Key Insights

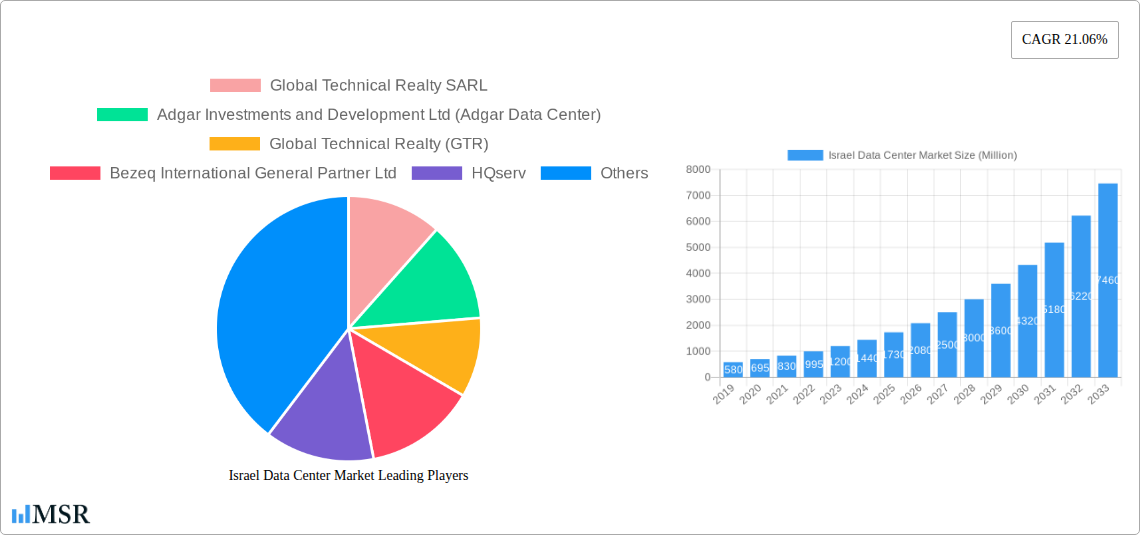

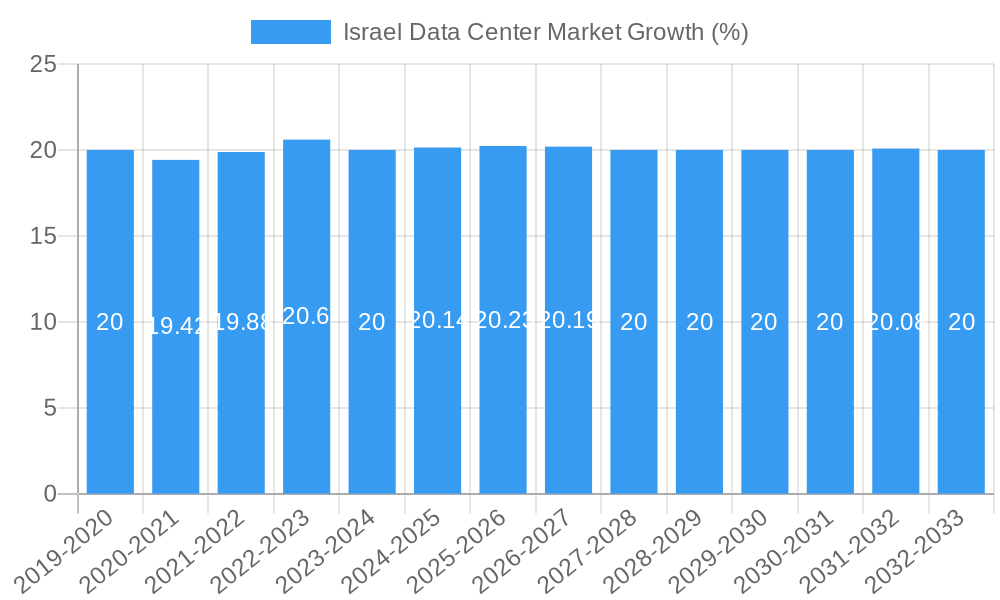

The Israel Data Center Market is poised for explosive growth, projecting a significant market size of approximately $1,500 million by 2025, driven by a remarkable Compound Annual Growth Rate (CAGR) of 21.06% through 2033. This robust expansion is fueled by a confluence of powerful drivers, including the burgeoning demand for cloud computing services, the rapid digitalization across key industries like BFSI, e-commerce, and government, and the increasing adoption of advanced technologies such as AI and IoT. The ongoing digital transformation initiatives within Israel, coupled with substantial foreign investment in its technology sector, are creating an insatiable appetite for advanced data center infrastructure. Furthermore, the strategic importance of the region as a tech hub is attracting global hyperscalers and colocation providers, intensifying competition and fostering innovation in data center design and operations. The market is witnessing a significant shift towards hyperscale and large data center facilities to accommodate the ever-increasing data storage and processing needs.

The market's trajectory is also shaped by critical trends such as the increasing emphasis on sustainable data center operations, including the adoption of renewable energy sources and energy-efficient cooling technologies, driven by environmental consciousness and regulatory pressures. The rise of edge computing is another significant trend, with a growing need for localized data processing to reduce latency for applications like autonomous vehicles and real-time analytics. While the market exhibits immense potential, certain restraints, such as the high capital expenditure required for building and maintaining advanced data centers and potential cybersecurity concerns, need to be strategically addressed. The dominant segments within the market are expected to be Large and Massive data center sizes, alongside Tier 3 and Tier 4 facilities, catering to the demanding requirements of hyperscale and enterprise clients. Tel Aviv is emerging as the primary hotspot for data center development, with the rest of Israel also showing promising growth potential.

This comprehensive report provides an in-depth analysis of the Israel Data Center Market, offering strategic insights for industry stakeholders. Explore market dynamics, key trends, emerging opportunities, and competitive landscapes from the historical period of 2019–2024 through the forecast period of 2025–2033. With a base year of 2025 and an estimated year also of 2025, this study leverages extensive data to project future growth trajectories. Dive into the burgeoning Israeli data center industry, covering essential aspects such as colocation, hyperscale data centers, cloud infrastructure, and enterprise data solutions. Understand the strategic importance of Tel Aviv as a leading hotspot and the growing demand across various segments including BFSI, e-commerce, and telecom.

Israel Data Center Market Market Concentration & Dynamics

The Israel Data Center Market exhibits a dynamic concentration influenced by significant investment and technological innovation. The ecosystem thrives on a blend of global players and agile local enterprises, fostering a competitive yet collaborative environment. Innovation is primarily driven by the nation's strong tech sector, leading to advanced data center design and operational efficiencies. Regulatory frameworks, while evolving, generally support digital infrastructure development, attracting substantial foreign investment. The threat of substitute products is relatively low, given the critical need for physical, secure data processing and storage. End-user trends highlight a significant shift towards cloud adoption and the expansion of e-commerce platforms, both heavily reliant on robust data center capacity. Mergers and acquisitions (M&A) are a key dynamic, consolidating market share and enhancing capabilities. For instance, the acquisition activity signals a growing appetite for established and developing data center assets in Israel. Key metrics such as market share distribution and recent M&A deal counts are crucial for understanding the competitive landscape and identifying potential growth avenues.

Israel Data Center Market Industry Insights & Trends

The Israel Data Center Market is experiencing robust growth, projected to reach significant market size by 2033 with a compelling Compound Annual Growth Rate (CAGR). This expansion is propelled by several key drivers. Firstly, the escalating demand for cloud services from both enterprises and government bodies, fueled by digital transformation initiatives, is a primary catalyst. Organizations are increasingly migrating their IT infrastructure to off-premise data centers to leverage scalability, flexibility, and cost-efficiency. Secondly, the burgeoning cybersecurity landscape in Israel necessitates highly secure and resilient data center facilities to protect sensitive information from sophisticated threats. Thirdly, the proliferation of Big Data analytics and the rise of Artificial Intelligence (AI) and Machine Learning (ML) applications require immense computing power and low-latency connectivity, directly boosting the need for advanced data center infrastructure.

Technological disruptions are playing a pivotal role. The adoption of edge computing solutions is gaining traction, especially for applications requiring real-time data processing and minimal latency, such as IoT devices and autonomous systems. Furthermore, advancements in cooling technologies, power efficiency, and renewable energy integration are making data centers more sustainable and cost-effective. Evolving consumer behaviors, characterized by a continuous demand for seamless digital experiences, online services, and personalized content, further amplify the need for high-performance and readily accessible data storage and processing capabilities. The increasing penetration of smartphones and the growth of the digital economy contribute to a sustained upward trend in data traffic, necessitating expanded data center capacity. The market is also witnessing a trend towards high-density computing, requiring specialized data center solutions to accommodate advanced hardware.

Key Markets & Segments Leading Israel Data Center Market

The Israel Data Center Market is characterized by strong growth across several key markets and segments.

Hotspot: Tel Aviv

- Dominance: Tel Aviv stands out as the primary data center hotspot due to its status as the economic and technological heart of Israel. Its concentration of businesses, startups, and financial institutions drives unparalleled demand for colocation and enterprise data center services.

- Drivers:

- Proximity to major financial institutions (BFSI).

- High concentration of technology companies and R&D centers.

- Established network infrastructure and connectivity hubs.

- Availability of skilled IT workforce.

- The region benefits from existing hyperscale data center developments and significant investments in expanding data center capacity.

Data Center Size: Mega & Large

- Dominance: The demand for Mega and Large data center sizes is soaring, reflecting the needs of hyperscale cloud providers and large enterprises. These facilities are crucial for supporting significant compute and storage requirements.

- Drivers:

- Expansion of cloud providers' footprint.

- Increasing data storage needs for big data analytics.

- Demand for high-performance computing (HPC).

- These larger facilities are critical for economies of scale and meeting the growing appetite for cloud infrastructure.

Colocation Type: Hyperscale & Wholesale

- Dominance: Hyperscale and Wholesale colocation are leading the market. Hyperscale is driven by global cloud giants establishing or expanding their presence, while wholesale caters to large enterprises seeking dedicated, scalable space and power.

- Drivers:

- Outsourcing of IT infrastructure by enterprises.

- Need for scalable and flexible data center solutions.

- Cost-effectiveness compared to building and managing in-house facilities.

- The growth in these segments is directly tied to the digital transformation efforts of businesses and the expansion plans of cloud service providers.

End User: Cloud, BFSI, and Telecom

- Dominance: The Cloud sector is the largest consumer, followed closely by BFSI (Banking, Financial Services, and Insurance) and Telecom. These industries are at the forefront of digital adoption and require extensive, reliable data center infrastructure.

- Drivers:

- Cloud: Digital transformation, scalability, and agility.

- BFSI: Digital banking, regulatory compliance, data security, and fraud detection.

- Telecom: 5G deployment, network expansion, and increasing data consumption.

- The demand from these sectors is shaping the requirements for Tier 3 and Tier 4 data centers with high availability and robust security features.

Tier Type: Tier 3 & 4

- Dominance: Tier 3 and Tier 4 data centers are in high demand, signifying a critical need for uninterrupted operations and high uptime.

- Drivers:

- Business continuity and disaster recovery requirements.

- Stringent uptime SLAs for critical applications.

- Increasing regulatory compliance demands, especially in BFSI.

- The focus on resilience and availability is paramount for businesses operating in Israel's competitive digital landscape.

Israel Data Center Market Product Developments

The Israel Data Center Market is witnessing significant product developments focused on enhancing efficiency, security, and sustainability. Innovations in AI-powered cooling systems, modular data center designs, and advanced power distribution units are becoming increasingly prevalent. Market relevance is driven by the need for higher compute density, lower latency, and reduced operational costs. Companies are also investing in software-defined networking (SDN) and infrastructure as a service (IaaS) offerings, providing greater flexibility and control to end-users. These technological advancements are crucial for maintaining a competitive edge and meeting the evolving demands of a rapidly digitalizing economy.

Challenges in the Israel Data Center Market Market

The Israel Data Center Market faces several challenges that could impede its growth. Regulatory hurdles, particularly concerning land acquisition and environmental permits, can lead to project delays and increased development costs. Supply chain disruptions for specialized data center equipment and components, exacerbated by global events, pose a significant risk to timely project completion. Competitive pressures are also intensifying as more players enter the market, potentially leading to price wars and impacting profit margins. Furthermore, the high cost of electricity in Israel can impact operational expenses for data center operators, necessitating a focus on energy efficiency.

Forces Driving Israel Data Center Market Growth

Several powerful forces are propelling the growth of the Israel Data Center Market. The nation's robust technological ecosystem and strong government support for innovation foster a conducive environment for data center development. The escalating demand for cloud computing services, driven by digital transformation across all sectors, is a primary growth accelerator. Furthermore, the increasing adoption of technologies like AI, ML, and IoT necessitates substantial data processing and storage capabilities. Growing foreign investment in Israeli tech companies also translates to increased demand for enterprise data center solutions. The strategic geopolitical importance of Israel as a regional hub also contributes to the demand for secure and resilient data infrastructure.

Challenges in the Israel Data Center Market Market

While the growth trajectory is promising, long-term challenges persist. The continuous need for skilled personnel in data center operations, cybersecurity, and IT management can create a talent crunch. Ensuring sustainable energy sourcing and managing the significant power consumption of modern data centers remains a critical environmental and operational challenge. Geopolitical stability, though generally strong, can influence investor confidence and the willingness of international hyperscale providers to commit large-scale investments. The high cost of real estate in prime locations near major cities can also present a barrier to expansion for data center developers.

Emerging Opportunities in Israel Data Center Market

The Israel Data Center Market presents significant emerging opportunities. The expansion of edge data centers to support 5G networks and IoT applications in remote areas is a growing trend. Increased demand for specialized high-performance computing (HPC) data centers for research and development in fields like AI and life sciences is opening new avenues. The burgeoning cybersecurity sector in Israel creates a niche for highly secure, compliant data storage solutions. Furthermore, there's an opportunity for green data center initiatives, leveraging renewable energy sources and advanced cooling technologies to meet sustainability goals and attract environmentally conscious clients. The potential for regional connectivity and data exchange also presents a strategic growth avenue.

Leading Players in the Israel Data Center Market Sector

- Global Technical Realty SARL

- Adgar Investments and Development Ltd (Adgar Data Center)

- Global Technical Realty (GTR)

- Bezeq International General Partner Ltd

- HQserv

- Bynet Data Communications Ltd

- EdgeConneX Inc

- 3SAMNET

- Med 1 IC-1 (1999) Ltd

- Lian Group

- ServerFarm LLC

Key Milestones in Israel Data Center Market Industry

- July 2022: Berkshire Partners announced to pay more than USD 215 Million to acquire a 49% stake in MedOne, valuing the company at NIS 1.5 billion (USD 430 Million). This significant M&A activity highlights investor confidence and consolidation within the Israeli data center market.

- August 2021: EdgeConneX announced its agreement to acquire Global Data Center (GDC), an Israeli data center operator. This acquisition, bringing two new facilities into the EdgeConneX global platform, including highly secure underground facilities near Tel Aviv, signifies the growing interest of international players in expanding their data center footprint in Israel.

- August 2020: Bynet Data Communications was building an underground data center for Oracle Corporation in Jerusalem. This 14,000 sq m (460,000 sq ft) facility, located 50 meters below ground, demonstrates the trend towards constructing highly secure, resilient, and advanced data center infrastructure in Israel, catering to critical enterprise needs.

Strategic Outlook for Israel Data Center Market Market

- July 2022: Berkshire Partners announced to pay more than USD 215 Million to acquire a 49% stake in MedOne, valuing the company at NIS 1.5 billion (USD 430 Million). This significant M&A activity highlights investor confidence and consolidation within the Israeli data center market.

- August 2021: EdgeConneX announced its agreement to acquire Global Data Center (GDC), an Israeli data center operator. This acquisition, bringing two new facilities into the EdgeConneX global platform, including highly secure underground facilities near Tel Aviv, signifies the growing interest of international players in expanding their data center footprint in Israel.

- August 2020: Bynet Data Communications was building an underground data center for Oracle Corporation in Jerusalem. This 14,000 sq m (460,000 sq ft) facility, located 50 meters below ground, demonstrates the trend towards constructing highly secure, resilient, and advanced data center infrastructure in Israel, catering to critical enterprise needs.

Strategic Outlook for Israel Data Center Market Market

The Israel Data Center Market is poised for substantial growth, driven by an confluence of technological advancements, increasing digital adoption, and strategic investments. The continuous expansion of cloud infrastructure, the burgeoning demand for hyperscale facilities, and the critical need for secure enterprise data solutions will fuel market expansion. Future growth will be accelerated by the development of edge data centers, the integration of renewable energy sources for sustainable operations, and the increasing adoption of AI and Big Data technologies. Strategic opportunities lie in catering to the specific needs of the BFSI, Telecom, and E-Commerce sectors, as well as leveraging Israel's position as a regional innovation hub to attract further international investment and development in the data center sector.

Israel Data Center Market Segmentation

-

1. Hotspot

- 1.1. Tel Aviv

- 1.2. Rest of Isreal

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Israel Data Center Market Segmentation By Geography

- 1. Israel

Israel Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Tel Aviv

- 5.1.2. Rest of Isreal

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Global Technical Realty SARL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adgar Investments and Development Ltd (Adgar Data Center)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Global Technical Realty (GTR)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bezeq International General Partner Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HQserv

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bynet Data Communications Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EdgeConneX Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3SAMNET

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Med 1 IC-1 (1999) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lian Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ServerFarm LLC5 4 LIST OF COMPANIES STUDIE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Global Technical Realty SARL

List of Figures

- Figure 1: Israel Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Israel Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Israel Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Israel Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Israel Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Israel Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Israel Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Israel Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Israel Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Israel Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Israel Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Israel Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Israel Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Israel Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Israel Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Israel Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Israel Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Israel Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Israel Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Israel Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Israel Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Israel Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Israel Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Israel Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Israel Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Israel Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Israel Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Israel Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Israel Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Israel Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Israel Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Israel Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Data Center Market?

The projected CAGR is approximately 21.06%.

2. Which companies are prominent players in the Israel Data Center Market?

Key companies in the market include Global Technical Realty SARL, Adgar Investments and Development Ltd (Adgar Data Center), Global Technical Realty (GTR), Bezeq International General Partner Ltd, HQserv, Bynet Data Communications Ltd, EdgeConneX Inc, 3SAMNET, Med 1 IC-1 (1999) Ltd, Lian Group, ServerFarm LLC5 4 LIST OF COMPANIES STUDIE.

3. What are the main segments of the Israel Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

July 2022: Berkshire Partners announced to pay more than USD 215 million to acquire 49% stake in MedOne. The company was evaluated at NIS 1.5 billion (USD 430 Million).August 2021: EdgeConneX announced its agreement to acquire Global Data Center (GDC), an Israeli data center operator based in Herzliya district. Once completed, the acquisition would bring two new facilities into the EdgeConneX global data center platform, including GDC’s highly secure underground facilities in Herzliya and Petah Tikva, near Tel Aviv.August 2020: Bynet Data Communications was building an underground data center for Oracle Corporation in Jerusalem, Israel. The facility was a 14,000 sq m (460,000 sq ft) bunker located below five parking levels and a 17-story building in the city’s Har Hotzvim tech hub. The data center would extend over four floors at 50 meters (160 feet) below ground level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Data Center Market?

To stay informed about further developments, trends, and reports in the Israel Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence