Key Insights

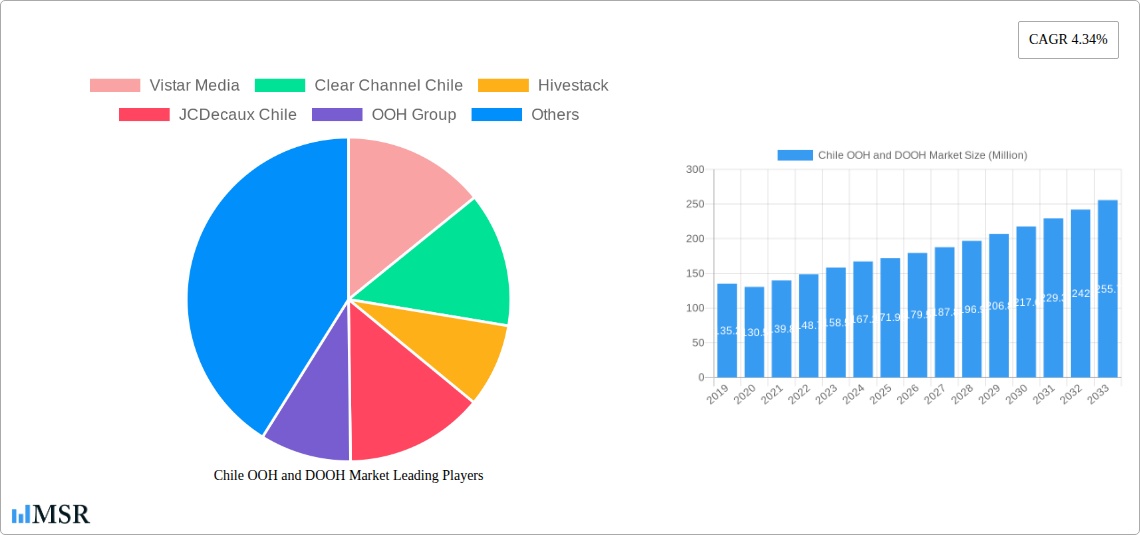

The Chilean Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for robust growth, projected to reach an estimated USD 171.95 million in 2025. This expansion is driven by a healthy Compound Annual Growth Rate (CAGR) of 4.34% over the forecast period (2025-2033). Key growth drivers include increasing urbanization, a rising disposable income among the Chilean populace, and a growing demand for sophisticated, data-driven advertising solutions. The digital transformation of OOH, particularly the proliferation of LED screens and programmatic OOH, is a significant trend, offering advertisers enhanced targeting capabilities, real-time campaign adjustments, and measurable ROI. This shift from static to dynamic OOH is attracting a diverse range of advertisers, from the automotive sector, which benefits from eye-catching visual displays, to the retail and consumer goods industry, leveraging high-traffic locations for brand visibility. The healthcare and BFSI (Banking, Financial Services, and Insurance) sectors are also increasingly recognizing the power of OOH to build trust and convey crucial information.

Chile OOH and DOOH Market Market Size (In Million)

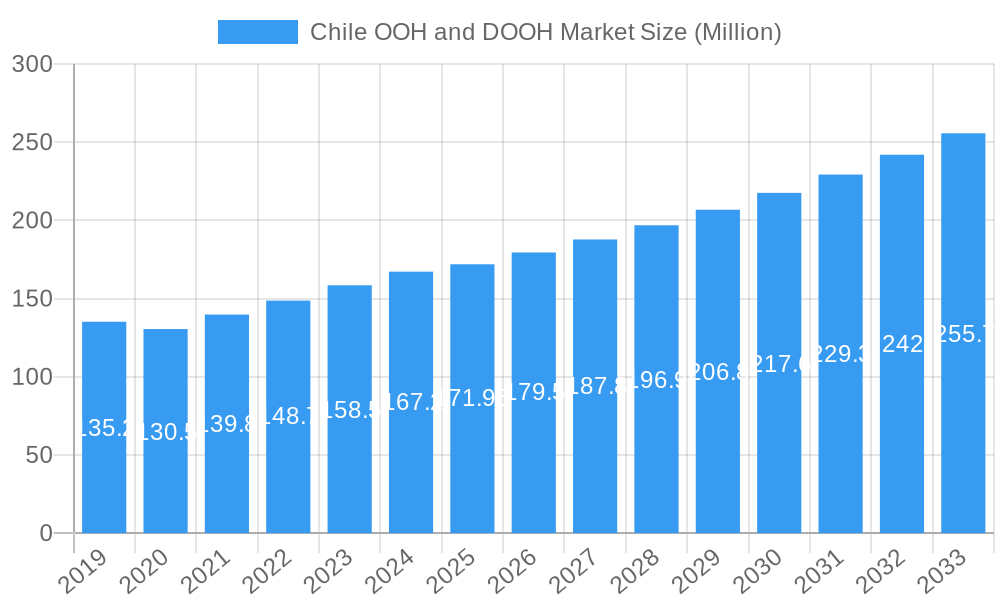

Despite the positive outlook, certain restraints could influence the market's trajectory. These may include the high initial investment required for digital OOH infrastructure, evolving regulatory landscapes regarding advertising content and placement, and the potential for ad fatigue if campaigns are not creatively executed. However, the market is actively addressing these challenges through innovations in programmatic buying and the development of more engaging, interactive ad formats. The segmentation of the Chilean OOH and DOOH market reveals a strong presence of static OOH, which continues to hold a significant share due to its cost-effectiveness and broad reach. Nonetheless, Digital OOH, encompassing LED screens and programmatic DOOH, is the fastest-growing segment, signifying a clear industry shift towards advanced advertising technologies. Applications are diverse, with billboards and transportation media (including airports and transit systems like buses) being prominent. Street furniture and other place-based media also contribute to the market's comprehensive coverage. Prominent companies like Clear Channel Chile, JCDecaux Chile, and Viva Outdoor are actively shaping the market, alongside technology-focused players like Vistar Media and Hivestack, indicating a dynamic competitive environment.

Chile OOH and DOOH Market Company Market Share

Unlock invaluable insights into Chile's dynamic Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising landscape. This comprehensive report provides a forward-looking analysis from 2019 to 2033, with a detailed focus on the base and estimated year of 2025 and a robust forecast period of 2025–2033. Delve into market concentration, key industry trends, segment dominance, product innovations, challenges, growth drivers, and emerging opportunities shaping the future of OOH advertising in Chile. The report examines crucial developments impacting this sector, including the recent acquisition of Entravision Global Partners by Aleph Group in July 2024, strengthening its presence in Latin America, including Chile, and Clear Channel Outdoor's strategic review of its Latin American operations in November 2023.

Chile OOH and DOOH Market Market Concentration & Dynamics

The Chilean Out-of-Home (OOH) and Digital Out-of-Home (DOOH) market is characterized by a moderate concentration, with several key players vying for market share. Innovation ecosystems are rapidly evolving, driven by the integration of programmatic DOOH, programmatic OOH buying, and the deployment of advanced LED screens. Regulatory frameworks, while generally supportive of advertising, can influence deployment and content, impacting market dynamics. Substitute products, primarily digital media channels like social media advertising and online video, present a constant competitive pressure, necessitating continuous adaptation by OOH providers. End-user trends are shifting towards data-driven campaign planning and measurable ROI, pushing for more sophisticated audience targeting and creative execution. Mergers & Acquisitions (M&A) activities, such as Aleph Group's recent acquisition of Entravision Global Partners, signal consolidation and strategic expansion within the Latin American OOH and digital advertising space, including Chile. These moves are crucial in reshaping market share and fostering a more competitive environment.

- Market Concentration: Moderate, with significant competition from both established OOH giants and emerging digital players.

- Innovation Ecosystems: Flourishing, particularly in programmatic DOOH, programmatic OOH, and data analytics for audience insights.

- Regulatory Frameworks: Generally stable, with an emphasis on public space aesthetics and advertising standards.

- Substitute Products: Digital advertising channels (social media, search, online video) remain the primary substitutes.

- End-User Trends: Increasing demand for programmatic buying, data-driven targeting, and performance-based advertising.

- M&A Activities: Active, with recent high-profile deals indicating strategic consolidation and growth in the region.

Chile OOH and DOOH Market Industry Insights & Trends

The Chilean OOH and DOOH market is poised for significant growth, driven by a confluence of economic recovery, technological advancements, and evolving consumer behaviors. The Chile OOH market size is projected to expand considerably, with the Digital Out-of-Home (DOOH) market in Chile emerging as a primary growth engine. This expansion is fueled by increased investment in programmatic DOOH capabilities, allowing for more dynamic and targeted advertising campaigns. The adoption of advanced LED screens is transforming static billboards into interactive and engaging digital displays, attracting a wider range of advertisers. The market's Compound Annual Growth Rate (CAGR) is expected to be robust, reflecting a sustained upward trajectory throughout the forecast period. Key growth drivers include the increasing urbanization of Chile, leading to higher foot traffic and greater exposure for OOH media, and a growing demand from businesses to reach consumers in both traditional and emerging digital spaces. The integration of programmatic OOH buying platforms is democratizing access to the medium, attracting smaller advertisers and facilitating more efficient media planning and buying. Furthermore, a renewed focus on experiential marketing and a desire for impactful brand presence are pushing advertisers to leverage the unique strengths of OOH, including its ability to create memorable brand moments in real-world environments. The Chile advertising market as a whole is witnessing a digital transformation, and OOH is no exception. The shift from Static (Traditional) OOH to Digital OOH (LED Screens) is a defining trend, offering advertisers greater flexibility, real-time campaign adjustments, and enhanced creative possibilities. This evolution is further supported by advancements in data analytics, enabling OOH providers to offer more precise audience segmentation and measurement.

Key Markets & Segments Leading Chile OOH and DOOH Market

The Chilean OOH and DOOH market's dominance is increasingly being shaped by the rapid expansion of Digital OOH (LED Screens), which is outpacing traditional Static (Traditional) OOH. This shift is particularly pronounced in urban centers like Santiago, where infrastructure development and consumer density create prime opportunities for impactful advertising. Within the Type segment, Digital OOH (LED Screens) is experiencing exponential growth, propelled by its inherent advantages in flexibility, dynamic content delivery, and programmatic capabilities. This segment is further diversified into Programmatic OOH, a critical enabler of data-driven advertising, and Others, which includes emerging digital display technologies.

The Application segment showcases the versatility of OOH advertising. Billboards continue to hold a significant share, especially in high-traffic arterial routes. However, Transportation (Transit) is emerging as a powerful growth area, encompassing both Airports, where captive audiences and premium demographics are readily available, and other transit modes like Buses, etc., which offer widespread reach in urban and suburban areas. Street Furniture, including bus shelters and kiosks, provides hyper-local targeting and high frequency. Other Place-Based Media, such as those found in shopping malls, gyms, and entertainment venues, caters to specific demographic and psychographic profiles.

The End-User segment reflects the broad appeal of OOH advertising across diverse industries. The Automotive sector is a consistent advertiser, leveraging OOH for new model launches and brand awareness. Retail and Consumer Goods are major contributors, utilizing OOH for promotional campaigns and in-store traffic driving. The Healthcare sector is increasingly exploring OOH for public health campaigns and pharmaceutical advertising. BFSI (Banking, Financial Services, and Insurance) utilizes OOH for brand building and product promotions, particularly in financial hubs. Other End Users, including government bodies, entertainment, and telecommunications, also contribute significantly to market demand.

Dominant Segments:

- Type: Digital OOH (LED Screens) (including Programmatic OOH)

- Application: Transportation (Transit) (especially Airports and Buses), Billboards

- End-User: Retail and Consumer Goods, Automotive

Key Drivers for Dominance:

- Economic Growth: Overall economic health in Chile fuels advertising spend across all sectors.

- Urbanization: Increasing population density in cities amplifies the reach and impact of OOH media.

- Technological Advancements: The proliferation of LED screens and programmatic buying platforms enhances the effectiveness and appeal of DOOH.

- Infrastructure Development: Investment in transportation networks and public spaces creates new OOH inventory.

- Consumer Behavior Shifts: A growing demand for engaging and contextually relevant advertising favors DOOH.

Chile OOH and DOOH Market Product Developments

Product developments in the Chilean OOH and DOOH market are centered on enhancing audience engagement and campaign measurability. The integration of programmatic OOH buying platforms allows for real-time bidding and dynamic content insertion, making campaigns more responsive and efficient. Advances in LED screen technology are leading to higher resolution, greater flexibility in installation (e.g., curved screens), and improved energy efficiency. Furthermore, the development of data analytics and measurement tools is enabling advertisers to gain deeper insights into campaign performance, including reach, frequency, and even footfall attribution, thereby increasing the perceived ROI of OOH advertising.

Challenges in the Chile OOH and DOOH Market Market

Despite its growth potential, the Chilean OOH and DOOH market faces several challenges. Regulatory hurdles concerning public space permits and digital advertising content can slow down deployment and innovation. Supply chain issues, particularly for specialized digital hardware and installation services, can impact project timelines and costs. Competitive pressures from other media channels, including pervasive digital advertising, necessitate continuous innovation and demonstration of OOH's unique value proposition. Moreover, measuring the precise impact and ROI of OOH campaigns can still be a challenge for some advertisers, requiring further development of sophisticated analytics.

Forces Driving Chile OOH and DOOH Market Growth

Several forces are propelling the growth of the Chile OOH and DOOH market. Technological advancements, particularly in programmatic DOOH and the widespread adoption of LED screens, are making OOH more dynamic and accessible. Economic factors, including a recovering economy and increased consumer spending, translate into higher advertising budgets. Urbanization trends continue to create captive audiences in densely populated areas. Regulatory support for infrastructure development and public advertising can also contribute positively. The inherent impact and visibility of OOH, especially in uncluttered environments, remains a strong draw for brands seeking to build awareness and create memorable experiences.

Challenges in the Chile OOH and DOOH Market Market

Long-term growth catalysts for the Chile OOH and DOOH market lie in continuous innovation and strategic market expansion. The increasing adoption of data analytics and AI in OOH will enable hyper-targeted campaigns and sophisticated audience segmentation, further solidifying its relevance in a digital-first world. Partnerships between OOH providers, technology companies, and data firms will unlock new revenue streams and enhance service offerings. Market expansions into emerging urban areas and specialized locations (e.g., entertainment districts, educational institutions) will broaden inventory and reach. The ongoing development of interactive and immersive OOH experiences will also be crucial in capturing consumer attention.

Emerging Opportunities in Chile OOH and DOOH Market

Emerging opportunities in the Chile OOH and DOOH market are ripe for exploitation. The growing adoption of Programmatic OOH platforms presents a significant opportunity for agencies and advertisers to optimize media buying and campaign execution. The development of data-driven insights and measurement tools will unlock new avenues for demonstrating campaign effectiveness, attracting a wider range of advertisers. Interactive OOH formats, such as those incorporating augmented reality (AR) or QR codes, offer novel ways to engage consumers and drive digital interaction. Furthermore, the increasing focus on sustainability and eco-friendly OOH solutions presents an opportunity for market differentiation and appeal to environmentally conscious brands.

Leading Players in the Chile OOH and DOOH Market Sector

- Vistar Media

- Clear Channel Chile

- Hivestack

- JCDecaux Chile

- OOH Group

- Taggify

- Lamar Media Corp

- Viva outdoor

- Dentsu Creative Chile

- Outdoor Media Buyers

Key Milestones in Chile OOH and DOOH Market Industry

- July 2024: Aleph Group finalized its acquisition of Entravision Global Partners ("EGP"), significantly strengthening its presence in Latin America, including Chile, Mexico, Brazil, Argentina, Colombia, Peru, Puerto Rico, and Ecuador. This move is expected to enhance connectivity between digital media platforms and advertisers in these key emerging markets.

- November 2023: Clear Channel Outdoor Holdings, Inc. completed the sale of its French business and initiated a strategic review of its Latin American operations, encompassing Mexico, Brazil, Chile, and Peru. This indicates a potential shift in strategic focus and portfolio management for the company within the region.

Strategic Outlook for Chile OOH and DOOH Market Market

The strategic outlook for the Chile OOH and DOOH market is exceptionally positive, driven by a robust convergence of technological innovation and evolving advertiser demands. The increasing integration of programmatic buying, advanced analytics, and dynamic digital displays will continue to elevate the efficiency and effectiveness of OOH campaigns. Future growth accelerators include the expansion of programmatic DOOH to capture a larger share of digital ad spend, the development of immersive and interactive ad formats to enhance consumer engagement, and the creation of sophisticated measurement solutions to prove ROI. Strategic partnerships and ongoing investment in infrastructure will further solidify Chile's position as a key market for out-of-home advertising in Latin America, offering unparalleled opportunities for brands to connect with audiences in the physical world.

Chile OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

1.3. By Appli

- 1.3.1. Billboard

-

1.3.2. Transportation (Transit)

- 1.3.2.1. Airports

- 1.3.2.2. Others (Buses, etc.)

- 1.3.3. Street Furniture

- 1.3.4. Other Place-Based Media

-

1.4. By End-U

- 1.4.1. Automotive

- 1.4.2. Retail and Consumer Goods

- 1.4.3. Healthcare

- 1.4.4. BFSI

- 1.4.5. Other End Users

Chile OOH and DOOH Market Segmentation By Geography

- 1. Chile

Chile OOH and DOOH Market Regional Market Share

Geographic Coverage of Chile OOH and DOOH Market

Chile OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.34% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Towards Digital Advertising Aided by Increased Spending on Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.1.3. By Appli

- 5.1.3.1. Billboard

- 5.1.3.2. Transportation (Transit)

- 5.1.3.2.1. Airports

- 5.1.3.2.2. Others (Buses, etc.)

- 5.1.3.3. Street Furniture

- 5.1.3.4. Other Place-Based Media

- 5.1.4. By End-U

- 5.1.4.1. Automotive

- 5.1.4.2. Retail and Consumer Goods

- 5.1.4.3. Healthcare

- 5.1.4.4. BFSI

- 5.1.4.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vistar Media

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clear Channel Chile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hivestack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JCDecaux Chile

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OOH Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Taggify

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lamar Media Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viva outdoor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dentsu Creative Chile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Outdoor Media Buyers*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vistar Media

List of Figures

- Figure 1: Chile OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Chile OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Chile OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Chile OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Chile OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Chile OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Chile OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 7: Chile OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Chile OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile OOH and DOOH Market?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Chile OOH and DOOH Market?

Key companies in the market include Vistar Media, Clear Channel Chile, Hivestack, JCDecaux Chile, OOH Group, Taggify, Lamar Media Corp, Viva outdoor, Dentsu Creative Chile, Outdoor Media Buyers*List Not Exhaustive.

3. What are the main segments of the Chile OOH and DOOH Market?

The market segments include Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 171.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States.

6. What are the notable trends driving market growth?

Ongoing Shift Towards Digital Advertising Aided by Increased Spending on Smart City Projects.

7. Are there any restraints impacting market growth?

Ongoing Shift Towards Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry has aided the spending on Airport Advertisement in the United States.

8. Can you provide examples of recent developments in the market?

July 2024: Aleph Group, a global player in connecting major digital media platforms with advertisers and consumers, especially in emerging markets, has finalized its acquisition of Entravision Global Partners ("EGP"), the digital commercial arm of Entravision Communications Corporation. Some of the major markets strengthened by this acquisition in Latin America include Chile, Mexico, Brazil, Argentina, Colombia, Peru, Puerto Rico, and Ecuador, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Chile OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence