Key Insights

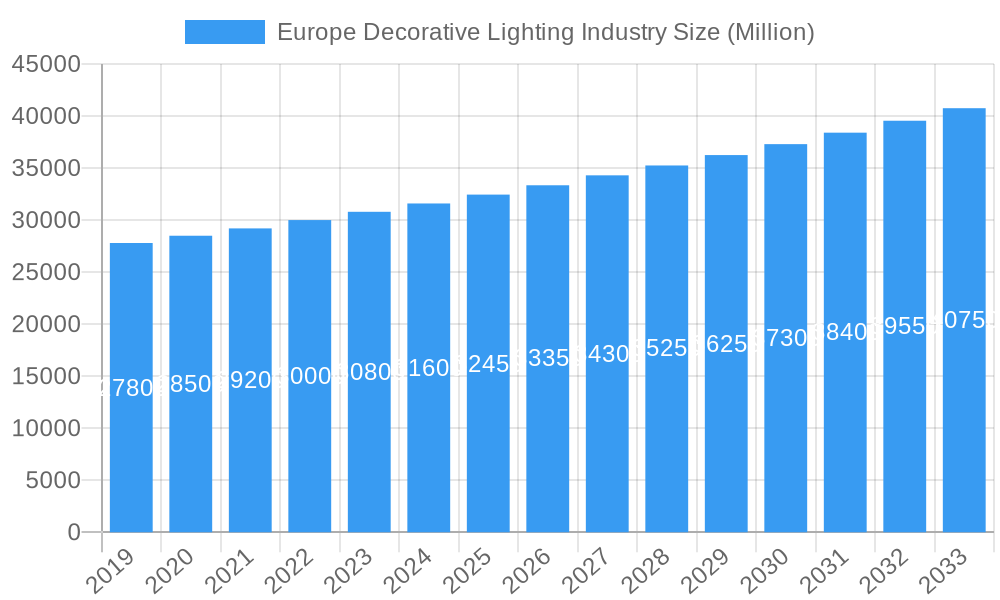

The European decorative lighting market is projected for substantial growth, expected to reach $44 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.8%. This expansion is driven by rising consumer demand for aesthetically pleasing, energy-efficient lighting that enhances residential and commercial environments. Key growth factors include increasing disposable incomes, smart home integration trends, and the recognized impact of lighting on ambiance and well-being. The commercial sector is investing in decorative lighting to create sophisticated spaces in retail and hospitality. Continuous innovation, particularly in LED technology, offering durability, energy savings, and diverse design options, is a significant market contributor.

Europe Decorative Lighting Industry Market Size (In Billion)

The market is segmented by dominant LED lighting, owing to its efficiency and versatility. Both commercial and residential applications show strong growth, indicating demand for decorative lighting in public and private spaces. Specialty light stores and online retail are key distribution channels. Market restraints include potential raw material cost fluctuations and the challenge of counterfeit products. However, the trend toward sophisticated interior design, personalized living spaces, and government support for energy efficiency will continue to drive the European decorative lighting industry. Leading players like Signify (Philips Lighting), OSRAM GmbH, and Hubbell Lighting are focusing on product innovation and strategic collaborations.

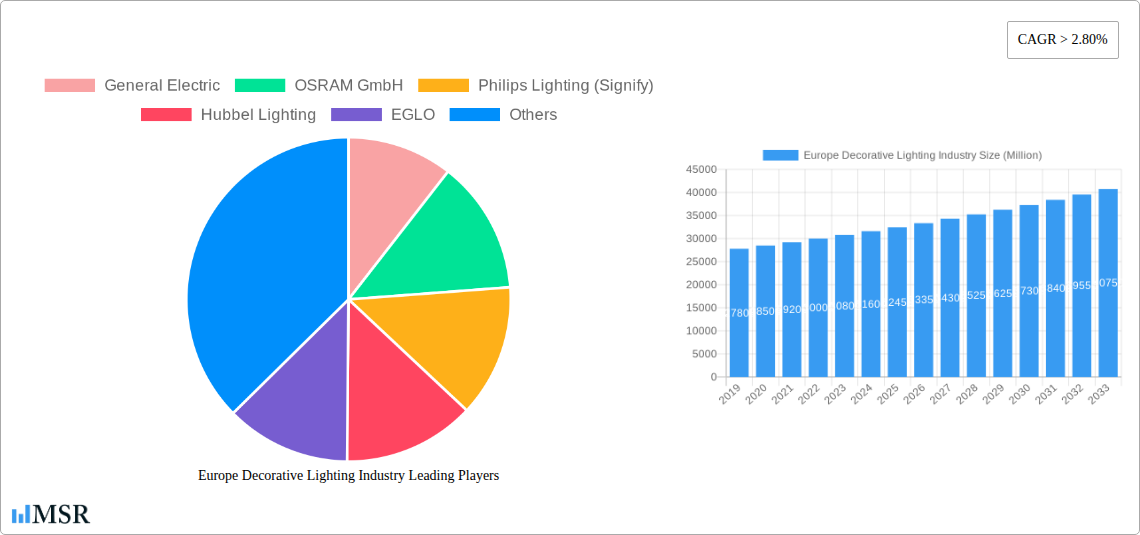

Europe Decorative Lighting Industry Company Market Share

Europe Decorative Lighting Industry Market Report: Unveiling Growth, Innovations, and Key Players (2019-2033)

This comprehensive report delves into the dynamic Europe Decorative Lighting Industry, offering in-depth analysis and actionable insights for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study illuminates market trends, technological advancements, and competitive landscapes. We dissect key segments including Lighting Type (LED, Fluorescent, Incandescent, Others), Application (Commercial, Household), Mount Type (Sconce, Flush Mount, Pendant, Others), and Distribution Channel (Specialty Light Stores, Lifestyle Retailers, Wholesale Stores, DIY, Online Retailing), providing critical data for strategic decision-making. Discover the influential role of General Electric, OSRAM GmbH, Philips Lighting (Signify), Hubbell Lighting, EGLO, Flos S p A, Briloner, Acuity Brands Lighting and many others in shaping this vibrant market.

Europe Decorative Lighting Industry Market Concentration & Dynamics

The Europe Decorative Lighting Industry exhibits a moderate to high market concentration, with a few major players holding significant market share. In 2025, the top 5 companies are estimated to control approximately 65% of the market. Innovation is driven by a robust ecosystem of established manufacturers and agile start-ups, fostering continuous product development in areas like smart lighting and energy efficiency. Regulatory frameworks, particularly those related to energy standards and environmental impact, play a crucial role in shaping product design and market entry. Substitute products, such as general lighting solutions, pose a competitive challenge, although decorative lighting's emphasis on aesthetics and ambiance differentiates it. End-user trends are increasingly favoring sustainability, smart home integration, and personalized design experiences. Mergers and acquisitions (M&A) activities are prevalent, with an estimated xx deal counts in the historical period (2019-2024), indicating strategic consolidation and expansion by leading companies to enhance their product portfolios and market reach.

Europe Decorative Lighting Industry Industry Insights & Trends

The Europe Decorative Lighting Industry is poised for substantial growth, projected to reach a market size of €XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of X.X% from 2025 to 2033. This expansion is primarily fueled by the escalating demand for aesthetically pleasing and energy-efficient lighting solutions across both Commercial and Household applications. The widespread adoption of LED technology continues to be a dominant force, offering superior performance, longevity, and design flexibility, contributing significantly to the market's overall value. Technological disruptions are a key theme, with the integration of smart home capabilities, IoT connectivity, and advanced control systems transforming decorative lighting from mere illumination to interactive and customizable elements. Evolving consumer behaviors, driven by a growing emphasis on interior design, well-being, and personalized living spaces, are creating new opportunities for innovative and stylish lighting fixtures. The increasing disposable income and a desire for sophisticated home and commercial environments further propel market expansion. The push towards sustainable and eco-friendly products is also influencing consumer choices, favoring manufacturers with a strong commitment to environmental responsibility.

Key Markets & Segments Leading Europe Decorative Lighting Industry

LED lighting unequivocally leads the Lighting Type segment within the Europe Decorative Lighting Industry. Its dominance stems from superior energy efficiency, extended lifespan, and remarkable design versatility, allowing for intricate and innovative decorative lighting fixtures. In 2025, LED is estimated to capture over 80% of the market share for decorative lighting.

The Household application segment is the primary revenue generator, driven by homeowners investing in enhancing their living spaces with stylish and functional decorative lighting. However, the Commercial application segment, encompassing hospitality, retail, and office spaces, is exhibiting robust growth, propelled by the increasing recognition of ambient and accent lighting's impact on customer experience and brand perception.

In terms of Mount Type, Pendant lights and Sconce lights are particularly popular due to their visual impact and ability to define specific areas within a space. Flush Mounts are also significant, particularly for modern and minimalist interiors.

The Distribution Channel landscape is evolving, with Online Retailing experiencing the most rapid growth, offering unparalleled convenience and a wider selection for consumers. Specialty Light Stores maintain a strong presence, providing expert advice and curated collections, while Lifestyle Retailers cater to a broader consumer base seeking integrated home décor solutions. DIY channels are also significant for consumers seeking to personalize their lighting installations.

Key drivers for the dominance of these segments include:

- Economic Growth: Rising disposable incomes and increased consumer spending on home improvement and interior design.

- Technological Advancements: Continuous innovation in LED technology, smart controls, and material science.

- Urbanization and Housing Market Trends: Growing demand for aesthetically pleasing lighting solutions in new constructions and renovations.

- Sustainability Initiatives: Consumer preference for energy-efficient and environmentally friendly lighting options.

- E-commerce Penetration: Increased accessibility and convenience of online purchasing channels.

Europe Decorative Lighting Industry Product Developments

Product development in the Europe Decorative Lighting Industry is characterized by a relentless pursuit of innovation, focusing on smart functionalities, sustainable materials, and unique aesthetic designs. advancements in LED technology have enabled the creation of highly customizable lighting solutions, including color-changing capabilities, tunable white light, and dynamic lighting effects controlled via smartphone applications. The integration of IoT capabilities allows for seamless integration into smart home ecosystems, offering convenience and energy management benefits. Manufacturers are also exploring novel materials and manufacturing processes to reduce environmental impact and enhance product durability. The market relevance of these developments is high, directly addressing evolving consumer demands for personalized, efficient, and aesthetically superior lighting.

Challenges in the Europe Decorative Lighting Industry Market

The Europe Decorative Lighting Industry faces several challenges, including stringent energy efficiency regulations that necessitate continuous product adaptation. Supply chain disruptions, particularly in sourcing raw materials and components, can impact production timelines and costs, estimated to have caused a Y% increase in operational expenses during peak disruptions. Intense competitive pressures from both established brands and new entrants drive down profit margins, requiring companies to focus on differentiation and value-added services. The complexity of smart lighting integration can also be a barrier for some consumers, requiring clearer user interfaces and robust technical support.

Forces Driving Europe Decorative Lighting Industry Growth

Several forces are driving the growth of the Europe Decorative Lighting Industry. Technological advancements in LED lighting offer unparalleled energy efficiency and design flexibility, making them the preferred choice for decorative applications. The increasing consumer focus on interior design and home aesthetics fuels demand for unique and stylish lighting fixtures that enhance ambiance and create focal points. Government initiatives promoting energy conservation indirectly benefit the decorative lighting sector by encouraging the adoption of energy-efficient technologies like LEDs. Furthermore, the burgeoning smart home market integrates decorative lighting into connected ecosystems, offering enhanced control and personalized user experiences.

Challenges in the Europe Decorative Lighting Industry Market

Long-term growth catalysts for the Europe Decorative Lighting Industry are rooted in continuous innovation and market expansion. The persistent development of energy-efficient and sustainable lighting solutions will remain a key driver, aligning with global environmental trends and regulatory pressures. The increasing adoption of smart lighting technologies, including advanced control systems and IoT integration, will create new revenue streams and enhance product value propositions. Furthermore, exploring and penetrating emerging geographical markets within and beyond Europe, coupled with strategic partnerships and collaborations within the interior design and smart home industries, will accelerate market growth and solidify competitive positioning.

Emerging Opportunities in Europe Decorative Lighting Industry

Emerging opportunities in the Europe Decorative Lighting Industry lie in the growing demand for biophilic lighting, which mimics natural light patterns to enhance well-being. The expansion of the smart home market presents significant opportunities for integrated decorative lighting solutions offering advanced control and customization. Customizable and modular lighting systems catering to specific design needs and project scales are also gaining traction. Furthermore, the increasing focus on sustainable and ethically sourced materials in product manufacturing opens avenues for eco-conscious brands to capture a larger market share. The penetration of online retail platforms continues to offer direct access to a wider customer base, facilitating niche product sales.

Leading Players in the Europe Decorative Lighting Industry Sector

- General Electric

- OSRAM GmbH

- Philips Lighting (Signify)

- Hubbell Lighting

- EGLO

- Flos S p A

- Briloner

- Acuity Brands Lighting

Key Milestones in Europe Decorative Lighting Industry Industry

- 2019: Increased investment in smart lighting research and development by major players.

- 2020: Significant growth in online sales of decorative lighting due to shifting consumer purchasing habits.

- 2021: Introduction of new, highly energy-efficient LED decorative lighting lines by multiple manufacturers.

- 2022: Several key acquisitions within the industry, focusing on smart home integration and design capabilities.

- 2023: Growing emphasis on sustainable materials and circular economy principles in product design and manufacturing.

- 2024: Increased adoption of biophilic design principles in decorative lighting solutions.

Strategic Outlook for Europe Decorative Lighting Industry Market

The strategic outlook for the Europe Decorative Lighting Industry is overwhelmingly positive, driven by sustained innovation and evolving consumer preferences. The continued dominance of LED technology and its ongoing advancements, coupled with the pervasive integration of smart home capabilities, will remain key growth accelerators. Manufacturers are encouraged to focus on developing high-design, energy-efficient, and user-friendly products that cater to the growing demand for personalized living and working environments. Strategic partnerships with interior designers, architects, and smart home technology providers will be crucial for market expansion and capturing new opportunities. The emphasis on sustainability will also play a pivotal role in shaping future product development and brand positioning, ensuring long-term market relevance and consumer appeal.

Europe Decorative Lighting Industry Segmentation

-

1. Lighting Type

- 1.1. LED

- 1.2. Fluorescent

- 1.3. Incandescent

- 1.4. Others

-

2. Application

- 2.1. Commercial

- 2.2. Household

-

3. Mount Type

- 3.1. Sconce

- 3.2. Flush Mount

- 3.3. Pendant

- 3.4. Others

-

4. Distribution Channel

- 4.1. Specialty Light Stores

- 4.2. Lifestyle Retailers

- 4.3. Wholesale Stores

- 4.4. DIY

- 4.5. Online Retailing

Europe Decorative Lighting Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

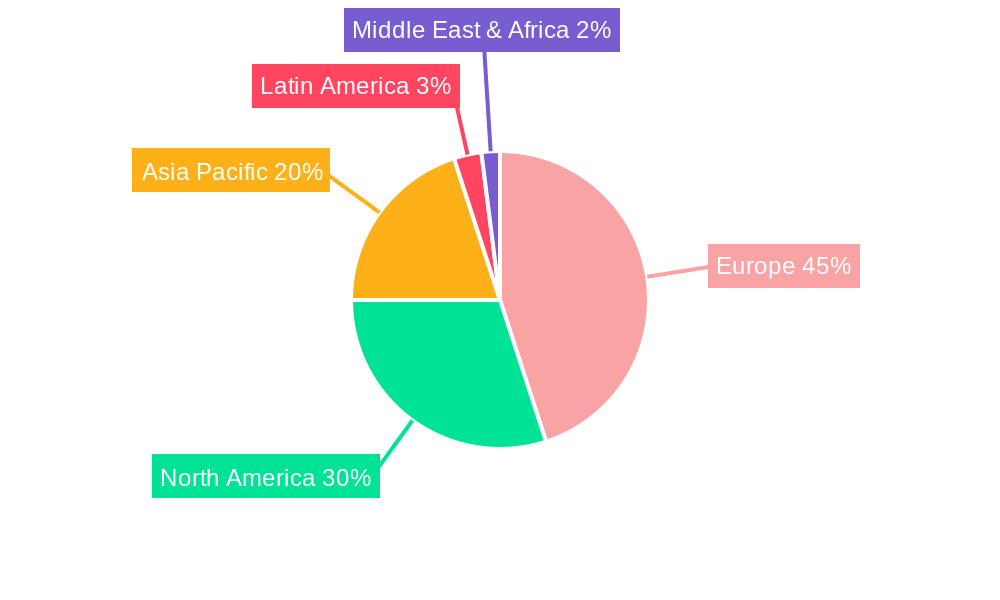

Europe Decorative Lighting Industry Regional Market Share

Geographic Coverage of Europe Decorative Lighting Industry

Europe Decorative Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Major innovations in lighting design and trend towards premiumization expected to drive growth in Europe; Growing focus on energy-efficient ambient lighting and LED-based lights

- 3.3. Market Restrains

- 3.3.1. Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins

- 3.4. Market Trends

- 3.4.1. Growing focus on energy-efficient ambient lighting and LED-based lights

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 5.1.1. LED

- 5.1.2. Fluorescent

- 5.1.3. Incandescent

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Household

- 5.3. Market Analysis, Insights and Forecast - by Mount Type

- 5.3.1. Sconce

- 5.3.2. Flush Mount

- 5.3.3. Pendant

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Specialty Light Stores

- 5.4.2. Lifestyle Retailers

- 5.4.3. Wholesale Stores

- 5.4.4. DIY

- 5.4.5. Online Retailing

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Lighting Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Electric

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OSRAM GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips Lighting (Signify)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hubbel Lighting

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EGLO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flos S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Briloner

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acuity Brands Lighting

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 General Electric

List of Figures

- Figure 1: Europe Decorative Lighting Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Decorative Lighting Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Decorative Lighting Industry Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 2: Europe Decorative Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Decorative Lighting Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 4: Europe Decorative Lighting Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Europe Decorative Lighting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Decorative Lighting Industry Revenue billion Forecast, by Lighting Type 2020 & 2033

- Table 7: Europe Decorative Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Decorative Lighting Industry Revenue billion Forecast, by Mount Type 2020 & 2033

- Table 9: Europe Decorative Lighting Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Europe Decorative Lighting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Decorative Lighting Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Decorative Lighting Industry?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the Europe Decorative Lighting Industry?

Key companies in the market include General Electric, OSRAM GmbH, Philips Lighting (Signify), Hubbel Lighting, EGLO, Flos S p A, Briloner, Acuity Brands Lighting.

3. What are the main segments of the Europe Decorative Lighting Industry?

The market segments include Lighting Type, Application, Mount Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 44 billion as of 2022.

5. What are some drivers contributing to market growth?

; Major innovations in lighting design and trend towards premiumization expected to drive growth in Europe; Growing focus on energy-efficient ambient lighting and LED-based lights.

6. What are the notable trends driving market growth?

Growing focus on energy-efficient ambient lighting and LED-based lights .

7. Are there any restraints impacting market growth?

Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Decorative Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Decorative Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Decorative Lighting Industry?

To stay informed about further developments, trends, and reports in the Europe Decorative Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence