Key Insights

The Asia Pacific vacuum pump market is projected for substantial growth, expected to reach $6.5 billion by 2025, driven by a CAGR of 5.3% through 2033. Key growth drivers include rising demand from electronics manufacturing, chemical processing, and the expanding oil and gas sectors across China, India, and Southeast Asia. Advancements in industrial automation, increased investment in advanced manufacturing infrastructure, and stringent environmental regulations promoting efficient industrial processes are significant market accelerators. The region's rapid industrialization and adoption of cutting-edge technologies in manufacturing and research are creating sustained demand for high-performance vacuum solutions.

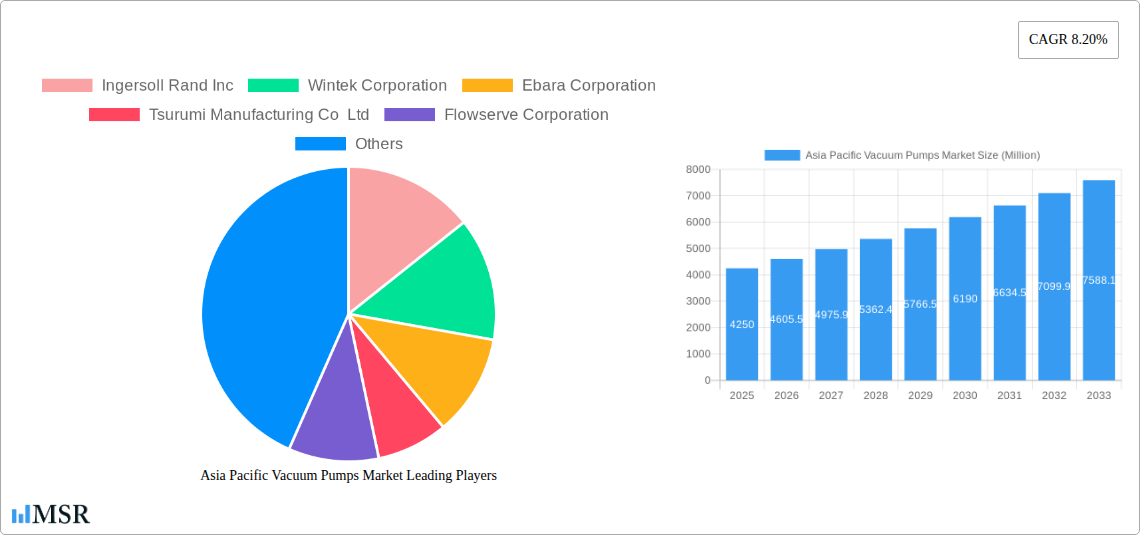

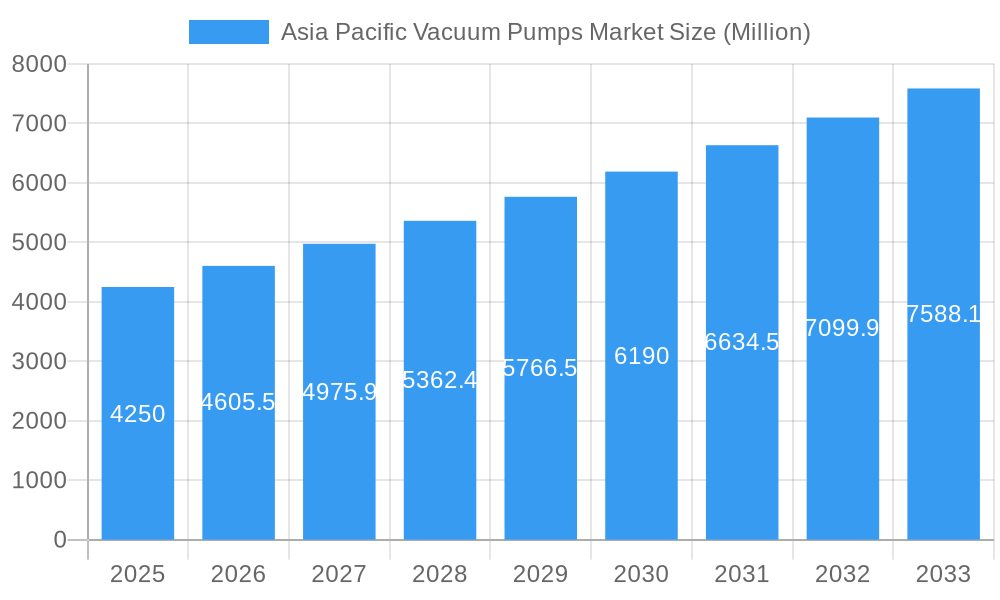

Asia Pacific Vacuum Pumps Market Market Size (In Billion)

Rotary vane, screw, claw, and roots pumps are gaining traction due to their versatility in diverse industrial applications. Kinetic vacuum pumps, such as turbomolecular and diffusion pumps, are increasingly used in specialized sectors like semiconductor fabrication and research requiring ultra-high vacuum. Niche applications are also driving the adoption of cryogenic and getter pumps for specific vacuum levels and purity. While the initial cost of advanced technologies and the need for skilled maintenance present moderate challenges, continuous innovation and a focus on upgrading industrial capabilities ensure a promising outlook for vacuum pump manufacturers in the Asia Pacific.

Asia Pacific Vacuum Pumps Market Company Market Share

Asia Pacific Vacuum Pumps Market: Comprehensive Growth Analysis (2019-2033)

This in-depth report delivers critical insights into the Asia Pacific Vacuum Pumps Market, offering a granular analysis of market dynamics, growth drivers, segmentation, competitive landscape, and future opportunities. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for industry stakeholders seeking to capitalize on the burgeoning demand for vacuum technology across diverse applications. The vacuum pump market size in the Asia Pacific region is projected for significant expansion, driven by innovation and increasing industrialization.

Asia Pacific Vacuum Pumps Market Market Concentration & Dynamics

The Asia Pacific Vacuum Pumps Market exhibits a moderate to high concentration, with a few key global players and a growing number of regional manufacturers vying for market share. Innovation ecosystems are thriving, particularly in countries like China, Japan, and South Korea, where R&D investments are driving advancements in pump efficiency and specialized applications. Regulatory frameworks concerning industrial emissions and safety standards are becoming more stringent, influencing product development and adoption. Substitute products, while present in certain niche applications, are largely outmatched by the versatility and performance of advanced vacuum pumps. End-user trends highlight a growing demand for energy-efficient and IoT-enabled vacuum solutions, catering to Industry 4.0 initiatives. Mergers and acquisitions (M&A) activities are strategically shaping the market landscape. For instance, Atlas Copco's acquisition of HHV Pumps Pvt. Ltd. in January 2022 demonstrates a clear strategy to consolidate market presence and expand product portfolios within specialized segments. The number of M&A deals is expected to increase as companies seek to broaden their technological capabilities and geographical reach. Key players are focusing on optimizing their supply chains and expanding distribution networks to better serve the vast and diverse Asia Pacific market.

Asia Pacific Vacuum Pumps Market Industry Insights & Trends

The Asia Pacific Vacuum Pumps Market is poised for substantial growth, driven by a confluence of robust economic expansion, rapid industrialization, and increasing technological sophistication across the region. The estimated market size for vacuum pumps in the Asia Pacific is projected to reach approximately USD 3,500 Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of around 5.8% during the forecast period of 2025–2033. This upward trajectory is fueled by escalating demand from critical sectors such as electronics manufacturing, oil and gas exploration and processing, and the burgeoning pharmaceutical and medical industries. Advancements in semiconductor fabrication are particularly significant, requiring highly precise and contaminant-free vacuum environments. Furthermore, the growing emphasis on sustainable manufacturing practices and stricter environmental regulations are propelling the adoption of energy-efficient and environmentally friendly vacuum pump technologies, such as oil-free rotary vane pumps and screw pumps. The digitalization trend, or Industry 4.0, is also playing a pivotal role, with manufacturers increasingly seeking "smart" vacuum pumps equipped with advanced monitoring, control, and predictive maintenance capabilities. This integration allows for optimized operational efficiency, reduced downtime, and improved overall productivity, aligning with the evolving operational paradigms of modern industries. The expansion of infrastructure projects, including power generation facilities and chemical processing plants, further contributes to the robust demand for reliable and high-performance vacuum pump solutions across the Asia Pacific region.

Key Markets & Segments Leading Asia Pacific Vacuum Pumps Market

The Asia Pacific Vacuum Pumps Market is characterized by the dominance of key segments and emerging regional powerhouses, with China emerging as the largest and fastest-growing market, driven by its vast manufacturing base and significant investments in advanced industries. Within the product type segmentation, Rotary Vacuum Pumps are leading the market, accounting for a substantial share.

- Rotary Vacuum Pumps: This segment includes sub-types like Rotary Vane Pumps, which are widely adopted due to their reliability and cost-effectiveness in general industrial applications. Screw and Claw Pumps are gaining traction for their energy efficiency and suitability for demanding processes in industries like chemical processing and automotive. Roots Pumps are essential for achieving higher vacuum levels and are crucial in semiconductor manufacturing and scientific research.

- Reciprocating Vacuum Pumps: While not as dominant as rotary pumps, Diaphragm Pumps are critical in laboratory settings and for handling corrosive or sensitive materials due to their oil-free operation. Piston Pumps find applications in specific high-pressure vacuum requirements.

- Kinetic Vacuum Pumps: Ejector Pumps, utilizing steam or gas, are cost-effective for bulk air removal. Turbomolecular Pumps are indispensable for ultra-high vacuum applications in semiconductor lithography and scientific research, a segment with significant growth potential. Diffusion Pumps continue to be used in specialized high-vacuum applications.

- Dynamic Pumps: Liquid Ring Pumps are favored for their robustness and ability to handle large volumes of vapor and particulate matter in chemical processing and power generation. Side Channel Pumps offer compact solutions for specific industrial tasks.

- Specialized Vacuum Pumps: Demand for Getter Pumps and Cryogenic Pumps is growing in niche markets like space simulation and advanced materials research.

In terms of End-user Application, the Electronics sector, encompassing semiconductor manufacturing and display production, is a major driver of growth due to its stringent vacuum requirements. The Oil and Gas industry is a significant consumer, utilizing vacuum pumps in refining, petrochemical processes, and exploration. The Chemical Processing industry relies heavily on vacuum technology for distillation, drying, and material handling. The Medicine sector is witnessing increasing adoption for sterilization, laboratory analysis, and medical device manufacturing. The Food and Beverages industry utilizes vacuum pumps for packaging, deaeration, and freeze-drying. Power Generation, particularly in thermal power plants for condenser evacuation, also represents a key application area.

Asia Pacific Vacuum Pumps Market Product Developments

The Asia Pacific vacuum pumps market is witnessing continuous product innovation aimed at enhancing efficiency, reducing energy consumption, and improving user experience. A prime example is Atlas Copco's launch of its diverse range of GHS VSD+ vacuum pumps in May 2022. These speed-driven screw pumps feature a novel design for superior performance, a compact footprint, optimized oil separation, and an advanced controller supporting Industry 4.0 capabilities, underscoring the trend towards smarter, more connected vacuum solutions. These developments highlight the industry's focus on delivering technologically advanced products that meet the evolving needs of diverse industrial applications.

Challenges in the Asia Pacific Vacuum Pumps Market Market

Despite robust growth prospects, the Asia Pacific Vacuum Pumps Market faces several challenges. Intense price competition, particularly from domestic manufacturers in emerging economies, can pressure profit margins for global players. Supply chain disruptions, exacerbated by geopolitical factors and trade uncertainties, can lead to extended lead times and increased costs for critical components. Stringent environmental regulations, while driving innovation, also necessitate significant investment in R&D and product redesign. Furthermore, the availability of skilled labor for installation, maintenance, and repair of advanced vacuum systems can be a bottleneck in certain regions, potentially impacting adoption rates for complex technologies.

Forces Driving Asia Pacific Vacuum Pumps Market Growth

The growth of the Asia Pacific Vacuum Pumps Market is propelled by several potent forces. Rapid industrialization and economic development across countries like China, India, and Southeast Asian nations are creating an ever-increasing demand for vacuum technology in manufacturing and processing. The burgeoning electronics industry, particularly the semiconductor sector, is a significant growth engine due to its reliance on ultra-high vacuum environments. Government initiatives promoting advanced manufacturing, technological upgrades, and stringent environmental standards are also catalyzing market expansion. Furthermore, the increasing adoption of Industry 4.0 principles, necessitating smart and connected industrial equipment, is driving demand for advanced, efficient, and digitally integrated vacuum pump solutions.

Challenges in the Asia Pacific Vacuum Pumps Market Market

Looking ahead, long-term growth catalysts for the Asia Pacific Vacuum Pumps Market will be rooted in continuous technological innovation and strategic market expansion. The development of next-generation vacuum pumps with even higher energy efficiency, lower operational costs, and enhanced environmental performance will be crucial. Partnerships and collaborations between technology providers, research institutions, and end-users will foster the development of bespoke solutions for emerging applications. Market expansion into less developed but rapidly industrializing economies within the Asia Pacific region, coupled with strong after-sales service and support networks, will unlock significant new revenue streams. The growing demand for vacuum solutions in specialized fields like advanced materials science, renewable energy manufacturing, and biotechnology will also contribute to sustained long-term growth.

Emerging Opportunities in Asia Pacific Vacuum Pumps Market

Emerging opportunities in the Asia Pacific Vacuum Pumps Market are diverse and promising. The increasing focus on sustainable energy solutions is creating demand for vacuum pumps in solar panel manufacturing and battery production. The growing adoption of advanced medical devices and diagnostic equipment presents opportunities in the healthcare sector. The expansion of the aerospace and defense industries in the region will drive demand for specialized high-vacuum systems. Furthermore, the growing trend of miniaturization in electronics and the development of new materials are creating a need for ultra-precise and contaminant-free vacuum processes, opening doors for innovative pump designs and technologies. The "smart factory" revolution also presents an opportunity for integrated vacuum solutions with IoT capabilities.

Leading Players in the Asia Pacific Vacuum Pumps Market Sector

- Ingersoll Rand Inc

- Wintek Corporation

- Ebara Corporation

- Tsurumi Manufacturing Co Ltd

- Flowserve Corporation

- Continental AG

- Atlas copco

- Robert Bosch

- Agilent Technologies Inc

- Becker Pumps Corporation

Key Milestones in Asia Pacific Vacuum Pumps Market Industry

- May 2022: Atlas Copco launched a diverse range of GHS VSD+ vacuum pumps, featuring enhanced performance, a smaller footprint, optimal oil separation, and an innovative Industry 4.0-ready controller.

- January 2022: Atlas Copco acquired HHV Pumps Pvt. Ltd., strengthening its position in vacuum pumps for chemical, pharmaceutical, and general industries, as well as for refrigeration and air-conditioning manufacturing.

Strategic Outlook for Asia Pacific Vacuum Pumps Market Market

The strategic outlook for the Asia Pacific Vacuum Pumps Market is exceptionally positive, driven by a clear trajectory of sustained demand and technological advancement. Key growth accelerators will include the continued investment in advanced manufacturing capabilities, particularly in the electronics and semiconductor sectors, where high-performance vacuum pumps are indispensable. The ongoing push towards digitalization and Industry 4.0 adoption will favor suppliers offering intelligent, connected, and energy-efficient vacuum solutions. Furthermore, the growing emphasis on sustainability and stringent environmental regulations will create opportunities for providers of eco-friendly and energy-saving vacuum technologies. Strategic partnerships, focus on after-sales service, and expansion into emerging economies within the region will be critical for maintaining competitive advantage and capturing market share.

Asia Pacific Vacuum Pumps Market Segmentation

-

1. Type

-

1.1. Rotary Vacuum Pumps

- 1.1.1. Rotary Vane Pumps

- 1.1.2. Screw and Claw Pumps

- 1.1.3. Roots Pumps

-

1.2. Reciprocating Vacuum Pumps

- 1.2.1. Diaphragm Pumps

- 1.2.2. Piston Pumps

-

1.3. Kinetic Vacuum Pumps

- 1.3.1. Ejector Pumps

- 1.3.2. Turbomolecular Pumps

- 1.3.3. Diffusion Pumps

-

1.4. Dynamic Pumps

- 1.4.1. Liquid Ring Pumps

- 1.4.2. Side Channel Pumps

-

1.5. Specialized Vacuum Pumps

- 1.5.1. Getter Pumps

- 1.5.2. Cryogenic Pumps

-

1.1. Rotary Vacuum Pumps

-

2. End-user Application

- 2.1. Oil and Gas

- 2.2. Electronics

- 2.3. Medicine

- 2.4. Chemical Processing

- 2.5. Food and Beverages

- 2.6. Power Generation

- 2.7. Other

Asia Pacific Vacuum Pumps Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Vacuum Pumps Market Regional Market Share

Geographic Coverage of Asia Pacific Vacuum Pumps Market

Asia Pacific Vacuum Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of MEMS Technology; Increasing Demand for Dry Vacuum Pump

- 3.3. Market Restrains

- 3.3.1. ; Unstable Raw Material Prices; Complications in Installation

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rotary Vacuum Pumps

- 5.1.1.1. Rotary Vane Pumps

- 5.1.1.2. Screw and Claw Pumps

- 5.1.1.3. Roots Pumps

- 5.1.2. Reciprocating Vacuum Pumps

- 5.1.2.1. Diaphragm Pumps

- 5.1.2.2. Piston Pumps

- 5.1.3. Kinetic Vacuum Pumps

- 5.1.3.1. Ejector Pumps

- 5.1.3.2. Turbomolecular Pumps

- 5.1.3.3. Diffusion Pumps

- 5.1.4. Dynamic Pumps

- 5.1.4.1. Liquid Ring Pumps

- 5.1.4.2. Side Channel Pumps

- 5.1.5. Specialized Vacuum Pumps

- 5.1.5.1. Getter Pumps

- 5.1.5.2. Cryogenic Pumps

- 5.1.1. Rotary Vacuum Pumps

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Oil and Gas

- 5.2.2. Electronics

- 5.2.3. Medicine

- 5.2.4. Chemical Processing

- 5.2.5. Food and Beverages

- 5.2.6. Power Generation

- 5.2.7. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 7. Japan Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 8. India Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 9. South Korea Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 10. Taiwan Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 11. Australia Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Asia-Pacific Asia Pacific Vacuum Pumps Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Ingersoll Rand Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Wintek Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ebara Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tsurumi Manufacturing Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Flowserve Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Continental AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Atlas copco

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Robert Bosch

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Agilent Technologies Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Becker Pumps Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Ingersoll Rand Inc

List of Figures

- Figure 1: Asia Pacific Vacuum Pumps Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Vacuum Pumps Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 6: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 7: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 11: China Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: China Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Japan Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: India Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Taiwan Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Taiwan Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia-Pacific Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia-Pacific Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by End-user Application 2020 & 2033

- Table 28: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 29: Asia Pacific Vacuum Pumps Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia Pacific Vacuum Pumps Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: China Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: China Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Japan Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Japan Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: South Korea Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Korea Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: India Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: India Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Australia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Australia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: New Zealand Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: New Zealand Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Indonesia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Indonesia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Malaysia Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Malaysia Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Singapore Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Singapore Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Thailand Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Thailand Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Vietnam Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Vietnam Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Philippines Asia Pacific Vacuum Pumps Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Philippines Asia Pacific Vacuum Pumps Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Vacuum Pumps Market?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Asia Pacific Vacuum Pumps Market?

Key companies in the market include Ingersoll Rand Inc, Wintek Corporation, Ebara Corporation, Tsurumi Manufacturing Co Ltd, Flowserve Corporation, Continental AG, Atlas copco, Robert Bosch, Agilent Technologies Inc, Becker Pumps Corporation.

3. What are the main segments of the Asia Pacific Vacuum Pumps Market?

The market segments include Type, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of MEMS Technology; Increasing Demand for Dry Vacuum Pump.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

; Unstable Raw Material Prices; Complications in Installation.

8. Can you provide examples of recent developments in the market?

May 2022 - Atlas Copco launched a diverse range of GHS VSD+ vacuum pumps. The new GHS 1402-2002 VSD+ series pumps feature a new design for better performance, a smaller footprint, optimal oil separation, and an innovative new controller to support the use cases of Industry 4.0. The company offers these speed-driven screw pumps in three pumping speed classes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Vacuum Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Vacuum Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Vacuum Pumps Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Vacuum Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence