Key Insights

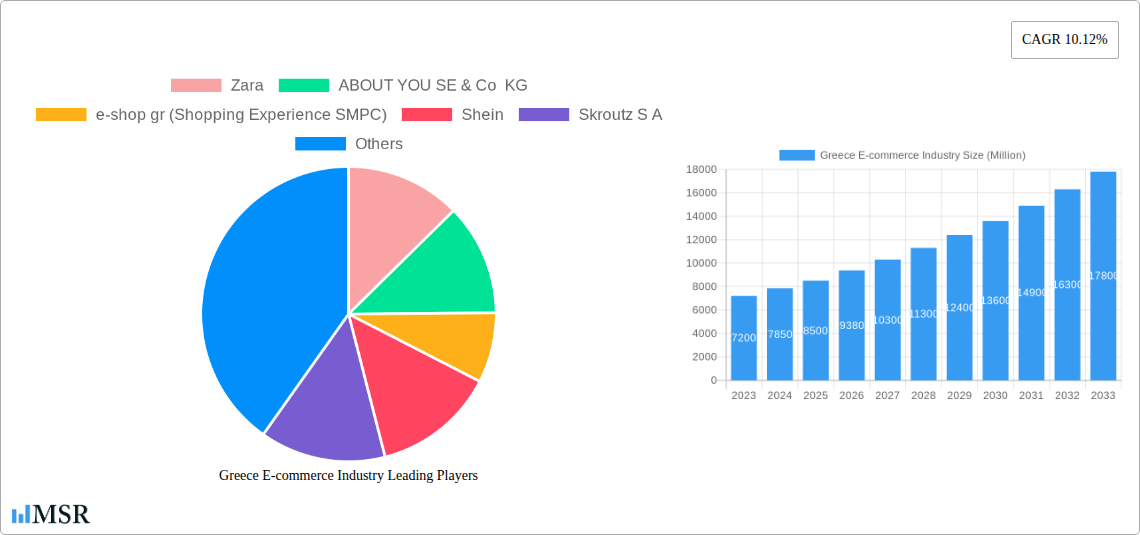

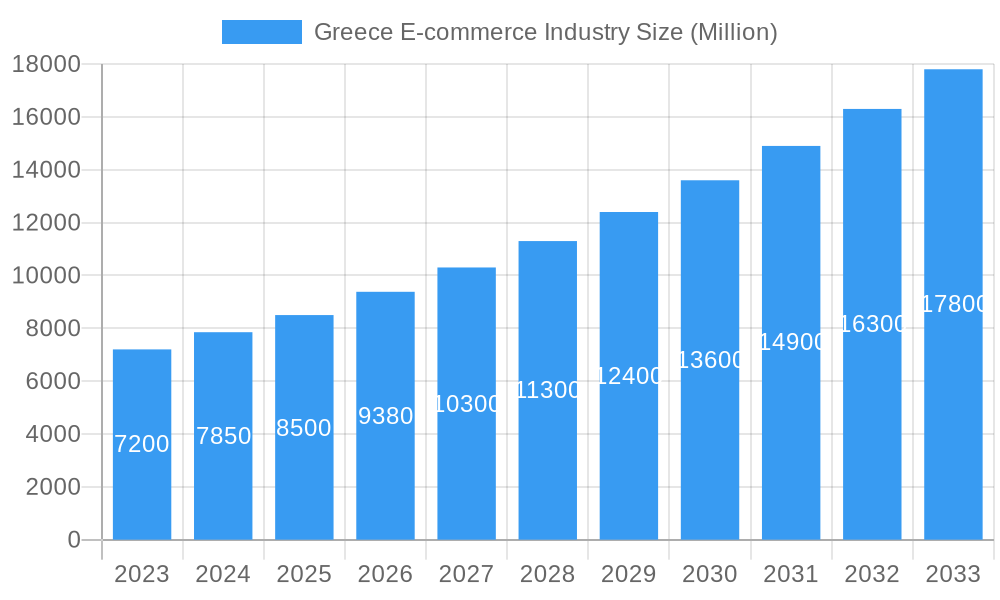

The Greek e-commerce market is projected for substantial expansion, forecast to grow from a base market size of 34.63 billion. With a compelling Compound Annual Growth Rate (CAGR) of 9.97%, the market is estimated to reach 14,700 million by the base year 2025 and is expected to exceed 23,000 million by 2033. Key growth drivers include increasing internet and smartphone penetration, enhanced consumer trust in online transactions, and the combined influence of global e-commerce leaders and emerging local competitors. Accelerated digital transformation among businesses further expands online product and service offerings, catering to evolving consumer preferences for convenience and personalized shopping experiences.

Greece E-commerce Industry Market Size (In Billion)

Market segmentation highlights varied growth across key verticals. Fashion & Apparel and Consumer Electronics remain dominant segments, leveraging online convenience and extensive product availability. Beauty & Personal Care is experiencing notable growth, propelled by influencer marketing and dedicated online retailers. While historically slower to adopt online channels, Food & Beverage and Furniture & Home are now seeing significant upturns due to improving logistics and consumer comfort with digital purchases. The "Others" category, including toys, DIY, and media, also contributes to the diverse digital marketplace. The Business-to-Business (B2B) e-commerce segment represents another crucial area of development, indicating a maturing and diversifying Greek digital economy.

Greece E-commerce Industry Company Market Share

Greece E-commerce Industry Report: Market Size, Trends, and Growth Opportunities (2019-2033)

Unlock the potential of the rapidly expanding Greek e-commerce market with this comprehensive industry report. Delve into in-depth analysis of B2C and B2B e-commerce trends, market segmentation, key players, and future growth catalysts. Discover actionable insights and strategic opportunities for stakeholders in the dynamic Greek online retail landscape.

Greece E-commerce Industry Market Concentration & Dynamics

The Greece e-commerce industry exhibits a dynamic market concentration, characterized by a mix of established international players and burgeoning local enterprises. Innovation ecosystems are flourishing, driven by advancements in digital payment solutions and last-mile delivery technologies. Regulatory frameworks are continuously evolving to support online trade, fostering a more conducive business environment. Substitute products, while present, are increasingly challenged by the convenience and breadth of online offerings. End-user trends underscore a growing preference for personalized shopping experiences, seamless checkout processes, and efficient delivery services. Mergers and acquisitions (M&A) activities are on the rise, indicating a consolidation phase and strategic expansion by key companies. The Greek online retail market is witnessing increasing M&A deal counts as companies seek to gain market share and operational efficiencies.

Greece E-commerce Industry Industry Insights & Trends

The Greece e-commerce industry is poised for robust growth, fueled by increasing internet penetration, a rising smartphone user base, and a young, tech-savvy population. The market size for the period of 2017-2027 is projected to reach significant figures, with a Compound Annual Growth Rate (CAGR) that signifies a healthy expansion trajectory. Technological disruptions, including the adoption of AI for personalized recommendations and enhanced customer service, alongside advancements in mobile commerce, are reshaping the consumer journey. Evolving consumer behaviors are marked by a demand for greater convenience, a wider product selection, and competitive pricing, pushing online shopping in Greece to new heights. The integration of social commerce and live streaming are also emerging trends that are influencing purchasing decisions. Digital transformation initiatives across various sectors are further bolstering the adoption of e-commerce solutions. The Greek online marketplace is a fertile ground for innovation, with a strong emphasis on user experience and value-added services.

Key Markets & Segments Leading Greece E-commerce Industry

The B2C e-commerce market size in Greece, projected from 2017-2027, showcases strong growth across various applications. The Fashion & Apparel segment consistently emerges as a dominant force, driven by the accessibility of global brands and a strong local fashion scene. Consumer Electronics also holds a significant share, propelled by the demand for the latest gadgets and home appliances. The Beauty & Personal Care sector is experiencing remarkable growth, with consumers increasingly opting for online convenience for their purchases. Furniture & Home segments are also gaining traction as online retailers offer wider selections and competitive pricing. The Food & Beverage segment, though nascent compared to others, is demonstrating promising growth potential, particularly with the rise of grocery delivery services.

Drivers for Segment Dominance:

- Economic Growth: A recovering and growing Greek economy directly translates to increased disposable income, fueling consumer spending across all e-commerce segments.

- Infrastructure Development: Investments in logistics and digital infrastructure enhance the efficiency and reach of e-commerce operations, particularly for last-mile delivery.

- Digital Adoption: High internet and smartphone penetration rates enable a larger consumer base to engage with online shopping platforms.

- Consumer Trust: Increasing consumer confidence in online transactions and secure payment gateways reduces barriers to entry.

The B2B e-commerce market size for the period of 2017-2027 is also expected to witness substantial expansion, driven by businesses seeking greater operational efficiency, wider supplier networks, and streamlined procurement processes. The adoption of digital procurement solutions and online wholesale platforms is a key trend in this segment.

Market Size (GMV) for the Period of 2017-2027 (USD Million):

- Total B2C E-commerce Market Size: Predicted to reach over 15,000 Million in 2027.

- Application Segmentation:

- Beauty & Personal Care: Expected to surpass 2,500 Million in 2027.

- Consumer Electronics: Projected to exceed 4,000 Million in 2027.

- Fashion & Apparel: Forecasted to reach over 5,000 Million in 2027.

- Food & Beverage: Anticipated to grow beyond 1,000 Million in 2027.

- Furniture & Home: Estimated to reach over 1,500 Million in 2027.

- Others (Toys, DIY, Media, etc.): Expected to grow to over 1,000 Million in 2027.

B2B E-commerce Market Size for the period of 2017-2027 (USD Million):

- Projected to exceed 8,000 Million in 2027.

Greece E-commerce Industry Product Developments

Product developments in the Greek e-commerce sector are increasingly focused on enhancing customer experience and operational efficiency. Innovations include the integration of augmented reality (AR) for virtual try-ons in fashion and furniture, personalized product recommendations powered by AI, and the development of sustainable packaging solutions. Advanced logistics and inventory management software are also crucial, enabling faster fulfillment and reduced costs. The market relevance of these developments lies in their ability to attract and retain customers in a competitive landscape. Companies are leveraging technology to offer unique value propositions, from hyper-personalized shopping journeys to seamless omnichannel experiences. The focus on user-friendly interfaces and intuitive navigation continues to be a key driver of product innovation.

Challenges in the Greece E-commerce Industry Market

The Greece e-commerce industry faces several challenges, including the need for further development of robust logistical infrastructure, particularly in rural areas, to ensure efficient last-mile delivery. Bridging the digital divide and enhancing digital literacy among a portion of the population remains a concern, limiting wider adoption. Intense competition from both international giants and agile local players necessitates continuous innovation and competitive pricing strategies. Navigating evolving regulatory landscapes and ensuring compliance with data privacy laws also present ongoing hurdles. High shipping costs and return management complexities can impact profitability.

Forces Driving Greece E-commerce Industry Growth

Several key forces are propelling the growth of the Greek e-commerce industry. The widespread adoption of smartphones and increasing internet penetration are fundamental drivers, providing a larger addressable market. Government initiatives promoting digitalization and supporting small and medium-sized enterprises (SMEs) in adopting online sales channels are also significant. The growing preference for convenience and the availability of a wider product range online, coupled with competitive pricing, are attracting consumers. Furthermore, advancements in digital payment solutions and the increasing trust in online transactions are removing key barriers to entry.

Challenges in the Greece E-commerce Industry Market

Long-term growth catalysts for the Greece e-commerce industry lie in continued investment in digital infrastructure, including faster internet speeds and broader mobile network coverage. Fostering a culture of digital innovation through education and support for startups will be crucial. Strategic partnerships between e-commerce platforms, logistics providers, and traditional retailers will unlock new distribution channels and customer acquisition opportunities. Expanding into underserved regions and developing specialized e-commerce offerings for niche markets will also contribute to sustained growth.

Emerging Opportunities in Greece E-commerce Industry

Emerging opportunities in the Greek e-commerce industry are diverse and promising. The growing adoption of cross-border e-commerce presents a significant avenue for expansion, allowing Greek businesses to reach international markets. The rise of sustainable and ethical consumption is creating demand for eco-friendly products and transparent supply chains, offering a competitive edge to businesses that prioritize these values. The integration of artificial intelligence and machine learning for hyper-personalization and predictive analytics presents opportunities for enhanced customer engagement and targeted marketing. The burgeoning gig economy also offers potential for flexible and efficient last-mile delivery solutions.

Leading Players in the Greece E-commerce Industry Sector

- Zara

- ABOUT YOU SE & Co KG

- e-shop gr (Shopping Experience SMPC)

- Shein

- Skroutz S A

- Marks and Spencer plc

- Plaisio Computers

- RetailWorld S A (public gr)

- Kotsovolos

- Apple Inc

Key Milestones in Greece E-commerce Industry Industry

- April 2022: Heloo, a Croatian provider of outsourced specialized services, was bought by TaskUs. Heloo is a customer care provider for European technology companies, focusing on the E-commerce and gaming industries. TASK expands its European language capabilities, diversifies its client base, and helps scale its global operations by expanding into Eastern Europe. Cross-selling prospects with Heloo's clientele in Greece, Germany, Austria, Switzerland, Finland, and other countries will benefit TASK.

- April 2022: Swipbox partnered with Skroutz S.A. to launch the SwipBox parcel locker (battery-driven Infinity Lockers) network with Skroutz Last Mile at Skroutz checkpoint locations, offering last mile courier checkpoints for efficient delivery of nationwide shipments. The lockers were installed in March 2022 in Athens, and the parcel lockers will be located conveniently for end users, such as petrol stations, housing estates, shopping centers, etc.

Strategic Outlook for Greece E-commerce Industry Market

The strategic outlook for the Greece e-commerce market is exceptionally bright, characterized by sustained growth and increasing sophistication. Key growth accelerators include leveraging data analytics for deeper customer insights, investing in omnichannel strategies to bridge online and offline experiences, and exploring emerging technologies like blockchain for enhanced supply chain transparency and security. Further development of digital payment ecosystems and fostering a talent pool with specialized e-commerce skills will be crucial for long-term success. Strategic partnerships and potential consolidation will continue to shape the competitive landscape, offering exciting prospects for stakeholders prepared to adapt and innovate.

Greece E-commerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the Period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the Period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size for the period of 2017-2027

Greece E-commerce Industry Segmentation By Geography

- 1. Greece

Greece E-commerce Industry Regional Market Share

Geographic Coverage of Greece E-commerce Industry

Greece E-commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Apparel and Footwear Industry.; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. lack of awareness of mobile accessibility features and mobile internet are key barriers

- 3.4. Market Trends

- 3.4.1. Significant Market Growth is Expected Post the COVID-19 Outbreak

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Greece E-commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the Period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the Period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Greece

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABOUT YOU SE & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 e-shop gr (Shopping Experience SMPC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shein

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skroutz S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Marks and Spencer plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plaisio Computers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RetailWorld S A (public gr)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kotsovolos

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zara

List of Figures

- Figure 1: Greece E-commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Greece E-commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Greece E-commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Greece E-commerce Industry Revenue billion Forecast, by Market size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 3: Greece E-commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Greece E-commerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Greece E-commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Greece E-commerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Greece E-commerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 8: Greece E-commerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 9: Greece E-commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Greece E-commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Greece E-commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Greece E-commerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Greece E-commerce Industry Revenue billion Forecast, by Market size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 14: Greece E-commerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Greece E-commerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Greece E-commerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Greece E-commerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Greece E-commerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 19: Greece E-commerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 20: Greece E-commerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Greece E-commerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Greece E-commerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Greece E-commerce Industry?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the Greece E-commerce Industry?

Key companies in the market include Zara, ABOUT YOU SE & Co KG, e-shop gr (Shopping Experience SMPC), Shein, Skroutz S A, Marks and Spencer plc, Plaisio Computers, RetailWorld S A (public gr), Kotsovolos, Apple Inc *List Not Exhaustive.

3. What are the main segments of the Greece E-commerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the Period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Apparel and Footwear Industry.; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Significant Market Growth is Expected Post the COVID-19 Outbreak.

7. Are there any restraints impacting market growth?

lack of awareness of mobile accessibility features and mobile internet are key barriers.

8. Can you provide examples of recent developments in the market?

April 2022 - Heloo, a Croatian provider of outsourced specialized services, was bought by TaskUs. Heloo is a customer care provider for European technology companies, focusing on the E-commerce and gaming industries. TASK expands its European language capabilities, diversifies its client base, and helps scale its global operations by expanding into Eastern Europe. Cross-selling prospects with Heloo's clientele in Greece, Germany, Austria, Switzerland, Finland, and other countries will benefit TASK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Greece E-commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Greece E-commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Greece E-commerce Industry?

To stay informed about further developments, trends, and reports in the Greece E-commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence