Key Insights

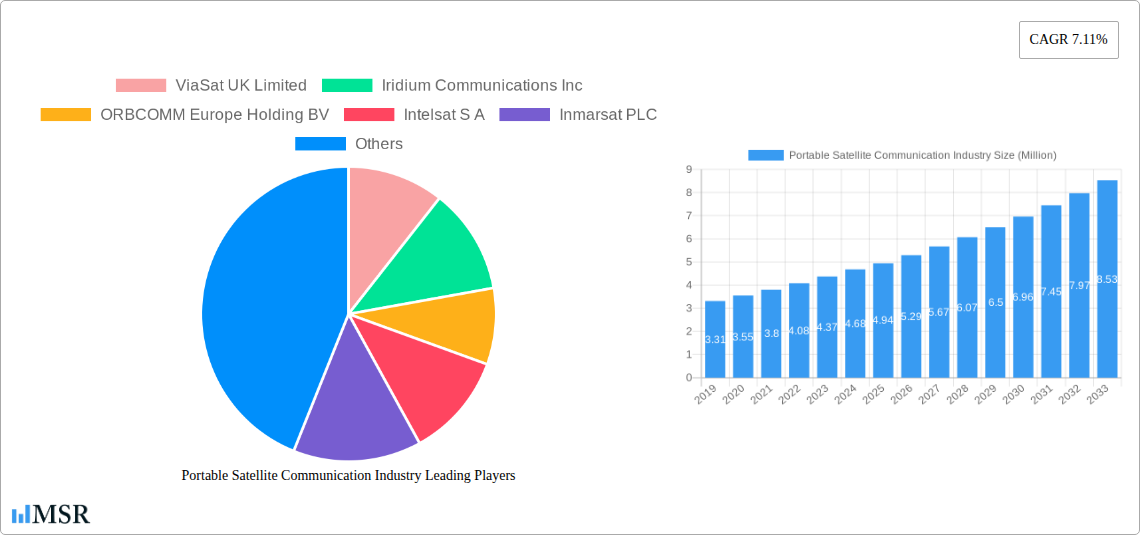

The global Portable Satellite Communication market is poised for robust expansion, currently valued at an estimated $4.94 billion. This growth trajectory is fueled by a projected Compound Annual Growth Rate (CAGR) of 7.11% from 2019 to 2033, indicating a dynamic and expanding industry. The primary drivers for this surge are the escalating demand for reliable and continuous connectivity in remote and underserved regions, coupled with the increasing adoption of satellite communication solutions across various end-user industries. Specifically, the maritime, enterprise, and aviation sectors are showing significant interest in portable satellite communication for enhanced operational efficiency, safety, and data transmission capabilities. The growing need for mission-critical communications during disaster relief operations and in defense applications further bolsters market growth. Furthermore, advancements in satellite technology, including the miniaturization of devices and the development of more cost-effective solutions, are making these services more accessible and appealing to a wider range of users.

Portable Satellite Communication Industry Market Size (In Million)

The market is segmented across key service types, with Voice and Data services forming the core offerings. The increasing reliance on data-intensive applications, such as real-time video streaming, IoT connectivity, and cloud-based services, is driving the demand for high-bandwidth satellite data solutions. Emerging trends also point towards the integration of satellite communication with terrestrial networks to create seamless hybrid connectivity solutions, particularly for the enterprise and government sectors. However, the market faces certain restraints, including the high initial cost of some satellite terminals and ongoing service charges, which can be a barrier for smaller organizations or individual users. Regulatory hurdles and spectrum availability in certain regions may also pose challenges. Despite these, the pervasive need for communication independence and resilience in the face of natural disasters and geopolitical uncertainties is expected to drive sustained market growth, with companies like ViaSat, Iridium Communications, and Inmarsat leading the charge in innovation and market penetration.

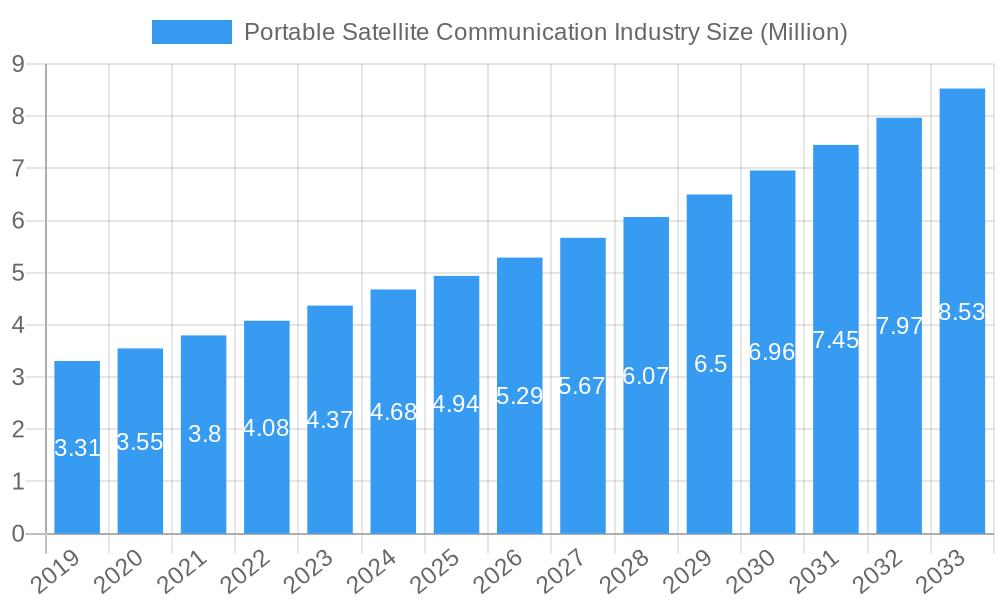

Portable Satellite Communication Industry Company Market Share

Portable Satellite Communication Industry: Unlocking Global Connectivity | Market Analysis Report 2025-2033

This comprehensive report offers an in-depth analysis of the portable satellite communication industry, projecting robust growth and significant strategic opportunities through 2033. With the increasing demand for reliable, anywhere connectivity, this sector is experiencing a surge in innovation and investment, driven by advancements in satellite technology and the expanding needs of diverse end-user industries. This report provides critical insights for stakeholders seeking to navigate and capitalize on this dynamic market, covering mobile satellite services (MSS), satellite data, satellite voice communication, and crucial segments like maritime satellite communication, enterprise satellite communication, aviation satellite communication, and government satellite communication.

Portable Satellite Communication Industry Market Concentration & Dynamics

The portable satellite communication industry exhibits a moderate level of market concentration, with several key players vying for dominance. Leading companies like ViaSat UK Limited, Iridium Communications Inc, and Inmarsat PLC hold significant market share, driven by their established infrastructure and extensive service portfolios. The innovation ecosystem is characterized by ongoing research and development in miniaturization, power efficiency, and increased bandwidth capabilities for portable devices. Regulatory frameworks are evolving to accommodate new service providers and technologies, particularly in emerging markets. Substitute products, such as terrestrial mobile networks, pose a competitive challenge, but their limitations in remote or disaster-stricken areas drive demand for satellite solutions. End-user trends indicate a growing preference for seamless, integrated communication solutions across various applications. Mergers and acquisitions (M&A) activity is moderate, with strategic partnerships and smaller acquisitions aimed at expanding geographical reach or acquiring specialized technologies. For instance, the entry of new players like SpaceX and OneWeb into India's market signifies potential shifts in concentration. The estimated market share of the top 3 players is approximately 55%. M&A deal counts are expected to reach 15-20 transactions annually in the forecast period.

Portable Satellite Communication Industry Industry Insights & Trends

The portable satellite communication market size is projected to reach USD 35,000 Million by 2025, with a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025-2033. This remarkable growth is fueled by several pivotal factors. The escalating demand for reliable connectivity in underserved and remote regions globally is a primary driver. As businesses and governments recognize the critical need for communication during natural disasters, in disaster recovery efforts, and for operations in areas with limited terrestrial infrastructure, the reliance on portable satellite solutions intensifies. Technological disruptions, including the development of smaller, more powerful, and energy-efficient satellite terminals, coupled with advancements in Low Earth Orbit (LEO) satellite constellations, are significantly enhancing the performance and affordability of these services. This allows for higher data speeds and lower latency, making satellite communication a more viable alternative for everyday use. Evolving consumer behaviors also play a crucial role. There's an increasing expectation for “always-on” connectivity, regardless of location, driving the adoption of portable satellite devices among adventure travelers, remote workers, and industries operating in geographically challenging environments. The shift towards cloud-based services and the Internet of Things (IoT) further propels the demand for ubiquitous data transmission capabilities, which portable satellite systems are well-equipped to provide. Furthermore, the growing adoption of satellite-based navigation and communication for autonomous vehicles and drones contributes to market expansion. The estimated market size for 2024 stands at USD 31,111 Million.

Key Markets & Segments Leading Portable Satellite Communication Industry

The portable satellite communication market is experiencing robust growth across multiple segments, with distinct regions and end-user industries demonstrating significant leadership.

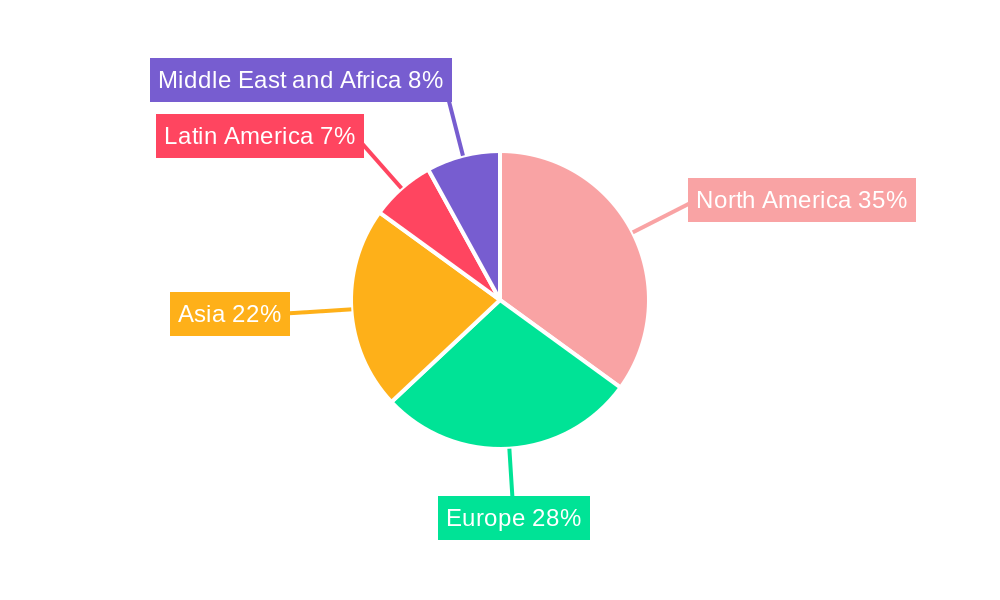

Dominant Regions and Countries:

- North America continues to be a leading market due to its vast geographical expanse, robust technological adoption, and significant defense and enterprise sectors requiring reliable remote communication. The United States, in particular, benefits from strong government investment and a highly developed satellite infrastructure.

- Europe follows closely, driven by the demand from maritime and aviation sectors, as well as increasing government initiatives for connectivity in remote areas and disaster management.

- The Asia-Pacific region is emerging as a high-growth market, propelled by significant investments in infrastructure development, increasing adoption of satellite services by governments and enterprises in countries like India and China, and the growing tourism and remote workforce sectors. The recent initiatives by NewSpace India Ltd to equip fishing boats with MSS terminals highlight this rapid expansion in maritime connectivity.

Leading Segments:

- Data Services: This segment is experiencing the most significant growth, driven by the increasing need for high-bandwidth connectivity for data-intensive applications, IoT devices, and remote operations.

- Drivers:

- Rise of the Internet of Things (IoT) requiring constant data transmission.

- Demand for real-time data analytics in various industries.

- Advancements in LEO constellations offering higher data speeds and lower latency.

- Increased use of video conferencing and cloud-based services in remote locations.

- Drivers:

- Maritime: This segment is a cornerstone of the portable satellite communication industry. Vessels operating in open seas rely heavily on satellite communication for navigation, safety, crew welfare, and operational efficiency.

- Drivers:

- Stricter maritime regulations mandating real-time tracking and communication.

- Growth in global trade and shipping requiring constant communication links.

- Demand for high-speed internet access for crew members.

- Increasing adoption of smart shipping technologies.

- Drivers:

- Government: Government agencies, including defense, emergency services, and disaster management, are major consumers of portable satellite communication solutions due to their critical need for reliable and secure communication in any situation.

- Drivers:

- National security requirements and military operations.

- Disaster preparedness and response initiatives.

- Need for communication in remote or conflict zones.

- Expansion of public safety communication networks.

- Drivers:

- Enterprise: Businesses operating in remote locations, construction sites, mining operations, and oil and gas exploration rely on portable satellite systems for operational continuity and productivity.

- Drivers:

- Expansion of industrial operations into remote areas.

- Need for reliable communication for remote workforce management.

- Demand for asset tracking and monitoring solutions.

- Support for business continuity and disaster recovery plans.

- Drivers:

- Aviation: While typically relying on integrated systems, the demand for portable satellite communication solutions for emergency situations, business jets, and smaller aircraft is growing, particularly for in-flight connectivity and operational support.

- Drivers:

- Growing demand for in-flight connectivity.

- Need for communication in remote flight paths.

- Use in aviation maintenance and operational support.

- Drivers:

Portable Satellite Communication Industry Product Developments

Recent product developments in the portable satellite communication industry are focused on enhancing user experience, miniaturization, and cost-effectiveness. Innovations include the introduction of ruggedized, lightweight satellite terminals with integrated Wi-Fi hotspots, supporting both voice and high-speed data services. Advances in antenna technology are enabling smaller form factors while maintaining robust signal reception. Furthermore, the integration of AI and machine learning is improving network management and data compression, leading to more efficient bandwidth utilization. The market is witnessing a proliferation of multi-band terminals capable of switching between different satellite networks, offering greater flexibility and resilience. These advancements are making satellite data services and satellite voice communication more accessible and competitive.

Challenges in the Portable Satellite Communication Industry Market

The portable satellite communication industry faces several significant challenges that can impede its growth.

- High upfront costs of equipment and service plans can be a barrier for smaller organizations and individual users.

- Regulatory hurdles and spectrum allocation complexities in different countries can slow down market entry and service deployment.

- Interference and signal degradation due to atmospheric conditions or terrestrial obstructions can impact service reliability.

- Competition from rapidly advancing terrestrial networks, particularly 5G, in densely populated areas, presents a challenge for market share.

- Supply chain disruptions and the need for specialized components can affect product availability and pricing.

Forces Driving Portable Satellite Communication Industry Growth

The portable satellite communication industry is propelled by several powerful growth drivers. The ever-increasing global demand for reliable connectivity, especially in remote, underserved, and disaster-prone regions, forms the bedrock of this growth. Technological advancements, such as the proliferation of LEO satellite constellations, are significantly enhancing data speeds, reducing latency, and lowering the overall cost of satellite data services. The growing adoption of the Internet of Things (IoT) across various industries necessitates ubiquitous data transmission, a role perfectly suited for portable satellite solutions. Furthermore, the increasing frequency of natural disasters and the need for robust disaster recovery communication infrastructure are driving government and enterprise investment.

Challenges in the Portable Satellite Communication Industry Market

Long-term growth catalysts for the portable satellite communication industry are deeply rooted in continued technological innovation and strategic market expansion. The development of even more compact, power-efficient, and user-friendly satellite terminals will democratize access to anywhere connectivity. The integration of satellite communication with emerging technologies like 5G and AI will create synergistic opportunities, enabling advanced applications in autonomous systems and smart infrastructure. Strategic partnerships between satellite operators, technology providers, and end-user industries will be crucial for developing tailored solutions that address specific market needs. Expansion into new geographical markets with developing infrastructure and the increasing focus on sustainable and resilient communication networks will also foster sustained growth.

Emerging Opportunities in Portable Satellite Communication Industry

Emerging opportunities in the portable satellite communication industry are abundant and poised for significant expansion. The burgeoning IoT market, requiring constant data streams from remote sensors and devices, presents a vast new revenue stream. The increasing adoption of satellite-based connectivity for autonomous vehicles, drones, and other unmanned systems is another burgeoning area. Furthermore, the demand for enhanced in-flight connectivity in the aviation sector and advanced communication solutions for the growing space exploration industry represent lucrative prospects. The trend towards remote work and the increasing popularity of adventure tourism are also fueling demand for personal, portable satellite communication devices. The development of integrated satellite-terrestrial communication solutions offers a seamless connectivity experience, opening up new market segments.

Leading Players in the Portable Satellite Communication Industry Sector

- ViaSat UK Limited

- Iridium Communications Inc

- ORBCOMM Europe Holding BV

- Intelsat S A

- Inmarsat PLC

- Ericsson Inc

- Globalstar Inc

- Thuraya Telecommunications Company

- EchoStar Mobile Limited

Key Milestones in Portable Satellite Communication Industry Industry

- June 2023: NewSpace India Ltd, the commercial arm of ISRO, initiated setting up mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 coastal states to enhance maritime communication and monitoring of Indian waters. This initiative aims to bolster maritime ship communication and support systems for monitoring, control, and surveillance in marine fishing vessels, involving the selection of private contractors for terminal supply, installation, and commissioning.

- December 2022: Nelco, a member of the Tata Group, applied for the Global Mobile Personal Communication by Satellite (GMPCS) license, marking a significant indication of increased interest and substantial growth potential in India's emerging satellite communication market. This move positions them alongside other licensed entities like SpaceX, OneWeb, and Reliance Jio Infocomm.

- August 2022: Vodafone PNG and Kacific collaborated to extend Mobile Backhaul services via satellite to rural areas in Papua New Guinea. This partnership aimed to provide Vodafone PNG's voice and 3G/4G data network in remote regions, supporting the digital transformation of the country's government, schools, businesses, and communities, leveraging Kacific's capabilities to enhance rural mobile connectivity across the Asia-Pacific.

Strategic Outlook for Portable Satellite Communication Industry Market

The strategic outlook for the portable satellite communication industry is exceptionally promising, driven by a confluence of technological advancements, market demand, and strategic investments. The continued miniaturization of satellite terminals, coupled with the expansion of LEO satellite constellations, will further democratize access to high-speed, reliable connectivity, making it a ubiquitous utility. Strategic opportunities lie in developing integrated solutions that seamlessly blend satellite and terrestrial networks, catering to the evolving needs of mobile workforces, the IoT ecosystem, and the burgeoning demand for connectivity in remote tourism and exploration. Partnerships between satellite operators, technology providers, and end-user industries will be crucial for unlocking niche markets and creating tailored applications. The increasing focus on resilient communication for disaster management and critical infrastructure will also provide significant growth avenues. The market is poised for sustained expansion, driven by innovation and the relentless pursuit of global connectivity.

Portable Satellite Communication Industry Segmentation

-

1. Service

- 1.1. Voice

- 1.2. Data

-

2. End-User Industry

- 2.1. Maritime

- 2.2. Enterprise

- 2.3. Aviation

- 2.4. Government

Portable Satellite Communication Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Portable Satellite Communication Industry Regional Market Share

Geographic Coverage of Portable Satellite Communication Industry

Portable Satellite Communication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Integration Demands for Satellite and Terrestrial Mobile Technology; Growing Interest from Government and Military

- 3.3. Market Restrains

- 3.3.1. Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology

- 3.4. Market Trends

- 3.4.1. Voice Service Segment is expected to register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Voice

- 5.1.2. Data

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Maritime

- 5.2.2. Enterprise

- 5.2.3. Aviation

- 5.2.4. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Voice

- 6.1.2. Data

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Maritime

- 6.2.2. Enterprise

- 6.2.3. Aviation

- 6.2.4. Government

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Voice

- 7.1.2. Data

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Maritime

- 7.2.2. Enterprise

- 7.2.3. Aviation

- 7.2.4. Government

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Voice

- 8.1.2. Data

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Maritime

- 8.2.2. Enterprise

- 8.2.3. Aviation

- 8.2.4. Government

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Voice

- 9.1.2. Data

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Maritime

- 9.2.2. Enterprise

- 9.2.3. Aviation

- 9.2.4. Government

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Portable Satellite Communication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Voice

- 10.1.2. Data

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Maritime

- 10.2.2. Enterprise

- 10.2.3. Aviation

- 10.2.4. Government

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ViaSat UK Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iridium Communications Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ORBCOMM Europe Holding BV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intelsat S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inmarsat PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ericsson Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Globalstar Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thuraya Telecommunications Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EchoStar Mobile Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ViaSat UK Limited

List of Figures

- Figure 1: Global Portable Satellite Communication Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 9: Europe Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Asia Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 21: Latin America Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: Latin America Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Latin America Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Latin America Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by Service 2025 & 2033

- Figure 27: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Portable Satellite Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Portable Satellite Communication Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Portable Satellite Communication Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 9: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Portable Satellite Communication Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global Portable Satellite Communication Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global Portable Satellite Communication Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portable Satellite Communication Industry?

The projected CAGR is approximately 7.11%.

2. Which companies are prominent players in the Portable Satellite Communication Industry?

Key companies in the market include ViaSat UK Limited, Iridium Communications Inc, ORBCOMM Europe Holding BV, Intelsat S A, Inmarsat PLC, Ericsson Inc, Globalstar Inc, Thuraya Telecommunications Company, EchoStar Mobile Limited.

3. What are the main segments of the Portable Satellite Communication Industry?

The market segments include Service, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Integration Demands for Satellite and Terrestrial Mobile Technology; Growing Interest from Government and Military.

6. What are the notable trends driving market growth?

Voice Service Segment is expected to register a Significant Growth.

7. Are there any restraints impacting market growth?

Lack of Interoperability between MSS Systems; Increasing Regulations on the Use of Satellite Technology.

8. Can you provide examples of recent developments in the market?

June 2023: To establish better communication with vessels in the sea and monitor Indian waters more efficiently, NewSpace India Ltd, the commercial arm of the Indian Space Research Organisation (ISRO), is setting up mobile satellite service (MSS) terminals on at least one lakh motorized and fishing boats across 13 coastal states. In order to set up maritime ship communication and support systems for monitoring, control, and surveillance in marine fishing vessels, NewSpace India has initiated a selection of private contractors that would supply, install, and commission MSS terminals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portable Satellite Communication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portable Satellite Communication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portable Satellite Communication Industry?

To stay informed about further developments, trends, and reports in the Portable Satellite Communication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence