Key Insights

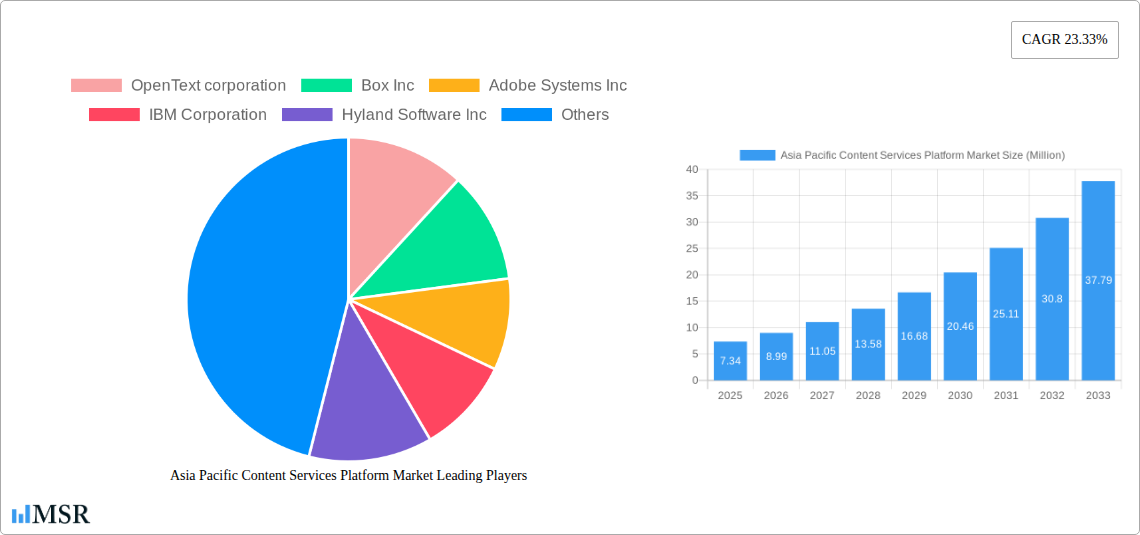

The Asia Pacific Content Services Platform (CSP) market is poised for substantial expansion, projected to reach a market size of USD 7.34 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 23.33% through 2033. This remarkable growth is primarily propelled by the escalating need for efficient document and records management, coupled with the imperative for enhanced information security and governance across diverse industries. The increasing adoption of digital transformation initiatives, the surge in data volumes, and the growing regulatory compliance requirements are significant drivers fueling this market's upward trajectory. Furthermore, the cloud deployment model is gaining considerable traction, offering scalability, flexibility, and cost-effectiveness, thereby accelerating the adoption of CSP solutions among both small and medium-sized enterprises (SMEs) and large enterprises in the region. The BFSI, Healthcare and Life Sciences, and Government sectors are expected to lead this adoption, leveraging CSPs to streamline operations, improve decision-making, and ensure data integrity.

Asia Pacific Content Services Platform Market Market Size (In Million)

Key trends shaping the Asia Pacific CSP market include the growing demand for intelligent automation and AI-powered features within CSP solutions, such as advanced data capture and workflow automation. The emphasis on robust information security and governance frameworks is also a critical trend, as organizations grapple with increasingly sophisticated cyber threats and stringent data privacy regulations. While the market presents immense opportunities, certain restraints, such as the initial implementation costs and the need for specialized IT expertise, might pose challenges for some organizations, particularly SMEs. However, the continuous innovation by leading players like OpenText, Box, and Adobe, alongside the expanding reach of cloud-based offerings, is expected to mitigate these challenges and foster sustained market growth. The region's diverse economic landscape, with countries like China, Japan, India, and South Korea spearheading digital advancements, will continue to be a focal point for CSP market development, driving further innovation and adoption.

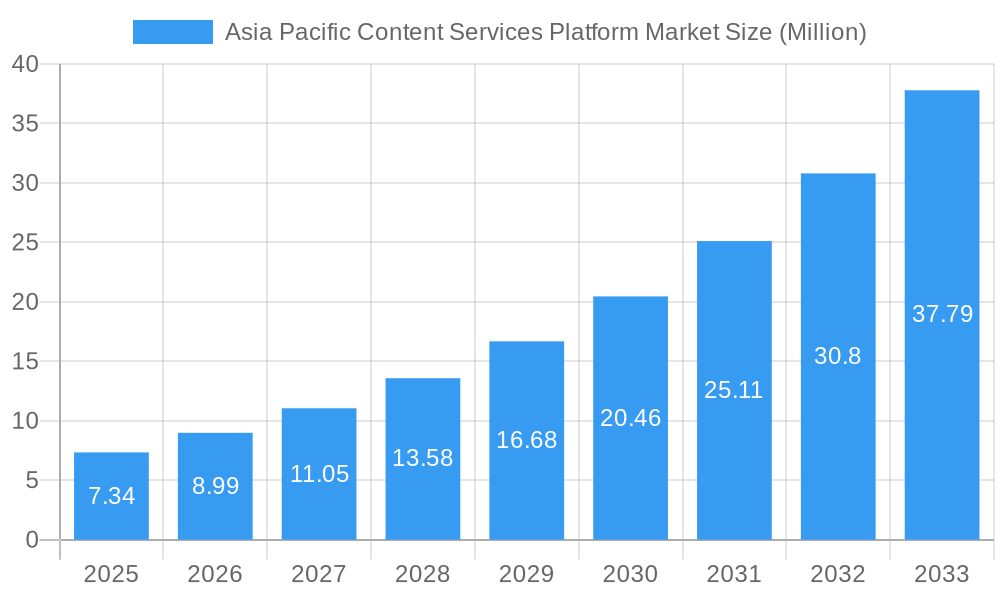

Asia Pacific Content Services Platform Market Company Market Share

This comprehensive report delves into the dynamic Asia Pacific Content Services Platform (CSP) Market, analyzing its trajectory from 2019 to 2033. With a focus on content management solutions, digital transformation, and information governance, this study provides actionable insights for industry stakeholders navigating the evolving landscape. The Asia Pacific CSP market is projected to reach an estimated USD 30,000 Million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 12.50% during the forecast period of 2025-2033. This growth is fueled by increasing adoption of cloud content management, workflow automation, and stringent regulatory compliance demands across key sectors.

Asia Pacific Content Services Platform Market Market Concentration & Dynamics

The Asia Pacific Content Services Platform market exhibits a moderate to high concentration, with a few dominant players holding significant market share, alongside a growing number of agile innovators. Key players are actively investing in research and development to enhance their AI-powered content analysis, intelligent document processing, and cybersecurity features. The innovation ecosystem is thriving, driven by the need for robust records management systems and seamless enterprise content management. Regulatory frameworks, particularly concerning data privacy and residency, are becoming increasingly influential, shaping product development and deployment strategies. Substitute products, such as standalone document management systems and legacy on-premise solutions, are gradually being replaced by integrated CSPs offering a holistic approach to content lifecycle management. End-user trends indicate a strong preference for cloud-based solutions, enhanced collaboration features, and scalable architectures. Mergers and acquisitions (M&A) activities are expected to remain a significant driver of market consolidation and expansion, with recent deal counts indicating strategic moves to acquire complementary technologies and broaden market reach.

Asia Pacific Content Services Platform Market Industry Insights & Trends

The Asia Pacific Content Services Platform market is experiencing unprecedented growth, driven by the imperative for organizations to manage vast amounts of digital information effectively. The escalating volume of unstructured data, coupled with the increasing need for compliance with evolving data protection regulations, is a primary growth driver. Businesses across the region are recognizing CSPs as crucial for streamlining operations, enhancing collaboration, and improving decision-making through readily accessible and well-governed content. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into CSPs, are revolutionizing how content is captured, processed, and analyzed. These advancements enable automated metadata extraction, intelligent content classification, and predictive analytics, significantly boosting operational efficiency. Evolving consumer behaviors, particularly the demand for seamless digital experiences and remote work capabilities, are further accelerating the adoption of cloud-native CSP solutions. The market size is projected to witness substantial expansion, reaching an estimated USD 30,000 Million by 2025, with a projected CAGR of 12.50% from 2025 to 2033. This upward trajectory signifies a strong market appetite for comprehensive content management and governance solutions that can support digital transformation initiatives and foster business agility.

Key Markets & Segments Leading Asia Pacific Content Services Platform Market

The Asia Pacific Content Services Platform Market is characterized by significant regional variations and segment dominance. Cloud deployment is emerging as the leading deployment type, driven by its scalability, flexibility, and cost-effectiveness, with an estimated market share of 65%. Within the Component segment, Solution/Software holds the largest share, with Document and Records Management and Workflow Management being the most sought-after functionalities, collectively accounting for over 50% of the software market. The BFSI and Government and Public Sector industries are the primary end-users, propelled by stringent regulatory requirements and the need for secure handling of sensitive information.

- Dominant Region: East Asia, particularly China, Japan, and South Korea, is expected to lead the market due to rapid digitalization, strong IT infrastructure, and a high concentration of large enterprises.

- Component Dominance:

- Solution/Software: Document and Records Management, Workflow Management, Information Security and Governance.

- Services: Implementation, Consulting, and Support services are crucial for successful CSP adoption.

- Deployment Type Dominance: Cloud is outperforming On-premise due to its agility and cost benefits.

- Organization Size Dominance: Large Enterprises are currently the biggest adopters, but Small and Medium-sized Enterprises (SMEs) are rapidly increasing their adoption due to the availability of more affordable and scalable cloud solutions.

- End-user Industry Dominance:

- BFSI: Driven by regulatory compliance, fraud prevention, and customer data management.

- Government and Public Sector: Mandates for digital record-keeping and citizen service delivery.

- Healthcare and Life Sciences: Critical for managing patient records, research data, and regulatory submissions.

Asia Pacific Content Services Platform Market Product Developments

The Asia Pacific Content Services Platform market is witnessing a surge in innovative product developments aimed at enhancing user experience and operational efficiency. Companies are heavily investing in AI and ML capabilities to offer advanced features like automated document classification, intelligent data extraction, and predictive content analysis. Integration with other enterprise systems, such as CRM and ERP, is becoming standard, creating a unified information ecosystem. Emphasis is placed on enhancing security features, including advanced encryption, granular access controls, and robust audit trails, to meet stringent data privacy regulations. Furthermore, the development of low-code/no-code platforms for building custom workflows is empowering businesses to adapt CSP solutions to their unique needs. These advancements are crucial for staying competitive and addressing the evolving demands for comprehensive content lifecycle management.

Challenges in the Asia Pacific Content Services Platform Market Market

Despite robust growth, the Asia Pacific Content Services Platform market faces several challenges. The high cost of implementing and maintaining advanced CSP solutions can be a significant barrier for SMEs. Data security and privacy concerns, especially with cross-border data flows and varying regional regulations, continue to be a major hurdle. The complex integration of new CSPs with existing legacy systems often leads to technical difficulties and project delays. Moreover, a shortage of skilled professionals proficient in content management technologies and data governance practices can impede widespread adoption and effective utilization of these platforms. Overcoming these challenges will be crucial for unlocking the full potential of CSPs in the region.

Forces Driving Asia Pacific Content Services Platform Market Growth

Several key forces are propelling the growth of the Asia Pacific Content Services Platform market. The escalating volume of digital data across all industries necessitates robust solutions for management and governance. Digital transformation initiatives are pushing organizations to adopt modern content management strategies for improved efficiency and collaboration. Increasingly stringent regulatory compliance requirements, such as GDPR and local data privacy laws, are mandating secure and auditable content handling. Furthermore, the growing adoption of cloud computing provides a scalable and flexible foundation for CSP deployment, making these solutions more accessible and cost-effective. The demand for enhanced customer experiences and streamlined internal processes further amplifies the need for integrated content services.

Challenges in the Asia Pacific Content Services Platform Market Market

Long-term growth catalysts for the Asia Pacific Content Services Platform market lie in continued innovation and strategic market expansion. The increasing integration of AI and ML will unlock deeper insights from content, driving predictive analytics and intelligent automation. Partnerships and collaborations between CSP vendors and technology providers will foster integrated ecosystems, offering comprehensive solutions. As emerging economies in the region mature, increased investment in digital infrastructure will create new market opportunities. Furthermore, the development of industry-specific CSP solutions tailored to the unique needs of sectors like healthcare and logistics will drive deeper penetration and sustained growth.

Emerging Opportunities in Asia Pacific Content Services Platform Market

Emerging opportunities in the Asia Pacific Content Services Platform market are abundant, driven by technological advancements and evolving business needs. The growing adoption of AI-powered analytics within CSPs presents opportunities for enhanced data-driven decision-making and predictive insights. The increasing demand for low-code/no-code development platforms within CSPs empowers businesses to create customized workflows and applications, fostering agility. Furthermore, the expansion of content security and governance solutions to meet stringent regional data privacy regulations, such as those in China and Southeast Asia, offers significant growth potential. The growing trend of remote work and hybrid work models is also creating opportunities for CSPs that offer robust collaboration and document sharing functionalities.

Leading Players in the Asia Pacific Content Services Platform Market Sector

- OpenText Corporation

- Box Inc

- Adobe Systems Inc

- IBM Corporation

- Hyland Software Inc

- Microsoft Corporation

- M-Files Inc

- Hewlett Packard Enterprise (Micro Focus)

- Oracle Corporation

- Laserfiche Inc

Key Milestones in Asia Pacific Content Services Platform Market Industry

- April 2022: Box launched Box Canvas, a part of Box's larger strategy to provide a solution that manages the life cycle of an organization's most crucial information. This contains capabilities for publication, eSignatures, statistics, and many more, in addition to creating content and interaction. The new tool allows customers to communicate graphically in real-time or sequentially while staying within the Box platform.

- March 2022: Hyland introduced Content Services and Intelligent Automation product enhancements for organizations so that they can synchronize end-to-end automating with the completely redesigned Web Manager, which offers improved security, user control, and advanced analytical insights.

Strategic Outlook for Asia Pacific Content Services Platform Market Market

The strategic outlook for the Asia Pacific Content Services Platform Market is highly optimistic, driven by the sustained digital transformation efforts across the region. Key growth accelerators include the continuous integration of AI and ML for intelligent automation and advanced analytics, enhancing the value proposition of CSPs. The increasing demand for secure and compliant content management solutions, particularly in regulated industries, will continue to fuel adoption. Furthermore, strategic partnerships and the expansion of cloud-native offerings will cater to the growing needs of SMEs. The market is poised for significant expansion as organizations prioritize efficient information governance and leverage content as a strategic asset for competitive advantage.

Asia Pacific Content Services Platform Market Segmentation

-

1. Component

-

1.1. Solution/Software

- 1.1.1. Document and Records Management

- 1.1.2. Data Capture

- 1.1.3. Workflow Management

- 1.1.4. Information Security and Governance

- 1.1.5. Case Management

- 1.1.6. Other Solutions

- 1.2. Services

-

1.1. Solution/Software

-

2. Deployment Type

- 2.1. On-premise

- 2.2. Cloud

-

3. Organization Size

- 3.1. Small and Medium-sized Enterprises

- 3.2. Large Enterprises

-

4. End-user Industry

- 4.1. BFSI

- 4.2. Government and Public Sector

- 4.3. Healthcare and Life Sciences

- 4.4. IT, Telecom, Retail, & E-commerce

- 4.5. Transportation and Logistics

- 4.6. Other End-user Industries

Asia Pacific Content Services Platform Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Content Services Platform Market Regional Market Share

Geographic Coverage of Asia Pacific Content Services Platform Market

Asia Pacific Content Services Platform Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of SMAC Technologies; Increase of Digital Content Across the Enterprises; Demand for Delivering Contextualized User Experience

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. The Solution and Software Segment is Expected to Accounted for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution/Software

- 5.1.1.1. Document and Records Management

- 5.1.1.2. Data Capture

- 5.1.1.3. Workflow Management

- 5.1.1.4. Information Security and Governance

- 5.1.1.5. Case Management

- 5.1.1.6. Other Solutions

- 5.1.2. Services

- 5.1.1. Solution/Software

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium-sized Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. BFSI

- 5.4.2. Government and Public Sector

- 5.4.3. Healthcare and Life Sciences

- 5.4.4. IT, Telecom, Retail, & E-commerce

- 5.4.5. Transportation and Logistics

- 5.4.6. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. China Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 7. Japan Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 8. India Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 9. South Korea Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 10. Taiwan Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 11. Australia Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Asia-Pacific Asia Pacific Content Services Platform Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 OpenText corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Box Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Adobe Systems Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 IBM Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hyland Software Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Microsoft Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 M-Files Inc *List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hewlett Packard enterprise (Micro Focus)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Oracle Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Laserfiche Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 OpenText corporation

List of Figures

- Figure 1: Asia Pacific Content Services Platform Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Content Services Platform Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 4: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 5: Asia Pacific Content Services Platform Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: China Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Taiwan Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia-Pacific Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 17: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 18: Asia Pacific Content Services Platform Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia Pacific Content Services Platform Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: New Zealand Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Singapore Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Thailand Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Vietnam Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Philippines Asia Pacific Content Services Platform Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Content Services Platform Market?

The projected CAGR is approximately 23.33%.

2. Which companies are prominent players in the Asia Pacific Content Services Platform Market?

Key companies in the market include OpenText corporation, Box Inc, Adobe Systems Inc, IBM Corporation, Hyland Software Inc, Microsoft Corporation, M-Files Inc *List Not Exhaustive, Hewlett Packard enterprise (Micro Focus), Oracle Corporation, Laserfiche Inc.

3. What are the main segments of the Asia Pacific Content Services Platform Market?

The market segments include Component, Deployment Type, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of SMAC Technologies; Increase of Digital Content Across the Enterprises; Demand for Delivering Contextualized User Experience.

6. What are the notable trends driving market growth?

The Solution and Software Segment is Expected to Accounted for the Largest Market Share.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

April 2022 - Box launched Box Canvas, a part of Box's larger strategy to provide a solution that manages the life cycle of an organization's most crucial information. This contains capabilities for publication, eSignatures, statistics, and many more, in addition to creating content and interaction. The new tool allows customers to communicate graphically in real-time or sequentially while staying within the Box platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Content Services Platform Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Content Services Platform Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Content Services Platform Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Content Services Platform Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence