Key Insights

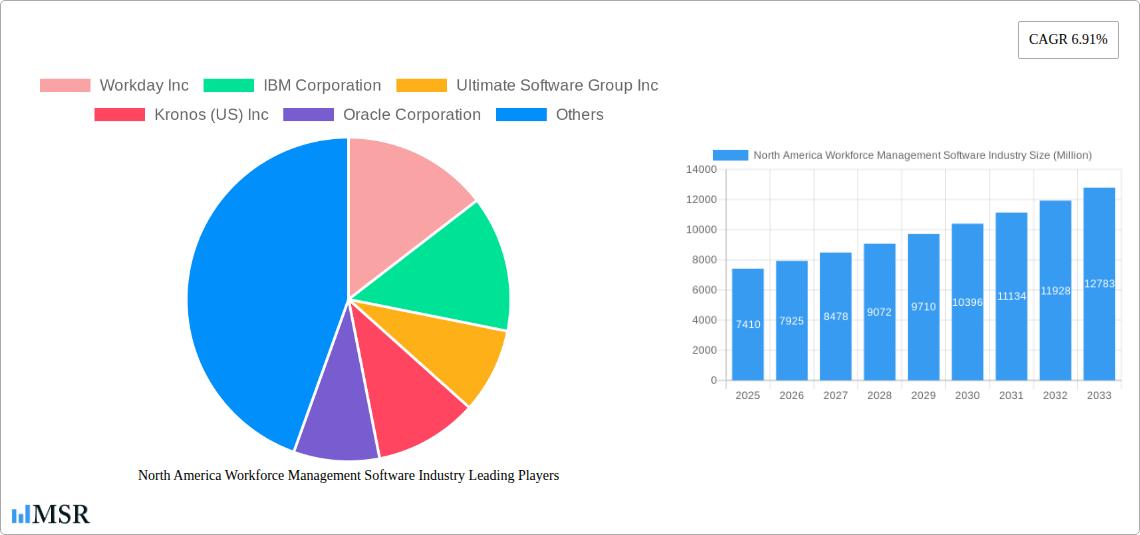

The North American Workforce Management Software market is poised for robust expansion, projected to reach a substantial USD 7.41 billion in 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 6.91%, indicating sustained and dynamic market development throughout the forecast period of 2025-2033. Key drivers behind this surge include the increasing need for organizations to optimize labor costs, enhance employee productivity, and ensure compliance with complex labor regulations across diverse industries. The escalating adoption of cloud-based solutions, offering greater scalability, flexibility, and accessibility, is a significant trend transforming the market. Furthermore, the growing emphasis on data-driven decision-making, empowered by advanced workforce analytics, is compelling businesses to invest in sophisticated WFM solutions. The market is segmented into crucial components such as Workforce Scheduling and Analytics, Time and Attendance Management, Performance and Goal Management, and Absence and Leave Management, each contributing to the overall value proposition of comprehensive workforce oversight.

North America Workforce Management Software Industry Market Size (In Billion)

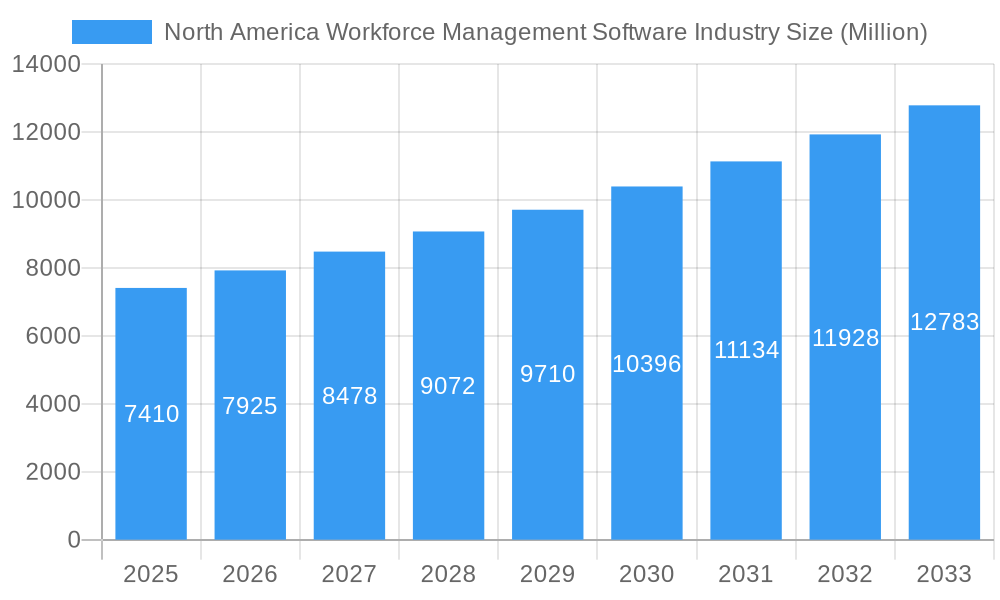

The North American market for workforce management software is characterized by a competitive landscape featuring established players like Workday Inc., IBM Corporation, Ultimate Software Group Inc., and Oracle Corporation, alongside agile innovators such as WorkForce Software LLC. These companies are continuously enhancing their offerings to address the evolving needs of end-user industries including BFSI, Consumer Goods and Retail, Healthcare, and Manufacturing. While the market benefits from strong adoption in the United States, Canada, and Mexico, potential restraints could include the initial investment costs associated with advanced WFM systems and the ongoing need for skilled IT professionals to manage and implement these solutions effectively. However, the inherent benefits of improved operational efficiency, reduced administrative burden, and enhanced employee engagement are expected to outweigh these challenges, propelling sustained market growth and innovation in the coming years.

North America Workforce Management Software Industry Company Market Share

Unlocking Efficiency: A Deep Dive into the North America Workforce Management Software Industry Market (2019–2033)

This comprehensive report offers an in-depth analysis of the North America Workforce Management Software industry, providing critical insights for stakeholders seeking to navigate this dynamic and rapidly evolving market. With a study period spanning from 2019 to 2033, the report leverages a base year of 2025 and a forecast period of 2025–2033, building upon historical data from 2019–2024. Discover key market dynamics, growth drivers, emerging trends, and strategic opportunities within this essential sector. This report is your definitive guide to understanding the North American workforce management landscape, identifying areas for strategic investment, and optimizing operational efficiency through advanced software solutions.

North America Workforce Management Software Industry Market Concentration & Dynamics

The North America Workforce Management Software market is characterized by a moderate to high level of concentration, driven by the presence of established enterprise software giants and specialized niche players. Innovation ecosystems are thriving, fueled by significant R&D investments in AI, machine learning, and predictive analytics to enhance workforce scheduling, workforce analytics, and performance and goal management. Regulatory frameworks, particularly concerning labor laws and data privacy (e.g., GDPR, CCPA), are increasingly influencing software design and compliance features. Substitute products, such as manual processes or fragmented point solutions, are steadily being displaced by integrated cloud-based workforce management solutions. End-user trends indicate a strong demand for flexible work arrangements, remote workforce management, and employee self-service capabilities, pushing vendors to develop more agile and user-friendly platforms. Merger and acquisition (M&A) activities remain a key dynamic, with approximately 15-25 M&A deals recorded annually over the historical period, as larger players seek to acquire innovative technologies and expand their market share. Key players like Workday Inc., IBM Corporation, Oracle Corporation, and Kronos (US) Inc. hold significant market share, estimated to be between 15%-25% collectively, driving consolidation and competitive differentiation in areas like time and attendance management and absence and leave management.

North America Workforce Management Software Industry Industry Insights & Trends

The North America Workforce Management Software market is projected to experience robust growth, with an estimated market size of $12,500 Million in the base year of 2025, expanding at a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This substantial growth is primarily propelled by the increasing need for organizations to optimize labor costs, improve employee productivity, and ensure compliance with complex labor regulations. Technological disruptions, particularly the widespread adoption of cloud computing and advancements in Artificial Intelligence (AI) and Machine Learning (ML), are revolutionizing the capabilities of these software solutions. AI-powered predictive analytics are enabling more accurate workforce scheduling, reducing overtime expenses and preventing understaffing. Furthermore, the growing emphasis on employee experience and engagement is driving the demand for modules focused on performance and goal management, talent development, and continuous feedback. Evolving consumer behaviors, influenced by the gig economy and the demand for work-life balance, are pushing companies to adopt flexible workforce management strategies, including remote work support and on-demand staffing, which are increasingly being integrated into comprehensive WFM platforms. The shift towards digital transformation across all industries, from BFSI and Healthcare to Consumer Goods and Retail and Manufacturing, is a fundamental driver, as businesses recognize WFM software as a critical component for operational efficiency and strategic human capital management. The market is also witnessing a rise in the adoption of integrated suites over standalone solutions, as businesses seek streamlined operations and a unified view of their workforce data.

Key Markets & Segments Leading North America Workforce Management Software Industry

The cloud deployment mode stands as the dominant segment within the North America Workforce Management Software industry, accounting for an estimated 70% of the market share in 2025. This dominance is fueled by the inherent advantages of cloud solutions: scalability, flexibility, reduced IT infrastructure costs, and seamless updates, all of which are critical for businesses across diverse industries. The Healthcare sector is a particularly strong adopter, driven by the need for intricate scheduling to manage 24/7 operations, ensure compliance with patient-to-staff ratios, and optimize the deployment of highly specialized personnel. Economic growth and an increasing focus on operational efficiency are also significant drivers for this segment.

The Workforce Scheduling and Workforce Analytics segment is another leading force, projected to capture a substantial portion of the market. This is due to the critical need for businesses to accurately forecast labor demands, optimize staffing levels, and gain actionable insights into workforce performance, productivity, and potential risks. The surge in data availability and the advancements in analytics capabilities are making this segment indispensable for strategic decision-making.

In terms of end-user industries, Consumer Goods and Retail and Manufacturing are pivotal markets, representing a combined market share of approximately 35% in 2025. These sectors are characterized by fluctuating demand, seasonal peaks, and a need for precise labor allocation to manage production lines, inventory, and customer service effectively. The drive for supply chain optimization and cost reduction further propels the adoption of sophisticated WFM solutions in these areas.

Dominant Deployment Mode:

- Cloud: Driven by cost-effectiveness, scalability, remote accessibility, and rapid deployment.

- On-premise: Still relevant for highly regulated industries or those with specific data security concerns, though its market share is gradually declining.

Key Segment Focus:

- Workforce Scheduling and Workforce Analytics: Essential for operational efficiency, cost control, and strategic workforce planning.

- Time and Attendance Management: Fundamental for accurate payroll processing and compliance.

- Performance and Goal Management: Growing in importance for employee engagement, development, and productivity enhancement.

Leading End-User Industries:

- Consumer Goods and Retail: High volume of hourly workers, complex scheduling needs, and demand fluctuations.

- Manufacturing: Production line optimization, shift management, and compliance with safety regulations.

- Healthcare: Critical 24/7 operations, specialized staff scheduling, and stringent regulatory requirements.

- BFSI: Growing adoption for compliance and efficient branch operations.

North America Workforce Management Software Industry Product Developments

Recent product developments in the North America Workforce Management Software industry are heavily focused on leveraging Artificial Intelligence (AI) and Machine Learning (ML) to deliver predictive insights and automation. Innovations include AI-driven workforce scheduling that dynamically adjusts to real-time demand, intelligent workforce analytics for identifying productivity bottlenecks, and automated performance feedback loops. Enhanced mobile capabilities for employee self-service and seamless integration with other HR systems are also key trends. For instance, the launch of EY.ai Workforce by EY and IBM in October 2023 exemplifies the integration of AI into HR processes, promising significant productivity gains. WorkForce Software's presence at the Gartner ReimagineHR Conference in October 2022 highlighted modern solutions for global employers, showcasing the impact of digital HR transformation. Furthermore, ActiveOps PLC's June 2022 launch of CaseworkiQ addresses operational efficiency for large caseloads, demonstrating a commitment to specialized workforce optimization. These advancements empower businesses with greater agility, improved employee engagement, and enhanced operational control.

Challenges in the North America Workforce Management Software Industry Market

The North America Workforce Management Software industry faces several challenges that can impede growth and adoption.

- Integration Complexity: Integrating WFM solutions with existing legacy HR and payroll systems can be a significant hurdle, requiring substantial IT resources and potentially leading to implementation delays.

- Data Security and Privacy Concerns: With increasing data breaches and stringent privacy regulations, ensuring robust data security and compliance remains a paramount concern for businesses, especially in sensitive sectors like healthcare.

- Cost of Implementation and Adoption: While cloud solutions offer long-term savings, the initial investment in software licenses, implementation services, and employee training can be substantial, particularly for small and medium-sized enterprises (SMEs).

- Resistance to Change: Overcoming employee and management resistance to adopting new technologies and processes can be a significant barrier to successful WFM implementation.

Forces Driving North America Workforce Management Software Industry Growth

Several powerful forces are propelling the growth of the North America Workforce Management Software market.

- Digital Transformation Initiatives: The overarching trend of digital transformation across all industries necessitates modern HR solutions, with WFM software playing a crucial role in optimizing human capital.

- Demand for Cost Optimization: Businesses are increasingly focused on managing labor costs effectively. WFM software provides tools for reducing overtime, minimizing absenteeism, and improving overall labor productivity.

- Evolving Labor Regulations: Complex and ever-changing labor laws and compliance requirements drive the need for sophisticated WFM solutions that automate compliance processes and reduce the risk of penalties.

- Advancements in AI and Analytics: The integration of AI and machine learning is enhancing WFM capabilities, offering predictive insights, intelligent automation, and personalized employee experiences.

Challenges in the North America Workforce Management Software Industry Market

Long-term growth catalysts in the North America Workforce Management Software market are deeply rooted in continuous innovation and strategic market expansion. The relentless pursuit of Artificial Intelligence (AI) and Machine Learning (ML) integration will unlock unprecedented levels of predictive workforce analytics, enabling proactive decision-making and hyper-personalized employee experiences. Furthermore, strategic partnerships between WFM software providers and complementary HR technology vendors will create comprehensive, end-to-end solutions, simplifying the HR tech stack for businesses. Market expansion into underserved sectors and the development of tailored solutions for emerging industries will also serve as significant growth accelerators, ensuring the continued relevance and demand for WFM software.

Emerging Opportunities in North America Workforce Management Software Industry

Emerging opportunities within the North America Workforce Management Software industry are vast and ripe for exploitation. The increasing adoption of remote and hybrid work models presents a significant opportunity for WFM solutions that specialize in managing distributed teams, tracking productivity, and fostering engagement across geographical boundaries. The burgeoning gig economy and the rise of contingent workforces create a demand for flexible scheduling, contractor management, and streamlined onboarding processes within WFM platforms. Furthermore, the growing emphasis on employee well-being and mental health offers opportunities for WFM solutions to integrate features that support work-life balance, manage workloads effectively, and promote a healthier work environment. The continued evolution of AI and predictive analytics will also unlock new possibilities in talent management, skill gap analysis, and personalized employee development pathways.

Leading Players in the North America Workforce Management Software Industry Sector

- Workday Inc.

- IBM Corporation

- Ultimate Software Group Inc.

- Kronos (US) Inc.

- Oracle Corporation

- WorkForce Software LLC

- TimeClock Plus LLC

Key Milestones in North America Workforce Management Software Industry Industry

- October 2023: The EY organization and IBM launched EY.ai Workforce, an innovative HR solution integrating AI into key HR business processes, marking a significant step in AI-driven HR productivity.

- October 2022: WorkForce Software showcased modern workforce management solutions at the Gartner ReimagineHR Conference, highlighting HR digital transformation journeys and the business impact of updated WFM systems.

- June 2022: ActiveOps PLC announced the launch of CaseworkiQ, a workforce management solution designed to bolster operations with large caseloads and high compliance scenarios, optimizing performance, reducing risk, and costs.

Strategic Outlook for North America Workforce Management Software Industry Market

The strategic outlook for the North America Workforce Management Software industry is exceptionally positive, characterized by sustained growth and continuous innovation. Future market potential is significantly influenced by the deeper integration of AI and machine learning, promising advanced predictive analytics for talent acquisition, employee retention, and strategic workforce planning. Key growth accelerators include the development of more holistic and integrated HR suites that seamlessly combine WFM with other HR functions, offering a unified employee experience. Strategic opportunities lie in catering to the evolving needs of the hybrid and remote workforce, providing robust solutions for managing flexible work arrangements, and enhancing employee engagement through personalized development and feedback mechanisms. The continuous evolution of cloud technologies and the increasing demand for data-driven decision-making will further solidify WFM software's position as an indispensable tool for organizational success.

North America Workforce Management Software Industry Segmentation

-

1. Type

- 1.1. Workforce Scheduling and Workforce Analytics

- 1.2. Time and Attendance Management

- 1.3. Performance and Goal Management

- 1.4. Absence and Leave Management

- 1.5. Other So

-

2. Deployment Mode

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Consumer Goods and Retail

- 3.3. Automotive

- 3.4. Energy and Utilities

- 3.5. Healthcare

- 3.6. Manufacturing

- 3.7. Other End-user Industries

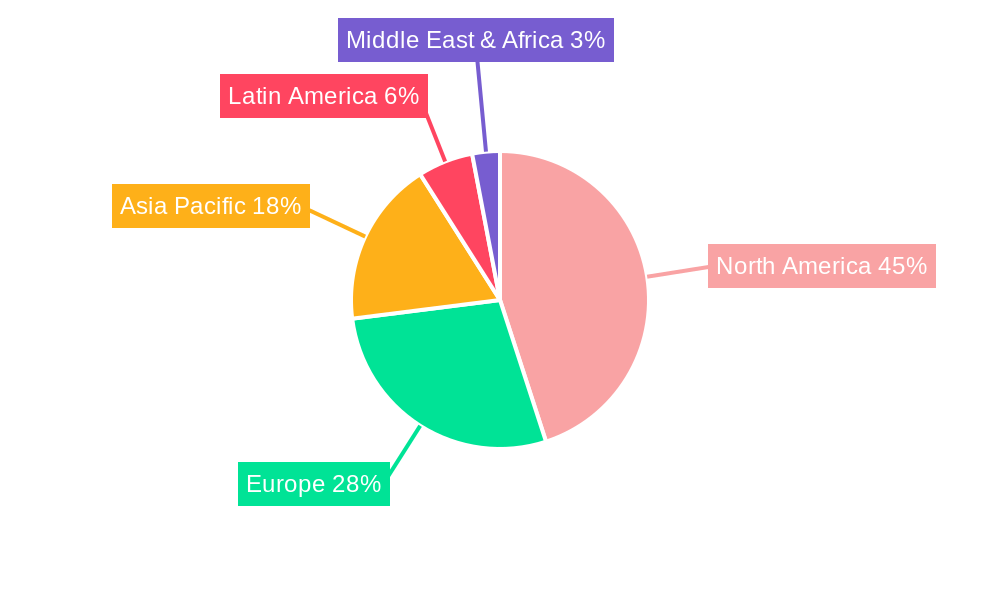

North America Workforce Management Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Workforce Management Software Industry Regional Market Share

Geographic Coverage of North America Workforce Management Software Industry

North America Workforce Management Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market; Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness among Professionals

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Workforce Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Workforce Scheduling and Workforce Analytics

- 5.1.2. Time and Attendance Management

- 5.1.3. Performance and Goal Management

- 5.1.4. Absence and Leave Management

- 5.1.5. Other So

- 5.2. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Consumer Goods and Retail

- 5.3.3. Automotive

- 5.3.4. Energy and Utilities

- 5.3.5. Healthcare

- 5.3.6. Manufacturing

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Workforce Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 7. Canada North America Workforce Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 8. Mexico North America Workforce Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 9. Rest of North America North America Workforce Management Software Industry Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Workday Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ultimate Software Group Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kronos (US) Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Oracle Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 WorkForce Software LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 TimeClock Plus LLC*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Workday Inc

List of Figures

- Figure 1: North America Workforce Management Software Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Workforce Management Software Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Workforce Management Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: North America Workforce Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Workforce Management Software Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 4: North America Workforce Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: North America Workforce Management Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Workforce Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: North America Workforce Management Software Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: North America Workforce Management Software Industry Revenue Million Forecast, by Deployment Mode 2020 & 2033

- Table 13: North America Workforce Management Software Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: North America Workforce Management Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Workforce Management Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Workforce Management Software Industry?

The projected CAGR is approximately 6.91%.

2. Which companies are prominent players in the North America Workforce Management Software Industry?

Key companies in the market include Workday Inc, IBM Corporation, Ultimate Software Group Inc, Kronos (US) Inc, Oracle Corporation, WorkForce Software LLC, TimeClock Plus LLC*List Not Exhaustive.

3. What are the main segments of the North America Workforce Management Software Industry?

The market segments include Type, Deployment Mode, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market; Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth.

6. What are the notable trends driving market growth?

Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness among Professionals.

8. Can you provide examples of recent developments in the market?

October 2023 - The EY organization and IBM have announced the launch of EY.ai Workforce, an innovative HR solution that helps enable organizations to integrate artificial intelligence (AI) into their key HR business processes where it makes pivotal next step in the collaboration between the companies and a significant milestone in the role of AI increasing productivity within the HR function.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Workforce Management Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Workforce Management Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Workforce Management Software Industry?

To stay informed about further developments, trends, and reports in the North America Workforce Management Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence