Key Insights

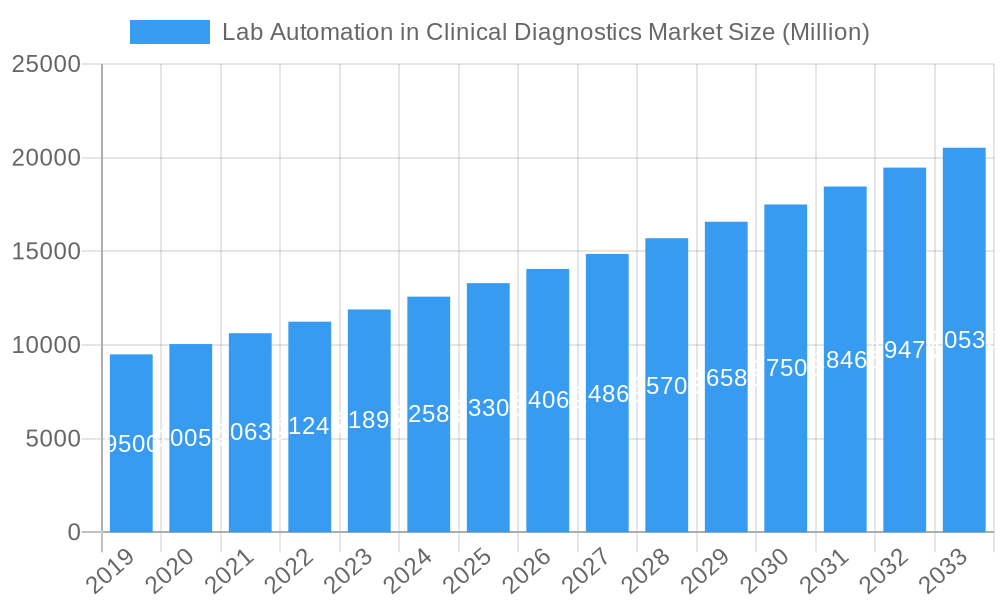

The Global Lab Automation in Clinical Diagnostics Market is projected for substantial growth, anticipated to reach a market size of $6.36 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is driven by the increasing demand for enhanced laboratory efficiency, accuracy, and throughput, addressing the growing healthcare needs and the complexity of modern diagnostic testing. Key factors fueling this growth include the rising incidence of chronic diseases, the widespread adoption of advanced molecular diagnostics, and the critical need for faster patient result turnaround times. Technological advancements in robotics, artificial intelligence, and machine learning are also pivotal, enabling the development of sophisticated automation solutions that streamline workflows and improve diagnostic reliability.

Lab Automation in Clinical Diagnostics Market Market Size (In Billion)

The market's evolution is further influenced by trends such as the integration of laboratory information systems (LIS) with automated platforms and the emergence of modular, scalable automation solutions for diverse laboratory needs. The growing focus on personalized medicine and high-throughput genomic and proteomic analysis are significant growth catalysts. Challenges include the substantial initial investment required for advanced automation systems and a shortage of skilled personnel to operate and maintain them. Nevertheless, strategic initiatives from key market players, including collaborations and product development, are continually enhancing market capabilities and ensuring sustained growth.

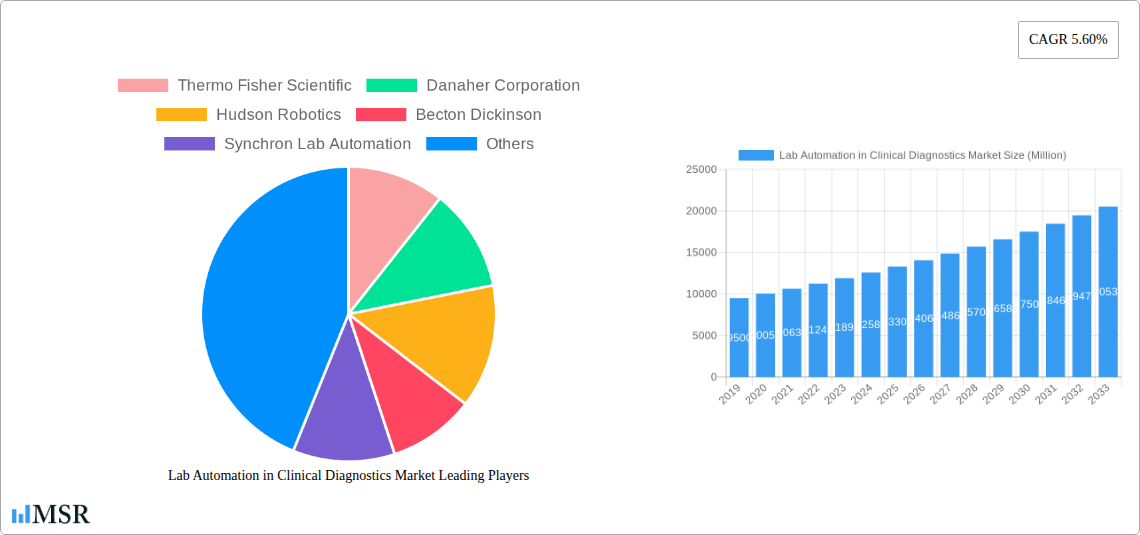

Lab Automation in Clinical Diagnostics Market Company Market Share

Global Lab Automation in Clinical Diagnostics Market Analysis: Forecast 2025-2033

Gain critical insights into the dynamic Lab Automation in Clinical Diagnostics Market. This report details market trends, clinical diagnostics automation solutions, laboratory automation equipment, and in vitro diagnostics (IVD) automation. Analyzing the base year 2025 and the forecast period 2025-2033, discover key growth drivers and emerging opportunities. Essential for IVD manufacturers, laboratory directors, biotech companies, pharmaceutical firms, and healthcare providers seeking to optimize operations and improve diagnostic outcomes.

Lab Automation in Clinical Diagnostics Market Market Concentration & Dynamics

The Lab Automation in Clinical Diagnostics Market is characterized by a moderate to high level of concentration, with key players dominating through strategic acquisitions and significant R&D investments. The innovation ecosystem is robust, driven by the increasing demand for faster, more accurate diagnostic results and the persistent need to address laboratory staff shortages and operational inefficiencies. Regulatory frameworks, such as those governed by the FDA and EMA, play a crucial role in shaping market entry and product development, emphasizing safety, efficacy, and data integrity. Substitute products, while existing in traditional manual processes, are rapidly being displaced by automated solutions due to their inherent advantages in throughput and standardization. End-user trends are strongly leaning towards integrated, modular, and scalable automation systems that can adapt to diverse laboratory needs, from high-throughput screening to specialized molecular diagnostics. Mergers and Acquisition (M&A) activities are a significant dynamic, with companies actively consolidating their market positions and expanding their technology portfolios. For instance, recent M&A activities have focused on acquiring companies with specialized AI-driven analytics or advanced robotics capabilities, aiming to offer end-to-end automated solutions. Market share is consolidated among top players, with significant investments in expanding production capacities and global distribution networks. M&A deal counts have shown a steady increase, indicating a strategic consolidation phase within the industry.

Lab Automation in Clinical Diagnostics Market Industry Insights & Trends

The Lab Automation in Clinical Diagnostics Market is experiencing substantial growth, projected to reach a market size of USD 25,000 Million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period (2025-2033). This impressive expansion is fueled by a confluence of factors, including the escalating prevalence of chronic and infectious diseases, which in turn drives the demand for higher testing volumes and more sophisticated diagnostic capabilities. The imperative to improve turnaround times for diagnostic results is a critical market growth driver, enabling faster patient treatment decisions and better disease management. Technological disruptions are at the forefront of this market's evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into laboratory automation systems is revolutionizing data analysis, predictive diagnostics, and workflow optimization. Advancements in robotics, miniaturization, and microfluidics are leading to the development of more compact, efficient, and cost-effective automated solutions. Evolving consumer behaviors, particularly the rising patient expectations for personalized medicine and quicker access to health information, are also pushing the adoption of advanced diagnostic technologies. Furthermore, the global push towards personalized medicine and companion diagnostics necessitates highly automated and precise testing platforms capable of handling complex genomic and proteomic analyses. The clinical diagnostics automation market is also benefiting from increased government spending on healthcare infrastructure and research initiatives aimed at improving public health outcomes. The need for reduced human error in diagnostic testing, especially in critical care settings, further propels the adoption of automation. The integration of digital pathology and liquid biopsy technologies into automated workflows is another significant trend that is shaping the future of in vitro diagnostics automation. The increasing complexity of assays and the growing number of tests performed per patient are creating an undeniable need for higher throughput and greater standardization, which only automation can reliably provide.

Key Markets & Segments Leading Lab Automation in Clinical Diagnostics Market

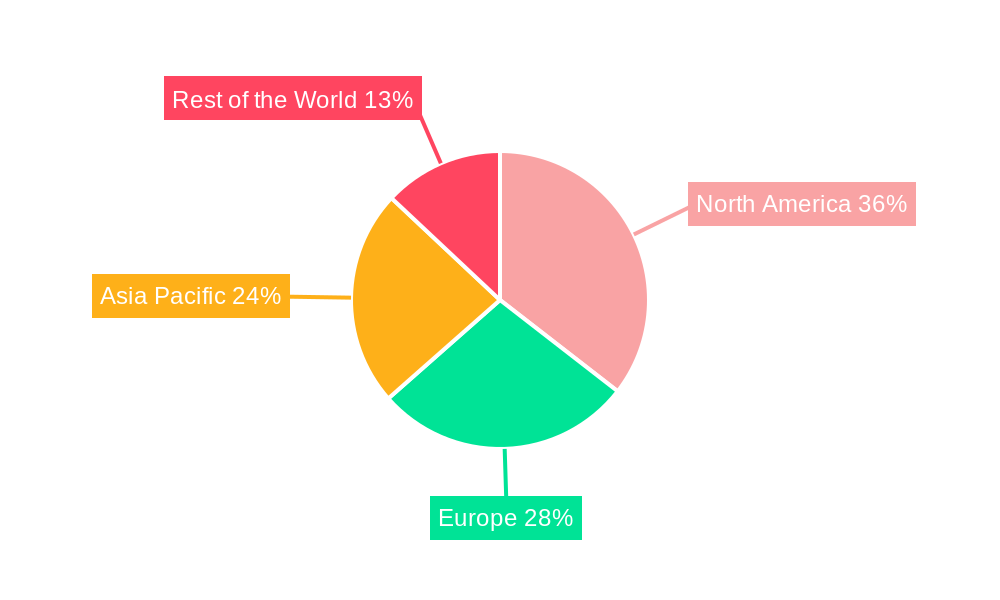

North America currently leads the Lab Automation in Clinical Diagnostics Market, driven by a strong existing healthcare infrastructure, significant R&D investments, and a high adoption rate of advanced technologies. The United States, in particular, is a dominant country within this region, characterized by a high density of diagnostic laboratories, a favorable regulatory environment for innovation, and a substantial patient population demanding efficient healthcare services.

Within the Equipment segment, Automated Liquid Handlers are a primary driver of market growth.

- Drivers for Automated Liquid Handlers:

- High Throughput Requirements: Essential for processing large volumes of samples in research and clinical settings.

- Precision and Reproducibility: Minimizing human error in pipetting, crucial for accurate diagnostic results.

- Cost-Effectiveness: Reducing reagent waste and labor costs over time.

- Versatility: Adaptable to a wide range of assays, from molecular diagnostics to immunoassay testing.

Automated Plate Handlers also hold significant market share, facilitating the efficient movement and processing of microplates, which are ubiquitous in diagnostic assays. Their dominance is linked to their ability to streamline workflows in high-throughput screening and drug discovery.

Robotic Arms are increasingly being integrated into more complex laboratory automation solutions.

- Drivers for Robotic Arms:

- Flexibility and Dexterity: Capable of performing complex manipulations and adapting to varied lab layouts.

- Integration Capabilities: Easily integrated with other automated systems for end-to-end workflow solutions.

- Reduced Manual Intervention: Essential for minimizing exposure to hazardous materials and repetitive strain injuries.

Automated Storage and Retrieval Systems (AS/RS) are gaining traction in large diagnostic facilities, enabling efficient management and tracking of vast sample libraries, thereby improving sample accessibility and integrity.

Vision Systems are becoming crucial for quality control, sample identification, and plate reader integration, ensuring the accuracy and reliability of automated processes.

The growth in these segments is further propelled by economic growth, leading to increased healthcare expenditure and infrastructure development, particularly in emerging economies where investment in advanced laboratory capabilities is a priority.

Lab Automation in Clinical Diagnostics Market Product Developments

Product developments in the Lab Automation in Clinical Diagnostics Market are focused on enhancing modularity, connectivity, and intelligence. Innovations are centered on integrated platforms that combine multiple analytical technologies on a single, compact unit, such as the launch of cobas pure integrated solutions by Roche. Furthermore, companies like Thermo Fisher Scientific are strategically acquiring capabilities, as seen in their planned acquisition of QIAGEN N.V., to expand their specialty diagnostics portfolio with advanced molecular diagnostic features and automation-friendly instruments. These advancements aim to reduce bench time, improve data accuracy, and deliver actionable insights faster, directly impacting patient care.

Challenges in the Lab Automation in Clinical Diagnostics Market Market

The Lab Automation in Clinical Diagnostics Market faces several significant challenges. High initial investment costs for sophisticated automation systems can be a barrier, particularly for smaller laboratories or those in developing regions. Stringent regulatory approval processes for new automated diagnostic platforms can also lead to extended time-to-market. Supply chain disruptions, as witnessed during recent global events, can impact the availability of critical components and finished products, leading to delays and increased costs. Furthermore, the need for skilled personnel to operate and maintain complex automated systems, along with ongoing training requirements, presents a continuous challenge for many healthcare institutions.

Forces Driving Lab Automation in Clinical Diagnostics Market Growth

Several key forces are driving the growth of the Lab Automation in Clinical Diagnostics Market. The increasing global burden of diseases, both infectious and chronic, necessitates higher testing volumes and faster turnaround times, which automation effectively addresses. Rapid advancements in diagnostic technologies, such as next-generation sequencing and PCR, require sophisticated automated platforms for efficient execution. The growing demand for personalized medicine and companion diagnostics further fuels the need for precise and high-throughput automated testing. Additionally, government initiatives promoting healthcare infrastructure development and the adoption of digital health solutions are creating a supportive environment for market expansion.

Challenges in the Lab Automation in Clinical Diagnostics Market Market

Long-term growth catalysts in the Lab Automation in Clinical Diagnostics Market are deeply rooted in continuous innovation and strategic market expansions. The increasing integration of AI and machine learning within automation platforms promises to unlock predictive diagnostics and further optimize laboratory workflows, offering significant competitive advantages. Partnerships between technology providers and diagnostic assay developers are crucial for creating seamless, end-to-end solutions that cater to evolving clinical needs. Furthermore, the expansion of automation solutions into emerging markets, coupled with efforts to develop more affordable and scalable systems, will be instrumental in achieving sustained market growth.

Emerging Opportunities in Lab Automation in Clinical Diagnostics Market

Emerging opportunities in the Lab Automation in Clinical Diagnostics Market are abundant and span new technological frontiers and geographical expansions. The rise of point-of-care diagnostics presents a significant opportunity for compact, user-friendly automated systems that can deliver rapid results in decentralized settings. The growing adoption of telehealth and remote patient monitoring is creating demand for automated diagnostic solutions that can integrate with digital health ecosystems. Furthermore, the increasing focus on infectious disease surveillance and preparedness offers a fertile ground for the development and deployment of highly automated screening and diagnostic platforms. Opportunities also lie in developing specialized automation for niche diagnostic areas, such as toxicology or pharmacogenomics, catering to specific market demands.

Leading Players in the Lab Automation in Clinical Diagnostics Market Sector

- Thermo Fisher Scientific

- Danaher Corporation

- Hudson Robotics

- Becton Dickinson

- Synchron Lab Automation

- Agilent Technologies Inc

- Siemens Healthineers AG

- Tecan Group Ltd

- Perkinelmer Inc

- Honeywell International Inc

- Bio-Rad Laboratories Inc

- Roche Holding AG

- Shimadzu Corporation

- Aurora Biomed

Key Milestones in Lab Automation in Clinical Diagnostics Market Industry

- March 2021: Roche announced the launch of cobas pure integrated solutions in countries accepting the CE mark. This new compact analyzer combines three technologies on a single platform helping to simplify daily operations in labs with limited space and resources.

- March 2020: Thermo Fisher announced to acquire QIAGEN N.V., where the company plans to expand specialty diagnostics portfolio with attractive molecular diagnostics capabilities, including infectious disease testing. In addition, QIAGEN's instruments can be used to automate these workflows, while its bioinformatics systems provide customers with relevant, actionable insights.

Strategic Outlook for Lab Automation in Clinical Diagnostics Market Market

The strategic outlook for the Lab Automation in Clinical Diagnostics Market is exceptionally positive, driven by sustained demand for efficiency, accuracy, and speed in healthcare diagnostics. Future growth will be accelerated by the continued integration of advanced technologies like AI, IoT, and cloud computing, enabling smarter, more connected laboratory environments. Key strategies will involve developing modular and scalable automation solutions that cater to diverse laboratory sizes and needs, from high-throughput screening centers to smaller, specialized labs. Strategic partnerships and acquisitions will remain crucial for companies aiming to expand their product portfolios and market reach, offering comprehensive, end-to-end automation solutions that enhance diagnostic capabilities and improve patient outcomes globally.

Lab Automation in Clinical Diagnostics Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Vision Systems

Lab Automation in Clinical Diagnostics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Clinical Diagnostics Market Regional Market Share

Geographic Coverage of Lab Automation in Clinical Diagnostics Market

Lab Automation in Clinical Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics

- 3.3. Market Restrains

- 3.3.1. Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Vision Systems

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Vision Systems

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Vision Systems

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Vision Systems

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Thermo Fisher Scientific

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Danaher Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hudson Robotics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Becton Dickinson

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Synchron Lab Automation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Agilent Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens Healthineers AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tecan Group Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Perkinelmer Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Honeywell International Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bio-Rad Laboratories Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Roche Holding AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Shimadzu Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Aurora Biomed*List Not Exhaustive

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Thermo Fisher Scientific

List of Figures

- Figure 1: Global Lab Automation in Clinical Diagnostics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Lab Automation in Clinical Diagnostics Market Revenue (billion), by Equipment 2025 & 2033

- Figure 3: North America Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 4: North America Lab Automation in Clinical Diagnostics Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Lab Automation in Clinical Diagnostics Market Revenue (billion), by Equipment 2025 & 2033

- Figure 7: Europe Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 8: Europe Lab Automation in Clinical Diagnostics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue (billion), by Equipment 2025 & 2033

- Figure 11: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue (billion), by Equipment 2025 & 2033

- Figure 15: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 16: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 2: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 4: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 6: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 8: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Equipment 2020 & 2033

- Table 10: Global Lab Automation in Clinical Diagnostics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Clinical Diagnostics Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Lab Automation in Clinical Diagnostics Market?

Key companies in the market include Thermo Fisher Scientific, Danaher Corporation, Hudson Robotics, Becton Dickinson, Synchron Lab Automation, Agilent Technologies Inc, Siemens Healthineers AG, Tecan Group Ltd, Perkinelmer Inc, Honeywell International Inc, Bio-Rad Laboratories Inc, Roche Holding AG, Shimadzu Corporation, Aurora Biomed*List Not Exhaustive.

3. What are the main segments of the Lab Automation in Clinical Diagnostics Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics.

6. What are the notable trends driving market growth?

Automated Liquid Handlers is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics.

8. Can you provide examples of recent developments in the market?

March 2021 - Roche announced the launch of cobas pure integrated solutions in countries accepting the CE mark. This new compact analyzer combines three technologies on a single platform helping to simplify daily operations in labs with limited space and resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Clinical Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Clinical Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Clinical Diagnostics Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Clinical Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence