Key Insights

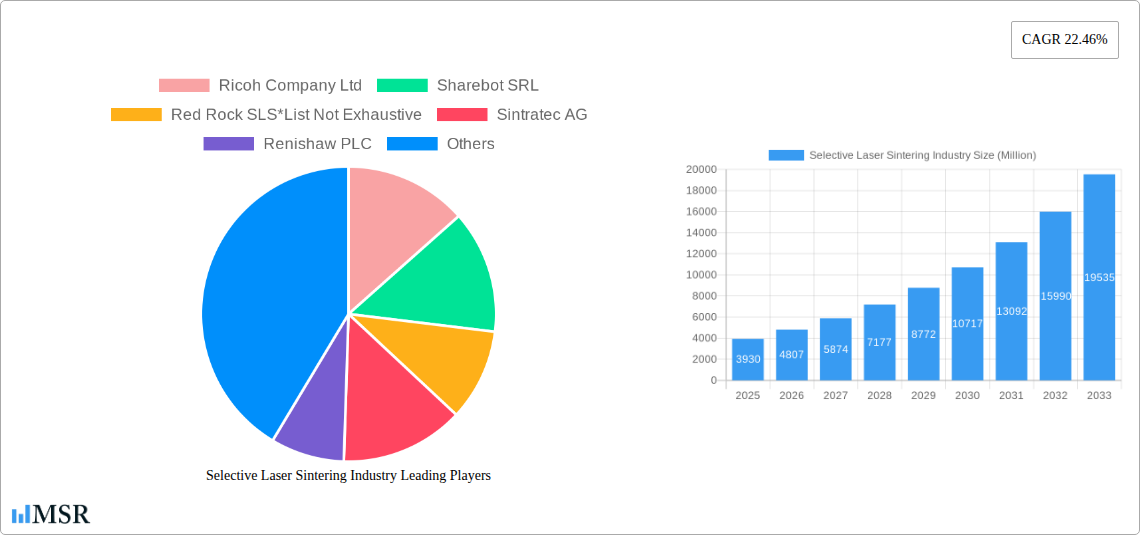

The Selective Laser Sintering (SLS) industry is poised for remarkable expansion, driven by its ability to produce complex, high-performance parts with excellent material properties. The market is valued at a robust USD 3.93 billion in the base year of 2025, and is projected to experience a substantial Compound Annual Growth Rate (CAGR) of 22.46% over the forecast period spanning 2025 to 2033. This aggressive growth trajectory underscores the increasing adoption of SLS technology across a multitude of demanding sectors. Key drivers fueling this surge include the escalating need for lightweight yet durable components in the automotive and aerospace industries, the demand for intricate prototypes and patient-specific implants in healthcare, and the continuous innovation in material science, particularly the development of advanced polymers and composite powders. Furthermore, the inherent advantages of SLS, such as its design freedom, minimal post-processing requirements, and cost-effectiveness for low-to-medium volume production, are making it an indispensable tool for manufacturers seeking to streamline their production cycles and enhance product performance.

Selective Laser Sintering Industry Market Size (In Billion)

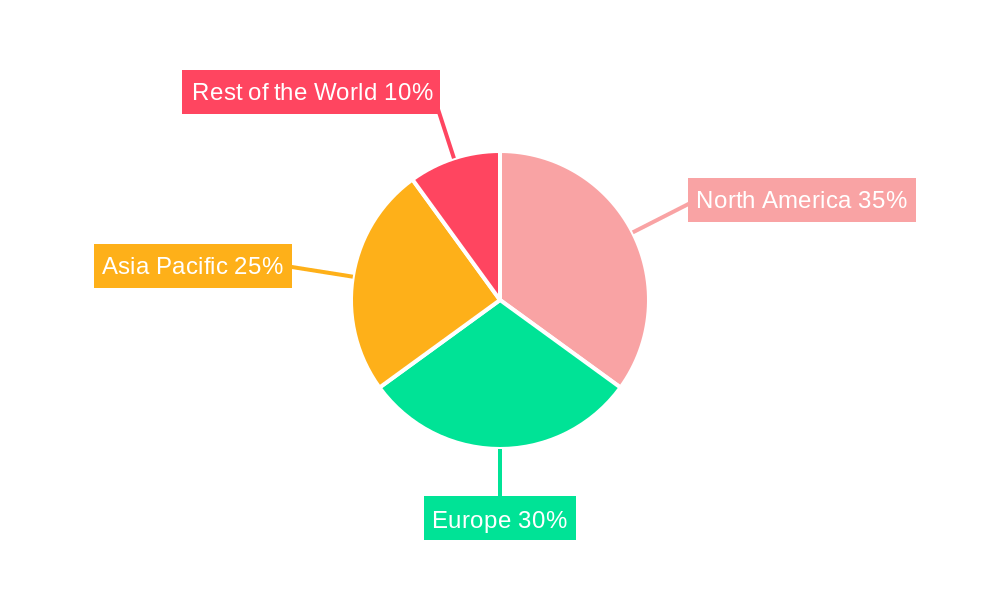

The market segmentation reveals a dynamic landscape. In terms of materials, both metal and plastic powders are significant contributors, with plastic likely holding a larger share due to its wider application in prototyping and consumer goods. The component aspect is multifaceted, encompassing hardware (the 3D printers themselves), software (design and slicing tools), and services (printing bureaus and material supply). The growing complexity and sophistication of SLS systems and software are expected to drive growth in the hardware and software segments, while the increasing outsourcing of 3D printing by enterprises will bolster the services sector. The end-user industry breakdown highlights the critical role of automotive, aerospace and defense, and healthcare in propelling market growth. These sectors consistently push the boundaries of material performance and design complexity, making SLS an ideal solution. The electronics industry is also emerging as a significant adopter for specialized components. While specific regional data is not provided, North America and Europe are likely to remain dominant markets due to established advanced manufacturing ecosystems and significant R&D investments. However, the Asia Pacific region is expected to witness the fastest growth, fueled by increasing manufacturing capabilities, government initiatives promoting additive manufacturing, and a burgeoning demand from its diverse industrial base. The competitive landscape is characterized by a mix of established players and innovative newcomers, all vying to capture market share through technological advancements and strategic partnerships.

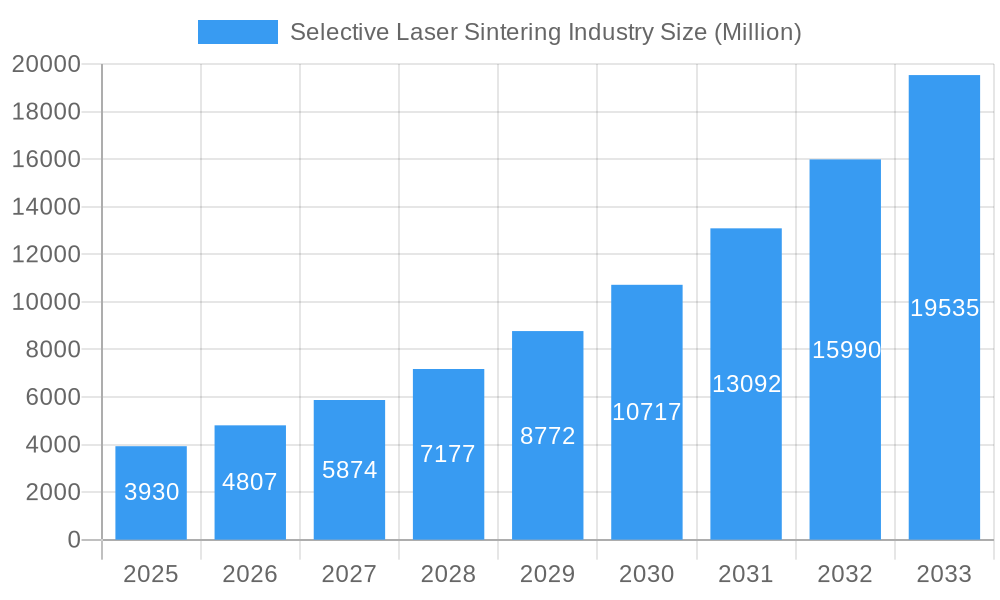

Selective Laser Sintering Industry Company Market Share

Selective Laser Sintering (SLS) Industry Market Report: Unlocking Innovation in Additive Manufacturing (2019-2033)

Dive deep into the rapidly evolving Selective Laser Sintering (SLS) industry with this comprehensive market report. Covering the study period of 2019–2033, this analysis provides critical insights for stakeholders navigating the additive manufacturing landscape. With a base year of 2025 and a forecast period of 2025–2033, this report meticulously dissects market dynamics, technological advancements, and key players shaping the future of 3D printing. Explore the potential of metal SLS printing, plastic SLS materials, and the crucial components of SLS hardware, SLS software, and SLS services. Understand the impact of SLS technology across vital end-user industries such as automotive manufacturing, aerospace and defense, healthcare additive manufacturing, and electronics production. This report is your indispensable guide to maximizing opportunities within the SLS market.

Selective Laser Sintering Industry Market Concentration & Dynamics

The SLS industry exhibits moderate to high market concentration, with established players like EOS GmbH Electro Optical Systems and 3D Systems Inc. holding significant market share. The innovation ecosystem is robust, driven by continuous R&D in SLS materials and SLS hardware. Regulatory frameworks are evolving to address safety and standardization for additive manufacturing applications. Substitute products, primarily traditional manufacturing methods, are gradually being displaced by the cost-effectiveness and design freedom offered by SLS printing. End-user trends show an increasing demand for customized, low-volume production and complex geometries, particularly in sectors like aerospace and defense and healthcare. Merger and acquisition activities are notable, as larger companies seek to consolidate their position and acquire specialized SLS technology expertise. For example, recent years have seen strategic acquisitions aimed at expanding metal SLS printing capabilities and enhancing SLS software solutions. The market share of leading vendors is closely watched, with EOS GmbH Electro Optical Systems consistently leading in industrial SLS systems. M&A deal counts have seen a steady increase, reflecting consolidation and strategic investment.

Selective Laser Sintering Industry Industry Insights & Trends

The SLS industry is experiencing remarkable growth, driven by several key factors. The market size for selective laser sintering is projected to reach XX Billion USD by 2025, with a compelling Compound Annual Growth Rate (CAGR) of XX% during the 2025–2033 forecast period. Technological disruptions are at the forefront, with advancements in SLS materials enabling broader applications. The development of high-performance polymers and metal powders for SLS printing is expanding the design envelope for complex components. Evolving consumer behaviors are leaning towards mass customization and on-demand production, areas where SLS technology excels. The automotive industry is increasingly adopting SLS for rapid prototyping and tooling, while the aerospace and defense sector leverages it for lightweight, high-strength parts. The healthcare industry benefits from SLS for patient-specific implants and surgical guides. The integration of AI and machine learning in SLS software is further optimizing build processes and material utilization, contributing to higher efficiency and reduced costs. The continuous improvement in SLS machine speed and precision is also a significant trend, making additive manufacturing a viable option for series production.

Key Markets & Segments Leading Selective Laser Sintering Industry

The SLS industry is dominated by key regions and segments that are driving innovation and adoption.

Dominant Region: North America and Europe currently lead the SLS market, propelled by robust R&D investments, established manufacturing bases in aerospace and defense and automotive, and a strong presence of SLS technology providers.

- Economic Growth: Favorable economic conditions and increased disposable income in these regions fuel demand for advanced manufacturing solutions.

- Infrastructure Development: Significant investments in industrial infrastructure support the adoption of 3D printing technologies.

- Government Initiatives: Supportive government policies and funding for advanced manufacturing research accelerate the growth of the SLS sector.

Dominant Material Segment: Plastic SLS materials currently hold the largest market share due to their versatility, cost-effectiveness, and wide range of applications in prototyping and end-use parts across various industries. However, metal SLS materials are experiencing rapid growth, particularly for high-value applications in aerospace and defense and healthcare.

- Plastic SLS: Ideal for functional prototypes, jigs, fixtures, and end-use parts in automotive, consumer goods, and electronics.

- Metal SLS: Crucial for aerospace components, medical implants, and high-performance automotive parts requiring strength and durability.

Dominant Component Segment: The SLS hardware segment is the largest contributor to the market revenue, driven by the increasing demand for industrial-grade SLS machines. However, the SLS software and SLS services segments are growing at a faster pace, reflecting the industry's focus on integrated solutions and expertise.

- Hardware: Encompasses a wide range of SLS printers, from desktop to industrial-scale systems.

- Software: Includes design, simulation, build preparation, and post-processing software essential for efficient SLS workflows.

- Services: Offers outsourced 3D printing, material development, and design optimization services, catering to businesses looking to leverage SLS technology without significant capital investment.

Dominant End-user Industry: The Automotive and Aerospace and Defense industries are leading the adoption of SLS technology.

- Automotive: Utilizes SLS for rapid prototyping of complex designs, tooling, and the production of lightweight, high-performance components.

- Aerospace and Defense: Employs SLS for creating intricate, lightweight, and highly durable parts for aircraft, satellites, and defense equipment, where performance and reliability are paramount.

- Healthcare: Rapidly growing segment for custom implants, prosthetics, surgical tools, and anatomical models.

- Electronics: Used for rapid prototyping of enclosures, connectors, and functional components.

Selective Laser Sintering Industry Product Developments

Product innovations in the SLS industry are continuously pushing the boundaries of what's possible in additive manufacturing. Key developments include the introduction of new SLS materials with enhanced properties, such as higher temperature resistance, improved mechanical strength, and biocompatibility. Advancements in SLS printer technology are leading to faster build speeds, larger build volumes, and increased precision, making SLS more viable for production environments. Furthermore, the integration of intelligent software for process monitoring and optimization is enhancing build reliability and material efficiency. For example, the development of advanced plastic powders and novel metal alloys specifically engineered for SLS printing is expanding the range of functional parts that can be produced. These innovations are crucial for maintaining a competitive edge and addressing the evolving needs of industries like automotive, aerospace, and healthcare.

Challenges in the Selective Laser Sintering Industry Market

Despite its immense potential, the SLS industry faces several challenges. High initial capital investment for industrial-grade SLS machines remains a significant barrier for some businesses. The availability and cost of specialized SLS materials can also be a constraint, particularly for niche applications. Achieving consistent part quality and meeting stringent industry standards for critical applications, especially in aerospace and defense and healthcare, requires rigorous process control and validation. Furthermore, the limited understanding and adoption of SLS technology among certain segments of the manufacturing workforce necessitate ongoing education and training initiatives. Supply chain complexities for raw materials and the need for specialized post-processing also add to operational challenges.

Forces Driving Selective Laser Sintering Industry Growth

Several forces are driving the significant growth of the SLS industry. Technological advancements in SLS machines and SLS materials are making the technology more accessible, faster, and capable of producing higher-quality parts. The increasing demand for mass customization and on-demand manufacturing across various sectors, including automotive, aerospace, and healthcare, perfectly aligns with the capabilities of SLS. Economic factors, such as the desire for reduced production costs and shorter lead times compared to traditional methods, are also accelerating adoption. Furthermore, supportive government policies and research initiatives promoting additive manufacturing are fostering innovation and market expansion. The growing awareness of SLS as a sustainable manufacturing solution, enabling lightweighting and reduced material waste, is another crucial growth catalyst.

Challenges in the Selective Laser Sintering Industry Market

The long-term growth of the SLS industry will be shaped by overcoming specific hurdles. Continued innovation in SLS materials to offer a wider range of properties, including conductive and transparent options, will be critical. Expanding the integration of SLS technology into established production workflows and supply chains will require greater interoperability between different manufacturing processes. Developing more intuitive and intelligent SLS software that simplifies design, simulation, and build preparation for a broader user base is essential. Furthermore, fostering stronger partnerships between SLS equipment manufacturers, material suppliers, and end-users will drive collaborative development and accelerate the adoption of advanced SLS solutions. Addressing the skills gap through comprehensive training programs will also ensure a qualified workforce capable of leveraging the full potential of SLS printing.

Emerging Opportunities in Selective Laser Sintering Industry

The SLS industry is ripe with emerging opportunities. The expansion of metal SLS printing into new industries beyond aerospace, such as high-performance sporting goods and specialized industrial machinery, presents significant growth potential. The development of novel SLS materials, including bio-compatible and recycled polymers, opens doors for sustainable applications in consumer goods and medical devices. The increasing adoption of SLS for direct digital manufacturing and series production, rather than just prototyping, is a major trend. Furthermore, the integration of AI and machine learning into SLS workflows for predictive maintenance and real-time process optimization offers substantial efficiency gains. The growing demand for localized manufacturing and on-demand spare parts also positions SLS technology as a key enabler for distributed production models.

Leading Players in the Selective Laser Sintering Industry Sector

- Ricoh Company Ltd

- Sharebot SRL

- Red Rock SLS

- Sintratec AG

- Renishaw PLC

- Farsoon Technologies

- EOS GmbH Electro Optical Systems

- Sinterit Sp Zoo

- 3D Systems Inc

- Prodways Group

- Concept Laser GmbH (General Electric)

- Formlabs Inc

Key Milestones in Selective Laser Sintering Industry Industry

- August 2022: Belfast-based Laser Prototypes Europe Ltd (LPE) expanded its metal 3D printing service by installing a second EOS M 290 machine to cater to rising demand for metal sintering parts. LPE also enhanced its in-house selective laser sintering capabilities with the addition of three post-processing systems from DyeMansion.

- June 2022: Igus launched a specialized 3D printing resin for DLP 3D printing of wearing parts, enabling the additive manufacturing of small, precise components with an extended service life, 30x to 60x longer than conventional resins.

Strategic Outlook for Selective Laser Sintering Industry Market

The strategic outlook for the SLS industry is exceptionally positive, driven by continuous technological advancements and increasing adoption across diverse sectors. Key growth accelerators include the ongoing development of higher-performance SLS materials, enabling more demanding applications in aerospace, automotive, and healthcare. The trend towards on-demand manufacturing and mass customization will further fuel the demand for SLS solutions. Strategic opportunities lie in expanding the application of metal SLS printing, developing more integrated and intelligent SLS software platforms, and fostering closer collaborations across the additive manufacturing ecosystem. The industry is poised for significant expansion as SLS technology becomes increasingly integral to the future of manufacturing, offering unparalleled design freedom, efficiency, and customization capabilities.

Selective Laser Sintering Industry Segmentation

-

1. Material

- 1.1. Metal

- 1.2. Plastic

-

2. Component

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Aerospace and Defense

- 3.3. Healthcare

- 3.4. Electronics

- 3.5. Other End-user Industries

Selective Laser Sintering Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Selective Laser Sintering Industry Regional Market Share

Geographic Coverage of Selective Laser Sintering Industry

Selective Laser Sintering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduced Time for the End Product to Reach the Market; Increased Government Initiatives Across Various Regions

- 3.3. Market Restrains

- 3.3.1. High Product Associated Costs and Availability of 3D Printing Materials

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Selective Laser Sintering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Metal

- 5.1.2. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Aerospace and Defense

- 5.3.3. Healthcare

- 5.3.4. Electronics

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Selective Laser Sintering Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Metal

- 6.1.2. Plastic

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Aerospace and Defense

- 6.3.3. Healthcare

- 6.3.4. Electronics

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Selective Laser Sintering Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Metal

- 7.1.2. Plastic

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Aerospace and Defense

- 7.3.3. Healthcare

- 7.3.4. Electronics

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Selective Laser Sintering Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Metal

- 8.1.2. Plastic

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Aerospace and Defense

- 8.3.3. Healthcare

- 8.3.4. Electronics

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of the World Selective Laser Sintering Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Metal

- 9.1.2. Plastic

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Aerospace and Defense

- 9.3.3. Healthcare

- 9.3.4. Electronics

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ricoh Company Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sharebot SRL

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Red Rock SLS*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sintratec AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Renishaw PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Farsoon Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 EOS GmbH Electro Optical Systems

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sinterit Sp Zoo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 3D Systems Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Prodways Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Concept Laser GmbH (General Electric)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Formlabs Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Ricoh Company Ltd

List of Figures

- Figure 1: Global Selective Laser Sintering Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Selective Laser Sintering Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Selective Laser Sintering Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Selective Laser Sintering Industry Revenue (Million), by Component 2025 & 2033

- Figure 5: North America Selective Laser Sintering Industry Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Selective Laser Sintering Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Selective Laser Sintering Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Selective Laser Sintering Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Selective Laser Sintering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Selective Laser Sintering Industry Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Selective Laser Sintering Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Selective Laser Sintering Industry Revenue (Million), by Component 2025 & 2033

- Figure 13: Europe Selective Laser Sintering Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: Europe Selective Laser Sintering Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Selective Laser Sintering Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Selective Laser Sintering Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Selective Laser Sintering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Selective Laser Sintering Industry Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Selective Laser Sintering Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Selective Laser Sintering Industry Revenue (Million), by Component 2025 & 2033

- Figure 21: Asia Pacific Selective Laser Sintering Industry Revenue Share (%), by Component 2025 & 2033

- Figure 22: Asia Pacific Selective Laser Sintering Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Selective Laser Sintering Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Selective Laser Sintering Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Selective Laser Sintering Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Selective Laser Sintering Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Rest of the World Selective Laser Sintering Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Rest of the World Selective Laser Sintering Industry Revenue (Million), by Component 2025 & 2033

- Figure 29: Rest of the World Selective Laser Sintering Industry Revenue Share (%), by Component 2025 & 2033

- Figure 30: Rest of the World Selective Laser Sintering Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Selective Laser Sintering Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World Selective Laser Sintering Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Selective Laser Sintering Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Selective Laser Sintering Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Selective Laser Sintering Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Selective Laser Sintering Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Selective Laser Sintering Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Selective Laser Sintering Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Selective Laser Sintering Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 7: Global Selective Laser Sintering Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Selective Laser Sintering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Selective Laser Sintering Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Global Selective Laser Sintering Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Selective Laser Sintering Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Selective Laser Sintering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Selective Laser Sintering Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 14: Global Selective Laser Sintering Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 15: Global Selective Laser Sintering Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Selective Laser Sintering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Selective Laser Sintering Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 18: Global Selective Laser Sintering Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global Selective Laser Sintering Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Selective Laser Sintering Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Selective Laser Sintering Industry?

The projected CAGR is approximately 22.46%.

2. Which companies are prominent players in the Selective Laser Sintering Industry?

Key companies in the market include Ricoh Company Ltd, Sharebot SRL, Red Rock SLS*List Not Exhaustive, Sintratec AG, Renishaw PLC, Farsoon Technologies, EOS GmbH Electro Optical Systems, Sinterit Sp Zoo, 3D Systems Inc, Prodways Group, Concept Laser GmbH (General Electric), Formlabs Inc.

3. What are the main segments of the Selective Laser Sintering Industry?

The market segments include Material, Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Reduced Time for the End Product to Reach the Market; Increased Government Initiatives Across Various Regions.

6. What are the notable trends driving market growth?

Aerospace and Defense Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Product Associated Costs and Availability of 3D Printing Materials.

8. Can you provide examples of recent developments in the market?

August 2022 - Belfast-based Laser Prototypes Europe Ltd (LPE) has expanded its metal 3D printing service with the installation of a second EOS M 290 machine to handle the increased demand for metal sintering parts. Recently LPE has also expanded its in-house selective laser sintering capabilities by installing three post-processing systems from DyeMansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Selective Laser Sintering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Selective Laser Sintering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Selective Laser Sintering Industry?

To stay informed about further developments, trends, and reports in the Selective Laser Sintering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence