Key Insights

The Asia Pacific smartphone camera lens market is projected for significant expansion, anticipated to reach $800 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 15% through 2033. This growth is propelled by the escalating demand for superior mobile photography experiences across all smartphone tiers in the region. Key drivers include the expanding middle class in markets like India and Southeast Asia, alongside rapid technological advancements in China and South Korea, fostering the adoption of smartphones with advanced camera systems. Primary growth factors encompass the integration of multi-lens configurations, the rising popularity of computational photography, and continuous innovation in lens technologies such as periscope lenses for optical zoom and advanced image stabilization. The need for higher resolution sensors and enhanced low-light performance also stimulates investment in cutting-edge lens designs and materials.

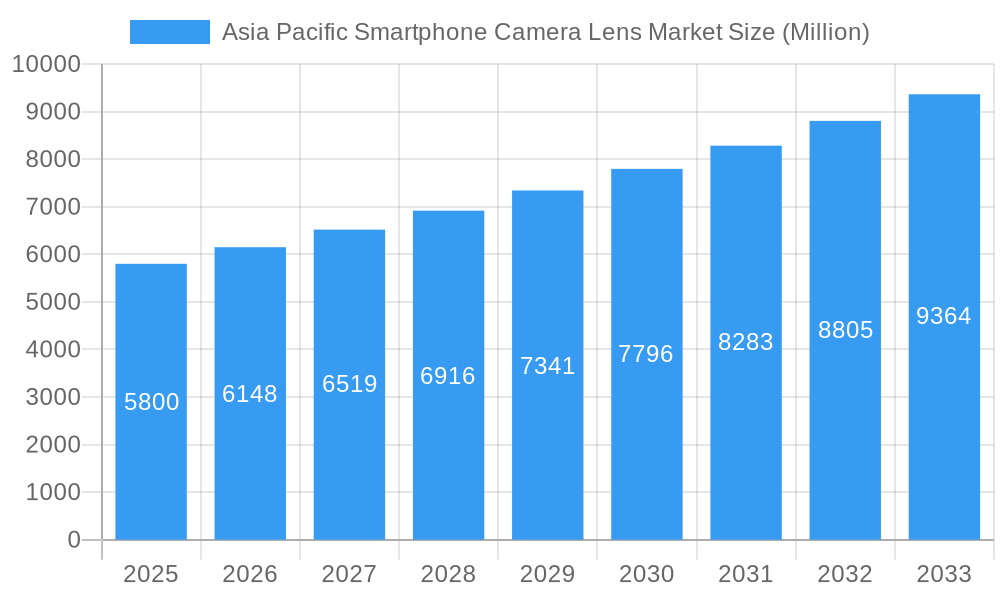

Asia Pacific Smartphone Camera Lens Market Market Size (In Million)

The market is shaped by a synergy of technological innovation and evolving consumer preferences. Autofocus lenses are expected to maintain dominance due to their crucial role in capturing sharp images, while fixed-focus lenses will likely serve entry-level segments. The increasing adoption of advanced lens types, including telephoto and wide-angle lenses in mid-to-high-end smartphones, addresses diverse photographic needs. While demand is robust, potential restraints include supply chain disruptions and the increasing complexity and cost of high-performance lens manufacturing. However, strategic efforts by leading companies such as Largan Precision Company Limited, Genius Electronic Optical (GSEO), and Sunny Optical Technology Company Limited, focusing on innovation and cost-efficiency, are poised to overcome these challenges. The Asia Pacific region, with its vast smartphone user base and rapid product development, remains a focal point for market growth.

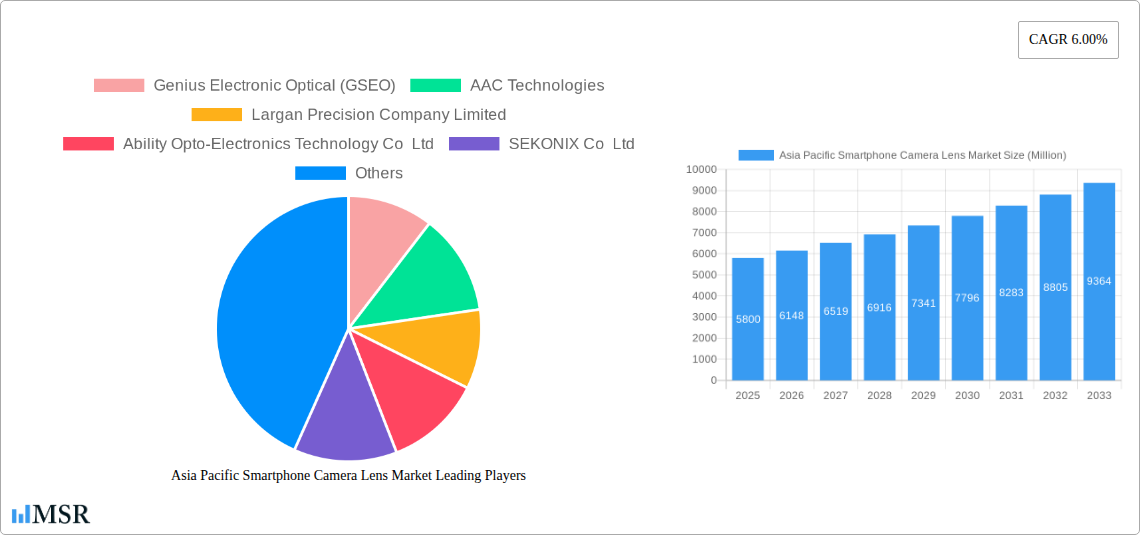

Asia Pacific Smartphone Camera Lens Market Company Market Share

Gain comprehensive insights into the dynamic Asia Pacific Smartphone Camera Lens Market. This report, covering a study period from 2019 to 2033, with a base year of 2025, offers actionable intelligence for industry stakeholders. Explore market dynamics, emerging trends, key segments, product innovations, challenges, and growth drivers defining the future of smartphone camera lenses in the APAC region.

Asia Pacific Smartphone Camera Lens Market Market Concentration & Dynamics

The Asia Pacific smartphone camera lens market is characterized by a moderate to high level of concentration, with a few dominant players holding significant market share. Key players like Largan Precision Company Limited and Sunny Optical Technology Company Limited are at the forefront, driving innovation and production volumes. The innovation ecosystem is robust, fueled by continuous R&D investments in advanced optical technologies such as higher pixel counts, improved aperture ratios, and enhanced optical image stabilization (OIS). Regulatory frameworks within various APAC countries generally support manufacturing and technological advancement, though specific import/export regulations may vary. Substitute products, such as advanced computational photography software, are gaining traction but are unlikely to fully replace the fundamental need for high-quality optical lenses in the near to medium term. End-user trends heavily favor devices with superior camera capabilities, driving demand across all smartphone tiers. Merger and acquisition (M&A) activities, while not consistently high in volume, are strategic, often aimed at consolidating expertise or expanding market reach. For instance, recent M&A deal counts have been estimated at around 5-10 significant transactions in the historical period (2019-2024). Market share analysis indicates that the top 3-5 players collectively hold over 70% of the market.

Asia Pacific Smartphone Camera Lens Market Industry Insights & Trends

The Asia Pacific smartphone camera lens market is projected to experience robust growth, with an estimated market size of approximately $8,500 Million in the base year 2025, and a projected Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period of 2025–2033. This expansion is primarily driven by the insatiable consumer demand for enhanced mobile photography and videography experiences. The rapid adoption of 5G technology across the region is a significant catalyst, enabling higher data transfer rates that support the transmission and processing of high-resolution image and video content. Furthermore, the increasing integration of artificial intelligence (AI) and machine learning (ML) in smartphone camera systems necessitates sophisticated lens modules capable of capturing detailed data for AI algorithms, further bolstering market growth.

Technological disruptions are constantly reshaping the landscape. The relentless pursuit of higher pixel counts, wider apertures, and advanced optical stabilization systems are key trends. Miniaturization of components while maintaining or improving optical performance is another critical area of focus, driven by the ever-thinning designs of modern smartphones. The development of specialized lenses, such as periscope lenses for enhanced optical zoom capabilities, is also a significant trend, catering to consumers seeking professional-grade photography on their mobile devices.

Evolving consumer behaviors are deeply intertwined with market dynamics. Consumers are increasingly making purchasing decisions based on camera specifications, treating their smartphones as their primary photography tools. This has led to a premiumization of mid-range and even entry-level smartphones, as manufacturers equip them with more advanced camera hardware to remain competitive. The rise of content creation platforms and social media further amplifies this trend, as users seek to capture and share high-quality visual content. The demand for features like low-light performance, advanced bokeh effects, and high-resolution video recording continues to grow, pushing lens manufacturers to innovate at an unprecedented pace. The historical period (2019-2024) saw a steady increase in unit shipments and average selling prices, reflecting these evolving consumer preferences and technological advancements. The market size in the historical period grew from approximately $5,200 Million in 2019 to an estimated $7,800 Million in 2024.

Key Markets & Segments Leading Asia Pacific Smartphone Camera Lens Market

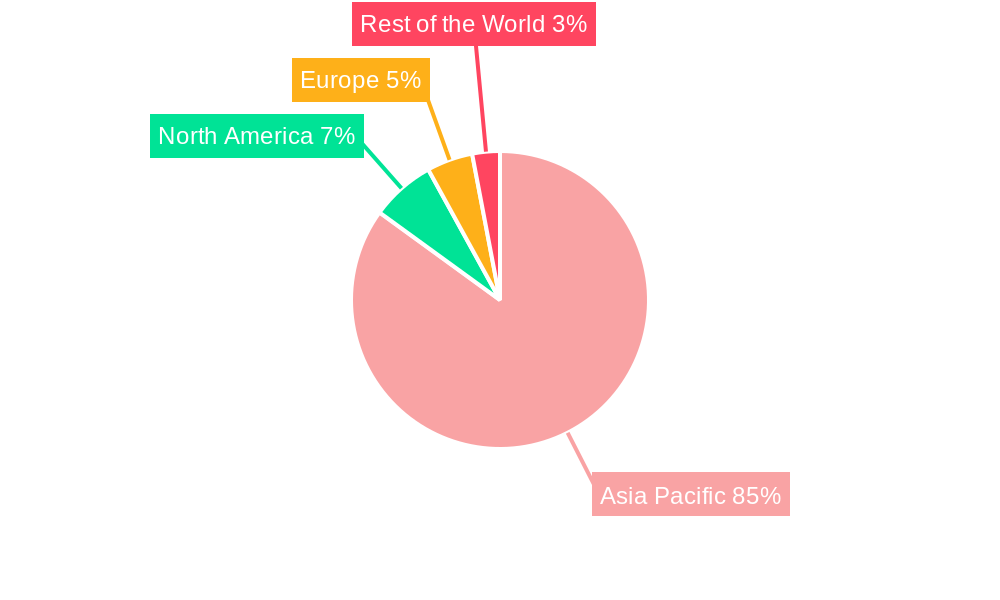

The Asia Pacific region itself stands as the undisputed leader in the global smartphone camera lens market, driven by its massive smartphone manufacturing base and a substantial consumer market. Within the APAC region, China emerges as the dominant country, housing the majority of global smartphone production and a significant portion of lens manufacturing capabilities. The dominance is fueled by several key factors.

Drivers of Dominance:

- Manufacturing Hub: China's established electronics manufacturing ecosystem, skilled labor force, and robust supply chain infrastructure make it the primary location for smartphone and component production.

- Consumer Demand: A vast and growing middle class with increasing disposable income fuels high smartphone sales, driving demand for advanced camera features.

- Technological Advancement: Significant R&D investments by local and international players in China have propelled innovation in optical technologies and lens manufacturing.

- Government Support: Favorable government policies and incentives for the electronics manufacturing sector further bolster the region's leadership.

Segment Dominance:

- Type: Autofocus: The Autofocus segment overwhelmingly dominates the market. This is a direct consequence of its integration into virtually all smartphones beyond the most basic models. Autofocus technology is crucial for capturing sharp, clear images across a variety of shooting conditions and distances, a non-negotiable feature for modern smartphone users. The market size for Autofocus lenses is estimated to be around $7,200 Million in 2025.

- Lens Type: Wide-Angle & Telephoto: While Wide-Angle lenses are ubiquitous for everyday photography and capturing expansive scenes, the increasing demand for photographic versatility is propelling the Telephoto lens segment. The integration of multi-camera systems, with dedicated telephoto lenses for optical zoom, is a key trend driven by consumers seeking to capture distant subjects with clarity. The combined market for Wide-Angle and Telephoto lenses is estimated to be over $6,500 Million in 2025, with Telephoto experiencing a higher growth rate.

- End-Use: Mid-Range & High-End Smartphones: The Mid-Range Smartphones segment represents the largest volume and revenue driver for camera lenses, as manufacturers equip these devices with increasingly sophisticated camera systems to compete effectively. However, the High-End Smartphones segment, while smaller in volume, commands higher average selling prices due to the integration of cutting-edge, premium camera technologies. The market size for Mid-Range Smartphone camera lenses is estimated at $4,800 Million in 2025, and for High-End Smartphones at $2,500 Million. Entry-Level Smartphones, while still significant, utilize more basic lens configurations.

Asia Pacific Smartphone Camera Lens Market Product Developments

Product innovation in the Asia Pacific smartphone camera lens market is characterized by a relentless pursuit of enhanced optical performance and miniaturization. Advancements include the development of ultra-thin aspherical lenses, improved multi-layer anti-reflective coatings for reduced glare and ghosting, and the integration of sophisticated optical image stabilization (OIS) mechanisms. The emergence of periscope lens designs enabling significant optical zoom capabilities within slim smartphone profiles is a key market relevance, catering to user demand for professional-grade photography. Furthermore, innovations in material science are leading to more durable and scratch-resistant lens surfaces, ensuring longevity and sustained image quality. The market relevance of these developments is high, directly impacting smartphone competitiveness and consumer purchasing decisions.

Challenges in the Asia Pacific Smartphone Camera Lens Market Market

The Asia Pacific smartphone camera lens market faces several significant challenges. Intense price competition among numerous manufacturers, particularly in the commoditized segments, exerts downward pressure on profit margins. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, pose a constant risk to production timelines and costs. Rising R&D expenditures required to keep pace with technological advancements, such as advanced computational photography integration and novel optical designs, represent a substantial financial burden. Furthermore, stringent quality control requirements and the need to meet ever-evolving consumer expectations for image quality can lead to higher production costs and increased defect rates.

Forces Driving Asia Pacific Smartphone Camera Lens Market Growth

Several key forces are propelling the growth of the Asia Pacific smartphone camera lens market. The escalating consumer demand for superior mobile photography and videography capabilities is a primary driver. The widespread adoption of 5G technology necessitates and enables higher-resolution imaging, thereby boosting demand for advanced camera lenses. Continuous technological innovation, including advancements in lens design, sensor technology, and image processing, fuels the upgrade cycle for smartphones. The increasing integration of AI and machine learning in smartphone cameras also requires sophisticated optical components to capture rich data. Furthermore, the growing content creation culture across social media platforms encourages users to invest in devices with exceptional camera performance.

Challenges in the Asia Pacific Smartphone Camera Lens Market Market

Long-term growth catalysts for the Asia Pacific smartphone camera lens market are deeply rooted in sustained technological innovation and strategic market expansions. The ongoing development of entirely new optical technologies, such as liquid lenses or meta-lenses, holds the potential to revolutionize smartphone camera capabilities and create new market segments. Strategic partnerships between lens manufacturers and smartphone brands, as well as with AI chip developers, will be crucial for co-creating integrated imaging solutions. Exploring untapped potential in emerging economies within the APAC region and catering to niche applications like augmented reality (AR) and virtual reality (VR) integration will also contribute significantly to sustained long-term growth.

Emerging Opportunities in Asia Pacific Smartphone Camera Lens Market

Emerging opportunities in the Asia Pacific smartphone camera lens market are multifaceted. The increasing demand for computational photography enhancements presents a significant avenue for growth, as lenses need to be optimized to capture data for complex AI algorithms. The burgeoning market for foldable smartphones requires specialized, highly flexible, and durable lens solutions. Furthermore, the growing interest in augmented reality (AR) and virtual reality (VR) applications on mobile devices will necessitate advanced camera modules with enhanced depth sensing and wider field-of-view capabilities. Opportunities also lie in developing more sustainable and eco-friendly manufacturing processes and materials for camera lenses.

Leading Players in the Asia Pacific Smartphone Camera Lens Market Sector

- Genius Electronic Optical (GSEO)

- AAC Technologies

- Largan Precision Company Limited

- Ability Opto-Electronics Technology Co Ltd

- SEKONIX Co Ltd

- Sunny Optical Technology Company Limited

- Union Optech (Zhongshan) Co Ltd

- IM Co Ltd

- Cowell Optics

- Kantatsu Co Ltd

- Kinko Optical Co Ltd

Key Milestones in Asia Pacific Smartphone Camera Lens Market Industry

- 2019: Introduction of 100MP+ camera sensors, driving demand for higher-resolution lens designs.

- 2020: Significant advancements in periscope lens technology, enabling 5x and 10x optical zoom in smartphones.

- 2021: Increased adoption of larger aperture lenses (f/1.5, f/1.4) for improved low-light performance.

- 2022: Growing integration of advanced optical image stabilization (OIS) across mid-range smartphone segments.

- 2023: Emergence of foldable smartphone designs with unique lens requirements and manufacturing challenges.

- 2024: Enhanced focus on AI-driven computational photography, requiring more precise lens data capture.

Strategic Outlook for Asia Pacific Smartphone Camera Lens Market Market

The strategic outlook for the Asia Pacific smartphone camera lens market is exceptionally bright, driven by continuous technological innovation and expanding market applications. Future growth accelerators include the integration of next-generation optical technologies, such as meta-lenses and advanced liquid lens systems, which promise to unlock new levels of optical performance and miniaturization. Strategic collaborations with AI and machine learning developers will be pivotal in creating integrated imaging solutions that cater to the evolving demands of smartphone users. Furthermore, the untapped potential in emerging markets and niche applications like AR/VR will offer significant avenues for market expansion and revenue diversification.

Asia Pacific Smartphone Camera Lens Market Segmentation

-

1. Type

- 1.1. Fixed Focus

- 1.2. Autofocus

-

2. Lens Type

- 2.1. Telephoto

- 2.2. Wide-Angle

- 2.3. Macro

-

3. End-Use

- 3.1. Entry-Level Smartphones

- 3.2. Mid-Range Smartphones

- 3.3. High-End Smartphones

Asia Pacific Smartphone Camera Lens Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Smartphone Camera Lens Market Regional Market Share

Geographic Coverage of Asia Pacific Smartphone Camera Lens Market

Asia Pacific Smartphone Camera Lens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies

- 3.3. Market Restrains

- 3.3.1. Competition from Other Substitutes

- 3.4. Market Trends

- 3.4.1. Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Smartphone Camera Lens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Focus

- 5.1.2. Autofocus

- 5.2. Market Analysis, Insights and Forecast - by Lens Type

- 5.2.1. Telephoto

- 5.2.2. Wide-Angle

- 5.2.3. Macro

- 5.3. Market Analysis, Insights and Forecast - by End-Use

- 5.3.1. Entry-Level Smartphones

- 5.3.2. Mid-Range Smartphones

- 5.3.3. High-End Smartphones

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Genius Electronic Optical (GSEO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AAC Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Largan Precision Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ability Opto-Electronics Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SEKONIX Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunny Optical Technology Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Union Optech (Zhongshan) Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IM Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cowell Optics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kantatsu Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kinko Optical Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Genius Electronic Optical (GSEO)

List of Figures

- Figure 1: Asia Pacific Smartphone Camera Lens Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Smartphone Camera Lens Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by Lens Type 2020 & 2033

- Table 4: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by Lens Type 2020 & 2033

- Table 5: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by End-Use 2020 & 2033

- Table 6: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by End-Use 2020 & 2033

- Table 7: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by Lens Type 2020 & 2033

- Table 12: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by Lens Type 2020 & 2033

- Table 13: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by End-Use 2020 & 2033

- Table 14: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by End-Use 2020 & 2033

- Table 15: Asia Pacific Smartphone Camera Lens Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Smartphone Camera Lens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: China Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Pacific Smartphone Camera Lens Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Pacific Smartphone Camera Lens Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Smartphone Camera Lens Market?

The projected CAGR is approximately 15%.

2. Which companies are prominent players in the Asia Pacific Smartphone Camera Lens Market?

Key companies in the market include Genius Electronic Optical (GSEO), AAC Technologies, Largan Precision Company Limited, Ability Opto-Electronics Technology Co Ltd, SEKONIX Co Ltd, Sunny Optical Technology Company Limited, Union Optech (Zhongshan) Co Ltd, IM Co Ltd, Cowell Optics, Kantatsu Co Ltd, Kinko Optical Co Ltd.

3. What are the main segments of the Asia Pacific Smartphone Camera Lens Market?

The market segments include Type , Lens Type, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 800 million as of 2022.

5. What are some drivers contributing to market growth?

; Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies.

6. What are the notable trends driving market growth?

Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies.

7. Are there any restraints impacting market growth?

Competition from Other Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Smartphone Camera Lens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Smartphone Camera Lens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Smartphone Camera Lens Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Smartphone Camera Lens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence