Key Insights

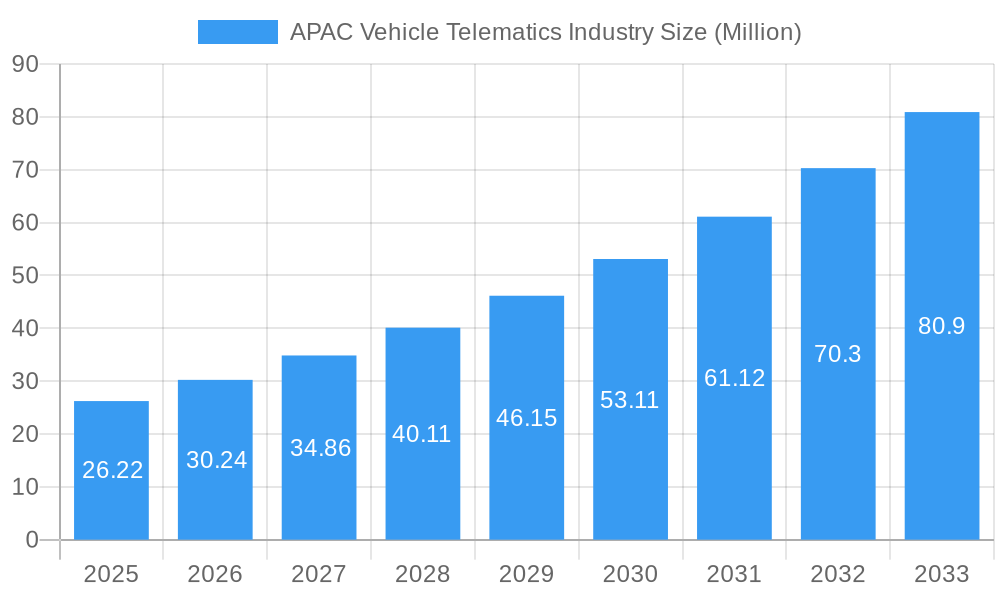

The APAC Vehicle Telematics Industry is poised for substantial growth, projected to reach a market size of $26.22 million with a robust Compound Annual Growth Rate (CAGR) exceeding 15.37% from 2025 to 2033. This remarkable expansion is fueled by several key drivers. The increasing adoption of connected vehicle technologies across commercial and passenger segments, driven by the need for enhanced fleet management, operational efficiency, and improved safety, forms a primary catalyst. Furthermore, stringent government regulations mandating the implementation of telematics solutions for fleet tracking, compliance, and accident reconstruction are playing a significant role in market penetration. The growing demand for real-time data analytics for predictive maintenance, route optimization, and fuel efficiency management in commercial vehicles, particularly trucks and LCVs, is also a major growth stimulant. The rise of sophisticated telematics solutions integrating IoT, AI, and big data analytics is further propelling market dynamism, offering advanced features like driver behavior monitoring, remote diagnostics, and enhanced security.

APAC Vehicle Telematics Industry Market Size (In Million)

The market's trajectory is further shaped by emerging trends and evolving consumer expectations. The increasing pervasiveness of smartphones and the burgeoning digital infrastructure in the APAC region are facilitating the seamless integration of telematics applications for both personal and commercial use. The aftermarket segment is witnessing significant traction as fleet operators and individual vehicle owners seek to upgrade existing systems with advanced telematics capabilities. While growth is robust, certain restraints exist, including the initial high cost of some advanced telematics systems and the varying levels of digital infrastructure across different sub-regions within APAC, which can create adoption disparities. However, the overarching trend is one of rapid innovation and widespread adoption, with companies continuously introducing more affordable and feature-rich solutions. Key players like Concox Information Technology Co Ltd, Arya Omnitalk Wireless Solutions, and Tata Consultancy Services are actively investing in R&D and expanding their product portfolios to cater to the diverse needs of the APAC market, solidifying its position as a leading global hub for vehicle telematics.

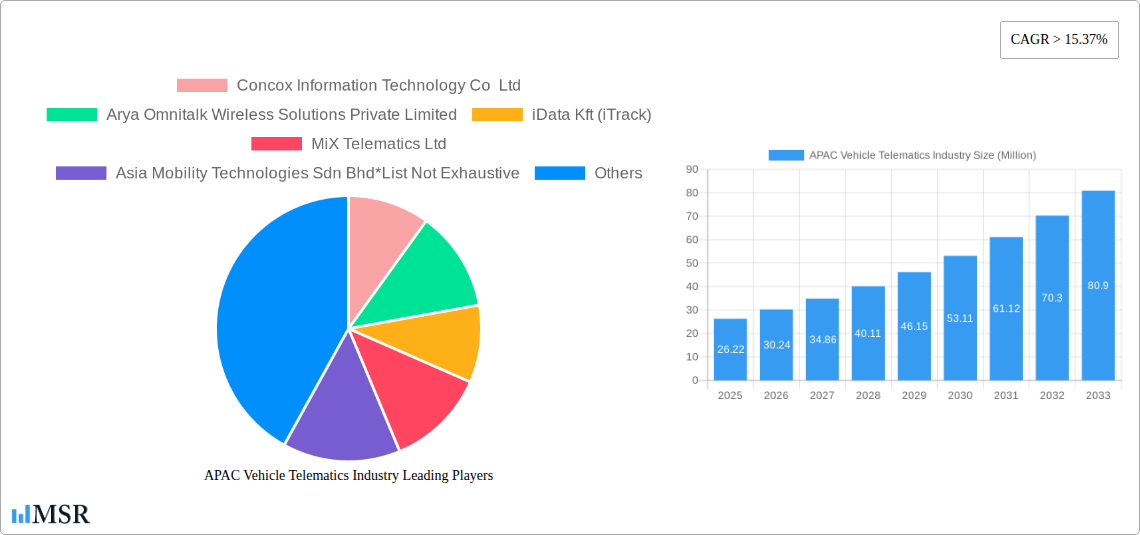

APAC Vehicle Telematics Industry Company Market Share

APAC Vehicle Telematics Industry: Unlocking Future Mobility & Connectivity (2019-2033)

Gain unparalleled insights into the dynamic APAC Vehicle Telematics Industry. This comprehensive report, spanning the Study Period of 2019–2033 with a Base Year of 2025, delivers a deep dive into market dynamics, key segments, emerging technologies, and strategic opportunities. Understand the growth trajectory of vehicle telematics in Asia Pacific, driven by increasing adoption of connected car technology, fleet management solutions, and IoT in automotive. Discover how players are leveraging advancements in GPS tracking, real-time diagnostics, and data analytics to shape the future of transportation. With a meticulous forecast for the Forecast Period of 2025–2033 and historical analysis from 2019–2024, this report is essential for stakeholders seeking to capitalize on this rapidly expanding market.

APAC Vehicle Telematics Industry Market Concentration & Dynamics

The APAC Vehicle Telematics Industry is characterized by a moderate to high degree of market concentration, with a few key players holding significant market share, while a growing number of innovative startups are disrupting the landscape. Innovation ecosystems are flourishing, fueled by increasing government support for smart transportation and the rapid development of 5G infrastructure across the region. Regulatory frameworks are evolving, with a growing emphasis on data privacy, cybersecurity, and standardization of telematics solutions. Substitute products, such as basic GPS navigators, are increasingly being superseded by advanced telematics systems offering a broader range of functionalities. End-user trends are shifting towards a demand for enhanced safety, improved operational efficiency for commercial fleets, and personalized in-car experiences for passenger vehicles. Mergers & Acquisitions (M&A) activities are on the rise as larger companies seek to acquire innovative technologies and expand their market reach. For instance, an estimated xx M&A deals are anticipated during the forecast period, signifying consolidation and strategic partnerships aimed at enhancing competitive capabilities. The market share distribution among top players is projected to see shifts, with the top 5 companies estimated to hold approximately 55% of the market by 2033.

- Market Share: Top players collectively hold an estimated 48% of the market in the Base Year (2025).

- M&A Activities: Anticipated xx number of strategic acquisitions and partnerships between 2025 and 2033.

- Innovation Ecosystems: Active venture capital funding in telematics startups, with an estimated $500 Million invested in the past two years.

- Regulatory Landscape: Ongoing development of data privacy laws and cybersecurity mandates impacting telematics data handling.

APAC Vehicle Telematics Industry Industry Insights & Trends

The APAC Vehicle Telematics Industry is poised for substantial growth, driven by a confluence of factors including the burgeoning automotive sector, increasing adoption of commercial vehicle fleet management, and the rising demand for advanced driver-assistance systems (ADAS) and in-vehicle infotainment. The market size is estimated to reach $18,500 Million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 18.5% projected for the Forecast Period of 2025–2033. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) enhancing predictive maintenance, driver behavior analysis, and route optimization. The proliferation of the Internet of Things (IoT) in vehicles is creating a connected ecosystem, enabling seamless data exchange between vehicles, infrastructure, and cloud platforms. Evolving consumer behaviors are increasingly demanding safer, more efficient, and personalized driving experiences. This includes a growing interest in usage-based insurance (UBI), real-time traffic information, and remote vehicle diagnostics and control. Furthermore, the push towards electric vehicles (EVs) is introducing new telematics requirements related to battery management, charging infrastructure integration, and range optimization. The ongoing digital transformation within the automotive industry is a critical driver, pushing manufacturers and service providers to offer integrated telematics solutions as a standard or premium feature. The market is witnessing a significant shift from basic GPS tracking to sophisticated platforms offering comprehensive fleet management, asset tracking, and driver safety monitoring, thereby contributing to the projected market expansion. The increasing penetration of smartphones and the widespread availability of mobile internet are further accelerating the adoption of app-based telematics solutions.

Key Markets & Segments Leading APAC Vehicle Telematics Industry

The Commercial (Truck) LCV Vs. M/HCV segment is emerging as the dominant force within the APAC Vehicle Telematics Industry, propelled by the critical need for efficient fleet management, cost optimization, and enhanced supply chain visibility across the region. Countries such as China, India, and Southeast Asian nations are experiencing a surge in logistics and transportation activities, making telematics an indispensable tool for managing large fleets of light commercial vehicles (LCVs) and medium/heavy commercial vehicles (M/HCVs). Economic growth and substantial investments in infrastructure development are further bolstering this segment's expansion. The Aftermarket channel is also showing significant traction, as fleet operators and individual vehicle owners seek to upgrade their existing vehicles with advanced telematics capabilities, independent of the original equipment manufacturer (OEM).

- Dominant Segment - Commercial Vehicles:

- Drivers: Increased e-commerce penetration, urbanization, and the need for real-time tracking of goods.

- Market Penetration: Estimated to account for 65% of the total APAC telematics market by 2033.

- Key Features: Route optimization, fuel consumption monitoring, driver behavior analysis, and theft prevention.

- Growing Channel - Aftermarket:

- Drivers: Retrofitting existing fleets, cost-effectiveness compared to OEM solutions, and the availability of specialized aftermarket devices.

- Market Share Growth: Projected to grow from an estimated 25% in 2025 to 35% by 2033.

- Passenger (Car) Segment:

- Drivers: Growing demand for connected car features, safety applications, and in-car entertainment.

- Market Influence: While smaller than the commercial segment, it is experiencing steady growth driven by premiumization and consumer expectations.

APAC Vehicle Telematics Industry Product Developments

Product innovations in the APAC Vehicle Telematics Industry are centered around enhanced data accuracy, AI-driven insights, and seamless integration capabilities. Companies are developing advanced telematics devices featuring sophisticated sensors for real-time diagnostics, driver behavior monitoring, and proactive maintenance alerts. The focus is increasingly on creating comprehensive platforms that offer end-to-end solutions, from data acquisition to actionable intelligence for fleet managers and vehicle owners. The market relevance of these products is amplified by their ability to improve operational efficiency, reduce costs, and enhance safety. For example, the development of miniaturized and power-efficient telematics units is enabling their integration into a wider range of vehicles, including two and three-wheelers. Advancements in cloud-based analytics and mobile applications are providing users with intuitive interfaces for accessing critical vehicle data and receiving personalized alerts, thereby creating a competitive edge for developers.

Challenges in the APAC Vehicle Telematics Industry Market

The APAC Vehicle Telematics Industry faces several hurdles, including stringent data privacy regulations and evolving cybersecurity threats that necessitate robust security measures. The high cost of advanced telematics hardware and software can be a significant barrier for smaller businesses and individual consumers, impacting adoption rates. Furthermore, inconsistent infrastructure development and limited internet connectivity in certain rural areas of the region can hinder the seamless operation of real-time telematics services. Intense competition among a growing number of players can also lead to price wars and pressure on profit margins.

- Data Privacy & Cybersecurity: Compliance with varying regional data protection laws and protection against data breaches.

- Cost of Implementation: High initial investment for hardware, software, and installation.

- Infrastructure Limitations: Uneven internet penetration and network stability in remote areas.

- Interoperability Issues: Lack of standardized protocols leading to compatibility challenges between different systems.

Forces Driving APAC Vehicle Telematics Industry Growth

Several powerful forces are propelling the growth of the APAC Vehicle Telematics Industry. The escalating demand for improved fleet management efficiency, driven by the surge in e-commerce and logistics, is a primary catalyst. Government initiatives promoting smart cities and intelligent transportation systems are creating a conducive environment for telematics adoption. Technological advancements, particularly in IoT, AI, and 5G, are enabling more sophisticated and value-added telematics solutions. The increasing awareness among businesses and consumers about the benefits of vehicle tracking, safety monitoring, and proactive maintenance is also a significant growth driver.

- Fleet Management Efficiency: Optimization of routes, fuel, and driver performance.

- Government Initiatives: Support for smart transportation and digital infrastructure.

- Technological Advancements: IoT, AI, and 5G integration enabling enhanced features.

- Safety & Security Concerns: Rising awareness of driver behavior monitoring and vehicle security.

Challenges in the APAC Vehicle Telematics Industry Market

Long-term growth catalysts in the APAC Vehicle Telematics Industry are deeply rooted in continuous innovation and strategic market expansion. The increasing integration of telematics with emerging technologies like autonomous driving and vehicle-to-everything (V2X) communication promises to unlock new functionalities and revenue streams. Partnerships between telematics providers, automotive manufacturers, and insurance companies are expected to foster the development of integrated solutions, such as usage-based insurance (UBI) and predictive maintenance services. Market expansions into developing economies within APAC, coupled with localization of services to meet specific regional needs, will also be crucial for sustained growth.

Emerging Opportunities in APAC Vehicle Telematics Industry

Emerging opportunities in the APAC Vehicle Telematics Industry are ripe for exploitation. The rapidly growing electric vehicle (EV) market presents a significant avenue for telematics solutions focused on battery health monitoring, charging optimization, and range prediction. The burgeoning two and three-wheeler segment, particularly in emerging economies, offers substantial potential for low-cost, essential telematics features like location tracking and basic diagnostics. The integration of telematics data with smart city infrastructure for traffic management and urban planning is another promising frontier. Furthermore, the increasing demand for personalized in-car experiences, including advanced infotainment and driver assistance features, is opening up new avenues for service innovation.

- Electric Vehicle (EV) Integration: Battery management, charging optimization, and range prediction services.

- Two & Three-Wheeler Market: Development of cost-effective telematics for emerging economies.

- Smart City Solutions: Data integration for traffic management and urban mobility planning.

- Personalized In-Car Experiences: Advanced infotainment and driver assistance integration.

Leading Players in the APAC Vehicle Telematics Industry Sector

- Concox Information Technology Co Ltd

- Arya Omnitalk Wireless Solutions Private Limited

- iData Kft (iTrack)

- MiX Telematics Ltd

- Asia Mobility Technologies Sdn Bhd

- Meitrack Group

- Tata Consultancy Services Ltd

- Bright Box Hungary Kft

- Trimble Inc

- Tech Mahindra Limited

- Efkon India Pvt Ltd

- LG Corporation

- Octo Group S p A

Key Milestones in APAC Vehicle Telematics Industry Industry

- November 2022: Minda Corporation, the flagship company of the Spark Minda group, entered into a technology license agreement with LocoNav for the white-labelling of telematics software. This collaboration aims to equip Spark Minda's telematics devices with LocoNav's software to provide comprehensive solutions to Original Equipment Manufacturers (OEMs).

- October 2022: Borq's Technologies successfully ventured into the two and three-wheeler automotive space by developing and demonstrating a Telematics Control Unit (TCU). This TCU enables connected two-wheelers with mobile telephony, data connectivity, vehicle diagnostics, location services, remote vehicle control, battery management, and sensing capabilities.

Strategic Outlook for APAC Vehicle Telematics Industry Market

The strategic outlook for the APAC Vehicle Telematics Industry is overwhelmingly positive, driven by continuous technological advancements and expanding market penetration. Future growth will be accelerated by the increasing adoption of AI and machine learning for predictive analytics, enhancing fleet efficiency and safety. The sustained growth of the commercial vehicle segment, coupled with the burgeoning potential in the passenger car and two/three-wheeler segments, presents significant expansion opportunities. Strategic partnerships and collaborations between telematics providers, OEMs, and technology firms will be crucial for developing innovative, integrated solutions that cater to evolving consumer and business demands. Focus on data security and privacy will remain paramount, ensuring trust and fostering long-term adoption. The industry is set to witness a robust CAGR of 18.5% through 2033, making it a highly attractive sector for investment and innovation.

APAC Vehicle Telematics Industry Segmentation

-

1. Type of Vehicle

- 1.1. Commercial (Truck) LCV Vs. M/HCV

- 1.2. Passenger (Car)

-

2. Channel

- 2.1. OEM

- 2.2. Newsprint

- 2.3. Aftermarket

APAC Vehicle Telematics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

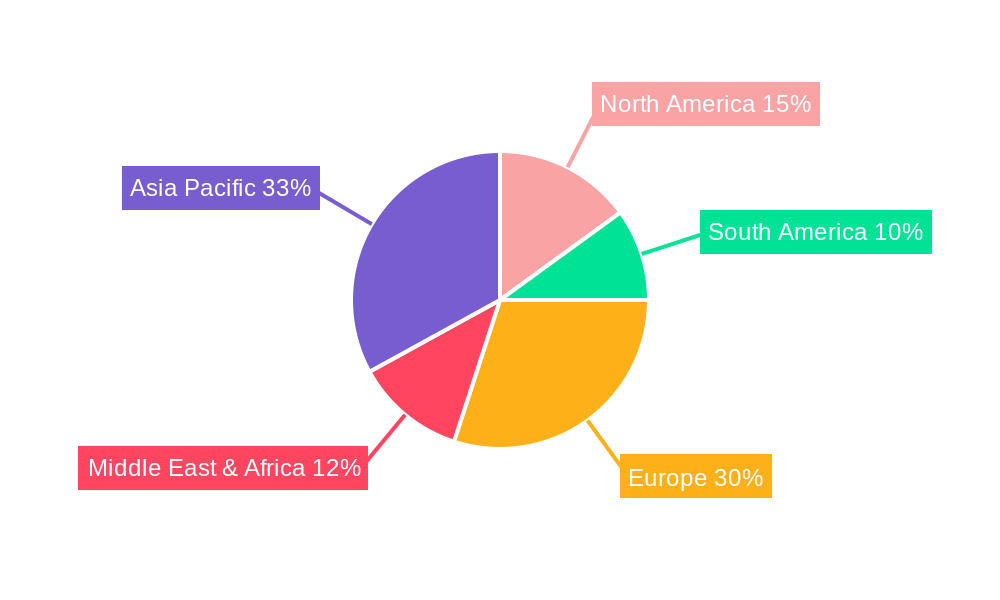

APAC Vehicle Telematics Industry Regional Market Share

Geographic Coverage of APAC Vehicle Telematics Industry

APAC Vehicle Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 15.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Connected Cars Services; Growing Demand for Easy Vehicle Diagnostics

- 3.3. Market Restrains

- 3.3.1. Threats to Data Security in the form of Data Hacking

- 3.4. Market Trends

- 3.4.1. Passenger Type of Vehicles Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Vehicle Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 5.1.1. Commercial (Truck) LCV Vs. M/HCV

- 5.1.2. Passenger (Car)

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. OEM

- 5.2.2. Newsprint

- 5.2.3. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 6. North America APAC Vehicle Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 6.1.1. Commercial (Truck) LCV Vs. M/HCV

- 6.1.2. Passenger (Car)

- 6.2. Market Analysis, Insights and Forecast - by Channel

- 6.2.1. OEM

- 6.2.2. Newsprint

- 6.2.3. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 7. South America APAC Vehicle Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 7.1.1. Commercial (Truck) LCV Vs. M/HCV

- 7.1.2. Passenger (Car)

- 7.2. Market Analysis, Insights and Forecast - by Channel

- 7.2.1. OEM

- 7.2.2. Newsprint

- 7.2.3. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 8. Europe APAC Vehicle Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 8.1.1. Commercial (Truck) LCV Vs. M/HCV

- 8.1.2. Passenger (Car)

- 8.2. Market Analysis, Insights and Forecast - by Channel

- 8.2.1. OEM

- 8.2.2. Newsprint

- 8.2.3. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 9. Middle East & Africa APAC Vehicle Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 9.1.1. Commercial (Truck) LCV Vs. M/HCV

- 9.1.2. Passenger (Car)

- 9.2. Market Analysis, Insights and Forecast - by Channel

- 9.2.1. OEM

- 9.2.2. Newsprint

- 9.2.3. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 10. Asia Pacific APAC Vehicle Telematics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 10.1.1. Commercial (Truck) LCV Vs. M/HCV

- 10.1.2. Passenger (Car)

- 10.2. Market Analysis, Insights and Forecast - by Channel

- 10.2.1. OEM

- 10.2.2. Newsprint

- 10.2.3. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Type of Vehicle

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Concox Information Technology Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arya Omnitalk Wireless Solutions Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 iData Kft (iTrack)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MiX Telematics Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asia Mobility Technologies Sdn Bhd*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Meitrack Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tata Consultancy Services Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bright Box Hungary Kft

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trimble Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tech Mahindra Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Efkon India Pvt Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LG Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Octo Group S p A

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Concox Information Technology Co Ltd

List of Figures

- Figure 1: Global APAC Vehicle Telematics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Vehicle Telematics Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 3: North America APAC Vehicle Telematics Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 4: North America APAC Vehicle Telematics Industry Revenue (Million), by Channel 2025 & 2033

- Figure 5: North America APAC Vehicle Telematics Industry Revenue Share (%), by Channel 2025 & 2033

- Figure 6: North America APAC Vehicle Telematics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America APAC Vehicle Telematics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Vehicle Telematics Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 9: South America APAC Vehicle Telematics Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 10: South America APAC Vehicle Telematics Industry Revenue (Million), by Channel 2025 & 2033

- Figure 11: South America APAC Vehicle Telematics Industry Revenue Share (%), by Channel 2025 & 2033

- Figure 12: South America APAC Vehicle Telematics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America APAC Vehicle Telematics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Vehicle Telematics Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 15: Europe APAC Vehicle Telematics Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 16: Europe APAC Vehicle Telematics Industry Revenue (Million), by Channel 2025 & 2033

- Figure 17: Europe APAC Vehicle Telematics Industry Revenue Share (%), by Channel 2025 & 2033

- Figure 18: Europe APAC Vehicle Telematics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe APAC Vehicle Telematics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Vehicle Telematics Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 21: Middle East & Africa APAC Vehicle Telematics Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 22: Middle East & Africa APAC Vehicle Telematics Industry Revenue (Million), by Channel 2025 & 2033

- Figure 23: Middle East & Africa APAC Vehicle Telematics Industry Revenue Share (%), by Channel 2025 & 2033

- Figure 24: Middle East & Africa APAC Vehicle Telematics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Vehicle Telematics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Vehicle Telematics Industry Revenue (Million), by Type of Vehicle 2025 & 2033

- Figure 27: Asia Pacific APAC Vehicle Telematics Industry Revenue Share (%), by Type of Vehicle 2025 & 2033

- Figure 28: Asia Pacific APAC Vehicle Telematics Industry Revenue (Million), by Channel 2025 & 2033

- Figure 29: Asia Pacific APAC Vehicle Telematics Industry Revenue Share (%), by Channel 2025 & 2033

- Figure 30: Asia Pacific APAC Vehicle Telematics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Vehicle Telematics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 2: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 3: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 5: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 6: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 11: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 12: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 17: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 18: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 29: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 30: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Type of Vehicle 2020 & 2033

- Table 38: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 39: Global APAC Vehicle Telematics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Vehicle Telematics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Vehicle Telematics Industry?

The projected CAGR is approximately > 15.37%.

2. Which companies are prominent players in the APAC Vehicle Telematics Industry?

Key companies in the market include Concox Information Technology Co Ltd, Arya Omnitalk Wireless Solutions Private Limited, iData Kft (iTrack), MiX Telematics Ltd, Asia Mobility Technologies Sdn Bhd*List Not Exhaustive, Meitrack Group, Tata Consultancy Services Ltd, Bright Box Hungary Kft, Trimble Inc, Tech Mahindra Limited, Efkon India Pvt Ltd, LG Corporation, Octo Group S p A.

3. What are the main segments of the APAC Vehicle Telematics Industry?

The market segments include Type of Vehicle, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Connected Cars Services; Growing Demand for Easy Vehicle Diagnostics.

6. What are the notable trends driving market growth?

Passenger Type of Vehicles Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Threats to Data Security in the form of Data Hacking.

8. Can you provide examples of recent developments in the market?

November 2022 - The flagship company of the Spark Minda group, Minda Corporation, entered into a technology license agreement with LocoNav for the white-labelling of telematics software. Through this collaboration, Spark Minda will combine software developed by LocoNav for its own telematic devices to offer Original Equipment Manufacturers (OEMs) a comprehensive solution.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Vehicle Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Vehicle Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Vehicle Telematics Industry?

To stay informed about further developments, trends, and reports in the APAC Vehicle Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence