Key Insights

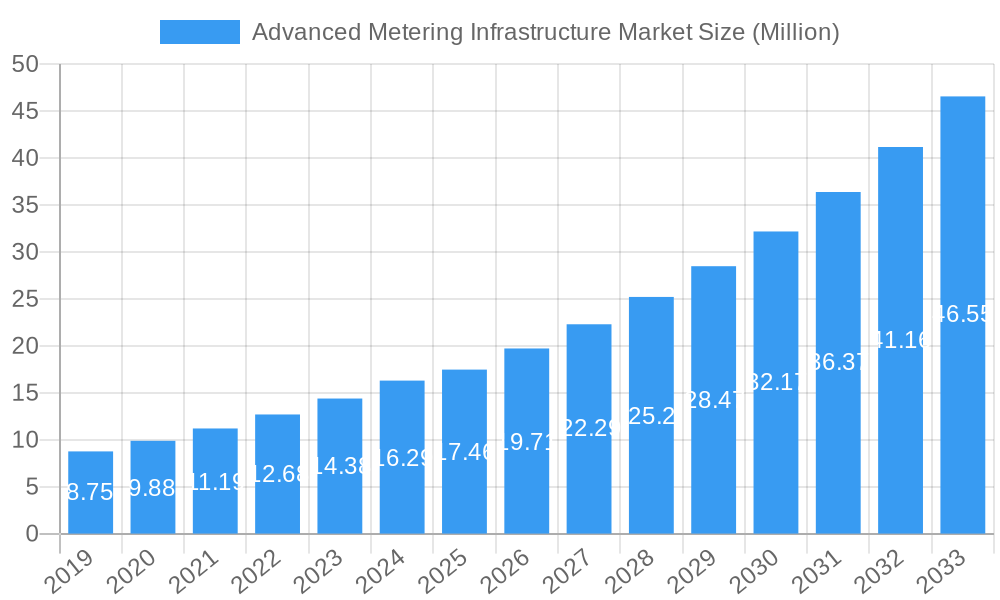

The Advanced Metering Infrastructure (AMI) market is poised for significant expansion, with a current estimated market size of USD 17.46 billion. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 12.76% over the study period spanning from 2019 to 2033, with the base and estimated year set at 2025. This upward trajectory is primarily fueled by the global drive towards smart grid modernization, increasing demand for efficient energy management solutions, and the pressing need to reduce non-revenue water losses. Governments worldwide are actively promoting smart meter deployment through supportive policies and initiatives, further accelerating market penetration. The integration of advanced communication technologies, data analytics, and software solutions for meter data management is central to this growth, enabling utilities to optimize operations, improve billing accuracy, and enhance customer engagement. The residential segment is expected to lead in adoption, driven by consumer demand for greater control over energy consumption and cost savings, alongside an increasing prevalence of smart home devices.

Advanced Metering Infrastructure Market Market Size (In Million)

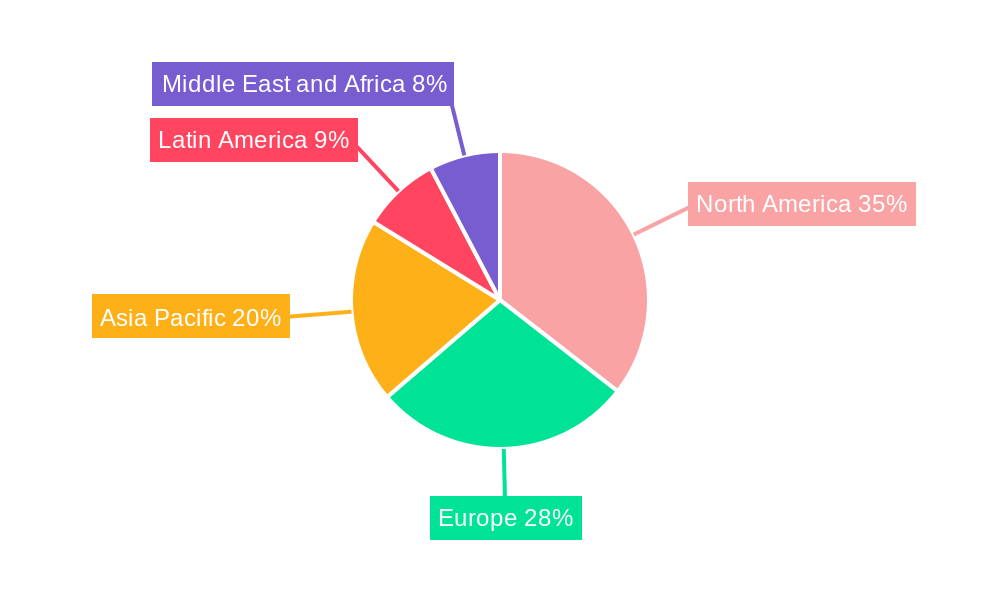

The AMI market's dynamism is further shaped by a variety of trends and potential restraints. Key growth drivers include the imperative for enhanced grid reliability and resilience, the growing adoption of renewable energy sources necessitating dynamic grid management, and the rising focus on smart cities initiatives that heavily rely on interconnected infrastructure. The solution segment is witnessing a substantial shift towards more sophisticated meter data management and analytics software, moving beyond basic communication infrastructure. Services, including installation, maintenance, and data processing, are also gaining prominence as utilities outsource complex operations. While the market exhibits strong momentum, potential restraints such as the high initial investment cost for deployment, data security and privacy concerns, and the need for skilled personnel to manage and interpret the vast amounts of data generated could pose challenges. However, the long-term benefits in terms of operational efficiency, cost savings, and environmental sustainability are expected to outweigh these limitations, ensuring sustained market growth across all major regions, particularly in North America and Europe, which are leading in smart grid adoption, with Asia Pacific showing rapid development.

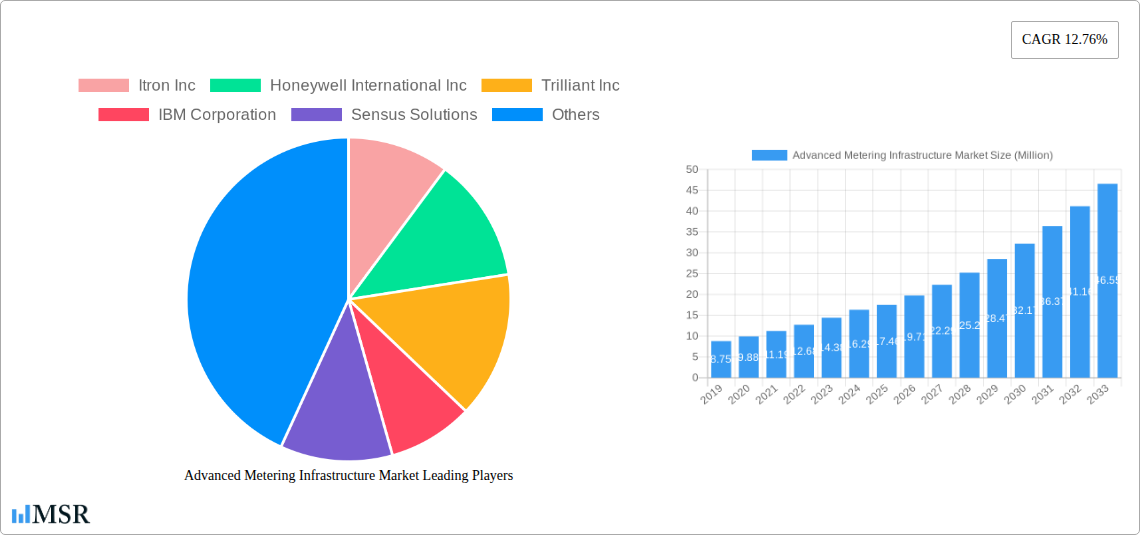

Advanced Metering Infrastructure Market Company Market Share

Unlock the future of energy management with our comprehensive Advanced Metering Infrastructure (AMI) Market Report. This in-depth analysis provides actionable insights and forecasts for the global AMI market, covering smart meter solutions, data management, and critical industry trends from 2019 to 2033.

Advanced Metering Infrastructure Market Market Concentration & Dynamics

The Advanced Metering Infrastructure (AMI) market exhibits moderate to high concentration, driven by a few prominent global players and a growing ecosystem of specialized solution providers. Key companies like Itron Inc., Honeywell International Inc., Siemens AG, and Schneider Electric SE hold significant market share, bolstered by their extensive product portfolios and established customer relationships. Innovation is a key differentiator, with companies investing heavily in R&D to enhance cybersecurity, data analytics capabilities, and grid modernization solutions. Regulatory frameworks, particularly those promoting smart grid deployment and energy efficiency, significantly influence market dynamics, encouraging widespread adoption. Substitute products, while present in basic metering, are increasingly being phased out in favor of advanced AMI solutions that offer a broader range of functionalities. End-user trends are leaning towards greater demand for real-time data, remote management, and integration with distributed energy resources. Mergers and acquisitions (M&A) are a recurring theme, with strategic consolidations aimed at expanding technological capabilities, market reach, and customer bases. For instance, recent M&A activities indicate a trend towards acquiring specialized software and cybersecurity expertise. The market sees approximately 5-10 significant M&A deals annually, aimed at strengthening competitive positions.

Advanced Metering Infrastructure Market Industry Insights & Trends

The global Advanced Metering Infrastructure (AMI) market is poised for substantial growth, driven by an increasing focus on energy efficiency, grid modernization, and the integration of renewable energy sources. The market size was estimated at approximately $20,000 Million in the base year 2025 and is projected to reach $50,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period (2025-2033). Technological disruptions are at the forefront of this expansion. The proliferation of the Internet of Things (IoT) has enabled more sophisticated communication networks for smart meters, facilitating seamless data transfer and remote management. Advancements in meter data management (MDM) software and meter data analytics are empowering utilities with deeper insights into consumption patterns, enabling better load balancing, outage detection, and fraud prevention. Evolving consumer behaviors are also playing a crucial role. End-users, both residential and commercial, are increasingly seeking greater control over their energy consumption, demanding access to real-time data to optimize usage and reduce costs. This growing awareness is pushing utilities to deploy advanced metering solutions that can support these demands. Furthermore, regulatory mandates and government initiatives aimed at building smarter, more resilient energy grids are acting as significant growth catalysts. The shift towards decentralized energy generation and the growing adoption of electric vehicles necessitate a more dynamic and intelligent grid infrastructure, for which AMI is a fundamental building block. The increasing threat landscape also propels the demand for robust cybersecurity solutions within AMI systems, a critical area of investment and innovation.

Key Markets & Segments Leading Advanced Metering Infrastructure Market

North America currently dominates the Advanced Metering Infrastructure (AMI) market, driven by significant government investments in grid modernization, stringent energy efficiency regulations, and the early adoption of smart grid technologies. The United States, in particular, accounts for a substantial share of the global market due to its extensive utility infrastructure and ongoing smart meter deployment programs.

Dominant Segments:

- Type: Smart Meters

- Drivers:

- Mandatory government mandates for smart meter deployment.

- Technological advancements in meter capabilities (e.g., two-way communication, remote disconnect/reconnect).

- Enhanced demand for real-time consumption data for billing and analytics.

- Drivers:

- Solution: Meter Communication Infrastructure

- Drivers:

- Need for reliable and secure data transmission between meters and utility back-office systems.

- Integration of diverse communication technologies (e.g., cellular, RF mesh, PLC).

- Support for expanded grid management functionalities.

- Drivers:

- End-user: Residential

- Drivers:

- Consumer demand for energy management tools and cost savings.

- Government incentives for smart home technologies.

- Increasing adoption of distributed energy resources (e.g., rooftop solar).

- Drivers:

Within the solution segment, Meter Data Management (MDM) software is crucial for processing, storing, and analyzing the vast amounts of data generated by smart meters. The increasing complexity of grid operations and the growing demand for sophisticated analytical insights are fueling the growth of Meter Data Analytics.

Advanced Metering Infrastructure Market Product Developments

Recent product developments in the Advanced Metering Infrastructure (AMI) market are heavily focused on enhancing cybersecurity and grid intelligence. The integration of zero-trust, meter-level cybersecurity protection solutions, as seen with Renesas Electronics Corp. utilizing NanoLock Security, is a critical advancement, safeguarding smart meters against diverse cyber threats and insider manipulation without impeding time-to-market. Concurrently, initiatives like the Linux Foundation's Super Advanced Meter (SAM) project are focusing on developing a widely applicable smart meter data gateway. This aims to accelerate the energy transition by transforming the meter into a reliable virtual node for the energy grid, facilitating edge computing and delivering enhanced services to customers worldwide. These developments underscore a strategic shift towards more secure, intelligent, and versatile smart metering ecosystems.

Challenges in the Advanced Metering Infrastructure Market Market

Despite its strong growth trajectory, the Advanced Metering Infrastructure (AMI) market faces several challenges.

- High upfront investment costs for utilities in deploying smart meters and associated communication infrastructure can be a significant barrier, especially for smaller utility providers.

- Cybersecurity concerns remain paramount, with the continuous need to update and strengthen defenses against evolving cyber threats, potentially leading to increased operational expenditures.

- Interoperability issues between different vendors' systems and legacy infrastructure can complicate integration and deployment, requiring substantial customization efforts.

- Data privacy regulations and consumer concerns regarding the collection and use of granular energy consumption data necessitate robust data governance policies and transparent communication.

Forces Driving Advanced Metering Infrastructure Market Growth

Several key factors are propelling the Advanced Metering Infrastructure (AMI) market forward. The global push towards decarbonization and the integration of renewable energy sources necessitate a smarter, more flexible grid that AMI provides. Government mandates and regulatory incentives promoting grid modernization and energy efficiency play a pivotal role in driving adoption. Furthermore, the increasing demand for real-time data and granular insights by both utilities and consumers for better energy management, cost optimization, and demand-response programs is a significant growth catalyst. The continuous technological advancements in communication networks, data analytics, and cybersecurity solutions are also making AMI systems more capable and cost-effective.

Challenges in the Advanced Metering Infrastructure Market Market

Long-term growth in the Advanced Metering Infrastructure (AMI) market will be sustained by continuous innovation and strategic market expansions. The evolution of smart grid technologies, including the integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics and grid optimization, will unlock new levels of efficiency. Partnerships between utility companies, technology providers, and cybersecurity firms will be crucial for developing comprehensive and secure AMI solutions. Furthermore, expanding AMI deployment into emerging economies, where grid modernization is still in its nascent stages, presents substantial market expansion opportunities. The development of new revenue streams for utilities through advanced data services and grid flexibility offerings will also fuel sustained investment in AMI.

Emerging Opportunities in Advanced Metering Infrastructure Market

Emerging opportunities in the Advanced Metering Infrastructure (AMI) market are diverse and rapidly evolving. The increasing adoption of electric vehicles (EVs) presents a significant opportunity for AMI to manage charging loads and integrate them seamlessly into the grid. The growth of the Internet of Things (IoT) ecosystem allows for greater integration of smart meters with other smart home devices, enabling comprehensive energy management solutions. Furthermore, the development of advanced analytics platforms for identifying energy theft and non-technical losses offers substantial economic benefits to utilities. Exploring new business models, such as providing data-driven services to third parties or enabling peer-to-peer energy trading, can unlock new revenue streams and further drive AMI adoption. The ongoing digitalization of utilities creates a fertile ground for innovation in grid resilience and operational efficiency.

Leading Players in the Advanced Metering Infrastructure Market Sector

- Itron Inc.

- Honeywell International Inc.

- Trilliant Inc.

- IBM Corporation

- Sensus Solutions

- Cisco Systems Inc.

- Siemens AG

- Schneider Electric SE

- Aclara Technologies LLC

- Tieto Corporation

- Mueller Systems LLC

- Landis+Gyr

Key Milestones in Advanced Metering Infrastructure Market Industry

- November 2022: Renesas Electronics Corp. began utilizing NanoLock Security, enhancing zero-trust, meter-level cybersecurity protection for smart meter products, enabling faster development of attack-resilient solutions.

- October 2022: The Linux Foundation (LF) Energy announced the Super Advanced Meter (SAM) project, focusing on a widely applicable smart meter data gateway to accelerate the energy transition and transform meters into reliable virtual grid nodes.

Strategic Outlook for Advanced Metering Infrastructure Market Market

The strategic outlook for the Advanced Metering Infrastructure (AMI) market is exceptionally positive, driven by global energy transition initiatives and the imperative for a more resilient and efficient power grid. Future growth will be accelerated by the integration of AI and ML for advanced grid management, predictive maintenance, and enhanced demand-side response capabilities. The increasing demand for granular energy data for innovative services, such as EV charging optimization and distributed energy resource management, will further solidify AMI's importance. Strategic collaborations between technology providers, utilities, and regulatory bodies will be crucial for navigating complex deployment challenges and fostering wider market acceptance. The market is set to witness continued innovation in cybersecurity and data analytics, making AMI a cornerstone of the smart energy future.

Advanced Metering Infrastructure Market Segmentation

-

1. Type

- 1.1. Smart Me

-

1.2. Solution

- 1.2.1. Meter Communication Infrastructure (Solution)

-

1.2.2. Software

- 1.2.2.1. Meter Data Management

- 1.2.2.2. Meter Data Analytics

- 1.2.2.3. Other Software Types

- 1.3. Services

-

2. End-user

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

Advanced Metering Infrastructure Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Advanced Metering Infrastructure Market Regional Market Share

Geographic Coverage of Advanced Metering Infrastructure Market

Advanced Metering Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift Toward Energy Efficient/Saving Alternatives; Favorable Governmental Initiatives Driving Adoption

- 3.3. Market Restrains

- 3.3.1. Data Pricacy Concerns

- 3.4. Market Trends

- 3.4.1. Smart Metering Devices Will have the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Advanced Metering Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Smart Me

- 5.1.2. Solution

- 5.1.2.1. Meter Communication Infrastructure (Solution)

- 5.1.2.2. Software

- 5.1.2.2.1. Meter Data Management

- 5.1.2.2.2. Meter Data Analytics

- 5.1.2.2.3. Other Software Types

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Advanced Metering Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Smart Me

- 6.1.2. Solution

- 6.1.2.1. Meter Communication Infrastructure (Solution)

- 6.1.2.2. Software

- 6.1.2.2.1. Meter Data Management

- 6.1.2.2.2. Meter Data Analytics

- 6.1.2.2.3. Other Software Types

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Advanced Metering Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Smart Me

- 7.1.2. Solution

- 7.1.2.1. Meter Communication Infrastructure (Solution)

- 7.1.2.2. Software

- 7.1.2.2.1. Meter Data Management

- 7.1.2.2.2. Meter Data Analytics

- 7.1.2.2.3. Other Software Types

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Advanced Metering Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Smart Me

- 8.1.2. Solution

- 8.1.2.1. Meter Communication Infrastructure (Solution)

- 8.1.2.2. Software

- 8.1.2.2.1. Meter Data Management

- 8.1.2.2.2. Meter Data Analytics

- 8.1.2.2.3. Other Software Types

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Advanced Metering Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Smart Me

- 9.1.2. Solution

- 9.1.2.1. Meter Communication Infrastructure (Solution)

- 9.1.2.2. Software

- 9.1.2.2.1. Meter Data Management

- 9.1.2.2.2. Meter Data Analytics

- 9.1.2.2.3. Other Software Types

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Advanced Metering Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Smart Me

- 10.1.2. Solution

- 10.1.2.1. Meter Communication Infrastructure (Solution)

- 10.1.2.2. Software

- 10.1.2.2.1. Meter Data Management

- 10.1.2.2.2. Meter Data Analytics

- 10.1.2.2.3. Other Software Types

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.2.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Itron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Trilliant Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sensus Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aclara Technologies LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tieto Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mueller Systems LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Landis+Gyr

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Itron Inc

List of Figures

- Figure 1: Global Advanced Metering Infrastructure Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Advanced Metering Infrastructure Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Advanced Metering Infrastructure Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Advanced Metering Infrastructure Market Revenue (Million), by End-user 2025 & 2033

- Figure 5: North America Advanced Metering Infrastructure Market Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Advanced Metering Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Advanced Metering Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Advanced Metering Infrastructure Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Advanced Metering Infrastructure Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Advanced Metering Infrastructure Market Revenue (Million), by End-user 2025 & 2033

- Figure 11: Europe Advanced Metering Infrastructure Market Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Advanced Metering Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Advanced Metering Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Advanced Metering Infrastructure Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Advanced Metering Infrastructure Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Advanced Metering Infrastructure Market Revenue (Million), by End-user 2025 & 2033

- Figure 17: Asia Pacific Advanced Metering Infrastructure Market Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Advanced Metering Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Advanced Metering Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Advanced Metering Infrastructure Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Advanced Metering Infrastructure Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Advanced Metering Infrastructure Market Revenue (Million), by End-user 2025 & 2033

- Figure 23: Latin America Advanced Metering Infrastructure Market Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Advanced Metering Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Advanced Metering Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Advanced Metering Infrastructure Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Advanced Metering Infrastructure Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Advanced Metering Infrastructure Market Revenue (Million), by End-user 2025 & 2033

- Figure 29: Middle East and Africa Advanced Metering Infrastructure Market Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East and Africa Advanced Metering Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Advanced Metering Infrastructure Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 3: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 6: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 9: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 12: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 15: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by End-user 2020 & 2033

- Table 18: Global Advanced Metering Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Advanced Metering Infrastructure Market?

The projected CAGR is approximately 12.76%.

2. Which companies are prominent players in the Advanced Metering Infrastructure Market?

Key companies in the market include Itron Inc, Honeywell International Inc, Trilliant Inc, IBM Corporation, Sensus Solutions, Cisco Systems Inc, Siemens AG, Schneider Electric SE, Aclara Technologies LLC, Tieto Corporation, Mueller Systems LLC, Landis+Gyr.

3. What are the main segments of the Advanced Metering Infrastructure Market?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift Toward Energy Efficient/Saving Alternatives; Favorable Governmental Initiatives Driving Adoption.

6. What are the notable trends driving market growth?

Smart Metering Devices Will have the Significant Market Share.

7. Are there any restraints impacting market growth?

Data Pricacy Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: Renesas Electronics Corp., a provider of smart meter solutions, has begun utilizing NanoLock Security, a solution that provides zero-trust meter-level cyber security protection for smart meter products. With the help of this new solution, Renesas' clients, especially those smart meter manufacturers, can quickly develop a product that is safe from all attack vectors, including insider manipulation and human error, without delaying the time to market or meter operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Advanced Metering Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Advanced Metering Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Advanced Metering Infrastructure Market?

To stay informed about further developments, trends, and reports in the Advanced Metering Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence