Key Insights

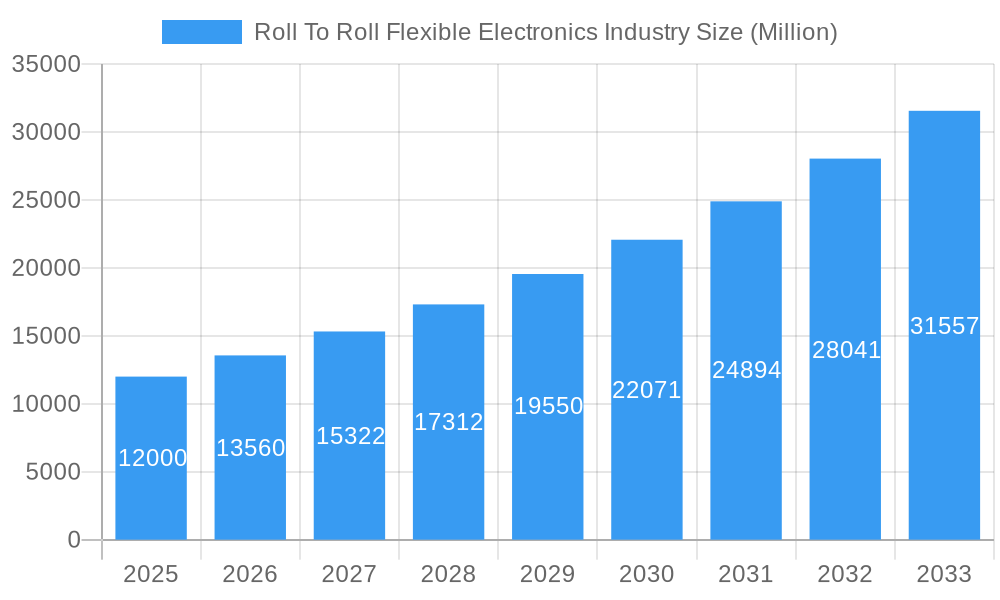

The global Roll-to-Roll Flexible Electronics market is set for significant expansion, projected to reach $23.66 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) of 10.4%. This growth is propelled by the increasing demand for lightweight, bendable, and integrated electronic components across diverse industries. Key applications fueling this trend include advanced sensors for IoT and wearables, vibrant displays for next-generation devices, high-performance batteries for portable and sustainable energy, and efficient photovoltaic cells for renewable energy generation. The burgeoning consumer electronics sector, alongside automotive advancements in integrated dashboards and EV components, critical healthcare needs for flexible medical sensors, and aerospace and defense requirements for resilient electronics, are key contributors to market momentum.

Roll To Roll Flexible Electronics Industry Market Size (In Billion)

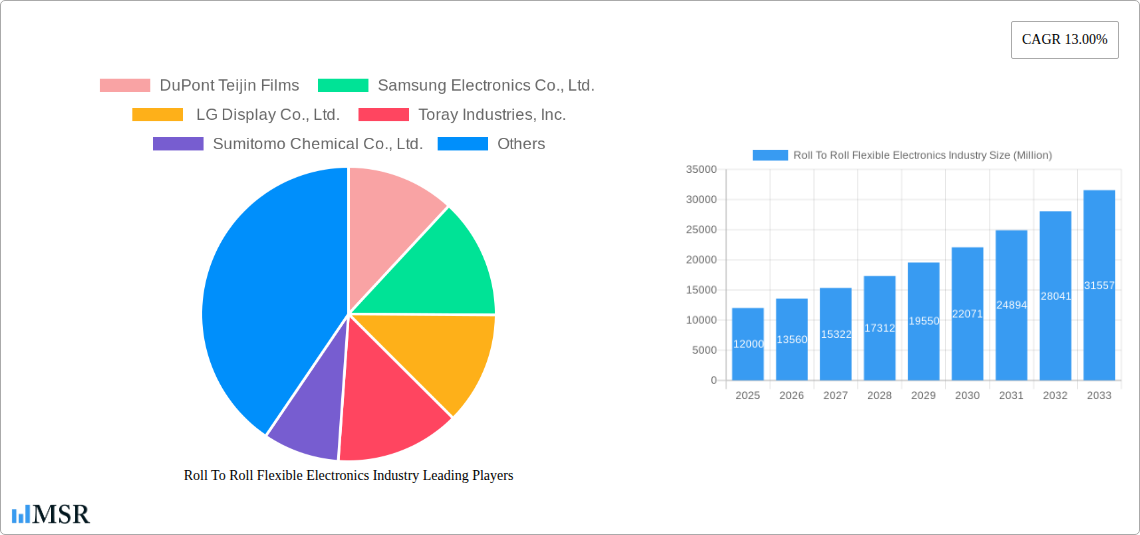

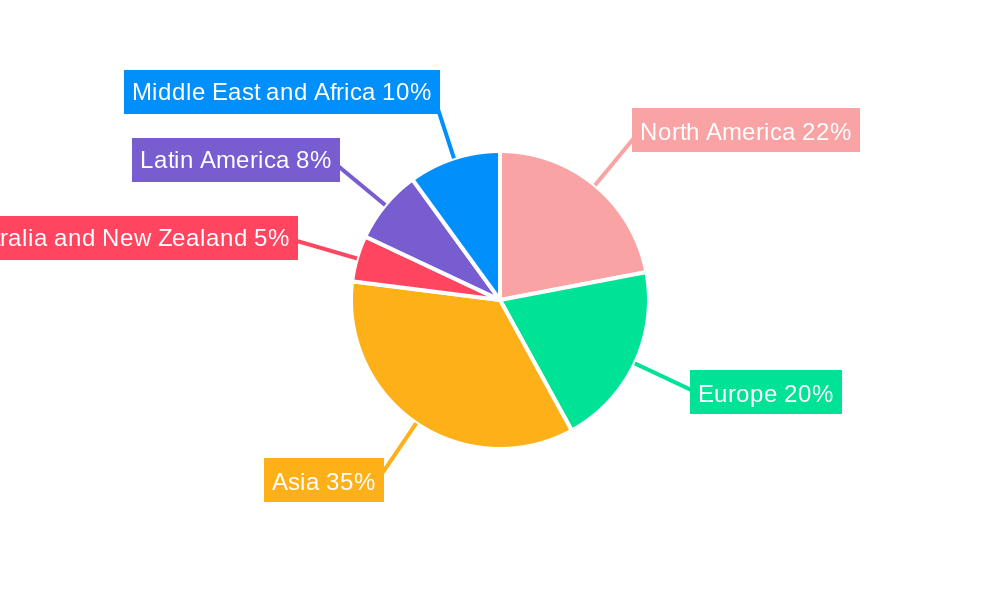

Market dynamics are further shaped by miniaturization, novel conductive inks, and advancements in printing technologies. Sustainability is a significant driver, with roll-to-roll manufacturing offering eco-friendly and cost-effective production. Challenges include ensuring the long-term reliability of flexible components and the need for substantial investment in advanced manufacturing infrastructure. However, collaborative efforts from leading companies such as DuPont Teijin Films, Samsung Electronics Co., Ltd., LG Display Co., Ltd., Toray Industries, Inc., and Sumitomo Chemical Co., Ltd., coupled with expanding R&D investments, are paving the way for the ubiquitous adoption of flexible electronics. The market is expected to experience robust growth globally, with Asia leading due to its strong manufacturing base and rapid technology adoption.

Roll To Roll Flexible Electronics Industry Company Market Share

This report offers an in-depth analysis of the global Roll-to-Roll Flexible Electronics Industry, a sector poised for substantial growth. Covering the study period of 2019–2033, with a base year of 2025, this report provides critical insights into market dynamics, trends, challenges, and opportunities. Forecasts for the period 2025–2033 are meticulously detailed, building upon historical data. Discover key market drivers, emerging technologies, and the strategic landscape for stakeholders including DuPont Teijin Films, Samsung Electronics Co., Ltd., LG Display Co., Ltd., Toray Industries, Inc., and Sumitomo Chemical Co., Ltd.

Roll To Roll Flexible Electronics Industry Market Concentration & Dynamics

The Roll To Roll Flexible Electronics Industry exhibits a moderate to high degree of market concentration, with leading players like Samsung Electronics Co., Ltd. and LG Display Co., Ltd. wielding significant influence through extensive R&D investments and established manufacturing capabilities. The innovation ecosystem is characterized by intense competition and strategic collaborations focused on developing advanced materials and manufacturing processes. Regulatory frameworks are gradually evolving to support the integration of flexible electronics in diverse applications, though standards for interoperability and safety are still under development. Substitute products, such as rigid electronics, continue to exist, but the unique advantages of flexibility, lightweight design, and cost-effectiveness are driving adoption in niche and mainstream markets. End-user trends are heavily influenced by the growing demand for wearable devices, smart packaging, and advanced medical sensors. Merger and acquisition (M&A) activities, while not yet at their peak, are expected to accelerate as companies seek to consolidate market share, acquire critical technologies, and expand their geographical reach. The market is projected to see an estimated XX Million in M&A deals within the forecast period, with key players actively scouting for strategic targets.

Roll To Roll Flexible Electronics Industry Industry Insights & Trends

The Roll To Roll Flexible Electronics Industry is on an upward trajectory, driven by a confluence of technological advancements and increasing end-user demand. The market size is estimated to reach $XXX Billion by 2033, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust growth is fueled by several key factors. Firstly, the relentless pursuit of miniaturization and enhanced functionality in consumer electronics necessitates flexible form factors, enabling the development of sleeker smartphones, foldable displays, and advanced wearables. Secondly, the automotive sector's increasing integration of smart features, including flexible displays for dashboards and sensors embedded in vehicle interiors, is a significant growth catalyst. The healthcare industry is another major contributor, with a rising demand for wearable health monitors, flexible biosensors, and implantable medical devices that leverage the unique properties of roll-to-roll manufactured electronics. Furthermore, the burgeoning Internet of Things (IoT) ecosystem requires cost-effective, mass-producible electronic components, a niche perfectly suited for roll-to-roll processing. Advancements in materials science, particularly in conductive inks, organic semiconductors, and advanced substrates, are continuously pushing the boundaries of performance and durability, making flexible electronics a viable alternative to traditional rigid components. The development of sophisticated printing and coating techniques within the roll-to-roll manufacturing paradigm is further reducing production costs and increasing manufacturing speeds, thereby enhancing market accessibility and adoption rates.

Key Markets & Segments Leading Roll To Roll Flexible Electronics Industry

The Roll To Roll Flexible Electronics Industry is witnessing significant dominance from the Asia-Pacific region, particularly China, South Korea, and Japan, owing to their robust manufacturing infrastructure, strong government support for technological innovation, and a high concentration of leading electronics manufacturers. Within the Application segment, Displays are currently the largest market share holder, projected to account for an estimated XX% of the total market by 2033. This is driven by the widespread adoption of flexible displays in smartphones, televisions, and other consumer electronics, with companies like LG Display Co., Ltd. and Samsung Electronics Co., Ltd. at the forefront. The Sensors segment is experiencing rapid growth, expected to reach $XX Billion by 2033, propelled by the increasing demand for smart wearables, IoT devices, and advanced medical diagnostics. Key drivers for this segment include enhanced functionality, miniaturization, and the ability to integrate sensors seamlessly into various surfaces.

- Dominant Application Segments & Drivers:

- Displays:

- Economic Growth: Robust consumer spending on advanced electronic devices.

- Technological Advancement: Development of foldable, rollable, and transparent display technologies.

- Market Penetration: Increasing adoption in smartphones, tablets, and emerging form factors.

- Sensors:

- IoT Expansion: Growing demand for connected devices requiring integrated sensing capabilities.

- Healthcare Innovation: Rise of wearable health trackers, point-of-care diagnostics, and implantable sensors.

- Automotive Integration: Increased use of sensors for safety, driver assistance, and infotainment systems.

- Batteries:

- Demand for Portable Power: Need for flexible and lightweight energy storage solutions for wearables and IoT devices.

- Electric Vehicle Growth: Potential for integration into vehicle designs, though rigid battery technology still dominates.

- Photovoltaic Cells:

- Renewable Energy Push: Growing interest in flexible solar panels for building-integrated photovoltaics (BIPV) and portable power generation.

- Cost Reduction: Efforts to make flexible solar cells more competitive with traditional silicon-based panels.

- Displays:

The End-user Industry landscape is primarily led by Consumer Electronics, accounting for an estimated XX% of the market in 2025. However, the Automotive and Transportation sector is emerging as a significant growth driver, with its increasing demand for flexible displays, sensors, and lighting solutions. The Healthcare industry is also a key area of expansion, driven by the need for advanced medical devices and patient monitoring systems. The Aerospace and Defense sector presents niche opportunities for lightweight, durable flexible electronics in applications like flexible displays for cockpits and advanced sensor systems.

Roll To Roll Flexible Electronics Industry Product Developments

Product innovation in the Roll To Roll Flexible Electronics Industry is primarily focused on enhancing performance, reducing manufacturing costs, and expanding application possibilities. Key developments include the creation of highly conductive and flexible inks, improved organic semiconductor materials offering better charge mobility, and advanced polymer substrates providing enhanced durability and thermal stability. Manufacturers are also innovating in printing techniques, such as inkjet and gravure printing, to achieve higher resolution and greater throughput. The market is seeing a surge in flexible OLED displays with improved brightness and energy efficiency, alongside the development of flexible sensors capable of detecting a wider range of stimuli with increased accuracy. Furthermore, the integration of flexible batteries and energy harvesting solutions is paving the way for truly autonomous and self-powered flexible electronic devices.

Challenges in the Roll To Roll Flexible Electronics Industry Market

Despite its promising growth, the Roll To Roll Flexible Electronics Industry faces several significant challenges. Achieving high yields and consistent quality in mass production remains a hurdle, with defect rates often higher compared to traditional rigid electronics manufacturing. The cost of advanced materials, such as high-performance conductive inks and specialized substrates, can also be a deterrent for widespread adoption. Furthermore, the development of robust and standardized interoperability protocols for flexible electronic components is crucial for seamless integration into complex systems. Supply chain complexities, including the sourcing of raw materials and ensuring a stable supply of specialized manufacturing equipment, add another layer of difficulty. Regulatory approval processes for flexible electronics in sensitive applications like healthcare and automotive can also be lengthy and demanding. Competitive pressures from established rigid electronics manufacturers also require continuous innovation and cost optimization.

Forces Driving Roll To Roll Flexible Electronics Industry Growth

Several key forces are propelling the growth of the Roll To Roll Flexible Electronics Industry. Technological advancements in materials science and printing techniques are fundamental drivers, enabling the creation of more sophisticated and cost-effective flexible electronic components. The increasing demand for miniaturization and novel form factors in consumer electronics, driven by evolving consumer preferences for sleek, portable, and versatile devices, is a major catalyst. The expansion of the Internet of Things (IoT) ecosystem necessitates flexible, low-cost electronic solutions for a wide array of connected devices. Government initiatives and investments in advanced manufacturing and emerging technologies are also playing a crucial role in fostering industry growth. Furthermore, the growing awareness and adoption of sustainable energy solutions are creating opportunities for flexible photovoltaic cells and energy storage devices.

Challenges in the Roll To Roll Flexible Electronics Industry Market

Long-term growth catalysts for the Roll To Roll Flexible Electronics Industry lie in overcoming existing technological and manufacturing hurdles. Continued research and development into novel materials with enhanced conductivity, flexibility, and durability will be critical. Further optimization of roll-to-roll manufacturing processes to achieve higher yields, greater precision, and reduced waste is essential for cost competitiveness. Strategic partnerships and collaborations between material suppliers, equipment manufacturers, and end-product developers will accelerate innovation and market adoption. Expansion into new and emerging markets, such as smart textiles, flexible displays for augmented reality, and advanced medical implants, will unlock significant future growth potential. Establishing robust intellectual property protection and standardized testing methodologies will also contribute to market maturity and investor confidence.

Emerging Opportunities in Roll To Roll Flexible Electronics Industry

Emerging opportunities within the Roll To Roll Flexible Electronics Industry are abundant and diverse. The development of flexible and transparent electronics for augmented reality (AR) and virtual reality (VR) applications represents a significant frontier. Smart textiles, integrating flexible electronic sensors and displays into clothing for health monitoring, communication, and haptic feedback, offer a vast untapped market. The increasing demand for sustainable and disposable electronics in packaging and medical applications presents another promising avenue. Furthermore, the miniaturization and flexibility of electronic components are opening doors for advanced implantable medical devices and flexible prosthetics, revolutionizing healthcare. The integration of AI and machine learning capabilities within flexible electronic devices will further enhance their functionality and market appeal.

Leading Players in the Roll To Roll Flexible Electronics Industry Sector

- DuPont Teijin Films

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

Key Milestones in Roll To Roll Flexible Electronics Industry Industry

- 2019: Launch of foldable smartphones with flexible OLED displays, marking a significant consumer adoption milestone.

- 2020: Development of advanced conductive inks with significantly improved conductivity and printability, enhancing manufacturing efficiency.

- 2021: Introduction of thinner and more durable flexible substrates, enabling wider applications in wearables and IoT devices.

- 2022: Increased investment in R&D for flexible sensors for healthcare applications, leading to prototypes for advanced diagnostics.

- 2023: Emergence of flexible battery technologies with improved energy density and charging capabilities, addressing power limitations.

- 2024: Significant advancements in roll-to-roll printing for large-area flexible displays, paving the way for wider adoption in public displays and signage.

Strategic Outlook for Roll To Roll Flexible Electronics Industry Market

The strategic outlook for the Roll To Roll Flexible Electronics Industry is overwhelmingly positive, driven by continuous innovation and expanding application horizons. The market is poised for sustained growth, fueled by the increasing demand for personalized and connected devices across consumer, automotive, and healthcare sectors. Strategic opportunities lie in the development of highly integrated flexible electronic systems that combine sensing, processing, and communication capabilities. Further investment in advanced materials and manufacturing processes will be crucial for cost reduction and performance enhancement. Companies that can effectively navigate regulatory landscapes, establish strong supply chains, and foster strategic partnerships will be well-positioned for success. The future promises a world where electronics are seamlessly integrated into our environment, enabled by the ubiquitous adoption of roll-to-roll flexible technologies.

Roll To Roll Flexible Electronics Industry Segmentation

-

1. Application

- 1.1. Sensors

- 1.2. Displays

- 1.3. Batteries

- 1.4. Photovoltaics Cells

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive and Transportation

- 2.3. Healthcare

- 2.4. Aerospace and Defense

- 2.5. Other End-user Industries

Roll To Roll Flexible Electronics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Roll To Roll Flexible Electronics Industry Regional Market Share

Geographic Coverage of Roll To Roll Flexible Electronics Industry

Roll To Roll Flexible Electronics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low acquisition costs of object-based solutions (especially for large-scale storage); Technological advancements such as multi-cloud data management and introduction of ML In storage analytics

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Interoperability

- 3.3.3 and Security Concerns

- 3.4. Market Trends

- 3.4.1. North America to be a Substantial Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sensors

- 5.1.2. Displays

- 5.1.3. Batteries

- 5.1.4. Photovoltaics Cells

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive and Transportation

- 5.2.3. Healthcare

- 5.2.4. Aerospace and Defense

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sensors

- 6.1.2. Displays

- 6.1.3. Batteries

- 6.1.4. Photovoltaics Cells

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Automotive and Transportation

- 6.2.3. Healthcare

- 6.2.4. Aerospace and Defense

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sensors

- 7.1.2. Displays

- 7.1.3. Batteries

- 7.1.4. Photovoltaics Cells

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Automotive and Transportation

- 7.2.3. Healthcare

- 7.2.4. Aerospace and Defense

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sensors

- 8.1.2. Displays

- 8.1.3. Batteries

- 8.1.4. Photovoltaics Cells

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Automotive and Transportation

- 8.2.3. Healthcare

- 8.2.4. Aerospace and Defense

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Australia and New Zealand Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sensors

- 9.1.2. Displays

- 9.1.3. Batteries

- 9.1.4. Photovoltaics Cells

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Automotive and Transportation

- 9.2.3. Healthcare

- 9.2.4. Aerospace and Defense

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sensors

- 10.1.2. Displays

- 10.1.3. Batteries

- 10.1.4. Photovoltaics Cells

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Consumer Electronics

- 10.2.2. Automotive and Transportation

- 10.2.3. Healthcare

- 10.2.4. Aerospace and Defense

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Middle East and Africa Roll To Roll Flexible Electronics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Sensors

- 11.1.2. Displays

- 11.1.3. Batteries

- 11.1.4. Photovoltaics Cells

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Consumer Electronics

- 11.2.2. Automotive and Transportation

- 11.2.3. Healthcare

- 11.2.4. Aerospace and Defense

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DuPont Teijin Films

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Samsung Electronics Co. Ltd.

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 LG Display Co. Ltd.

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Toray Industries Inc.

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sumitomo Chemical Co. Ltd.

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.1 DuPont Teijin Films

List of Figures

- Figure 1: Global Roll To Roll Flexible Electronics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Roll To Roll Flexible Electronics Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Roll To Roll Flexible Electronics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Roll To Roll Flexible Electronics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Roll To Roll Flexible Electronics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Roll To Roll Flexible Electronics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Roll To Roll Flexible Electronics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Roll To Roll Flexible Electronics Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: Europe Roll To Roll Flexible Electronics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Roll To Roll Flexible Electronics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Roll To Roll Flexible Electronics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Roll To Roll Flexible Electronics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Roll To Roll Flexible Electronics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Roll To Roll Flexible Electronics Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Asia Roll To Roll Flexible Electronics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Roll To Roll Flexible Electronics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Roll To Roll Flexible Electronics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Roll To Roll Flexible Electronics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Roll To Roll Flexible Electronics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Roll To Roll Flexible Electronics Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Australia and New Zealand Roll To Roll Flexible Electronics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Australia and New Zealand Roll To Roll Flexible Electronics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Roll To Roll Flexible Electronics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Roll To Roll Flexible Electronics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Roll To Roll Flexible Electronics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Roll To Roll Flexible Electronics Industry Revenue (billion), by Application 2025 & 2033

- Figure 27: Latin America Roll To Roll Flexible Electronics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Latin America Roll To Roll Flexible Electronics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Latin America Roll To Roll Flexible Electronics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Roll To Roll Flexible Electronics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin America Roll To Roll Flexible Electronics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Roll To Roll Flexible Electronics Industry Revenue (billion), by Application 2025 & 2033

- Figure 33: Middle East and Africa Roll To Roll Flexible Electronics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Middle East and Africa Roll To Roll Flexible Electronics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 35: Middle East and Africa Roll To Roll Flexible Electronics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Roll To Roll Flexible Electronics Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Middle East and Africa Roll To Roll Flexible Electronics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Roll To Roll Flexible Electronics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Roll To Roll Flexible Electronics Industry?

The projected CAGR is approximately 10.4%.

2. Which companies are prominent players in the Roll To Roll Flexible Electronics Industry?

Key companies in the market include DuPont Teijin Films , Samsung Electronics Co., Ltd. , LG Display Co., Ltd. , Toray Industries, Inc., Sumitomo Chemical Co., Ltd., .

3. What are the main segments of the Roll To Roll Flexible Electronics Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Low acquisition costs of object-based solutions (especially for large-scale storage); Technological advancements such as multi-cloud data management and introduction of ML In storage analytics.

6. What are the notable trends driving market growth?

North America to be a Substantial Market.

7. Are there any restraints impacting market growth?

Costs. Interoperability. and Security Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Roll To Roll Flexible Electronics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Roll To Roll Flexible Electronics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Roll To Roll Flexible Electronics Industry?

To stay informed about further developments, trends, and reports in the Roll To Roll Flexible Electronics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence