Key Insights

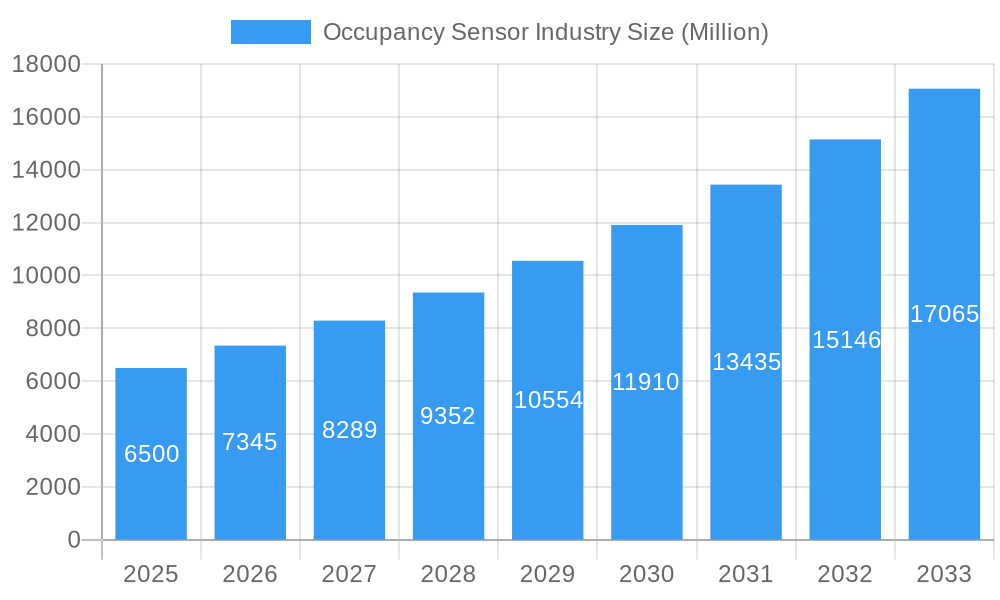

The global Occupancy Sensor market is projected for significant expansion, anticipated to reach an estimated USD 3.07 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.92%. This growth is primarily driven by the increasing demand for energy efficiency and sustainability in residential and commercial buildings. Key factors fueling this market surge include government regulations promoting energy-saving building practices, rising electricity costs, and growing awareness of the environmental and financial benefits of intelligent building management. Occupancy sensors optimize lighting and HVAC systems by accurately detecting human presence, resulting in substantial energy consumption and operational cost reductions. Technological advancements, including IoT integration and improved sensor accuracy, further enhance their appeal and drive widespread adoption.

Occupancy Sensor Industry Market Size (In Billion)

The market is segmented by technology, including Ultrasonic, Passive Infrared (PIR), and Microwave sensors, each catering to specific application needs. PIR sensors are expected to maintain a significant market share due to their cost-effectiveness and reliability. While wired networks currently dominate, the rapid evolution and increasing affordability of wireless technologies forecast considerable future growth. Primary end-users include residential and commercial buildings, with applications in lighting control, HVAC management, and security. Innovations in smart home and smart building technologies are further stimulating demand for integrated occupancy sensing solutions. Potential challenges, such as initial installation costs and system interoperability, are being addressed by ongoing technological advancements and market maturity.

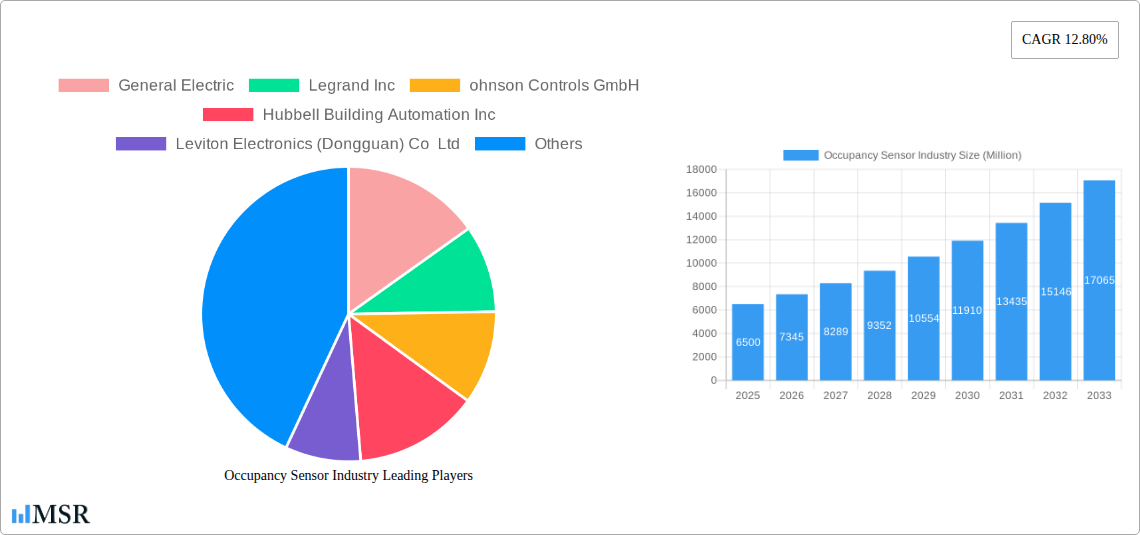

Occupancy Sensor Industry Company Market Share

Gain comprehensive insights into the Occupancy Sensor market dynamics, technological trends, and growth prospects across residential, commercial, and industrial sectors with our detailed report. This analysis, optimized for keywords such as "occupancy sensor market," "smart building technology," "IoT sensors," and "energy efficiency solutions," provides essential guidance for navigating the evolving occupancy sensing landscape.

Occupancy Sensor Industry Market Concentration & Dynamics

The occupancy sensor industry is characterized by a moderate to high market concentration, with key players like Honeywell International, Schneider Electric, and Johnson Controls GmbH holding significant market shares. The innovation ecosystem thrives on a blend of established giants and emerging tech firms focusing on advanced AI integration and data analytics for enhanced spatial intelligence. Regulatory frameworks surrounding data privacy and energy standards are increasingly influencing product development and adoption. While direct substitute products are limited, advancements in passive sensing and AI-powered analytics are subtly reshaping the competitive landscape. End-user trends heavily favor energy efficiency, enhanced security, and optimized space utilization, driving demand for sophisticated occupancy sensing solutions. M&A activities, with an estimated xx significant deals in the historical period, indicate strategic consolidation and expansion efforts by major corporations seeking to broaden their portfolios and technological capabilities. The market share of leading companies is estimated to be approximately 65% collectively in the base year 2025.

Occupancy Sensor Industry Industry Insights & Trends

The global Occupancy Sensor Industry is poised for robust expansion, projected to reach a market size of USD 9.5 Million by 2033, exhibiting a compound annual growth rate (CAGR) of 15.2% during the forecast period of 2025–2033. This impressive growth is fueled by a confluence of factors, including the escalating demand for energy-efficient building solutions and the widespread adoption of smart building technologies. The integration of the Internet of Things (IoT) is a significant driver, enabling seamless connectivity and data exchange for real-time monitoring and control. As urbanization continues its relentless pace, the need for optimized space management and enhanced occupant comfort in both residential and commercial sectors becomes paramount, further propelling the market forward. Technological disruptions, particularly in the realm of artificial intelligence and machine learning, are enabling more sophisticated occupancy detection and predictive analytics, leading to smarter building operations. Evolving consumer behaviors, with a growing preference for automated and responsive environments, are also contributing to the market's upward trajectory. The historical period (2019–2024) witnessed a steady increase in adoption, laying a strong foundation for future growth. In the base year 2025, the estimated market size is USD 4.8 Million.

Key Markets & Segments Leading Occupancy Sensor Industry

The Commercial segment is the undisputed leader in the Occupancy Sensor Industry, driven by significant investments in smart building infrastructure for offices, retail spaces, and healthcare facilities. This dominance is further amplified by the robust adoption of Wireless network types, offering greater installation flexibility and scalability, crucial for complex commercial environments.

- Technology:

- Passive Infrared (PIR) technology continues to hold a substantial market share due to its cost-effectiveness and proven reliability for general occupancy detection, particularly in lighting control applications.

- Microwave sensors are gaining traction for their ability to detect motion through obstacles, offering enhanced accuracy in larger or more complex spaces.

- Ultrasonic sensors are crucial for applications requiring precise detection of subtle movements or in environments where PIR may be less effective.

- Building Type:

- Commercial buildings represent the largest market share, encompassing offices, retail stores, educational institutions, and hospitality venues. The focus here is on energy savings, security, and optimizing space utilization.

- Residential buildings are a rapidly growing segment, driven by smart home adoption and increasing consumer awareness of energy efficiency benefits.

- Application:

- Lighting Control remains the primary application, with occupancy sensors significantly reducing energy consumption by automatically turning lights on and off.

- HVAC control is another major driver, optimizing heating and cooling systems based on actual occupancy, leading to substantial energy savings and improved comfort.

- Security and Surveillance applications are leveraging occupancy sensors for enhanced threat detection and activity monitoring.

- Other Applications, including people counting, space utilization analysis, and asset tracking, are emerging as significant growth areas.

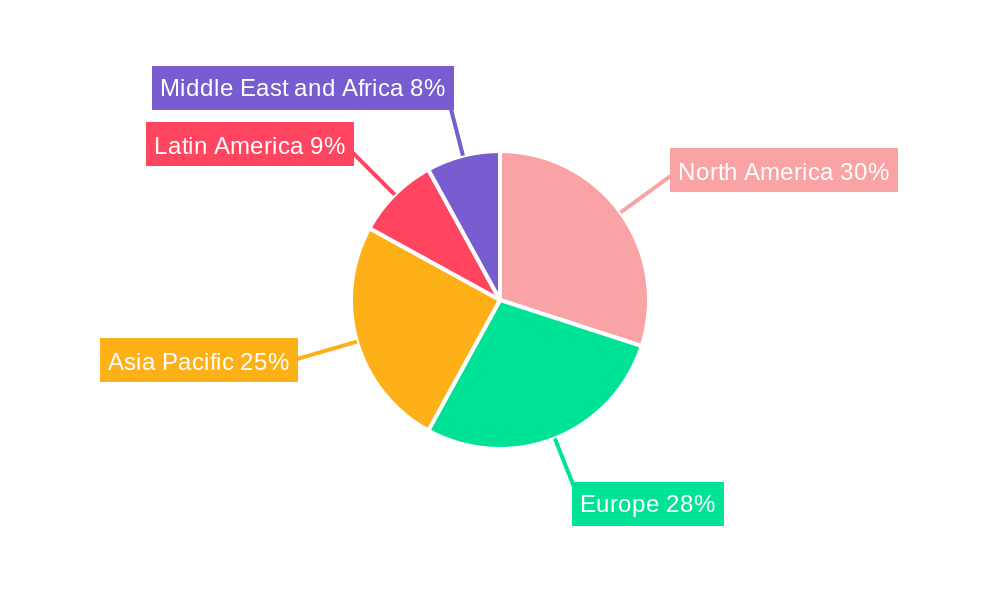

The North America region consistently leads in market adoption, owing to early technological integration, stringent energy efficiency mandates, and a high concentration of smart building initiatives. The United States, in particular, spearheads this growth through government incentives and a strong presence of key industry players.

Occupancy Sensor Industry Product Developments

Product development in the occupancy sensor industry is intensely focused on enhancing intelligence, integration, and privacy. Innovations include advanced AI-powered sensors that not only detect presence but also analyze activity patterns and distinguish between occupants and inanimate objects. Increased integration with building management systems (BMS) and smart home platforms allows for seamless control of lighting, HVAC, and security. Miniaturization and improved power efficiency are enabling discreet and versatile deployment in a wider range of applications. Furthermore, a growing emphasis on edge computing and privacy-preserving analytics is addressing concerns about data security.

Challenges in the Occupancy Sensor Industry Market

Despite its growth trajectory, the Occupancy Sensor Industry faces several challenges. High initial installation costs for complex integrated systems can be a deterrent for some businesses. Cybersecurity concerns related to connected sensors and data transmission are a growing apprehension, demanding robust security protocols. Interoperability issues between different vendor ecosystems can hinder seamless integration. Furthermore, evolving regulatory landscapes concerning data privacy and sensor deployment require continuous adaptation. Supply chain disruptions and the availability of skilled labor for installation and maintenance also present hurdles. The market is also susceptible to fluctuations in construction and infrastructure spending, impacting adoption rates.

Forces Driving Occupancy Sensor Industry Growth

The primary forces propelling the Occupancy Sensor Industry are the unyielding global drive towards energy efficiency and sustainability, mandated by governments and embraced by corporations. The rapid proliferation of smart building technologies and the Internet of Things (IoT) ecosystem creates a natural demand for occupancy sensors as a fundamental component of intelligent infrastructure. Increased awareness of the benefits, such as reduced operational costs, improved occupant comfort, and enhanced safety and security, is a significant catalyst. Government incentives and favorable policies promoting green building practices further accelerate market adoption. The growing trend of workplace optimization and the need for better space utilization in commercial settings also contribute significantly to market expansion.

Challenges in the Occupancy Sensor Industry Market

Long-term growth catalysts for the Occupancy Sensor Industry are deeply rooted in continuous technological innovation and market expansion. The development of more sophisticated AI algorithms for advanced analytics, such as predictive occupancy modeling and personalized environmental control, will unlock new revenue streams. Strategic partnerships between sensor manufacturers, building automation companies, and software providers will foster a more integrated and comprehensive smart building ecosystem. Expanding into emerging markets with nascent smart building initiatives and addressing the specific needs of diverse industries will be crucial for sustained growth. The increasing demand for occupant well-being and health monitoring solutions presents a significant opportunity for feature-rich occupancy sensors.

Emerging Opportunities in Occupancy Sensor Industry

Emerging opportunities in the Occupancy Sensor Industry are multifaceted, driven by evolving technological capabilities and shifting market demands. The integration of occupancy sensing with advanced AI and machine learning presents opportunities for hyper-personalized building environments and predictive maintenance. The growing focus on health and well-being in buildings opens avenues for sensors that monitor air quality, temperature, and occupancy density to optimize health outcomes. The expansion of smart cities initiatives will create substantial demand for networked occupancy sensors for public spaces, traffic management, and resource optimization. Furthermore, the development of low-power, long-range sensor technologies will facilitate wider adoption in applications previously limited by connectivity constraints, such as remote infrastructure monitoring.

Leading Players in the Occupancy Sensor Industry Sector

- General Electric

- Legrand Inc

- Johnson Controls GmbH

- Hubbell Building Automation Inc

- Leviton Electronics (Dongguan) Co Ltd

- Honeywell International

- Schneider Electric

- Texas Instruments Incorporated

- Pammvi Group

- Philips Ltd

- Lutron Electronics Inc

- Eaton Corporation

Key Milestones in Occupancy Sensor Industry Industry

- June 2022: Butlr launched as an occupancy-sensing platform that captures the presence and movement of individuals within a space in real-time. The platform's spatial insights, occupancy, and activity analytics may be utilized to make data-driven real estate and design decisions, as well as to improve the tenant experience, revolutionizing the workplace.

- April 2022: Lumentum Holdings Inc. and Ambarella Inc. launched a new collaborative reference design for smart building applications that integrates edge artificial intelligence (AI) with privacy. This combination enables the deployment of small AIoT sensors with local processing throughout buildings for applications such as occupancy sensor systems, intelligent space management, and smart retail.

Strategic Outlook for Occupancy Sensor Industry Market

The strategic outlook for the Occupancy Sensor Industry market is overwhelmingly positive, driven by a confluence of technological advancements and a growing global imperative for smart, sustainable, and efficient buildings. Future growth will be accelerated by the deeper integration of AI for predictive analytics and personalized user experiences, the expansion into emerging markets, and the development of novel applications beyond traditional lighting and HVAC control. Strategic alliances and ecosystem development will be crucial for creating comprehensive smart building solutions. The increasing focus on occupant well-being and data privacy will necessitate the development of advanced, secure, and user-centric sensing technologies.

Keywords: Occupancy Sensor Market, Smart Building Technology, IoT Sensors, Energy Efficiency Solutions, Lighting Control, HVAC Control, Commercial Buildings, Residential Buildings, Wireless Sensors, PIR Sensors, Microwave Sensors, Ultrasonic Sensors, Building Automation, Facility Management, Workplace Optimization, Data Analytics, AI in Buildings, Smart Homes, Green Buildings, Honeywell, Schneider Electric, Johnson Controls, Lutron, Eaton.

Occupancy Sensor Industry Segmentation

-

1. Network Type

- 1.1. Wired

- 1.2. Wireless

-

2. Technology

- 2.1. Ultrasonic

- 2.2. Passive Infrared

- 2.3. Microwave

-

3. Building Type

- 3.1. Residential

- 3.2. Commercial

-

4. Application

- 4.1. Lighting Control

- 4.2. HVAC

- 4.3. Security and Surveillance

- 4.4. Other Applications

Occupancy Sensor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Rest of Latin America

- 5. Middle East and Africa

Occupancy Sensor Industry Regional Market Share

Geographic Coverage of Occupancy Sensor Industry

Occupancy Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Energy-efficient Devices; Demand for Passive Infrared Due to Low Cost and High Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Smart City to Increase the Growth of the Occupancy Sensor Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Occupancy Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Network Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Ultrasonic

- 5.2.2. Passive Infrared

- 5.2.3. Microwave

- 5.3. Market Analysis, Insights and Forecast - by Building Type

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Lighting Control

- 5.4.2. HVAC

- 5.4.3. Security and Surveillance

- 5.4.4. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Network Type

- 6. North America Occupancy Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Network Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Ultrasonic

- 6.2.2. Passive Infrared

- 6.2.3. Microwave

- 6.3. Market Analysis, Insights and Forecast - by Building Type

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Lighting Control

- 6.4.2. HVAC

- 6.4.3. Security and Surveillance

- 6.4.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Network Type

- 7. Europe Occupancy Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Network Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Ultrasonic

- 7.2.2. Passive Infrared

- 7.2.3. Microwave

- 7.3. Market Analysis, Insights and Forecast - by Building Type

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Lighting Control

- 7.4.2. HVAC

- 7.4.3. Security and Surveillance

- 7.4.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Network Type

- 8. Asia Pacific Occupancy Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Network Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Ultrasonic

- 8.2.2. Passive Infrared

- 8.2.3. Microwave

- 8.3. Market Analysis, Insights and Forecast - by Building Type

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Lighting Control

- 8.4.2. HVAC

- 8.4.3. Security and Surveillance

- 8.4.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Network Type

- 9. Latin America Occupancy Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Network Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Ultrasonic

- 9.2.2. Passive Infrared

- 9.2.3. Microwave

- 9.3. Market Analysis, Insights and Forecast - by Building Type

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Lighting Control

- 9.4.2. HVAC

- 9.4.3. Security and Surveillance

- 9.4.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Network Type

- 10. Middle East and Africa Occupancy Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Network Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Ultrasonic

- 10.2.2. Passive Infrared

- 10.2.3. Microwave

- 10.3. Market Analysis, Insights and Forecast - by Building Type

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Lighting Control

- 10.4.2. HVAC

- 10.4.3. Security and Surveillance

- 10.4.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Network Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Electric

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Legrand Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ohnson Controls GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hubbell Building Automation Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leviton Electronics (Dongguan) Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Honeywell International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schneider Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Texas Instruments Incorporated*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pammvi Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Philips Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lutron Electronics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eaton Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 General Electric

List of Figures

- Figure 1: Global Occupancy Sensor Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Occupancy Sensor Industry Revenue (billion), by Network Type 2025 & 2033

- Figure 3: North America Occupancy Sensor Industry Revenue Share (%), by Network Type 2025 & 2033

- Figure 4: North America Occupancy Sensor Industry Revenue (billion), by Technology 2025 & 2033

- Figure 5: North America Occupancy Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Occupancy Sensor Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 7: North America Occupancy Sensor Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 8: North America Occupancy Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Occupancy Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Occupancy Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Occupancy Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Occupancy Sensor Industry Revenue (billion), by Network Type 2025 & 2033

- Figure 13: Europe Occupancy Sensor Industry Revenue Share (%), by Network Type 2025 & 2033

- Figure 14: Europe Occupancy Sensor Industry Revenue (billion), by Technology 2025 & 2033

- Figure 15: Europe Occupancy Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Europe Occupancy Sensor Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 17: Europe Occupancy Sensor Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 18: Europe Occupancy Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Europe Occupancy Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Occupancy Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Occupancy Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Occupancy Sensor Industry Revenue (billion), by Network Type 2025 & 2033

- Figure 23: Asia Pacific Occupancy Sensor Industry Revenue Share (%), by Network Type 2025 & 2033

- Figure 24: Asia Pacific Occupancy Sensor Industry Revenue (billion), by Technology 2025 & 2033

- Figure 25: Asia Pacific Occupancy Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Asia Pacific Occupancy Sensor Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 27: Asia Pacific Occupancy Sensor Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 28: Asia Pacific Occupancy Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Occupancy Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Occupancy Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Occupancy Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Occupancy Sensor Industry Revenue (billion), by Network Type 2025 & 2033

- Figure 33: Latin America Occupancy Sensor Industry Revenue Share (%), by Network Type 2025 & 2033

- Figure 34: Latin America Occupancy Sensor Industry Revenue (billion), by Technology 2025 & 2033

- Figure 35: Latin America Occupancy Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Latin America Occupancy Sensor Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 37: Latin America Occupancy Sensor Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 38: Latin America Occupancy Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 39: Latin America Occupancy Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Latin America Occupancy Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Latin America Occupancy Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Occupancy Sensor Industry Revenue (billion), by Network Type 2025 & 2033

- Figure 43: Middle East and Africa Occupancy Sensor Industry Revenue Share (%), by Network Type 2025 & 2033

- Figure 44: Middle East and Africa Occupancy Sensor Industry Revenue (billion), by Technology 2025 & 2033

- Figure 45: Middle East and Africa Occupancy Sensor Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 46: Middle East and Africa Occupancy Sensor Industry Revenue (billion), by Building Type 2025 & 2033

- Figure 47: Middle East and Africa Occupancy Sensor Industry Revenue Share (%), by Building Type 2025 & 2033

- Figure 48: Middle East and Africa Occupancy Sensor Industry Revenue (billion), by Application 2025 & 2033

- Figure 49: Middle East and Africa Occupancy Sensor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 50: Middle East and Africa Occupancy Sensor Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East and Africa Occupancy Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Occupancy Sensor Industry Revenue billion Forecast, by Network Type 2020 & 2033

- Table 2: Global Occupancy Sensor Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global Occupancy Sensor Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 4: Global Occupancy Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Occupancy Sensor Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Occupancy Sensor Industry Revenue billion Forecast, by Network Type 2020 & 2033

- Table 7: Global Occupancy Sensor Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Occupancy Sensor Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 9: Global Occupancy Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Occupancy Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Occupancy Sensor Industry Revenue billion Forecast, by Network Type 2020 & 2033

- Table 14: Global Occupancy Sensor Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 15: Global Occupancy Sensor Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 16: Global Occupancy Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Occupancy Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United Kingdom Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: France Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Occupancy Sensor Industry Revenue billion Forecast, by Network Type 2020 & 2033

- Table 24: Global Occupancy Sensor Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 25: Global Occupancy Sensor Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 26: Global Occupancy Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Occupancy Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Occupancy Sensor Industry Revenue billion Forecast, by Network Type 2020 & 2033

- Table 34: Global Occupancy Sensor Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 35: Global Occupancy Sensor Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 36: Global Occupancy Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Occupancy Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Mexico Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Latin America Occupancy Sensor Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Occupancy Sensor Industry Revenue billion Forecast, by Network Type 2020 & 2033

- Table 41: Global Occupancy Sensor Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 42: Global Occupancy Sensor Industry Revenue billion Forecast, by Building Type 2020 & 2033

- Table 43: Global Occupancy Sensor Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global Occupancy Sensor Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Occupancy Sensor Industry?

The projected CAGR is approximately 11.92%.

2. Which companies are prominent players in the Occupancy Sensor Industry?

Key companies in the market include General Electric, Legrand Inc, ohnson Controls GmbH, Hubbell Building Automation Inc, Leviton Electronics (Dongguan) Co Ltd, Honeywell International, Schneider Electric, Texas Instruments Incorporated*List Not Exhaustive, Pammvi Group, Philips Ltd, Lutron Electronics Inc, Eaton Corporation.

3. What are the main segments of the Occupancy Sensor Industry?

The market segments include Network Type, Technology, Building Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Energy-efficient Devices; Demand for Passive Infrared Due to Low Cost and High Energy Efficiency.

6. What are the notable trends driving market growth?

Smart City to Increase the Growth of the Occupancy Sensor Market.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

June 2022 - Butlr launched as an occupancy-sensing platform that captures the presence and movement of individuals within a space in real-time, stating that the data gathered by the platform can be utilized to revolutionize the workplace. Butlr's platform's spatial insights, occupancy, and activity analytics may be utilized to make data-driven real estate and design decisions, as well as to improve the tenant experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Occupancy Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Occupancy Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Occupancy Sensor Industry?

To stay informed about further developments, trends, and reports in the Occupancy Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence