Key Insights

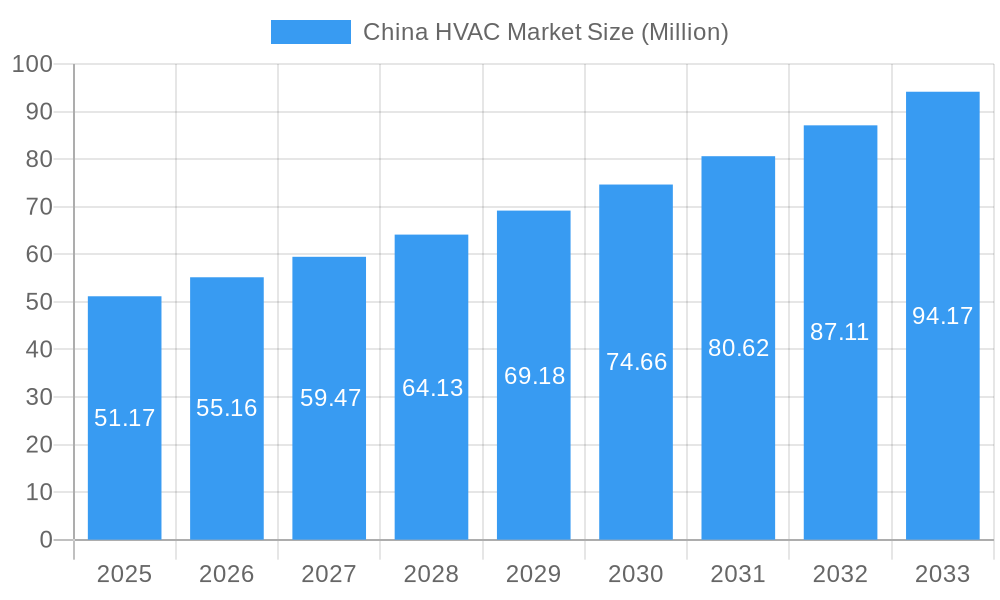

The China HVAC market is poised for significant expansion, currently valued at approximately USD 51.17 million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 7.83% from 2019 to 2033. This substantial growth is propelled by a confluence of factors, including escalating urbanization, rising disposable incomes, and an increasing awareness of energy efficiency and environmental regulations. The demand for advanced HVAC systems in both residential and commercial sectors is a primary driver, fueled by new construction projects and the retrofitting of older buildings with more sophisticated climate control solutions. Furthermore, government initiatives promoting green building standards and smart city development are creating a favorable ecosystem for HVAC innovations and adoption. The market is segmented into HVAC equipment, including heating, air conditioning, and ventilation units, and HVAC services, encompassing installation, maintenance, and repair. This dual segmentation highlights the comprehensive nature of the HVAC industry and its integral role in modern infrastructure.

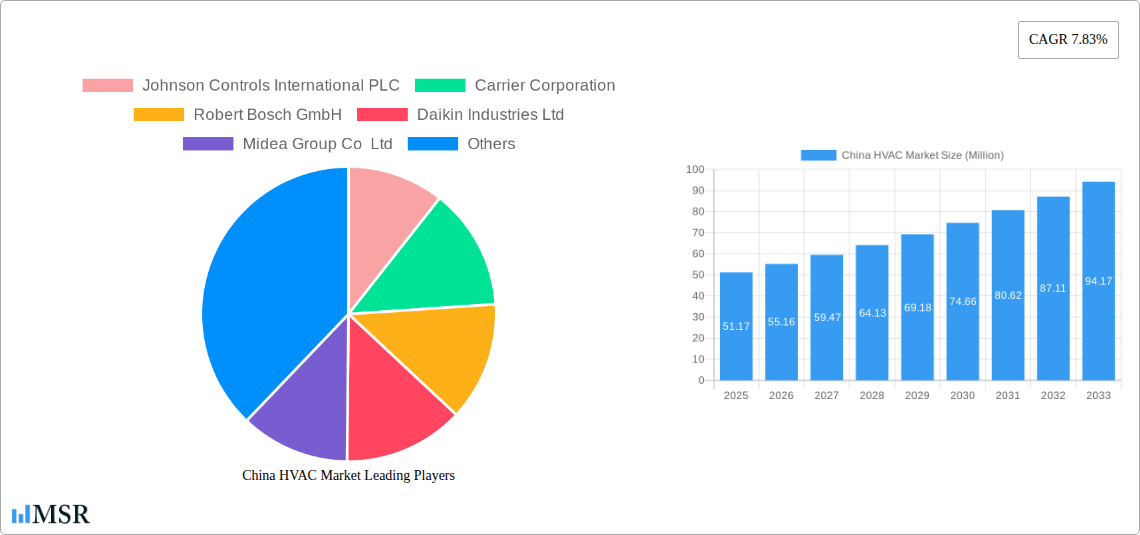

China HVAC Market Market Size (In Million)

Key trends shaping the China HVAC market include a strong inclination towards energy-efficient and smart HVAC systems, driven by both cost-saving opportunities and environmental concerns. The integration of IoT technology for remote monitoring, control, and predictive maintenance is becoming increasingly prevalent. Furthermore, the growing adoption of Variable Refrigerant Flow (VRF) systems, heat pumps, and advanced ventilation solutions that prioritize indoor air quality (IAQ) is a notable trend. While the market exhibits immense potential, certain restraints such as high initial investment costs for advanced systems and the availability of skilled labor for installation and maintenance can pose challenges. However, the sheer scale of the Chinese market, coupled with continuous technological advancements and supportive government policies, is expected to outweigh these restraints, ensuring sustained and dynamic growth for the HVAC sector in the coming years.

China HVAC Market Company Market Share

Unlock critical insights into the dynamic China HVAC market. This in-depth report analyzes market trends, competitive landscapes, technological advancements, and future opportunities, providing actionable intelligence for industry stakeholders. Covering HVAC equipment, services, and end-user sectors (Residential, Commercial, Industrial), this study is your definitive guide to navigating the lucrative Chinese heating, ventilation, and air conditioning sector.

China HVAC Market Market Concentration & Dynamics

The China HVAC market exhibits a moderate to high concentration, with key global players like Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, Daikin Industries Ltd, and Midea Group Co Ltd holding significant market share. The market is characterized by intense competition driven by innovation and strategic alliances. The HVAC equipment segment, encompassing Heating Equipment and Air Conditioning / Ventilation Equipment, forms the backbone of the market, while the burgeoning HVAC Services sector, including installation, maintenance, and repair, is experiencing robust growth. End-user industries such as Residential, Commercial, and Industrial all contribute significantly to market demand. Innovation ecosystems are thriving, fueled by government initiatives promoting energy efficiency and environmental protection. Regulatory frameworks are evolving, with a growing emphasis on stricter emission standards and the adoption of eco-friendly refrigerants. The threat of substitute products is relatively low for core HVAC functions, but advancements in smart home technology and integrated building management systems are creating new integrated solutions. Mergers and acquisitions (M&A) activities, though not at an exceptionally high count recently, are strategically aimed at consolidating market position and expanding product portfolios. The market share of leading players is estimated to be around 60% for the top 5 companies. Recent M&A deal counts are estimated to be around 5-7 annually, focused on acquiring niche technologies or regional distribution networks.

China HVAC Market Industry Insights & Trends

The China HVAC market is poised for substantial growth, driven by a confluence of factors including rapid urbanization, rising disposable incomes, and an increasing focus on indoor air quality and comfort. The market size for HVAC equipment and services is projected to reach approximately USD 50 Billion by 2025, with a Compound Annual Growth Rate (CAGR) of an estimated 8.5% between 2025 and 2033. This growth is significantly propelled by government policies promoting energy-efficient buildings and the development of smart cities. Technological disruptions are reshaping the industry, with the integration of IoT, AI, and advanced control systems leading to the development of intelligent and connected HVAC solutions. The demand for Variable Refrigerant Flow (VRF) systems, heat pumps, and advanced ventilation solutions is on an upward trajectory. Evolving consumer behaviors are also playing a pivotal role; consumers are increasingly prioritizing energy savings, health benefits associated with improved air quality, and the convenience offered by smart and automated systems. The Residential sector is witnessing a surge in demand for high-efficiency air conditioners and smart thermostats, while the Commercial sector, including offices, retail spaces, and hospitality, is increasingly adopting advanced HVAC solutions for optimized comfort and operational efficiency. The Industrial sector is demanding robust and energy-efficient HVAC systems for manufacturing processes, data centers, and cleanroom environments. The overall market size in the historical period (2019-2024) reached an estimated USD 40 Billion in 2024. The CAGR for the forecast period (2025-2033) is estimated at 8.5%.

Key Markets & Segments Leading China HVAC Market

The China HVAC market is predominantly led by the Commercial end-user industry, accounting for an estimated 45% of the total market share, closely followed by the Residential sector at approximately 35%, and the Industrial sector at 20%. Within the HVAC Equipment segment, Air Conditioning / Ventilation Equipment dominates, representing around 70% of the market, with Heating Equipment comprising the remaining 30%.

Commercial Sector Dominance:

- Drivers: Rapid expansion of office buildings, retail complexes, hotels, and entertainment venues; increasing demand for comfortable and healthy indoor environments for employees and customers; stringent energy efficiency regulations for commercial buildings.

- Detailed Analysis: The burgeoning service economy and sustained infrastructure development in China have created a massive demand for reliable and efficient commercial HVAC systems. Large-scale projects like new airport terminals, convention centers, and mixed-use developments significantly drive the adoption of advanced HVAC solutions. The focus on creating modern, sustainable, and employee-friendly workspaces further amplifies the demand for sophisticated climate control.

Residential Sector Growth:

- Drivers: Rising middle-class population and increasing disposable incomes; growing awareness of indoor air quality and health benefits; government incentives for energy-efficient home appliances; increasing new home construction and renovation projects.

- Detailed Analysis: As Chinese households upgrade their living standards, the demand for advanced residential HVAC solutions, including inverter air conditioners, smart thermostats, and energy-saving heat pumps, continues to surge. The increasing adoption of technologies that enhance comfort and convenience at home is a significant growth catalyst for this segment.

Industrial Sector Demand:

- Drivers: Expansion of manufacturing industries, particularly in electronics, pharmaceuticals, and automotive sectors; increasing need for precise temperature and humidity control in data centers and specialized industrial processes; growing emphasis on energy-efficient solutions to reduce operational costs.

- Detailed Analysis: The industrial segment, while smaller in percentage, represents a high-value market due to the specialized and robust nature of the HVAC equipment required. Industries like semiconductor manufacturing and pharmaceutical production necessitate highly controlled environments, driving demand for sophisticated HVAC systems that ensure product quality and process integrity.

Within HVAC Services, installation, maintenance, and after-sales support are crucial contributors, with an estimated market share of 30% of the overall HVAC market value. The HVAC Equipment market itself is valued at approximately USD 35 Billion in 2025.

China HVAC Market Product Developments

The China HVAC market is characterized by continuous innovation, with companies like Panasonic Corporation and Mitsubishi Electric Corporation at the forefront. In March 2024, Panasonic announced the launch of three new commercial air-to-water (A2W) heat pumps, utilizing eco-friendly natural refrigerants for multi-dwelling units, stores, and offices, underscoring a commitment to sustainability and expanding their product lineup for diverse consumer needs. Furthermore, in November 2023, Mitsubishi Electric unveiled an innovative aluminum vertical flat tube (VFT) design for heat exchangers, boosting heat-pump air conditioner performance by up to 40% and reducing refrigerant charge by up to 20%. These advancements highlight a trend towards enhanced efficiency, reduced environmental impact, and improved performance, providing a competitive edge in the market.

Challenges in the China HVAC Market Market

Navigating the China HVAC market presents several challenges. Intense competition from both established international players and rapidly growing domestic manufacturers leads to price pressures and the need for constant innovation. Stringent and evolving environmental regulations, while driving demand for sustainable solutions, also necessitate significant investment in research and development and product upgrades. Supply chain disruptions, amplified by global geopolitical events and localized lockdowns, can impact production timelines and material costs. Furthermore, the need for skilled labor for the installation and maintenance of advanced HVAC systems presents a persistent challenge. The market for counterfeit products also poses a risk to brand reputation and consumer safety. Estimated impact of these challenges on market growth can be around 1-2% reduction in CAGR.

Forces Driving China HVAC Market Growth

Several powerful forces are propelling the China HVAC market forward. Firstly, the ongoing urbanization and infrastructure development in China create a consistent demand for new construction and retrofitting of buildings with advanced HVAC systems. Secondly, government initiatives promoting energy efficiency, green building standards, and reduced carbon emissions are a significant catalyst, encouraging the adoption of eco-friendly technologies like heat pumps and intelligent HVAC solutions. Thirdly, the rising disposable incomes and increasing consumer awareness of comfort, health, and indoor air quality are driving demand for higher-performance and feature-rich HVAC products. Finally, technological advancements, including the integration of IoT, AI, and smart home compatibility, are creating new market opportunities for intelligent and connected HVAC solutions.

Challenges in the China HVAC Market Market

Long-term growth catalysts in the China HVAC market are firmly rooted in sustained technological innovation, strategic market expansions, and robust partnerships. The continuous development of more energy-efficient and environmentally friendly refrigerants and system designs will be crucial. Companies are expected to invest heavily in smart HVAC technologies, including AI-powered predictive maintenance and energy management systems, to enhance operational efficiency and user experience. Expanding reach into emerging Tier 3 and Tier 4 cities, where demand is still nascent but growing rapidly, presents a significant avenue for market penetration. Collaborations between HVAC manufacturers, smart home technology providers, and real estate developers will foster integrated building solutions, further driving market growth.

Emerging Opportunities in China HVAC Market

Emerging opportunities in the China HVAC market are diverse and promising. The increasing adoption of Variable Refrigerant Flow (VRF) systems, particularly in light commercial and residential applications, presents a significant growth area due to their energy efficiency and flexibility. The burgeoning demand for heat pump technology, driven by government support for renewable energy sources and the phasing out of fossil fuels, is another key opportunity. Furthermore, the focus on improving indoor air quality (IAQ) due to health concerns, especially post-pandemic, is creating demand for advanced ventilation and air purification integrated into HVAC systems. The development of smart and connected HVAC solutions catering to the expanding smart home ecosystem offers considerable potential for market expansion and differentiation.

Leading Players in the China HVAC Market Sector

- Johnson Controls International PLC

- Carrier Corporation

- Robert Bosch GmbH

- Daikin Industries Ltd

- Midea Group Co Ltd

- System Air AB

- LG Electronics Inc

- Mitsubishi Electric Corporation

- Danfoss A/S

- Lennox International Inc

- Hitachi Ltd

- Panasonic Corporation

Key Milestones in China HVAC Market Industry

- March 2024: Panasonic Corporation announced that its Heating & Ventilation A/C Company (HVAC) plans to launch three new commercial air-to-water (A2W) heat pumps that utilize environmentally friendly natural refrigerants. These models are designed for use in multi-dwelling units, stores, offices, and other light commercial properties. With their compact designs, they are positioned at the top of the industry and will expand the company's lineup of models for standalone homes to fulfill a broad range of consumer needs.

- November 2023: Mitsubishi Electric Corporation announced that it has developed an aluminum vertical flat tube (VFT) design that improves heat exchanger performance by up to an unprecedented 40% in heat-pump air conditioners used for heating and cooling. Compared to conventional aluminum horizontal flat tube (HFT) heat exchangers, Mitsubishi Electric's new VFT heat exchanger also reduces refrigerant charge thanks to about up to 20% smaller internal volume compared to HFT designs.

Strategic Outlook for China HVAC Market Market

The strategic outlook for the China HVAC market is exceptionally positive, driven by strong underlying growth accelerators. Future market potential lies in the continued adoption of sustainable and energy-efficient technologies, particularly heat pumps and systems utilizing natural refrigerants. The expansion of smart and connected HVAC solutions, integrated with the broader smart home and building automation ecosystems, will be a key growth driver. Strategic opportunities include deeper penetration into emerging urban centers and catering to the evolving demands of the healthcare and hospitality sectors for enhanced IAQ. Furthermore, strategic partnerships and joint ventures will be crucial for navigating the complex regulatory landscape and for accessing new technologies and distribution channels, ensuring sustained growth and market leadership.

China HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning /Ventilation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

China HVAC Market Segmentation By Geography

- 1. China

China HVAC Market Regional Market Share

Geographic Coverage of China HVAC Market

China HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand

- 3.3. Market Restrains

- 3.3.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand

- 3.4. Market Trends

- 3.4.1. HVAC Equipment Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China HVAC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning /Ventilation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daikin Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Midea Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 System Air AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Electric Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Danfoss A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lennox International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hitachi Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Panasonic Corporatio

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: China HVAC Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China HVAC Market Share (%) by Company 2025

List of Tables

- Table 1: China HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 2: China HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 3: China HVAC Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: China HVAC Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 5: China HVAC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China HVAC Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China HVAC Market Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 8: China HVAC Market Volume Billion Forecast, by Type of Component 2020 & 2033

- Table 9: China HVAC Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: China HVAC Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 11: China HVAC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China HVAC Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China HVAC Market?

The projected CAGR is approximately 7.83%.

2. Which companies are prominent players in the China HVAC Market?

Key companies in the market include Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, Daikin Industries Ltd, Midea Group Co Ltd, System Air AB, LG Electronics Inc, Mitsubishi Electric Corporation, Danfoss A/S, Lennox International Inc, Hitachi Ltd, Panasonic Corporatio.

3. What are the main segments of the China HVAC Market?

The market segments include Type of Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand.

6. What are the notable trends driving market growth?

HVAC Equipment Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Increasing Demand for Energy Efficient Devices; Increased Construction and Retrofit Activity to Aid Demand.

8. Can you provide examples of recent developments in the market?

March 2024: Panasonic Corporation announced that its Heating & Ventilation A/C Company (HVAC) plans to launch three new commercial air-to-water (A2W) heat pumps that utilize environmentally friendly natural refrigerants. These models are designed for use in multi-dwelling units, stores, offices, and other light commercial properties. With their compact designs, they are positioned at the top of the industry and will expand the company's lineup of models for standalone homes to fulfill a broad range of consumer needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China HVAC Market?

To stay informed about further developments, trends, and reports in the China HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence