Key Insights

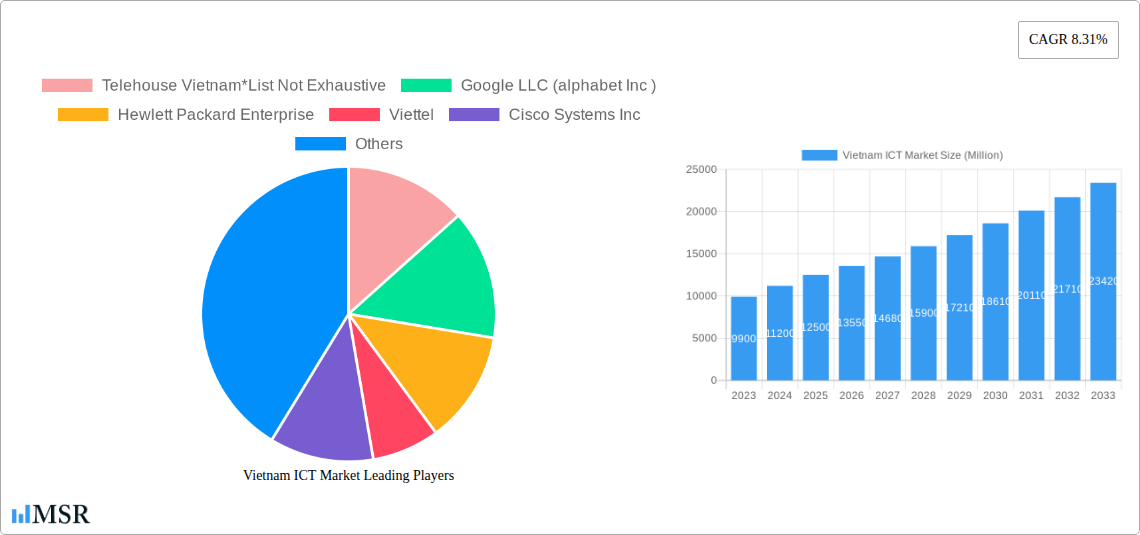

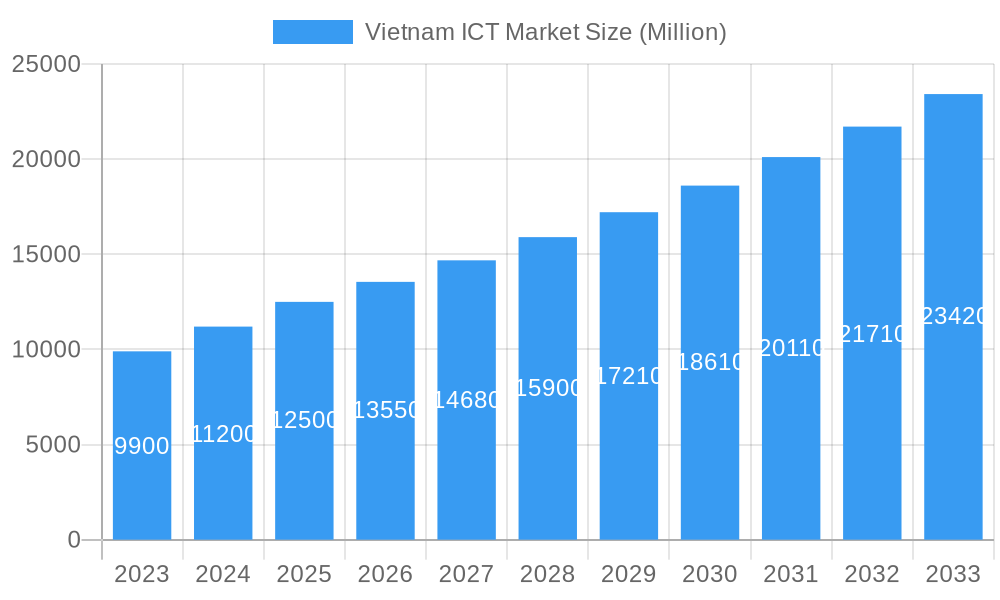

The Vietnam ICT market is poised for significant expansion, projected to reach an estimated market size of approximately $12,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.31% through 2033. This growth is primarily fueled by accelerating digital transformation initiatives across key industry verticals. The BFSI sector, driven by the demand for advanced fintech solutions and enhanced customer experiences, is a major contributor. Similarly, the IT and Telecom sector's relentless innovation in cloud computing, 5G deployment, and cybersecurity solutions is a powerful growth engine. Government initiatives promoting smart city development and e-governance further bolster market expansion. The retail and e-commerce sector's rapid adoption of digital platforms for sales and customer engagement, alongside manufacturing's embrace of Industry 4.0 technologies like IoT and AI for operational efficiency, also play pivotal roles. Emerging trends like the increasing adoption of AI and machine learning, the proliferation of IoT devices, and the growing demand for advanced cloud infrastructure are expected to shape the market landscape.

Vietnam ICT Market Market Size (In Billion)

Despite the optimistic outlook, certain restraints could temper growth. These include the evolving regulatory landscape, which may present compliance challenges, and the persistent cybersecurity threats that necessitate continuous investment in robust security solutions. The availability of skilled IT talent also remains a critical factor, as a shortage could hinder the timely implementation of sophisticated ICT projects. The market is segmented across hardware, software, IT and infrastructure services, and telecommunication services. Hardware, encompassing network switches, routers, WLAN, servers, storage, and fiber optics, forms a foundational element. Software solutions continue to evolve, addressing diverse business needs. The IT and Infrastructure Services segment, prominently featuring cloud offerings, is experiencing substantial adoption. Telecommunication services are crucial for enabling connectivity and supporting the digital ecosystem. Leading companies such as Google LLC, Hewlett Packard Enterprise, Cisco Systems Inc., Microsoft Corporation, and Fortinet are actively participating in this dynamic market, alongside strong local players like Viettel and Vietnamobile, indicating a competitive yet collaborative environment fostering innovation and growth.

Vietnam ICT Market Company Market Share

Vietnam ICT Market: Comprehensive Report & Analysis (2019-2033)

Unlock unparalleled insights into the dynamic Vietnam ICT market with this in-depth report. Spanning the historical period (2019-2024), base year (2025), and a robust forecast period (2025-2033), this analysis provides a strategic roadmap for stakeholders navigating this rapidly evolving landscape. Discover key growth drivers, emerging technologies like cloud computing, and the impact of digital transformation on sectors from BFSI to manufacturing. This report is your essential guide to understanding Vietnam's IT market trends, telecom services, hardware solutions, and software innovations.

Vietnam ICT Market Market Concentration & Dynamics

The Vietnam ICT market exhibits a dynamic concentration, balancing the presence of large, established global players with increasingly potent domestic enterprises. Innovation ecosystems are rapidly maturing, fueled by government initiatives promoting digital adoption and a growing pool of skilled IT professionals. Regulatory frameworks are evolving to support this growth, though complexities remain, particularly concerning data localization and cybersecurity. Substitute products are emerging, especially in software and cloud services, as local providers offer cost-effective alternatives. End-user trends point towards a strong demand for cloud-based solutions, AI-driven applications, and robust cybersecurity measures across all industry verticals. Merger and acquisition (M&A) activities are on the rise as companies seek to consolidate market share, acquire new technologies, and expand their service offerings. Key M&A deal counts are expected to increase by xx% during the forecast period, signaling intensified competition and strategic consolidation. Market share for leading players is varied, with a significant portion held by global tech giants and the remainder distributed among competitive local and regional entities. The market is characterized by both intense competition and strategic partnerships, driving innovation and customer-centric solutions.

Vietnam ICT Market Industry Insights & Trends

The Vietnam ICT market is poised for significant expansion, projected to reach approximately $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This robust growth is primarily propelled by escalating investments in digital infrastructure, the accelerated adoption of cloud computing services, and the increasing demand for advanced IT and infrastructure services. The government's unwavering commitment to becoming a digital nation, coupled with favorable foreign direct investment policies, further bolsters this upward trajectory.

Technological disruptions are at the forefront of market evolution. The widespread adoption of 5G technology is revolutionizing telecommunication services, enabling faster data speeds and supporting a new wave of innovative applications. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming business processes across sectors, from enhancing customer engagement in retail and e-commerce to optimizing operations in manufacturing and improving fraud detection in BFSI. The burgeoning demand for sophisticated hardware, including advanced network switches, routers, and WLAN devices, is critical for supporting this digital surge. Similarly, the market for servers and storage solutions is expanding to accommodate the ever-growing data volumes generated by businesses and consumers.

Evolving consumer behaviors are a key influencer. Vietnamese consumers are increasingly tech-savvy, demanding seamless digital experiences, personalized services, and secure online transactions. This shift is driving innovation in customer-facing technologies and pushing businesses to invest heavily in their digital presence. The BFSI sector, for instance, is rapidly embracing digital banking solutions and fintech innovations to cater to these preferences. The government sector is also undergoing a digital transformation, implementing e-governance initiatives to improve public services and citizen engagement. The IT and Telecom sector itself remains a powerhouse, continuously pushing the boundaries of connectivity and service delivery.

Key Markets & Segments Leading Vietnam ICT Market

The Vietnam ICT Market is driven by a confluence of dominant segments and thriving industry verticals, with IT and Infrastructure Services (including Cloud) emerging as a leading force. This segment's dominance is fueled by the pervasive need for scalable, flexible, and cost-effective computing solutions across businesses of all sizes. The accelerated adoption of cloud technologies, ranging from Infrastructure as a Service (IaaS) to Software as a Service (SaaS) and Platform as a Service (PaaS), is a significant growth catalyst. Enterprises are increasingly migrating their operations to the cloud to enhance agility, improve data accessibility, and reduce operational overheads.

Within the Hardware segment, Network Switches, Routers, and WLAN are witnessing substantial demand, driven by the expansion of enterprise networks and the increasing penetration of high-speed internet access. The growth of 5G infrastructure further amplifies the need for advanced networking equipment. Servers and Storage solutions are also critical, supporting the burgeoning data requirements of various industries, especially in the wake of big data analytics and AI adoption. Other Hardware, including Fiber Optics solutions, plays a vital role in building the foundational infrastructure for high-speed connectivity, essential for supporting the digital economy.

The Telecommunication Services segment continues to be a cornerstone of the Vietnamese ICT landscape, with ongoing investments in 5G deployment and network upgrades. This provides the essential connectivity backbone for all other ICT services and applications.

In terms of Industry Verticals, IT and Telecom remains a key driver, not only as a consumer of ICT solutions but also as an innovator and enabler for other sectors. The BFSI sector is a significant adopter of ICT, driven by the need for secure transactions, digital banking platforms, and advanced data analytics for risk management. Retail and E-commerce is experiencing explosive growth, necessitating robust online platforms, efficient supply chain management, and personalized customer experiences powered by ICT. Manufacturing is increasingly embracing Industry 4.0 principles, integrating automation, IoT, and data analytics to optimize production processes and enhance efficiency. The Government sector is actively pursuing digital transformation initiatives to improve public services and citizen engagement.

Vietnam ICT Market Product Developments

Product innovations within the Vietnam ICT market are increasingly focused on delivering intelligent, integrated, and scalable solutions. The launch of comprehensive cloud ecosystems, such as the Viettel Cloud Ecosystem, signifies a trend towards offering end-to-end cloud services tailored for enterprise transformation. This includes personalized and specialized solutions designed to accelerate digital adoption. Furthermore, advancements in edge networking services by global players like AWS are enhancing data processing capabilities closer to the source, crucial for real-time applications and IoT deployments. Product development is also emphasizing cybersecurity features, with an increasing integration of advanced threat detection and prevention capabilities across hardware and software solutions to safeguard sensitive data and critical infrastructure.

Challenges in the Vietnam ICT Market Market

Despite its robust growth, the Vietnam ICT market faces several challenges. Regulatory hurdles, particularly concerning data privacy and cybersecurity compliance, can create complexities for both domestic and international players. Supply chain issues, exacerbated by global economic uncertainties, can impact the timely availability and cost of essential hardware components. Intense competitive pressures, with a growing number of local and international vendors vying for market share, can lead to price erosion and necessitate continuous innovation to maintain profitability. Furthermore, a persistent digital skills gap in certain specialized areas can hinder the rapid deployment and adoption of advanced technologies.

Forces Driving Vietnam ICT Market Growth

Several potent forces are propelling the Vietnam ICT Market forward. The Vietnamese government's strategic vision for a digital economy, supported by favorable policies and investments in digital infrastructure, is a primary driver. The escalating demand for digital transformation across all industry verticals, from enhancing customer experiences in retail to optimizing operations in manufacturing, is creating significant market opportunities. The rapid expansion of high-speed internet penetration, including the ongoing rollout of 5G technology, is providing the necessary connectivity backbone. Furthermore, increasing foreign direct investment in the technology sector and a growing pool of skilled IT talent are fostering innovation and capacity building.

Challenges in the Vietnam ICT Market Market

The long-term growth catalysts for the Vietnam ICT Market lie in sustained innovation and strategic market expansion. Continued investment in research and development, particularly in emerging areas like Artificial Intelligence, Big Data analytics, and the Internet of Things (IoT), will be crucial. Strategic partnerships and collaborations between local and international technology providers will foster knowledge transfer and accelerate the adoption of advanced solutions. The expansion of cloud infrastructure and services, catering to the evolving needs of SMEs, will unlock significant growth potential. Furthermore, focusing on developing niche ICT solutions tailored to the specific requirements of emerging industries within Vietnam will create new avenues for sustainable growth.

Emerging Opportunities in Vietnam ICT Market

Emerging opportunities in the Vietnam ICT Market are abundant and diverse. The burgeoning demand for cybersecurity solutions presents a significant opportunity as businesses increasingly prioritize data protection. The expansion of the IoT ecosystem, driven by smart city initiatives and industrial automation, will create demand for connected devices and data management platforms. The healthcare sector's digital transformation, including telemedicine and electronic health records, offers a promising growth area. Furthermore, the increasing adoption of e-learning platforms and EdTech solutions presents substantial potential. The development of localized AI applications tailored to Vietnamese consumer needs and business contexts also represents a key emerging trend.

Leading Players in the Vietnam ICT Market Sector

- Telehouse Vietnam

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise

- Viettel

- Cisco Systems Inc.

- Fortinet

- Microsoft Corporation

- Vietnamobile

- Qualcomm Technologies Inc.

- Fujitsu

- D-Link Systems Inc.

Key Milestones in Vietnam ICT Market Industry

- October 2022: The Viettel Group launched the Viettel Cloud Ecosystem, cementing its position as Vietnam's largest cloud computing service provider. This launch will enable enterprise clients worldwide to accelerate cloud-enabled transformations with personalized and specialized solutions.

- October 2022: K-One signed an agreement with the Vietnam Distribution Joint Stock Company to prepare for a joint venture, which aligns with its plan to expand its cloud computing business in Vietnam.

- August 2022: Amazon Web Services (AWS) expanded its presence in Vietnam by launching new edge networking services in Ho Chi Minh City and Hanoi.

Strategic Outlook for Vietnam ICT Market Market

The strategic outlook for the Vietnam ICT Market is exceptionally bright, characterized by continued robust growth and increasing sophistication. Key growth accelerators include the deepening integration of cloud computing, the pervasive adoption of AI and IoT across industries, and the ongoing expansion of 5G networks. The government's commitment to digital transformation and the favorable investment climate will continue to attract both domestic and international players. Strategic opportunities lie in developing specialized solutions for burgeoning sectors such as fintech, e-health, and smart manufacturing, as well as in catering to the evolving needs of small and medium-sized enterprises seeking digital enablement. Emphasis on cybersecurity and data analytics will further solidify Vietnam's position as a key technology hub in Southeast Asia.

Vietnam ICT Market Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Network Switches

- 1.1.2. Routers and WLAN

- 1.1.3. Servers and Storage

- 1.1.4. Other Hardware (Fiber Optics solutions)

- 1.2. Software

- 1.3. IT and Infrastructure Services (includes Cloud)

- 1.4. Telecommunication Services

-

1.1. Hardware

-

2. Industry Vertical

- 2.1. BFSI

- 2.2. IT and Telecom

- 2.3. Government

- 2.4. Retail and E-commerce

- 2.5. Manufacturing

- 2.6. Energy and Utilities

- 2.7. Other Industry Verticals

Vietnam ICT Market Segmentation By Geography

- 1. Vietnam

Vietnam ICT Market Regional Market Share

Geographic Coverage of Vietnam ICT Market

Vietnam ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Smart City Initiatives Leading to Revamp of Technology Infrastructure; Digital Transformation and Industrial Automation; Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence)

- 3.3. Market Restrains

- 3.3.1. High Initial Cost for Infrastructure; Need for Technology-Specific Skillset and Awareness

- 3.4. Market Trends

- 3.4.1. Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence) is Expected to Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam ICT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Network Switches

- 5.1.1.2. Routers and WLAN

- 5.1.1.3. Servers and Storage

- 5.1.1.4. Other Hardware (Fiber Optics solutions)

- 5.1.2. Software

- 5.1.3. IT and Infrastructure Services (includes Cloud)

- 5.1.4. Telecommunication Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.2.1. BFSI

- 5.2.2. IT and Telecom

- 5.2.3. Government

- 5.2.4. Retail and E-commerce

- 5.2.5. Manufacturing

- 5.2.6. Energy and Utilities

- 5.2.7. Other Industry Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telehouse Vietnam*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (alphabet Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hewlett Packard Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Viettel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fortinet

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vietnamobile

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Qualcomm Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fujitsu

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 D-Link Systems Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Telehouse Vietnam*List Not Exhaustive

List of Figures

- Figure 1: Vietnam ICT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam ICT Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam ICT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Vietnam ICT Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Vietnam ICT Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 4: Vietnam ICT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Vietnam ICT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Vietnam ICT Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Vietnam ICT Market Revenue Million Forecast, by Industry Vertical 2020 & 2033

- Table 8: Vietnam ICT Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam ICT Market?

The projected CAGR is approximately 8.31%.

2. Which companies are prominent players in the Vietnam ICT Market?

Key companies in the market include Telehouse Vietnam*List Not Exhaustive, Google LLC (alphabet Inc ), Hewlett Packard Enterprise, Viettel, Cisco Systems Inc, Fortinet, Microsoft Corporation, Vietnamobile, Qualcomm Technologies Inc, Fujitsu, D-Link Systems Inc.

3. What are the main segments of the Vietnam ICT Market?

The market segments include Type, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Smart City Initiatives Leading to Revamp of Technology Infrastructure; Digital Transformation and Industrial Automation; Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence).

6. What are the notable trends driving market growth?

Increasing Investment on Key Technologies (Cloud Technology and Artificial Intelligence) is Expected to Drives the Market.

7. Are there any restraints impacting market growth?

High Initial Cost for Infrastructure; Need for Technology-Specific Skillset and Awareness.

8. Can you provide examples of recent developments in the market?

October 2022: The Viettel Group launched the Viettel Cloud Ecosystem, cementing its position as Vietnam's largest cloud computing service provider. This launch will enable enterprise clients worldwide to accelerate cloud-enabled transformations with personalized and specialized solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam ICT Market?

To stay informed about further developments, trends, and reports in the Vietnam ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence