Key Insights

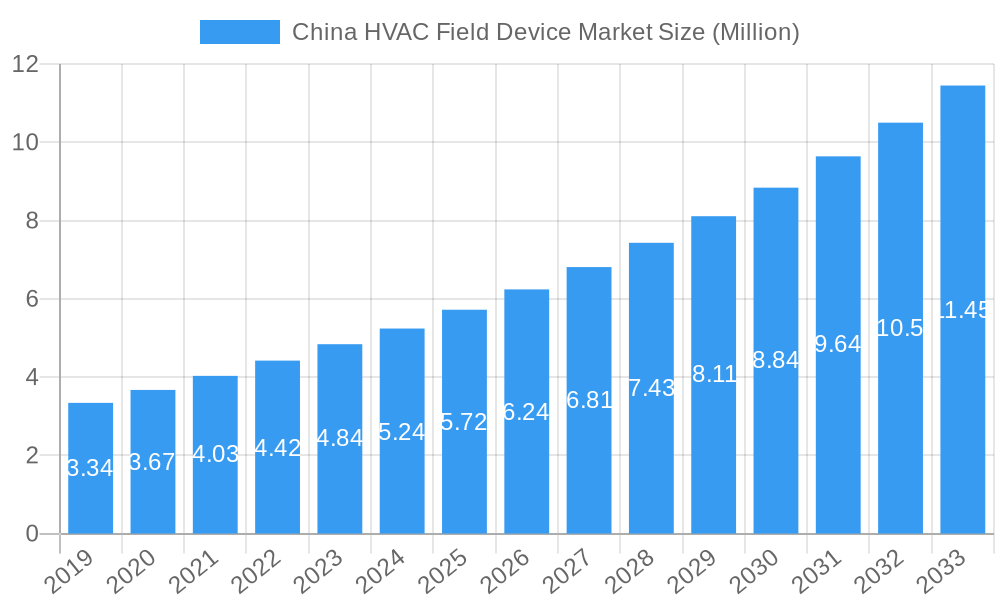

The China HVAC Field Device Market is poised for substantial expansion, with a current market size of $5.24 billion, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 9.10% from 2019 to 2033. This impressive growth trajectory is driven by a confluence of factors, including increasing urbanization, a rising demand for energy-efficient buildings, and the pervasive adoption of smart building technologies. The market is segmented into various crucial components, such as Control Valves, Balancing Valves, Pressure Independent Control Valves (PICVs), HVAC Dampers, Damper Actuators, and a diverse array of Sensors encompassing Environmental, Multi, Air Quality, and Occupancy and Lighting types. These components are critical for the efficient and effective operation of Heating, Ventilation, and Air Conditioning (HVAC) systems across commercial, residential, and industrial end-user segments. The emphasis on regulatory compliance for energy efficiency and indoor air quality is further fueling the demand for advanced HVAC field devices.

China HVAC Field Device Market Market Size (In Million)

Key growth drivers for this dynamic market include government initiatives promoting green building standards and the ongoing digital transformation of the construction and building management sectors. Trends such as the integration of the Internet of Things (IoT) in HVAC systems, the growing preference for intelligent and connected devices, and the increasing focus on occupant comfort and well-being are shaping market demand. While the market exhibits strong growth, certain restraints such as the initial high cost of some advanced devices and a potential shortage of skilled professionals for installation and maintenance could pose challenges. However, the overarching trend towards smart, sustainable, and automated building management systems, coupled with the strong presence of leading global and local players like Honeywell, Johnson Controls, Siemens, and Danfoss, ensures a vibrant and expanding market landscape in China. The recent focus on energy conservation and carbon emission reduction in China will further accelerate the adoption of these advanced HVAC field devices, particularly in new construction and major retrofitting projects.

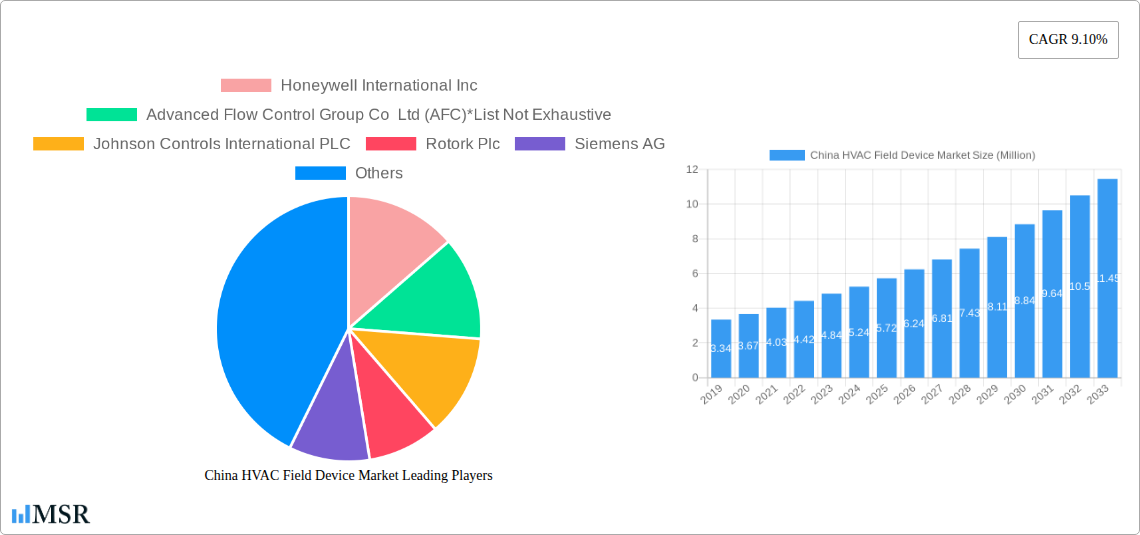

China HVAC Field Device Market Company Market Share

This in-depth report provides an unparalleled analysis of the China HVAC field device market, offering critical insights for HVAC control valves, balancing valves, PICVs, damper HVAC, damper actuators, and a comprehensive range of HVAC sensors, including environmental sensors, multi-sensors, air quality sensors, and occupancy and lighting solutions. Delving into the commercial HVAC, residential HVAC, and industrial HVAC sectors, this study leverages a robust forecast period (2025–2033), with the base year and estimated year at 2025, and a detailed historical period (2019–2024). Discover the market dynamics, key players, and future trajectory of this rapidly evolving industry.

China HVAC Field Device Market Market Concentration & Dynamics

The China HVAC field device market exhibits a dynamic blend of moderate to high market concentration, driven by a few dominant global players alongside a growing number of innovative domestic manufacturers. The innovation ecosystem is rapidly maturing, fueled by increasing demand for energy-efficient and intelligent building solutions. Regulatory frameworks are becoming more stringent, particularly concerning energy efficiency standards and indoor air quality (IAQ), pushing manufacturers to invest in advanced technologies. The threat of substitute products is relatively low for core HVAC field devices, but integration with broader building management systems (BMS) and the rise of smart home technologies present evolving competitive landscapes.

End-user trends are heavily influenced by urbanization, government initiatives promoting green buildings, and a rising middle class demanding improved comfort and health in both commercial and residential sectors. The industrial sector, driven by process optimization and safety requirements, also represents a significant segment. Mergers and acquisitions (M&A) activities are expected to increase as larger players seek to consolidate their market position, acquire new technologies, and expand their geographical reach. We anticipate XX M&A deal counts within the forecast period. Market share is currently fragmented but with leading players like Honeywell International Inc and Johnson Controls International PLC holding substantial positions.

China HVAC Field Device Market Industry Insights & Trends

The China HVAC field device market is poised for significant expansion, driven by a confluence of macro-economic factors, technological advancements, and shifting consumer preferences. The market is projected to reach USD XXX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). The historical period (2019–2024) laid the foundation for this growth, with a steady increase in demand for sophisticated HVAC solutions. Key growth drivers include escalating urbanization, leading to the construction of new commercial and residential buildings that necessitate advanced HVAC systems. Government policies promoting energy efficiency and reducing carbon emissions are further accelerating the adoption of intelligent field devices that optimize energy consumption.

Technological disruptions are a defining feature of this market. The integration of the Internet of Things (IoT) and Artificial Intelligence (AI) is transforming traditional HVAC field devices into smart, connected components that enable predictive maintenance, remote monitoring, and personalized climate control. The demand for advanced sensors, particularly those that monitor air quality, occupancy, and environmental conditions, is surging due to growing awareness of health and well-being, especially post-pandemic. Evolving consumer behaviors are characterized by a preference for comfort, convenience, and sustainability. Homeowners are increasingly willing to invest in smart thermostats and energy-efficient HVAC systems, while commercial building owners are prioritizing solutions that reduce operational costs and enhance tenant satisfaction. The shift towards decentralized HVAC systems in some applications, coupled with the growing adoption of Variable Refrigerant Flow (VRF) systems, also influences the types of field devices required. Furthermore, the increasing sophistication of building automation systems (BAS) and building management systems (BMS) creates a demand for interoperable and data-rich field devices. The development of Building Information Modeling (BIM) integration in HVAC design is also driving the need for accurate and well-documented field device specifications. The market is witnessing a growing emphasis on the lifecycle management of HVAC systems, leading to increased demand for durable and reliable field devices.

Key Markets & Segments Leading China HVAC Field Device Market

The Commercial segment is currently the dominant end-user market for HVAC field devices in China, driven by the rapid expansion of office buildings, retail spaces, hospitality venues, and healthcare facilities. These sectors require sophisticated HVAC systems for occupant comfort, process control, and regulatory compliance, making advanced control valves, balancing valves, PICVs, damper HVAC, and a wide array of sensors essential. The sheer volume of new construction and retrofitting projects in urban centers underpins this dominance.

Dominant Regions: While the entire nation is experiencing growth, the eastern coastal regions of China, including major cities like Shanghai, Beijing, and Guangzhou, represent the most significant markets due to their high concentration of economic activity and advanced infrastructure development.

Key Segments Driving Growth:

- Control Valves: Crucial for precise temperature and flow regulation in various HVAC applications, from large commercial buildings to industrial processes.

- Drivers: Increased automation in building management, demand for energy efficiency, stringent control requirements in industrial applications.

- Balancing Valves: Essential for ensuring optimal water flow distribution in hydronic systems, leading to improved comfort and energy savings.

- Drivers: Retrofitting of older buildings to improve efficiency, adoption of advanced hydronic system designs, demand for consistent temperature control.

- PICVs (Pressure Independent Control Valves): Offer superior flow control regardless of system pressure fluctuations, ensuring accurate temperature control in diverse applications.

- Drivers: Growing adoption in complex HVAC systems, demand for precise zone control in commercial buildings, improved occupant comfort.

- Damper HVAC & Damper Actuators HVAC: Vital for controlling airflow in ductwork, enabling zone control and ventilation management.

- Drivers: Increased focus on ventilation and IAQ, integration with smart building systems for optimized airflow, energy recovery in HVAC systems.

- Sensors:

- Environmental Sensors (Temperature, Humidity): Fundamental for HVAC system operation and comfort management.

- Drivers: Baseline requirement for all HVAC systems, integration with smart thermostats, energy optimization strategies.

- Multi-Sensors: Combining multiple sensing capabilities (e.g., CO2, VOCs, temperature, humidity) for comprehensive environmental monitoring.

- Drivers: Growing awareness of IAQ and its impact on health, demand for integrated building management solutions, smart building advancements.

- Air Quality Sensors: Crucial for monitoring pollutants and allergens, a growing concern in both residential and commercial spaces.

- Drivers: Public health initiatives, post-pandemic focus on IAQ, regulatory compliance for commercial spaces.

- Occupancy and Lighting Sensors: Enable demand-controlled ventilation and lighting, significantly reducing energy consumption.

- Drivers: Energy efficiency mandates, integration with smart lighting and HVAC controls, smart building initiatives.

- Environmental Sensors (Temperature, Humidity): Fundamental for HVAC system operation and comfort management.

The Residential segment is also experiencing substantial growth, fueled by rising disposable incomes, increasing demand for comfort, and government incentives for energy-efficient home appliances. As smart home technology becomes more mainstream, the integration of smart HVAC controls and sensors in residential applications is set to accelerate. The Industrial segment, while smaller in volume, represents high-value applications where precise environmental control is critical for production processes, safety, and regulatory compliance, driving demand for specialized and robust field devices.

China HVAC Field Device Market Product Developments

Recent product developments in the China HVAC field device market underscore a strong trend towards enhanced intelligence, connectivity, and modularity. Innovations focus on improving energy efficiency, optimizing performance, and facilitating integration with building automation systems. For instance, the June 2023 introduction of Rotork's CKQ part-turn variant for their CK range of modular electric valve actuators highlights the industry's push for configurable and rapidly deployable solutions that offer high degrees of flexibility. Similarly, Attune's March 2023 launch of their Outdoor Air Quality Monitoring (OAQ) Kit demonstrates the growing emphasis on comprehensive environmental monitoring, extending indoor air quality solutions to outdoor applications. These advancements allow for more precise data collection, proactive system adjustments, and ultimately, healthier and more sustainable indoor environments. The competitive edge in this market is increasingly defined by these technological leaps, enabling seamless data exchange and smarter control strategies.

Challenges in the China HVAC Field Device Market Market

Despite the robust growth, the China HVAC field device market faces several challenges. Intense competition from both domestic and international players leads to price pressures and necessitates continuous innovation. Supply chain disruptions, as seen globally, can impact the availability and cost of raw materials and finished goods. Evolving and complex regulatory landscapes, particularly concerning product certifications and environmental standards, can pose compliance hurdles for manufacturers. Furthermore, interoperability issues between different manufacturers' systems and the need for skilled technicians for installation and maintenance can hinder widespread adoption of advanced technologies. The initial cost of sophisticated smart HVAC field devices can also be a barrier for some segments of the market, particularly in cost-sensitive residential applications.

Forces Driving China HVAC Field Device Market Growth

Several forces are propelling the growth of the China HVAC field device market. Stringent government regulations and policies promoting energy efficiency and reducing carbon emissions are primary catalysts. The continuous urbanization and infrastructure development drive the demand for new HVAC installations in commercial and residential buildings. Technological advancements, particularly in IoT, AI, and sensor technology, enable smarter, more efficient, and connected HVAC systems. A growing public awareness of indoor air quality (IAQ) and its impact on health is increasing demand for advanced air monitoring and control solutions. Furthermore, rising disposable incomes and living standards are leading consumers to prioritize comfort and well-being, thus boosting the adoption of advanced HVAC solutions.

Challenges in the China HVAC Field Device Market Market

(Note: This section is a duplicate of the previous "Challenges" section. Assuming this is an oversight and will be treated as an additional perspective on long-term growth catalysts if that's the intent, or removed if it's a true duplicate.)

Assuming this section is intended to discuss long-term growth catalysts rather than challenges:

Long-term growth catalysts in the China HVAC field device market are deeply rooted in sustainable development initiatives and technological evolution. The ongoing shift towards a circular economy and net-zero emissions targets will continue to drive demand for highly efficient HVAC field devices that minimize energy consumption and environmental impact. Continued innovation in sensor technology, focusing on greater accuracy, miniaturization, and cost-effectiveness, will unlock new applications and improve existing ones. The expansion of smart city projects and the increasing integration of HVAC systems into the broader smart building ecosystem present significant opportunities for interconnected field devices that contribute to overall building intelligence and operational efficiency. Furthermore, partnerships between HVAC manufacturers, technology providers, and construction firms will be crucial for developing integrated solutions that meet the evolving demands of the market.

Emerging Opportunities in China HVAC Field Device Market

Emerging opportunities in the China HVAC field device market are abundant, driven by technological innovation and evolving market demands. The digitalization of buildings, including the widespread adoption of Building Management Systems (BMS) and the Internet of Things (IoT), creates a significant demand for connected and data-rich HVAC field devices. The increasing focus on predictive maintenance and remote diagnostics for HVAC systems opens avenues for sensors and actuators that provide real-time performance data. The growing demand for healthier indoor environments, amplified by public health concerns, is spurring the market for advanced air quality sensors and ventilation control solutions. Furthermore, the development of district heating and cooling networks, along with the integration of renewable energy sources into HVAC systems, presents new application areas for specialized field devices. Opportunities also lie in the retrofitting market, where older buildings are being upgraded with modern, energy-efficient HVAC systems.

Leading Players in the China HVAC Field Device Market Sector

- Honeywell International Inc

- Johnson Controls International PLC

- Siemens AG

- Rotork Plc

- Danfoss A/S

- Belimo Holding AG

- Robert Bosch GmbH

- Dwyer Instruments Inc

- Advanced Flow Control Group Co Ltd (AFC)

- Electrolux AB

Key Milestones in China HVAC Field Device Market Industry

- June 2023: Rotork extended the CK range of modular electric valve actuators to include a new part-turn variant, the CKQ. The entire range has a modular design that provides high degrees of configurability and flexibility while enabling quick delivery. This development enhances the market's ability to deploy customized actuator solutions rapidly.

- March 2023: Attune launched its latest product for outdoor air quality monitoring. The Outdoor Air Quality Monitoring (OAQ) Kit repackages Attune's UL-2905-certified indoor air quality monitoring sensors for outdoor usage, delivering data on air quality around any given site. This signifies a crucial expansion in environmental sensing capabilities, catering to a growing need for comprehensive outdoor IAQ data.

Strategic Outlook for China HVAC Field Device Market Market

The strategic outlook for the China HVAC field device market is one of sustained and accelerated growth, driven by a strong emphasis on smart building technologies, energy efficiency, and occupant well-being. Key growth accelerators include the continued integration of IoT and AI into HVAC field devices, enabling advanced analytics, predictive maintenance, and optimized performance. The increasing adoption of green building standards and government mandates for energy conservation will further fuel demand for sophisticated control and sensing solutions. Opportunities for market expansion lie in the residential sector as smart home adoption rises, and in the industrial sector for specialized applications requiring precise environmental control. Strategic partnerships and technological collaborations will be crucial for manufacturers to navigate the competitive landscape and capitalize on emerging trends, ensuring long-term market leadership.

China HVAC Field Device Market Segmentation

-

1. Type

- 1.1. Control Valve

- 1.2. Balancing Valve

- 1.3. PICV

- 1.4. Damper HVAC

- 1.5. Damper Actuator HVAC

-

2. Sensors

- 2.1. Environmental Sensors

- 2.2. Multi Sensors

- 2.3. Air Quality Sensors

- 2.4. Occupancy and Lighting

-

3. End User

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

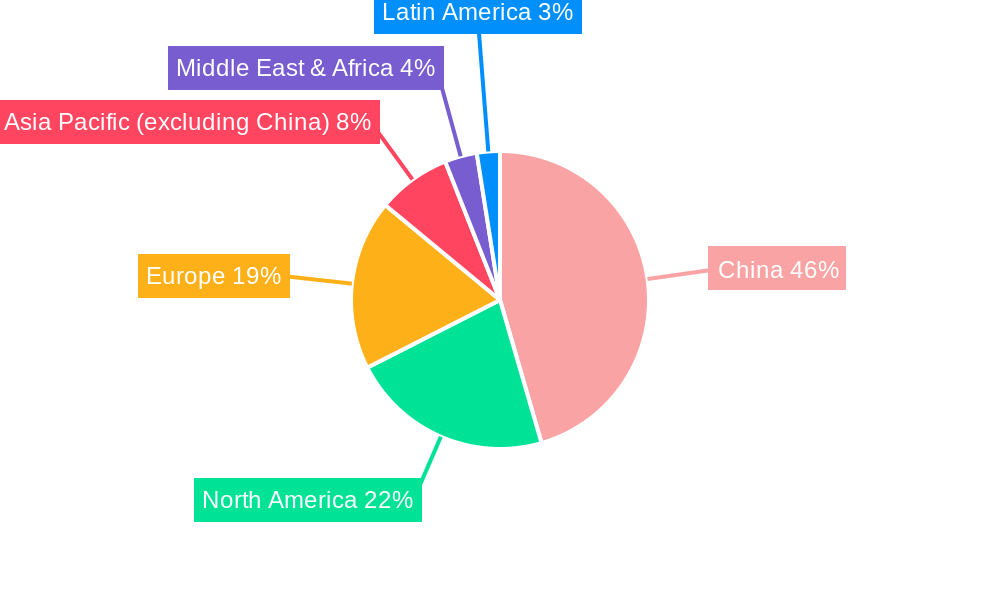

China HVAC Field Device Market Segmentation By Geography

- 1. China

China HVAC Field Device Market Regional Market Share

Geographic Coverage of China HVAC Field Device Market

China HVAC Field Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Usage of Heating

- 3.2.2 Ventilation

- 3.2.3 and Air Conditioning Systems; Increase in Commercial Construction Activities

- 3.3. Market Restrains

- 3.3.1. Dependence on Macro-economic Conditions; High Initial Cost of Energy Efficient Systems

- 3.4. Market Trends

- 3.4.1. Control Valve Holding Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China HVAC Field Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Control Valve

- 5.1.2. Balancing Valve

- 5.1.3. PICV

- 5.1.4. Damper HVAC

- 5.1.5. Damper Actuator HVAC

- 5.2. Market Analysis, Insights and Forecast - by Sensors

- 5.2.1. Environmental Sensors

- 5.2.2. Multi Sensors

- 5.2.3. Air Quality Sensors

- 5.2.4. Occupancy and Lighting

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Advanced Flow Control Group Co Ltd (AFC)*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls International PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rotork Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dwyer Instruments Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Belimo Holding AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrolux AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: China HVAC Field Device Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China HVAC Field Device Market Share (%) by Company 2025

List of Tables

- Table 1: China HVAC Field Device Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China HVAC Field Device Market Revenue Million Forecast, by Sensors 2020 & 2033

- Table 3: China HVAC Field Device Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: China HVAC Field Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China HVAC Field Device Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: China HVAC Field Device Market Revenue Million Forecast, by Sensors 2020 & 2033

- Table 7: China HVAC Field Device Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: China HVAC Field Device Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China HVAC Field Device Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the China HVAC Field Device Market?

Key companies in the market include Honeywell International Inc, Advanced Flow Control Group Co Ltd (AFC)*List Not Exhaustive, Johnson Controls International PLC, Rotork Plc, Siemens AG, Dwyer Instruments Inc, Belimo Holding AG, Robert Bosch GmbH, Electrolux AB, Danfoss A/S.

3. What are the main segments of the China HVAC Field Device Market?

The market segments include Type, Sensors, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.24 Million as of 2022.

5. What are some drivers contributing to market growth?

High Usage of Heating. Ventilation. and Air Conditioning Systems; Increase in Commercial Construction Activities.

6. What are the notable trends driving market growth?

Control Valve Holding Significant Market Share.

7. Are there any restraints impacting market growth?

Dependence on Macro-economic Conditions; High Initial Cost of Energy Efficient Systems.

8. Can you provide examples of recent developments in the market?

June 2023 - Rotork extended the CK range of modular electric valve actuators to include a new part-turn variant, the CKQ. The entire range has a modular design that provides high degrees of configurability and flexibility while enabling quick delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China HVAC Field Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China HVAC Field Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China HVAC Field Device Market?

To stay informed about further developments, trends, and reports in the China HVAC Field Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence