Key Insights

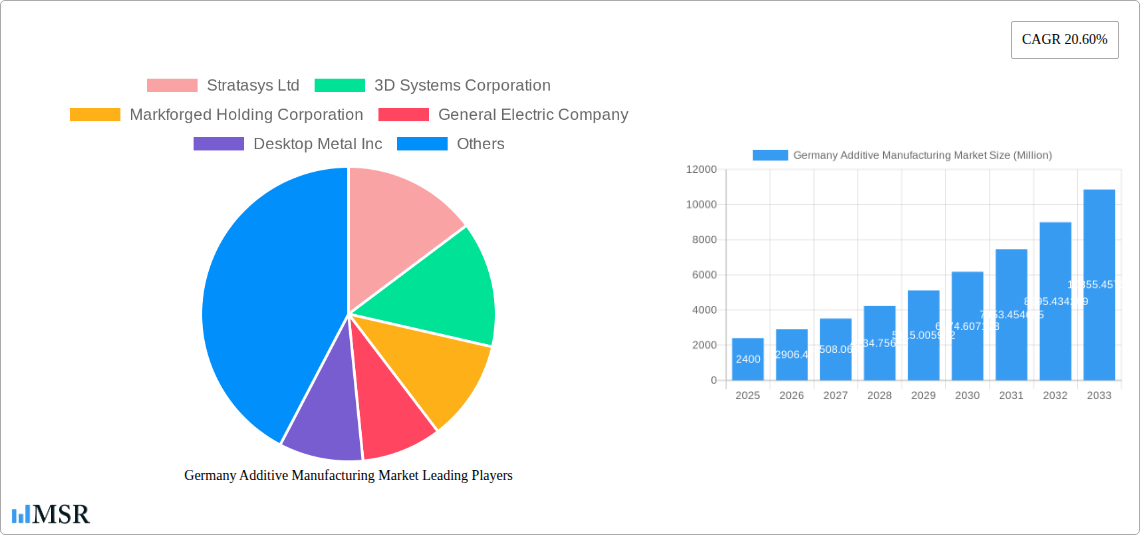

The German Additive Manufacturing market is poised for substantial growth, with an estimated market size of €2.40 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 20.60% through 2033. This robust expansion is fueled by a confluence of transformative drivers, including increasing demand for customized and complex parts, significant advancements in 3D printing technologies like Material Jetting and Powder Bed Fusion, and the growing adoption of high-performance materials such as advanced polymers and metals. Furthermore, the integration of additive manufacturing into traditional production workflows, coupled with government initiatives promoting digitalization and innovation, is significantly bolstering market penetration across various sectors. The services segment is also expected to witness considerable growth as companies increasingly outsource their additive manufacturing needs, leveraging specialized expertise and advanced capabilities.

Germany Additive Manufacturing Market Market Size (In Billion)

Key trends shaping the German additive manufacturing landscape include the burgeoning use of 3D printing for rapid prototyping and on-demand production, which significantly reduces lead times and costs for industries like automotive and aerospace. The development of new, high-strength materials is enabling the creation of end-use parts with enhanced performance characteristics, further driving adoption. While the market is overwhelmingly positive, certain restraints, such as the initial high cost of industrial-grade 3D printers and the need for skilled labor to operate and maintain these sophisticated systems, could present challenges. However, these are being progressively addressed through technological innovation and workforce development programs. The healthcare sector, in particular, is a significant growth area, with 3D printing enabling personalized medical devices, prosthetics, and implants.

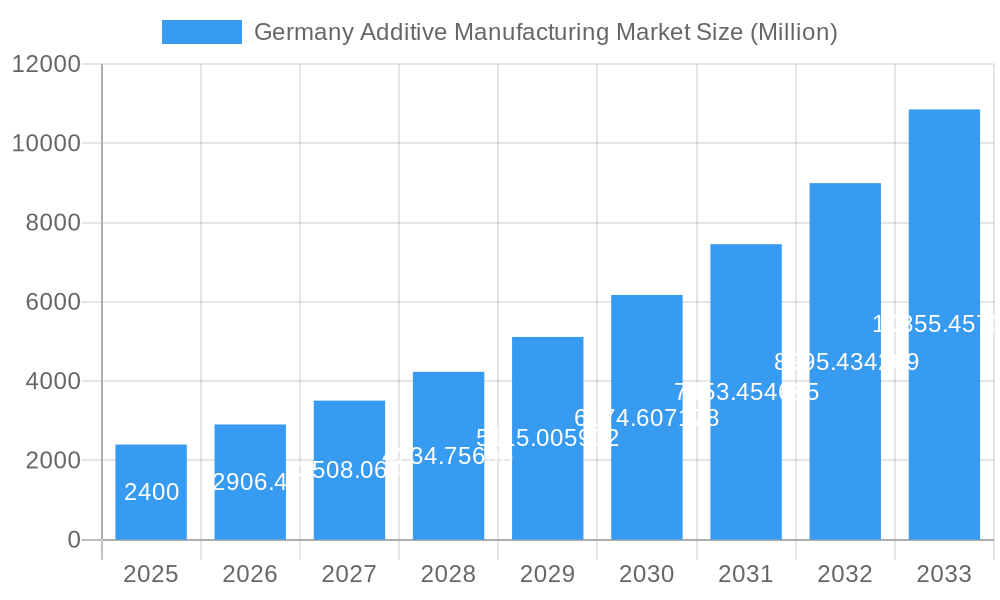

Germany Additive Manufacturing Market Company Market Share

Here is an SEO-optimized, engaging report description for the Germany Additive Manufacturing Market:

Unlock the Future of Manufacturing: Germany Additive Manufacturing Market Report 2024-2033

Dive deep into the dynamic Germany additive manufacturing market, a pivotal sector driving innovation and shaping the future of production. This comprehensive report provides unparalleled insights into market size, growth trajectories, and emerging trends from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033. Discover the key drivers, segments, and leading players that are defining 3D printing in Germany, from advanced metal additive manufacturing to cutting-edge polymer 3D printing solutions.

This in-depth analysis covers the entire value chain, including additive manufacturing hardware, diverse 3D printing materials (metals, polymers, ceramics, construction), and essential additive manufacturing services. Explore the profound impact of 3D printing applications across critical industries such as automotive 3D printing, aerospace and defense additive manufacturing, healthcare 3D printing, electronics 3D printing, and the burgeoning construction 3D printing sector. With a focus on actionable intelligence and quantifiable data, this report is indispensable for manufacturers, suppliers, investors, and policymakers seeking to capitalize on the immense growth potential of Germany's industrial 3D printing landscape.

Key Report Highlights:

Gain a competitive edge by understanding the forces shaping Germany's advanced manufacturing ecosystem. Whether you are looking to invest, innovate, or integrate additive manufacturing technologies, this report provides the critical data and strategic foresight needed for success in the rapidly evolving German 3D printing market.

- Market Size & CAGR: Precise valuation and projected growth rates for the German additive manufacturing sector.

- Segment Dominance: In-depth analysis of Hardware (Extrusion, Vat Photopolymerization, Powder Bed Fusion, Material Jetting, Others), Materials, Services, and End-User Industries.

- Key Players: Comprehensive profiling of industry leaders like Stratasys Ltd, 3D Systems Corporation, Markforged Holding Corporation, General Electric Company, Desktop Metal Inc, EOS GmBH, Fraunhofer IGCV, SLM Solutions, Protolabs, Shapeway Holdings Inc, Velo3D Inc, and many more.

- Industry Developments: Timely insights into crucial milestones, including BASF's Forward AM expansion (July 2024), Quantica's Series A funding (June 2024), and Gefertec GmbH's arc80X WAAM launch (March 2024).

- Strategic Outlook: Actionable recommendations and insights for navigating market challenges and capitalizing on future opportunities.

Germany Additive Manufacturing Market Market Concentration & Dynamics

The Germany additive manufacturing market exhibits a moderately concentrated landscape, characterized by a blend of large multinational corporations and specialized domestic players. The innovation ecosystem is robust, driven by significant investment in R&D from both industry giants and research institutions like Fraunhofer IGCV. Regulatory frameworks are evolving to support the adoption of additive manufacturing, particularly in sensitive sectors like aerospace and healthcare, focusing on standardization and safety protocols. While substitute products exist in traditional manufacturing, the unique advantages of additive manufacturing—customization, complex geometries, and on-demand production—continue to drive its differentiation. End-user trends show an increasing demand for lightweight components, rapid prototyping, and localized production, particularly in the automotive and aerospace sectors. Mergers and acquisitions (M&A) activities are a significant indicator of market dynamics, with strategic acquisitions aimed at expanding technological capabilities or market reach. For instance, the consolidation of material suppliers and service bureaus highlights a drive towards integrated solutions. M&A deal counts are steadily rising, reflecting confidence in the long-term growth potential. Market share analysis reveals a strong presence of established players in specific technology segments, such as EOS GmBH in Powder Bed Fusion.

Germany Additive Manufacturing Market Industry Insights & Trends

The Germany additive manufacturing market is experiencing robust growth, projected to reach a market size of approximately EUR XX,XXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx.x% during the forecast period (2025–2033). This expansion is fundamentally driven by the burgeoning demand for customized solutions, rapid prototyping, and the inherent efficiency gains offered by additive manufacturing technologies. Technological disruptions, particularly in metal additive manufacturing and advanced polymer printing, are continuously pushing the boundaries of what's possible, enabling the production of complex, high-performance parts previously unattainable through conventional methods.

Evolving consumer behaviors, coupled with industry-wide pressures for greater sustainability and reduced lead times, are further fueling the adoption of 3D printing services and 3D printing materials. The push towards Industry 4.0 and smart manufacturing initiatives across Germany's dominant industrial sectors provides a fertile ground for additive manufacturing integration. Companies are increasingly recognizing the strategic advantages of distributed manufacturing and on-demand production, which additive manufacturing inherently supports. This shift reduces inventory costs, minimizes waste, and enhances supply chain resilience. Furthermore, advancements in material science are leading to the development of novel 3D printing filaments and powders with enhanced mechanical, thermal, and chemical properties, opening up new application frontiers. The increasing accessibility and affordability of advanced 3D printing machines are also democratizing the technology, allowing a broader range of businesses, from SMEs to large enterprises, to leverage its benefits. The emphasis on lightweighting in the automotive and aerospace sectors remains a significant growth catalyst, as 3D printed components can achieve superior strength-to-weight ratios. The healthcare industry's growing reliance on patient-specific implants, prosthetics, and surgical guides further solidifies the upward trajectory of the market. The construction sector is also beginning to embrace construction 3D printing for its potential to accelerate building processes and create innovative architectural designs.

Key Markets & Segments Leading Germany Additive Manufacturing Market

The Germany additive manufacturing market's dominance is a multifaceted phenomenon driven by specific segments that are capitalizing on technological advancements and industry demands.

Hardware Dominance:

- Powder Bed Fusion (PBF): This technology, encompassing Selective Laser Sintering (SLS) and Selective Laser Melting (SLM), commands a significant market share due to its ability to produce high-precision metal and polymer parts for demanding applications. Its prevalence in aerospace and automotive for complex geometries and functional prototypes is a key driver.

- Extrusion: As a widely accessible and cost-effective technology for prototyping and end-use parts, Extrusion (like Fused Deposition Modeling) continues to hold a strong position, particularly for polymer applications.

- Vat Photopolymerization: Technologies like Stereolithography (SLA) and Digital Light Processing (DLP) are leading in applications requiring high resolution and intricate surface finishes, especially in dental and jewelry manufacturing.

- Material Jetting: This technology excels in producing multi-material and full-color prototypes, finding traction in consumer electronics and product design.

- Others (DED and Binder Jetting): Directed Energy Deposition (DED) is gaining traction for repair and large-format metal part production, while Binder Jetting is emerging as a fast and cost-effective method for mass production of metal components.

Materials Leadership:

- Metal: The demand for high-performance metal alloys (e.g., titanium, stainless steel, aluminum alloys) in aerospace, automotive, and medical implants is a primary growth engine for this segment.

- Polymers: Advanced polymers, including high-temperature plastics and reinforced composites, are crucial for functional prototypes and end-use parts across various industries, driven by their versatility and cost-effectiveness.

- Ceramics: While a niche segment, advanced ceramics are increasingly used for specialized applications requiring high temperature resistance and biocompatibility.

- Construction: The nascent but rapidly growing segment of construction materials for 3D printing, including concrete mixtures, is poised for significant expansion.

End-User Industry Ascendancy:

- Automotive: This sector is a major consumer of additive manufacturing for rapid prototyping, tooling, lightweight component production, and customization of interior and exterior parts. The drive for electric vehicles (EVs) and advanced driver-assistance systems (ADAS) further boosts demand for complex, integrated 3D printed parts.

- Aerospace & Defense: The inherent need for lightweight, high-strength, and complex components makes this industry a perennial leader in additive manufacturing adoption for both prototyping and flight-critical parts.

- Healthcare: From patient-specific implants and prosthetics to surgical guides and anatomical models, the healthcare sector is a significant driver, leveraging the precision and customization capabilities of 3D printing in healthcare.

- Electronics: The demand for rapid prototyping of intricate electronic components and custom casings fuels the adoption of additive manufacturing in this sector.

- Construction: With emerging technologies for 3D printed buildings and infrastructure, this sector represents a significant future growth market.

The synergistic growth across these segments, supported by government initiatives and industry collaborations, solidifies Germany's position as a global leader in additive manufacturing.

Germany Additive Manufacturing Market Product Developments

Product developments in the Germany additive manufacturing market are characterized by continuous innovation aimed at enhancing precision, speed, and material capabilities. Key advancements include the development of new high-performance polymer filaments and metal powders that offer improved mechanical properties and wider application ranges. Furthermore, 3D printer manufacturers are focusing on creating more sophisticated hardware, such as high-speed extrusion systems and advanced powder bed fusion machines capable of handling larger build volumes and intricate designs. The integration of AI and machine learning in 3D printing software is also a significant trend, enabling automated design optimization, process control, and defect detection, thereby improving part quality and reducing development cycles. These advancements collectively contribute to the increasing industrial adoption and market expansion of additive manufacturing.

Challenges in the Germany Additive Manufacturing Market Market

Despite its promising growth, the Germany additive manufacturing market faces several challenges. Regulatory hurdles, particularly concerning the standardization and certification of 3D printed parts for critical applications like aerospace and medical devices, can slow down adoption. Supply chain issues related to the consistent availability and quality of specialized 3D printing materials can impact production timelines and costs. Moreover, the initial high capital investment required for industrial-grade 3D printers and sophisticated software can be a barrier for smaller enterprises. Competitive pressures from established traditional manufacturing methods, especially for high-volume production of simpler parts, also persist. Addressing these challenges through policy support, material innovation, and accessible financing models is crucial for sustained market expansion.

Forces Driving Germany Additive Manufacturing Market Growth

Several powerful forces are propelling the growth of the Germany additive manufacturing market. Technologically, continuous improvements in 3D printing resolution, speed, and material science are expanding the range of feasible applications. Economically, the drive for cost reduction through optimized designs, reduced waste, and on-demand production is a significant motivator. Government initiatives supporting Industry 4.0 and advanced manufacturing technologies, including substantial R&D funding and favorable policy frameworks, play a crucial role. Furthermore, the increasing demand from key sectors like automotive and aerospace for lightweight, complex, and customized components directly fuels additive manufacturing adoption. The growing awareness and acceptance of 3D printed parts as viable end-use components, rather than just prototypes, is also a major growth accelerator.

Challenges in the Germany Additive Manufacturing Market Market

Long-term growth catalysts for the Germany additive manufacturing market are deeply rooted in continuous innovation and strategic market evolution. The development of entirely new material classes, such as advanced composites and biocompatible ceramics, will unlock novel applications in specialized fields. Strategic partnerships and collaborations between material suppliers, printer manufacturers, software developers, and end-users are essential for fostering a holistic ecosystem that accelerates technology integration. Market expansion into emerging sectors like personalized medicine, decentralized energy production, and sustainable construction will create new demand centers. Furthermore, the ongoing refinement of post-processing techniques, automation of the printing workflow, and the development of more intuitive and intelligent software solutions will enhance efficiency and accessibility, paving the way for broader industrial integration and sustained, exponential growth.

Emerging Opportunities in Germany Additive Manufacturing Market

Emerging opportunities in the Germany additive manufacturing market are diverse and rapidly evolving. The burgeoning field of personalized medicine, driven by advancements in bioprinting and patient-specific implants, presents a significant growth avenue. The increasing focus on sustainability and circular economy principles is creating opportunities for 3D printing in recycling and upcycling materials, as well as for producing more efficient and durable products with reduced environmental footprints. The integration of additive manufacturing into the construction industry for affordable housing and complex architectural designs is another promising frontier. Furthermore, the expansion of distributed manufacturing networks, powered by digital design files and localized 3D printing hubs, offers opportunities for increased supply chain resilience and faster delivery times. The development of specialized industrial 3D printing services tailored to specific niche applications is also a growing area of opportunity.

Leading Players in the Germany Additive Manufacturing Market Sector

- Stratasys Ltd

- 3D Systems Corporation

- Markforged Holding Corporation

- General Electric Company

- Desktop Metal Inc

- EOS GmBH

- Fraunhofer IGCV

- SLM Solutions

- Protolabs

- Shapeway Holdings Inc

- Velo3D Inc

Key Milestones in Germany Additive Manufacturing Market Industry

- July 2024: BASF's Forward AM division took over BASF's additive manufacturing business, including the Sculpteo service, rebranding it as Forward AM Technologies. This move aims to enhance customer support and market responsiveness, leveraging BASF's backing.

- June 2024: Quantica successfully raised EUR 19.7 million in Series A funding, led by West Hill Capital, with participation from a dental sector family company, Quantica's management, and Big Bang Angels.

- March 2024: Gefertec GmbH unveiled its arc80X Wire Arc Additive Manufacturing (WAAM) machine, offering compatibility with various welding systems, enabling customer customization and future upgradability.

Strategic Outlook for Germany Additive Manufacturing Market Market

The strategic outlook for the Germany additive manufacturing market is exceptionally positive, driven by a confluence of factors that will accelerate its growth and embed it further into the industrial fabric. The increasing demand for highly customized, complex, and lightweight components across key sectors like automotive, aerospace, and healthcare will continue to be a primary growth accelerator. Significant investments in research and development, particularly in novel materials and advanced printing technologies, will unlock new application possibilities. Government support for Industry 4.0 and digitalization initiatives, coupled with a strong focus on sustainability and circular economy principles, will further encourage the adoption of additive manufacturing. Strategic collaborations between technology providers, material scientists, and end-users will be crucial for developing integrated solutions and addressing industry-specific challenges. The market is poised for continued expansion as additive manufacturing transitions from a prototyping tool to a mainstream production methodology, offering enhanced efficiency, reduced lead times, and greater design freedom.

Germany Additive Manufacturing Market Segmentation

-

1. Component

-

1.1. Hardware

-

1.1.1. By Technology

- 1.1.1.1. Extrusion

- 1.1.1.2. Vat Photopolymerization

- 1.1.1.3. Powder Bed Fusion

- 1.1.1.4. Material Jetting

- 1.1.1.5. Others (DED and Binder Jetting)

-

1.1.1. By Technology

-

1.2. Materials

- 1.2.1. Metal

- 1.2.2. Polymers

- 1.2.3. Ceramics and Construction

- 1.3. Services

-

1.1. Hardware

-

2. End User Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Healthcare

- 2.4. Electronics

- 2.5. Construction and Other Emerging Industries

Germany Additive Manufacturing Market Segmentation By Geography

- 1. Germany

Germany Additive Manufacturing Market Regional Market Share

Geographic Coverage of Germany Additive Manufacturing Market

Germany Additive Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission

- 3.3. Market Restrains

- 3.3.1. Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission

- 3.4. Market Trends

- 3.4.1. Metals are Expected to Observe a Considerable Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Additive Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. By Technology

- 5.1.1.1.1. Extrusion

- 5.1.1.1.2. Vat Photopolymerization

- 5.1.1.1.3. Powder Bed Fusion

- 5.1.1.1.4. Material Jetting

- 5.1.1.1.5. Others (DED and Binder Jetting)

- 5.1.1.1. By Technology

- 5.1.2. Materials

- 5.1.2.1. Metal

- 5.1.2.2. Polymers

- 5.1.2.3. Ceramics and Construction

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Healthcare

- 5.2.4. Electronics

- 5.2.5. Construction and Other Emerging Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Stratasys Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3D Systems Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Markforged Holding Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Electric Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Desktop Metal Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EOS GmBH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fraunhofer IGCV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SLM Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Protolabs

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shapeway Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Velo3D Inc *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Stratasys Ltd

List of Figures

- Figure 1: Germany Additive Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Additive Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Additive Manufacturing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Germany Additive Manufacturing Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Germany Additive Manufacturing Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 4: Germany Additive Manufacturing Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 5: Germany Additive Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Germany Additive Manufacturing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Germany Additive Manufacturing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Germany Additive Manufacturing Market Volume Billion Forecast, by Component 2020 & 2033

- Table 9: Germany Additive Manufacturing Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 10: Germany Additive Manufacturing Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 11: Germany Additive Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Additive Manufacturing Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Additive Manufacturing Market?

The projected CAGR is approximately 20.60%.

2. Which companies are prominent players in the Germany Additive Manufacturing Market?

Key companies in the market include Stratasys Ltd, 3D Systems Corporation, Markforged Holding Corporation, General Electric Company, Desktop Metal Inc, EOS GmBH, Fraunhofer IGCV, SLM Solutions, Protolabs, Shapeway Holdings Inc, Velo3D Inc *List Not Exhaustive.

3. What are the main segments of the Germany Additive Manufacturing Market?

The market segments include Component, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission.

6. What are the notable trends driving market growth?

Metals are Expected to Observe a Considerable Growth.

7. Are there any restraints impacting market growth?

Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission.

8. Can you provide examples of recent developments in the market?

July 2024: BASF's Forward AM division took over BASF's additive manufacturing business, which includes the Sculpteo service. The division will operate under the name Forward AM Technologies. Backed by BASF, this strategic move seeks to enhance customer support and market responsiveness. The company will continue to offer its solutions and services to its strong customer base across the globe.June 2024: Quantica successfully raised its Series A funding, totaling EUR 19.7 million. The funding extension was spearheaded by West Hill Capital, a British private equity and venture capital firm. They were joined by a family-owned company from the dental sector, Quantica's management team, and Big Bang Angels, a venture capital firm from Korea.March 2024: Gefertec GmbH unveiled its arc80X Wire Arc Additive Manufacturing (WAAM) machine, which supports a range of welding systems from various manufacturers. This feature empowers customers to tailor the machine to their specific needs. Furthermore, this adaptability means the machine can be upgraded or modified should customers decide to incorporate new functionalities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Additive Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Additive Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Additive Manufacturing Market?

To stay informed about further developments, trends, and reports in the Germany Additive Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence