Key Insights

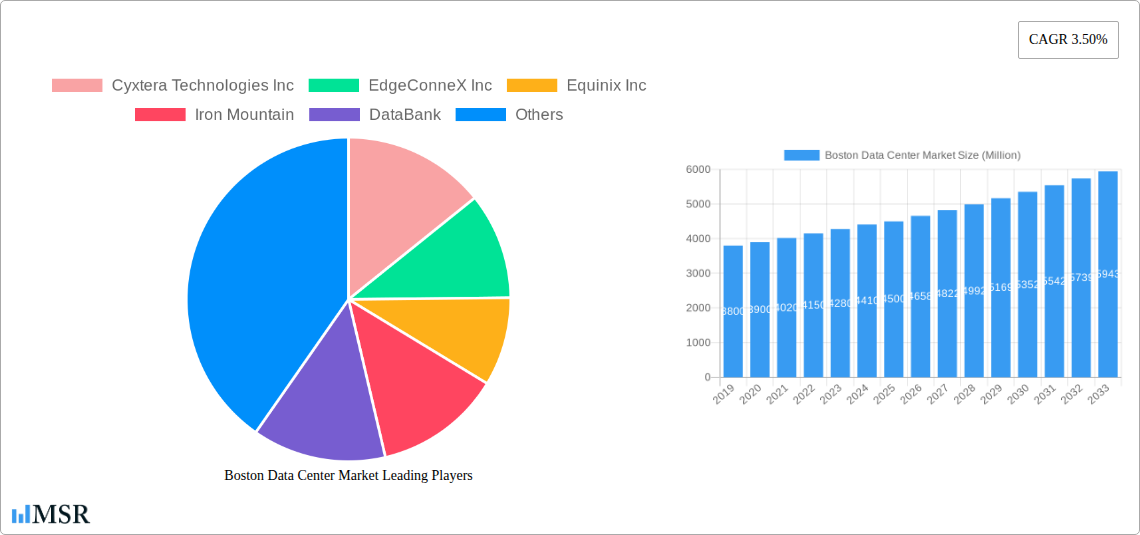

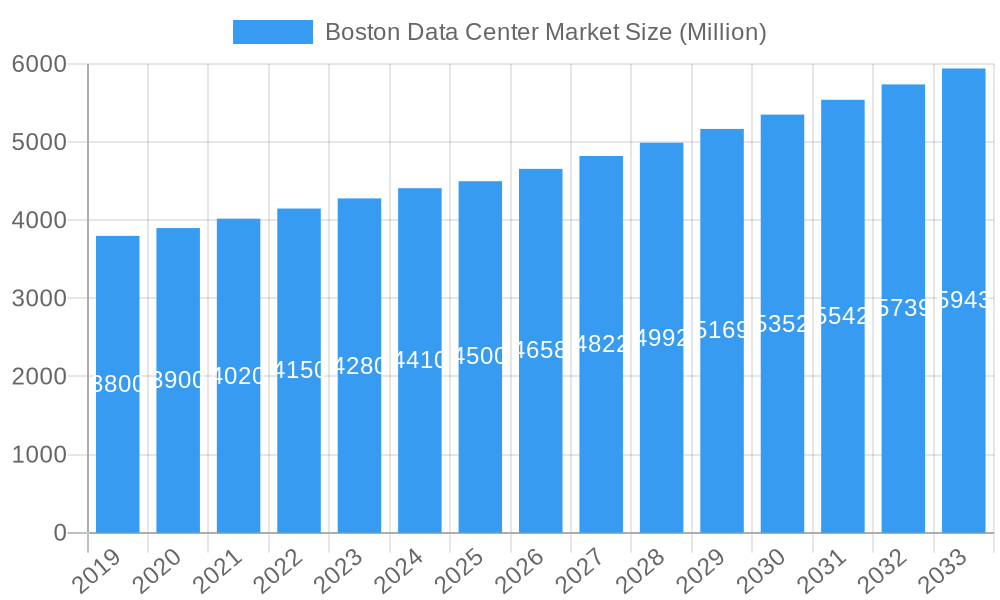

The Boston data center market is poised for robust expansion, projected to reach a significant market size of approximately $4,500 million by 2025, with a healthy Compound Annual Growth Rate (CAGR) of 3.50% expected through 2033. This growth is primarily fueled by a confluence of powerful drivers, including the escalating demand for cloud computing services, the burgeoning adoption of edge computing to reduce latency, and the continuous expansion of the telecommunications infrastructure necessary for 5G deployment. The Massachusetts technology corridor, with its strong presence in biotech, higher education, and a thriving startup ecosystem, acts as a critical hub, necessitating substantial data processing and storage capabilities. Furthermore, the increasing digitalization across all end-user segments, from BFSI and healthcare to media and entertainment and government, further bolsters this demand. The market is segmented across various DC sizes, from Small to Mega, and also by Tier Type, indicating a demand for diverse colocation options. Absorption is a key metric, with utilized capacity, particularly in retail and wholesale colocation for cloud providers and telecom giants, showing strong uptake.

Boston Data Center Market Market Size (In Billion)

While the market benefits from significant growth drivers, certain restraints warrant consideration. The high upfront capital investment required for data center construction, coupled with the increasing operational costs associated with power consumption and cooling, present a financial challenge. Additionally, stringent environmental regulations and the ongoing pursuit of sustainable energy sources necessitate careful planning and investment in green technologies. The competitive landscape is characterized by established players like Equinix Inc. and Digital Realty Trust Inc., alongside emerging providers, all vying for market share. The Boston region, specifically, is witnessing a surge in demand for hyperscale and wholesale colocation facilities to support the data-intensive operations of major cloud providers and enterprise clients. The ongoing development and densification of existing facilities, alongside new builds, will be crucial in meeting the projected growth in data storage and processing needs across the region's diverse economic sectors.

Boston Data Center Market Company Market Share

Unlocking the Future: Boston Data Center Market Analysis & Growth Forecast (2019-2033)

Dive deep into the dynamic Boston Data Center Market with this comprehensive industry report. Discover critical insights into market concentration, growth drivers, segment dominance, and emerging opportunities shaping the future of digital infrastructure in New England. With an estimated market size of $XXX Million in 2025 and a projected CAGR of X.XX% through 2033, this report is your essential guide for strategic planning and investment decisions.

Boston Data Center Market Market Concentration & Dynamics

The Boston Data Center Market exhibits a moderate to high concentration, with key players like Digital Realty Trust Inc, Equinix Inc, and Cyxtera Technologies Inc commanding significant market share. Innovation is fueled by the robust technology and life sciences sectors prevalent in the region, driving demand for high-performance computing and cloud services. Regulatory frameworks are generally supportive, although evolving environmental and energy efficiency standards are becoming increasingly influential. Substitute products, such as edge computing solutions and private cloud deployments, present a growing challenge to traditional colocation models. End-user trends are heavily influenced by the rapid adoption of AI, IoT, and advanced analytics, necessitating greater network connectivity and low latency. M&A activities have been strategic, focusing on acquiring capacity, expanding geographic reach, and integrating new technologies, with XX M&A deals recorded during the historical period.

Boston Data Center Market Industry Insights & Trends

The Boston Data Center Market is on a robust growth trajectory, propelled by a confluence of factors including the escalating demand for cloud services, the burgeoning AI and machine learning ecosystem, and the expansion of 5G networks. The market size, estimated at $XXX Million in 2025, is poised for sustained expansion driven by digital transformation initiatives across various industries. Technological disruptions, such as advancements in liquid cooling, AI-powered data center management, and the increasing adoption of hyperscale architectures, are reshaping operational efficiencies and capacity planning. Evolving consumer behaviors, characterized by the increasing reliance on digital platforms for work, entertainment, and communication, further amplify the need for scalable and resilient data center infrastructure. The study period from 2019 to 2033, with a base year of 2025, forecasts a Compound Annual Growth Rate (CAGR) of X.XX%, underscoring the market's significant potential.

Key Markets & Segments Leading Boston Data Center Market

The Boston Data Center Market is characterized by the dominance of Large and Mega DC sizes, catering to the immense power and space requirements of hyperscale operators and large enterprises. The Tier 3 and Tier 4 segments are paramount, reflecting the critical need for high availability and fault tolerance, especially for BFSI and healthcare end-users.

- DC Size Dominance:

- Large & Mega DCs: Driven by hyperscale cloud providers and major enterprises requiring substantial rack space and power density to support advanced computing workloads.

- Medium DCs: Steady demand from mid-sized businesses and specialized IT service providers.

- Tier Type Dominance:

- Tier 3 & 4: Essential for industries with stringent uptime requirements, including BFSI, government, and healthcare, where data integrity and continuous operation are non-negotiable.

- Tier 1 & 2: Less prevalent for critical applications but may serve non-essential workloads or disaster recovery sites.

- Absorption Dominance:

- Hyperscale Colocation: Leading in absorption due to massive build-outs by major cloud players.

- Wholesale Colocation: Significant uptake from enterprises seeking dedicated capacity and control over their infrastructure.

- Retail Colocation: Steady demand from smaller businesses and startups requiring flexible, scalable solutions.

- End-User Absorption:

- Cloud & IT: Consistently the largest consumer, leveraging data centers for cloud infrastructure and managed services.

- BFSI: High demand for secure, low-latency environments to support trading platforms and financial operations.

- Telecom: Essential for network backbone expansion and supporting increasing data traffic.

- Media & Entertainment: Growing demand driven by streaming services and content delivery networks.

- Government: Significant presence due to security and compliance requirements.

The dominance of these segments is underpinned by the region's strong economic growth, its status as a hub for innovation in sectors like biotechnology and AI, and the continuous upgrade of digital infrastructure to support emerging technologies.

Boston Data Center Market Product Developments

Product innovations in the Boston Data Center Market are increasingly focused on energy efficiency, sustainability, and advanced cooling solutions. Developments in AI-driven operational management are optimizing power consumption and predictive maintenance, while advancements in modular data center designs offer greater flexibility and faster deployment. The integration of renewable energy sources and sophisticated heat recapture systems are becoming standard, enhancing the environmental footprint of data center operations and aligning with global sustainability goals. These technological advancements are crucial for meeting the demands of power-intensive applications like AI and high-performance computing.

Challenges in the Boston Data Center Market Market

The Boston Data Center Market faces several critical challenges. Stringent zoning regulations and lengthy permitting processes can significantly delay new construction and expansion projects. The high cost of power, exacerbated by environmental mandates and a competitive energy market, presents a substantial operational expense. Furthermore, the escalating demand for skilled labor in data center operations and cybersecurity creates a talent acquisition bottleneck. Supply chain disruptions for specialized equipment, particularly semiconductors and networking gear, can impact build-out timelines and project costs, with potential delays of up to XX months.

Forces Driving Boston Data Center Market Growth

Several powerful forces are propelling the growth of the Boston Data Center Market. The burgeoning AI and machine learning sector, with its insatiable demand for computational power, is a primary driver. The expansion of 5G networks necessitates distributed infrastructure for low-latency applications. Government initiatives supporting digital transformation and cybersecurity investments further bolster demand. Moreover, Boston's status as a leading innovation hub, attracting tech giants and startups alike, creates a continuous need for advanced data center solutions.

Challenges in the Boston Data Center Market Market

Long-term growth catalysts in the Boston Data Center Market are deeply rooted in its commitment to innovation and sustainability. The continuous evolution of AI and IoT technologies will require increasingly sophisticated and power-efficient data processing capabilities. Strategic partnerships between data center providers and academic institutions are fostering a pipeline of skilled talent and cutting-edge research. Furthermore, the expansion of fiber optic networks, as exemplified by initiatives like the Hub Express System, is crucial for enhancing connectivity and enabling next-generation digital services, laying the groundwork for sustained market expansion.

Emerging Opportunities in Boston Data Center Market

Emerging opportunities in the Boston Data Center Market lie in the growing demand for edge computing solutions to support real-time data processing for IoT devices and autonomous systems. The increasing focus on sustainability presents opportunities for data centers utilizing renewable energy and implementing advanced green technologies. Furthermore, the expansion of specialized data center services for life sciences research and quantum computing applications offers significant growth potential. The increasing need for secure and compliant data storage for government agencies also represents a lucrative segment.

Leading Players in the Boston Data Center Market Sector

- Cyxtera Technologies Inc

- EdgeConneX Inc

- Equinix Inc

- Iron Mountain

- DataBank

- Evocative

- Sungard Availability Services

- Expedient

- Cogent

- Evoque

- Digital Realty Trust Inc

- Tierpoint LLC

Key Milestones in Boston Data Center Market Industry

- January 2023: TOWARDEX completed the first open-access utility entrance solution for fiber optic networks in the Boston area at CoreSite DC. The Hub Express System, a new fiber optic corridor, provides a hyper-scale network of underground conduits to accommodate carrier installations of more than 135 additional fiber optic cables, significantly increasing the area's digital infrastructure capabilities for interconnected data centers and laying the groundwork for the continued growth of internet traffic throughout New England.

Strategic Outlook for Boston Data Center Market Market

The strategic outlook for the Boston Data Center Market remains exceptionally strong. Continued investment in infrastructure, driven by hyperscale expansion and enterprise digital transformation, will be a key growth accelerator. Focus on sustainability and energy efficiency will be critical for long-term viability and attracting environmentally conscious clients. The development of specialized facilities catering to AI, life sciences, and quantum computing will further diversify and strengthen the market. Partnerships with local utilities and technology providers will be essential for navigating regulatory landscapes and driving innovation.

Boston Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Boston Data Center Market Segmentation By Geography

- 1. Boston

Boston Data Center Market Regional Market Share

Geographic Coverage of Boston Data Center Market

Boston Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Cloud Computing in BFSI will increase the demand of Data Center

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Boston

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Boston Data Center Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 EdgeConneX Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Iron Mountain

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 DataBank

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Evocative

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sungard Availability Services

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Expedient

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cogent

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Evoque

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Digital Realty Trust Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Tierpoint LLC

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Boston Data Center Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Boston Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Boston Data Center Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Boston Data Center Market Revenue Million Forecast, by DC Size 2020 & 2033

- Table 3: Boston Data Center Market Revenue Million Forecast, by Tier Type 2020 & 2033

- Table 4: Boston Data Center Market Revenue Million Forecast, by Absorption 2020 & 2033

- Table 5: Boston Data Center Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Boston Data Center Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Boston Data Center Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Boston Data Center Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Boston Data Center Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Boston Data Center Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Boston Data Center Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Boston Data Center Market Revenue Million Forecast, by DC Size 2020 & 2033

- Table 19: Boston Data Center Market Revenue Million Forecast, by Tier Type 2020 & 2033

- Table 20: Boston Data Center Market Revenue Million Forecast, by Absorption 2020 & 2033

- Table 21: Boston Data Center Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Boston Data Center Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Boston Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, EdgeConneX Inc, Equinix Inc, Iron Mountain, DataBank, Evocative, Sungard Availability Services, Expedient, Cogent, Evoque, Digital Realty Trust Inc, Tierpoint LLC.

3. What are the main segments of the Boston Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Cloud Computing in BFSI will increase the demand of Data Center.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

January 2023: TOWARDEX completed the first open-access utility entrance solution for fiber optic networks in the Boston area at CoreSite DC. The Hub Express System, a new fiber optic corridor, provides a hyper-scale network of underground conduits to accommodate carrier installations of more than 135 additional fiber optic cables, significantly increasing the area's digital infrastructure capabilities for interconnected data centers and laying the groundwork for the continued growth of internet traffic throughout New England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Boston Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Boston Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Boston Data Center Market?

To stay informed about further developments, trends, and reports in the Boston Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence