Key Insights

The Ireland Data Center Cooling Market is projected for substantial expansion, driven by the increasing demand for robust and efficient cooling solutions to support evolving data processing needs across diverse industries. With an estimated market size of 206.52 million and a projected Compound Annual Growth Rate (CAGR) of 21.7% between 2025 and 2033, the market is poised for sustained growth. Key catalysts include the rapid adoption of cloud computing, the proliferation of Artificial Intelligence (AI) and Machine Learning (ML) workloads, and the continuous expansion of hyperscale data centers, leveraging Ireland's strategic European location. The growing density of IT equipment necessitates advanced cooling technologies to maintain optimal operating temperatures, prevent hardware failures, and enhance energy efficiency, thereby reducing operational costs. Furthermore, a heightened focus on sustainability and environmental regulations is accelerating the adoption of eco-friendly cooling methods.

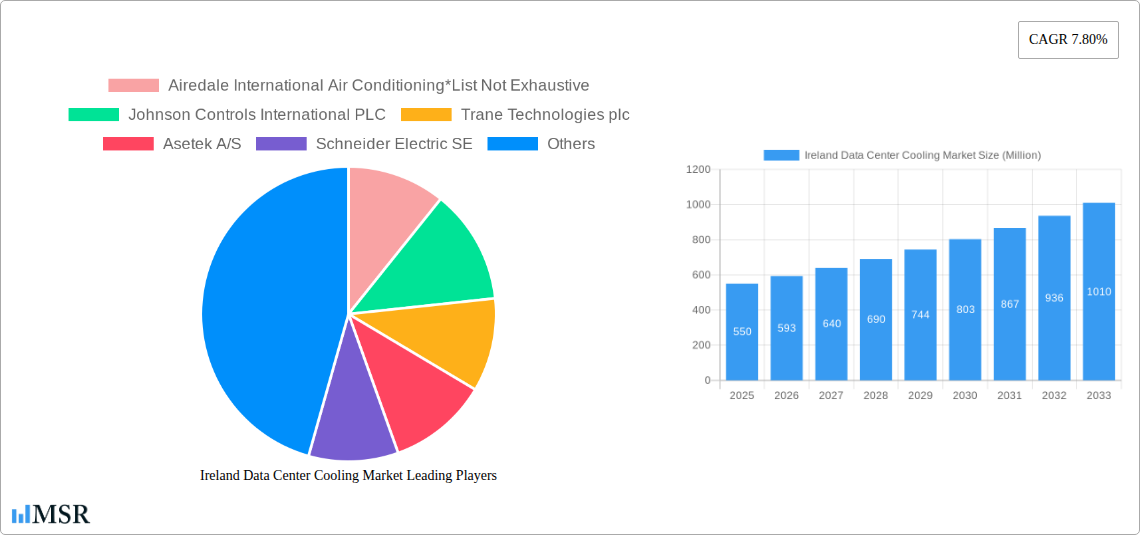

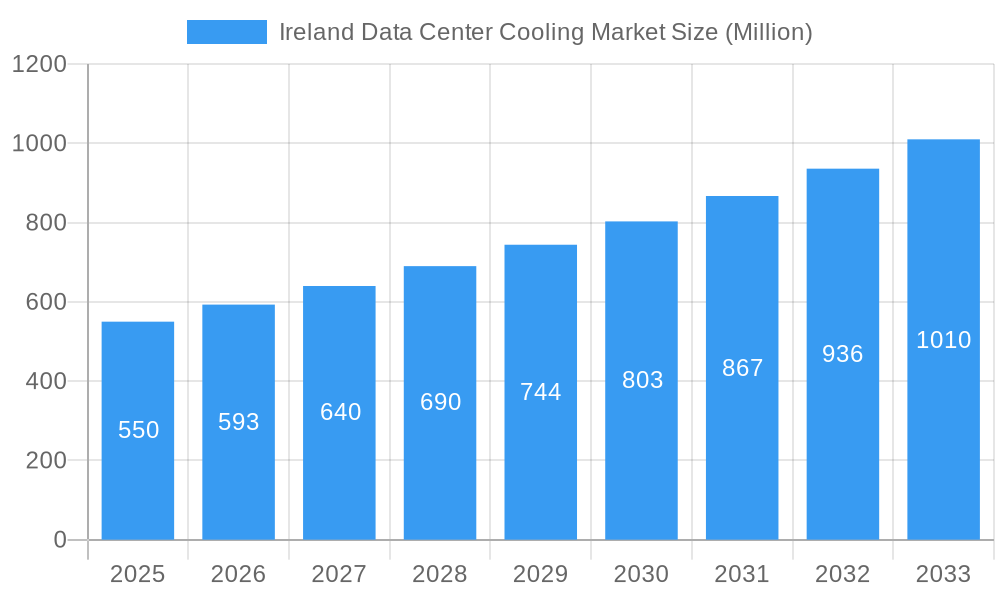

Ireland Data Center Cooling Market Market Size (In Million)

Market segmentation reveals a dynamic landscape. Air-based cooling, including chillers, economizers, and CRAH units, continues to command a significant share, fulfilling foundational cooling requirements. However, liquid-based cooling technologies, such as immersion cooling and direct-to-chip cooling, are gaining significant traction due to their superior thermal management capabilities for high-density computing environments and their potential for substantial energy savings. Hyperscale operators, driven by massive scalability needs, are primary consumers of these solutions, followed by enterprise data centers prioritizing on-premise infrastructure and colocation facilities serving a varied clientele. The IT and Telecom sector remains the dominant end-user industry, with notable growth anticipated from Healthcare, Media and Entertainment, and Federal and Institutional Agencies, all experiencing an increase in data-intensive operations. Leading players such as Schneider Electric, Vertiv Group Corp, and Johnson Controls International PLC are at the forefront, delivering innovative solutions to meet these evolving demands, with an increasing emphasis on AI-driven cooling optimization and sustainable practices.

Ireland Data Center Cooling Market Company Market Share

This comprehensive report provides an in-depth analysis of the Ireland Data Center Cooling Market, offering critical insights into market dynamics, technological advancements, and future growth trajectories. Examining the period from 2019 to 2033, with a base and estimated year of 2025, this report serves as an indispensable resource for industry stakeholders, including data center operators, IT infrastructure providers, cooling solution manufacturers, and investors looking to capitalize on the burgeoning Irish data center landscape.

Discover intricate details of market concentration, innovation ecosystems, and regulatory frameworks shaping Ireland's data center cooling sector. Our analysis delves into evolving end-user trends, the impact of substitute products, and strategic mergers and acquisitions activity.

Explore key drivers propelling market growth, the disruptive influence of technological innovations, and shifting consumer behaviors that are redefining demand. This report quantifies the market size and forecasts Compound Annual Growth Rates (CAGR) to provide a clear roadmap for strategic decision-making.

Gain a granular understanding of dominant markets and segments, from advanced Air-based Cooling technologies (Chillers, Economizers, CRAH units) to cutting-edge Liquid-based Cooling systems (Immersion Cooling, Direct-to-chip Cooling, Rear-door Heat Exchangers). We dissect performance across Hyperscaler (Owned and Leased), Enterprise (On-premise), and Colocation segments, and analyze the influence of end-user industries such as IT and Telecom, Retail and Consumer Goods, Healthcare, Media and Entertainment, and Federal and Institutional Agencies.

Ireland Data Center Cooling Market Market Concentration & Dynamics

The Ireland Data Center Cooling Market exhibits a moderate to high level of market concentration, with a few key players dominating the landscape. Innovation ecosystems are thriving, driven by increasing demand for energy-efficient and high-performance cooling solutions. Regulatory frameworks, particularly those focused on sustainability and energy efficiency, are playing an increasingly significant role in shaping market dynamics and product development. Substitute products are emerging, but their market penetration remains limited compared to established cooling technologies. End-user trends are heavily influenced by the rapid expansion of hyperscale data centers and the growing adoption of edge computing, necessitating advanced cooling capabilities. Merger and acquisition activities are on the rise as companies seek to consolidate market share, acquire new technologies, and expand their service offerings. Key players are actively investing in research and development to enhance cooling efficiency and reduce the environmental impact of data center operations.

- Market Share Dynamics: Leading vendors are focused on expanding their presence in the rapidly growing Irish market.

- M&A Activities: Several strategic acquisitions are anticipated to consolidate the market and drive innovation.

Ireland Data Center Cooling Market Industry Insights & Trends

The Ireland Data Center Cooling Market is poised for substantial growth, driven by a confluence of factors including the relentless expansion of digital infrastructure, the proliferation of data-intensive applications, and a strong governmental push towards sustainability and renewable energy. Ireland's strategic location in Europe, coupled with favorable business conditions, continues to attract significant foreign direct investment in the data center sector, particularly from hyperscale providers. This influx of investment fuels the demand for sophisticated cooling solutions that can manage the increasing heat loads generated by high-density computing environments. Technological disruptions are at the forefront of market evolution, with a discernible shift towards liquid-based cooling technologies, such as immersion cooling and direct-to-chip solutions, offering superior thermal management and energy efficiency compared to traditional air-based systems. Evolving consumer behaviors, characterized by the ever-increasing consumption of digital content and services, are indirectly contributing to the demand for more powerful and efficient data processing capabilities, thereby escalating the need for advanced data center cooling. The market size is projected to reach approximately $650 Million by 2025, with an estimated CAGR of xx% during the forecast period of 2025–2033. The historical period (2019–2024) saw consistent growth, laying the foundation for future expansion.

Key Markets & Segments Leading Ireland Data Center Cooling Market

The Ireland Data Center Cooling Market is characterized by strong performance across several key segments, driven by specific demands and technological adoptions. The IT and Telecom end-user industry segment is undoubtedly the most dominant, owing to Ireland's position as a major hub for cloud computing and digital services. The increasing deployment of 5G infrastructure and the ongoing digital transformation initiatives further bolster demand within this sector.

Within Cooling Technology, Air-based Cooling continues to hold a significant share, particularly Chillers and Economizers and CRAH (Computer Room Air Handler) units, which are essential for maintaining optimal operating temperatures in existing and new data center builds. However, Liquid-based Cooling technologies are experiencing rapid growth. Immersion Cooling, in particular, is gaining traction due to its exceptional thermal efficiency and suitability for high-density computing, aligning with the sustainability goals of major data center operators.

In terms of Type, the Hyperscaler (Owned and Leased) segment is a primary growth engine. Hyperscale operators, with their massive infrastructure investments, require scalable and highly efficient cooling solutions to manage their extensive data processing needs. The Colocation segment also plays a crucial role, as colocation providers are increasingly investing in advanced cooling infrastructure to attract and retain clients.

- Dominant End-user Industry: The IT and Telecom sector, driven by hyperscale expansion and digital transformation, leads demand for robust cooling solutions.

- Growth in Liquid Cooling: Immersion Cooling and Direct-to-chip Cooling are emerging as critical technologies for managing high heat densities and improving energy efficiency.

- Hyperscale Dominance: Hyperscale data centers, both owned and leased, represent the largest consumers of advanced cooling infrastructure.

- Drivers for Air-based Cooling: Chillers, Economizers, and CRAH units remain foundational for many data center deployments, ensuring reliable thermal management.

Ireland Data Center Cooling Market Product Developments

Product developments in the Ireland Data Center Cooling Market are increasingly focused on enhancing energy efficiency, improving thermal management capabilities, and addressing the specific needs of emerging technologies like AI and high-performance computing. Innovations in liquid cooling solutions, such as advancements in immersion cooling fluids and direct-to-chip cooling systems, are offering superior heat dissipation for high-density racks. Furthermore, manufacturers are developing smart cooling systems that leverage AI and machine learning to optimize performance, reduce energy consumption, and proactively identify potential issues. The market is also witnessing the development of modular and scalable cooling solutions that can adapt to the dynamic needs of data center operators.

Challenges in the Ireland Data Center Cooling Market Market

The Ireland Data Center Cooling Market faces several challenges that could impede its growth trajectory. High upfront investment costs associated with advanced cooling technologies, particularly liquid-based solutions, can be a significant barrier for some operators. The availability of skilled labor for installation, maintenance, and repair of complex cooling systems is another concern. Stringent environmental regulations, while driving innovation, can also create compliance hurdles and increase operational complexity. Furthermore, supply chain disruptions, exacerbated by global events, can impact the timely delivery of critical components and equipment, leading to project delays. Competitive pressures among cooling solution providers can also lead to pricing challenges.

Forces Driving Ireland Data Center Cooling Market Growth

Several powerful forces are driving the growth of the Ireland Data Center Cooling Market. The exponential growth in data generation and consumption, fueled by cloud computing, big data analytics, IoT, and AI, necessitates the expansion of data center capacity, thereby increasing demand for cooling solutions. Ireland's strategic position as a European digital hub continues to attract significant hyperscale investments, further stimulating market expansion. Government initiatives promoting digital infrastructure development and sustainability are also key accelerators. Moreover, the increasing focus on energy efficiency and reducing the carbon footprint of data centers is driving the adoption of advanced, eco-friendly cooling technologies.

Challenges in the Ireland Data Center Cooling Market Market

Long-term growth catalysts for the Ireland Data Center Cooling Market lie in continuous innovation and strategic partnerships. The development of next-generation cooling technologies, such as advanced immersion cooling and highly efficient free cooling systems, will be crucial. Furthermore, strategic alliances between cooling solution providers, data center developers, and technology manufacturers will foster integrated solutions and accelerate market adoption. Expansion into emerging areas like edge data centers and specialized high-performance computing environments will also contribute to sustained growth. The increasing emphasis on circular economy principles and the development of more sustainable cooling solutions will further shape the long-term market landscape.

Emerging Opportunities in Ireland Data Center Cooling Market

Emerging opportunities in the Ireland Data Center Cooling Market are multifaceted. The rapid growth of edge computing presents a significant opportunity for compact, efficient, and localized cooling solutions. The increasing demand for sustainable and green data centers is driving interest in advanced liquid cooling technologies and renewable energy integration. Furthermore, the expansion of specialized data centers for AI and machine learning workloads, which generate immense heat, offers a niche but high-value market segment. The development of intelligent cooling systems that utilize AI and IoT for predictive maintenance and optimized performance also represents a significant growth avenue.

Leading Players in the Ireland Data Center Cooling Market Sector

- Airedale International Air Conditioning

- Johnson Controls International PLC

- Trane Technologies plc

- Asetek A/S

- Schneider Electric SE

- Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- Iceotope Technologies Limited

- Fujitsu General Limited

- Stulz GmbH

- Vertiv Group Corp

- Rittal GMBH & Co KG

Key Milestones in Ireland Data Center Cooling Market Industry

- July 2022: Iceotope Technologies collaborated with Intel and Hewlett Packard Enterprise (HPE) to significantly reduce energy consumption in edge data centers by 30%, advancing net-zero sustainability goals through precision cooling technology integration.

- July 2022: nVent Electric plc announced a strategic investment in Iceotope Technologies Ltd. This alliance leverages nVent's accessories and energy-efficient products with Iceotope's immersion cooling technology, enhancing modular solutions for data centers, edge computing, and high-performance cooling.

Strategic Outlook for Ireland Data Center Cooling Market Market

The strategic outlook for the Ireland Data Center Cooling Market is exceptionally promising, driven by sustained demand for digital infrastructure and a strong commitment to sustainability. Growth accelerators include the continued expansion of hyperscale facilities, the increasing adoption of liquid cooling technologies for enhanced efficiency, and the development of innovative solutions for the burgeoning edge computing segment. Strategic investments in research and development, coupled with collaborative partnerships, will be pivotal in addressing the evolving thermal management challenges. The market is poised for robust growth as Ireland solidifies its position as a leading European data center destination.

Ireland Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Air-based Cooling Technologies

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-chip Cooling

- 1.2.3. Rear-door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscaler (Owned and Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Federal and Institutional Agencies

- 3.6. Other End-user Industries

Ireland Data Center Cooling Market Segmentation By Geography

- 1. Ireland

Ireland Data Center Cooling Market Regional Market Share

Geographic Coverage of Ireland Data Center Cooling Market

Ireland Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Rack Power Density; Increasing Trend of High-Performance Computing across Europe

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Cooling Infrastructure.; Cooling machines in many data centers are not equipped for the changing climate.

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment holds the major share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ireland Data Center Cooling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Air-based Cooling Technologies

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-chip Cooling

- 5.1.2.3. Rear-door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscaler (Owned and Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Federal and Institutional Agencies

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ireland

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Airedale International Air Conditioning*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Controls International PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trane Technologies plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Asetek A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Iceotope Technologies Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fujitsu General Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stulz GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rittal GMBH & Co KG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Airedale International Air Conditioning*List Not Exhaustive

List of Figures

- Figure 1: Ireland Data Center Cooling Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Ireland Data Center Cooling Market Share (%) by Company 2025

List of Tables

- Table 1: Ireland Data Center Cooling Market Revenue million Forecast, by Cooling Technology 2020 & 2033

- Table 2: Ireland Data Center Cooling Market Revenue million Forecast, by Type 2020 & 2033

- Table 3: Ireland Data Center Cooling Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Ireland Data Center Cooling Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Ireland Data Center Cooling Market Revenue million Forecast, by Cooling Technology 2020 & 2033

- Table 6: Ireland Data Center Cooling Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: Ireland Data Center Cooling Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Ireland Data Center Cooling Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ireland Data Center Cooling Market?

The projected CAGR is approximately 21.7%.

2. Which companies are prominent players in the Ireland Data Center Cooling Market?

Key companies in the market include Airedale International Air Conditioning*List Not Exhaustive, Johnson Controls International PLC, Trane Technologies plc, Asetek A/S, Schneider Electric SE, Mitsubishi Electric Hydronics & IT Cooling Systems S p A, Iceotope Technologies Limited, Fujitsu General Limited, Stulz GmbH, Vertiv Group Corp, Rittal GMBH & Co KG.

3. What are the main segments of the Ireland Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 206.52 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Rack Power Density; Increasing Trend of High-Performance Computing across Europe.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment holds the major share..

7. Are there any restraints impacting market growth?

The High Costs Associated with Cooling Infrastructure.; Cooling machines in many data centers are not equipped for the changing climate..

8. Can you provide examples of recent developments in the market?

July 2022: Iceotope Technologies, a leading provider of IT cooling solutions, collaborated with Intel and Hewlett Packard Enterprise (HPE) to significantly reduce energy consumption in edge data centers by 30%. The joint initiative is aimed at advancing their shared commitment to achieving net-zero sustainability goals by integrating Iceotope's precision cooling technology into edge data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ireland Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ireland Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ireland Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Ireland Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence