Key Insights

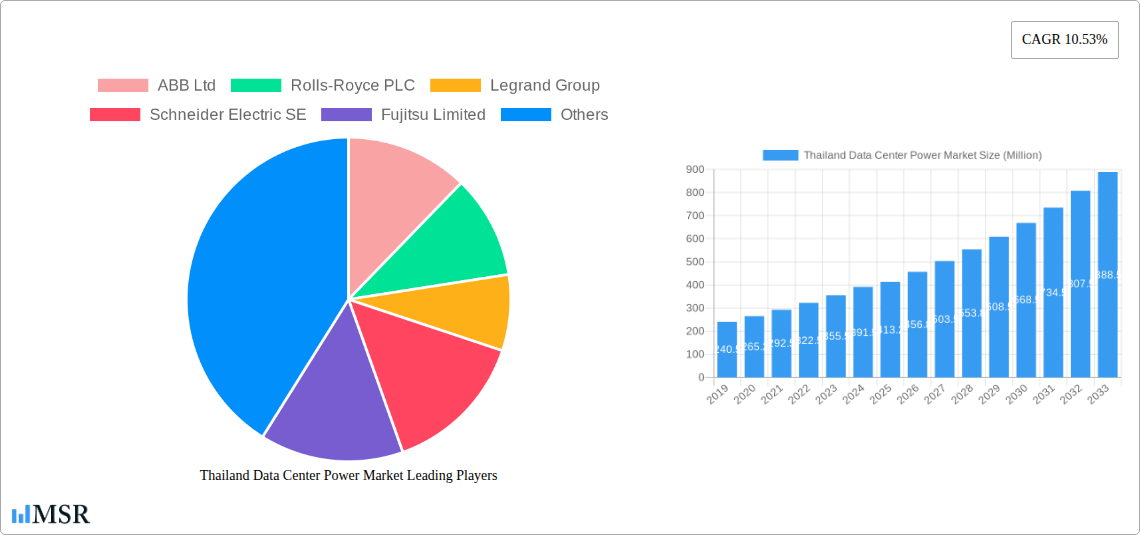

The Thailand Data Center Power Market is poised for substantial growth, projected to reach an estimated USD 413.20 million in 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 10.53% through 2033. This significant expansion is primarily fueled by the escalating demand for data storage and processing capabilities driven by the burgeoning digital economy. Key growth drivers include the rapid adoption of cloud computing services, the proliferation of Internet of Things (IoT) devices, and the increasing need for advanced IT infrastructure to support big data analytics and artificial intelligence applications across various sectors. Furthermore, government initiatives promoting digital transformation and the development of smart cities are creating a favorable environment for data center expansion, consequently boosting the demand for sophisticated power solutions.

Thailand Data Center Power Market Market Size (In Million)

The market segmentation reveals a strong emphasis on Power Infrastructure, with UPS Systems, Generators, and diverse Power Distribution Solutions (including PDUs, switchgear, and critical power distribution units) being critical components. The Service segment is also expected to witness considerable growth, encompassing installation, maintenance, and support for these complex power systems. The IT and Telecommunication sector, alongside BFSI and Government, represent major end-users, reflecting their substantial reliance on resilient and efficient data center operations. Emerging trends include the increasing adoption of energy-efficient power solutions, the integration of renewable energy sources to enhance sustainability, and the growing importance of robust cybersecurity measures for power management. While the market exhibits strong growth potential, potential restraints could include the high initial investment costs for advanced power infrastructure and evolving regulatory landscapes. Companies such as ABB Ltd, Schneider Electric SE, Eaton Corporation, and Vertiv Group Corp are key players actively shaping this dynamic market.

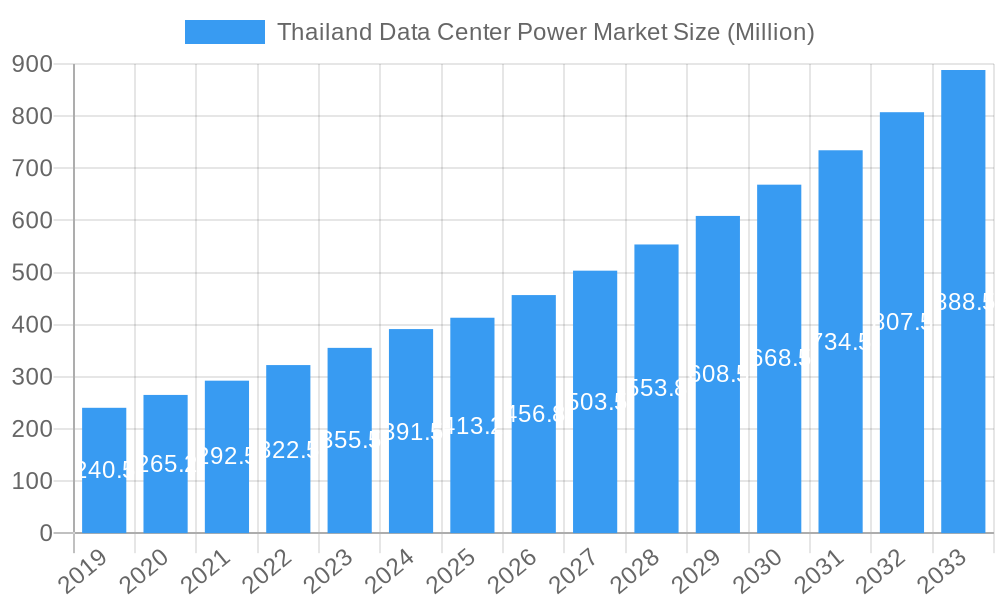

Thailand Data Center Power Market Company Market Share

Unlock critical insights into the Thailand data center power market, a rapidly expanding sector fueled by burgeoning digital infrastructure and surging demand for reliable power solutions. This in-depth report offers a detailed examination of market dynamics, key trends, technological advancements, and competitive landscapes, providing actionable intelligence for data center operators, power solution providers, IT and telecommunication companies, BFSI institutions, government agencies, and media and entertainment firms. Dive into expert analysis covering the study period of 2019–2033, with a base year of 2025 and a comprehensive forecast period from 2025–2033, building upon robust historical data from 2019–2024.

Thailand Data Center Power Market Market Concentration & Dynamics

The Thailand data center power market exhibits a dynamic blend of established players and emerging innovators, characterized by moderate to high market concentration. Key companies such as ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc, Cummins Inc, Vertiv Group Corp, and Eaton Corporation are at the forefront, driving innovation and market share. The ecosystem thrives on a robust innovation pipeline, with continuous development in UPS systems, generators, and advanced power distribution solutions including PDUs, switchgear, critical power distribution, transfer switches, and remote power panels. Regulatory frameworks are evolving to support sustainable energy adoption and data center efficiency, influencing investment decisions. Substitute products, while present, are increasingly challenged by the specialized needs of modern data centers. End-user trends, particularly the exponential growth in IT and Telecommunication, BFSI, and Government sectors, significantly shape demand. Mergers and acquisition (M&A) activities, though currently moderate, are expected to increase as companies seek to consolidate market positions and expand their service portfolios, especially in critical power solutions and sustainable energy integration.

Thailand Data Center Power Market Industry Insights & Trends

The Thailand data center power market is experiencing robust growth, projected to reach an estimated USD XX Billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This surge is primarily driven by the escalating demand for hyperscale and colocation data centers, propelled by the rapid adoption of cloud computing, big data analytics, and the Internet of Things (IoT) across various industries. The Thai government's commitment to digital transformation and its "Thailand 4.0" initiative further accelerate the development of digital infrastructure, necessitating substantial investments in reliable data center power solutions. Technological disruptions are a key theme, with a notable shift towards more energy-efficient and resilient power systems. The integration of renewable energy sources and advanced battery storage solutions is gaining traction, driven by both environmental consciousness and the need to reduce operational costs and improve uptime. Evolving consumer behaviors, characterized by an insatiable demand for digital services and uninterrupted connectivity, place immense pressure on data center providers to ensure high availability and low latency, thereby amplifying the importance of robust power infrastructure. Furthermore, the increasing adoption of edge computing is creating new opportunities for distributed power solutions designed for smaller, localized data centers, requiring specialized UPS systems and power distribution units. The market's trajectory is also influenced by global trends in green data centers and the growing emphasis on sustainable power management within the IT infrastructure.

Key Markets & Segments Leading Thailand Data Center Power Market

The Thailand data center power market is significantly influenced by advancements in the Power Infrastructure segment, with Electrical Solutions acting as the primary driver. Within electrical solutions, UPS Systems and Generators are paramount for ensuring continuous operation and redundancy. The sub-segment of Power Distribution Solutions is witnessing substantial growth, encompassing PDUs, Switchgear, Critical Power Distribution, Transfer Switches, Remote Power Panels, and Other Power Distribution Solutions. These components are crucial for efficiently managing and distributing power within data centers, minimizing energy loss, and enhancing operational safety.

The IT and Telecommunication end-user segment is the largest contributor to market demand, owing to the exponential growth of data traffic and the continuous expansion of network infrastructure. The BFSI sector is another significant driver, as financial institutions rely heavily on secure and uninterrupted data center operations for their critical services. Government entities are increasingly investing in data center infrastructure to support e-governance initiatives and national cybersecurity efforts. The Media and Entertainment industry also contributes to demand through the proliferation of streaming services and content delivery networks.

- Drivers in Electrical Solution (Power Infrastructure):

- Rising demand for high-density computing and AI workloads requiring robust power.

- Increasing adoption of cloud services and hybrid cloud architectures.

- Government initiatives promoting digital transformation and smart city development.

- Need for enhanced power reliability and redundancy to prevent data loss and downtime.

- Technological advancements leading to more efficient and compact power solutions.

- Drivers in End User Segments:

- IT and Telecommunication: Expansion of 5G networks, growth of IoT devices, and increasing data center capacity.

- BFSI: Digitalization of banking services, fintech innovation, and stringent regulatory compliance requirements for data security.

- Government: Digital transformation of public services, cybersecurity mandates, and smart city projects.

- Media and Entertainment: Proliferation of on-demand streaming services, digital content creation, and high-volume data storage needs.

The dominance of these segments is attributed to the foundational role of reliable power in supporting the intensive computational and storage demands of modern digital operations. The continuous investment in upgrading and expanding data center facilities to accommodate future growth underscores the sustained importance of these power infrastructure components and the key end-user industries driving their adoption.

Thailand Data Center Power Market Product Developments

Product innovations in the Thailand data center power market are focused on enhancing efficiency, reliability, and sustainability. Companies are actively developing next-generation UPS systems with improved energy density and modular designs, allowing for scalable power deployment. Advancements in generator technology, including the exploration of alternative fuels like hydrogen, are a key trend, aiming to reduce the carbon footprint of critical power solutions. The development of intelligent power distribution units (PDUs) with advanced monitoring and control capabilities is enabling real-time power management and predictive maintenance. Furthermore, integrated switchgear and transfer switch solutions are being designed for seamless power transition and fault isolation, crucial for maintaining high uptime. The market relevance of these developments lies in their ability to meet the evolving demands for higher power densities, increased energy efficiency, and reduced environmental impact within data center operations, thereby providing a competitive edge for providers and enhancing operational resilience for data center owners.

Challenges in the Thailand Data Center Power Market Market

The Thailand data center power market faces several challenges that could impact its growth trajectory. Regulatory hurdles, particularly concerning land acquisition for new facilities and the integration of renewable energy sources into the national grid, can lead to project delays and increased costs. Supply chain disruptions, exacerbated by global geopolitical events and logistical complexities, pose a significant risk to the timely delivery of essential power equipment and components, potentially impacting project timelines and increasing capital expenditure. Competitive pressures from both domestic and international players necessitate continuous innovation and cost optimization, which can strain profit margins. The cost of electricity and the availability of stable power grids are also critical considerations, especially in less developed regions.

Forces Driving Thailand Data Center Power Market Growth

The Thailand data center power market is propelled by several key growth drivers. The increasing digitalization of the Thai economy and the government's push for Thailand 4.0 are fostering a robust demand for data center services. The exponential growth in data generation from cloud computing, AI, and IoT applications necessitates constant expansion of data center capacity, directly fueling the need for advanced power solutions. Furthermore, the growing adoption of hyperscale and colocation data centers, driven by the need for scalability and cost-efficiency, requires significant investments in reliable and high-performance power infrastructure. The evolving cybersecurity landscape also mandates enhanced data protection and uptime, emphasizing the importance of resilient power systems.

Challenges in the Thailand Data Center Power Market Market

Long-term growth catalysts for the Thailand data center power market include the continuous technological evolution of UPS systems, generators, and power distribution solutions towards greater energy efficiency and reduced environmental impact. The increasing focus on sustainable power management and the integration of renewable energy sources are creating new market opportunities. Strategic partnerships between technology providers, data center operators, and energy companies are expected to drive innovation and expand market reach. Furthermore, the ongoing expansion of digital services, including the metaverse and advanced AI applications, will create sustained demand for high-capacity and reliable data center infrastructure.

Emerging Opportunities in Thailand Data Center Power Market

Emerging opportunities in the Thailand data center power market are centered around the growing demand for edge computing solutions, which require smaller, distributed power systems. The increasing adoption of green data centers and the focus on reducing carbon emissions present significant opportunities for renewable energy integration and the development of energy-efficient power technologies. The expansion of hyperscale data centers to support emerging technologies like AI and machine learning will drive demand for high-density power solutions. Furthermore, the growing trend of managed services for data center power infrastructure offers a recurring revenue stream and opportunities for specialized service providers.

Leading Players in the Thailand Data Center Power Market Sector

- ABB Ltd

- Rolls-Royce PLC

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Milestones in Thailand Data Center Power Market Industry

- January 2024: Caterpillar Inc. partnered with Microsoft and Ballard Power Systems to test the use of large-format hydrogen fuel cells as a reliable and eco-friendly backup power source for multi-megawatt data centers. Hydrogen fuel cells are seen as a possible low-carbon alternative to diesel backup generators, which is expected to drive the growth of DC generators.

- March 2024: Schneider Electric announced the expansion of its US manufacturing facilities at two locations to support critical infrastructure of data centers and other industries. At both locations, the company planned to manufacture electrical switchgear and medium-voltage power distribution products.

Strategic Outlook for Thailand Data Center Power Market Market

The strategic outlook for the Thailand data center power market is exceptionally positive, driven by sustained digital transformation and increasing demand for robust data infrastructure. Key growth accelerators include continued investment in hyperscale and colocation facilities, the adoption of energy-efficient technologies, and the integration of renewable energy sources. Strategic opportunities lie in developing customized power solutions for the growing edge computing segment, expanding service offerings for power infrastructure management, and forging partnerships to enhance sustainability initiatives. The market's future trajectory will be shaped by its ability to adapt to evolving technological demands and contribute to a more resilient and environmentally conscious digital ecosystem.

Thailand Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Other Power Distribution Solutions

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT and Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media and Entertainment

- 2.5. Other End Users

Thailand Data Center Power Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Power Market Regional Market Share

Geographic Coverage of Thailand Data Center Power Market

Thailand Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Have Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Other Power Distribution Solutions

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media and Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rolls-Royce PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Legrand Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rittal GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cummins Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eaton Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Thailand Data Center Power Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Data Center Power Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Thailand Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 3: Thailand Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Thailand Data Center Power Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Thailand Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Thailand Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2020 & 2033

- Table 7: Thailand Data Center Power Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Thailand Data Center Power Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Power Market?

The projected CAGR is approximately 10.53%.

2. Which companies are prominent players in the Thailand Data Center Power Market?

Key companies in the market include ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the Thailand Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 413.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT and Telecom to Have Significant Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

January 2024: Caterpillar Inc. partnered with Microsoft and Ballard Power Systems to test the use of large-format hydrogen fuel cells as a reliable and eco-friendly backup power source for multi-megawatt data centers. Hydrogen fuel cells are seen as a possible low-carbon alternative to diesel backup generators, which is expected to drive the growth of DC generators.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Power Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence