to 2033, indicating a dynamic and rapidly evolving industry. This surge is primarily driven by the insatiable demand for higher bandwidth and lower power consumption solutions across critical sectors. Data centers and high-performance computing environments are at the forefront, requiring advanced optical interconnects to handle escalating data traffic and computational loads. The telecommunications industry is also a significant contributor, as the rollout of 5G networks and the expansion of fiber optic infrastructure necessitate faster and more efficient data transmission capabilities. Furthermore, the automotive sector is increasingly adopting silicon photonics for applications like LiDAR and advanced driver-assistance systems (ADAS), leveraging its speed and miniaturization potential. Other emerging applications are also contributing to this robust growth trajectory.

Silicon Photonics Industry Market Size (In Billion)

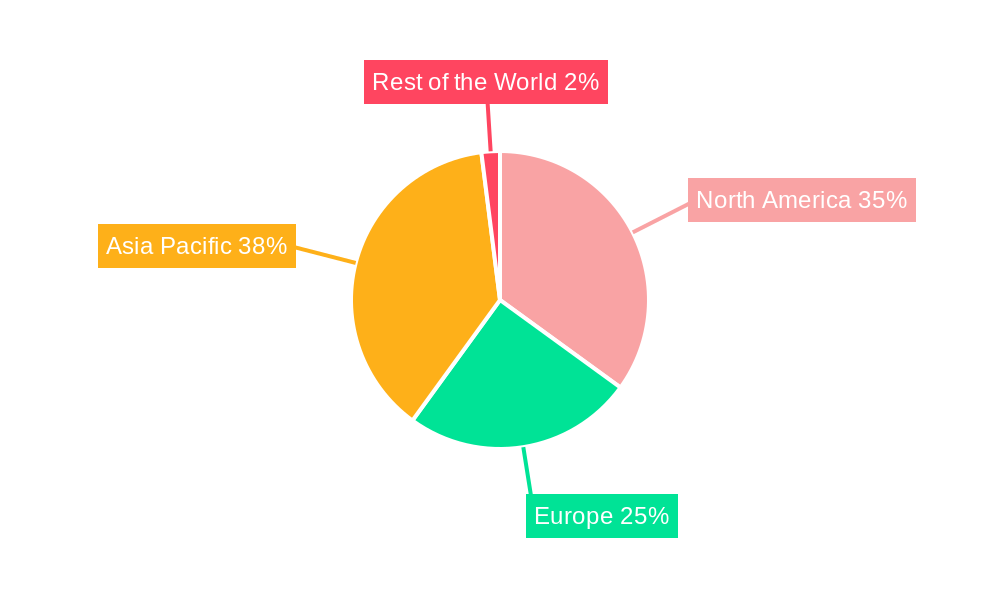

While the market exhibits strong upward momentum, certain factors could influence its pace. The high cost of initial research and development, coupled with the intricate manufacturing processes involved in silicon photonics, can present a restraint. However, ongoing innovation and economies of scale are expected to gradually mitigate these challenges. Key players such as Broadcom Limited, Marvell Technology Inc., Coherent Corporation, and Cisco Systems Inc. are heavily investing in R&D and strategic collaborations to maintain a competitive edge. The Asia Pacific region is anticipated to lead market share due to its robust manufacturing capabilities and increasing adoption of advanced technologies in data centers and telecommunications. North America and Europe are also significant markets, driven by strong technological infrastructure and a focus on high-performance computing and AI development. The sustained investment in innovation and the widening array of applications solidify silicon photonics as a critical technology for the future of high-speed data transfer and advanced computing.

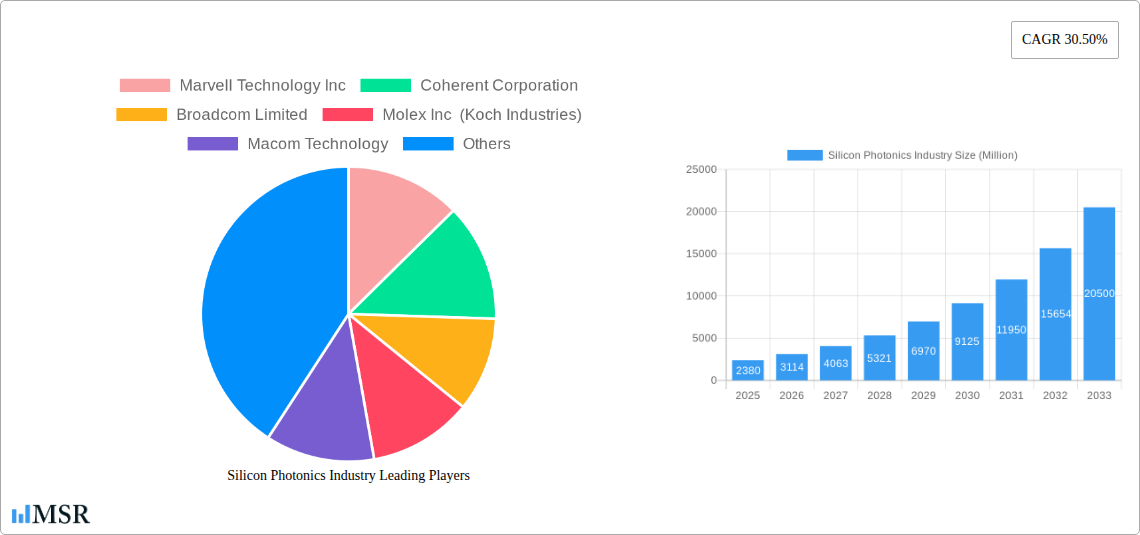

Silicon Photonics Industry Company Market Share

Unlock critical insights into the rapidly evolving silicon photonics market. This comprehensive report, spanning 2019-2033 with a base year of 2025, provides in-depth analysis for industry leaders, investors, and innovators. Discover market dynamics, technological advancements, key players, and future opportunities shaping high-speed data transmission and advanced computing.

Silicon Photonics Industry Market Concentration & Dynamics

The silicon photonics industry is characterized by a dynamic and moderately concentrated market structure. Leading players like Broadcom Limited, Marvell Technology Inc., Intel Corporation, and Cisco Systems Inc. hold significant market share, driven by their extensive R&D investments and established supply chains. Innovation ecosystems are thriving, with a growing number of collaborations between foundries, foundries, and end-users. Regulatory frameworks are generally supportive of technological advancement, with a focus on standardization and interoperability. Substitute products, such as traditional copper interconnects, are being increasingly challenged by the superior bandwidth and energy efficiency of silicon photonics, particularly in data-intensive applications. End-user trends heavily favor higher data rates and reduced power consumption, directly fueling silicon photonics adoption. Mergers and acquisitions (M&A) are a key aspect of market consolidation and strategic expansion. Notable M&A activities include the USD 750 Million acquisition of Cloud Light Technology by Lumentum Operations LLC, aimed at bolstering their presence in automotive sensors and data center interconnects. The M&A deal count is expected to remain robust as companies seek to integrate advanced silicon photonics capabilities.

- Market Share Dominance: Held by a mix of established semiconductor giants and specialized silicon photonics firms.

- Innovation Ecosystems: Driven by partnerships between foundries, chip designers, and OEMs.

- Regulatory Landscape: Generally permissive, with an emphasis on driving innovation and performance standards.

- Substitute Product Impact: Declining relevance in high-bandwidth applications due to performance limitations of traditional methods.

- End-User Trends: Prioritizing speed, efficiency, and miniaturization.

- M&A Activity: Active, with strategic acquisitions to enhance product portfolios and market reach.

Silicon Photonics Industry Industry Insights & Trends

The global silicon photonics market is poised for exponential growth, projected to reach an estimated USD XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This surge is primarily propelled by the insatiable demand for faster and more efficient data transmission across various sectors. The escalating volume of data generated by cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) necessitates advanced networking solutions that traditional electrical interconnects struggle to meet. Silicon photonics, leveraging the speed of light on silicon chips, offers a compelling solution with its inherent advantages in bandwidth, reach, and power efficiency. Technological disruptions are continuously pushing the boundaries of performance. For instance, Marvell Technology's October 2023 demonstration of 200 Gbit/s-per-lane electrical I/O for high-speed copper data center interconnect marks a significant stride, laying the groundwork for next-generation AI clusters and cloud infrastructure. This advancement, utilizing advanced PAM4 DSP technology and 5nm 224G long-reach SerDes technology, showcases the industry's relentless pursuit of higher data rates and enhanced signal integrity, capable of overcoming substantial insertion loss. Evolving consumer behaviors, characterized by increased reliance on streaming services, online gaming, and immersive virtual experiences, further amplify the need for robust and high-capacity network infrastructure, directly translating into higher demand for silicon photonics components. The integration of silicon photonics into consumer electronics, while still nascent, presents a future growth avenue as devices become more data-intensive. The historical period (2019–2024) has witnessed steady adoption, with significant investments in R&D and early-stage commercialization, setting the stage for the accelerated growth anticipated in the coming years.

Key Markets & Segments Leading Silicon Photonics Industry

The Data Centers and High-performance Computing segment stands as the undisputed frontrunner in the silicon photonics industry, driving significant market demand. This dominance is fueled by several critical factors:

- Exponential Data Growth: The relentless increase in data traffic within data centers, driven by cloud services, AI/ML workloads, and big data analytics, necessitates ultra-high bandwidth solutions. Silicon photonics excels at providing the necessary data rates for inter-chip and intra-rack communication.

- Power Efficiency Demands: As data centers expand, power consumption becomes a critical concern. Silicon photonics offers a more energy-efficient alternative to traditional electrical interconnects, leading to reduced operational costs and environmental impact.

- Reduced Latency Requirements: High-performance computing and AI applications demand extremely low latency for optimal performance. Silicon photonics' inherent speed advantage significantly reduces signal delay.

- Scalability and Miniaturization: The ability to integrate photonic components onto silicon wafers allows for increased density and miniaturization of optical modules, crucial for space-constrained data center environments.

Telecommunications is another pivotal segment, experiencing substantial growth due to the ongoing rollout of 5G networks and the increasing demand for faster broadband services. The need for high-speed optical transceivers in core networks, metro networks, and access networks is a major driver for silicon photonics adoption. The ability of silicon photonics to achieve higher data rates at lower costs makes it an attractive solution for telecommunication operators looking to upgrade their infrastructure.

The Automotive segment is emerging as a significant growth frontier for silicon photonics. The increasing adoption of advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-car infotainment systems requires sophisticated sensor and communication solutions. Silicon photonics plays a crucial role in LiDAR systems, radar, and high-speed in-vehicle networks. The acquisition of Cloud Light Technology by Lumentum, with its focus on automotive sensor modules, underscores the growing importance of silicon photonics in this sector.

Other Applications, while currently representing a smaller market share, hold immense future potential. This includes areas like medical imaging, industrial automation, and advanced sensing technologies, where the unique capabilities of silicon photonics can provide significant advantages. As the technology matures and costs decrease, its penetration into these diverse markets is expected to accelerate.

Silicon Photonics Industry Product Developments

Product innovations in silicon photonics are rapidly advancing, focusing on higher data rates, improved energy efficiency, and increased integration. Key developments include higher bandwidth transceivers for data centers and telecommunications, miniaturized optical engines for automotive sensors, and specialized devices for sensing and metrology. Marvell Technology's recent demonstration of 200 Gbit/s-per-lane electrical I/O showcases the cutting-edge capabilities being developed, enabling next-generation AI clusters. Lumentum's strategic acquisition of Cloud Light Technology highlights the market's focus on advanced optical modules for automotive and data center applications. These advancements are crucial for maintaining a competitive edge and meeting the ever-increasing demands for faster and more efficient data processing and transmission.

Challenges in the Silicon Photonics Industry Market

Despite its immense promise, the silicon photonics market faces several significant challenges. High manufacturing costs associated with specialized fabrication processes can be a barrier to widespread adoption, particularly for price-sensitive applications. Interoperability and standardization across different vendors and technologies remain a concern, potentially hindering seamless integration into existing infrastructure. Supply chain complexities and the reliance on specialized foundries can also lead to lead time issues and production bottlenecks. Furthermore, competition from advanced copper interconnects and other emerging photonic technologies presents a constant challenge.

Forces Driving Silicon Photonics Industry Growth

Several powerful forces are propelling the silicon photonics industry forward. The insatiable demand for bandwidth driven by cloud computing, AI, and 5G networks is a primary catalyst. Technological advancements in integration, miniaturization, and data processing capabilities are continuously improving performance and reducing costs. Increased energy efficiency requirements in data centers and networking equipment make silicon photonics a highly attractive solution. Government initiatives and R&D investments in advanced technologies are also fostering innovation and adoption. The growing ecosystem of specialized companies and foundry services is crucial for scaling production and driving down costs.

Challenges in the Silicon Photonics Industry Market

The long-term growth of the silicon photonics industry is underpinned by several key catalysts. The maturation of manufacturing processes and increased economies of scale are expected to significantly reduce production costs. Continued innovation in packaging and integration techniques will further enhance performance and enable new applications. Strategic partnerships and collaborations between technology providers, equipment manufacturers, and end-users are crucial for accelerating market penetration and addressing complex technical challenges. The ongoing expansion of data-intensive industries like AI, IoT, and autonomous systems will create sustained demand for high-performance optical interconnects.

Emerging Opportunities in Silicon Photonics Industry

The silicon photonics market is ripe with emerging opportunities. The growing demand for optical interconnects in edge computing presents a new frontier for high-speed data processing closer to the source. The advancement of silicon photonic integrated circuits (PICs) for a wider range of sensing applications, including environmental monitoring and industrial inspection, is a significant growth area. The potential for silicon photonics in quantum computing as a critical component for interconnecting qubits and controlling quantum systems opens up entirely new possibilities. Furthermore, the increasing adoption in medical diagnostics and imaging due to the precision and speed offered by photonic technologies represents a promising avenue for expansion.

Leading Players in the Silicon Photonics Industry Sector

- Marvell Technology Inc.

- Coherent Corporation

- Broadcom Limited

- Molex Inc (Koch Industries)

- Macom Technology

- Cisco Systems Inc

- Juniper Networks Inc

- Lumentum Operations LLC (Lumentum Holdings Inc )

- Global Foundries Inc

- Sicoya GMBH

- Hamamatsu Photonics K

- Intel Corporation

Key Milestones in Silicon Photonics Industry Industry

- October 2023: Lumentum and Cloud Light Technology enter into a definitive agreement for Lumentum's acquisition of Cloud Light for approximately USD 750 Million. This strategic move enhances Lumentum's capabilities in advanced optical modules for automotive sensors and data center interconnect applications.

- October 2023: Marvell Technology demonstrates 200 Gbit/s-per-lane electrical I/O for high-speed copper data center interconnect. The 200G/lane active electrical cable (AEC) technology, powered by PAM4 DSP and 5nm 224G long-reach SerDes technology capable of driving 40dB+ of insertion loss at 224G/lane, is set to form the foundation for next-generation AI clusters and cloud infrastructure from Marvell.

Strategic Outlook for Silicon Photonics Industry Market

The strategic outlook for the silicon photonics industry market remains exceptionally strong, driven by ongoing technological innovation and burgeoning market demand. The continuous push for higher data rates, lower power consumption, and increased integration in data centers, telecommunications, and automotive sectors will fuel sustained growth. Strategic opportunities lie in leveraging advancements in AI for network optimization and the development of novel photonic components for emerging applications like quantum computing and advanced sensing. Companies that can effectively navigate supply chain challenges, foster strong industry partnerships, and invest in next-generation R&D will be well-positioned to capitalize on the immense future potential of silicon photonics.

Silicon Photonics Industry Segmentation

-

1. Application

- 1.1. Data Centers and High-performance Computing

- 1.2. Telecommunications

- 1.3. Automotive

- 1.4. Other Applications

Silicon Photonics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Silicon Photonics Industry Regional Market Share

Geographic Coverage of Silicon Photonics Industry

Silicon Photonics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers

- 3.3. Market Restrains

- 3.3.1. Risk of Thermal Effect

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Data Centers and High-performance Computing

- 5.1.2. Telecommunications

- 5.1.3. Automotive

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Data Centers and High-performance Computing

- 6.1.2. Telecommunications

- 6.1.3. Automotive

- 6.1.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Data Centers and High-performance Computing

- 7.1.2. Telecommunications

- 7.1.3. Automotive

- 7.1.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Data Centers and High-performance Computing

- 8.1.2. Telecommunications

- 8.1.3. Automotive

- 8.1.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Silicon Photonics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Data Centers and High-performance Computing

- 9.1.2. Telecommunications

- 9.1.3. Automotive

- 9.1.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Marvell Technology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Coherent Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Broadcom Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Molex Inc (Koch Industries)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Macom Technology

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Juniper Networks Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lumentum Operations LLC (Lumentum Holdings Inc )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Global Foundries Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sicoya GMBH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hamamatsu Photonics K

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Marvell Technology Inc

List of Figures

- Figure 1: Global Silicon Photonics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: Europe Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Asia Pacific Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Silicon Photonics Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Rest of the World Silicon Photonics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Silicon Photonics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Silicon Photonics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Silicon Photonics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Silicon Photonics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Silicon Photonics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Silicon Photonics Industry?

The projected CAGR is approximately 30.50%.

2. Which companies are prominent players in the Silicon Photonics Industry?

Key companies in the market include Marvell Technology Inc, Coherent Corporation, Broadcom Limited, Molex Inc (Koch Industries), Macom Technology, Cisco Systems Inc, Juniper Networks Inc, Lumentum Operations LLC (Lumentum Holdings Inc ), Global Foundries Inc, Sicoya GMBH, Hamamatsu Photonics K, Intel Corporation.

3. What are the main segments of the Silicon Photonics Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers.

6. What are the notable trends driving market growth?

Automotive Segment to Witness Major Growth.

7. Are there any restraints impacting market growth?

Risk of Thermal Effect.

8. Can you provide examples of recent developments in the market?

In October 2023, Lumentum and Cloud Light Technology entered into a definitive agreement under which Lumentum would acquire Cloud Light in a deal valued at approximately USD 750 million. Cloud Light designs, markets, and manufactures advanced optical modules for automotive sensors and data center interconnect applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Silicon Photonics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Silicon Photonics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Silicon Photonics Industry?

To stay informed about further developments, trends, and reports in the Silicon Photonics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence