Key Insights

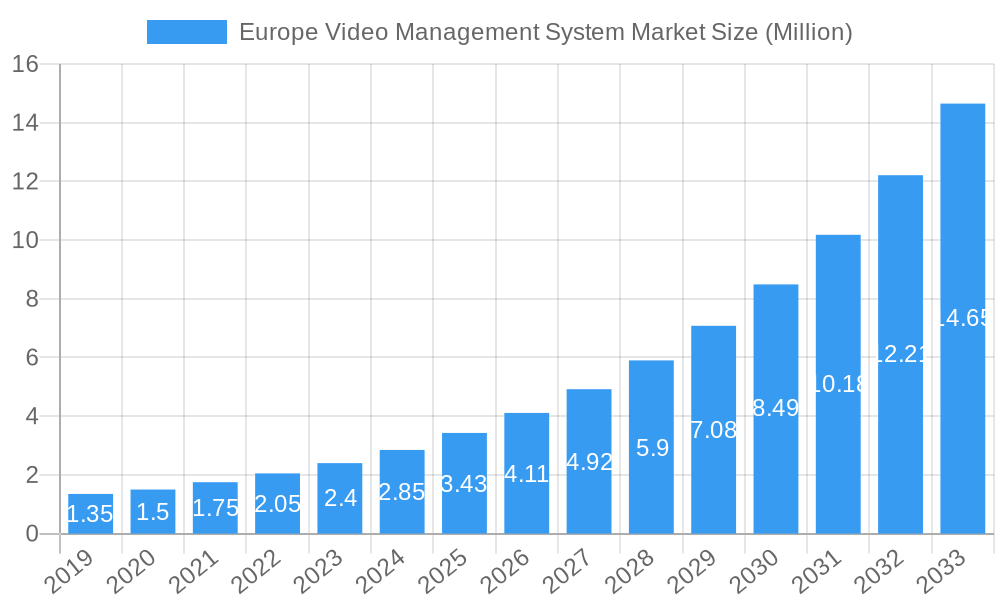

The European Video Management System (VMS) market is poised for significant expansion, projected to reach a substantial valuation of \$3.43 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 19.81%, indicating a dynamic and rapidly evolving landscape. A primary driver for this surge is the escalating demand for enhanced security and surveillance across diverse end-user industries. Sectors like Banking and Financial Services, Retail, Transportation, and Airports are increasingly investing in advanced VMS solutions to mitigate risks, prevent theft, and ensure operational efficiency. The growing adoption of cloud-based VMS deployments is a key trend, offering greater scalability, flexibility, and accessibility compared to traditional on-premise systems. This shift is facilitated by improved internet infrastructure and the rising need for remote monitoring capabilities. Furthermore, the integration of advanced technologies such as Artificial Intelligence (AI) and machine learning within VMS platforms is transforming surveillance from reactive to proactive, enabling intelligent video analytics, facial recognition, and anomaly detection. These technological advancements are crucial in providing actionable insights and automating complex security tasks, thus fueling market adoption.

Europe Video Management System Market Market Size (In Million)

While the market benefits from strong growth drivers, certain restraints can influence its trajectory. The initial high cost of sophisticated VMS solutions and the complex integration process with existing security infrastructures can present challenges, particularly for small and medium-sized enterprises. Data privacy concerns and stringent regulatory frameworks across Europe also necessitate careful consideration and compliance, potentially slowing down widespread adoption in some sensitive applications. However, the continuous innovation in VMS technology, leading to more cost-effective and user-friendly solutions, alongside increasing awareness of the benefits of intelligent surveillance, are expected to overcome these hurdles. The market segmentation reveals a strong demand for both system and service components, with IP-based technologies gradually outperforming analog-based systems due to their superior performance and scalability. The prevalence of cloud deployments is set to grow, while on-premise solutions will continue to serve niche requirements. Across Europe, countries like the United Kingdom, Germany, and France are leading the adoption, driven by robust economic conditions and a heightened focus on public and private security.

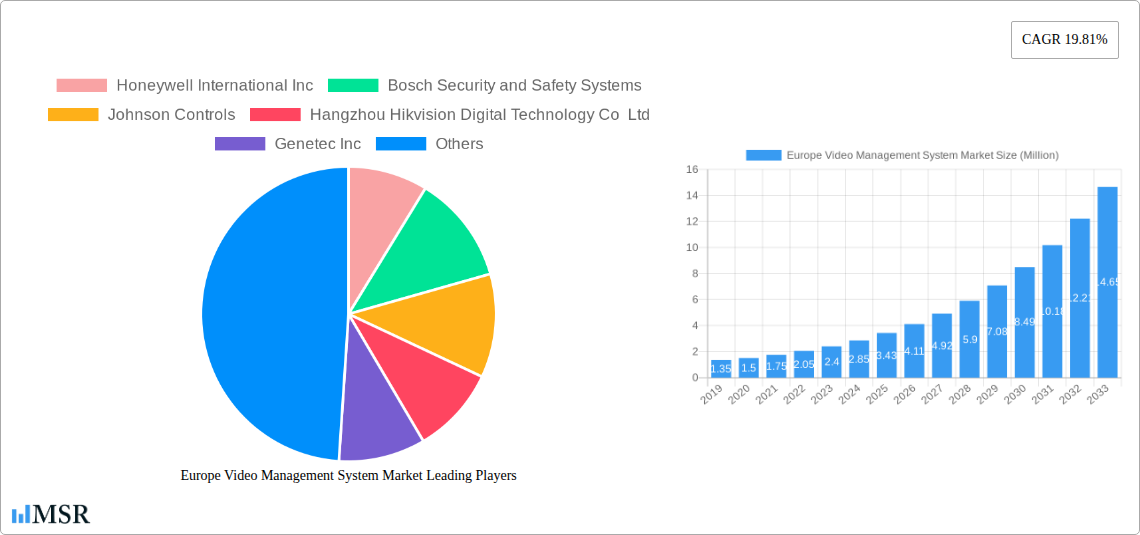

Europe Video Management System Market Company Market Share

Europe Video Management System Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a thorough examination of the Europe Video Management System (VMS) market, analyzing historical trends, current dynamics, and future projections. Leveraging extensive data and expert insights, we dissect key growth drivers, emerging opportunities, and critical challenges shaping this vital sector of the physical security landscape. With a study period spanning 2019 to 2033 and a base year of 2025, this report offers actionable intelligence for industry stakeholders seeking to capitalize on the evolving VMS market.

Europe Video Management System Market Market Concentration & Dynamics

The Europe Video Management System market is characterized by a moderate to high concentration, with a blend of established global players and innovative regional providers vying for market share. The innovation ecosystem thrives on continuous advancements in AI-powered analytics, cloud integration, and cybersecurity, fostering a competitive landscape. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR) and video surveillance deployment, significantly influence market dynamics and necessitate robust compliance strategies from VMS vendors. The prevalence of substitute products, such as standalone analytics solutions or integrated building management systems, presents a constant challenge, demanding VMS providers to offer superior value propositions.

End-user trends indicate a strong shift towards intelligent video analytics for proactive threat detection and operational efficiency, driving demand for advanced VMS capabilities. Mergers and Acquisitions (M&A) activities remain a strategic imperative for market leaders aiming to expand their product portfolios, geographical reach, and technological prowess. For instance, the past two years have seen notable M&A deals aimed at consolidating market positions and acquiring niche technologies. Overall, the market is shaped by a dynamic interplay of technological innovation, regulatory compliance, and evolving end-user demands.

Europe Video Management System Market Industry Insights & Trends

The Europe Video Management System (VMS) market is experiencing robust growth, fueled by an escalating demand for enhanced security solutions across diverse sectors. The market size for Europe's VMS market was valued at approximately €2,500 million in 2025, and is projected to witness a Compound Annual Growth Rate (CAGR) of around 12.5% during the forecast period of 2025-2033. This significant expansion is driven by a confluence of factors, including the increasing adoption of IP-based surveillance systems, the proliferation of smart city initiatives, and a heightened awareness of security threats. Technological disruptions are at the forefront of this growth. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into VMS platforms is revolutionizing video analysis, enabling advanced features like facial recognition, object detection, anomaly detection, and predictive analytics. These intelligent capabilities allow organizations to move beyond passive surveillance to proactive threat mitigation and operational optimization.

Evolving consumer behaviors, particularly in the retail and banking sectors, are also contributing to market expansion. Retailers are leveraging VMS for loss prevention, customer behavior analysis, and optimizing store layouts, while financial institutions are deploying sophisticated VMS solutions for fraud detection, compliance monitoring, and enhanced branch security. The ongoing digital transformation across industries necessitates integrated security solutions, positioning VMS as a critical component of a comprehensive security infrastructure. Furthermore, the increasing adoption of cloud-based VMS solutions is democratizing access to advanced features, offering scalability, flexibility, and cost-effectiveness, particularly for small and medium-sized enterprises (SMEs). This shift towards cloud deployment is a key trend reshaping the market landscape. The ongoing development of cybersecurity features within VMS is crucial, addressing concerns around data breaches and unauthorized access, and further solidifying the market's growth trajectory. The market is also influenced by the increasing need for remote monitoring and management capabilities, a trend accelerated by recent global events.

Key Markets & Segments Leading Europe Video Management System Market

The Europe Video Management System market is a dynamic landscape with distinct leaders emerging across various segments.

Dominant Regions and Countries:

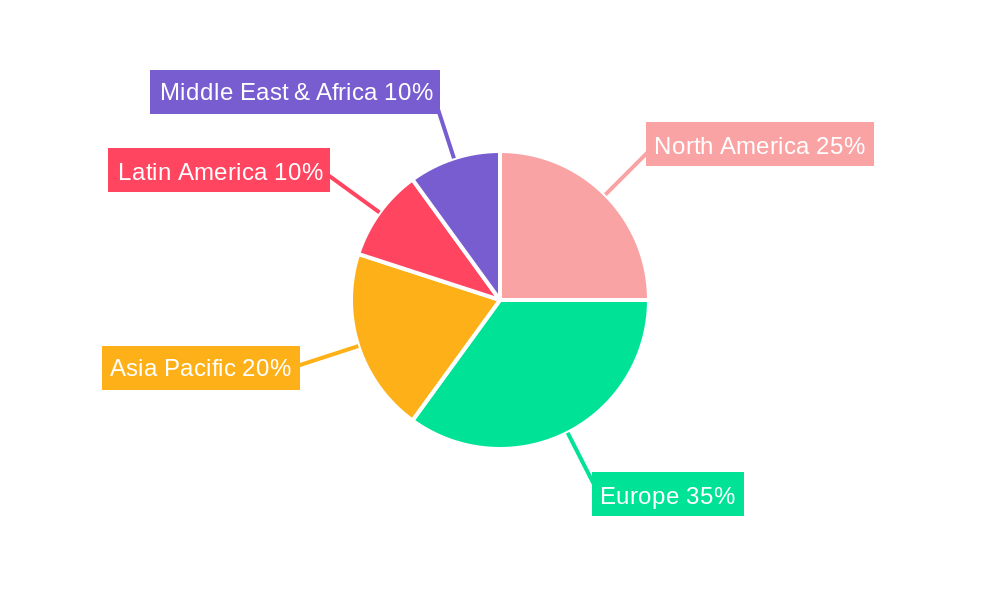

- Western Europe, particularly countries like Germany, the United Kingdom, and France, currently holds the largest market share. This dominance is attributed to their advanced economies, high adoption rates of sophisticated security technologies, and stringent regulatory environments that mandate advanced surveillance solutions.

- Nordic countries are also significant contributors due to their emphasis on public safety and smart city development.

Key Segment Dominance:

Component: The System segment, encompassing the core VMS software and associated hardware, currently leads the market. However, the Services segment, including installation, integration, maintenance, and cloud-based VMS offerings, is exhibiting a higher growth rate.

- Drivers for System Dominance:

- High initial investment in robust surveillance infrastructure.

- Demand for integrated and feature-rich VMS platforms.

- Advancements in video analytics hardware.

- Drivers for Services Growth:

- Increasing preference for subscription-based cloud VMS.

- Need for specialized integration with existing security systems.

- Demand for ongoing support and updates.

- Drivers for System Dominance:

Technology: The IP-Based technology segment is the undisputed leader and is rapidly eclipsing Analog-Based systems.

- Drivers for IP-Based Dominance:

- Superior image quality and resolution.

- Network flexibility and scalability.

- Integration capabilities with IT infrastructure.

- Advanced features like two-way audio and remote access.

- Analog-Based Systems: While declining, these systems still hold a niche in legacy installations or cost-sensitive applications.

- Drivers for IP-Based Dominance:

Mode of Deployment: The On-Premise mode of deployment has historically dominated, particularly in large enterprises with stringent data control requirements. However, the Cloud mode of deployment is witnessing explosive growth.

- Drivers for On-Premise Dominance:

- Concerns over data sovereignty and security for sensitive industries.

- Established infrastructure and IT expertise within organizations.

- Compliance with specific industry regulations.

- Drivers for Cloud Growth:

- Cost-effectiveness and reduced upfront investment.

- Enhanced scalability and remote accessibility.

- Faster deployment and easier updates.

- Increased availability of advanced VMS features through SaaS models.

- Drivers for On-Premise Dominance:

End-user Industry: The Banking and Financial Services sector is a major driver of VMS adoption due to its critical need for security, fraud prevention, and regulatory compliance. Retail is another significant segment, leveraging VMS for loss prevention, customer analytics, and operational efficiency. The Transportation and Logistics sectors are increasingly adopting VMS for infrastructure security, asset tracking, and operational monitoring. Airports represent a high-security environment with extensive VMS deployment for passenger safety and threat detection.

- Drivers for Dominance in these Industries:

- High-value assets and sensitive data requiring robust security.

- Regulatory mandates and compliance requirements.

- Need for real-time monitoring and incident response.

- Integration with existing security and operational systems.

- Drivers for Dominance in these Industries:

Europe Video Management System Market Product Developments

Recent product developments in the Europe Video Management System market highlight a strong focus on intelligent analytics, cloud integration, and enhanced cybersecurity. Companies are investing heavily in AI and machine learning to empower VMS with advanced capabilities such as object recognition, anomaly detection, and behavioral analysis, enabling proactive security measures and operational insights. The trend towards cloud-native VMS solutions continues, offering greater scalability, flexibility, and remote management. These platforms are designed for seamless integration with a growing ecosystem of IoT devices and third-party security applications, creating unified security environments. Cybersecurity remains a paramount concern, with vendors embedding robust encryption, access control, and threat detection mechanisms to protect sensitive video data and prevent unauthorized access, ensuring the market's technological edge and competitive relevance.

Challenges in the Europe Video Management System Market Market

The Europe Video Management System market faces several significant challenges. High implementation costs associated with advanced IP-based systems and sophisticated analytics can be a barrier for smaller organizations. Data privacy regulations, particularly GDPR, impose strict compliance requirements on data collection, storage, and processing, necessitating careful system design and robust data management strategies. Interoperability issues between different VMS platforms and legacy systems can complicate integration efforts, leading to increased complexity and costs. Furthermore, the shortage of skilled cybersecurity professionals capable of managing and securing complex VMS deployments poses a significant operational hurdle. Supply chain disruptions for critical hardware components can also impact product availability and lead times, further exacerbating these challenges.

Forces Driving Europe Video Management System Market Growth

Several powerful forces are driving the growth of the Europe Video Management System market. The escalating threat landscape, including terrorism and organized crime, necessitates enhanced surveillance and security measures across public and private sectors. The rapid adoption of IP-based surveillance technology offers superior image quality and integration capabilities, making it the preferred choice. Technological advancements, particularly in AI and machine learning, are enabling VMS to provide more intelligent and proactive security solutions, moving beyond mere recording to actionable insights. The growing implementation of smart city initiatives across Europe further boosts demand for integrated VMS solutions for public safety, traffic management, and urban monitoring. Additionally, increasing investments in infrastructure development in sectors like transportation and logistics require robust security systems, directly impacting VMS adoption.

Challenges in the Europe Video Management System Market Market

Long-term growth catalysts for the Europe Video Management System market are firmly rooted in continuous innovation and strategic market expansion. The ongoing evolution of Artificial Intelligence (AI) and Machine Learning (ML) algorithms promises to unlock even more sophisticated analytical capabilities, such as predictive policing and advanced behavioral analysis, driving demand for upgraded VMS. Partnerships and collaborations between VMS providers, cybersecurity firms, and IoT device manufacturers are crucial for developing comprehensive, end-to-end security solutions. Furthermore, market expansion into emerging economies within Europe and the development of tailored VMS solutions for specific niche industries will be key growth accelerators, catering to evolving security needs and regulatory landscapes.

Emerging Opportunities in Europe Video Management System Market

Emerging opportunities in the Europe Video Management System market are centered around the burgeoning demand for edge computing and AI-powered analytics. Processing video data closer to the source, on cameras or local servers, reduces latency and bandwidth requirements, paving the way for real-time decision-making. The integration of VMS with Internet of Things (IoT) devices opens up new possibilities for comprehensive data analysis and automation, creating smarter buildings and safer environments. The increasing adoption of cloud-native VMS solutions by small and medium-sized enterprises (SMEs) represents a significant untapped market. Furthermore, the growing focus on privacy-preserving video analytics, which anonymizes data while still extracting valuable insights, addresses growing data protection concerns and unlocks new application areas.

Leading Players in the Europe Video Management System Market Sector

- Honeywell International Inc

- Bosch Security and Safety Systems

- Johnson Controls

- Hangzhou Hikvision Digital Technology Co Ltd

- Genetec Inc

- Dahua Technology

- AxxonSoft Inc

- Axis Communications AB

- Identiv Inc

- Milestone Systems

- Qognify Inc

- Verint Systems

Key Milestones in Europe Video Management System Market Industry

- April 2024: Axis Communications launched Axis Cloud Connect, an innovative cloud-based platform developed to deliver customers more secure, adaptable, and scalable security solutions. Axis Cloud Connect is customized to seamlessly integrate with Axis devices, empowering businesses with a comprehensive suite of managed services that support system and device management, video and data delivery, and meet the increasing demand for cybersecurity.

- January 2024: AxxonSoft announced the introduction of its Axxon One video management software (VMS), which is now version 2.0. This updated release boasts seamless integrations with various physical security systems, transforming the software into a comprehensive "unified" VMS. Axxon One 2.0 seamlessly incorporates ten physical security systems from diverse manufacturers and the universal OPC Data Access Wrapper interface. These integrations encompass access control systems, fire and security alarms, and perimeter intrusion detection systems.

Strategic Outlook for Europe Video Management System Market Market

The strategic outlook for the Europe Video Management System market is overwhelmingly positive, driven by continued technological innovation and expanding application areas. Key growth accelerators will include the deeper integration of Artificial Intelligence (AI) and Machine Learning (ML) for advanced analytics, leading to more predictive and proactive security measures. The shift towards cloud-based VMS solutions will continue to democratize access to sophisticated features and drive adoption among a wider range of businesses. Strategic partnerships focused on developing comprehensive cybersecurity solutions and IoT integrations will be crucial for market players. Furthermore, a sustained focus on user-friendly interfaces and seamless interoperability will be vital for capturing market share in this dynamic and evolving sector.

Europe Video Management System Market Segmentation

-

1. Component

- 1.1. System

- 1.2. Services

-

2. Technology

- 2.1. Analog-Based

- 2.2. IP- Based

-

3. Mode of Deployment

- 3.1. On-Premise

- 3.2. Cloud

-

4. End-user Industry

- 4.1. Banking and Financial Services

- 4.2. Education

- 4.3. Retail

- 4.4. Transportation

- 4.5. Logistics

- 4.6. Healthcare

- 4.7. Airports

Europe Video Management System Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Video Management System Market Regional Market Share

Geographic Coverage of Europe Video Management System Market

Europe Video Management System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.3. Market Restrains

- 3.3.1. Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development

- 3.4. Market Trends

- 3.4.1. Cloud Based Video Management System is Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Video Management System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. System

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analog-Based

- 5.2.2. IP- Based

- 5.3. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.3.1. On-Premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking and Financial Services

- 5.4.2. Education

- 5.4.3. Retail

- 5.4.4. Transportation

- 5.4.5. Logistics

- 5.4.6. Healthcare

- 5.4.7. Airports

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security and Safety Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genetec Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dahua Technology

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AxxonSoft Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Axis Communications AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Identiv Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Milestone Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qognify Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Verint Systems*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Video Management System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Video Management System Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Video Management System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Europe Video Management System Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Europe Video Management System Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Europe Video Management System Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 5: Europe Video Management System Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 6: Europe Video Management System Market Volume Billion Forecast, by Mode of Deployment 2020 & 2033

- Table 7: Europe Video Management System Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe Video Management System Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Europe Video Management System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Europe Video Management System Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Europe Video Management System Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Europe Video Management System Market Volume Billion Forecast, by Component 2020 & 2033

- Table 13: Europe Video Management System Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Europe Video Management System Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 15: Europe Video Management System Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 16: Europe Video Management System Market Volume Billion Forecast, by Mode of Deployment 2020 & 2033

- Table 17: Europe Video Management System Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Europe Video Management System Market Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Europe Video Management System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Europe Video Management System Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: France Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Netherlands Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Belgium Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Belgium Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Sweden Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Sweden Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Norway Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Norway Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Poland Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Poland Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Denmark Europe Video Management System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Denmark Europe Video Management System Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Video Management System Market?

The projected CAGR is approximately 19.81%.

2. Which companies are prominent players in the Europe Video Management System Market?

Key companies in the market include Honeywell International Inc, Bosch Security and Safety Systems, Johnson Controls, Hangzhou Hikvision Digital Technology Co Ltd, Genetec Inc, Dahua Technology, AxxonSoft Inc, Axis Communications AB, Identiv Inc, Milestone Systems, Qognify Inc, Verint Systems*List Not Exhaustive.

3. What are the main segments of the Europe Video Management System Market?

The market segments include Component, Technology, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

6. What are the notable trends driving market growth?

Cloud Based Video Management System is Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Increasing Security Cameras for Surveillence; Technological Advancement in New Product Development.

8. Can you provide examples of recent developments in the market?

April 2024: Axis Communications launched Axis Cloud Connect, an innovative cloud-based platform developed to deliver customers more secure, adaptable, and scalable security solutions. Axis Cloud Connect is customized to seamlessly integrate with Axis devices, empowering businesses with a comprehensive suite of managed services that support system and device management, video and data delivery, and meet the increasing demand for cybersecurity.January 2024: AxxonSoft announced the introduction of its Axxon One video management software (VMS), which is now version 2.0. This updated release boasts seamless integrations with various physical security systems, transforming the software into a comprehensive "unified" VMS. Axxon One 2.0 seamlessly incorporates ten physical security systems from diverse manufacturers and the universal OPC Data Access Wrapper interface. These integrations encompass access control systems, fire and security alarms, and perimeter intrusion detection systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Video Management System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Video Management System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Video Management System Market?

To stay informed about further developments, trends, and reports in the Europe Video Management System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence