Key Insights

The global Action Adventure Online Games market is set for substantial growth, projected to reach $343.22 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 to 2033. This expansion is driven by increasing consumer demand for immersive digital entertainment, the proliferation of high-speed internet, and advanced mobile devices. The popularity of free-to-play models and in-app purchases significantly contributes to market accessibility and player acquisition. Continuous innovation in game development, including compelling narratives, advanced gameplay, and high-fidelity visuals, fuels sustained engagement. The burgeoning esports and competitive gaming scene further invigorates the market, encouraging investment in new titles and platforms.

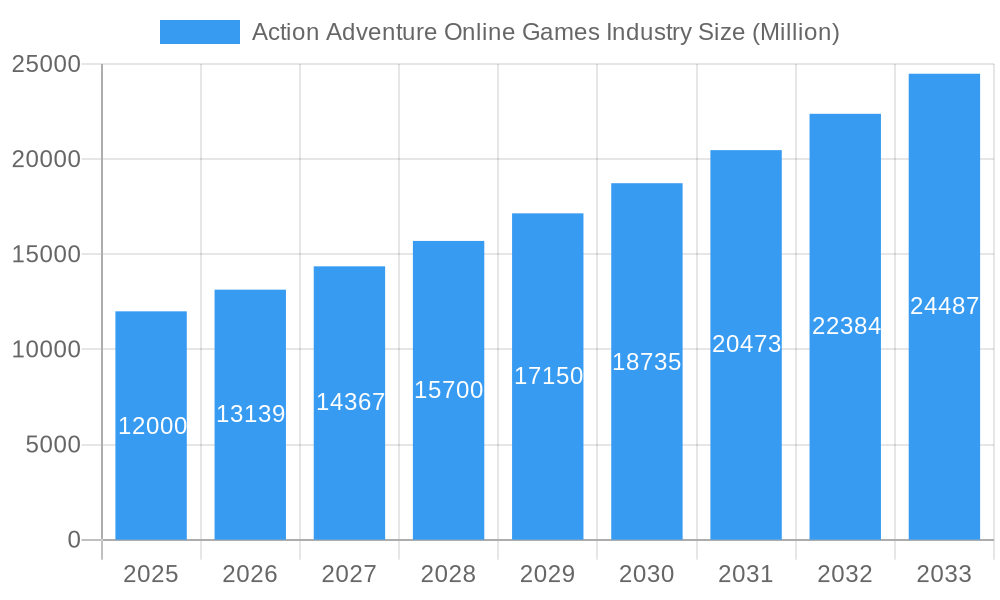

Action Adventure Online Games Industry Market Size (In Billion)

Key trends shaping the market include the integration of Augmented Reality (AR) and Virtual Reality (VR) for enhanced gameplay experiences. Cross-platform play is becoming standard, broadening audience reach. Cloud gaming services are a significant disruptor, offering high-end gaming without requiring powerful hardware. However, challenges such as rising development costs, combating cheating and piracy, and potential market saturation require strategic attention. Leading companies like Tencent Holdings Ltd, Electronic Arts, Activision Blizzard, Nintendo, and Epic Games are investing in R&D and acquisitions to maintain a competitive advantage.

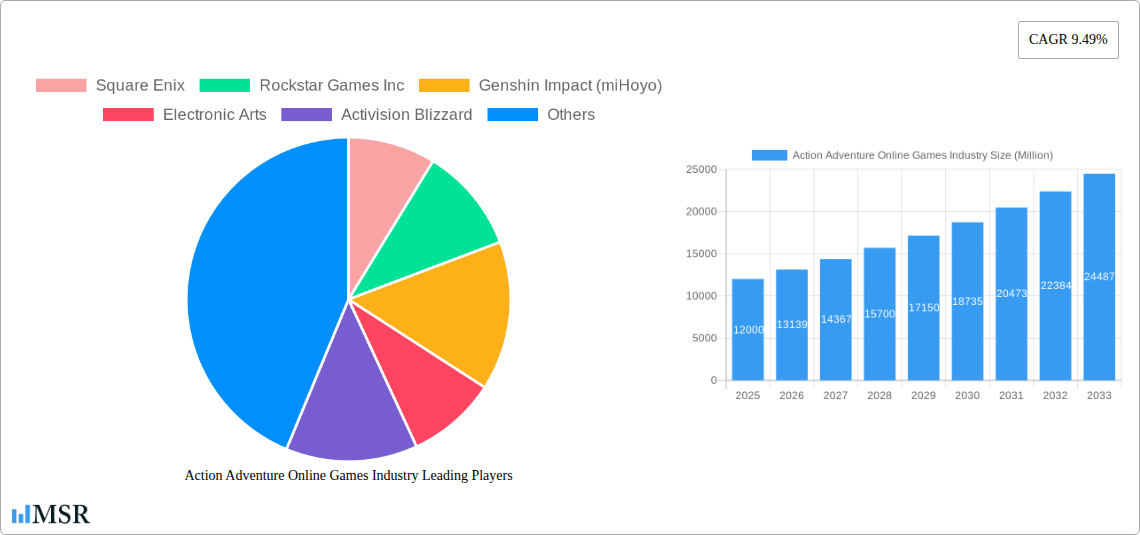

Action Adventure Online Games Industry Company Market Share

Discover the dynamic Action Adventure Online Games market, a sector experiencing significant expansion. This comprehensive report analyzes market concentration, growth drivers, emerging trends, and strategic insights for stakeholders. Our analysis covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, providing historical context (2019-2024) and future projections.

Explore the Action Adventure Online Games industry's impressive growth trajectory, projected to reach a substantial market size. This report offers crucial intelligence on revenue streams, technological advancements, and consumer engagement strategies, covering key segments such as Advertising, In-App Purchases, and Paid Apps.

Action Adventure Online Games Industry Market Concentration & Dynamics

The action adventure online games industry exhibits a moderately concentrated market, with major players like Tencent Holdings Ltd, Electronic Arts, and Activision Blizzard holding significant market share. However, the rise of innovative indie studios and platforms such as Roblox Corporation and EPIC GAMES continues to fuel competition and fragment market control, leading to an estimated XX% market share for the top 5 players in 2025. Innovation ecosystems are driven by advancements in game engines, AI-driven gameplay, and cloud gaming technologies, fostering a vibrant development landscape. Regulatory frameworks, particularly concerning in-game purchases and data privacy, are evolving globally, impacting operational strategies. Substitute products, including other online game genres and competitive entertainment options, pose a constant challenge, necessitating continuous engagement and value proposition enhancement. End-user trends show a growing demand for immersive single-player narratives with robust multiplayer components, and seamless cross-platform experiences. Mergers and acquisitions (M&A) activity remains a key dynamic, with an estimated XX M&A deals anticipated between 2025-2033, as larger entities seek to acquire innovative IPs and talent, further shaping market concentration.

Action Adventure Online Games Industry Industry Insights & Trends

The global action adventure online games industry is experiencing robust growth, driven by an expanding digital entertainment market and increasing accessibility through diverse platforms. The market size is projected to reach approximately $XX Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% anticipated between 2025 and 2033. Key growth drivers include the proliferation of high-speed internet connectivity, the increasing adoption of smartphones and gaming consoles, and the growing appeal of immersive storytelling and competitive gameplay. Technological disruptions are at the forefront of this evolution, with advancements in virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) promising to deliver more engaging and personalized player experiences. AI is revolutionizing game development through procedural content generation and more sophisticated NPC behaviors, while VR/AR technologies are poised to offer unparalleled levels of immersion in future action-adventure titles. Evolving consumer behaviors are characterized by a demand for live-service games offering continuous content updates and social interaction, alongside a preference for free-to-play models with optional in-app purchases that provide a low barrier to entry for a broad audience. The increasing influence of esports and streaming platforms, such as Twitch and YouTube Gaming, further amplifies player engagement and global reach, driving demand for competitive and visually stunning action-adventure titles. This sustained interest, coupled with innovative game design and monetization strategies, underpins the industry’s upward trajectory.

Key Markets & Segments Leading Action Adventure Online Games Industry

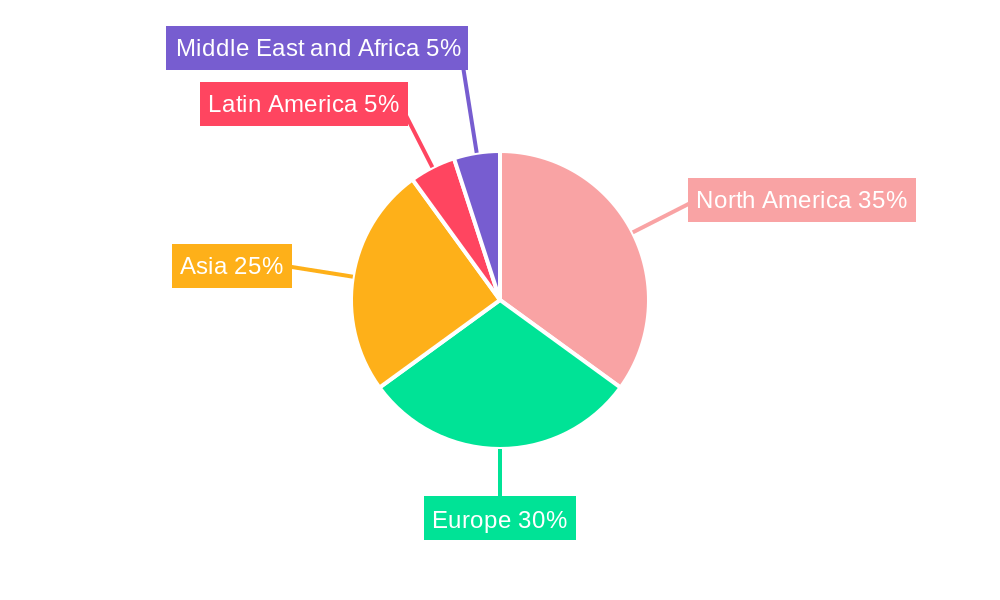

The North America region currently dominates the action adventure online games industry, driven by a mature market with high disposable incomes, strong technological infrastructure, and a deeply ingrained gaming culture. The United States, in particular, represents a significant market share due to the presence of major game developers and publishers and a vast player base actively engaging with online adventure titles. Economic growth in this region consistently fuels consumer spending on premium gaming experiences and in-app purchases.

Dominant Segments:

In-App Purchase (IAP): This segment holds the largest market share, accounting for an estimated XX% of the total industry revenue in 2025.

- Drivers: Low barrier to entry for free-to-play games, microtransactions for cosmetic items, character upgrades, and convenience features, high player engagement in live-service games.

- Detailed Dominance Analysis: The prevalence of free-to-play action adventure titles, such as Genshin Impact (miHoyo), has been instrumental in the dominance of the IAP segment. Players can access the core game experience without upfront cost, fostering large player bases. Monetization then occurs through optional purchases of virtual currency, character skins, powerful items, and season passes. This model leverages player loyalty and the desire for customization and progression, ensuring consistent revenue streams for publishers. The success of games like Genshin Impact exemplifies how well-designed IAP systems can integrate seamlessly with engaging gameplay, driving substantial revenue and long-term player retention.

Advertising: This segment is steadily growing, particularly within mobile-based action adventure games.

- Drivers: Wide reach of free-to-play mobile titles, integration of rewarded video ads and interstitial ads, increasing advertiser demand for targeted reach within engaged audiences.

- Detailed Dominance Analysis: While IAPs are the primary revenue driver, advertising plays a crucial role, especially in the mobile segment. Rewarded video ads, where players watch an advertisement in exchange for in-game currency or bonuses, have proven highly effective. Interstitial ads, appearing between gameplay sessions, also contribute to revenue. The sheer volume of players engaging with free mobile action adventure games makes this an attractive channel for advertisers seeking to reach a diverse and engaged demographic.

Paid App: This segment, while smaller in comparison to IAP, remains significant for premium, high-fidelity action adventure titles.

- Drivers: Consumer willingness to pay for high-quality, complete gaming experiences, established franchises with dedicated fan bases, perceived value of a one-time purchase.

- Detailed Dominance Analysis: Titles from renowned publishers like Square Enix and Rockstar Games Inc. often adopt a paid app model for their flagship action adventure releases. Players pay an upfront fee to access the full game, often with the option for post-launch downloadable content (DLC) which can further supplement revenue. This model appeals to players who prefer a definitive experience without ongoing monetization pressures and are willing to invest in established intellectual properties and high production value.

Action Adventure Online Games Industry Product Developments

The action adventure online games industry is characterized by continuous product innovation, with developers focusing on enhancing immersion, interactivity, and replayability. Recent advancements include the integration of sophisticated AI for more dynamic NPC interactions and adaptive difficulty, sophisticated procedural generation for vast, unique game worlds, and the exploration of advanced haptic feedback technologies to deepen player sensory engagement. The increasing adoption of cross-platform play facilitates seamless transitions between PC, console, and mobile devices, expanding player accessibility. Furthermore, the ongoing development of photorealistic graphics and complex physics engines, seen in titles developed by industry giants like Electronic Arts and Ubisoft, continues to push the boundaries of visual fidelity and gameplay realism, offering players unparalleled virtual adventures.

Challenges in the Action Adventure Online Games Industry Market

The action adventure online games industry faces several significant challenges. Regulatory hurdles, particularly concerning loot box mechanics and in-game purchase disclosures, are increasing globally, potentially impacting monetization strategies and requiring costly compliance. Supply chain issues can affect hardware availability for consoles and PC components, indirectly impacting game sales. Intense competitive pressures from a saturated market and the constant demand for novel content result in high development costs and significant risk associated with game launches, with an estimated xx% of new titles failing to recoup their investment. Monetization fatigue among players and the potential for exploitative practices also pose reputational risks, demanding a balance between revenue generation and player satisfaction.

Forces Driving Action Adventure Online Games Industry Growth

Several key forces are propelling the growth of the action adventure online games industry. Technological advancements, including the widespread adoption of cloud gaming, the maturation of VR/AR technologies, and the sophisticated use of AI in game design, are creating more immersive and accessible experiences. Economic factors, such as increasing disposable incomes in emerging markets and the continued global growth of digital entertainment spending, are expanding the potential player base. Furthermore, the growing popularity of esports and live-streaming platforms provides significant marketing reach and community building opportunities, fostering sustained player engagement and driving demand for competitive and visually compelling action-adventure titles.

Challenges in the Action Adventure Online Games Industry Market

Long-term growth catalysts for the action adventure online games industry are rooted in continuous innovation and strategic market expansion. The development of new monetization models beyond traditional IAPs, such as subscription services and blockchain-integrated ownership of in-game assets, presents significant future revenue potential. Strategic partnerships between game developers and hardware manufacturers, as well as collaborations with content creators and influencers, will be crucial for expanding market reach and building loyal communities. Exploring underserved markets and tailoring content to diverse cultural preferences will also be key to sustained global expansion, ensuring the industry's continued evolution and profitability.

Emerging Opportunities in Action Adventure Online Games Industry

Emerging opportunities within the action adventure online games industry are abundant, driven by technological advancements and evolving consumer preferences. The metaverse offers a significant frontier, with potential for persistent virtual worlds and new forms of interactive storytelling and social gaming experiences. The continued growth of mobile gaming presents opportunities for developing more sophisticated and engaging action-adventure titles that leverage the portability and accessibility of smartphones. Furthermore, the increasing interest in user-generated content platforms, exemplified by Roblox Corporation, opens avenues for players to co-create and monetize their own adventure game experiences, fostering a more dynamic and participatory ecosystem.

Leading Players in the Action Adventure Online Games Industry Sector

- Tencent Holdings Ltd

- Rockstar Games Inc

- Activision Blizzard

- Electronic Arts

- Square Enix

- Nintendo

- EPIC GAMES

- PLARIUM

- Roblox Corporation

- Ubisoft

- Zynga

- miHoyo (Genshin Impact)

Key Milestones in Action Adventure Online Games Industry Industry

- July 2022: PopOK Gaming introduces five new instant games – Flaming Fruit, Era of Dragons, Plinko, Magic Idol, and Gogo Banana – aiming to enhance the iGaming industry with fresh, visually appealing options that create new revenue streams for partners and engaging adventures for players.

- June 2022: Disruptive Games, an indie studio, secures a publishing agreement with Amazon Games for their upcoming online multiplayer adventure game, highlighting Amazon's strategy of developing its own IPs and publishing select works from talented external teams.

Strategic Outlook for Action Adventure Online Games Industry Market

The strategic outlook for the action adventure online games industry is exceptionally bright, characterized by sustained growth driven by innovation and expanding market reach. Key accelerators include the continued development and adoption of emerging technologies like AI and VR/AR to create hyper-realistic and deeply immersive gameplay experiences. Strategic partnerships with content creators, esports organizations, and hardware manufacturers will be vital for broadening appeal and fostering strong player communities. Furthermore, the exploration of new monetization avenues, such as player-owned digital assets facilitated by blockchain technology, and a focus on developing inclusive and diverse game narratives will ensure long-term relevance and profitability in this ever-evolving entertainment sector.

Action Adventure Online Games Industry Segmentation

-

1. Type

- 1.1. Advertising

- 1.2. In-App Purchase

- 1.3. Paid App

Action Adventure Online Games Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Italy

- 2.4. France

-

3. Asia

- 3.1. India

- 3.2. Japan

- 3.3. South Korea

- 4. Latin America

- 5. Middle East and Africa

Action Adventure Online Games Industry Regional Market Share

Geographic Coverage of Action Adventure Online Games Industry

Action Adventure Online Games Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Enormous Demand For New And Innovative Gaming Experiences; Rising Internet Penetration

- 3.2.2 5G And Technology advancement; Economic Growth in the developing regions

- 3.3. Market Restrains

- 3.3.1. Privacy and Security Issues And Government Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration Rate and Technologically Advanced Electronic Devices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Action Adventure Online Games Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Advertising

- 5.1.2. In-App Purchase

- 5.1.3. Paid App

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Action Adventure Online Games Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Advertising

- 6.1.2. In-App Purchase

- 6.1.3. Paid App

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Action Adventure Online Games Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Advertising

- 7.1.2. In-App Purchase

- 7.1.3. Paid App

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Action Adventure Online Games Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Advertising

- 8.1.2. In-App Purchase

- 8.1.3. Paid App

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Action Adventure Online Games Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Advertising

- 9.1.2. In-App Purchase

- 9.1.3. Paid App

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Action Adventure Online Games Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Advertising

- 10.1.2. In-App Purchase

- 10.1.3. Paid App

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Square Enix

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rockstar Games Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Genshin Impact (miHoyo)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Electronic Arts

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Activision Blizzard

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nintendo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EPIC GAMES

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PLARIUM

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Roblox Corportation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ubisoft

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zynga

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tencent Holdings Ltd *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Square Enix

List of Figures

- Figure 1: Global Action Adventure Online Games Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Action Adventure Online Games Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Action Adventure Online Games Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Action Adventure Online Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Action Adventure Online Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Action Adventure Online Games Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: Europe Action Adventure Online Games Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Action Adventure Online Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Action Adventure Online Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Action Adventure Online Games Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Asia Action Adventure Online Games Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Action Adventure Online Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Action Adventure Online Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Action Adventure Online Games Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Latin America Action Adventure Online Games Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Action Adventure Online Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Action Adventure Online Games Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Action Adventure Online Games Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Middle East and Africa Action Adventure Online Games Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Action Adventure Online Games Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Action Adventure Online Games Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Action Adventure Online Games Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Action Adventure Online Games Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Action Adventure Online Games Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Action Adventure Online Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Global Action Adventure Online Games Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Action Adventure Online Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Italy Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Action Adventure Online Games Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Action Adventure Online Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: India Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Action Adventure Online Games Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Action Adventure Online Games Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Action Adventure Online Games Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Action Adventure Online Games Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 21: Global Action Adventure Online Games Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Action Adventure Online Games Industry?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Action Adventure Online Games Industry?

Key companies in the market include Square Enix, Rockstar Games Inc, Genshin Impact (miHoyo), Electronic Arts, Activision Blizzard, Nintendo, EPIC GAMES, PLARIUM, Roblox Corportation, Ubisoft, Zynga, Tencent Holdings Ltd *List Not Exhaustive.

3. What are the main segments of the Action Adventure Online Games Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 343.22 billion as of 2022.

5. What are some drivers contributing to market growth?

The Enormous Demand For New And Innovative Gaming Experiences; Rising Internet Penetration. 5G And Technology advancement; Economic Growth in the developing regions.

6. What are the notable trends driving market growth?

Increasing Internet Penetration Rate and Technologically Advanced Electronic Devices.

7. Are there any restraints impacting market growth?

Privacy and Security Issues And Government Regulations.

8. Can you provide examples of recent developments in the market?

July 2022 - PopOK Gaming offers new, entertaining ideas destined to find a perfect home in the iGaming industry. Five intriguing instant games have been added to its entire library of games, and they are all poised to provide the sector with a chic new edge. With games like Flaming Fruit, Era of Dragons, Plinko, Magic Idol, and Gogo Banana, players have more options, and partners have access to additional revenue streams. These visually appealing games with straightforward instructions will soon provide an unforgettable adventure and boost profits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Action Adventure Online Games Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Action Adventure Online Games Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Action Adventure Online Games Industry?

To stay informed about further developments, trends, and reports in the Action Adventure Online Games Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence