Key Insights

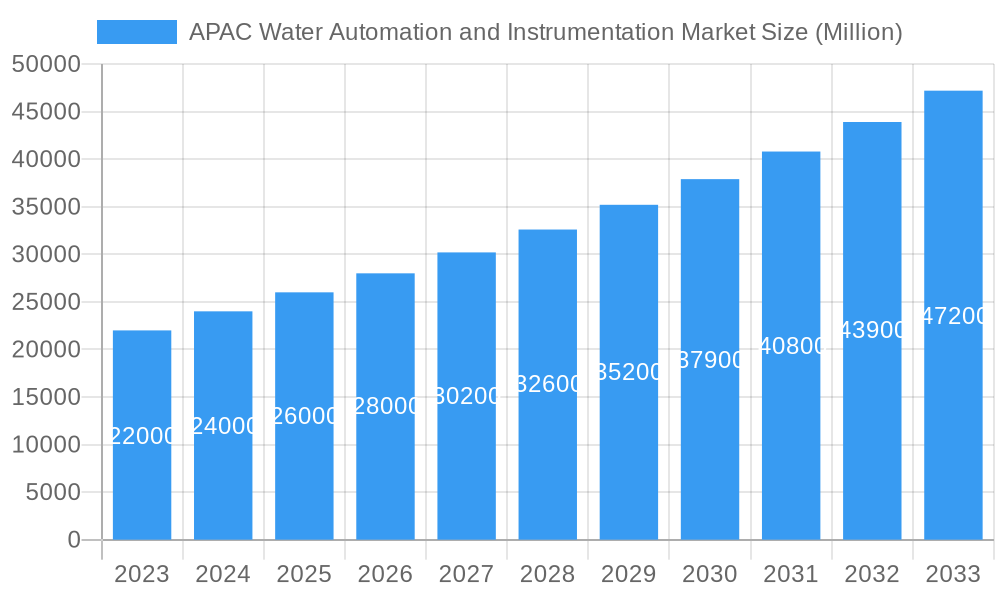

The Asia Pacific (APAC) Water Automation and Instrumentation Market is poised for substantial growth, projected to reach a market size of approximately $28,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.10% throughout the forecast period of 2025-2033. This robust expansion is fueled by a confluence of critical drivers, including the escalating demand for efficient water management solutions to address water scarcity, the stringent environmental regulations mandating improved water quality and wastewater treatment, and the accelerating adoption of smart technologies and IoT in industrial processes across the region. Furthermore, the burgeoning manufacturing, chemical, and food and beverage sectors in key APAC economies like China and India are significant contributors to this market's dynamism, necessitating advanced automation and precise instrumentation for optimized water usage and compliance.

APAC Water Automation and Instrumentation Market Market Size (In Billion)

The market segmentation reveals a strong demand for both Water Automation Solutions, encompassing DCS, SCADA, PLC, and HMI systems, and Water Instrumentation Solutions, including a wide array of sensors and analyzers like pressure transmitters, flow sensors, and liquid analyzers. The integration of these technologies is crucial for comprehensive water cycle management, from source to discharge. While the market benefits from significant drivers, certain restraints, such as the high initial investment costs for advanced systems and the need for skilled personnel for operation and maintenance, may present challenges in some developing economies within the region. However, continuous technological advancements, increasing government initiatives promoting water conservation, and the growing awareness of the economic and environmental benefits of efficient water management are expected to outweigh these restraints, ensuring a sustained growth trajectory for the APAC Water Automation and Instrumentation Market.

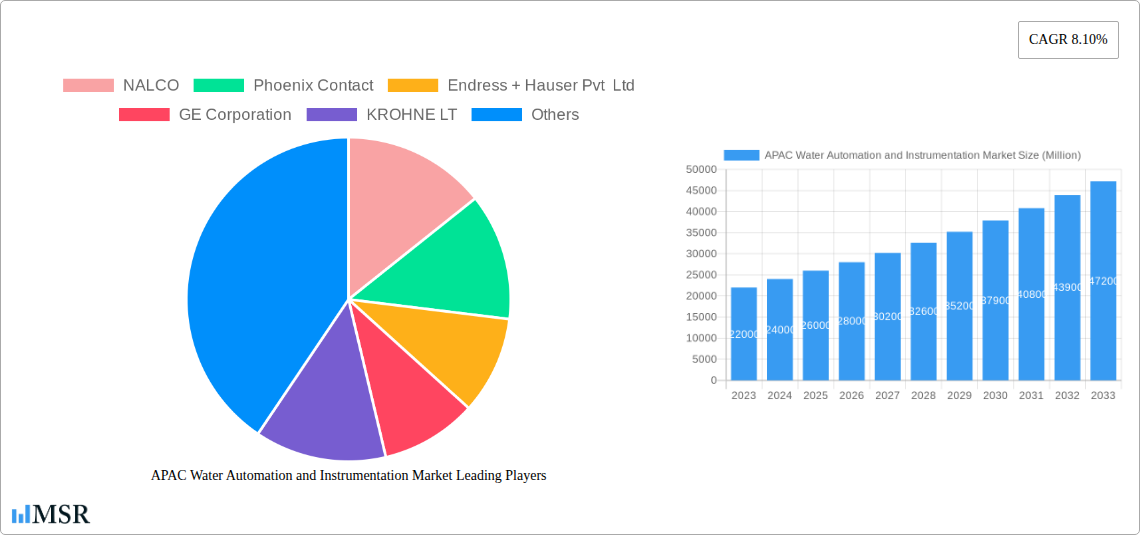

APAC Water Automation and Instrumentation Market Company Market Share

This in-depth report provides a definitive analysis of the APAC Water Automation and Instrumentation Market, offering critical insights and actionable intelligence for industry stakeholders. Spanning from 2019–2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this study delves into the intricate dynamics of water treatment automation, smart water management solutions, and industrial instrumentation across the Asia-Pacific region. Discover key trends, market drivers, challenges, and opportunities shaping the future of water infrastructure in this dynamic economic landscape.

APAC Water Automation and Instrumentation Market Market Concentration & Dynamics

The APAC Water Automation and Instrumentation Market exhibits a moderate to high level of concentration, with leading global players and significant regional companies vying for market share. Companies like Siemens AG, Schneider Electric SE, Emerson Electric, and ABB Group are at the forefront, leveraging their extensive portfolios of PLC, DCS, and SCADA systems to secure substantial market presence. Innovation ecosystems are rapidly evolving, driven by increased R&D investments in advanced sensing technologies and data analytics for smart water networks. Regulatory frameworks, while varying across countries, are increasingly emphasizing water quality standards, conservation, and the adoption of digital solutions, thereby fostering market growth. The availability of substitute products is limited in advanced automation and instrumentation, with innovation being the primary differentiator. End-user trends indicate a strong demand for integrated solutions that offer real-time monitoring, predictive maintenance, and improved operational efficiency in water and wastewater treatment plants. Merger and acquisition (M&A) activities are moderate, focused on acquiring niche technologies or expanding geographical reach. The market share of key players is closely watched, with recent trends showing consolidation among larger entities. M&A deal counts are expected to rise as companies seek to enhance their capabilities in areas like IoT for water management and AI-driven process optimization.

APAC Water Automation and Instrumentation Market Industry Insights & Trends

The APAC Water Automation and Instrumentation Market is experiencing robust growth, projected to reach an estimated market size of $XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This expansion is primarily fueled by escalating concerns regarding water scarcity, the urgent need for enhanced water quality in rapidly urbanizing and industrializing nations, and the imperative to upgrade aging water infrastructure. Technological disruptions, including the widespread adoption of the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing, are revolutionizing water treatment automation. These advancements enable real-time data acquisition, remote monitoring, and predictive analytics, leading to optimized resource allocation and reduced operational costs. The increasing demand for intelligent water instrumentation solutions, such as advanced flow sensors/transmitters, pressure transmitters, and liquid analyzers, is a significant market driver. Furthermore, government initiatives and stringent environmental regulations across countries like China, India, and Southeast Asian nations are compelling industries to invest in sophisticated water management systems to comply with discharge standards and promote sustainable water usage. The shift towards smart water grids and the implementation of leakage detection systems to minimize water loss are also contributing to market vitality. Evolving consumer behaviors, particularly the growing awareness of water conservation among both industrial and residential users, are indirectly influencing the adoption of efficient water management technologies. The market is witnessing a surge in demand for integrated solutions that encompass both automation and instrumentation, offering a comprehensive approach to water management.

Key Markets & Segments Leading APAC Water Automation and Instrumentation Market

The APAC Water Automation and Instrumentation Market is characterized by the dominance of several key regions and segments, driven by strong economic growth, increasing industrialization, and significant investments in water infrastructure development.

Dominant Regions and Countries:

- China stands as a colossal market, propelled by its vast industrial base, extensive urbanization, and substantial government investment in water and wastewater treatment projects. The country's aggressive pursuit of smart city initiatives and stringent environmental regulations further fuel the demand for advanced water automation solutions and instrumentation.

- India presents a rapidly expanding market, driven by increasing population, economic development, and a critical need to address water scarcity and improve water quality. Government programs like the Jal Jeevan Mission are significant catalysts for the adoption of water automation and instrumentation in both urban and rural areas.

- Southeast Asian nations, including countries like Singapore, Malaysia, and Vietnam, are experiencing substantial growth due to their burgeoning economies, growing manufacturing sectors, and a growing focus on sustainable water management practices.

Leading Segments:

Water Automation Solution:

- SCADA (Supervisory Control and Data Acquisition): This segment is highly dominant, owing to its critical role in real-time monitoring, control, and data collection for large-scale water and wastewater systems. Its ability to integrate various components and provide a centralized overview makes it indispensable for efficient operations.

- DCS (Distributed Control Systems): DCS solutions are widely adopted in complex industrial water treatment facilities and large municipal water networks where sophisticated process control and system integration are paramount.

- PLC (Programmable Logic Controllers): PLCs are fundamental building blocks for automation in smaller to medium-sized water applications and serve as crucial components within larger SCADA and DCS frameworks.

- HMI (Human-Machine Interface): HMI systems are essential for operators to interact with automated systems, visualize data, and manage operations effectively, driving their consistent demand.

Water Instrumentation Solution:

- Flow Sensors/Transmitters: Accurate flow measurement is fundamental to water management, making this segment a consistently high-demand area across all end-user industries.

- Liquid Analyzers: With increasing focus on water quality, the demand for liquid analyzers to monitor parameters like pH, turbidity, and dissolved oxygen is surging.

- Pressure Transmitters: Essential for monitoring pressure in pipelines and treatment processes, these instruments are vital for system integrity and efficient operation.

- Leakage Detection Systems: As water loss remains a significant concern, the adoption of advanced leakage detection systems is a key growth driver.

End-User Industry (Qualitative Analysis):

- Manufacturing: This sector is a major consumer of water automation and instrumentation for process control, wastewater treatment, and ensuring compliance with environmental regulations.

- Chemical Industry: The inherent need for precise process control and stringent safety measures makes the chemical industry a significant adopter of advanced automation and instrumentation solutions for their water-related operations.

- Food and Beverages: This industry relies heavily on purified water for production and requires robust wastewater treatment, driving the adoption of automation and instrumentation for quality and compliance.

APAC Water Automation and Instrumentation Market Product Developments

Product developments in the APAC Water Automation and Instrumentation Market are characterized by a strong emphasis on digitalization, connectivity, and enhanced analytical capabilities. Companies are actively introducing advanced SCADA systems with integrated GIS mapping and AI-driven predictive maintenance, as exemplified by Wellin Tech's recent solution for large water conservancy pumping stations, optimizing operational scheduling through real-time simulations and video imagery. Furthermore, collaborative research, such as the memorandum of understanding between Hokkaido University and other institutions for automated wastewater analysis of novel coronaviruses, highlights the trend towards leveraging automation for critical public health monitoring. Innovations are focused on developing smart sensors with embedded analytics, cloud-based platforms for remote monitoring and control of water treatment automation, and the integration of IoT devices for comprehensive smart water management. These advancements aim to improve efficiency, reduce operational costs, and ensure greater compliance with environmental standards, providing a significant competitive edge in the market.

Challenges in the APAC Water Automation and Instrumentation Market Market

Despite robust growth, the APAC Water Automation and Instrumentation Market faces several significant challenges. High initial investment costs for advanced water automation solutions and sophisticated water instrumentation can be a deterrent for smaller utilities and industries, particularly in developing economies. The lack of skilled personnel to operate and maintain these complex systems is another major hurdle. Moreover, fragmented regulatory landscapes across different APAC countries can create complexities for global players. Cybersecurity threats to interconnected smart water management systems and the potential for data breaches pose a growing concern, necessitating robust security measures. Lastly, supply chain disruptions, as experienced during recent global events, can impact the availability and cost of critical components for industrial instrumentation and automation hardware.

Forces Driving APAC Water Automation and Instrumentation Market Growth

Several powerful forces are propelling the APAC Water Automation and Instrumentation Market forward. The escalating scarcity of clean water due to climate change and rapid population growth is creating an undeniable need for efficient water management. Stringent government regulations and environmental protection policies are compelling industries to invest in advanced water treatment automation and pollution control technologies. The increasing adoption of smart water management solutions driven by the digital transformation wave, including IoT and AI, is enhancing operational efficiency and reducing water wastage. Furthermore, substantial government investments in upgrading water and wastewater infrastructure across key APAC nations are creating significant opportunities for automation and instrumentation providers. The growing emphasis on water conservation and sustainability practices by both industries and consumers further underpins market expansion.

Challenges in the APAC Water Automation and Instrumentation Market Market

While opportunities abound, long-term growth catalysts in the APAC Water Automation and Instrumentation Market are intricately linked to continuous innovation and strategic market development. The ongoing advancements in sensor technology, data analytics, and AI will drive the creation of more intelligent and autonomous water management systems. Strategic partnerships and collaborations between technology providers, water utilities, and industrial end-users will foster the development and deployment of tailored solutions. Market expansions into emerging economies within the APAC region, coupled with tailored product offerings to suit local needs and price sensitivities, will be crucial. Furthermore, the increasing focus on circular economy principles and water reuse initiatives will create new avenues for advanced water automation and instrumentation applications, ensuring sustained market relevance and growth.

Emerging Opportunities in APAC Water Automation and Instrumentation Market

Emerging opportunities in the APAC Water Automation and Instrumentation Market are diverse and promising. The burgeoning demand for advanced leakage detection systems and predictive maintenance solutions presents a significant growth area. The increasing adoption of IoT-enabled water monitoring and control systems for smart agriculture and industrial water reuse offers substantial potential. Furthermore, the growing focus on resilient water infrastructure in response to extreme weather events will drive demand for robust and adaptable water automation and instrumentation. The development of specialized solutions for emerging contaminants and decentralized water treatment systems also represents a niche but rapidly growing market segment. The increasing adoption of cloud-based platforms for data analytics and remote management of water assets is creating opportunities for service-oriented business models.

Leading Players in the APAC Water Automation and Instrumentation Market Sector

- NALCO

- Phoenix Contact

- Endress + Hauser Pvt Ltd

- GE Corporation

- KROHNE LT

- MJK Automation

- Siemens AG

- Schneider Electric SE

- Emerson Electric

- ABB Group

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Mitsubishi Motors Corporation

- Eurotek India

Key Milestones in APAC Water Automation and Instrumentation Market Industry

- March 2021: Hokkaido University, Robotic Biology Institute Inc., iLAC Co., Ltd, and Shionogi & Co., Ltd entered a memorandum of understanding toward the establishment of an automated system for the analysis of the novel coronavirus in wastewater. This milestone signifies the growing application of automation in public health monitoring and early disease detection through water systems.

- August 2020: Wellin Tech introduced a SCADA system solution for a large water conservancy pumping station. This development showcases the increasing sophistication of SCADA systems, integrating simulation animation, video images, and GIS information for real-time status display and optimized scheduling of complex water management operations.

Strategic Outlook for APAC Water Automation and Instrumentation Market Market

The strategic outlook for the APAC Water Automation and Instrumentation Market is highly optimistic, driven by a confluence of factors. The increasing global focus on water security, coupled with stringent environmental mandates, will continue to fuel demand for advanced water treatment automation and precise water instrumentation. Key growth accelerators include the pervasive adoption of digital technologies like IoT, AI, and cloud computing, which are enabling more intelligent and efficient water management. Strategic opportunities lie in developing integrated solutions that combine automation and instrumentation, catering to the diverse needs of industries and municipalities. Expansion into rapidly developing economies within the APAC region, coupled with a focus on localized product development and support, will be crucial for market leadership. Furthermore, the growing trend towards water reuse and circular economy models presents a significant avenue for innovative product development and market penetration.

APAC Water Automation and Instrumentation Market Segmentation

-

1. Water Automation Solution

- 1.1. DCS

- 1.2. SCADA

- 1.3. PLC

- 1.4. HMI

- 1.5. Other Water Automation Solutions

-

2. Water Instrumentation Solution

- 2.1. Pressure Transmitter

- 2.2. Level Transmitter

- 2.3. Temperature Transmitter

- 2.4. Liquid Analyzers

- 2.5. Gas Analyzers

- 2.6. Leakage Detection Systems

- 2.7. Flow Sensors/Transmitters

- 2.8. Other Water Instrumentation Solutions

-

3. End-User Industry (Qualitative Analysis)

- 3.1. Chemical

- 3.2. Manufacturing

- 3.3. Food and Beverages

APAC Water Automation and Instrumentation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

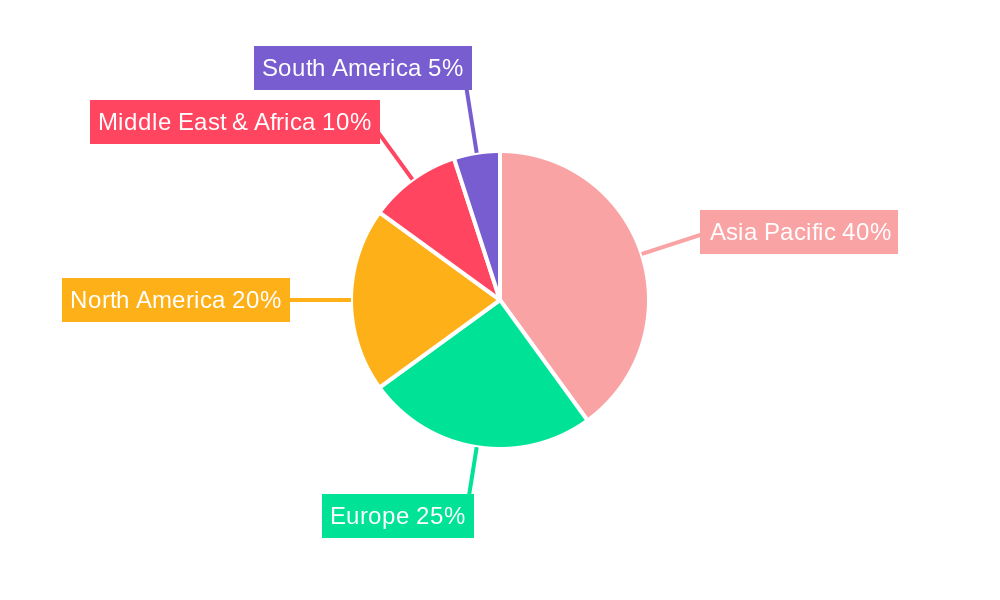

APAC Water Automation and Instrumentation Market Regional Market Share

Geographic Coverage of APAC Water Automation and Instrumentation Market

APAC Water Automation and Instrumentation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulation to Save Water Resources and Energy; Increase in Adoption of Smart Water Technologies

- 3.3. Market Restrains

- 3.3.1. Data Privacy; The Complex Structure of Cloud Storage

- 3.4. Market Trends

- 3.4.1. Demand from Food and Beverage Industry to Witness a Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Water Automation and Instrumentation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 5.1.1. DCS

- 5.1.2. SCADA

- 5.1.3. PLC

- 5.1.4. HMI

- 5.1.5. Other Water Automation Solutions

- 5.2. Market Analysis, Insights and Forecast - by Water Instrumentation Solution

- 5.2.1. Pressure Transmitter

- 5.2.2. Level Transmitter

- 5.2.3. Temperature Transmitter

- 5.2.4. Liquid Analyzers

- 5.2.5. Gas Analyzers

- 5.2.6. Leakage Detection Systems

- 5.2.7. Flow Sensors/Transmitters

- 5.2.8. Other Water Instrumentation Solutions

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry (Qualitative Analysis)

- 5.3.1. Chemical

- 5.3.2. Manufacturing

- 5.3.3. Food and Beverages

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 6. North America APAC Water Automation and Instrumentation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 6.1.1. DCS

- 6.1.2. SCADA

- 6.1.3. PLC

- 6.1.4. HMI

- 6.1.5. Other Water Automation Solutions

- 6.2. Market Analysis, Insights and Forecast - by Water Instrumentation Solution

- 6.2.1. Pressure Transmitter

- 6.2.2. Level Transmitter

- 6.2.3. Temperature Transmitter

- 6.2.4. Liquid Analyzers

- 6.2.5. Gas Analyzers

- 6.2.6. Leakage Detection Systems

- 6.2.7. Flow Sensors/Transmitters

- 6.2.8. Other Water Instrumentation Solutions

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry (Qualitative Analysis)

- 6.3.1. Chemical

- 6.3.2. Manufacturing

- 6.3.3. Food and Beverages

- 6.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 7. South America APAC Water Automation and Instrumentation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 7.1.1. DCS

- 7.1.2. SCADA

- 7.1.3. PLC

- 7.1.4. HMI

- 7.1.5. Other Water Automation Solutions

- 7.2. Market Analysis, Insights and Forecast - by Water Instrumentation Solution

- 7.2.1. Pressure Transmitter

- 7.2.2. Level Transmitter

- 7.2.3. Temperature Transmitter

- 7.2.4. Liquid Analyzers

- 7.2.5. Gas Analyzers

- 7.2.6. Leakage Detection Systems

- 7.2.7. Flow Sensors/Transmitters

- 7.2.8. Other Water Instrumentation Solutions

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry (Qualitative Analysis)

- 7.3.1. Chemical

- 7.3.2. Manufacturing

- 7.3.3. Food and Beverages

- 7.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 8. Europe APAC Water Automation and Instrumentation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 8.1.1. DCS

- 8.1.2. SCADA

- 8.1.3. PLC

- 8.1.4. HMI

- 8.1.5. Other Water Automation Solutions

- 8.2. Market Analysis, Insights and Forecast - by Water Instrumentation Solution

- 8.2.1. Pressure Transmitter

- 8.2.2. Level Transmitter

- 8.2.3. Temperature Transmitter

- 8.2.4. Liquid Analyzers

- 8.2.5. Gas Analyzers

- 8.2.6. Leakage Detection Systems

- 8.2.7. Flow Sensors/Transmitters

- 8.2.8. Other Water Instrumentation Solutions

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry (Qualitative Analysis)

- 8.3.1. Chemical

- 8.3.2. Manufacturing

- 8.3.3. Food and Beverages

- 8.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 9. Middle East & Africa APAC Water Automation and Instrumentation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 9.1.1. DCS

- 9.1.2. SCADA

- 9.1.3. PLC

- 9.1.4. HMI

- 9.1.5. Other Water Automation Solutions

- 9.2. Market Analysis, Insights and Forecast - by Water Instrumentation Solution

- 9.2.1. Pressure Transmitter

- 9.2.2. Level Transmitter

- 9.2.3. Temperature Transmitter

- 9.2.4. Liquid Analyzers

- 9.2.5. Gas Analyzers

- 9.2.6. Leakage Detection Systems

- 9.2.7. Flow Sensors/Transmitters

- 9.2.8. Other Water Instrumentation Solutions

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry (Qualitative Analysis)

- 9.3.1. Chemical

- 9.3.2. Manufacturing

- 9.3.3. Food and Beverages

- 9.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 10. Asia Pacific APAC Water Automation and Instrumentation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 10.1.1. DCS

- 10.1.2. SCADA

- 10.1.3. PLC

- 10.1.4. HMI

- 10.1.5. Other Water Automation Solutions

- 10.2. Market Analysis, Insights and Forecast - by Water Instrumentation Solution

- 10.2.1. Pressure Transmitter

- 10.2.2. Level Transmitter

- 10.2.3. Temperature Transmitter

- 10.2.4. Liquid Analyzers

- 10.2.5. Gas Analyzers

- 10.2.6. Leakage Detection Systems

- 10.2.7. Flow Sensors/Transmitters

- 10.2.8. Other Water Instrumentation Solutions

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry (Qualitative Analysis)

- 10.3.1. Chemical

- 10.3.2. Manufacturing

- 10.3.3. Food and Beverages

- 10.1. Market Analysis, Insights and Forecast - by Water Automation Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NALCO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Phoenix Contact

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Endress + Hauser Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KROHNE LT

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MJK Automation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emerson Electric

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ABB Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockwell Automation Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Yokogawa Electric Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mitsubishi Motors Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Eurotek India

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 NALCO

List of Figures

- Figure 1: Global APAC Water Automation and Instrumentation Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Water Automation and Instrumentation Market Revenue (Million), by Water Automation Solution 2025 & 2033

- Figure 3: North America APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Automation Solution 2025 & 2033

- Figure 4: North America APAC Water Automation and Instrumentation Market Revenue (Million), by Water Instrumentation Solution 2025 & 2033

- Figure 5: North America APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Instrumentation Solution 2025 & 2033

- Figure 6: North America APAC Water Automation and Instrumentation Market Revenue (Million), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 7: North America APAC Water Automation and Instrumentation Market Revenue Share (%), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 8: North America APAC Water Automation and Instrumentation Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC Water Automation and Instrumentation Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Water Automation and Instrumentation Market Revenue (Million), by Water Automation Solution 2025 & 2033

- Figure 11: South America APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Automation Solution 2025 & 2033

- Figure 12: South America APAC Water Automation and Instrumentation Market Revenue (Million), by Water Instrumentation Solution 2025 & 2033

- Figure 13: South America APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Instrumentation Solution 2025 & 2033

- Figure 14: South America APAC Water Automation and Instrumentation Market Revenue (Million), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 15: South America APAC Water Automation and Instrumentation Market Revenue Share (%), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 16: South America APAC Water Automation and Instrumentation Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC Water Automation and Instrumentation Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Water Automation and Instrumentation Market Revenue (Million), by Water Automation Solution 2025 & 2033

- Figure 19: Europe APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Automation Solution 2025 & 2033

- Figure 20: Europe APAC Water Automation and Instrumentation Market Revenue (Million), by Water Instrumentation Solution 2025 & 2033

- Figure 21: Europe APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Instrumentation Solution 2025 & 2033

- Figure 22: Europe APAC Water Automation and Instrumentation Market Revenue (Million), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 23: Europe APAC Water Automation and Instrumentation Market Revenue Share (%), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 24: Europe APAC Water Automation and Instrumentation Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC Water Automation and Instrumentation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue (Million), by Water Automation Solution 2025 & 2033

- Figure 27: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Automation Solution 2025 & 2033

- Figure 28: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue (Million), by Water Instrumentation Solution 2025 & 2033

- Figure 29: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Instrumentation Solution 2025 & 2033

- Figure 30: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue (Million), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 31: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue Share (%), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 32: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Water Automation and Instrumentation Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Water Automation and Instrumentation Market Revenue (Million), by Water Automation Solution 2025 & 2033

- Figure 35: Asia Pacific APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Automation Solution 2025 & 2033

- Figure 36: Asia Pacific APAC Water Automation and Instrumentation Market Revenue (Million), by Water Instrumentation Solution 2025 & 2033

- Figure 37: Asia Pacific APAC Water Automation and Instrumentation Market Revenue Share (%), by Water Instrumentation Solution 2025 & 2033

- Figure 38: Asia Pacific APAC Water Automation and Instrumentation Market Revenue (Million), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 39: Asia Pacific APAC Water Automation and Instrumentation Market Revenue Share (%), by End-User Industry (Qualitative Analysis) 2025 & 2033

- Figure 40: Asia Pacific APAC Water Automation and Instrumentation Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Water Automation and Instrumentation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Automation Solution 2020 & 2033

- Table 2: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Instrumentation Solution 2020 & 2033

- Table 3: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by End-User Industry (Qualitative Analysis) 2020 & 2033

- Table 4: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Automation Solution 2020 & 2033

- Table 6: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Instrumentation Solution 2020 & 2033

- Table 7: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by End-User Industry (Qualitative Analysis) 2020 & 2033

- Table 8: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Automation Solution 2020 & 2033

- Table 13: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Instrumentation Solution 2020 & 2033

- Table 14: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by End-User Industry (Qualitative Analysis) 2020 & 2033

- Table 15: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Automation Solution 2020 & 2033

- Table 20: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Instrumentation Solution 2020 & 2033

- Table 21: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by End-User Industry (Qualitative Analysis) 2020 & 2033

- Table 22: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Automation Solution 2020 & 2033

- Table 33: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Instrumentation Solution 2020 & 2033

- Table 34: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by End-User Industry (Qualitative Analysis) 2020 & 2033

- Table 35: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Automation Solution 2020 & 2033

- Table 43: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Water Instrumentation Solution 2020 & 2033

- Table 44: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by End-User Industry (Qualitative Analysis) 2020 & 2033

- Table 45: Global APAC Water Automation and Instrumentation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Water Automation and Instrumentation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Water Automation and Instrumentation Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the APAC Water Automation and Instrumentation Market?

Key companies in the market include NALCO, Phoenix Contact, Endress + Hauser Pvt Ltd, GE Corporation, KROHNE LT, MJK Automation, Siemens AG, Schneider Electric SE, Emerson Electric, ABB Group, Rockwell Automation Inc, Yokogawa Electric Corporation, Mitsubishi Motors Corporation, Eurotek India.

3. What are the main segments of the APAC Water Automation and Instrumentation Market?

The market segments include Water Automation Solution, Water Instrumentation Solution, End-User Industry (Qualitative Analysis).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulation to Save Water Resources and Energy; Increase in Adoption of Smart Water Technologies.

6. What are the notable trends driving market growth?

Demand from Food and Beverage Industry to Witness a Significant Growth Rate.

7. Are there any restraints impacting market growth?

Data Privacy; The Complex Structure of Cloud Storage.

8. Can you provide examples of recent developments in the market?

March 2021 - In response to the COVID-19 pandemic, Hokkaido University, Robotic Biology Institute Inc., iLAC Co., Ltd, and Shionogi & Co., Ltd entered a memorandum of understanding toward the establishment of an automated system for the analysis of the novel coronavirus in wastewater.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Water Automation and Instrumentation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Water Automation and Instrumentation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Water Automation and Instrumentation Market?

To stay informed about further developments, trends, and reports in the APAC Water Automation and Instrumentation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence