Key Insights

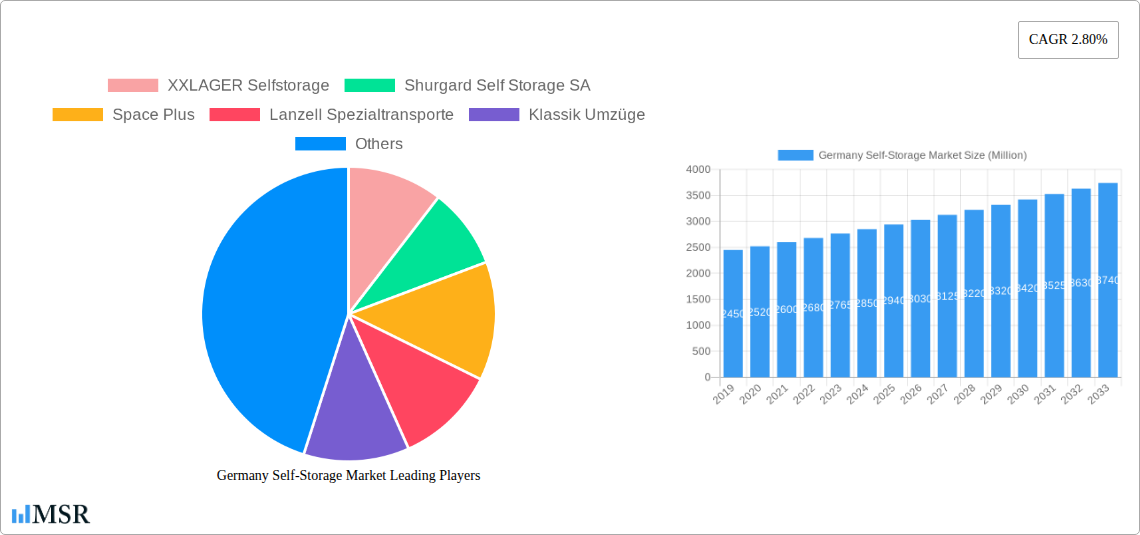

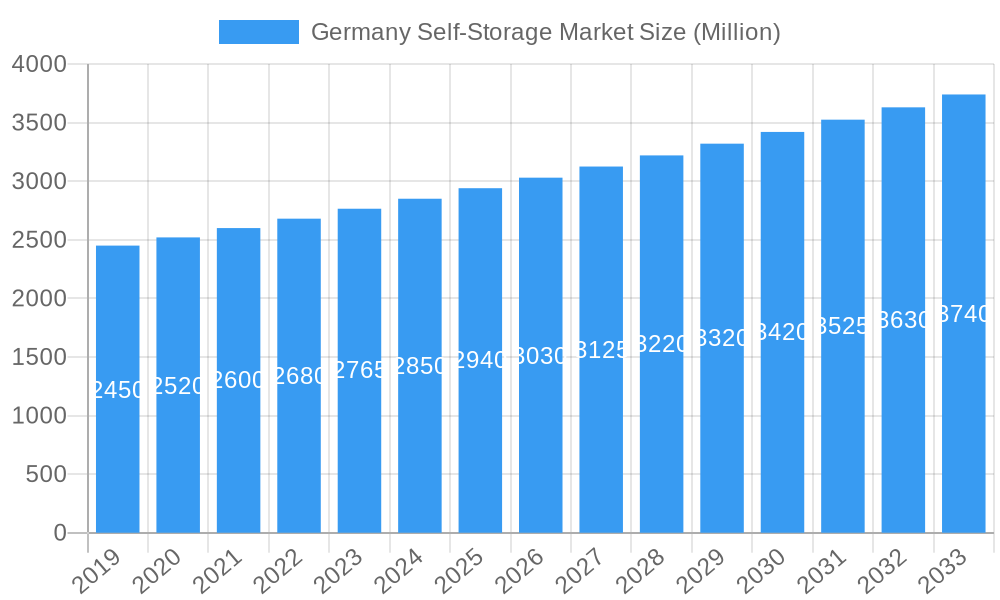

The German self-storage market is set for robust expansion, forecasted to reach 850 million by 2024, with a Compound Annual Growth Rate (CAGR) of 7.3% anticipated through 2033. This growth is driven by increasing demand for flexible storage solutions from both residential and commercial sectors. Residential demand is influenced by evolving housing trends, including smaller living spaces and a desire for decluttered homes, leading individuals to seek external storage for seasonal items, furniture, and personal belongings. The commercial sector is a significant contributor, with businesses utilizing self-storage for inventory management, document archiving, and flexible workspace solutions. The accessibility and cost-effectiveness of self-storage facilities are key facilitators, making them an attractive option for individuals and businesses navigating the dynamic German economy. Leading players such as XXLAGER Selfstorage, Shurgard Self Storage SA, and Space Plus are strategically expanding their presence to meet this rising demand.

Germany Self-Storage Market Market Size (In Million)

Several key trends are shaping the German self-storage market. The increasing adoption of online booking platforms and digital access technologies is enhancing customer convenience and operational efficiency for providers. Furthermore, the growing emphasis on specialized storage solutions, such as climate-controlled units for sensitive items and secure storage for valuable possessions, is creating niche market opportunities. Despite the positive outlook, certain restraints may impact growth trajectories. The initial capital investment required for developing new facilities and acquiring prime real estate can be substantial. Additionally, local zoning regulations and permitting processes can present expansion challenges. Nevertheless, the overall market sentiment remains optimistic, with a clear upward trajectory driven by fundamental shifts in consumer behavior and business operational needs within Germany.

Germany Self-Storage Market Company Market Share

Germany Self-Storage Market: Comprehensive Report | Forecast 2025-2033

Unlock critical insights into the burgeoning Germany Self-Storage Market with this definitive industry report. Covering the period 2019–2033, with a base and estimated year of 2025, this research provides an in-depth analysis of market dynamics, growth drivers, and competitive landscapes. Discover opportunities within key segments like Personal Storage Solutions and Business Storage for entrepreneurs and enterprises seeking flexible, scalable space. This report leverages high-ranking keywords such as German self-storage facilities, self-storage units Germany, European self-storage growth, and storage space solutions Germany to ensure maximum visibility for industry stakeholders.

Germany Self-Storage Market Market Concentration & Dynamics

The Germany Self-Storage Market exhibits a moderate to high level of concentration, with a few dominant players and a growing number of independent operators. Innovation is a key differentiator, with companies focusing on smart access technologies, integrated digital platforms, and sustainable operational practices. The regulatory framework is evolving, with a focus on consumer protection and building standards, influencing development and operational costs. Substitute products, such as traditional warehousing and extended home storage, exist but are increasingly challenged by the convenience, flexibility, and specialized services offered by self-storage. End-user trends point towards increased demand from both personal and business segments, driven by urbanization, smaller living spaces, and the gig economy. Merger and acquisition (M&A) activities are on the rise as larger players seek to consolidate market share and expand their geographical footprint. M&A deal counts in the European self-storage sector are projected to see continued activity in the coming years. Key metrics like market share for leading operators are crucial for understanding competitive positioning.

Germany Self-Storage Market Industry Insights & Trends

The Germany Self-Storage Market is poised for significant expansion, driven by a confluence of economic, social, and technological factors. The market size is projected to reach an estimated value in the billions of Euros by 2025, with a robust Compound Annual Growth Rate (CAGR) anticipated throughout the forecast period of 2025–2033. This growth is fueled by increasing urbanization, leading to smaller residential units and a greater need for external storage. The rise of e-commerce and the growing popularity of the gig economy are also significant drivers, as small businesses and freelancers require flexible, cost-effective storage solutions for inventory, equipment, and archival documents. Technological disruptions are transforming the sector, with smart locks, app-based access, automated inventory management, and advanced security systems becoming standard offerings. Evolving consumer behaviors are leaning towards on-demand services and a preference for convenience and accessibility, which self-storage facilities are increasingly catering to. The self-storage solutions Germany landscape is becoming more sophisticated, offering tailored packages for diverse needs. Furthermore, the demand for climate-controlled units and specialized storage (e.g., for art, wine, or sensitive documents) is on the rise, creating niche market opportunities. The integration of IoT devices for remote monitoring and management is enhancing operational efficiency and customer experience, solidifying the German self-storage market's growth trajectory. The historical period of 2019–2024 has laid the groundwork for this accelerated growth, characterized by steady market penetration and increasing investor interest.

Key Markets & Segments Leading Germany Self-Storage Market

The Germany Self-Storage Market is experiencing substantial growth, with key regions and user segments driving this expansion.

Dominant Geographic Markets: Major metropolitan areas such as Berlin, Munich, Hamburg, Frankfurt, and Cologne (the "Big Seven") are leading the market due to higher population density, smaller average dwelling sizes, and a greater concentration of businesses. These urban centers offer the most significant demand for accessible and convenient self-storage units Germany.

User Type: Personal Storage Dominance:

- Drivers:

- Urbanization & Smaller Living Spaces: As more people move to cities, apartments and houses are becoming smaller, necessitating off-site storage for personal belongings, seasonal items, furniture during renovations, or downsizing.

- Life Events: Major life transitions like moving homes, getting married, divorce, or dealing with estate management often require temporary or long-term storage solutions.

- Hobbies & Collections: Individuals with extensive collections, sporting equipment, or seasonal hobby items find self-storage invaluable.

- Convenience & Accessibility: Modern self-storage facilities offer 24/7 access, climate-controlled units, and flexible rental terms, catering to the on-demand lifestyle.

- Detailed Dominance Analysis: The personal storage segment represents the largest share of the German self-storage market. This is primarily due to the widespread need for decluttering and space optimization in residential settings. The increasing disposable income and a growing awareness of the benefits of professional storage solutions contribute to this dominance. For instance, a family needing to store winter clothing or sporting equipment during the summer months will opt for a readily available storage unit rather than cluttering their home. The European self-storage growth trend strongly reflects this personal demand.

- Drivers:

User Type: Business Storage Growth:

- Drivers:

- Small & Medium-sized Enterprises (SMEs): Many SMEs, especially those in retail, e-commerce, and service industries, require storage for inventory, equipment, tools, and archives.

- E-commerce Fulfillment: The booming online retail sector relies heavily on self-storage for efficient inventory management and order fulfillment, providing a flexible alternative to dedicated warehouse space.

- Startups & Freelancers: New businesses and independent contractors need affordable and scalable storage for their operational needs.

- Document Archiving: Businesses often need secure and organized storage for important documents, records, and legal paperwork, especially with evolving data protection regulations.

- Detailed Dominance Analysis: While the personal segment leads, the business segment is a rapidly growing force. The flexibility and cost-effectiveness of self-storage make it an attractive option for businesses looking to avoid the high costs associated with traditional commercial real estate. Companies can scale their storage space up or down as their business needs fluctuate. The increasing digitization of business processes also means that physical storage needs may shift but remain critical for certain types of assets. Storage space solutions Germany are increasingly tailored to meet the specific demands of businesses, offering features like drive-up access, larger unit sizes, and enhanced security.

- Drivers:

Germany Self-Storage Market Product Developments

Product developments in the Germany Self-Storage Market are characterized by a strong emphasis on technological integration and enhanced customer experience. Innovations include advanced smart lock systems allowing keyless entry via mobile apps, providing greater security and convenience. Many facilities are implementing integrated inventory management software for business users, streamlining their operations. Climate-controlled units are becoming more sophisticated, offering precise temperature and humidity regulation for sensitive items like art, wine, and electronics. The market is also seeing the development of modular and customizable storage solutions, allowing users to adapt their space as needed. Furthermore, the incorporation of IoT devices for real-time monitoring of environmental conditions and unit occupancy is enhancing operational efficiency and user confidence in the security of their stored goods. These advancements are crucial for maintaining a competitive edge and catering to evolving customer demands for smart, secure, and flexible self-storage solutions Germany.

Challenges in the Germany Self-Storage Market Market

The Germany Self-Storage Market faces several challenges that could impact its growth trajectory. Regulatory hurdles, including stringent zoning laws and building permits for new facilities, can slow down development and increase construction costs. Supply chain issues, particularly concerning building materials and skilled labor, can also lead to project delays and cost overruns. Intense competitive pressures from established national operators, international players, and an increasing number of independent providers can lead to price wars and impact profit margins. Furthermore, the perception of self-storage as a mature market in some regions may require sustained marketing efforts to educate potential customers about its evolving benefits.

Forces Driving Germany Self-Storage Market Growth

Several key forces are propelling the Germany Self-Storage Market forward. Technological advancements, such as the proliferation of smart locks and integrated digital platforms, are enhancing convenience and security, attracting a wider customer base. Economic factors, including a strong German economy and the growth of small and medium-sized enterprises (SMEs), are increasing the demand for flexible storage solutions. Regulatory support, in the form of clearer guidelines for development and operation, can facilitate market expansion. Furthermore, evolving consumer behaviors, driven by smaller living spaces and the desire for organized lifestyles, are creating a consistent demand for self-storage units Germany.

Challenges in the Germany Self-Storage Market Market

Long-term growth catalysts for the Germany Self-Storage Market are rooted in sustained innovation and strategic market penetration. The ongoing development of smart technologies, including AI-powered customer service and advanced security features, will continue to enhance the value proposition. Partnerships with related industries, such as moving companies, real estate agencies, and e-commerce platforms, can create new customer acquisition channels. Furthermore, the expansion into underserved urban areas and the introduction of specialized storage offerings (e.g., for vintage cars, sensitive documents) will unlock new market segments. Continued investment in sustainability initiatives by operators will also resonate with an increasingly environmentally conscious consumer base, fostering long-term loyalty and market resilience.

Emerging Opportunities in Germany Self-Storage Market

Emerging opportunities in the Germany Self-Storage Market are diverse and promising. The growing demand for climate-controlled and specialized storage solutions, such as wine storage or art storage, presents a significant niche market. The expansion of "last-mile" delivery services and the increasing need for inventory management by online retailers offer substantial growth potential for business-focused storage facilities. The development of integrated service offerings, combining storage with packing, moving, or concierge services, can create new revenue streams and enhance customer convenience. Furthermore, the untapped potential in smaller German cities and suburban areas, coupled with innovative marketing strategies targeting specific demographic groups, represents a fertile ground for new market entrants and expansion.

Leading Players in the Germany Self-Storage Market Sector

- XXLAGER Selfstorage

- Shurgard Self Storage SA

- Space Plus

- Lanzell Spezialtransporte

- Klassik Umzüge

- Hertling GmbH & Co KG

- Rousselet Group (HOMEBOX)

- SelfStorage Dein Lagerraum GmbH (My Place Storage)

- BOXIE

- Pickens Selfstorage GmbH

Key Milestones in Germany Self-Storage Market Industry

- November 2023: Shurgard, a prominent European self-storage operator, secured planning permission for a new facility in Dusseldorf. This c. 5,800 Sqm development, slated for a 2024 opening, will offer approximately 750 units, catering to both residents and businesses in a major German city, highlighting expansion efforts in key urban markets.

- March 2023: MyPlace-Self Storage launched "exchange room," a sustainability initiative focused on a neighborhood market for second-hand goods and products from regional startups. This campaign underscores a growing trend towards eco-friendly practices and community engagement within the self-storage sector.

Strategic Outlook for Germany Self-Storage Market Market

The strategic outlook for the Germany Self-Storage Market is highly optimistic, driven by continued urbanization, economic resilience, and technological integration. Growth accelerators include the expansion of smart storage solutions, offering enhanced security and remote management capabilities. Strategic opportunities lie in the consolidation of fragmented markets through mergers and acquisitions, as well as in developing specialized storage offerings to cater to niche demands. The increasing adoption of flexible, on-demand services by both personal and business users will further fuel market expansion. Operators focusing on customer experience, sustainability, and strategic location selection are best positioned for sustained success in this dynamic market.

Germany Self-Storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

Germany Self-Storage Market Segmentation By Geography

- 1. Germany

Germany Self-Storage Market Regional Market Share

Geographic Coverage of Germany Self-Storage Market

Germany Self-Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Government Regulations on Storage

- 3.4. Market Trends

- 3.4.1. Rising Urbanization and Smaller Living Spaces Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Self-Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. North Rhine-Westphalia Germany Self-Storage Market Analysis, Insights and Forecast, 2020-2032

- 7. Bavaria Germany Self-Storage Market Analysis, Insights and Forecast, 2020-2032

- 8. Baden-Württemberg Germany Self-Storage Market Analysis, Insights and Forecast, 2020-2032

- 9. Lower Saxony Germany Self-Storage Market Analysis, Insights and Forecast, 2020-2032

- 10. Hesse Germany Self-Storage Market Analysis, Insights and Forecast, 2020-2032

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 XXLAGER Selfstorage

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shurgard Self Storage SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Space Plus

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lanzell Spezialtransporte

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klassik Umzüge

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hertling GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rousselet Group (HOMEBOX)*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SelfStorage Dein Lagerraum GmbH (My Place Storage)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BOXIE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pickens Selfstorage GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 XXLAGER Selfstorage

List of Figures

- Figure 1: Germany Self-Storage Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Germany Self-Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Self-Storage Market Revenue million Forecast, by Region 2020 & 2033

- Table 2: Germany Self-Storage Market Revenue million Forecast, by User Type 2020 & 2033

- Table 3: Germany Self-Storage Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Germany Self-Storage Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: North Rhine-Westphalia Germany Self-Storage Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Bavaria Germany Self-Storage Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Baden-Württemberg Germany Self-Storage Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Lower Saxony Germany Self-Storage Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Hesse Germany Self-Storage Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Self-Storage Market Revenue million Forecast, by User Type 2020 & 2033

- Table 11: Germany Self-Storage Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Self-Storage Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Germany Self-Storage Market?

Key companies in the market include XXLAGER Selfstorage, Shurgard Self Storage SA, Space Plus, Lanzell Spezialtransporte, Klassik Umzüge, Hertling GmbH & Co KG, Rousselet Group (HOMEBOX)*List Not Exhaustive, SelfStorage Dein Lagerraum GmbH (My Place Storage), BOXIE, Pickens Selfstorage GmbH.

3. What are the main segments of the Germany Self-Storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 850 million as of 2022.

5. What are some drivers contributing to market growth?

Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior.

6. What are the notable trends driving market growth?

Rising Urbanization and Smaller Living Spaces Drive the Market.

7. Are there any restraints impacting market growth?

Government Regulations on Storage.

8. Can you provide examples of recent developments in the market?

November 2023 - Shurgard, one of the largest developers and operators of self-storage centers in Europe, has received planning permission for a self-storage facility in the Dusseldorf region, one of Germany’s “Big Seven” cities, Where the future c. 5,800 Sqm purpose-built self-storage facility is set to open in 2024 and will offer approximately 750 clean and secure self-storage units to local residents and businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Self-Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Self-Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Self-Storage Market?

To stay informed about further developments, trends, and reports in the Germany Self-Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence