Key Insights

The Active Dosimeter Market is set for substantial expansion, projected to reach a market size of $4.59 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.9%. This growth is driven by heightened radiation safety imperatives across diverse industries. The Medical sector is a key contributor, propelled by increasing cancer diagnoses and the subsequent rise in radiation-based diagnostics and therapies, demanding advanced radiation monitoring. The growing utilization of nuclear medicine and sophisticated imaging techniques further fuels the need for precise, real-time radiation measurement devices. Concurrently, the Industrial sector, including Oil & Gas and Mining, is escalating the adoption of active dosimeters due to stringent worker safety regulations in environments with potential radiation exposure, such as geological surveys and radioactive material handling. Global expansion of nuclear power generation also significantly boosts demand, underscoring the critical need for safe nuclear facility operations and maintenance.

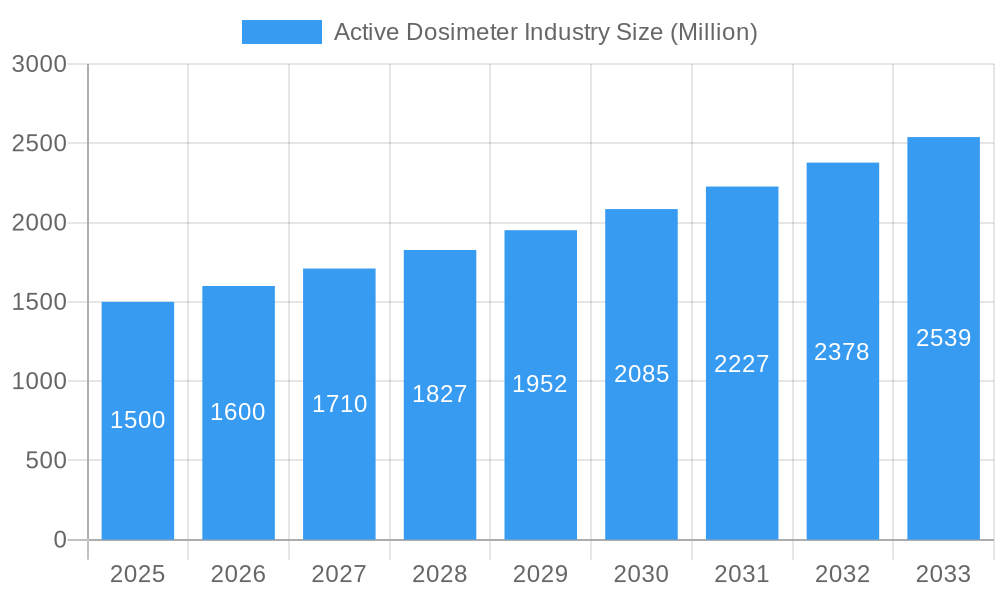

Active Dosimeter Industry Market Size (In Billion)

The Military and Homeland Security segments are crucial growth areas, driven by the necessity for advanced threat detection and personnel protection against radiological threats. The Power & Energy sector, encompassing nuclear energy and emerging renewable sources that may involve radioactive materials, further supports market growth. Key market trends include innovations in sensor technology, leading to more compact, user-friendly, and cost-effective active dosimeters with enhanced data logging and connectivity. While significant growth is anticipated, potential challenges include high initial investment costs for advanced systems and the requirement for specialized user training. Nevertheless, the overarching commitment to safeguarding human health and adhering to evolving safety regulations provides a strong foundation for the active dosimeter market's continued advancement.

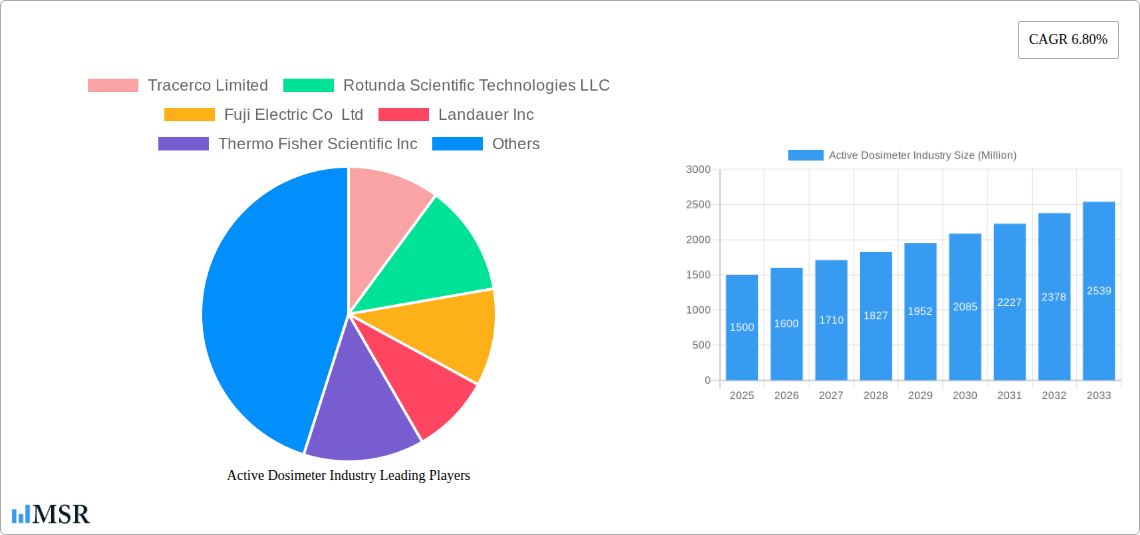

Active Dosimeter Industry Company Market Share

This comprehensive report offers a strategic analysis of the Active Dosimeter Market, a vital segment for radiation safety in critical applications including Medical, Industrial (Oil & Gas, Mining), Military and Homeland Security, and Power & Energy. Analyzing historical data (2019–2024) and projecting through the forecast period (2025–2033), with 2025 as the base year, this report delivers crucial insights into market dynamics, key trends, competitive landscapes, and future growth opportunities. With an estimated market size projected to reach $4.59 billion by 2025 and a CAGR of 7.9% during the forecast period, this analysis is indispensable for stakeholders aiming to navigate and capitalize on this evolving market. Gain actionable intelligence on market concentration, technological innovations, regulatory impacts, and strategic imperatives shaping the future of active dosimetry.

Active Dosimeter Industry Market Concentration & Dynamics

The Active Dosimeter Industry exhibits a moderate market concentration, with a mix of established global players and specialized regional manufacturers. Key companies like Thermo Fisher Scientific Inc, Mirion Technologies Inc, and Fuji Electric Co Ltd hold significant market share, driven by their extensive product portfolios, robust R&D investments, and global distribution networks. The innovation ecosystem is characterized by a continuous drive towards miniaturization, enhanced sensitivity, real-time monitoring capabilities, and sophisticated data analytics. Regulatory frameworks, particularly those governing radiation safety in healthcare and industrial settings, play a crucial role in dictating product development and market access. Substitute products, primarily passive dosimeters, continue to coexist, but the increasing demand for real-time data and immediate alerts favors active dosimetry solutions. End-user trends are increasingly focused on user-friendly interfaces, wireless connectivity, and integration with broader safety management systems. Mergers and acquisition (M&A) activities, while not at peak levels, are strategic, focusing on acquiring niche technologies or expanding market reach. For instance, the integration of advanced sensor technologies and AI-driven analytics are key M&A targets. The total number of M&A deals over the historical period is estimated at 7-10, indicating strategic consolidation rather than broad market acquisition.

Active Dosimeter Industry Industry Insights & Trends

The Active Dosimeter Industry is experiencing robust growth, propelled by an escalating global emphasis on radiation safety and stringent regulatory mandates across diverse sectors. The estimated market size for active dosimeters was $4.2 Billion in 2024, projected to reach $5.6 Billion by 2025. The forecast period (2025–2033) anticipates a healthy Compound Annual Growth Rate (CAGR) of 8.9%, underscoring the sector's significant expansion potential. Key growth drivers include the increasing adoption of advanced radiation monitoring technologies in nuclear power plants for enhanced safety protocols, the burgeoning use of radiation therapy in oncology, and the rising demand for sophisticated personal radiation monitoring devices in industrial environments such as oil and gas exploration and mining operations. Technological disruptions are primarily centered on the development of smaller, more energy-efficient, and highly sensitive active dosimeters with real-time data transmission capabilities. The integration of IoT (Internet of Things) and AI-powered analytics is revolutionizing how radiation exposure data is collected, interpreted, and managed, enabling proactive safety measures and predictive maintenance. Evolving consumer behaviors, particularly in industrial and security sectors, are pushing for integrated, connected solutions that provide comprehensive oversight of radiation hazards. The increasing awareness of the long-term health impacts of radiation exposure is also a significant factor driving the demand for more precise and reliable dosimetry solutions, especially within the medical and military spheres. Furthermore, government initiatives promoting occupational health and safety standards are indirectly bolstering the market. The development of cloud-based platforms for data management and reporting is also a growing trend, enhancing accessibility and compliance.

Key Markets & Segments Leading Active Dosimeter Industry

The Active Dosimeter Industry is witnessing significant growth across multiple key markets and segments, with distinct drivers fueling dominance in each.

Medical Segment:

- Drivers: Increasing prevalence of cancer cases globally, driving demand for radiation therapy; advancements in diagnostic imaging technologies utilizing radiation; stringent patient safety regulations in healthcare facilities.

- Dominance Analysis: The medical segment is a leading force in the active dosimeter market due to the critical need for precise and real-time monitoring of radiation doses administered during cancer treatments and diagnostic procedures. Hospitals and specialized clinics are major adopters of these devices to ensure both patient safety and occupational health for medical personnel. The integration of advanced dosimetry solutions with treatment planning systems enhances accuracy and reduces potential harm. The demand for both personal and area monitoring in this segment remains consistently high.

Industrial (Oil & Gas, Mining):

- Drivers: Expansion of exploration and extraction activities in remote and potentially hazardous environments; strict safety regulations governing worker exposure to naturally occurring radioactive materials (NORM); increasing automation in industrial processes requiring remote monitoring.

- Dominance Analysis: The oil & gas and mining sectors represent a substantial and growing market for active dosimeters. Workers in these industries often face exposure to radiation from geological formations or process materials. Active dosimeters provide crucial real-time feedback, enabling immediate action to mitigate risks and ensure compliance with occupational health standards. The harsh operating conditions in these sectors necessitate rugged, reliable, and easily deployable dosimetry solutions.

Military and Homeland Security:

- Drivers: Growing geopolitical tensions and the need for radiation detection in defense and security operations; development of advanced radiological and nuclear threat detection systems; deployment of personnel in potentially contaminated zones.

- Dominance Analysis: This segment is characterized by a demand for highly specialized, robust, and sensitive active dosimeters capable of detecting and quantifying various types of radiation in diverse operational environments. The need for rapid threat assessment and personnel protection during military deployments or counter-terrorism operations makes advanced active dosimetry indispensable. The focus here is on reliability, portability, and sophisticated analytical capabilities.

Power & Energy:

- Drivers: Continued reliance on nuclear energy as a significant power source; ongoing maintenance and decommissioning activities in nuclear power plants; strict safety regulations for nuclear facility personnel.

- Dominance Analysis: The power and energy sector, particularly nuclear power generation, has long been a cornerstone market for active dosimeters. These devices are essential for monitoring the radiation exposure of workers involved in plant operation, maintenance, and waste management. The lifecycle of nuclear facilities, from construction to decommissioning, necessitates continuous and accurate radiation monitoring, making this a stable and significant segment.

Other Applications:

- Drivers: Emerging uses in research laboratories, educational institutions, and industrial radiography.

- Dominance Analysis: While smaller in scale, this segment includes a diverse range of applications where active dosimetry is employed for research, quality control, and specialized industrial processes, contributing to the overall market diversification.

Active Dosimeter Industry Product Developments

Product development in the Active Dosimeter Industry is characterized by a focus on enhancing real-time monitoring, miniaturization, wireless connectivity, and data analytics capabilities. Innovations include advanced semiconductor detectors offering higher sensitivity and spectral analysis, sophisticated algorithms for dose estimation and risk assessment, and user-friendly interfaces with mobile app integration for remote data access and alerts. For example, the introduction of SaaS options for quality management platforms, as seen with Mirion Technologies' Sun Nuclear solution, streamlines workflows for radiation therapy quality assurance, emphasizing patient safety and operational efficiency. These technological advancements provide a competitive edge by offering more precise, convenient, and actionable radiation safety solutions.

Challenges in the Active Dosimeter Industry Market

The Active Dosimeter Industry faces several challenges, including stringent and evolving regulatory compliance requirements across different regions, which can increase product development costs and time-to-market. Supply chain disruptions for specialized components can impact production volumes and lead times. Furthermore, the high initial cost of advanced active dosimetry systems compared to passive alternatives can be a barrier to adoption in price-sensitive markets. Competitive pressures from both established players and emerging technology providers necessitate continuous innovation and cost optimization. The market also grapples with the need for robust cybersecurity measures to protect sensitive radiation data.

Forces Driving Active Dosimeter Industry Growth

Several key forces are driving the growth of the Active Dosimeter Industry. Escalating global concerns regarding radiation safety in healthcare, industrial, and defense sectors are paramount. Stringent government regulations mandating occupational exposure limits and monitoring protocols create consistent demand. Technological advancements, such as the development of more sensitive, portable, and real-time monitoring devices, are expanding the application scope and attractiveness of active dosimetry. The increasing application of radiation in medicine, particularly in oncology, further fuels market expansion. Economic growth in developing nations also leads to increased industrialization and infrastructure development, requiring enhanced safety measures.

Challenges in the Active Dosimeter Industry Market

Long-term growth catalysts in the Active Dosimeter Industry are intrinsically linked to ongoing innovation and strategic market expansion. The continuous drive for miniaturization and integration of active dosimeters into wearable devices or existing infrastructure will unlock new application areas and improve user convenience. Strategic partnerships between technology developers and end-users can accelerate the adoption of tailored solutions. Market expansion into emerging economies, coupled with localized regulatory support and education initiatives, presents significant untapped potential. Furthermore, the development of predictive analytics based on collected dosimetry data can transform radiation safety from reactive to proactive management.

Emerging Opportunities in Active Dosimeter Industry

Emerging opportunities in the Active Dosimeter Industry lie in the burgeoning fields of personalized medicine and advanced industrial automation. The development of wearable, IoT-enabled dosimeters that provide real-time, location-specific exposure data offers significant potential for improved occupational health tracking. Expansion into niche applications such as food irradiation monitoring and environmental radiation surveying also presents growth avenues. The increasing demand for integrated safety solutions that combine radiation monitoring with other environmental hazard detection is another promising trend. Furthermore, the growing focus on radiation safety in space exploration and disaster management scenarios creates new frontiers for active dosimetry technologies.

Leading Players in the Active Dosimeter Industry Sector

- Tracerco Limited

- Rotunda Scientific Technologies LLC

- Fuji Electric Co Ltd

- Landauer Inc

- Thermo Fisher Scientific Inc

- Raeco Rents LLC

- Mirion Technologies Inc

- Far West Technology Inc

- Polimaster Inc

- ATOMTEX SPE

- Unfors RaySafe AB

Key Milestones in Active Dosimeter Industry Industry

- September 2022: Thermo Fisher Scientific announced an Investment of $160 Million to Expand Bioproduction Capacity in Greater Boston. This expansion will enhance the supply of critical biological materials for vaccines and breakthrough therapies, indirectly supporting the medical applications segment of the active dosimeter market by driving innovation in cancer treatments and other health-related advancements that may require precise radiation management.

- April 2022: Mirion Technologies, Inc, through its subsidiary Sun Nuclear, introduced a New SaaS Option for its Sun Check Quality Management platform. This innovation streamlines Radiation Therapy Quality Assurance (QA) workflows, enhances patient safety in cancer care, and offers scalability, security, and operational efficiencies for health systems. This development directly impacts the medical segment by improving the quality and accessibility of radiation safety management.

Strategic Outlook for Active Dosimeter Industry Market

The strategic outlook for the Active Dosimeter Industry is exceptionally positive, driven by an unwavering commitment to radiation safety and technological innovation. Future growth will be accelerated by the continued integration of AI and IoT for enhanced data analytics and predictive safety measures. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, will be crucial for capturing new demand. Strategic collaborations, focusing on developing user-centric solutions and addressing specific industry challenges, will be key. The industry is poised for sustained growth as regulatory landscapes evolve and the importance of real-time, accurate radiation monitoring becomes even more critical across all sectors.

Active Dosimeter Industry Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Industrial (Oil & Gas, Mining)

- 1.3. Military and Homeland Security

- 1.4. Power & Energy

- 1.5. Other Applications

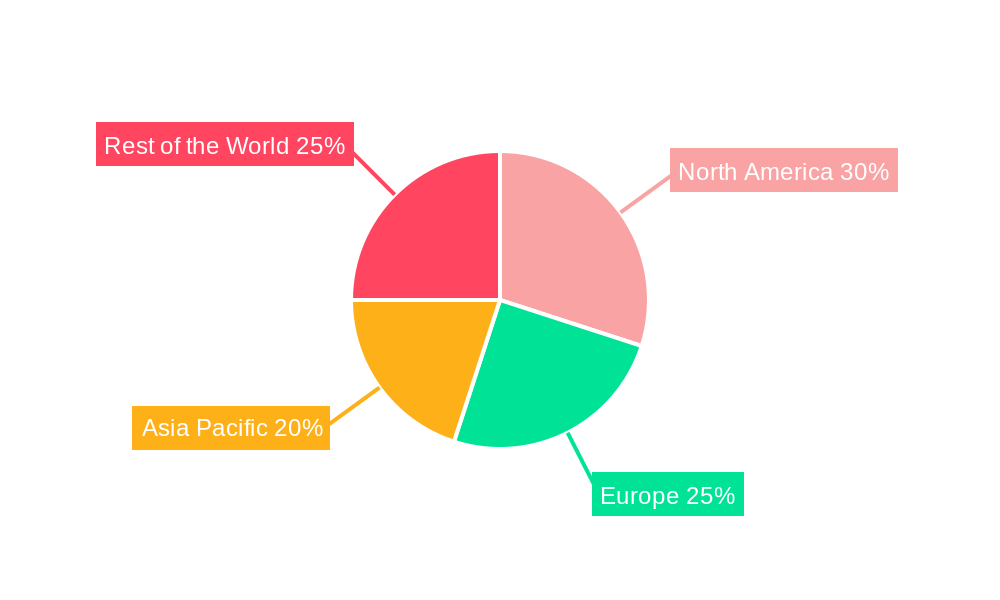

Active Dosimeter Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Active Dosimeter Industry Regional Market Share

Geographic Coverage of Active Dosimeter Industry

Active Dosimeter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction of Nuclear Reactors; Growing Application Across Medical & Lifescience Sector

- 3.3. Market Restrains

- 3.3.1. High cost of device; Sensitivity toward Mechanical Instability

- 3.4. Market Trends

- 3.4.1. Medical Application is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Active Dosimeter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Industrial (Oil & Gas, Mining)

- 5.1.3. Military and Homeland Security

- 5.1.4. Power & Energy

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Active Dosimeter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Industrial (Oil & Gas, Mining)

- 6.1.3. Military and Homeland Security

- 6.1.4. Power & Energy

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Active Dosimeter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Industrial (Oil & Gas, Mining)

- 7.1.3. Military and Homeland Security

- 7.1.4. Power & Energy

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Active Dosimeter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Industrial (Oil & Gas, Mining)

- 8.1.3. Military and Homeland Security

- 8.1.4. Power & Energy

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Active Dosimeter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Industrial (Oil & Gas, Mining)

- 9.1.3. Military and Homeland Security

- 9.1.4. Power & Energy

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tracerco Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rotunda Scientific Technologies LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fuji Electric Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Landauer Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thermo Fisher Scientific Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Raeco Rents LLC *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mirion Technologies Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Far West Technology Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Polimaster Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ATOMTEX SPE

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Unfors RaySafe AB

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Tracerco Limited

List of Figures

- Figure 1: Global Active Dosimeter Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Active Dosimeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Active Dosimeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Active Dosimeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Active Dosimeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Active Dosimeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Active Dosimeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Active Dosimeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Active Dosimeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Active Dosimeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Active Dosimeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Active Dosimeter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Active Dosimeter Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Rest of the World Active Dosimeter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Active Dosimeter Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Active Dosimeter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Active Dosimeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Active Dosimeter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Active Dosimeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Active Dosimeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Active Dosimeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Active Dosimeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Active Dosimeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Active Dosimeter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Active Dosimeter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Active Dosimeter Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Active Dosimeter Industry?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Active Dosimeter Industry?

Key companies in the market include Tracerco Limited, Rotunda Scientific Technologies LLC, Fuji Electric Co Ltd, Landauer Inc, Thermo Fisher Scientific Inc, Raeco Rents LLC *List Not Exhaustive, Mirion Technologies Inc, Far West Technology Inc, Polimaster Inc, ATOMTEX SPE, Unfors RaySafe AB.

3. What are the main segments of the Active Dosimeter Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction of Nuclear Reactors; Growing Application Across Medical & Lifescience Sector.

6. What are the notable trends driving market growth?

Medical Application is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

High cost of device; Sensitivity toward Mechanical Instability.

8. Can you provide examples of recent developments in the market?

September 2022 - Thermo Fisher Scientific has announced its Investment of $160 Million to Expand the Bioproduction Capacity in Greater Boston; the 85,000-square-foot facility will help meet the growing demand for the biological materials needed to produce vaccines and breakthrough therapies for cancer and other diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Active Dosimeter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Active Dosimeter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Active Dosimeter Industry?

To stay informed about further developments, trends, and reports in the Active Dosimeter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence