Key Insights

The Austria Facility Management Market is projected to reach $4.8 billion by 2033, expanding at a CAGR of 5.7% from a base year of 2024. This growth is fueled by the increasing demand for operational efficiency and cost optimization across commercial, institutional, industrial, and public sectors. Businesses are increasingly outsourcing facility management to focus on core operations, enhance employee well-being, and ensure compliance with evolving safety and sustainability regulations. Technological advancements, including smart building solutions and data analytics, are revolutionizing facility management through predictive maintenance, energy optimization, and streamlined operations.

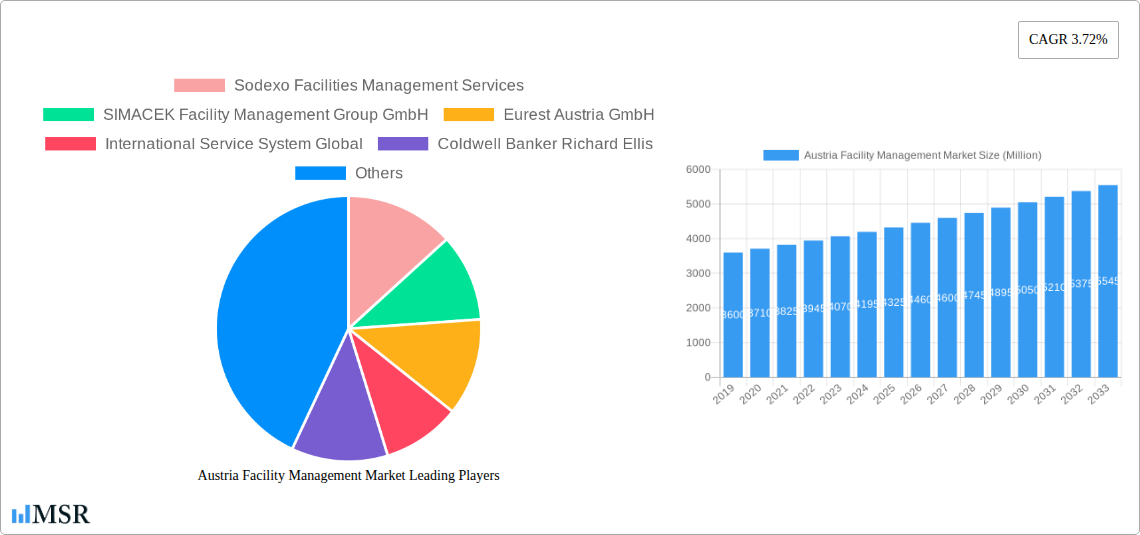

Austria Facility Management Market Market Size (In Billion)

The market is segmented by service type, with outsourced facility management services (single, bundled, and integrated) anticipated to dominate. Both Hard FM (e.g., building maintenance, HVAC, security) and Soft FM (e.g., cleaning, catering, reception) services are experiencing strong demand. The adoption of integrated FM solutions is a key trend, offering a holistic approach for greater economies of scale and accountability, thus supporting Austrian enterprises' strategic objectives.

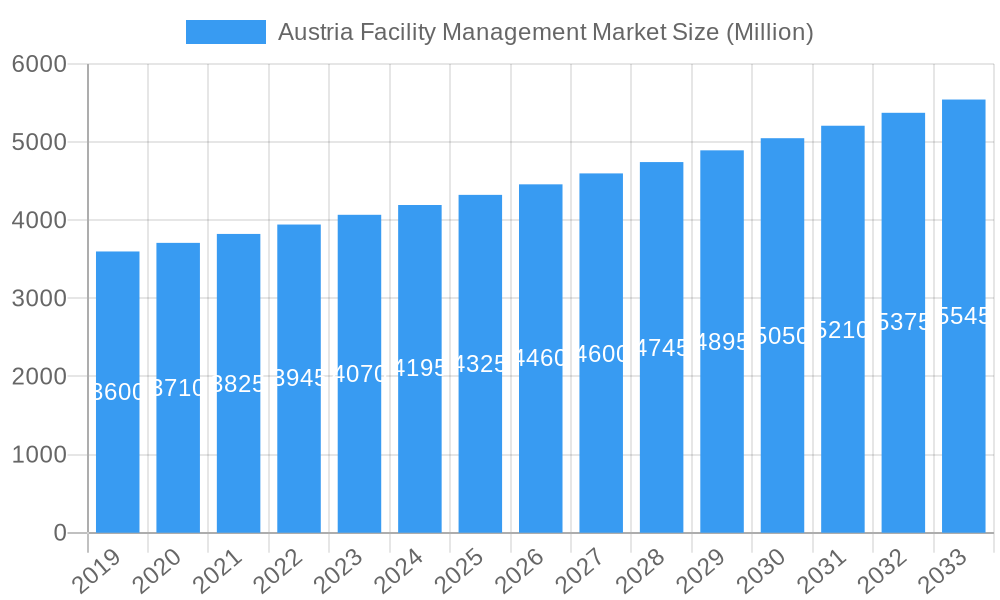

Austria Facility Management Market Company Market Share

Gain comprehensive insights into the Austria Facility Management Market. This report analyzes market dynamics, identifies key growth drivers, and forecasts trends from 2019–2033, with a base year of 2024. Explore the evolving landscape of facility management services in Austria, including outsourced facility management, integrated facility management, hard FM, and soft FM solutions. This essential resource is designed for facility management companies, real estate developers, corporate clients, and industry stakeholders.

Austria Facility Management Market Market Concentration & Dynamics

The Austria Facility Management Market exhibits a moderate to high level of concentration, with a few prominent players dominating significant market share. Leading companies such as Sodexo Facilities Management Services, SIMACEK Facility Management Group GmbH, Eurest Austria GmbH, International Service System Global, Coldwell Banker Richard Ellis, Equans, Leadec, Apleona GmbH, VINCI Energies, and Jones Lang LaSalle IP Inc are actively shaping the competitive environment. Innovation ecosystems are flourishing, driven by increasing demand for smart building technologies, energy efficiency solutions, and sustainable practices in facility operations. Regulatory frameworks, while generally supportive of business operations, present a consistent baseline for service delivery and compliance. The proliferation of outsourced facility management, encompassing single, bundled, and integrated FM models, signals a shift away from traditional in-house operations. End-user demand is diverse, spanning commercial, institutional, public/infrastructure, and industrial sectors, each with unique facility management requirements. Mergers and acquisitions (M&A) are a significant aspect of market dynamics, as evidenced by the March 2022 acquisition of Siemens Gebäudemanagement & -Services (SGS) by Apleona, a move that significantly bolstered Apleona's Austrian presence and integrated approximately EUR 75 Million in annual revenues and 260 employees. This M&A activity indicates a trend towards consolidation and strategic expansion, aimed at achieving economies of scale and broadening service portfolios.

Austria Facility Management Market Industry Insights & Trends

The Austria Facility Management Market is poised for substantial growth, projected to expand significantly between 2025 and 2033. The market size, estimated at approximately XXX Million in 2025, is expected to witness a healthy Compound Annual Growth Rate (CAGR) driven by a confluence of economic, technological, and societal factors. A primary growth driver is the increasing adoption of outsourced facility management services across all end-user segments. Businesses are increasingly recognizing the cost-effectiveness, efficiency, and specialized expertise that outsourced providers bring to managing complex facility operations. This trend is particularly pronounced in the commercial and industrial sectors, where optimizing operational expenses and maintaining high standards of service are critical for competitiveness.

Technological disruptions are fundamentally reshaping the facility management landscape. The integration of the Internet of Things (IoT) for smart building management, predictive maintenance through AI-powered analytics, and the implementation of Building Information Modeling (BIM) are becoming standard expectations. These advancements enable more efficient resource allocation, reduced energy consumption, and enhanced occupant comfort and safety, directly impacting the demand for advanced hard FM and soft FM solutions. Furthermore, the growing emphasis on sustainability and environmental, social, and governance (ESG) principles is compelling organizations to adopt greener facility management practices. This includes energy-efficient retrofitting, waste management optimization, and the implementation of renewable energy sources, creating new service opportunities for facility management providers adept in these areas.

Evolving consumer behaviors, particularly within the workforce, are also influencing the market. The demand for flexible workspaces, enhanced employee well-being, and seamless user experiences within facilities is driving the need for sophisticated soft FM services. This includes catering, cleaning, security, and space management that prioritizes occupant satisfaction and productivity. The rise of hybrid work models necessitates adaptable facility solutions that can accommodate fluctuating occupancy levels and evolving space utilization patterns. Consequently, integrated facility management (IFM) models are gaining traction, offering a holistic approach that combines multiple service lines under a single contract, thereby streamlining operations and improving overall efficiency for clients. The market is also witnessing a greater focus on data-driven decision-making, with clients expecting facility management companies to provide detailed performance metrics and actionable insights to optimize their facility investments.

Key Markets & Segments Leading Austria Facility Management Market

The Austria Facility Management Market is characterized by strong performance across several key segments. Outsourced Facility Management is emerging as the dominant model, eclipsing traditional Inhouse Facility Management. Within outsourced services, Integrated Facility Management (IFM) is experiencing particularly robust growth due to its ability to offer comprehensive, end-to-end solutions. This model appeals to organizations seeking to simplify their vendor landscape and achieve greater operational efficiencies by consolidating multiple facility services under a single point of accountability. Bundled FM, which combines several core services, also holds a significant market share, catering to clients with specific but multi-faceted needs.

In terms of offerings, both Hard FM and Soft FM are critical components of the market, with a growing demand for their synergistic integration. Hard FM, encompassing technical building services like HVAC, electrical systems, and plumbing maintenance, is essential for ensuring the functionality and safety of facilities. Soft FM, covering services such as cleaning, security, catering, and reception, is crucial for occupant well-being and the overall user experience. The increasing emphasis on employee well-being and creating productive work environments is fueling the demand for advanced and personalized Soft FM solutions.

The Commercial sector represents a major end-user segment, driven by the presence of multinational corporations, office complexes, and retail spaces that require sophisticated facility management to maintain operational continuity and enhance brand image. The Public/Infrastructure segment, including government buildings, hospitals, and educational institutions, is another significant contributor, driven by stringent regulatory requirements and a constant need for reliable and efficient facility operations. The Institutional sector, encompassing organizations with specific operational needs, also plays a vital role. While the Industrial segment has its own unique demands, often related to specialized maintenance and safety protocols, the overarching trend points towards a consolidated demand for integrated solutions across all segments.

Drivers for Dominance:

- Economic Growth: A stable and growing Austrian economy underpins demand for facility services across all sectors.

- Increasing Urbanization: Concentration of businesses and populations in urban centers drives the need for efficient facility management in commercial and residential complexes.

- Technological Advancements: Adoption of smart building technologies and automation enhances the appeal and efficiency of outsourced and integrated FM.

- Focus on Core Competencies: Businesses increasingly outsource non-core functions like facility management to focus on their primary operations.

- Sustainability Initiatives: Growing environmental awareness and regulatory push for ESG compliance are driving demand for green facility management solutions.

- Aging Infrastructure: The need for maintenance, upgrades, and modernization of existing public and commercial buildings fuels the Hard FM segment.

Austria Facility Management Market Product Developments

The Austria Facility Management Market is witnessing significant product developments focused on enhancing efficiency, sustainability, and occupant experience. Innovations in smart building technology, including IoT-enabled sensors for real-time monitoring of energy consumption, air quality, and space utilization, are becoming increasingly prevalent. Predictive maintenance software, powered by AI and machine learning, is revolutionizing Hard FM by identifying potential equipment failures before they occur, minimizing downtime and operational costs. In the realm of Soft FM, advancements include the integration of mobile applications for streamlined service requests, automated cleaning solutions, and enhanced security systems utilizing facial recognition and advanced access control. The market relevance of these developments is high, as they directly address the growing demand for data-driven, cost-effective, and sustainable facility management solutions that improve the overall functionality and user satisfaction of built environments.

Challenges in the Austria Facility Management Market Market

The Austria Facility Management Market faces several challenges that impact growth and operational efficiency. A primary restraint is the shortage of skilled labor, particularly in specialized technical roles for Hard FM services. This scarcity can lead to increased labor costs and potential delays in service delivery. Regulatory complexities and evolving compliance standards, though essential for quality, can also present a burden for smaller providers. Furthermore, intense competitive pressure among a significant number of players can lead to price wars and reduced profit margins, especially for basic service offerings. Supply chain disruptions, although less prevalent than in some other sectors, can still impact the availability of critical parts and materials for maintenance and repairs. Quantifiable impacts include an estimated 5-10% increase in operational costs due to labor shortages and potential project delays.

Forces Driving Austria Facility Management Market Growth

Several powerful forces are propelling the growth of the Austria Facility Management Market. Technological advancements are paramount, with the widespread adoption of IoT, AI, and automation driving demand for smart building management, energy efficiency solutions, and predictive maintenance. Economic stability and growth in Austria provide a solid foundation for businesses to invest in professional facility management services, optimizing their operational expenditures. The increasing emphasis on sustainability and ESG compliance is a significant catalyst, pushing organizations to adopt greener practices and invest in services that reduce environmental impact. Furthermore, evolving workplace trends, such as hybrid work models and the growing importance of employee well-being, are driving demand for adaptable and user-centric facility management solutions. Regulatory support for energy efficiency and building standards also plays a crucial role.

Challenges in the Austria Facility Management Market Market

Long-term growth catalysts in the Austria Facility Management Market are deeply intertwined with ongoing innovation and strategic market expansions. The continued development and integration of smart building technologies will remain a cornerstone, offering enhanced data analytics for operational optimization and energy savings. Partnerships and collaborations between facility management providers and technology firms will be crucial for delivering cutting-edge solutions. Market expansion will likely occur through the penetration of IFM models into segments that are currently more fragmented, offering a more holistic and efficient service offering. Furthermore, the increasing focus on the circular economy and sustainable construction practices will open new avenues for specialized facility management services, such as waste valorization and lifecycle management of building materials.

Emerging Opportunities in Austria Facility Management Market

Emerging opportunities within the Austria Facility Management Market are abundant and varied. The growing demand for sustainable facility management presents a significant avenue for growth, with a focus on energy efficiency retrofitting, renewable energy integration, and waste management optimization. The increasing adoption of smart building technologies and the Internet of Things (IoT) creates opportunities for providers offering data analytics, predictive maintenance, and smart space management solutions. The trend towards flexible and hybrid work models is driving demand for adaptable workplace environments, necessitating sophisticated facility services that can cater to fluctuating occupancy. Furthermore, the development of specialized services for niche sectors, such as data centers, healthcare facilities, and the life sciences industry, presents lucrative expansion possibilities.

Leading Players in the Austria Facility Management Market Sector

- Sodexo Facilities Management Services

- SIMACEK Facility Management Group GmbH

- Eurest Austria GmbH

- International Service System Global

- Coldwell Banker Richard Ellis

- Equans

- Leadec

- Apleona GmbH

- VINCI Energies

- Jones Lang LaSalle IP Inc

Key Milestones in Austria Facility Management Market Industry

- March 2022: Apleona acquires Siemens Gebäudemanagement & -Services (SGS), significantly bolstering its foothold in the Austrian market. This strategic acquisition integrated SGS, headquartered in Vienna with offices across Austria and approximately 260 employees generating annual revenues of around EUR 75 Million, into Apleona's extensive European integrated facility management network. This move is expected to enhance Apleona's service portfolio and market reach within Austria, contributing to market consolidation and innovation.

Strategic Outlook for Austria Facility Management Market Market

The strategic outlook for the Austria Facility Management Market is highly positive, driven by sustained demand for integrated and technology-driven solutions. Growth accelerators include the increasing adoption of outsourced facility management, particularly the Integrated Facility Management (IFM) model, which offers comprehensive operational efficiency. The ongoing digital transformation of buildings, with the integration of IoT, AI, and smart technologies, presents significant opportunities for providers offering advanced Hard FM and Soft FM services. Furthermore, the strong emphasis on sustainability and ESG compliance will continue to drive demand for green facility management practices. Strategic opportunities lie in expanding service portfolios to include specialized offerings for emerging sectors, investing in skilled labor development, and forming partnerships to leverage technological innovations. The market is expected to witness further consolidation through M&A activities, leading to stronger, more capable players addressing the evolving needs of Austrian businesses.

Austria Facility Management Market Segmentation

-

1. Type of Facility Management Type

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Mangement

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offerings

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others

Austria Facility Management Market Segmentation By Geography

- 1. Austria

Austria Facility Management Market Regional Market Share

Geographic Coverage of Austria Facility Management Market

Austria Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of Facility Management; Growing Investments in Commercial Properties

- 3.3. Market Restrains

- 3.3.1. Lack of Managerial Awareness

- 3.4. Market Trends

- 3.4.1. Commercial Buildings Remains the Largest Market Share Holder

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austria Facility Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management Type

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Mangement

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offerings

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austria

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sodexo Facilities Management Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SIMACEK Facility Management Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurest Austria GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Service System Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coldwell Banker Richard Ellis

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Equans

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leadec

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Apleona GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VINCI Energies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jones Lang LaSalle IP Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sodexo Facilities Management Services

List of Figures

- Figure 1: Austria Facility Management Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Austria Facility Management Market Share (%) by Company 2025

List of Tables

- Table 1: Austria Facility Management Market Revenue billion Forecast, by Type of Facility Management Type 2020 & 2033

- Table 2: Austria Facility Management Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 3: Austria Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Austria Facility Management Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Austria Facility Management Market Revenue billion Forecast, by Type of Facility Management Type 2020 & 2033

- Table 6: Austria Facility Management Market Revenue billion Forecast, by Offerings 2020 & 2033

- Table 7: Austria Facility Management Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Austria Facility Management Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austria Facility Management Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Austria Facility Management Market?

Key companies in the market include Sodexo Facilities Management Services, SIMACEK Facility Management Group GmbH, Eurest Austria GmbH, International Service System Global, Coldwell Banker Richard Ellis, Equans, Leadec, Apleona GmbH, VINCI Energies, Jones Lang LaSalle IP Inc.

3. What are the main segments of the Austria Facility Management Market?

The market segments include Type of Facility Management Type, Offerings, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of Facility Management; Growing Investments in Commercial Properties.

6. What are the notable trends driving market growth?

Commercial Buildings Remains the Largest Market Share Holder.

7. Are there any restraints impacting market growth?

Lack of Managerial Awareness.

8. Can you provide examples of recent developments in the market?

March 2022 - Apleona acquires Siemens Gebäudemanagement & -Services, bolstering its foothold in Austria. Apleona, a leading European integrated facility management firm headquartered in Neu-Isenburg near Frankfurt am Main, announced the acquisition of Siemens Gebäudemanagement & -Services GmbH (SGS). SGS headquartered in Vienna, with offices around Austria. With around 260 employees, the firm generates annual revenues of approximately EUR 75 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austria Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austria Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austria Facility Management Market?

To stay informed about further developments, trends, and reports in the Austria Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence