Key Insights

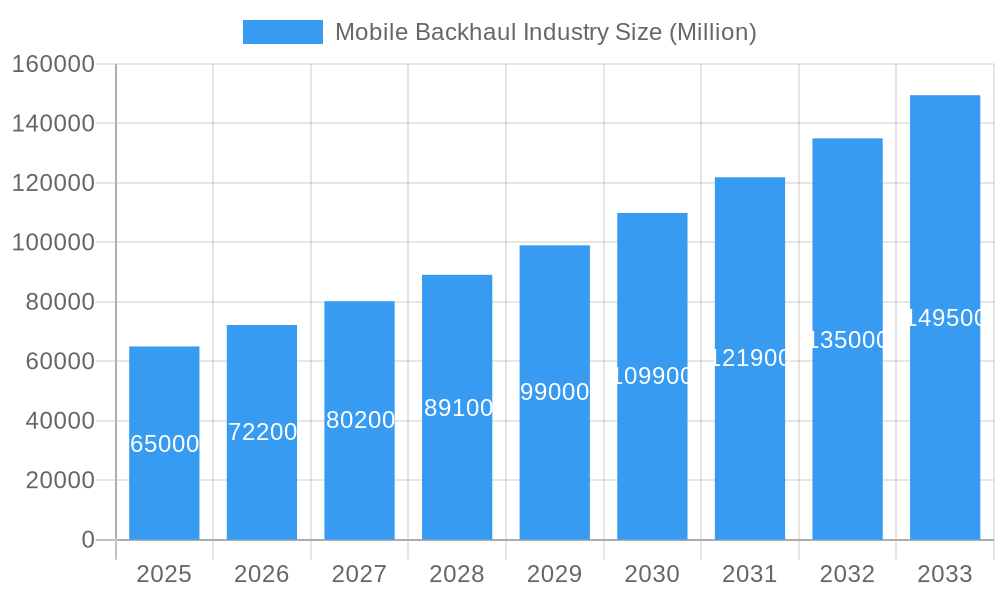

The global Mobile Backhaul industry is projected for substantial growth, with an estimated market size of $30.98 billion by 2033, driven by a CAGR of 11.7% from the base year 2025. This expansion is fueled by the escalating demand for higher bandwidth and lower latency to support 5G network adoption and the proliferation of connected devices. Continuous evolution in mobile technology necessitates significant backhaul infrastructure upgrades, making it crucial for enhanced mobile experiences. Key drivers include increasing data consumption, deployment of new mobile services like AR/VR, and cellular network expansion into underserved areas. The growing adoption of IoT solutions and the need for efficient data aggregation from numerous endpoints also contribute to market momentum.

Mobile Backhaul Industry Market Size (In Billion)

Market segmentation highlights strong demand for both solutions and services. The deployment segment features a dynamic interplay between wired and wireless technologies, with wireless solutions, including Point-to-Point and Point-to-Multipoint networks, offering increasing flexibility and cost-effectiveness, especially in challenging terrains and rapidly expanding urban areas. Major industry players are investing in advanced backhaul solutions. While the market shows a promising trajectory, high capital expenditure for infrastructure upgrades and the complexity of integrating new technologies with legacy systems may pose challenges. However, strategic partnerships and innovative deployment models are expected to mitigate these hurdles, ensuring sustained growth.

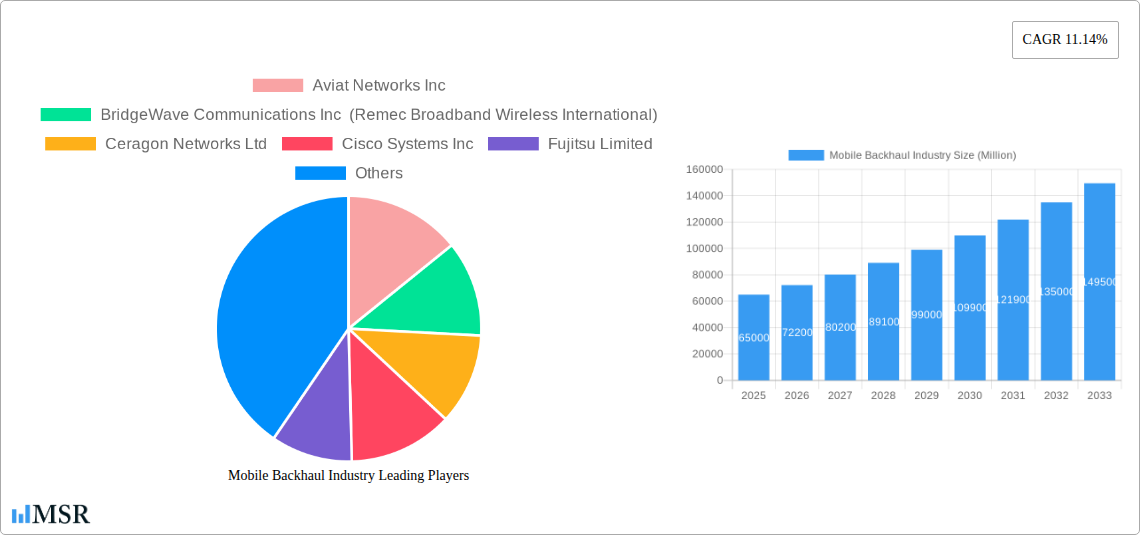

Mobile Backhaul Industry Company Market Share

This comprehensive Mobile Backhaul industry report offers an in-depth analysis of the global market landscape, projecting significant growth and transformation from 2025 to 2033. Covering the period from 2019-2024 and focusing on the base and estimated year of 2025, this study is an indispensable resource for telecom infrastructure providers, mobile network operators, technology innovators, and industry stakeholders seeking to capitalize on the booming demand for seamless, high-capacity wireless connectivity. With a projected market size of $30.98 billion in 2025, the mobile backhaul market is poised for unprecedented expansion, driven by 5G deployment, IoT expansion, and the increasing need for robust wireless backhaul solutions. This report delves into market dynamics, key trends, competitive landscapes, and emerging opportunities, providing actionable insights for strategic decision-making.

Mobile Backhaul Industry Market Concentration & Dynamics

The mobile backhaul industry is characterized by a moderately concentrated market with key players like Huawei Technologies, Ericsson Inc, Nokia Corporation (represented by Nokia), and ZTE Corporation holding significant market shares. Innovation ecosystems are rapidly evolving, spurred by the need for higher bandwidth and lower latency to support 5G networks and advanced applications. Regulatory frameworks, particularly around spectrum allocation and infrastructure deployment, play a crucial role in shaping market access and competition. Substitute products, such as fiber optic backhaul, present competition, yet the agility and cost-effectiveness of wireless solutions continue to drive their adoption. End-user trends are heavily influenced by the proliferation of data-intensive services, including video streaming, cloud gaming, and enterprise mobility, demanding increasingly sophisticated backhaul capabilities. Mergers and acquisitions (M&A) activities, while not at extreme levels, are strategically focused on consolidating technological expertise and expanding geographic reach. The M&A deal count in the historical period (2019-2024) is estimated at XX, indicating a steady but targeted consolidation.

Mobile Backhaul Industry Industry Insights & Trends

The mobile backhaul market is experiencing robust growth, propelled by the accelerating global 5G rollout and the ever-increasing demand for mobile data. The market size in 2025 is estimated at XX Million, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Key growth drivers include the insatiable appetite for higher bandwidth and lower latency services, fueled by immersive mobile experiences, the expansion of the Internet of Things (IoT), and the growing adoption of private wireless networks by enterprises. Technological disruptions are primarily centered around advancements in wireless transmission technologies, such as millimeter-wave (mmWave) and sub-6 GHz spectrum utilization, alongside innovative modulation schemes and beamforming techniques that enhance capacity and efficiency. Evolving consumer behaviors, characterized by a reliance on mobile connectivity for work, entertainment, and communication, further underscore the critical role of a resilient and high-performance mobile backhaul infrastructure. The transition from 4G to 5G necessitates a significant upgrade of existing backhaul networks, creating substantial opportunities for wireless backhaul solutions and microwave backhaul providers.

Key Markets & Segments Leading Mobile Backhaul Industry

The mobile backhaul industry is witnessing significant growth across various segments and regions.

- Dominant Deployment Segment:

- Wireless Backhaul: This segment, encompassing Point-to-Point Network and Point-to-Multipoint Network architectures, is expected to lead the market.

- Drivers: Cost-effectiveness for rural and remote deployments, rapid deployment times compared to wired solutions, and enhanced flexibility.

- Dominance Analysis: Point-to-Point networks are crucial for high-capacity links between cell towers and aggregation points, while Point-to-Multipoint networks offer efficient connectivity to multiple sites from a central location. The increasing density of 5G small cells and the need to connect dispersed infrastructure are major contributors to the dominance of wireless backhaul. Other Wireless Networks, including satellite backhaul for extremely remote locations, also represent a growing niche.

- Wireless Backhaul: This segment, encompassing Point-to-Point Network and Point-to-Multipoint Network architectures, is expected to lead the market.

- Dominant Type Segment:

- Solutions: Integrated mobile backhaul solutions that combine hardware, software, and services are gaining traction.

- Drivers: Demand for end-to-end connectivity, simplified network management, and performance optimization.

- Dominance Analysis: Operators are increasingly seeking comprehensive solutions that address all aspects of their backhaul infrastructure, from spectrum management to network monitoring and security. This trend is driven by the complexity of modern networks and the desire to streamline operations.

- Solutions: Integrated mobile backhaul solutions that combine hardware, software, and services are gaining traction.

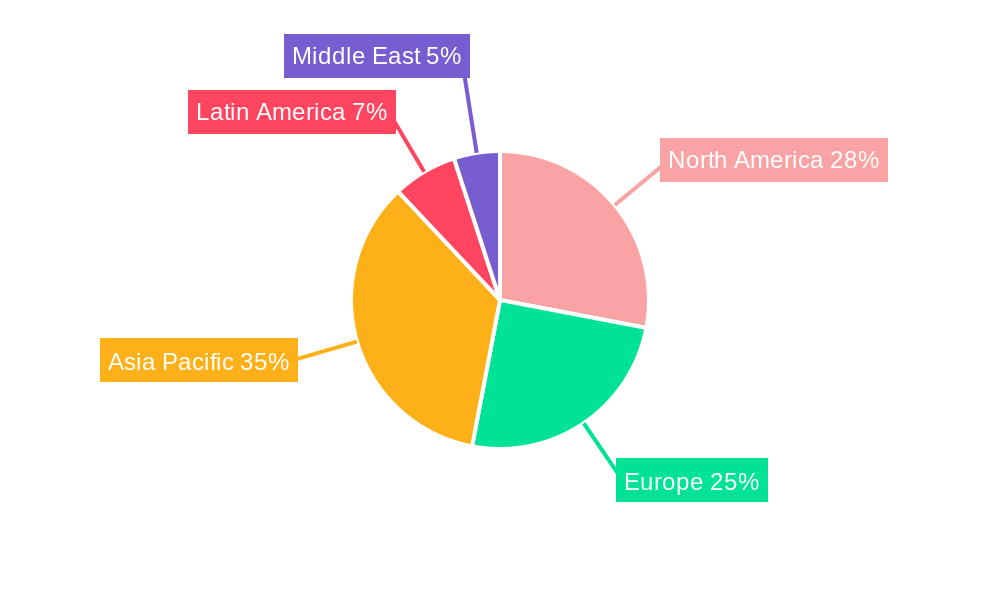

- Dominant Region:

- Asia Pacific: This region is a key growth engine for the mobile backhaul market.

- Drivers: Rapid 5G network expansion in countries like China, India, and South Korea, a burgeoning demand for mobile data services, and significant investments in telecommunications infrastructure.

- Dominance Analysis: The sheer scale of mobile subscribers and the aggressive deployment of advanced wireless technologies in APAC make it a critical market for mobile backhaul equipment and backhaul services.

- Asia Pacific: This region is a key growth engine for the mobile backhaul market.

Mobile Backhaul Industry Product Developments

Product innovations in the mobile backhaul industry are centered on enhancing capacity, reducing latency, and improving spectral efficiency. Companies are developing ultra-high-capacity microwave links capable of carrying massive amounts of data, essential for 5G and future network generations. Advancements in software-defined networking (SDN) and network function virtualization (NFV) are enabling more intelligent and flexible backhaul management. The exploration of higher frequency bands, such as the D-Band (130-175 GHz), promises to unlock unprecedented bandwidth for 5G backhaul and fronthaul in congested urban areas, offering up to 50 times more traffic capacity than current microwave bands. These developments are critical for maintaining competitive advantages and meeting the ever-growing demands of mobile connectivity.

Challenges in the Mobile Backhaul Industry Market

The mobile backhaul industry faces several challenges.

- Spectrum Availability and Licensing: Limited availability of suitable spectrum and complex licensing procedures can hinder deployment.

- Infrastructure Deployment Costs: High costs associated with acquiring sites, obtaining permits, and installing equipment, especially in challenging terrains.

- Cybersecurity Threats: Protecting sensitive data and network infrastructure from sophisticated cyberattacks remains a paramount concern.

- Skilled Workforce Shortage: A lack of adequately trained personnel for the installation, maintenance, and operation of advanced backhaul systems.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different regions can be complex and time-consuming.

Forces Driving Mobile Backhaul Industry Growth

Several forces are driving the growth of the mobile backhaul industry.

- 5G Network Expansion: The global rollout of 5G necessitates a significant upgrade and expansion of backhaul networks to support higher speeds and lower latency.

- Increasing Mobile Data Consumption: The exponential growth in video streaming, cloud services, and online gaming is placing immense pressure on existing backhaul capacities.

- IoT Proliferation: The expanding Internet of Things ecosystem, with its myriad of connected devices, requires robust and scalable backhaul infrastructure to handle the massive influx of data.

- Digital Transformation Initiatives: Governments and enterprises worldwide are investing in digital transformation, which heavily relies on reliable and high-performance mobile connectivity, including backhaul.

- Technological Advancements: Continuous innovation in wireless transmission technologies, such as millimeter-wave and advanced modulation techniques, is enabling higher capacities and greater efficiency.

Challenges in the Mobile Backhaul Industry Market

Long-term growth catalysts for the mobile backhaul industry are deeply rooted in continuous innovation and strategic market positioning. The development and adoption of novel spectrum utilization techniques, such as dynamic spectrum sharing and advanced interference management, will be crucial. Furthermore, the integration of AI and machine learning into backhaul network management will enable proactive optimization, predictive maintenance, and enhanced security. Strategic partnerships between telecom equipment manufacturers, mobile network operators, and cloud service providers will unlock new revenue streams and foster integrated connectivity solutions. The expansion into emerging markets with growing mobile penetration and the development of cost-effective solutions for underserved areas will also fuel sustainable long-term growth.

Emerging Opportunities in Mobile Backhaul Industry

Emerging opportunities in the mobile backhaul industry are vast and varied. The expansion of private wireless networks for industrial applications, smart cities, and rural broadband presents significant untapped potential. The increasing demand for edge computing necessitates low-latency backhaul solutions that can support data processing closer to the source. Furthermore, the development of integrated transport networks that seamlessly blend wired and wireless backhaul will create more resilient and efficient connectivity. Opportunities also lie in providing specialized mobile backhaul services for sectors like autonomous vehicles, augmented reality (AR), and virtual reality (VR), which require ultra-reliable, high-bandwidth connections. The adoption of satellite backhaul for bridging connectivity gaps in extremely remote or disaster-prone areas is another promising avenue.

Leading Players in the Mobile Backhaul Industry Sector

- Aviat Networks Inc

- BridgeWave Communications Inc (Remec Broadband Wireless International)

- Ceragon Networks Ltd

- Cisco Systems Inc

- Fujitsu Limited

- NEC Corporation

- Ericsson Inc

- ZTE Corporation

- Huawei Technologies

- AT&T Inc

Key Milestones in Mobile Backhaul Industry Industry

- October 2022: Reliance Jio Infocomm Ltd. (Jio), one of India's largest telecom firms, announced long-term partnerships with Ericsson and Nokia for 5G network equipment. Jio announced the agreements with Swedish and Finnish telecom infrastructure companies were for 5G radio access network (RAN) equipment, base stations, huge MIMO antennas, and network software needed to build a 5G standalone (SA). Among other things, Jio would deploy Ericsson's RAN equipment and mobile backhaul solutions.

- August 2022: Kacific partnered with Vodafone PNG to provide mobile backhaul services in the rural region. The collaboration would expand Vodafone PNG's voice and 3G/4G data network into Papua New Guinea's remote areas to assist digital transformation throughout government, schools, enterprises, and communities. Kacific currently operates throughout the Asia Pacific, including New Zealand, Singapore, Australia, Fiji, PNG, and other Pacific Islands. The new project would use the company's capabilities to improve mobile connectivity and services in rural areas.

- April 2022: Nokia announced the successful demonstration of a live microwave link using the D-Band spectrum (130-175 GHz), which provides much more bandwidth than other microwave bands and serves as an ultra-high-capacity extension for 5G backhaul and fronthaul in crowded metropolitan contexts. The research, which was carried out by Nokia using Nokia Bell Labs equipment, looked into how higher frequencies above 100 GHz may enable enormous channel bandwidths and carry up to 50 times more traffic than microwave bands commonly utilized for mobile network backhaul.

Strategic Outlook for Mobile Backhaul Industry Market

The strategic outlook for the mobile backhaul industry is exceptionally positive, driven by the ongoing evolution of mobile networks and the increasing demand for data-intensive applications. The continued investment in 5G advanced technologies, the expansion of the IoT ecosystem, and the growing adoption of private wireless networks will sustain robust market growth. Key strategic imperatives for stakeholders include focusing on innovation in high-capacity wireless solutions, optimizing network management through AI and automation, and forming strategic alliances to address complex connectivity challenges. The industry is expected to witness a surge in demand for integrated telecom infrastructure solutions, emphasizing efficiency, scalability, and security. Opportunities abound for companies that can deliver cost-effective and future-proof backhaul solutions, particularly in underserved regions and emerging use cases.

Mobile Backhaul Industry Segmentation

-

1. Deployment

- 1.1. Wired

-

1.2. Wireless

- 1.2.1. Point-to-Point Network

- 1.2.2. Point-to-Multipoint Network

- 1.2.3. Other Wireless Networks

-

2. Type

- 2.1. Solution

- 2.2. Services

Mobile Backhaul Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Mobile Backhaul Industry Regional Market Share

Geographic Coverage of Mobile Backhaul Industry

Mobile Backhaul Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Smartphones and Connected Devices; Proliferation of 5G Leading to Faster Consumption of Data

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Cost to Act as a Restraint

- 3.4. Market Trends

- 3.4.1. Growing Demand for Smartphones and Connected Devices Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Backhaul Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.1.2.1. Point-to-Point Network

- 5.1.2.2. Point-to-Multipoint Network

- 5.1.2.3. Other Wireless Networks

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solution

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Mobile Backhaul Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.1.2.1. Point-to-Point Network

- 6.1.2.2. Point-to-Multipoint Network

- 6.1.2.3. Other Wireless Networks

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solution

- 6.2.2. Services

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Mobile Backhaul Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.1.2.1. Point-to-Point Network

- 7.1.2.2. Point-to-Multipoint Network

- 7.1.2.3. Other Wireless Networks

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solution

- 7.2.2. Services

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Mobile Backhaul Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.1.2.1. Point-to-Point Network

- 8.1.2.2. Point-to-Multipoint Network

- 8.1.2.3. Other Wireless Networks

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solution

- 8.2.2. Services

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Mobile Backhaul Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.1.2.1. Point-to-Point Network

- 9.1.2.2. Point-to-Multipoint Network

- 9.1.2.3. Other Wireless Networks

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solution

- 9.2.2. Services

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East Mobile Backhaul Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.1.2.1. Point-to-Point Network

- 10.1.2.2. Point-to-Multipoint Network

- 10.1.2.3. Other Wireless Networks

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solution

- 10.2.2. Services

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aviat Networks Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BridgeWave Communications Inc (Remec Broadband Wireless International)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ceragon Networks Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fujitsu Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NEC Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ericsson Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZTE Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Huawei Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AT&T Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Aviat Networks Inc

List of Figures

- Figure 1: Global Mobile Backhaul Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Mobile Backhaul Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 3: North America Mobile Backhaul Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Mobile Backhaul Industry Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Mobile Backhaul Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Mobile Backhaul Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Mobile Backhaul Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mobile Backhaul Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 9: Europe Mobile Backhaul Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Mobile Backhaul Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Mobile Backhaul Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Mobile Backhaul Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Mobile Backhaul Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Mobile Backhaul Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Mobile Backhaul Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Mobile Backhaul Industry Revenue (billion), by Type 2025 & 2033

- Figure 17: Asia Pacific Mobile Backhaul Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Mobile Backhaul Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Mobile Backhaul Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Mobile Backhaul Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 21: Latin America Mobile Backhaul Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Latin America Mobile Backhaul Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: Latin America Mobile Backhaul Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Mobile Backhaul Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Mobile Backhaul Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Mobile Backhaul Industry Revenue (billion), by Deployment 2025 & 2033

- Figure 27: Middle East Mobile Backhaul Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Middle East Mobile Backhaul Industry Revenue (billion), by Type 2025 & 2033

- Figure 29: Middle East Mobile Backhaul Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Mobile Backhaul Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Mobile Backhaul Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mobile Backhaul Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global Mobile Backhaul Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Mobile Backhaul Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Mobile Backhaul Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 5: Global Mobile Backhaul Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Mobile Backhaul Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Mobile Backhaul Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 8: Global Mobile Backhaul Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Mobile Backhaul Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Mobile Backhaul Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 11: Global Mobile Backhaul Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Mobile Backhaul Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Mobile Backhaul Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: Global Mobile Backhaul Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Mobile Backhaul Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Mobile Backhaul Industry Revenue billion Forecast, by Deployment 2020 & 2033

- Table 17: Global Mobile Backhaul Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Mobile Backhaul Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Backhaul Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Mobile Backhaul Industry?

Key companies in the market include Aviat Networks Inc, BridgeWave Communications Inc (Remec Broadband Wireless International), Ceragon Networks Ltd, Cisco Systems Inc, Fujitsu Limited, NEC Corporation, Ericsson Inc, ZTE Corporation, Huawei Technologies, AT&T Inc.

3. What are the main segments of the Mobile Backhaul Industry?

The market segments include Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Smartphones and Connected Devices; Proliferation of 5G Leading to Faster Consumption of Data.

6. What are the notable trends driving market growth?

Growing Demand for Smartphones and Connected Devices Drives the Market Growth.

7. Are there any restraints impacting market growth?

High Initial Investment Cost to Act as a Restraint.

8. Can you provide examples of recent developments in the market?

October 2022: Reliance Jio Infocomm Ltd. (Jio), one of India's largest telecom firms, announced long-term partnerships with Ericsson and Nokia for 5G network equipment. Jio announced the agreements with Swedish and Finnish telecom infrastructure companies were for 5G radio access network (RAN) equipment, base stations, huge MIMO antennas, and network software needed to build a 5G standalone (SA). Among other things, Jio would deploy Ericsson's RAN equipment and mobile backhaul solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Backhaul Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Backhaul Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Backhaul Industry?

To stay informed about further developments, trends, and reports in the Mobile Backhaul Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence