Key Insights

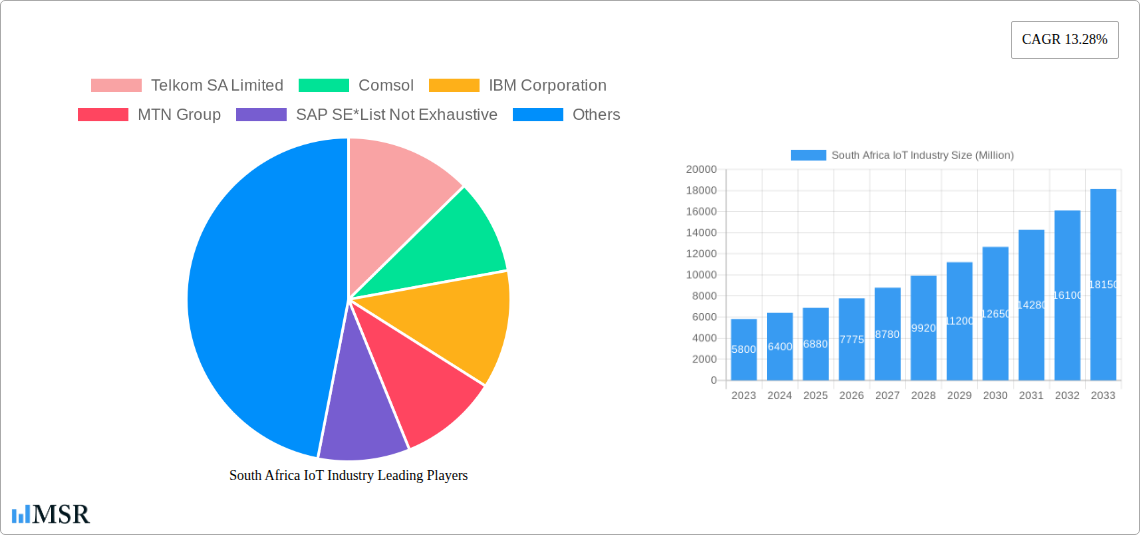

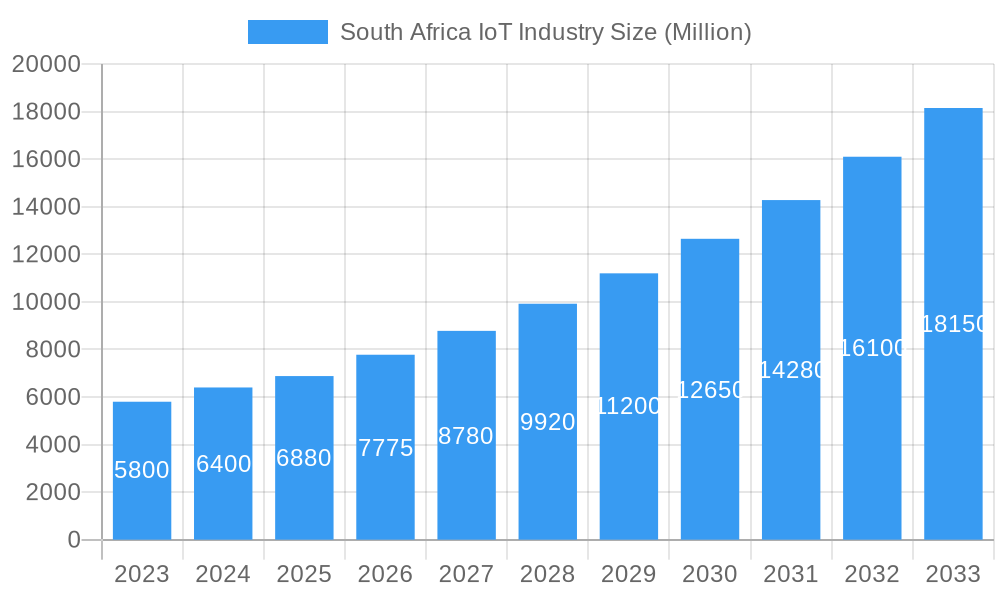

The South African Internet of Things (IoT) market is poised for substantial growth, projected to reach a significant size by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 13.28% through 2033. This robust expansion is fueled by a confluence of compelling drivers, including the increasing adoption of smart manufacturing technologies, the burgeoning demand for connected solutions in transportation and logistics, and the transformative potential of IoT in revolutionizing healthcare delivery and operational efficiencies within the energy and utilities sectors. The ongoing digital transformation initiatives across various industries in South Africa are creating fertile ground for IoT integration, enabling businesses to leverage data-driven insights for enhanced decision-making, cost optimization, and improved customer experiences. The market's segmentation reveals a strong emphasis on hardware and software solutions, supported by essential connectivity services and a growing demand for specialized IoT implementation and management services. This dynamic landscape is attracting significant investment and fostering innovation among key players like Telkom SA Limited, MTN Group, Vodacom Group, IBM Corporation, Microsoft Corporation, and Google, who are at the forefront of developing and deploying advanced IoT ecosystems.

South Africa IoT Industry Market Size (In Billion)

Further accelerating this growth are emerging trends such as the widespread deployment of 5G networks, which provide the high-speed, low-latency connectivity crucial for advanced IoT applications, and the increasing adoption of edge computing to process data closer to the source, thereby reducing latency and improving real-time responsiveness. The surge in artificial intelligence (AI) and machine learning (ML) integration with IoT platforms is unlocking sophisticated analytics and predictive capabilities, enabling predictive maintenance, intelligent automation, and personalized services across industries. While the market is predominantly driven by the manufacturing and energy sectors, the healthcare and retail industries are rapidly embracing IoT for improved patient care, supply chain visibility, and enhanced customer engagement. Despite these positive indicators, potential restraints such as cybersecurity concerns, the need for skilled talent, and initial implementation costs could present challenges. However, the strategic imperative for digital advancement and the clear return on investment offered by IoT solutions are expected to overcome these hurdles, solidifying South Africa's position as a rapidly growing IoT market.

South Africa IoT Industry Company Market Share

South Africa IoT Industry: Market Dynamics, Growth Drivers, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the South African IoT industry, exploring its market concentration, key growth drivers, leading segments, product developments, challenges, and emerging opportunities. Covering the study period from 2019 to 2033, with a base year of 2025, this report offers critical insights for stakeholders seeking to capitalize on the rapidly evolving Internet of Things (IoT) market in South Africa. Discover actionable strategies, market trends, and the competitive landscape shaped by major players like Telkom SA Limited, Comsol, IBM Corporation, MTN Group, SAP SE, Google, Microsoft Corporation, Vodacom Group, Cisco Systems, and Huawei Technologies.

South Africa IoT Industry Market Concentration & Dynamics

The South African IoT market exhibits a moderate level of concentration, with a few large telecommunication providers and technology giants dominating market share, alongside a growing ecosystem of specialized IoT solution providers. Innovation is increasingly driven by collaborations between established companies and agile startups, fostering a dynamic environment for IoT development in South Africa. Regulatory frameworks are evolving to support IoT adoption, particularly concerning data privacy and security, though some areas require further clarity. Substitute products, while present, are increasingly being integrated into comprehensive IoT solutions rather than acting as direct replacements. End-user trends indicate a strong demand for efficiency and automation across all sectors, with significant shifts towards data-driven decision-making. Mergers and acquisitions (M&A) activity is anticipated to increase as larger players seek to expand their IoT capabilities and market reach. While exact M&A deal counts are dynamic, the trend indicates consolidation and strategic partnerships within the South African IoT ecosystem.

South Africa IoT Industry Industry Insights & Trends

The South African IoT market size is projected to reach approximately XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This growth is propelled by several key factors including the increasing demand for smart city initiatives, the need for improved operational efficiency in various industries, and the burgeoning adoption of connected devices in both consumer and enterprise segments. Technological disruptions, such as advancements in 5G connectivity, edge computing, and AI-powered analytics, are significantly enhancing the capabilities and affordability of IoT solutions. Evolving consumer behaviors, characterized by a growing preference for personalized experiences and remote management, are also fueling the demand for smart home devices and connected consumer electronics. The expansion of cloud infrastructure and the decreasing cost of sensors and hardware further contribute to the widespread adoption of IoT solutions in South Africa. The focus on data analytics and the potential for predictive maintenance are also significant drivers for industrial IoT adoption.

Key Markets & Segments Leading South Africa IoT Industry

The Connectivity segment is currently a dominant force within the South African IoT industry, driven by the foundational need for reliable and widespread network access. Telecommunication providers are investing heavily in expanding their 4G and 5G networks, crucial for supporting the growing volume of connected devices.

- Connectivity Drivers:

- Expansion of 5G infrastructure across urban and semi-urban areas.

- Increasing availability of cost-effective IoT connectivity plans.

- Demand for low-power, wide-area network (LPWAN) technologies for remote asset tracking and monitoring.

The Services segment is also experiencing substantial growth, encompassing crucial areas like system integration, platform management, data analytics, and cybersecurity. As organizations increasingly adopt IoT, the demand for expert services to deploy, manage, and secure these complex systems rises.

- Services Drivers:

- Need for specialized IoT expertise for implementation and ongoing support.

- Growing importance of data analytics for deriving actionable insights from IoT deployments.

- Increasing focus on IoT security solutions to mitigate risks.

Among the End User Industries, Manufacturing and Energy and Utilities are leading the charge in IoT adoption. In manufacturing, IoT enables predictive maintenance, optimized production processes, and enhanced supply chain visibility. The energy and utilities sector leverages IoT for smart metering, grid management, and improved resource allocation.

- End User Industry Drivers (Manufacturing & Energy/Utilities):

- Demand for operational efficiency and cost reduction.

- Need for real-time monitoring and control of critical infrastructure.

- Focus on sustainability and resource management.

South Africa IoT Industry Product Developments

Product developments in the South African IoT industry are characterized by a move towards more integrated, intelligent, and secure solutions. Innovations are focused on enhancing device capabilities, improving connectivity options, and leveraging AI for advanced analytics. For instance, advancements in sensor technology are enabling more precise data collection for applications ranging from environmental monitoring to precision agriculture. The development of robust IoT platforms is facilitating seamless data integration and management across diverse applications. The market is also seeing the introduction of specialized IoT devices tailored for specific industry needs, such as advanced asset trackers for logistics and smart sensors for industrial automation, all contributing to a competitive edge and driving market relevance.

Challenges in the South Africa IoT Industry Market

Despite strong growth prospects, the South African IoT market faces several significant challenges. Regulatory hurdles, including evolving data privacy laws and standardization issues, can slow down adoption. Supply chain disruptions for critical hardware components can impact deployment timelines and costs. Furthermore, fierce competitive pressures from both local and international players necessitate continuous innovation and competitive pricing strategies. The initial investment cost for large-scale IoT deployments remains a barrier for some smaller businesses. Addressing these challenges through clear policy frameworks and fostering domestic manufacturing capabilities will be crucial for sustained growth.

Forces Driving South Africa IoT Industry Growth

The growth of the South African IoT industry is primarily driven by a confluence of technological advancements, economic imperatives, and supportive policy initiatives. The widespread availability of high-speed mobile networks, particularly the rollout of 5G technology, provides the essential connectivity backbone. The increasing adoption of cloud computing and edge computing further enhances the capabilities of IoT solutions. Economically, the demand for greater operational efficiency and cost reduction across various sectors, from manufacturing to agriculture, is a significant catalyst. Government initiatives aimed at fostering digital transformation and supporting innovation also play a crucial role in propelling the South African IoT market forward.

Challenges in the South Africa IoT Industry Market

Long-term growth catalysts for the South African IoT industry are deeply rooted in fostering innovation, building strategic partnerships, and expanding into underserved markets. Continued investment in research and development will be critical to create next-generation IoT solutions tailored to local needs. Collaborations between technology providers, telecommunications companies, and industry-specific enterprises will unlock new application areas and business models. Furthermore, extending IoT infrastructure and solutions to rural and remote areas, previously limited by connectivity, presents a significant opportunity for market expansion and inclusive economic development.

Emerging Opportunities in South Africa IoT Industry

Emerging opportunities in the South African IoT industry are abundant, fueled by evolving consumer preferences and technological advancements. The burgeoning demand for smart home automation and connected lifestyle devices presents a significant consumer market. In the industrial sector, the application of IoT in predictive maintenance for critical infrastructure, such as mining and energy, offers substantial cost-saving potential. The growth of agritech leveraging IoT for precision farming and livestock monitoring, especially in challenging terrains, is another area of significant promise. Furthermore, the development of secure and interoperable IoT platforms will unlock new possibilities for data monetization and innovative service offerings.

Leading Players in the South Africa IoT Industry Sector

- Telkom SA Limited

- Comsol

- IBM Corporation

- MTN Group

- SAP SE

- Microsoft Corporation

- Vodacom Group

- Cisco Systems

- Huawei Technologies

Key Milestones in South Africa IoT Industry Industry

- March 2023: Sateliot plans to launch the first-ever satellite under 3GPP 5G NB-IoT. This initiative aims to enable NB-IoT devices to connect to cellular or satellite networks, facilitating widespread IoT adoption, even in remote locations, reducing costs, and boosting efficiency. South African company Streamline is a partner, supporting livestock farmers in monitoring cattle.

- December 2022: Qualcomm launched the Make in Africa startup mentorship program to identify and support startups developing innovative end-to-end systems solutions, including hardware, for African needs, focusing on advanced connectivity and processing technologies.

Strategic Outlook for South Africa IoT Industry Market

The strategic outlook for the South African IoT industry is exceptionally positive, driven by the continuous evolution of connectivity, edge computing, and artificial intelligence. Future market potential lies in the deeper integration of IoT with other emerging technologies like blockchain for enhanced security and data integrity. Strategic opportunities include the development of localized IoT solutions that address specific South African challenges in sectors such as water management, waste reduction, and renewable energy optimization. Furthermore, fostering domestic talent and promoting cybersecurity best practices will be critical accelerators for sustainable and secure growth in the South African IoT market.

South Africa IoT Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Connectivity

- 1.4. Services

-

2. End User Industry

- 2.1. Manufacturing

- 2.2. Transportation

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Energy and Utilities

- 2.6. Other En

South Africa IoT Industry Segmentation By Geography

- 1. South Africa

South Africa IoT Industry Regional Market Share

Geographic Coverage of South Africa IoT Industry

South Africa IoT Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly increasing urbanization and increasing smart city initiatives; Increasing proliferation of mobile and IoT devices; Growing need for timely decision making and rising importance of data

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. The Retail Segment to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa IoT Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Connectivity

- 5.1.4. Services

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Manufacturing

- 5.2.2. Transportation

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Energy and Utilities

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Telkom SA Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Comsol

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MTN Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAP SE*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Google

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vodacom Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cisco Systems

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huawei Technologies

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Telkom SA Limited

List of Figures

- Figure 1: South Africa IoT Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa IoT Industry Share (%) by Company 2025

List of Tables

- Table 1: South Africa IoT Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: South Africa IoT Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 3: South Africa IoT Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Africa IoT Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 5: South Africa IoT Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: South Africa IoT Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa IoT Industry?

The projected CAGR is approximately 13.28%.

2. Which companies are prominent players in the South Africa IoT Industry?

Key companies in the market include Telkom SA Limited, Comsol, IBM Corporation, MTN Group, SAP SE*List Not Exhaustive, Google, Microsoft Corporation, Vodacom Group, Cisco Systems, Huawei Technologies.

3. What are the main segments of the South Africa IoT Industry?

The market segments include Component, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly increasing urbanization and increasing smart city initiatives; Increasing proliferation of mobile and IoT devices; Growing need for timely decision making and rising importance of data.

6. What are the notable trends driving market growth?

The Retail Segment to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

March 2023: Sateliot plans to launch the first-ever satellite under 3GPP 5G NB-IoT. After the launch of this satellite, every NB-IoT device is anticipated to be able to quickly connect to cellular or satellite networks, enabling widespread IoT adoption even in the most remote locations. Sateliot's NTN enables widespread IoT deployment, reducing costs and boosting efficiency across various industries. The South African company Streamline is a partner for this mission, and it will assist livestock farmers in being able to monitor the position and health conditions of thousands of cattle with meager connection costs compared to competitors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa IoT Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa IoT Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa IoT Industry?

To stay informed about further developments, trends, and reports in the South Africa IoT Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence