Key Insights

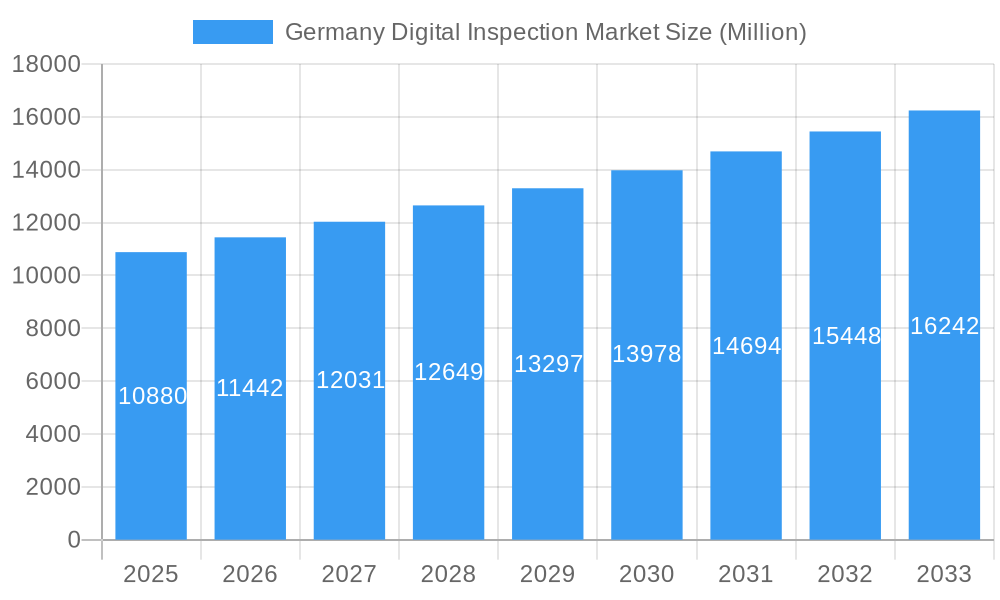

The German Digital Inspection Market is poised for significant expansion, projected to reach a substantial valuation. Driven by the increasing adoption of advanced technologies like AI, IoT, and machine learning within inspection processes, the market is witnessing a robust Compound Annual Growth Rate (CAGR) of 5.20%. This growth is fueled by an escalating demand for enhanced quality control, regulatory compliance, and operational efficiency across a diverse range of industries. Key sectors such as Manufacturing and Industrial Goods, Automotive, and Consumer Goods and Retail are leading this transformation, implementing digital inspection solutions to streamline workflows, reduce human error, and gain real-time insights. The inherent benefits of digital inspections, including improved accuracy, faster turnaround times, and remote monitoring capabilities, are compelling businesses to invest in these solutions, propelling the market forward. Furthermore, a growing emphasis on safety standards and product integrity across all verticals is reinforcing the necessity for sophisticated digital inspection methodologies.

Germany Digital Inspection Market Market Size (In Billion)

The market’s trajectory is further shaped by evolving trends such as the integration of predictive maintenance through data analytics derived from digital inspections, and the expansion of outsourced inspection services offering specialized expertise and advanced tooling. While the market benefits from strong growth drivers, certain restraints, such as the initial investment costs for adopting new digital technologies and the need for skilled personnel to operate and interpret data from these systems, may present challenges. However, the long-term value proposition of digital inspections, including cost savings through reduced downtime and improved product quality, is expected to outweigh these initial hurdles. The German market, in particular, is a key contributor to this growth due to its strong industrial base, commitment to innovation, and stringent quality standards, making it a fertile ground for the continued development and adoption of digital inspection technologies.

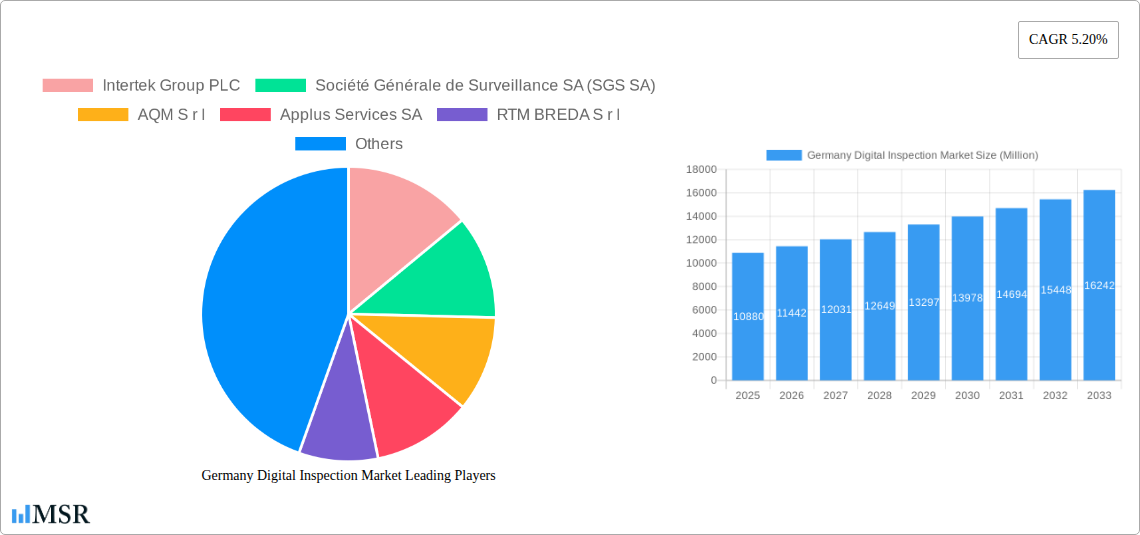

Germany Digital Inspection Market Company Market Share

This report offers an in-depth analysis of the Germany Digital Inspection Market, a rapidly evolving sector critical for ensuring quality, safety, and compliance across diverse industries. Leveraging advanced technologies, digital inspection solutions are transforming traditional methods, driving efficiency and accuracy. This study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033. We provide actionable insights into market dynamics, key segments, product developments, challenges, growth drivers, and strategic opportunities, making it an indispensable resource for industry stakeholders, investors, and decision-makers.

Germany Digital Inspection Market Market Concentration & Dynamics

The Germany Digital Inspection Market exhibits a moderate to high concentration, with several global players and specialized domestic firms vying for market share. Key players like Intertek Group PLC, Société Générale de Surveillance SA (SGS SA), and DEKRA SE hold significant influence due to their extensive service portfolios and established reputations. Innovation ecosystems are thriving, driven by significant investment in R&D and the adoption of cutting-edge technologies such as AI, IoT, and advanced analytics. Regulatory frameworks in Germany, emphasizing stringent quality and safety standards, act as both a catalyst and a control for the market. The increasing demand for digital testing and inspection services and certification services across various verticals fuels growth. Substitute products, primarily traditional inspection methods, are gradually being replaced by more efficient digital alternatives. Mergers and acquisitions (M&A) activity is a notable dynamic, with companies seeking to expand their service offerings and geographical reach. For instance, recent years have seen strategic acquisitions aimed at bolstering capabilities in areas like digital transformation and predictive maintenance. While specific M&A deal counts are proprietary, the trend indicates a consolidated market with ambitious growth strategies.

Germany Digital Inspection Market Industry Insights & Trends

The Germany Digital Inspection Market is projected to witness substantial growth, driven by an increasing emphasis on quality assurance, regulatory compliance, and the adoption of Industry 4.0 principles. The market size is estimated to reach approximately $XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). Technological disruptions, including the integration of Artificial Intelligence (AI) for anomaly detection, the Internet of Things (IoT) for real-time data collection, and advanced robotics for automated inspections, are reshaping the competitive landscape. The escalating demand for non-destructive testing (NDT) and digital quality control solutions across key sectors like automotive, manufacturing and industrial goods, and oil & gas and chemicals is a primary growth driver. Evolving consumer behaviors, particularly the demand for safer and higher-quality products, further bolster the need for robust inspection services. Furthermore, the German government's commitment to fostering innovation and digital transformation through various initiatives provides a supportive environment for market expansion. The shift towards sustainable practices also necessitates enhanced inspection protocols, particularly in sectors like food and agriculture and construction, to ensure environmental compliance and product integrity. The growing complexity of supply chains and the increasing need for traceability are also key trends contributing to the market's upward trajectory.

Key Markets & Segments Leading Germany Digital Inspection Market

The Germany Digital Inspection Market is characterized by a robust demand across multiple end-user verticals, with significant dominance observed in specific segments. The Sourcing Type of Outsourced services, particularly Testing and Inspection and Certification, leads the market, reflecting a strong reliance on specialized third-party expertise for quality assurance and regulatory adherence.

End-user Vertical Dominance:

- Manufacturing and Industrial Goods: This sector is a primary driver due to the inherent need for rigorous quality control, process optimization, and defect detection in complex manufacturing environments. The adoption of digital manufacturing solutions and smart factory initiatives directly fuels the demand for digital inspection services.

- Automotive: Germany's status as a global automotive hub means stringent safety and quality standards are paramount. Digital inspection of automotive components, vehicle assembly lines, and after-sales services contributes significantly to market growth. The increasing complexity of vehicle electronics and autonomous driving technology further necessitates advanced inspection capabilities.

- Oil & Gas and Chemicals: This sector demands high levels of safety and environmental compliance. Digital inspection of pipelines, refineries, and chemical plants is crucial for preventing accidents and ensuring operational integrity. The exploration of new energy sources and the increasing focus on sustainability also drive demand for specialized inspection services.

- Aerospace and Rail: These industries require exceptionally high safety standards and meticulous inspection protocols. The use of digital inspection tools for structural integrity, component reliability, and maintenance in aerospace and rail applications is critical.

Sourcing Type Dominance:

- Outsourced Testing and Inspection: Businesses increasingly opt for external expertise to ensure impartiality, access specialized equipment, and leverage advanced analytical capabilities offered by dedicated inspection service providers. This trend is driven by cost-efficiency and the need for specialized skills.

- Certification Services: Obtaining and maintaining various certifications (e.g., ISO standards) is vital for market access and customer trust. Outsourced certification bodies play a crucial role in verifying compliance, contributing significantly to the market's revenue.

The growth in these segments is propelled by factors such as increasing regulatory demands, the drive for operational efficiency, the adoption of advanced technologies, and the global interconnectedness of supply chains.

Germany Digital Inspection Market Product Developments

Recent product developments in the Germany Digital Inspection Market highlight a strong focus on enhancing precision, automation, and data-driven insights. A significant innovation occurred in June 2023 when TÜV SÜD Limited created and tested a new directional photometer. This pioneering tool offers unprecedented three-dimensional measuring information on light distribution, revolutionizing lighting system planning for designers and manufacturers. This advancement allows for more precise examination and evaluation of lighting conditions, enabling the creation of specific moods or environments. These technological leaps are crucial for industries demanding precise environmental control and advanced product performance.

Challenges in the Germany Digital Inspection Market Market

Despite robust growth, the Germany Digital Inspection Market faces several challenges that could impede its progress. These include:

- High Initial Investment Costs: The implementation of advanced digital inspection technologies, such as AI-powered systems and sophisticated sensor equipment, requires substantial upfront capital, posing a barrier for small and medium-sized enterprises (SMEs).

- Skilled Workforce Shortage: A significant challenge is the lack of adequately trained personnel capable of operating and interpreting data from advanced digital inspection tools, leading to a skills gap in the market.

- Data Security and Privacy Concerns: The collection and storage of vast amounts of sensitive inspection data raise concerns about cybersecurity threats and data privacy compliance, requiring robust security measures.

- Integration Complexity: Integrating new digital inspection systems with existing legacy infrastructure can be complex and time-consuming, potentially disrupting operational workflows.

- Standardization and Interoperability: The absence of universal standards for digital inspection data and protocols can hinder interoperability between different systems and platforms.

Forces Driving Germany Digital Inspection Market Growth

The Germany Digital Inspection Market is propelled by several potent forces. The escalating demand for enhanced quality assurance and stringent adherence to international and national regulatory frameworks are paramount. The widespread adoption of Industry 4.0 technologies, including AI, IoT, and robotics, is transforming inspection processes, making them more efficient, accurate, and cost-effective. Furthermore, a growing global emphasis on product safety and sustainability mandates rigorous inspection protocols across all stages of the product lifecycle. The increasing complexity of supply chains and the need for greater transparency and traceability also contribute significantly to market expansion. Government initiatives promoting digital transformation and innovation further foster a supportive ecosystem for growth.

Challenges in the Germany Digital Inspection Market Market

Long-term growth catalysts for the Germany Digital Inspection Market are multifaceted. Continued advancements in artificial intelligence and machine learning will enable more sophisticated predictive maintenance and anomaly detection capabilities, moving beyond simple quality checks. The expansion of IoT networks will facilitate real-time data streaming from connected devices, offering continuous monitoring and immediate alerts. Strategic partnerships between technology providers and inspection service companies will drive innovation and market penetration. Furthermore, the development of more accessible and cost-effective digital inspection solutions will broaden market reach into new segments and smaller enterprises. The increasing global demand for certified products and services will also serve as a sustained growth driver.

Emerging Opportunities in Germany Digital Inspection Market

Emerging opportunities in the Germany Digital Inspection Market are centered on leveraging new technologies and catering to evolving market needs. The increasing application of digital twins for simulating product performance and identifying potential defects before they occur presents a significant opportunity. The expansion of the circular economy will necessitate specialized inspection services for the reuse and recycling of materials, creating new service niches. The growing adoption of augmented reality (AR) and virtual reality (VR) in remote inspections and inspector training offers enhanced efficiency and safety. Furthermore, the demand for cybersecurity inspections for connected devices and industrial control systems is rapidly growing. Opportunities also lie in developing tailored digital inspection solutions for niche industries and emerging technologies, such as renewable energy infrastructure and advanced medical devices.

Leading Players in the Germany Digital Inspection Market Sector

The Germany Digital Inspection Market features a competitive landscape with a mix of global giants and specialized providers. Key players include:

- Intertek Group PLC

- Société Générale de Surveillance SA (SGS SA)

- AQM S r l

- Applus Services SA

- RTM BREDA S r l

- A/S Baltic Control Group Ltd

- TÜV SÜD Limited

- Mistras GMA - Holding GmbH

- TUV Nord

- CIS Commodity Inspection Services BV

- VIC Inspection Services Holding Ltd

- Element Materials Technology Group Limited

- DEKRA SE

- UL LLC

- Kiwa NV

- ALS Limited

- Bureau Veritas SA

- Eurofins Scientific SE

- ATG Technology Group

Key Milestones in Germany Digital Inspection Market Industry

- June 2023: TUV SUD developed and tested a new directional photometer for lighting system planning, offering precise 3D light spread information.

- June 2023: DAkkS accredited a biobank according to DIN EN ISO 20387, the Tissue Bank at the National Center for Tumour Diseases at Heidelberg University Hospital, demonstrating competence in handling human tissue samples.

Strategic Outlook for Germany Digital Inspection Market Market

The strategic outlook for the Germany Digital Inspection Market is exceptionally positive, driven by continuous technological innovation and an unwavering commitment to quality and safety. Key growth accelerators include the deepening integration of AI and machine learning for predictive analytics, the expansion of IoT-enabled real-time monitoring, and the adoption of AR/VR for remote and enhanced inspections. Strategic opportunities lie in forging collaborative partnerships, developing specialized solutions for emerging industries like green energy and biotechnology, and expanding service offerings to address evolving global regulatory landscapes. The market's future success will hinge on its ability to adapt to digital transformation trends, address data security concerns, and nurture a skilled workforce capable of leveraging advanced digital inspection technologies to drive efficiency and ensure compliance across diverse sectors.

Germany Digital Inspection Market Segmentation

-

1. Sourcing Type

-

1.1. Outsourced

-

1.1.1. Type of Service

- 1.1.1.1. Testing and Inspection

- 1.1.1.2. Certification

-

1.1.1. Type of Service

- 1.2. In-house/Government

-

1.1. Outsourced

-

2. End-user Vertical

- 2.1. Consumer Goods and Retail

- 2.2. Automotive

- 2.3. Food and Agriculture

- 2.4. Manufacturing and Industrial Goods

- 2.5. Minerals and Metals

- 2.6. Oil & Gas and Chemicals

- 2.7. Construction

- 2.8. Transport, Aerospace and Rail

- 2.9. Other End-user Verticals

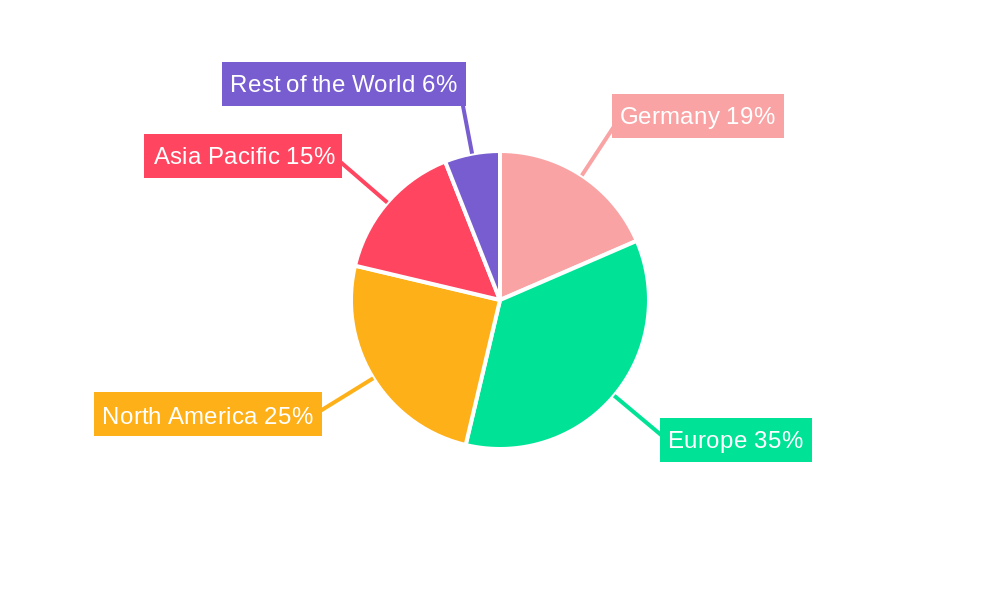

Germany Digital Inspection Market Segmentation By Geography

- 1. Germany

Germany Digital Inspection Market Regional Market Share

Geographic Coverage of Germany Digital Inspection Market

Germany Digital Inspection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 3.3. Market Restrains

- 3.3.1. Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain

- 3.4. Market Trends

- 3.4.1. Certification to be the Fastest Growing Type of Service

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Digital Inspection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 5.1.1. Outsourced

- 5.1.1.1. Type of Service

- 5.1.1.1.1. Testing and Inspection

- 5.1.1.1.2. Certification

- 5.1.1.1. Type of Service

- 5.1.2. In-house/Government

- 5.1.1. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Consumer Goods and Retail

- 5.2.2. Automotive

- 5.2.3. Food and Agriculture

- 5.2.4. Manufacturing and Industrial Goods

- 5.2.5. Minerals and Metals

- 5.2.6. Oil & Gas and Chemicals

- 5.2.7. Construction

- 5.2.8. Transport, Aerospace and Rail

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Sourcing Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Société Générale de Surveillance SA (SGS SA)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AQM S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus Services SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RTM BREDA S r l

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A/S Baltic Control Group Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TÜV SÜD Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mistras GMA - Holding GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TUV Nord*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CIS Commodity Inspection Services BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VIC Inspection Services Holding Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Element Materials Technology Group Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DEKRA SE

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 UL LLC

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Kiwa NV

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ALS Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bureau Veritas SA

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Eurofins Scientific SE

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 ATG Technology Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Germany Digital Inspection Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Digital Inspection Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 2: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Germany Digital Inspection Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Germany Digital Inspection Market Revenue Million Forecast, by Sourcing Type 2020 & 2033

- Table 5: Germany Digital Inspection Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Germany Digital Inspection Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Digital Inspection Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Germany Digital Inspection Market?

Key companies in the market include Intertek Group PLC, Société Générale de Surveillance SA (SGS SA), AQM S r l, Applus Services SA, RTM BREDA S r l, A/S Baltic Control Group Ltd, TÜV SÜD Limited, Mistras GMA - Holding GmbH, TUV Nord*List Not Exhaustive, CIS Commodity Inspection Services BV, VIC Inspection Services Holding Ltd, Element Materials Technology Group Limited, DEKRA SE, UL LLC, Kiwa NV, ALS Limited, Bureau Veritas SA, Eurofins Scientific SE, ATG Technology Group.

3. What are the main segments of the Germany Digital Inspection Market?

The market segments include Sourcing Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations and Mandates to Ensure Product Safety and Environmental Protection.

6. What are the notable trends driving market growth?

Certification to be the Fastest Growing Type of Service.

7. Are there any restraints impacting market growth?

Increase in Lead Times For Assessment Programs Due to the Growing Complexity of the Supply Chain.

8. Can you provide examples of recent developments in the market?

June 2023: The TUV SUD created and tested a new directional photometer for use in lighting system planning. The tool is the first to offer extremely precise three-dimensional measuring information on how light is spread over things in a place. Lighting designers and manufacturers can greatly benefit from this information, which will help them examine and evaluate lighting circumstances more precisely in order to create particular moods or conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Digital Inspection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Digital Inspection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Digital Inspection Market?

To stay informed about further developments, trends, and reports in the Germany Digital Inspection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence