Key Insights

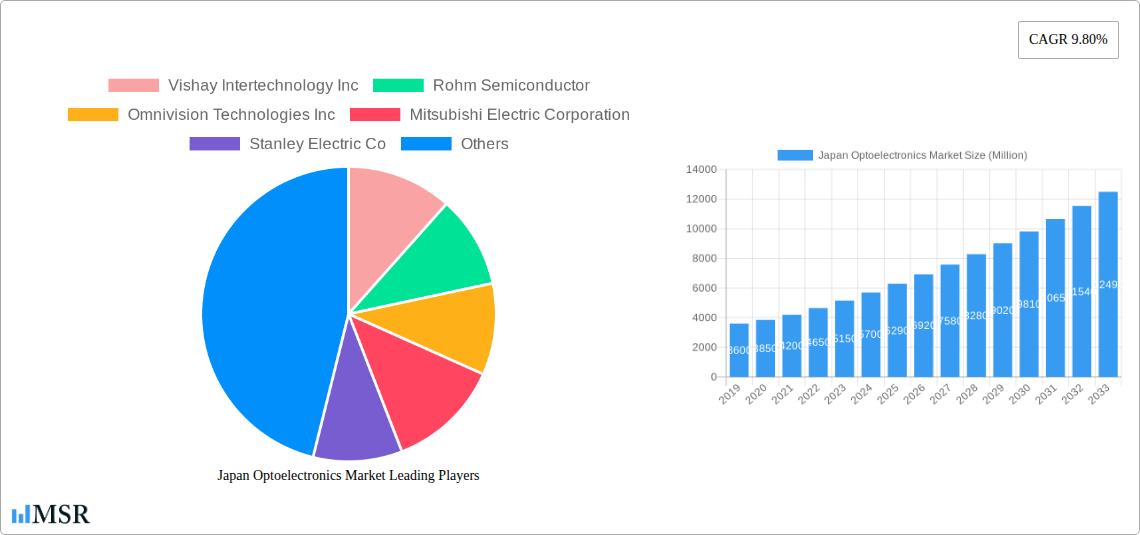

The Japanese optoelectronics market is poised for significant expansion, projected to reach an estimated \$6.29 million in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 9.80% through 2033. This growth is primarily fueled by the escalating demand across key sectors such as consumer electronics and automotive, where advanced optoelectronic components are integral to innovation and performance enhancement. The automotive industry, in particular, is witnessing a surge in the adoption of optoelectronics for sophisticated driver-assistance systems (ADAS), advanced lighting solutions, and in-cabin entertainment, directly contributing to market expansion. Similarly, the insatiable consumer appetite for next-generation smartphones, wearables, and high-definition displays, all heavily reliant on optoelectronic technologies like LED and image sensors, further propels market dynamics. The industrial sector's increasing integration of automation and smart manufacturing also presents a strong growth avenue, with optocouplers and optical sensors playing a critical role in ensuring operational efficiency and safety.

Japan Optoelectronics Market Market Size (In Billion)

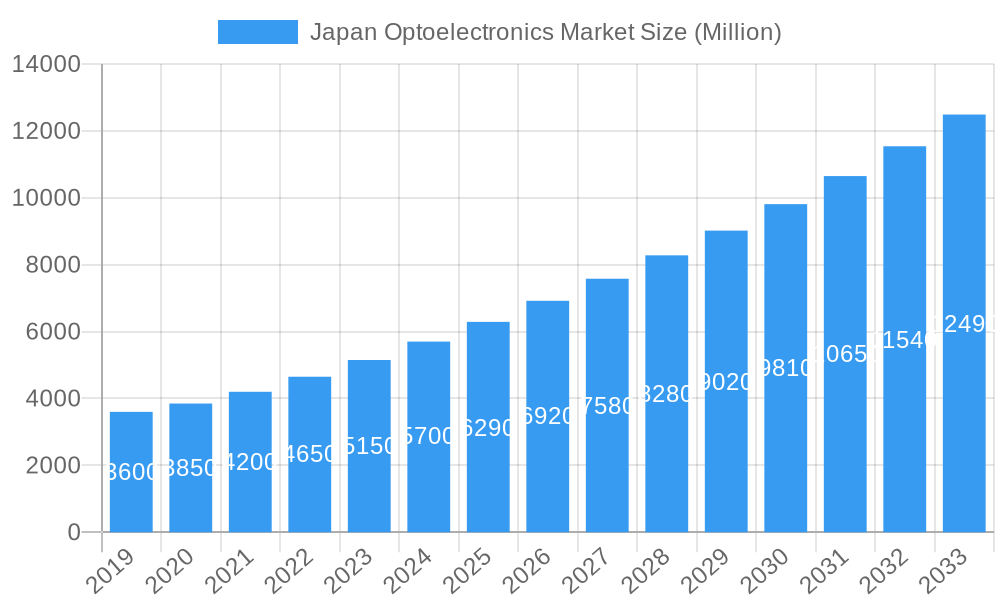

The competitive landscape features a blend of established global players and specialized domestic firms, each vying for market share through continuous innovation and strategic partnerships. Companies like Sony Corporation and Panasonic Corporation, with their deep roots in consumer electronics and advanced imaging, are well-positioned to capitalize on burgeoning demand. Mitsubishi Electric Corporation and Rohm Semiconductor are also prominent contributors, particularly in areas such as high-power optoelectronics and semiconductor components. Emerging trends such as the increasing miniaturization of devices, the development of energy-efficient optoelectronic solutions, and the integration of AI within optoelectronic systems are expected to shape the market's future trajectory. While the market benefits from strong domestic demand and technological prowess, potential challenges could arise from global supply chain disruptions and increasing competition from international markets. Nevertheless, the overall outlook for the Japanese optoelectronics market remains highly optimistic, driven by technological advancements and diverse application growth.

Japan Optoelectronics Market Company Market Share

This in-depth report provides a definitive analysis of the Japan Optoelectronics Market, encompassing LEDs, Laser Diodes, Image Sensors, Optocouplers, and Photovoltaic Cells. Discover critical insights into market size, growth drivers, technological innovations, and competitive landscapes shaping the Japanese optoelectronics industry. With a detailed forecast from 2025 to 2033, this report is an indispensable resource for semiconductor manufacturers, component suppliers, technology investors, and industry stakeholders seeking to capitalize on the burgeoning Japan optoelectronics sector.

Japan Optoelectronics Market Market Concentration & Dynamics

The Japan Optoelectronics Market exhibits a moderately concentrated landscape, characterized by a blend of established global giants and specialized domestic innovators. Key players are actively engaged in fostering robust innovation ecosystems, driven by significant R&D investments in advanced materials and next-generation optoelectronic devices. Regulatory frameworks in Japan prioritize technological advancement and safety standards, influencing product development and market entry strategies. The market is dynamic, with a constant evaluation of substitute products, particularly in lighting and display technologies. End-user trends are rapidly evolving, with a pronounced demand for high-performance image sensors in consumer electronics and LEDs in automotive applications. Merger and acquisition (M&A) activities, while present, are often strategic, focusing on acquiring niche technologies or expanding market reach. The number of M&A deals in the historical period (2019-2024) is estimated at 8-12, indicating a steady but not overly aggressive consolidation. Market share distribution is diverse, with leading companies holding significant but not dominant positions, reflecting a competitive environment.

Japan Optoelectronics Market Industry Insights & Trends

The Japan Optoelectronics Market is poised for robust expansion, projected to reach an estimated market size of over ¥4.5 Trillion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is underpinned by several key drivers, including the relentless demand for miniaturized and high-performance components in consumer electronics, the accelerating adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies in the automotive industry, and the increasing use of optoelectronic sensors in industrial automation and healthcare. Technological disruptions are continuously reshaping the market, with advancements in GaN-based LEDs offering enhanced efficiency and lifespan, and the evolution of laser diode technology enabling new applications in sensing and communication. The proliferation of AI and IoT devices further fuels the demand for sophisticated image sensors and specialized optocouplers for data acquisition and signal isolation. Evolving consumer behaviors, such as a preference for energy-efficient lighting solutions and immersive display experiences, are also contributing significantly to market growth. The increasing digitization of industries and the focus on smart city initiatives are creating new avenues for optoelectronic solutions. The Information Technology sector, in particular, is a major consumer of high-speed optical communication components, further bolstering market expansion.

Key Markets & Segments Leading Japan Optoelectronics Market

The Japan Optoelectronics Market is largely dominated by the Automotive and Consumer Electronics end-user industries, with significant contributions from Information Technology and Industrial sectors. Within component types, LEDs and Image Sensors are leading segments.

Automotive:

- Drivers: Increasing adoption of ADAS, LED lighting for enhanced safety and aesthetics, and the electrification of vehicles.

- The automotive sector's demand for high-reliability, high-performance optoelectronic components, especially advanced image sensors for cameras and LEDs for adaptive lighting systems, is a primary growth catalyst. The shift towards electric vehicles (EVs) further necessitates efficient power management and sensing solutions, where optoelectronics play a crucial role.

Consumer Electronics:

- Drivers: Proliferation of smartphones, wearables, smart home devices, and advanced display technologies.

- This segment continues to be a powerhouse, driven by the constant innovation in smartphones, where high-resolution image sensors are paramount, and the growing demand for smart home devices that utilize various optoelectronic components for sensing and connectivity. The development of next-generation displays, such as OLEDs, also relies heavily on advanced optoelectronic materials and manufacturing processes.

Information Technology:

- Drivers: Growth in data centers, high-speed communication networks, and cloud computing.

- The relentless expansion of data centers and the increasing need for high-speed data transmission are fueling the demand for fiber optic components and laser diodes. The IT sector's role in enabling digital transformation across other industries further solidifies its importance.

Industrial:

- Drivers: Automation, robotics, smart manufacturing (Industry 4.0), and advanced sensing applications.

- The industrial sector is witnessing a significant uptake of optoelectronic solutions for automation, quality control, and safety systems. Robotics and smart manufacturing initiatives rely heavily on precise sensing and control mechanisms enabled by optoelectronic components like sensors and vision systems.

While LEDs and Image Sensors lead, the demand for Laser Diodes is growing exponentially due to their applications in industrial marking, medical devices, and high-speed communications. Optocouplers remain critical for signal isolation in power electronics and industrial control systems. Photovoltaic cells are also seeing increased adoption in renewable energy initiatives.

Japan Optoelectronics Market Product Developments

Recent product developments in the Japan Optoelectronics Market highlight a strong emphasis on miniaturization, increased efficiency, and novel functionalities. Innovations in image sensors are leading to higher resolution, improved low-light performance, and integrated AI capabilities for advanced imaging applications in automotive and consumer electronics. Advancements in LED technology are focusing on higher brightness, wider color gamuts, and improved thermal management for applications ranging from automotive headlights to general lighting and displays. The development of compact and powerful laser diodes is enabling new applications in 3D sensing, LiDAR for autonomous systems, and high-speed optical communication. Furthermore, there's a growing trend towards integrated optoelectronic solutions, where multiple functionalities are combined into single chips, reducing form factors and power consumption. These technological leaps are driven by the demand for more sophisticated and compact devices across all end-user industries.

Challenges in the Japan Optoelectronics Market Market

Despite robust growth, the Japan Optoelectronics Market faces several challenges. Intense global competition, particularly from emerging economies, puts pressure on pricing and profit margins. Supply chain disruptions, exacerbated by geopolitical factors and natural disasters, can impact production and lead times, a concern highlighted by recent global events. Navigating complex and evolving regulatory frameworks for new technologies, such as advanced sensors and high-power LEDs, can also pose hurdles. The high cost of developing and implementing cutting-edge optoelectronic technologies, including R&D and specialized manufacturing, is another significant barrier. Furthermore, the scarcity of skilled labor in specialized fields like semiconductor manufacturing and optical engineering can impede growth. The estimated impact of supply chain issues on market growth is around 5-8% reduction if unmitigated.

Forces Driving Japan Optoelectronics Market Growth

Several key forces are propelling the Japan Optoelectronics Market forward. The relentless pursuit of technological advancement and innovation, deeply ingrained in Japanese industry, is a primary driver. Government initiatives and funding supporting semiconductor manufacturing and R&D create a favorable environment. The increasing demand for advanced solutions in key sectors like automotive (ADAS, autonomous driving), consumer electronics (smart devices, high-definition displays), and industrial automation (Industry 4.0) provides substantial market pull. The growing adoption of renewable energy sources also boosts the demand for photovoltaic cells. Furthermore, Japan's position as a leader in robotics and precision manufacturing ensures a continuous need for sophisticated optoelectronic components. The increasing focus on digitalization and connectivity across all industries is a fundamental growth accelerator.

Challenges in the Japan Optoelectronics Market Market

The long-term growth catalysts for the Japan Optoelectronics Market are deeply intertwined with its innovative capacity and strategic positioning. Continued investment in cutting-edge research and development, particularly in areas like quantum optics, advanced photonics, and novel semiconductor materials, will be crucial. Strategic partnerships and collaborations, both domestically and internationally, will facilitate knowledge exchange and accelerate market penetration. The expansion of applications into emerging fields such as augmented reality (AR), virtual reality (VR), and advanced medical diagnostics presents significant long-term growth potential. Furthermore, the ongoing digital transformation and the development of smart infrastructure will continue to create sustained demand for sophisticated optoelectronic solutions. The market's ability to adapt to evolving global technological trends and consumer demands will define its long-term trajectory.

Emerging Opportunities in Japan Optoelectronics Market

Emerging opportunities in the Japan Optoelectronics Market are diverse and promising. The rapid growth of the Internet of Things (IoT) ecosystem is creating significant demand for low-power, high-performance sensors and communication modules. The increasing sophistication of artificial intelligence (AI) and machine learning (ML) applications requires advanced image sensors and processing capabilities. The burgeoning market for augmented reality (AR) and virtual reality (VR) devices presents new avenues for high-resolution displays and spatial sensing technologies. Furthermore, advancements in medical diagnostics and treatment, including the use of lasers and optical imaging, offer substantial growth potential. The global push for sustainable energy solutions will continue to drive innovation and demand for efficient photovoltaic cells and related optoelectronic components. The integration of optoelectronics into advanced robotics and autonomous systems represents another significant opportunity.

Leading Players in the Japan Optoelectronics Market Sector

- Vishay Intertechnology Inc

- Rohm Semiconductor

- Omnivision Technologies Inc

- Mitsubishi Electric Corporation

- Stanley Electric Co

- Texas Instruments Inc

- Samsung Electronics Co Ltd

- General Electric Company

- Osram Licht AG

- Koninklijke Philips N V

- Panasonic Corporation

- Sony Corporation

Key Milestones in Japan Optoelectronics Market Industry

- February 2024: Analog Devices inks a strategic deal with TSMC, securing wafer supply through TSMC's Japan Advanced Semiconductor Manufacturing (JASM) subsidiary in Kumamoto Prefecture. This collaboration bolsters ADI's capacity for cutting-edge technology nodes crucial for sectors like wireless BMS and GMSL.

- February 2024: Qnami establishes a strategic commercial partnership with Quantum Design Japan and Quantum Design Korea, introducing its quantum sensing platform to East Asia. This move is set to advance applications in materials science, navigation, and life sciences, leveraging NV-based quantum sensors in their ProteusQ microscope for novel material exploration.

Strategic Outlook for Japan Optoelectronics Market Market

The strategic outlook for the Japan Optoelectronics Market is highly optimistic, driven by a confluence of technological innovation, strong end-user demand, and supportive government policies. Key growth accelerators include the continued integration of AI and IoT, the expansion of advanced driver-assistance systems and autonomous mobility, and the evolution of next-generation display technologies. Strategic opportunities lie in further developing highly integrated optoelectronic solutions, expanding into emerging markets with tailored products, and focusing on sustainable and energy-efficient technologies. The market's resilience and adaptability, coupled with a strong commitment to R&D, position it for sustained growth and leadership in the global optoelectronics landscape. Investment in talent development and fostering a robust supply chain will be crucial for realizing this potential.

Japan Optoelectronics Market Segmentation

-

1. Component type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic cells

- 1.6. Other Component Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential & Commercial

- 2.7. Industrial

- 2.8. Other End-user Industries

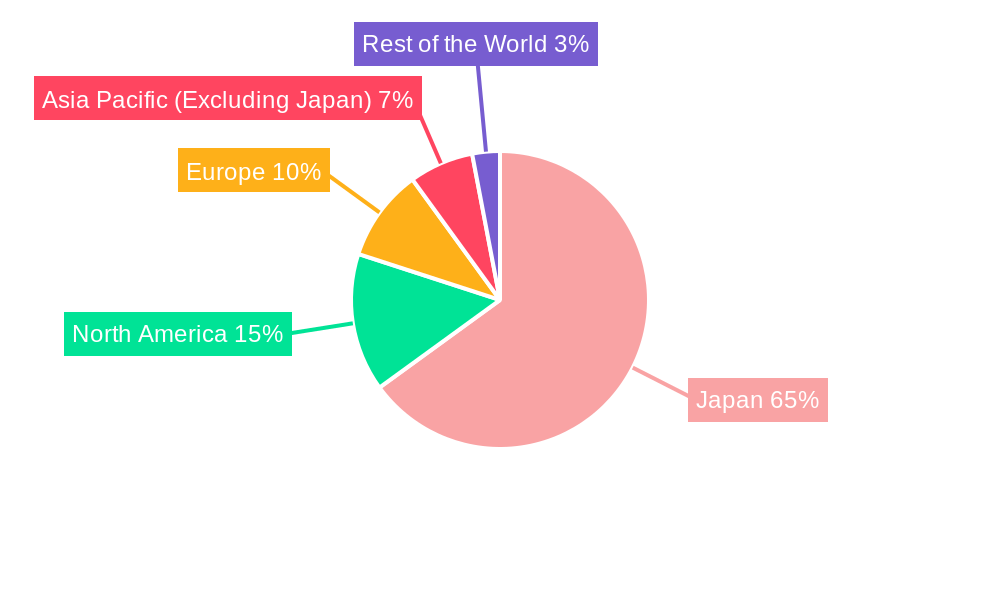

Japan Optoelectronics Market Segmentation By Geography

- 1. Japan

Japan Optoelectronics Market Regional Market Share

Geographic Coverage of Japan Optoelectronics Market

Japan Optoelectronics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Smart Consumer Electronics and Next Generation Technologies; Increasing Industrial Applications of the Technology

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Fabricating Costs

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Optoelectronics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic cells

- 5.1.6. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential & Commercial

- 5.2.7. Industrial

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vishay Intertechnology Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rohm Semiconductor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Omnivision Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mitsubishi Electric Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Stanley Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Texas Instruments Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Osram Licht AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Koninklijke Philips N V

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sony Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Japan Optoelectronics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Optoelectronics Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 2: Japan Optoelectronics Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Japan Optoelectronics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan Optoelectronics Market Revenue Million Forecast, by Component type 2020 & 2033

- Table 5: Japan Optoelectronics Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Japan Optoelectronics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Optoelectronics Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the Japan Optoelectronics Market?

Key companies in the market include Vishay Intertechnology Inc, Rohm Semiconductor, Omnivision Technologies Inc, Mitsubishi Electric Corporation, Stanley Electric Co, Texas Instruments Inc, Samsung Electronics Co Ltd, General Electric Company, Osram Licht AG, Koninklijke Philips N V, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Japan Optoelectronics Market?

The market segments include Component type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Smart Consumer Electronics and Next Generation Technologies; Increasing Industrial Applications of the Technology.

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Manufacturing and Fabricating Costs.

8. Can you provide examples of recent developments in the market?

February 2024 - Analog Devices has struck a strategic deal with TSMC. Under this agreement, TSMC, a prominent semiconductor foundry, will provide Analog Devices with a steady supply of wafers through Japan Advanced Semiconductor Manufacturing (JASM), a manufacturing subsidiary majority-owned by TSMC, located in Kumamoto Prefecture, Japan. This collaboration, an extension of ADI's ongoing partnership with TSMC, bolsters ADI's capabilities in securing additional capacity for cutting-edge technology nodes. These nodes are crucial for ADI's diverse business applications, notably in wireless BMS (wBMS) and Gigabit Multimedia Serial Link (GMSL) sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Optoelectronics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Optoelectronics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Optoelectronics Market?

To stay informed about further developments, trends, and reports in the Japan Optoelectronics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence